姜波克国际金融课后习题答案

国际金融课后答案中文

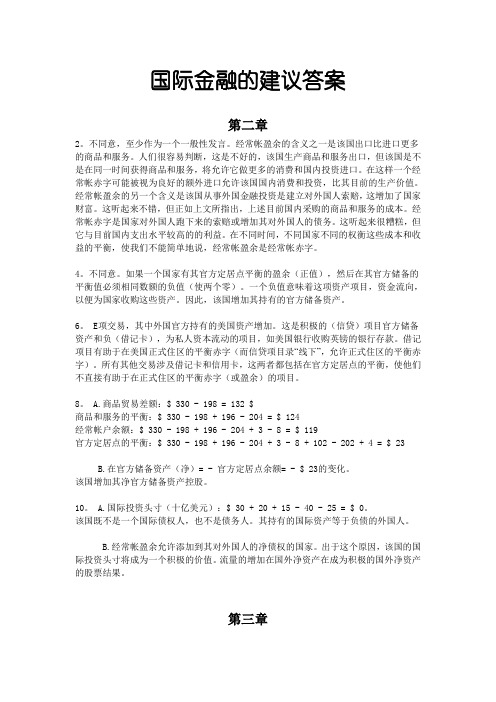

国际金融的建议答案第二章2。

不同意,至少作为一个一般性发言。

经常帐盈余的含义之一是该国出口比进口更多的商品和服务。

人们很容易判断,这是不好的,该国生产商品和服务出口,但该国是不是在同一时间获得商品和服务,将允许它做更多的消费和国内投资进口。

在这样一个经常帐赤字可能被视为良好的额外进口允许该国国内消费和投资,比其目前的生产价值。

经常帐盈余的另一个含义是该国从事外国金融投资是建立对外国人索赔,这增加了国家财富。

这听起来不错,但正如上文所指出,上述目前国内采购的商品和服务的成本。

经常帐赤字是国家对外国人跑下来的索赔或增加其对外国人的债务。

这听起来很糟糕,但它与目前国内支出水平较高的的利益。

在不同时间,不同国家不同的权衡这些成本和收益的平衡,使我们不能简单地说,经常帐盈余是经常帐赤字。

4。

不同意。

如果一个国家有其官方定居点平衡的盈余(正值),然后在其官方储备的平衡值必须相同数额的负值(使两个零)。

一个负值意味着这项资产项目,资金流向,以便为国家收购这些资产。

因此,该国增加其持有的官方储备资产。

6。

E项交易,其中外国官方持有的美国资产增加。

这是积极的(信贷)项目官方储备资产和负(借记卡),为私人资本流动的项目,如美国银行收购英镑的银行存款。

借记项目有助于在美国正式住区的平衡赤字(而信贷项目录“线下”,允许正式住区的平衡赤字)。

所有其他交易涉及借记卡和信用卡,这两者都包括在官方定居点的平衡,使他们不直接有助于在正式住区的平衡赤字(或盈余)的项目。

8。

A.商品贸易差额:$ 330 - 198 = 132 $商品和服务的平衡:$ 330 - 198 + 196 - 204 = $ 124经常帐户余额:$ 330 - 198 + 196 - 204 + 3 - 8 = $ 119官方定居点的平衡:$ 330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $ 23B.在官方储备资产(净)= - 官方定居点余额= - $ 23的变化。

国际金融学章节练习题答案

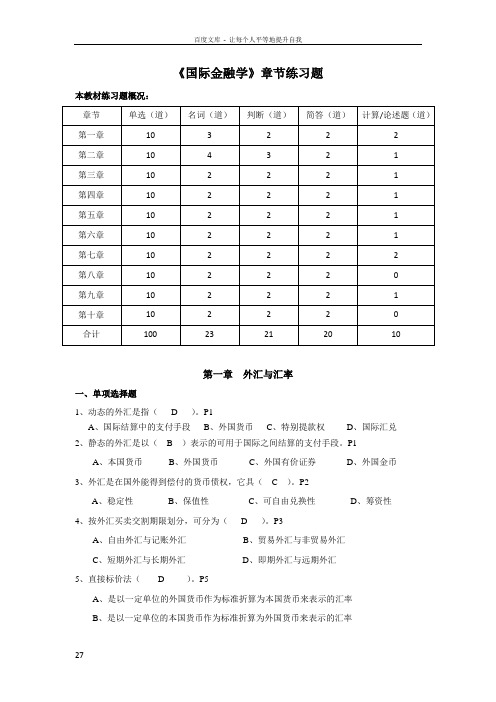

《国际金融学》章节练习题本教材练习题概况:第一章外汇与汇率一、单项选择题1、动态的外汇是指( D )。

P1A、国际结算中的支付手段B、外国货币C、特别提款权D、国际汇兑2、静态的外汇是以( B )表示的可用于国际之间结算的支付手段。

P1A、本国货币B、外国货币C、外国有价证券D、外国金币3、外汇是在国外能得到偿付的货币债权,它具( C )。

P2A、稳定性B、保值性C、可自由兑换性D、筹资性4、按外汇买卖交割期限划分,可分为( D )。

P3A、自由外汇与记账外汇B、贸易外汇与非贸易外汇C、短期外汇与长期外汇D、即期外汇与远期外汇5、直接标价法( D )。

P5A、是以一定单位的外国货币作为标准折算为本国货币来表示的汇率B、是以一定单位的本国货币作为标准折算为外国货币来表示的汇率C、是以美元为标准来表示各国货币的价格D、是以一定单位的本国货币作为标准折算为一定数额的外国货币来表示的汇率6、若某日外汇市场上A银行报价如下:美元/日元:欧元/美元:Z先生要向A银行购入1欧元,要支付多少日元( A )?P5A、B、143.7956 C、D、7、若某日外汇市场上A银行报价如下:美元/日元:美元/加元:Z先生要向A银行卖出10000日元,能获得多少加元( D )?P5A、B、72.20 C、D、8、金本位制下汇率的决定基础是( B )。

P9A、金平价B、铸币平价C、绝对购买力平价D、相对购买力平价9、利率对汇率的变动影响有( C )。

P12A、利率上升,本国汇率上升B、利率下降,本国汇率下降A、需比较国外汇率及本国的通货膨胀率而定D、无法确定10、人民币自由兑换的含义是( A )。

P17A、经常项目的交易中实现的人民币自由兑换B、资本项目的交易中实现的人民币自由兑换C、国内公民个人实现的人民币自由兑换D、经常项目和资本项目下都实现的人民币自由兑换二、名词解释题1、固定汇率:是指一国货币对另一国货币的汇率基本固定,同时将汇率的变动幅度限制在一个规定的较小范围内。

国际金融试题库

国际金融试题库姜波克国际金融学习题国际收支和国际收支平衡表一、单项选择题1.资本项目的利息收入应列入下列国际收支平衡表的哪一个项目中 A.资本项目B.经常项目C.国际储备D.净误差与遗漏2.国际旅游、保险引起的收支属于下列国际收支平衡表中的哪一个项目A.经常项目B.国际储备C.净误差与遗漏D.资本项目3.资本项目中的长期资本是指借贷期为多长的资本A.期限不定B.一年以内C.一年D.一年以上4.当国际收支平衡表中的收入大于支出时,就在“净误差与遗漏”的哪一方加上相差的数字。

A.右方B.左方C.收入方D.支出方5.一国国民收入增加,会引起进口商品与劳务增加,导致国际收支出现下列哪一种情况A.不确定B.不变C.逆差D.顺差6.狭义的国际收支仅指A.贸易收支B.经常项目收支C.外汇收支D.全部对外交易7.国际货币基金组织对国际收支的解释属于下列哪一种收支概念A.狭义的B.广义的C.事前的D.规划性的8.下列哪一项属于劳务收支项目A进口商品支出B国外捐款C侨民汇款D对外投资利润9.特别提款权不能直接用于A.换取外汇B.换回本币C.贸易支付D.归还贷款10.到岸价格中的运费和保险费属于A.无形收支B.有形收支C.转移收支D.资本项目收支11、国际收支基本差额是指()。

A、贸易差额B、经常项目差额C、经常项目差额与长期资本项目差额之和D、经常项目差额与短期资本项目差额之和12、根据《国际收支手册》第五版规定,记在资本金融帐户的是(A、服务收入B、股本收入C、债务核销D、债务收入。

)13、根据国际收支的定义,以下机构的工作人员属于一国居民的是()。

A、联合国C、IMFB、一国国外大使馆D、世界银行集团14、一国经济状况为经济膨胀和经常帐户顺差,采用调整政策是()。

A、紧缩性的货币政策B、扩张性财政政策C、紧缩性的货币政策和紧缩性的财政政策D、扩张性的货币政策和紧缩性的财政政策15、根据国际收支平衡表的记帐原则,属于借方项目的是()。

国际金融测试题库

国际金融试题库姜波克国际金融学习题国际收支和国际收支平衡表一、单项选择题1.资本项目的利息收入应列入下列国际收支平衡表的哪一个项目中A.资本项目B.经常项目C.国际储备D.净误差与遗漏2.国际旅游、保险引起的收支属于下列国际收支平衡表中的哪一个项目A.经常项目B.国际储备C.净误差与遗漏D.资本项目3.资本项目中的长期资本是指借贷期为多长的资本A.期限不定B.一年以内C.一年D.一年以上4.当国际收支平衡表中的收入大于支出时,就在“净误差与遗漏”的哪一方加上相差的数字。

A.右方B.左方C.收入方D.支出方5.—国国民收入增加,会引起进口商品与劳务增加,导致国际收支出现下列哪一种情况A.不确定B.不变C.逆差D.顺差6.狭义的国际收支仅指A.贸易收支B.经常项目收支C.外汇收支D.全部对外交易7.国际货币基金组织对国际收支的解释属于下列哪一种收支概念A.狭义的B.广义的C.事前的D.规划性的8.下列哪一项属于劳务收支项目A进口商品支出B国外捐款C侨民汇款D对外投资利润9.特别提款权不能直接用于A.换取外汇B.换回本币C.贸易支付D.归还贷款10.到岸价格中的运费和保险费属于A.无形收支B.有形收支C.转移收支D.资本项目收支11、国际收支基本差额是指()。

A、贸易差额B、经常项目差额C、经常项目差额与长期资本项目差额之和D、经常项目差额与短期资本项目差额之和12、根据《国际收支手册》第五版规定,记在资本金融帐户的是(A、服务收入B、股本收入C、债务核销D、债务收入o)13、根据国际收支的定义,以下机构的工作人员属于一国居民的是()。

A、联合国C、IMFB、一国国外大使馆D、世界银行集团14、一国经济状况为经济膨胀和经常帐户顺差,采用调整政策是()。

A、紧缩性的货币政策B、扩张性财政政策C、紧缩性的货币政策和紧缩性的财政政策D、扩张性的货币政策和紧缩性的财政政策15、根据国际收支平衡表的记帐原则,属于借方项目的是()。

国际金融课后习题题目

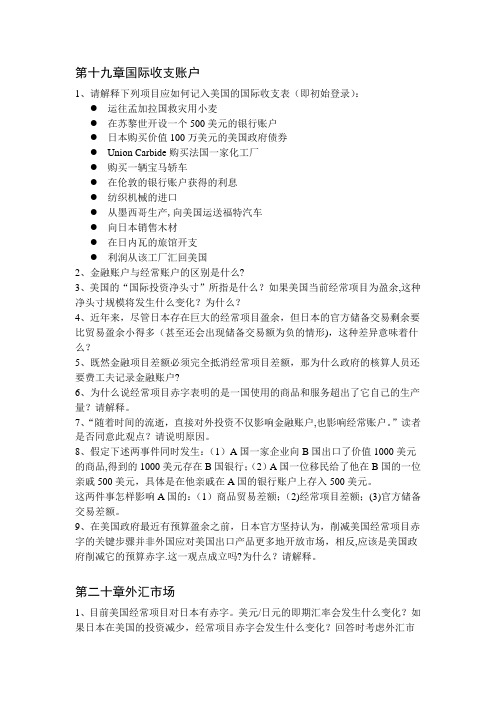

第十九章国际收支账户1、请解释下列项目应如何记入美国的国际收支表(即初始登录):●运往孟加拉国救灾用小麦●在苏黎世开设一个500美元的银行账户●日本购买价值100万美元的美国政府债券●Union Carbide购买法国一家化工厂●购买一辆宝马轿车●在伦敦的银行账户获得的利息●纺织机械的进口●从墨西哥生产,向美国运送福特汽车●向日本销售木材●在日内瓦的旅馆开支●利润从该工厂汇回美国2、金融账户与经常账户的区别是什么?3、美国的“国际投资净头寸”所指是什么?如果美国当前经常项目为盈余,这种净头寸规模将发生什么变化?为什么?4、近年来,尽管日本存在巨大的经常项目盈余,但日本的官方储备交易剩余要比贸易盈余小得多(甚至还会出现储备交易额为负的情形),这种差异意味着什么?5、既然金融项目差额必须完全抵消经常项目差额,那为什么政府的核算人员还要费工夫记录金融账户?6、为什么说经常项目赤字表明的是一国使用的商品和服务超出了它自己的生产量?请解释。

7、“随着时间的流逝,直接对外投资不仅影响金融账户,也影响经常账户。

”读者是否同意此观点?请说明原因。

8、假定下述两事件同时发生:(1)A国一家企业向B国出口了价值1000美元的商品,得到的1000美元存在B国银行;(2)A国一位移民给了他在B国的一位亲戚500美元,具体是在他亲戚在A国的银行账户上存入500美元。

这两件事怎样影响A国的:(1)商品贸易差额;(2)经常项目差额;(3)官方储备交易差额。

9、在美国政府最近有预算盈余之前,日本官方坚持认为,削减美国经常项目赤字的关键步骤并非外国应对美国出口产品更多地开放市场,相反,应该是美国政府削减它的预算赤字.这一观点成立吗?为什么?请解释。

第二十章外汇市场1、目前美国经常项目对日本有赤字。

美元/日元的即期汇率会发生什么变化?如果日本在美国的投资减少,经常项目赤字会发生什么变化?回答时考虑外汇市场。

2、2美元/英镑;0.0075美元/日元和0。

国际金融(第4版)课后题答案

第1章外汇与汇率知识掌握二、单项选择题1.C2. D3.B4.B5.C三、多项选择题1.ABCD2. ABD3. BCDE4. ADE知识应用一、案例分析题1.2015年“8.11”汇改后人民币贬值速度较快,一时间引起阵阵恐慌,加之内地缺少有效投资工具,导致大量中产阶级欲将资金转移至境外以寻求保护。

由于香港与内地特殊的政治经济关系而使其成为避险资金的首选,这属于正常现象。

但如果对此不加以约束,易造成资金外流的恶果。

2.人民币贬值对经济生活的影响可以从不同方面来解读:从进出口的角度看,人民币贬值有利于扩大出口,增强产品的国际竞争力;从资本流动的角度看,人民币的贬值会给投资者带来不安全感,对人民币的信心缺失,抛售人民币资产或将资产转移至境外,造成资本外流,而资本外流会进一步加大人民币贬值压力,从而形成恶性循环。

资本流动情况将直接影响国际储备情况,我国这两年外汇储备变动状况清楚地说明了这一点。

此外,人民币对外贬值对我国走出去战略也会产生一定影响,对于海外求学的人来说更不是利好。

知识掌握二、单项选择题1.B2.C 3.C 4.A5.B 6.B7.A8.B9.D 10.C 11.B12.A13.B 14. C 15. B 16.B 17.B知识应用一、案例分析题1.1950年以后,随着欧洲经济的苏和日本经济的崛起,美国贸易逆差不断扩大,黄金储备不断减少,导致美国无力维持美元官价兑换黄金,并最终停止以美元兑换黄金。

2.在布雷顿森森体系下实行的是以美元为中心的固定汇率制度。

以美元为中心的国际货币制度崩溃的根本原因,是这个制度本身存在着不可调和的矛盾。

一方面,美元作为国际支付手段与国际储备手段,要求美元币值稳定,才会在国际支付中被其他国家所普遍接受。

而美元币值稳定,不仅要求美国有足够的黄金储备,而且要求美国的国际收支必须保持顺差,从而使黄金不断流入美国而增加其黄金储备。

否则,人们在国际支付中就不愿接受美元。

另一方面,全世界要获得充足的外汇储备,又要求美国的国际收支保持逆差,否则全世界就会面临外汇储备短缺。

国际金融第三版课后习题集与答案解析

第一章外汇与外汇汇率Foreign Exchange & Exchange Rate练习题一、填空题练习说明:请结合学习情况在以下段落空白处填充适当的文字,使上下文合乎逻辑。

外汇的概念可以从两个角度来考察:其一,将一国货币兑换成另一国货币的过程,也就是(1)的外汇概念;其二,国际间为清偿债权债务关系进行的汇兑活动所凭借的手段和工具,也就是(2)的外汇概念。

通常意义上的外汇都是指后者。

外汇的主要特征体现在两个方面:外汇是以(3)表示的资产,外汇必须是可以(4)成其他形式的,或者以其他货币表示的资产。

因此,外汇并不仅仅包括可兑换的外国货币,外汇资产的形式有很多,例如,(5),(6),(7)等等。

(8)是外汇这样特殊商品的价格,又称(9),是不同货币之间兑换的比率或者比价,或者说是以一种货币表示的另一种货币的价格。

(10)和间接标价法是两种基本的汇率标价方法。

前者是指以一定单位的外国货币为标准,来计算折合多少单位的本国货币;后者是指以一定单位的本国货币为标准,来计算折合多少单位的外国货币。

目前,国际市场上通行的(11),是以美元作为标准公布外汇牌价。

汇率根据不同的标准可以分为不同的种类,例如,买入价,卖出价和中间价;即期汇率和远期汇率;(12)和套算汇率;电汇汇率,(13)和票汇汇率;官方汇率和市场汇率;贸易汇率和金融汇率;固定汇率和浮动汇率;名义汇率和实际汇率。

19世纪初到20世纪初,西方资本主义国家普遍实行的是(14)制度,各国货币都以黄金铸成,金铸币有一定的重量和成色,有法定含金量;金币可以(15)、(16)、自由输出入,具有无限清偿能力。

在这种货币制度下,汇率是相当稳定的,这是因为,两种货币汇率决定的基础是铸币平价,即两种货币(17)之比。

而各国货币法定的含金量一旦确定,一般不轻易改动,因而铸币平价是比较稳定的。

当然,金本位制度下的汇率同样会根据外汇供求关系的作用而上下浮动。

当某种货币供不应求时,汇价会上涨,超过铸币平价;反之,汇价就会下跌,低于铸币平价。

姜波克《国际金融新编》第6版考研真题精选(简答题)【圣才出品】

姜波克《国际金融新编》第6版考研真题精选四、简答题1.我国近年来一直为“双顺差”,但我国又是资本流出大国,请从国际收支平衡表构成的角度谈一谈这两者是否矛盾。

[复旦大学2018金融硕士]答:(1)国际收支双顺差,一是指经常账户顺差,二是指资本与金融账户(不含储备资产)顺差。

经常账户顺差具体来看,货物项目的差额是经常账户顺差的主要来源,而货物贸易顺差来自货物出口大于进口。

资本与金融账户顺差从国际收支平衡表来看,顺差的主要来源是外国对我国的直接投资,这反映了我国吸引外资从事直接生产的政策和对外国资本进入本国金融市场的管制状况。

(2)资本净流出主要是指资本账户的逆差,也就是资本账户的下辖项目支出大于收入,造成逆差。

资本账户主要包括资本转移和非生产非金融资产的收买或放弃。

资本转移主要包括:①固定资产所有权转移;②同固定资产收买或放弃相联系的或者以其为条件的资产转移;③债权人不索取回报而取消的债务。

非生产、非金融资产的收买或放弃是指各种无形资产如专利、版权、商标、经销权以及租赁和其他可转让合同的交易。

综上所述,从国际收支平衡表来看,资本与金融账户顺差,主要是金融账户的顺差,与资本账户逆差并无矛盾,是可以共存的。

只要金融账户的顺差额大于资本账户的逆差额,那整个资本与金融账户还是顺差的,同经常项目顺差一起构成了双顺差的现象。

(3)中国的双顺差持续了多年,在2015年后我国变成了经常项目顺差和资本与金融账户逆差的情况。

多年的双顺差对中国产生了重大影响,主要有三个方面:①双顺差带来了外汇储备的巨额累积,巨大的储备额实质上是将“双顺差”下以高成本引入的资金又通过购买低回报率美国国债或是增加在美国银行的美元存款等外汇储备资产经营的方式将实际资源“返还”给了外国。

由于外汇数量的充裕,外汇市场上外汇的价格有下降的趋势,人民币则逐步升值,这会对我国经济的总量和结构产生一定影响。

②影响国内宏观调控效果。

为保持人民币汇率稳定,新增顺差只能通过增加外汇储备来消化,这便给中央银行带来巨额的外汇占款压力。

国际金融部分重要课后习题答案

【国际金融】课后习题答案Suggested Answer for International FinanceChap 22. Disagree, at least as a general statement. One meaning of a current account surplus is that the country is exporting more goods and services than it is importing. One might easily judge that this is not good—the country is producing goods and services that are exported, but the country is not at the same time getting the imports of goods and services that would allow it do more consumption and domestic investment. In this way a current account deficit might be considered good—the extra imports allow the country to consume and invest domestically more than the value of its current production. Another meaning of a current account surplus is that the country is engaging in foreign financial investment—it is building up its claims on foreigners, and this adds to national wealth. This sounds good, but as noted above it comes at the cost of foregoing current domestic purchases of goods and services. A current account deficit is the country running down its claims on foreigners or increasing its indebtedness to foreigners. This sounds bad, but it comes with the benefit of higher levels of current domestic expenditure. Different countries at different times may weigh the balance of these costs and benefits differently, so that we cannot simply say that a current account surplus is better than a current account deficit.4. Disagree. If the country has a surplus (a positive value) for its official settlements balance, then the value for its official reserves balance must be a negative value of the same amount (so that the two add to zero). A negative value for this asset item means that funds are flowing out in order for the country to acquire more of these kinds of assets. Thus, the country is increasing its holdings of official reserve assets.6. Item e is a transaction in which foreign official holdings ofU.S.assets increase. This is a positive (credit) item for official reserve assets and a negative (debit) item for private capital flows as the U.S. bank acquires pound bank deposits. The debit item contributes to aU.S.deficit in the official settlements balance (while the credit item is recorded "below the line," permitting the official settlements balance to be in deficit). All other transactions involve debit and credit items both of which are included in the official settlements balance, so that they do not directly contribute to a deficit (or surplus) in the official settlements balance.8. a. Merchandise trade balance: $330 - 198 = $132Goods and services balance: $330 - 198 + 196 - 204 = $124Current account balance: $330 - 198 + 196 - 204 + 3 - 8 = $119Official settlements balance: $330 - 198 + 196 - 204 + 3 - 8 + 102 - 202 + 4 = $23b. Change in official reserve assets (net) = - official settlements balance = -$23.The country is increasing its net holdings of official reserve assets. 10. a. International investment position (billions): $30 + 20 + 15 - 40 - 25 = $0.The country is neither an international creditor nor a debtor. Its holding of international assets equals its liabilities to foreigners.b. A current account surplus permits the country to add to its net claims on foreigners. For this reason the country's international investment position will become a positive value. The flow increase in net foreign assets results in the stock of net foreign assets becoming positive.Chap 32. Exports of merchandise and services result in supply of foreign currency in the foreign exchange market. Domestic sellers often want to be paid using domestic currency, while the foreign buyers want to pay in their currency. In the process of paying for these exports, foreign currency is exchanged for domestic currency, creating supply of foreign currency. International capital inflows result in a supply of foreign currency in the foreign exchange market. In making investments in domestic financial assets, foreigninvestors often start with foreign currency and must exchange it for domestic currency before they can buy the domestic assets. The exchange creates a supply of foreign currency. Sales of foreign financial assets that the country's residents had previously acquired, and borrowing from foreigners by this country's residents are other forms of capital inflow that can create supply of foreign currency.4. TheU.S.firm obtains a quotation from its bank on the spot exchange rate for buying yen with dollars. If the rate is acceptable, the firm instructs its bank that it wants to use dollars from its dollar checking account to buy 1 million yen at this spot exchange rate. It also instructs its bank to send the yen to the bank account of the Japanese firm. To carry out this instruction, the U.S. bank instructs its correspondent bank inJapanto take 1 million yen from its account at the correspondent bank and transfer the yen to the bank account of the Japanese firm. (The U.S. bank could also use yen at its own branch if it has a branch inJapan.)6. The trader would seek out the best quoted spot rate for buying euros with dollars, either through direct contact with traders at other banks or by using the services of a foreign exchange broker. The trader would use the best rate to buy euro spot. Sometime in the next hour or so (or, typically at least by the end of the day), the trader will enter the interbank market again, to obtain the best quoted spot rate for selling euros for dollars. The trader will use the best spot rate to sell her previously acquired euros. If the spot value of the euro has risen during this short time, the trader makes a profit.8. a. The cross rate between the yen and the krone is too high (the yen value of the krone is too high) relative to the dollar-foreign currency exchange rates. Thus, in a profitable triangular arbitrage, you want to sell kroner at the high cross rate. The arbitrage will be: Use dollars to buy kroner at $0.20/krone, use these kroner to buy yen at 25 yen/krone, and use the yen to buy dollars at $0.01/yen. For each dollar that you sell initially, you can obtain 5 kroner, these 5 kroner can obtain 125 yen, and the 125 yen can obtain $1.25. The arbitrage profit for each dollar is therefore 25 cents.b. Selling kroner to buy yen puts downward pressure on the cross rate (the yen price of krone). The value of the cross rate must fall to 20 (=0.20/0.01)yen/krone to eliminate the opportunity for triangular arbitrage, assuming that the dollar exchange rates are unchanged.10. a. The increase in supply of Swiss francs puts downward pressure on the exchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.b. The increase in supply of francs puts downward pressure on the exchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.c. The increase in supply of francs puts downward pressure on the exchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.d. The decrease in demand for francs puts downward pressure on the exchange-rate value ($/SFr) of the franc. The monetary authorities must intervene to defend the fixed exchange rate by buying SFr and selling dollars.Chap 42. You will need data on four market rates: The current interest rate (or yield) on bonds issued by the U.S. government that mature in one year, the current interest rate (or yield) on bonds issued by the British government that mature in one year, the current spot exchange rate between the dollar and pound, and the current one-year forward exchange rate between the dollar and pound. Do these rates result in a covered interest differential that is very close to zero?4. a. TheU.S.firm has an asset position in yen—it has a long position in yen. To hedge its exposure to exchange rate risk, the firm should enter into a forward exchange contract now in which the firm commits to sell yen andreceive dollars at the current forward rate. The contract amounts are to sell 1 million yen and receive $9,000, both in 60 days.b. The student has an asset position in yen—a long position in yen. To hedge the exposure to exchange rate risk, the student should enter into a forward exchange contract now in which the student commits to sell yen and receive dollars at the current forward rate. The contract amounts are to sell 10 million yen and receive $90,000, both in 60 days.c. TheU.S.firm has an liability position in yen—a short position in yen. To hedge its exposure to exchange rate risk, the firm should enter into a forward exchange contract now in which the firm commits to sell dollars and receive yen at the current forward rate. The contract amounts are to sell $900,000 and receive 100 million yen, both in 60 days.6. Relative to your expected spot value of the euro in 90 days($1.22/euro), the current forward rate of the euro ($1.18/euro) is low—the forward value of the euro is relatively low. Using the principle of "buy low, sell high," you can speculate by entering into a forward contract now to buy euros at $1.18/euro. If you are correct in your expectation, then in 90 days you will be able to immediately resell those euros for $1.22/euro, pocketing a profit of $0.04 for each euro that you bought forward. If many people speculate in this way, then massive purchases now of euros forward (increasing the demand for euros forward) will tend to drive up the forward value of the euro, toward a current forward rate of $1.22/euro.8. a. The Swiss franc is at a forward premium. Its current forward value ($0.505/SFr) is greater than its current spot value ($0.500/SFr).b. The covered interest differential "in favor ofSwitzerland" is ((1 +0.005)×(0.505) / 0.500) - (1 + 0.01) = 0.005. (Note that the interest rate used must match the time period of the investment.) There is a covered interest differential of 0.5% for 30 days (6 percent at an annual rate). TheU.S.investor can make a higher return, covered against exchange rate risk, by investing in SFr-denominated bonds, so presumably the investor should make this coveredinvestment. Although the interest rate on SFr-denominated bonds is lower than the interest rate on dollar-denominated bonds, the forward premium on the franc is larger than this difference, so that the covered investment is a good idea.c. The lack of demand for dollar-denominated bonds (or the supply of these bonds as investors sell them in order to shift into SFr-denominated bonds) puts downward pressure on the prices ofU.S.bonds—upward pressureonU.S.interest rates. The extra demand for the franc in the spot exchange market (as investors buy SFr in order to buy SFr-denominated bonds) puts upward pressure on the spot exchange rate. The extra demand forSFr-denominated bonds puts upward pressure on the prices of Swiss bonds—downward pressure on Swiss interest rates. The extra supply of francs in the forward market (asU.S.investors cover their SFr investments back into dollars) puts downward pressure on the forward exchange rate. If the only rate that changes is the forward exchange rate, this rate must fall to about$0.5025/SFr. With this forward rate and the other initial rates, the covered interest differential is close to zero.10. In testing covered interest parity, all of the interest rates and exchange rates that are needed to calculate the covered interest differential are rates that can observed in the bond and foreign exchange markets. Determining whether the covered interest differential is about zero (covered interest parity) is then straightforward (although some more subtle issues regarding timing of transactions may also need to be addressed). In order to test uncovered interest parity, we need to know not only three rates—two interest rates and the current spot exchange rate—that can be observed in the market, but also one rate—the expected future spot exchange rate—that is not observed in any market. The tester then needs a way to find out about investors' expectations. One way is to ask them, using a survey, but they may not say exactly what they really think. Another way is to examine the actual uncovered interest differential after we know what the future spot exchange rate actually turns out to be, and see whether the statistical characteristics of the actual uncovered differential are consistent with an expected uncovered differential of about zero (uncovered interest parity).Chap 52. a. The euro is expected to appreciate at an annual rate of approximately ((1.005 - 1.000)/1.000)×(360/180)×100 = 1%. The expected uncovered interest differential is approximately 3% + 1% - 4% = 0, so uncovered interest parity holds (approximately).b. If the interest rate on 180-day dollar-denominated bonds declines to 3%, then the spot exchange rate is likely to increase—the euro will appreciate, the dollar depreciate. At the initial current spot exchange rate, the initial expected future spot exchange rate, and the initial euro interest rate, the expected uncovered interest differential shifts in favor of investing in euro-denominated bonds (the expected uncovered differential is now positive, 3% + 1% - 3% = 1%, favoring uncovered investment in euro-denominated bonds. The increased demand for euros in the spot exchange market tends to appreciate the euro. If the euro interest rate and the expected future spot exchange rate remain unchanged, then the current spot rate must change immediately to be $1.005/euro, to reestablish uncovered interest parity. When the current spot rate jumps to this value, the euro's exchange rate value is not expected to change in value subsequently during the next 180 days. The dollar has depreciated immediately, and the uncovered differential then again is zero (3% + 0% - 3% = 0).4. a. For uncovered interest parity to hold, investors must expect that the rate of change in the spot exchange-rate value of the yen equals the interest rate differential, which is zero. Investors must expect that the future spot value is the same as the current spot value, $0.01/yen.b. If investors expect that the exchange rate will be $0.0095/yen, then they expect the yen to depreciate from its initial spot value during the next 90 days. Given the other rates, investors tend to shift their investments towarddollar-denominated investments. The extra supply of yen (and demand for dollars) in the spot exchange market results in a decrease in the current spot value of the yen (the dollar appreciates). The shift to expecting that the yen will depreciate (the dollar appreciate) sometime during the next 90 days tends to cause the yen to depreciate (the dollar to appreciate) immediately in the current spot market.6. The law of one price will hold better for gold. Gold can be traded easily so that any price differences would lead to arbitrage that would tend to push gold prices (stated in a common currency by converting prices using market exchange rates) back close to equality. Big Macs cannot be arbitraged. If price differences exist, there is no arbitrage pressure, so the price differences can persist. The prices of Big Macs (stated in a common currency) vary widely around the world.8. According to PPP, the exchange rate value of the DM (relative to the dollar) has risen since the early 1970s because Germany has experienced less inflation than has the United States—the product price level has risen less in Germany since the early 1970s than it has risen in the United States. According to the monetary approach, the German price level has not risen as much because the German money supply has increased less than the money supply has increased in theUnited States, relative to the growth rates of real domestic production in the two countries. The British pound is the opposite case—more inflation inBritainthan in theUnited States, and higher money growth inBritain.10. a. Because the growth rate of the domestic money supply (M s) is two percentage points higher than it was previously, the monetary approach indicates that the exchange rate value (e) of the foreign currency will be higher than it otherwise would be—that is, the exchange rate value of the country's currency will be lower. Specifically, the foreign currency will appreciate by two percentage points more per year, or depreciate by two percentage points less. That is, the domestic currency will depreciate by two percentage points more per year, or appreciate by two percentage points less.b. The faster growth of the country's money supply eventually leads to a faster rate of inflation of the domestic price level (P). Specifically, the inflation rate will be two percentage points higher than it otherwise would be. According to relative PPP, a faster rate of increase in the domestic price level (P) leads toa higher rate of appreciation of the foreign currency.12. a. For theUnited Statesin 1975, 20,000 = k×100×800, or k = 0.25.For Pugelovia in 1975, 10,000 = k×100×200, or k = 0.5.b. For theUnited States, the quantity theory of money with a constant k means that the quantity equation with k = 0.25 should hold in 2002: 65,000 = 0.25×260×1,000. It does. Because the quantity equation holds for both years with the same k, the change in the price level from 1975 to 2002 is consistent with the quantity theory of money with a constant k. Similarly, for Pugelovia, the quantity equation with k = 0.5 should hold for 2002, and it does (58,500 = 0.5×390×300).14.a. The tightening typically leads to an immediate increase in the country's interest rates. In addition, the tightening probably also results in investors' expecting that the exchange-rate value of the country's currency is likely to be higher in the future. The higher expected exchange-rate value for the currency is based on the expectation that the country's price level will be lower in the future, and PPP indicates that the currency will then be stronger. For both of these reasons, international investors will shift toward investing in this country's bonds. The increase in demand for the country's currency in the spot exchange market causes the current exchange-rate value of the currency to increase. The currency may appreciate a lot because the current exchange rate must "overshoot" its expected future spot value. Uncovered interest parity is reestablished with a higher interest rate and a subsequent expected depreciation of the currency.b. If everything else is rather steady, the exchange rate (the domestic currency price of foreign currency) is likely to decrease quickly by a large amount. After this jump, the exchange rate may then increase gradually toward its long-run value—the value consistent with PPP in the long run.Chap 62. We often use the term pegged exchange rate to refer to a fixed exchange rate, because fixed rates generally are not fixed forever. An adjustable peg is an exchange rate policy in which the "fixed" exchange rate value of a currency can be changed from time to time, but usually it is changed rather seldom (for instance, not more than once every several years). Acrawling peg is an exchange rate policy in which the "fixed" exchange rate value of a currency is changed often (for instance, weekly or monthly), sometimes according to indicators such as the difference in inflation rates.4. Disagree. If a country is expected to impose exchange controls, which usually make it more difficult to move funds out of the country in the future, investors are likely to try to shift funds out of the country now before the controls are imposed. The increase in supply of domestic currency into the foreign exchange market (or increase in demand for foreign currency) puts downward pressure on the exchange rate value of the country's currency—the currency tends to depreciate.6. a. The market is attempting to depreciate the pnut (appreciate the dollar) toward a value of 3.5 pnuts per dollar, which is outside of the top of the allowable band (3.06 pnuts per dollar). In order to defend the pegged exchange rate, the Pugelovian monetary authorities could use official intervention to buy pnuts (in exchange for dollars). Buying pnuts prevents the pnut’s value from declining (selling dollars prevents the dollar’s value from rising). The intervention satisfies the excess private demand for dollars at the current pegged exchange rate.b. In order to defend the pegged exchange rate, the Pugelovian government could impose exchange controls in which some private individuals who want to sell pnuts and buy dollars are told that they cannot legally do this (or cannot do this without government permission, and not all requests are approved by the government). By artificially restricting the supply of pnuts (and the demand for dollars), the Pugelovian government can force the remaining private supply and demand to "clear" within the allowable band. The exchange controls attempt to stifle the excess private demand for dollars at the current pegged exchange rate.c. In order to defend the pegged exchange rate, the Pugelovian government could increase domestic interest rates (perhaps by a lot). The higher domestic interest rates shift the incentives for international capital flows toward investments in Pugelovian bonds. The increased flow of international financial capital into Pugelovia increases the demand for pnuts on the foreign exchange market. (Also, the decreased flow of international financial capitalout of Pugelovia reduces the supply of pnuts on the foreign exchange market.) By increasing the demand for pnuts (and decreasing the supply), the Pugelovian government can induce the private market to clear within the allowable band. The increased domestic interest rates attempt to shift the private supply and demand curves so that there is no excess private demand for dollars at the current pegged exchange rate value.8. a. The gold standard was a fixed rate system. The government of each country participating in the system agreed to buy or sell gold in exchange for its own currency at a fixed price of gold (in terms of its own currency). Because each currency was fixed to gold, the exchange rates between currencies also tended to be fixed, because individuals could arbitrage between gold and currencies if the currency exchange rates deviated from those implied by the fixed gold prices.b.Britainwas central to the system, because the British economy was the leader in industrialization and world trade, and becauseBritainwas considered financially secure and prudent.Britainwas able and willing to run payments deficits that permitted many other countries to run payments surpluses. The other countries used their surpluses to build up their holdings of gold reserves (and of international reserves in the form of sterling-denominated assets). These other countries were satisfied with the rate of growth of their holdings of liquid reserve assets, and most countries were able to avoid the crisis of running low on international reserves.c. During the height of the gold standard, from about 1870 to 1914, the economic shocks to the system were mild. A major shock—World War I—caused many countries to suspend the gold standard.d. Speculation was generally stabilizing, both for the exchange rates between the currencies of countries that were adhering to the gold standard, and for the exchange rates of countries that temporarily allowed their currencies to float.10. a. The Bretton Woods system was an adjustable pegged exchange rate system. Countries committed to set and defend fixed exchange rates, financing temporary payments imbalances out of their official reserve holdings. If a "fundamental disequilibrium" in a country's international payments developed, the country could change the value of its fixed exchange rate to a new value.b. TheUnited Stateswas central to the system. As the Bretton Woods system evolved, it became essentially a gold-exchange standard. The monetary authorities of other countries committed to peg the exchange rate values of their currencies to the U.S. dollar. TheU.S.monetary authority committed to buy and sell gold in exchange for dollars with other countries' monetary authorities at a fixed dollar price of gold.c. To a large extent speculation was stabilizing, both for the fixed rates followed by most countries, and for the exchange rate value of the Canadian dollar, which floated during 1950-62. However, the pegged exchange rate values of currencies sometimes did come under speculative pressure. International investors and speculators sometimes believed that they had a one-way speculative bet against currencies that were considered to be "in trouble.” If the country did manage to defend the pegged exchange rate value of its currency, the investors betting against the currency would lose little. They stood to gain a lot of profit if the currency was devalued. Furthermore, the large speculative flows against the currency required large interventions to defend the currency's pegged value, so that the government was more likely to run so low on official reserves that it was forced to devalue.12. a. The dollar bloc and the euro bloc. A number of countries peg their currencies to the U.S. dollar. A number of European countries use the euro, and, in addition, a number of other countries peg their currencies to the euro.b. The other major currencies that float independently include (as of the beginning of 2002) the Japanese yen, the British pound, the Canadian dollar, and the Swiss franc.c. The exchange rates between the U.S. dollar and the other major currencies have been floating since the early 1970s. The movements in these rates exhibit trends in the long run—over the entire period since the early 1970s. The rates also show substantial variability or volatility in the short and medium runs—periods of less than one year to periods of several years. The long run trends appear to be reasonably consistent with the economic fundamentals emphasized by purchasing power parity—differences in national inflation rates. The variability or volatility in the short or medium run is controversial. It may simply represent rational responses to the continuing flow of economic and political news that has implications for exchange rate values. The effects on rates can be large and rapid, because overshooting occurs as rates respond to important news. However, some part of the large volatility may also reflect speculative bandwagons that lead to bubbles that subsequently burst.Chap 82. Disagree. The recession in theUnited StatesreducesU.S.national income, soU.S.residents reduce spending on all kinds of things, including spending on imports. The decrease inU.S.imports is a decrease in the exports of other countries, includingEurope’s exports to theUnited States. The reduction in European exports reduces production inEurope, so the growth of real GDP inEuropedeclines. A recession in theUnited Statesis likely to lower the growth of European real GDP.4. a. The spending multiplier in this small open economy is about 1.82 (=1/(0.15 + 0.4)). If real spending initially declines by $2 billion, then domestic product and income will decline by about $3.64 billion (= 1.82 ´ $2 billion)b. If domestic product and income decline by $3.64 billion, then the country's imports will decline by about $1.46 billion (= $3.64 billion ´ 0.4).c. The decrease in this country's imports reduces other countries' exports, so foreign product and income decline.。

国际金融课后作业答案第136章

国际⾦融课后作业答案第136章国际⾦融课后作业答案:第1、3、章6.第⼀章国际收⽀⼀、基本概念(对照课本)国际收⽀、国际收⽀平衡表、国际收⽀失衡、⾃主性国际经济交易、“⽶德冲突”、“丁伯根法则”⼆、任意项选择:1、国际收⽀统计所指的“居民”是指在⼀国经济领⼟上具有经济利益,且居住期限在⼀年以上的法⼈和⾃然⼈。

它包括---------。

ABA、该国政府及其职能部门B、外国设在该国的企业C、外国政府驻该国⼤使馆D、外国到该国留学⼈员2、国际收⽀记录的经济交易包括--------。

ABCDA、海外投资利润转移;B、政府间军事援助;C、商品贸易收⽀;D、他国爱⼼捐赠3、国际收⽀经常项⽬包含的经济交易有-------。

ACDA、商品贸易B、债务减免C、投资收益收⽀D、政府单⽅⾯转移收⽀4、国际收⽀⾦融帐户包含的经济交易有-------。

ABCDA、海外直接投资;B、国际证券投资;C、资本转移;D、⾮⽣产⾮⾦融资产购买与放弃5、国际收⽀平衡表的调节性交易包括----------。

AA、⾮⽣产⾮⾦融资产购买与放弃;B、职⼯报酬收⽀;C、国际直接投资;D、官⽅储备资产变动6、国际收⽀平衡表的平衡项⽬是指---------。

DA、经常项⽬;B、资本项⽬;C、⾦融项⽬;D、错误与遗漏7、国际收⽀记帐⽅法是---------。

CA、收付法;B、增减法;C、借贷法;D、总计法8、商品与服务进出⼝应计⼊国际收⽀平衡表的--------。

BA、错误与遗漏项⽬;B、经常项⽬;C、资本项⽬;D、⾦融项⽬9、投资收益的收⽀应计⼊国际收⽀平衡表的--------。

BA、错误与遗漏项⽬;B、经常项⽬;C、资本项⽬;D、⾦融项⽬10、政府提供或接受的国际经济和军事援助应计⼊国际收⽀平衡表的-------B。

A、错误与遗漏项⽬;B、经常项⽬;C、资本项⽬;D、⾦融项⽬11、⼀国提供或接受国际债务注销应计⼊国际收⽀平衡表的--------C。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

学习必备 欢迎下载 习题答案 第一章 国际收支 本章重要概念 国际收支:国际收支是指一国或地区居民与非居民在一定时期内全部经济交易的货币价值之和。它体现的是一国的对外经济交往,是货币的、流量的、事后的概念。

国际收支平衡表:国际收支平衡表是将国际收支根据复式记账原则和特定账户分类原则编制出来的会计报表。它可分为经常项目、资本和金融项目以及错误和遗漏项目三大类。

丁伯根原则:1962 年,荷兰经济学家丁伯根在其所著的《经济政策:原理与设计》一书中提出:要实现若干个独立的政策目标,至少需要相互独立的若干个有效的政策工具。这一观点被称为“丁伯根原则”。

米德冲突:英国经济学家米德于1951 年在其名著《国际收支》当中最早提出了固定汇率制度下内外均衡冲突问题。米德指出,如果我们假定失业与通货膨胀是两种独立的情况,那么,单一的支出调整政策(包括财政、货币政策)无法实现内部均衡和外部均衡的目标。

分派原则:这一原则由蒙代尔提出,它的含义是:每一目标应当指派给对这一目标有相对最大的影响力,因而在影响政策目标上有相对优势的工具。

自主性交易:亦称事前交易,是指交易当事人自主地为某项动机而进行的交易。 国际收支失衡:国际收支失衡是指自主性交易发生逆差或顺差,需要用补偿性交易来弥补。它有不同的分类,根据时间标准进行分类,可分为静态失衡和动态失衡;根据国际收支的内容,可分为总量失衡和结构

失衡;根据国际收支失衡时所采取的经济政策,可分为实际失衡和潜在失衡。 复习思考题 1. 一国国际收支平衡表的经常账户是赤字的同时,该国的国际收支是否可能盈余,为什么? 答:可能,通常人们所讲的国际收支盈余或赤字就是指综合差额的盈余或赤字.这里综合差额的盈余或赤字 不仅包括经常账户,还包括资本与金融账户,这里,资本与金融账户和经常账户之间具有融资关系。但是, 随着国际金融一体化的发展,资本和金融账户与经常账户之间的这种融资关系正逐渐发生深刻变化。一方 面,资本和金融账户为经常账户提供融资受到诸多因素的制约。另一方面,资本和金融账户已经不再是被 动地由经常账户决定,并为经常账户提供融资服务了。而是有了自己独立的运动学习必备 欢迎下载 规律。因此,在这种情况下,一国国际收支平衡表的经常账户是赤字的同时,该国的国际收支也可能是盈余。

2.怎样理解国际收支的均衡与失衡? 答:由于一国的国际收支状况可以从不同的角度分析,因此,国际收支的均衡与失衡也由多种含义。 国际收支平衡的几种观点: 一,自主性交易与补偿性交易,它认为国际收支的平衡就是指自主性交易的平衡; 二,静态平衡与动态平衡的观点,静态平衡是指在一定时期内国际收支平衡表的收支相抵,差额为零的一种平衡模式。它注重强调期末时点上的平衡。动态平衡是指在较长的计划期内经过努力,实现期末国际收支的大体平衡。这种平衡要求在同际收支平衡的同时,达到政府所期望的经济目标; 三,局部均衡与全面均衡的观点,局部均衡观点认为外汇市场的平衡时国际收支平衡的基础,因此,要达到国际收支平衡,首先必须达到市场平衡。全面均衡是指在整个经济周期内国际收支自主性项目为零的平衡。 国际收支失衡要从几个方面进行理解,首先是国际收支失衡的类型,一,根据时间标准进行分类,可分为静态失衡和动态失衡。二,根据国际收支的内容,可分为总量失衡和结构失衡。三,根据国际收支失衡时所采取的经济政策,可分为实际失衡和潜在失衡。其次,国际收支不平衡的判定标准,一,账面平衡与实 际平衡;二,线上项目与线下项目;三,自主性收入与自主性支出。最后,国际收支不平衡的原因,导致国际收支失衡的原因是多方面的,周期性的失衡,结构性失衡,货币性失衡,收入性失衡,贸易竞争性失衡,过度债务性失衡,其他因素导致的临时性失衡。

3.国际收支平衡表的各项目之间有什么关系? 答:国际收支平衡表由三大项目组成,一是经常项目,二是资本与金融项目,三是错误与遗漏项目。经常项目是指货物,服务,收入和经常转移;资本与金融项目是指资本转移、非生产、非金融资产交易以及其他所有引起一经济体对外资产和负债发生变化的金融账户;错误与遗漏项目是人为设置的项目,目的是为了使国际收支平衡表借方和贷方平衡。首先,根据复式记账原理,借方和贷方最终必然相等,因此,经常项目与资本与金融项目中任何一个出现赤字或盈余,势必会伴随另一个项目的盈余或赤字;其次,经常项目与资本与金融项目有融资的关系,经常项目中实际资源的流动与资本和金融项目中资产所有权的流动是同一问题的两个方面,但是,随着国际金融一体化的发展,这种融资关系正在逐渐的减弱,资本与经常项目不在被动从属与经常项目,而是具有了自己独立的运动规律。错误与遗漏项目是根据经常项目和资本于金融项目的不平衡而设立的,如果前两个项目总和是借方差额,那么它就在贷方记相同金额,反之则反之。

4.请简述国际收支不平衡的几种原因。 答:导致国际收支失衡的原因是多方面的,既有客观的,又有主观的;既有内部的,又有外部的;既有经济的又有非经济的;既有经济发展阶段的,又有经济结构的。而且这些因素往往不是单独而是混合地发生作用。它主要有:1.周期性失衡,2.结构性失衡,3.货币性失衡,4.收入性失衡,5.贸易竞争性 学习必备 欢迎下载 失衡,6.过度债务性失衡,7.其他因素导致的临时性失衡。以上几方面原因不是截然分开的,而且,固定汇率制与浮动汇率制下国际收支不平衡,发展中国家与发达国家国际收支不平衡都是有区别和联系的。

5.汇率在国际收支失衡的协调中究竟意义何在? 答:在国际收支失衡的调节中,有一类是市场自动调节机制,另一类为各国政府的政策调节,在前一类的调节机制中,在浮动汇率制下,国际收支的调节是通过汇率的变动来实现的,如当一国的国际收支为赤字时,外汇市场上的外汇需求会大于外汇供给,汇率上升,这将导致进口增加,出口减少,国际收支得到改善。当自动调节机制不能完全解决国际收支失衡时,各国政府就会采取不同的政策进行调节,汇率政策就是其中的一类, 如当一国的国际收支发生逆差时,该国可使本国货币贬值,以增强本国商品在国外的竞争力,扩大出口;同时,国外商品的本币价格上升,竞争力下降,进口减少,国际收支逐步恢复平衡。由此可见,汇率无论是在自动调节还是政策调节中都发挥着重要的作用,汇率的上升下降不仅引起外汇市场供求的变化,更重要的是,他将导致进出口贸易的变化,使得国际收支失衡得以解决。

6.一国应该如何选择政策措施来调节国际收支的失衡? 答:一国的国际收支失衡的调节,首先取决于国际收支失衡的性质,其次取决于国际收支失衡时国内社会和宏观经济结构,再次取决于内部均衡与外部平衡之间的相互关系,由于有内外均衡冲突的存在。正确的政策搭配成为了国际收支调节的核心。国际收支失衡的政策调节包括有:货币政策,财政政策,汇率政策,直接管制政策,供给调节政策等,要相机的选择搭配使用各种政策,以最小的经济和社会代价达到国际收支的平衡或均衡。其次,在国际收支的国际调节中,产生了有名的“丁伯根原则”,“米德冲突”,“分派原则”,他们一起确定了开放经济条件下政策调控的基本思想,即针对内外均衡目标,确定不同政策工具的指 派对象,并且尽可能地进行协调以同时实现内外均衡。这就是政策搭配,比较有影响的政策搭配方法有:蒙代尔提出用财政政策和货币政策的搭配;索尔特和斯旺提出用支出转换政策和支出增减政策的搭配。

7.如何看待我国国际收支平衡表经常项目的变化?它们说明了什么? 答:2004 年,我国国际收支经常项目实现顺差686.59 亿美元,同比增长50%,就具体项目而言,表现在: 货物项下顺差规模较2003 年上升。根据国际收支统计口径,2004 年,我国货物贸易顺差289.82 亿美元,同比增长32%,其中出口5933.93 亿美元,进口5344.10 亿美元,同比分别增长35%和36%。2004 年我国进出口高速增长得益于全球经济复苏和国内经济快速发展,我国出口退税机制改革基本解决出口欠退税问题,改善了出口企业资金状况。在国际经济形势逐步好转、加入世界贸易组织后的积极影响等因素作用下,我国外贸出口增长较快。服务贸易规模进一步扩大。2004 年我国服务项下的收入与支出分别达到624.34 亿美元和721.33 亿美元,同比分别增长34%和30%。服务项下逆差呈现扩大趋势,达到96.99 亿美元,同比增长13%。

从具体构成看,运输是服务项目逆差的主要因素。国际旅游收支和其他商业服务为顺差。此外,我国保险服务、专有权利使用费和特许费、咨询项下逆差较大。学习必备 欢迎下载 项目逆差扩大表明,随着我国对世界贸易组织各项承诺的落实,我国服务行业竞争力有待提高。收益项下逆差规模有所下降。2004 年,我国收益项下收入205.44 亿美元,同比增长28%。支出240.67 亿美元,同比增长1%。随着外国来华直接投资规模的不断扩大,收益项下利润汇出有所增长,但收益再投资规模较小。经常转移项下流入增长较快。2004 年,经常转移顺差规模达到228.98 亿美元,同比增长30%,大大高于往年水平。其中,经常转移收入243.26 亿美元,支出14.28 亿美元。我国居民个人来自境外的侨汇收入增长,是经常转移呈现大幅顺差的主要原因。

第二章 外汇、汇率和外汇市场 本章重要概念 直接标价法:指以一定单位的外国货币作为标准,折算为一定数额的本国货币来表示其汇率。

间接标价法:指以一定单位的本国货币为标准,折算为一定数额的外国货币来表示其汇率。

即期汇率:指外汇买卖的双方在成交后的两个营业日内办理交割手续时所使用的汇率。

远期汇率:指外汇买卖的双方事先约定,据以在未来约定的期限办理交割时所使用的汇率。

基本汇率:在制定汇率时,选择某一货币为关键货币,并制订出本币对关键货币的汇率,它是确定本币与其他外币之间的汇率的基础。

套算汇率:指两种货币通过各自对第三种货币的汇率而算得的汇率。 即期外汇交易:指买卖双方约定于成交后的两个营业日内交割的外汇交易。 远期外汇交易:指外汇买卖成交后并不立即办理交割,而是根据合同的规定,在约定的日期按约定的汇率办理交割的外汇交易。

铸币平价:在典型的金本位制度下,两种货币之间含金量之比。 黄金输送点:指在金本位制度下外汇汇率波动引起黄金输出和输入国境的界限,它等于铸币平价加(减)运送黄金的费用。

复习思考题 1.试述外汇、汇率的基本含义和不同汇率标价法。