金融英语练习题第二章

The Demand for Money

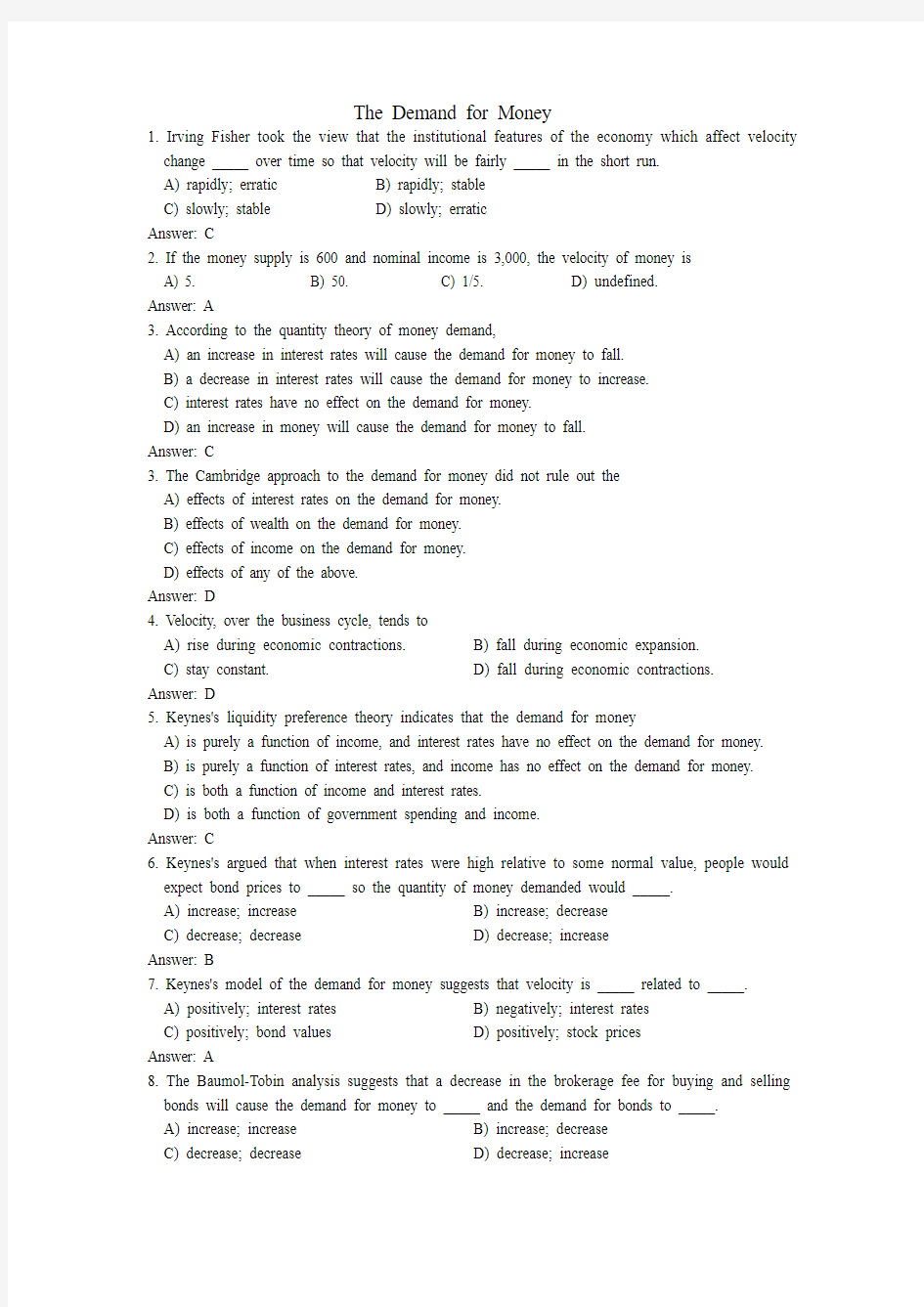

1. Irving Fisher took the view that the institutional features of the economy which affect velocity change _____ over time so that velocity will be fairly _____ in the short run.

A) rapidly; erratic B) rapidly; stable

C) slowly; stable D) slowly; erratic

Answer: C

2. If the money supply is 600 and nominal income is 3,000, the velocity of money is

A) 5. B) 50. C) 1/5. D) undefined.

Answer: A

3. According to the quantity theory of money demand,

A) an increase in interest rates will cause the demand for money to fall.

B) a decrease in interest rates will cause the demand for money to increase.

C) interest rates have no effect on the demand for money.

D) an increase in money will cause the demand for money to fall.

Answer: C

3. The Cambridge approach to the demand for money did not rule out the

A) effects of interest rates on the demand for money.

B) effects of wealth on the demand for money.

C) effects of income on the demand for money.

D) effects of any of the above.

Answer: D

4. Velocity, over the business cycle, tends to

A) rise during economic contractions. B) fall during economic expansion.

C) stay constant. D) fall during economic contractions. Answer: D

5. Keynes's liquidity preference theory indicates that the demand for money

A) is purely a function of income, and interest rates have no effect on the demand for money.

B) is purely a function of interest rates, and income has no effect on the demand for money.

C) is both a function of income and interest rates.

D) is both a function of government spending and income.

Answer: C

6. Keynes's argued that when interest rates were high relative to some normal value, people would expect bond prices to _____ so the quantity of money demanded would _____.

A) increase; increase B) increase; decrease

C) decrease; decrease D) decrease; increase

Answer: B

7. Keynes's model of the demand for money suggests that velocity is _____ related to _____.

A) positively; interest rates B) negatively; interest rates

C) positively; bond values D) positively; stock prices

Answer: A

8. The Baumol-Tobin analysis suggests that a decrease in the brokerage fee for buying and selling bonds will cause the demand for money to _____ and the demand for bonds to _____.

A) increase; increase B) increase; decrease

C) decrease; decrease D) decrease; increase

Answer: D

9. Friedman's assumption that money and goods are substitutes indicates that

A) changes in the money supply have only indirect effects on aggregate spending.

B) changes in the money supply may have a direct effect on aggregate spending.

C) interest rates have no effect on money demand, implying the velocity is constant.

D) both (b) and (c) of the above are true.

Answer: B

10. Irving Fisher's view that velocity is fairly constant in the short run transforms the equation of

exchange into the

A) Cambridge theory of income determination.

B) quantity theory of money.

C) Keynesian theory of income determination.

D) monetary theory of income determination.

Answer: B

11. In the 20th century, velocity

A) has been quite stable over periods as long as a decade.

B) has grown at a constant rate.

C) has been quite volatile.

D) both (a) and (b) of the above.

Answer: C

12. Because interest rates have substantial fluctuations, the _____ theory of the demand for money

indicates that velocity has substantial fluctuations as well.

A) classical B) Cambridge C) liquidity preference D) Pigouvian Answer: C

13. In the Baumol-Tobin analysis, the transactions demand for money is

A) negatively related to the level of income.

B) negatively related to the level of interest rates.

C) positively related to the expected return on other assets.

D) only (a) and (b) of the above.

14. In the Baumol-Tobin analysis, the transactions demand for money is

A) negatively related to the level of interest rates.

B) negatively related to the expected return on other assets.

C) positively related to the expected return on other assets.

D) only (a) and (b) of the above.

Answer: D

15. The Baumol-Tobin analysis suggests that an increase in the brokerage fee for buying and

selling bonds will cause the demand for money to ________ and the demand for bonds to ________.

A) increase; increase B) increase; decrease

C) decrease; increase D) decrease; decrease

Answer: B

16. If interest rates do not affect the demand for money, then velocity is _____ likely to be _____.

A) more; stable B) more; unstable C) more; procyclical D) less; stable Answer: A

17. People will want to buy more when the

A) price level rises, because the interest rate rises.

B) price level rises, because the interest rate falls.

C) price level falls, because the interest rate rises.

D) price level falls, because the interest rate falls.

18. A decrease in U.S. interest rates leads to

A) a depreciation of the dollar that leads to greater net exports.

B) a depreciation of the dollar that leads to smaller net exports.

C) an appreciation of the dollar that leads to greater net exports.

D) an appreciation of the dollar that leads to smaller net exports.

19. Other things the same, as the price level falls, a country's exchange rate

A) and interest rates rise.

B) and interest rates fall.

C) falls and interest rates rise.

D) rises and interest rates fall.

20. Which of the following will both make people spend more?

A) wealth and interest rates rise.

B) wealth rises and interest rates fall.

C) wealth falls and interest rates rise.

D) wealth falls and interest rates fall.

21. An increase in the interest rate causes investment to

A) rise and the exchange rate to appreciate.

B) fall and the exchange rate to depreciate.

C) rise and the exchange rate to depreciate.

D) fall and the exchange rate to appreciate.

22. When taxes decrease, consumption

A) decreases as shown by a movement to the left along a given aggregate-demand curve.

B) decreases as shown by a shift of the aggregate demand curve to the left.

C) increases as shown by a movement to the right along a given aggregate-demand curve.

D) increases as shown by a shift of the aggregate demand curve to the right.

23. When the money supply decreases

A) interest rates fall and so aggregate demand shifts right.

B) interest rates fall and so aggregate demand shifts left.

C) interest rates rise and so aggregate demand shifts right.

D) interest rates rise and so aggregate demand shifts left.

24. Aggregate demand shifts left when the government

A) decreases taxes.

B) cuts military expenditures.

C) creates a new investment tax credit

D) None of the above is correct.

25. The long-run aggregate supply curve would shift right if the government were to

A) increase the minimum-wage.

B) make unemployment benefits more generous.

C) raise taxes on investment spending.

D) None of the above is correct.

26. The long-run aggregate supply curve shifts right if

A) the price level rises.

B) the price level falls.

C) the capital stock increases.

D) the capital stock decreases.

答案:DABBD

DDBDC

27. Other things the same, if workers and firms expected prices to rise by 2 percent but instead they rise by 3 percent, then

A) employment and production rise.

B) employment rises and production falls.

C) employment falls and production rises.

D) employment and production fall.

28. Other things the same, an unexpected fall in the price level results in some firms having

A) lower than desired prices which increases their sales.

B) lower than desired prices which depresses their sales.

C) higher than desired prices which increases their sales.

D) higher than desired prices which depresses their sales.

29. If the price level rises above what was expected and nominal wages are fixed, then

A) production becomes less profitable so firms will hire fewer workers.

B) production becomes less profitable so firms will hire more workers.

C) production becomes more profitable so firms will hire fewer workers.

D) production become more profitable so firms will hire more workers.

30. Of the following theories, which is consistent with a vertical long-run aggregate supply curve?

A) the sticky-wage theory

B) misperceptions theory

C) both the sticky-wage and misperceptions theories.

D) neither the sticky-wage nor the misperceptions theory.

31. The effects of a higher than expected price level are shown by

A) shifting the short-run aggregate supply curve right.

B) shifting the short-run aggregate supply curve left.

C) moving to the right along a given aggregate supply curve.

D) moving to the left along a given aggregate supply curve.

32. An increase in the expected price level shifts the

A) short-run and long-run aggregate supply curves left.

B) the short-run but not the long-run aggregate supply curve left.

C) the long-run but not the short-run aggregate supply curve left.

D) neither the long-run nor the short-run aggregate supply curve left.

33. Which of the following shifts the short-run aggregate supply curve to the right?

A) a decrease in the actual price level

B) an increase in the actual price level

C) a decrease in the expected price level

D) an increase in the expected price level

34. Which of the following shifts short-run aggregate supply right?

A) an increase in the price level

B) an increase in the minimum wage

C) a decrease in the price of oil

D) more people migrate abroad than immigrate from abroad

35. Other things the same, if the price level rises by 2% and people were expecting it to rise by 5%, then some firms have

A) higher than desired prices which increases their sales.

B) higher than desired prices which depresses their sales.

C) lower than desired prices which increases their sales.

D) lower than desired prices which depresses their sales.

答案:ADDDC

BCCB

金融英语证书考试

金融英语证书考试(F E C T)E x e r c i s e s-1(1) of the following is not a function of money?______。? act as a medium of exchange act as a unit of account act as a store of value provide a double coincidence of wants act as a means of payment price in the foreign exchange market is called ______。 trade surplus exchange rate money price currency rate risk refers to the risk of______。 prices fluctuations payments of the following is not among the generally accepted accounting principles?______。 basis concern measurement。 is a documentary letter of credit?______。 conditional bank undertaking to pay an exporter on production of stipulated documentation method of lending against documentary security international trade settlement system biased in favour of importers of the above a group of assets reduces risk as long as the assets ______。 perfectly correlated completely independent not have precisely the same pattern of returns a correlation coefficient greater than one amount,payable in money goods,or service,owed by a business to a creditor,is known as a/an 。 function is money serving when you buy a ticket to a movie?______。 of value medium of exchange

《金融英语》教学大纲

经济学院经济类专业课程教学大纲 金融英语 课程名称:金融英语Financial English 课程编码:012099 学分:2分 总学时:32学时 适用专业:金融学 先修课程:基础英语、金融学、货币银行学 执笔人:曾江辉 审订人:王华明 一、课程的性质、目的与任务 金融英语是金融学专业选修课程,其目的是培养学生的金融专业英语语言能力和实际运用英语处理与金融有关业务的能力。金融英语不仅具有其独特的专业词语、常用句式和文体风格,而且具有金融行业的内在知识体系,具有融思想性、知识性、技术性为一体的特征。要求此课程以现代课程理念为指导,突出学生的主体和多学科知识的综合性,突出培养学生的学习能力。Financial English is a elective courses for Finance Major, which purpose is to cultivate the students' ability of using English language of Finance professional and practical use of English to deal with related financial business. Financial English not only has the professional words, but also has sentence patterns and unique style. It has the internal knowledge system and is melted with the thought and knowledge, technology as the characteristics. The requirements of this course is provided by modern curriculum ideas as a guide, the main highlight comprehensive for students and multi-disciplinary knowledge. It emphasizes the training of students learning ability. 二、教学内容与学时分配 Chapter 1 Money (2学时) 1.1 Definition of Money 1.2 Types of Money 1.3 Functions of Money 1.4 Interest and Interest Rate 1.5 Money Supply 1.6 China's Monetary System Exercises Chapter 2 Foreign Exchange (4学时) 2.1 Definitions and Quotations 2.2 Foreign Exchange Transactions Exercises Chapter 3 Balance of Payments (4学时)

金融专业英语阅读(答案)

Lesson One Translate the following passage into Chinese 1.紧缩性货币政策和扩张性货币政策都涉及到改变一个国家的货币供应量水平。 扩张性货币政策增加货币供应量,而紧缩性货币政策会减少货币供应量。 2.当联邦储备体系在公开市场上购买有价证券,会引起证券价格上涨。债券价格 和利率成反比关系。联邦贴现率就是一种利率,因此降低联邦利率实际上就是 降低利率。如果联邦储备系统决定降低法定储备要求,那么银行能够进行投资 的资金会增加。这会引起投资比如债券价格的上涨,因此利率会降低。无论联 邦储备体系用何种方法来增加货币供应量,利率都会降低,债券价格会上涨。 Translate the following sentences into English 1. China would maintain a stable currency and prudent monetary policy, and expected to stay within its growth and inflation targets this year 2.China would also maintain a prudent monetary policy to support economic development while preventing inflationary pressure and financial risks 3. China’s economy continued to grow steadily and rapidly in the first quarter, with investment in fixed assets slowing and domestic consumption accelerating. 4.because of China’s large increase in its trade surplus and foreign exchange reserves in the first quarter, the effectiveness of its monetary policy — used to help control inflation — was facing “serious challenges.” 5. The central bank would seek to further streamline its foreign exchange system to facilitate the orderly outflow of funds. At the same time, it would tighten the management of foreign exchange inflows and settlement. —Three Translation: Translate the following passage into Chinese 1.外汇交易当然是指两种不用货币之间的交易了。每一组货币的交易或“买卖”都包含两个部分。一个是即期市场,在这个市场中支付(交付)需在交易时立即进行(在实际操作中一般是在第二个交易日进行),另一个就是远期市场。远期市场的汇率是在交易的时候就先确定了,但实际的交易,或交付则是在未来的某个特定时间进行的。 2.外汇交易期权是指一种货币和另一种货币在未来进行交付的一个合同,在此合同中,

大学英语2课后习题答案

Unit 7 Comprehension of the Text I. 1. You should learn to take charge of your life and recognize there are many things beyond your control. 2. Being tense may cause tremendous and rapid increases in their blood pressure. 3. They found the excess alarm or stress chemicals could literally burst heart muscle fibers, creating many short circuits and causing crazy heat rhythms. 4. Fear, uncertainty, and doubt, together with lack of control. 5. One kind is professional women, and the other kind is people who have no compass in life. 6. The NICE factors –new, interesting, challenging experiences. 7. Cut it down to 6 and set priorities. 8. You must learn to flow. Vocabulary III. 1.react 2.tense 3.recommended 4.destructive 5. perceive 6.emphasis 7.stirred 8.priority 9.attributed 10. stimulate IV. 1. blow his top 2. Among other things 3. take charge of 4. put emphasis on 5. is attributed to 6. from my viewpoint 7. substituted low-fat oil for butter 8.cut down on 9. keep your audience in mind 10. out of control V. 1.N 2.E 3.G 4.J 5.I 6.A 7.C 8.L 9.D 10.O Word Building VI. 1.endless 2. thoughtful 3. harmful 4. restless 5.beautiful 6.successful 7.fearless 8.joyful VII. realize privatize characterize socialize nationalize economize normalize criticize 1.nationalized 2.criticized 3.normalized 4.economize 5.realized 6.socializing 7.privatized 8.characterizes Sentence structure VIII. 1. When you are studying abroad, misunderstandings can result from cultural differences, among other things. 2. Online learning requires, among other things, commitment and discipline to keep up with the flow of the course. 3. The research work was severely criticized for its poor management, among other things. 4. They discussed, among other things, the future of the oil industry. 5. The article shows, among other things, the negative effects of generation

金融英语课程简介

金融英语 Financial English 课程编号: 课程名称:金融英语 学分: 2 学时:32 考核形式:考查 适应专业:非英语专业本科学生 内容简介: 金融英语课程以教育部颁布的《大学英语课程要求》为指导,体现实用性英语教学原则,培养学生在金融领域的英语应用能力。金融英语将金融专业知识和英语语言技 能有机结合起来,按照专题知识分类,根据ESP教学的特点、金融业务的性质和要求 以及学习者的需求和目标,设计内容丰富、难度适中、形式多样的听力理解和口语训练 任务,选取一些有代表性的文章进行文本分析,帮助学习者了解金融业务的操作流程,熟练掌握常用的金融英语表达方式。在学习英语的同时学习金融知识,了解金融英语的 语言特点,培养良好的表达能力与思辨能力。 本课程教学时数为32学时。分为8个单元,每个单元涉及一种相对独立的金融知识或业务,涉及中国金融机构、银行存款业务、财务报表、金融工具、国际结算、外汇 贸易和证券保险市场。特定的金融业务的场景以及相关话题,金融业务场景中的各种工 作人员角色对话,银行各种业务操作流程等具体的专业知识及相关的交际策略和语言技 能。 课程以特定金融业务语言环境为背景涉及学习任务,让学生把完成学习任务与执行开展某种金融业务活动结合在一起。学习任务体现了真实性和现实性,类似于自然的职 业行为和社会行为,学生在解决问题完成任务过程中能够自然而然地学习和运用金融专 业英语术语,实现学习目标。学习者在学习过程中需明确要尽可能地了解掌握更多的金 融业务基本概念和基本词汇;要反复练习以提高金融业务场景所要求的职业语言交际技 能。培养学生的金融专业英语语言能力是首要任务,学生通过网络平台对一定的教学内 容进行听力练习,并在课堂教学中将听取内容进行反馈,进行金融业务情景对话、小组 活动,个人演讲或者新闻发布及文本信息汇报等活动。有助于学习者学习和掌握如何在 不同的金融业务场景中,用英文处理相关业务,强化听力内容的理解和掌握,最终达到 提高口语表达能力的目的。在各种学习任务开展中,对金融专业知识与概念,采取学生 “自主学习”、教师“点到为止”的策略,广泛介绍但不深入讲解,以激发学生进一步 自主学习的兴趣为目的。学生通过大量的听力训练与模拟情景口语训练,熟悉相关的金 融知识与概念,学习掌握相关的专业术语表达与语言技能,提高交际能力。学习者可以 运用所学专业知识和语言技能解决金融业务中可能遇到的实际问题,获取和交流信息并 处理相关金融业务,将语言技能的培养和金融专业知识的学习有机结合,最终提高金融 英语语言运用能力。 使用教材:《金融英语听说》,陈建辉主编,外语教学与研究出版社。

英文版国际金融试题和答案

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分1. If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. ( T ) 2. The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places upward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. Covered interest arbitrage is plausible when the forward premium reflect the interest rate differential between two countries specified by the interest rate parity formula.( F ) 8.The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) PartⅡ:Cloze (20%)每题2分,答错不扣分 1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power ) 2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a ( forward contract ) to sell that currency when the investment matures. 4. (Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. IFE is based on nominal interest rate ( differentials ), which are influenced by expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( value ) will be affected. 8. The option writer is obligated to buy the underlying commodity at a stated price if a ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. Any good secondary market for finance instruments must have an efficient clearing system. Most Eurobonds are cleared through either ( Euroclear ) or Cedel. PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分 1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given this information, is locational arbitrage possible?If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Yes!One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802.With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank.These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90.How will this spot rate adjust in two years if the United Kingdom experiences an inflation rate of 7 percent per year while the United

金融英语证书考试

金融英语证书考试(FECT )Exerci ses I. Which of the following is not a function of money ? ______ A. To act as a medium of excha nge B. To act as a unit of acco unt C. To act as a store of value D. To provide a double coin cide nee of wants E. To act as a mea ns of payme nt 2. ______________________________________________ T he price in the foreig n excha nge market is called ___________________________________ A. the trade surplus B. the excha nge rate C. the money price D. the curre ncy rate 3. _____________________________ Market risk refers to the risk of A. fi nan cial prices fluctuati ons B. default

C. fraud D. deferred payme nts 4. Which of the follow ing is not among the gen erally accepted acco un ti ng principles ? ________ 。 A. Cash basis B. Prude nee C. C on siste ncy D. Go ing concern E. M oney measureme nt。 5. What is a documentary letter of credit ? ______ 。 A. A conditional bank undertaking to pay an exporter on production of stipulated docume ntati on B. A method of lending aga inst docume ntary security C. A n intern ati onal trade settleme nt system biased in favour of importers D. All of the above 6. Holdi ng a group of assets reduces risk as long as the assets ____ 。 A. are perfectly correlated

金融英语教案

哈尔滨金融学院教案 课程名称:金融英语 课程代码: 开课系部:金融系 授课教师: 授课班级:12级金管1、2、3班; 2012级国际金融1、2班 开课学期:2014-2015上

一、课程简介(四号宋体加粗) 课程类别:必修课 授课对象:专科层次金融管理与实务专业;国际金融专业 场地器材:1#308 学时学分:×××(四号宋体) 使用教材:Ian MacKenzie,《剑桥金融财务英语》,人民邮电出版社,2010年 参考教材:《会计专业英语》 《英文国际贸易》 《金融英语》 二、教学目标 扩充学生的金融词汇量,了解地道的外国金融案例。本门课程分为四个领域,会计学、银行业、公司理财、经济与贸易,学生学习后从宏观上可以将4者结合,将所学的知识进行整合,整体上提高自己的就业竞争力。 三、教学过程 第一次课 2学时 教学内容 第一章Basic terms 第1节 money and income 1.Currency 2.Personal finance 第2节 business finance

1.Capital 2.Revenue 3.Financial statement 重点难点 Terminologies 教学组织 1.讲授法 2.集体授课 3. 多媒体教学,板书 作业布置 课后习题,背诵专业术语 第二次课 2学时 教学内容 第三章Banking 第19节 personal banking 1.Current accounts 2.Banking products and services 3.E-banking 第20节 commercial and retail banking https://www.360docs.net/doc/903283290.html,mercial and retail banks 2.Credit 3.Loans and credits 重点难点 1.Types of accounts 2.Differences on types of accounts at home and abroad

金融英语教程目录-张铁军

Chapter 1 Money 1.1 Definition of Money 1.2 Types of Money 1.3 Functions of Money 1.4 Interest and Interest Rate 1.5 Money Supply 1.6 China's Monetary System Exercises Chapter 2 Foreign Exchange 2.1 Definitions and Quotations 2.2 Foreign Exchange Transactions Exercises Chapter 3 Balance of Payments 3.1 The Definition of BOP 3.2 The General Principle of BOP 3.3 The Components of Balance of Payment Statement 3.4 Equilibrium of BOP Exercises Chapter 4 International Monetary System 4.1 The Gold Standard 4.2 Bretton Woods System 4.3 The Jamaica System 4.4 The Present and the Future Exercises Chapter 5 Financial Market 5.1 Introduction 5.2 Money Market 5.3 Capital Market Exercises Chapter 6 Securities 6.1 Overview 6.2 Stock 6.3 Bond Exercises Chapter 7 Loans 7.1 Introduction 7.2 Major Loan Categories 7.3 Loan Classification by Risk

金融英语FECT 单选题附答案

1. Which of the following is not a function of money? ______. A. To act as a medium of exchange B. To act as a unit of account C. To act as a store of value D. To provide a double coincidence of wants E. To act as a means of payment 2. The price in the foreign exchange market is called ______. A. the trade surplus B. the exchange rate C. the money price D. the currency rate 3. Market risk refers to the risk of______. A. financial prices fluctuations B. default C. fraud D. deferred payments 4. Which of the following is not among the generally accepted accounting principles? ______. A. Cash basis B. Prudence C. Consistency D. Going concern E. Money measurement.

5. What is a documentary letter of credit? ______. A. A conditional bank undertaking to pay an exporter on production of stipulated documentation B. A method of lending against documentary security C. An international trade settlement system biased in favour of importers D. All of the above 6. Holding a group of assets reduces risk as long as the assets ______. A. are perfectly correlated B. are completely independent C. do not have precisely the same pattern of returns D. have a correlation coefficient greater than one 7. An amount, payable in money goods, or service, owed by a business to a creditor, is known as a/an . A. liability B. debt C. equity D. asset 8. What function is money serving when you buy a ticket to a movie? ______. A. store of value B. a medium of exchange C. transaction demand D. a unit of account 9. If foreigners expect that the future price of sterling will be lower, the ______. A. supply of sterling will increase, demand for sterling will fall, and the exchange rate will fall

金融英语教学大纲修订版

金融英语教学大纲集团标准化小组:[VVOPPT-JOPP28-JPPTL98-LOPPNN]

《金融英语》教学大纲 制定依据:本大纲根据2014版本科人才培养方案制定 课程编号:W0231964 学时数:32 学分数:2 适用专业:英语专业 先修课程:国际金融 考核方式:考查 一、课程的性质和任务 改革开放以来,中国取得了举世瞩目的成就。随着中国加入世界贸易组织和现代服务业的快速发展,金融市场进一步对外开放,外资银行代表处、外资金融机构纷纷在华开办业务,并逐渐从货币经营发展到资本市场和金融服务各个领域。与此同时,中国的企业也开始走向国际、融入世界。在全球金融竞争日趋激烈的今天,金融英语的普及和掌握,已成为非英语国家人力资源发展水平的重要内容,也是衡量金融中心城市的一个指标。 通过学习该门课程,使学生在金融基础业务中较熟练地运用英语,熟悉基本的业务概念、术语及一般的业务程序与原理;听懂日常会话和一般的业务交谈;看懂与金融业务有关的一般文字材料,拟定一般的业务文件;在基础业务中掌握英语基本语法知识;掌握金融英语写作的文风要求;掌握信函和报告的写作方法;掌握阅读的技巧,提高学生的理解能力;牢固掌握英译汉和汉译英的技巧;掌握金融英语口译的基本技巧,胜任高级别会谈、重大场合即席讲话等类金融活动的口译工作。总之,这门课程为学生今后从事金融活动奠定一定的语言和理论基础。 二、教学内容与要求 理论教学(32学时) 第一章:Commercial Banking商业银行(6学时) (1)The Banking System 银行体系 Section A—The People s Bank of China 中国人民银行 Section B—Bank of China 中国四大国有商业银行之一:中国银行 Section C—Bank of America 美国商业银行之一:美洲银行 Section D—BOC International Holdings Limited 中银国际公司 (2)Retail Banking: Bank Accounts 私人业务: 银行账户 Section A—Deposit Accounts 存款账户

《金融专业英语》习题答案

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese. 1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOF is in charge of financial accounting and taxation part of banking regulation and management. 目前中国银行业主要由中国人民银行和银监会进行监管。此外,财政部负责银行业监管的财务会计及税收方面。 2.Currently Chinese fund management companies are engaged in the following business: securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses. 目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。 3.China's economy had 10% growth rate in the years before the world financial crisis of 2008. That economic expansion resulted from big trade surpluses and full investment. Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home. 在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。这一经济增长源于巨额贸易盈余和大量投资。中国现在正在寻求改变这一增长模式。中国正致力于平衡出口和国内需求。 二.Translate the following sentences into English 1.中国商业银行监管的程序是市场准入监管、市场运营监管和市场退出监管。 Regulatory procedures of China’s commercial banks are market access regulation, market operation regulation and market exit regulation. 2.国务院关于推进资本市场改革开放和稳定发展的若干意见。 Some opinions of the State Council on promoting the reform, opening and steady growth of the capital market 3.只有建立合理的股权结构,才能保证公司取得好的经营业绩。 Only establishing reasonable ownership structure can guarantee perfect corporate performance. 4.该公司股票暴跌,被伦敦交易所摘牌。 The company’s stock nosedived and it was delisted from the London exchange.

大学英语(二) 复习题答案

《大学英语》第二册期末复习题 Part I. 词汇和语法单项选择题:请从每小题A、B、C、D四个选项中,选出能填入空白处的最佳选项,并将相应选项的字母填入空白处。 1. I found the cat __A___ under the bed, who had caught a mouse. A. hiding B. hidden C. to hide D. having hidden 2. ---- How did he get back last night? ---- I think he __C___ back on foot, as there were no buses or taxies then at all. A.might have come B. needn't have come C. must have come D. should have come 3. The doctor would allow him to go home ____C_ he remained in bed. A. as though B. for fear that C. on condition that D. as far as 4. One of the most important social problems of today is __C___ jobs to the unemployed. A. what to be given B. having given C. how to give D. to have given 5. The doctor said I was over-weight. If only I __D___ less! A. ate B. have been eating C. have eaten D. had eaten 6. It is said that he got laughed at for __C___. A. his dishonest B. been dishonest C. being dishonest D. to be dishonest 7. A baby animal knows animals of __C___ own kind when it sees them, when it smells them and it hears them. A. her B. one's C. its D. Their 8. After Christmas, __A___ clothing on sale in that shop attracted quite a few housewives. A. a variety of B. a number of C. the number of D. the great deal of 9. The mayor promised the city government ____A_ the building of the new roads with the taxes it collected. A. shall finance B. may support C. can help D. should