会计专业英语模拟题(开卷)

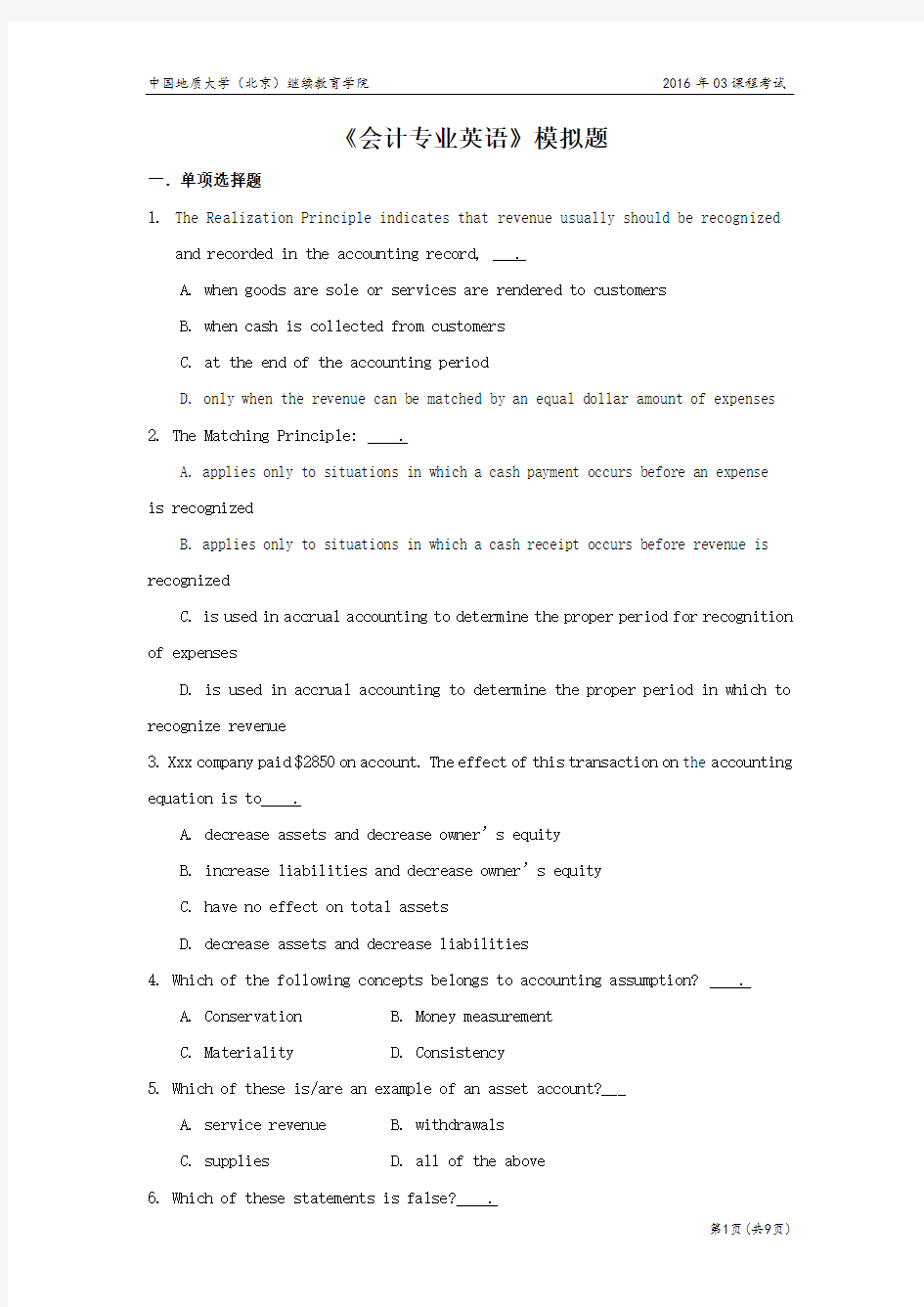

《会计专业英语》模拟题

一.单项选择题

1.The Realization Principle indicates that revenue usually should be recognized

and recorded in the accounting record, .

A. when goods are sole or services are rendered to customers

B. when cash is collected from customers

C. at the end of the accounting period

D. only when the revenue can be matched by an equal dollar amount of expenses

2. The Matching Principle: .

A. applies only to situations in which a cash payment occurs before an expense is recognized

B. applies only to situations in which a cash receipt occurs before revenue is recognized

C. is used in accrual accounting to determine the proper period for recognition of expenses

D. is used in accrual accounting to determine the proper period in which to recognize revenue

3. Xxx company paid $2850 on account. The effect of this transaction on the accounting equation is to .

A. decrease assets and decrease owner’s equity

B. increase liabilities and decrease owner’s equity

C. have no effect on total assets

D. decrease assets and decrease liabilities

4. Which of the following concepts belongs to accounting assumption? .

A. Conservation

B. Money measurement

C. Materiality

D. Consistency

5. Which of these is/are an example of an asset account?___

A. service revenue

B. withdrawals

C. supplies

D. all of the above

6. Which of these statements is false? .

A. increase in assets and increase in revenues are recorded with a debit

B. increase in liabilities and increase in owner’s e quity are recorded with

a credit

C. increase in both assets and withdrawals are recorded with a debit

D. decreases in liabilities and increase in expenses are recorded with a debit

二.判断题

1. Accounting provides financial information that is only useful to business management. ( )

2. The accounting process generates financial reports for both “internal” and “external” users. ( )

3. The basic concept of double-entry accounting is that total debits must equal total credits for every business transaction.()

4.A trial balance represents a listing of the ledger accounts and balances at a particular moment in time.()

5. The ledger account provides a chronological order of transactions.()

6. Post reference columns are found only in the journal, not in the ledger.()

https://www.360docs.net/doc/ce14580560.html,ually two signatures are required on a business check for it to be valid.

()8.When a check is written by a business, the immediate effect is to reduce both the balance shown in the checkbook and the balance on the bank's records. ()9.The final amounts shown on both sides of the bank reconciliation statement are labeled "Adjusted Balances."()

10. A leasehold is an example of a long-life asset.()

11. The accounting reporting period agrees to the calendar year. ( )

12.An increase in permanent capital is recorded as a credit to the account. ( )

13. Dollar signs are used in the amount areas of the ledger accounts. ( )

14.If the trial balance shows that the ledger is in balance, this means that the individual business transactions were recorded to the appropriate ledger accounts. ( )

15. Every business transaction is first recorded in the journal. ( )

16.Internal control of operations is equally complex in a small and in a large organization. ( )

17.There are only two parties to a check: the person who writes it (the drawee) and the person to whom it is written (the payee). ( )

18.Two documents used in preparing a bank reconciliation statement are the bank statement and the checkbook stubs.( )

19. A common cause of inequality between the balances on the bank statement and in the checkbook is outstanding checks. ( )

20.Depreciation expense is usually recorded at least once a year. ( )

21.Amortization is the conversion of the cost of an intangible asset to an expense. ( )

三.翻译题

1. Sole Proprietorship Enterprises

2. Profit cost and capital cost principle

3. Double entry system

4. Source documents

5. Environmental accounting

6. Matching principle

7. Gross profit 8. Perpetual inventory system

9. Intangible assets 10. 原始凭证

11. 固定资产

四.完成下列等式

1. Accounting Equation:

Assets =

2. Perpetual inventory system:

Ending Inv. =

五.编制银行存款余额调节表

The following information pertains to ABC company:

(1)cash balance per bank July 31, $7263

(2)July bank service charge not recorded by the depositor $15

(3) cash balance per book July 31, $7190

(4) Deposits in transit July 31, $1700

(5)Note for $1000 collected for ABC in July by bank plus interest $36, and charge $20 for service. The collection has not been recorded by

ABC and no interest has been accrued

(6)Outstanding checks July 31 , $772

Prepare Bank reconciliation at July 31.

六.编写借贷会计分录

On July 1, N. B. Edgar opened Coin-Op Laundry. Edgar’s acco untant

listed the following chart of accounts:

Cash Supplies Prepaid Insurance Equipment

Furniture and Fixtures Accounts Payable

N. B. Edgar, Capital N. B. Edgar, Drawing

Laundry Revenue Wages Expense

Rent Expense Utilities Expense Miscellaneous Expense

During July, the following transactions were completed:

a.Edgar deposited $20,000 in a bank account in the name of the business.

b.Bought tables and chairs for cash, $450

c.Paid the rent for the current month, $705

d.Bought washers and dryers from Eldon Equipment, $17,400, paying $4,000 in

cash and placing the balance on account.

e.Bought laundry supplies on account from Borkal Distributors, $410.

f.Sold services for cash, $862.

g.Bought insurance for one year, $468.

h.Paid on account to Eldon Equipment, a creditor, $550.

i.Received and paid the electric bill, $118.

j.Paid on account to Borkal Distributors, a creditor, $145.

k.Sod services to customers for cash for the second half of the month, $881.

l.Received and paid the bill for the business license, $45.

m.Paid wages to an employee, $1,146.

n.Edgar withdrew cash for personal use, $875.

Instructions

Record the transactions with “Dr.” and “Cr.”

七.编制试算平衡表

The bank statement of LA Company shows a final balance of $2119 as of March 31, the balance of the cash in the ledger as of that is $1552, LA accountant has taken the following steps.

Prepare bank reconciliation at March 31.

(1) Noted that the deposit made on March 31 was not recorded on the bank statement, $762.

(2) Noted outstanding checks: no.921, $626. no.985, $69. no.986, $438.

(3) Noted credit memo: note collected by the bank from ABC company ,$200, not recorded

in the journal.

(4) Noted debit memo: collection charge and service charge not recorded in the journal, $4.

八.存货成本计算

C asey Electronics’ ending inventory consists of 182 Model M43 C

D players acquired through various purchases, as follows:

Specific Purchase Number of Units Cost per Unit Total Cost

B e g i n n i n g i n v e n t o r y34$270$9180

First purchase 60 282 16,920

Second purchase 256 298 76,288

Third purchase 164 312 51,168

Total units available 514 $153,556

Of the 514 units available for sale, 182 units are still on hand and 332 have been sold.

Under the periodic inventory system, If Casey Electronics chooses LIFO method, how should it calculate the cost of the 182 CD players on hand?

九.设立T形账户并编制试算平衡表

(1) May1: Jill Jones and her family invested $8,000 in BBE Company and received 800 shares of

stock.

(2) May2: BBE purchased an equipment for $2,500 cash.

(3) May 8: BBE purchased a $15,000 truck. BBE paid $2,000 in cash and issued a note payable

for the remaining $13,000.

(4) May 18: BBE sold services on account to ABC Lawns, $150. ABC Lawns agree to pay BBE

within 30 days.

(5) May 29: BBE provided services for a client and received $750 in cash.

(6) May31:BBE purchased gasoline for the truck for $50 cash.

Please Analyze the above transactions of BBE Company, set up its "T" accounts, and prepare a trial balance.

参考答案:

一.单项选择题

1.A

2.C

3.D

4.B

5.C

6.A

二.判断题

1.F

2.T

3.T

4.T

5.F

6.F

7.T

8.F

9.T 10.F

11.F 12.T 13.F 14.F 15.T 16.F 17.F 18.T 19.T 20.T 21.T

三.翻译题

1. 独资企业

2. 划分收益性支出与资本性支出

3. 复式记帐法

4. 原始凭证

5.环境会计

6. 配比原则

7. 毛利

8. 永序盘存制

9.无形资产

10. source document 11.fixed asset

四.完成下列等式

1. Accounting Equation:

Assets = Liabilities + Owner's Equity

2. Perpetual inventory system:

Ending Inv. =Beg. Inv.+ Purchases-Cost of goods sold

五.编制银行存款余额调节表

ABC Company

Bank Reconciliation

July 31 20

Bank statement balance, July 31 $7263 Add. Deposits In Transit 1700

8963

Deduct: Outstanding checks 772 Adjusted bank statement balance 8191

Ledger balance of cash $7190 Add. Credit memo 1036

8226 Deduct: Bank service charge 20

15

Adjusted ledger balance of cash 8191 六.编写借贷会计分录

A Dr. Cash 20000

Cr. N. B. Edgar, Capital 20000

B Dr. Furniture and Fixtures 450

Cr. Cash 450

C Dr. Rent Expense 705

Cr. Cash 705

D Dr. Equipment 17400

Cr. Cash 4000

Accounts Payable 13400

E Dr. Supplies 410

Cr. Accounts Payable 410

F Dr. Cash 862

Cr. Laundry Revenue 862

G Dr. Prepaid Insurance 468

Cr. Cash 468

H Dr. Accounts Payable 550

Cr. Cash 550

I Dr. Utilities Expense 118

Cr. Cash 118

J Dr. Accounts Payable 145

Cr. Cash 145

K Dr. Cash 881

Cr. Laundry Revenue 881

L Dr. Miscellaneous Expense 45

Cr. Cash 45

M Dr. Wages Expense 1146

Cr. Cash 1146

N Dr. N. B. Edgar, Drawing 875

Cr. Cash 875

七.编制试算平衡表

LA Company

Bank reconciliation

March 31 2004

Bank statement balance, March 31 $2119

Add. Deposits In Transit 762

2881

Deduct: Outstanding checks

No. 921 $626

No. 985 69

No. 986 438 1133

Adjusted bank statement balance 1748

Ledger balance of cash $1552

Add. Note collected by bank 200

1752

Deduct: Bank service & collection charges 4

Adjusted Ledger Balance of Cash 1748

八.存货成本计算

34 Units(beginning inventory) @ $270 each = $9180

60 Units(first purchase) @ $282 each = 16920 88 Units(second purchase) @ $298 each = 26224

182 Units $52324

九.设立T形账户并编制试算平衡表

会计专业英语模拟试题及答案

《会计专业英语》模拟试题及答案 一、单选题(每题1分,共20分) 1. Which of the following statements about accounting concepts or assumptions are correct? 1)The money measurement assumption is that items in accounts are initially measured at their historical cost. 2)In order to achieve comparability it may sometimes be necessary to override the prudence concept. 3)To facilitate comparisons between different entities it is helpful if accounting policies and changes in them are disclosed. 4)To comply with the law, the legal form of a transaction must always be reflected in financial statements. A 1 and 3 B 1 and 4 C 3 only D 2 and 3 Johnny had receivables of $5 500 at the start of 2010. During the year to 31 Dec 2010 he makes credit sales of $55 000 and receives cash of $46 500 from credit customers. What is the balance on the accounts receivables at 31 Dec 2010? $8 500 Dr $8 500 Cr $14 000 Dr $14 000 Cr Should dividends paid appear on the face of a company’s cash flow statement? Yes No Not sure Either Which of the following inventory valuation methods is likely to lead to the highest figure for closing inventory at a time when prices are dropping? Weighted Average cost First in first out (FIFO) Last in first out (LIFO) Unit cost 5. Which of following items may appear as non-current assets in a company’s the statement of financial position? (1) plant, equipment, and property (2) company car (3) €4000 cash (4) €1000 cheque A. (1), (3) B. (1), (2) C. (2), (3)

会计专业专业术语中英文对照

会计专业专业术语中英文对照 一、会计与会计理论 会计 accounting 决策人 Decision Maker 投资人 Investor 股东 Shareholder 债权人 Creditor 财务会计 Financial Accounting 管理会计 Management Accounting 成本会计 Cost Accounting 私业会计 Private Accounting 公众会计 Public Accounting 注册会计师 CPA Certified Public Accountant 国际会计准则委员会 IASC 美国注册会计师协会 AICPA 财务会计准则委员会 FASB 管理会计协会 IMA 美国会计学会 AAA 税务稽核署 IRS 独资企业 Proprietorship 合伙人企业 Partnership 公司 Corporation

会计目标 Accounting Objectives 会计假设 Accounting Assumptions 会计要素 Accounting Elements 会计原则 Accounting Principles 会计实务过程 Accounting Procedures 财务报表 Financial Statements 财务分析Financial Analysis 会计主体假设 Separate-entity Assumption 货币计量假设 Unit-of-measure Assumption 持续经营假设 Continuity(Going-concern) Assumption 会计分期假设 Time-period Assumption 资产 Asset 负债 Liability 业主权益 Owner's Equity 收入 Revenue 费用 Expense 收益 Income 亏损 Loss 历史成本原则 Cost Principle 收入实现原则 Revenue Principle 配比原则 Matching Principle

会计专业英语期末试题 )

期期末测试题 Ⅰ、Translate The Following Terms Into Chinese 、 1、entity concept 主题概念 2、depreciation折旧 3、double entry system 4、inventories 5、stable monetary unit 6、opening balance 7、current asset 8、financial report 9、prepaid expense 10、internal control 11、cash flow statement 12、cash basis 13、tangible fixed asset 14、managerial accounting 15、current liability 16、internal control 17、sales return and allowance 18、financial position 19、balance sheet 20、direct write-off method Ⅱ、Translate The Following Sentences Into Chinese 、 1、Accounting is often described as an information system、It is the system that measures business activities, processes into reports and communicates these findings to decision makers、 2、The primary users of financial information are investors and creditors、Secondary users include the public, government regulatory agencies, employees, customers, suppliers, industry groups, labor unions, other companies, and academic researchers、 3、There are two sources of assets、One is liabilities and the other is owner’s equity、Liabilities are obligations of an entity arising from past transactions or events, the settlement of which may result in the transfer or use of assets or services in the future、 资产有两个来源,一个就是负债,另一个就是所有者权益。负债就是由过去得交易或事件产生得实体得义务,其结算可能导致未来资产或服务得转让或使用。 4、Accounting elements are basic classification of accounting practices、They are essential units to present the financial position and operating result of an entity、In China, we have six groups of accounting elements、They are assets, liabilities, owner’s equity, revenue, expense and profit (income)、会计要素就是会计实践得基础分类。它们就是保护财务状况与实体经营

会计学专业会计英语试题

一、w o r d s a n d p h r a s e s 1.残值 scrip value 2.分期付款 installment 3.concern 企业 4.reversing entry 转回分录 5.找零 change 6.报销 turn over 7.past due 过期 8.inflation 通货膨胀 9.on account 赊账 10.miscellaneous expense 其他费用 11.charge 收费 12.汇票 draft 13.权益 equity 14.accrual basis 应计制15.retained earnings 留存收益 16.trad-in 易新,以旧换新 17.in transit 在途 18.collection 托收款项 19.资产 asset 20.proceeds 现值 21.报销 turn over 22.dishonor 拒付 23.utility expenses 水电费 24.outlay 花费 25.IOU 欠条 26.Going-concern concept 持续经营 27.运费 freight 二、M ultiple-choice question 1.Which of the following does not describe accounting? ( C ) A. Language of business B. Useful ofr decision making C. Is an end rathe than a means to an end. https://www.360docs.net/doc/ce14580560.html,ed by business, government, nonprofit organizations, and individuals. 2.An objective of financial reporting is to ( B ) A. Assess the adequacy of internal control. B.Provide information useful for investor decisions. C.Evaluate management results compared with standards. D.Provide information on compliance with established procedures. 3.Which of the following statements is(are) correct?( B ) A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets. B.A company may use different depreciation methods in its financial statements and its income tax return. C.The cost of a machine includes the cost of repairing damage to the machine during the installation process. D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method. 4. Which of the following is(are) correct about a company’s balance sheet? ( B ) A.It displays sources and uses of cash for the period. B.It is an expansion of the basic accounting equation C.It is not sometimes referred to as a statement of financial position. D.It is unnecessary if both an income statement and statement of cash flows are availabe. 5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A ) https://www.360docs.net/doc/ce14580560.html,rmation used to determine which products to poduce https://www.360docs.net/doc/ce14580560.html,rmation about economic resources, claims to those resources, and changes in both resources and claims. https://www.360docs.net/doc/ce14580560.html,rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows. https://www.360docs.net/doc/ce14580560.html,rmation that is useful in making ivestment and credit decisions. 6.Each of the following measures strengthens internal control over cash receipts except. ( C )

《财会专业英语》期末试卷及答案

《财会专业英语》期终试卷 I.Put the following into corresponding groups. (15 points) 1.Cash on hand 2.Notes receivable 3.Advances to suppliers 4. Other receivables 5.Short-term loans 6.Intangible assets 7.Cost of production 8.Current year profit 9. Capital reserve 10.Long-term loans 11.Other payables 12. Con-operating expenses 13.Financial expenses 14.Cost of sale 15. Accrued payroll II.Please find the best answers to the following questions. (25 Points) 1. Aftin Co. performs services on account when Aftin collects the account receivable A.assets increase B.assets do not change C.owner’s equity d ecreases D.liabilities decrease 2. A balance sheet report . A. the assets, liabilities, and owner’s equity on a particular date B. the change in the owner’s capital during the period C. the cash receipt and cash payment during the period D. the difference between revenues and expenses during the period 3. The following information about the assets and liabilities at the end of 20 x 1 and 20 x 2 is given below: 20 x 1 20 x 2 Assets $ 75,000 $ 90,000 Liabilities 36,000 45,000 how much the owner’sequity at the end of 20 x 2 ? A.$ 4,500 B.$ 6,000 C.$ 45,000 D.$ 43,000

会计专业英语重点1

Unit 1 Financial information about a business is needed by many outsiders .These outsiders include owners, bankers, other creditors, potential investors, labor unions, government agencies ,and the public ,because all these groups have supplied money to the business or have some other interest in the business that will be served by information about its financial position and operating results. 许多企业外部的人士需要有关企业的财务信息,这些外部人员包括所有者、银行家、其他债权人、潜在投资者、工会、政府机构和公众,因为这些群体对企业投入了资金,或享有某些利益,所以必须得到企业财务状况和经营成果信息。 Unit 2 Each proprietorship, partnership, and corporation is a separate entity. 每一独资企业、合伙企业和股份公司都是一个单独的主体。 In accrual accounting, the impact of events on assets and equities is recognized on the accounting records in the time periods when services are rendered or utilized instead of when cash is received or disbursed. That is revenue is recognized as it is earned, and expenses are recognized as they are incurred –not when cash changes hands .if the cash basis accounting were used instead of the accrual basis, revenue and expense recognition would depend solely on the timing of various cash receipts and disbursements. 在权责发生制下,视服务的提供而非现金的收付在本期对资产和权益的影响作出会计记录。即,收入是在赚取时确认,费用是在发生时确认——而不是在现金转手时。如果现金收付制替代权责发生制,那么收入和费用仅仅依靠各种现金收付活动的时间确定来确认。 Unit 3 During each accounting year ,a sequence of accounting procedures called the accounting cycle is completed. 在每一会计年度内,要依次完成被称为会计循环的会计程序。 Transactions are analyzed on the basis of the business documents known as source documents and are recorded in either the general journal or the special journal, i. e . the sales journal ,the purchases journal (invoice register ) ,cash receipts journal and cash disbursements journal . 根据业务凭证即原始凭证分析各项交易,并记入普通日记账或特种日记账,也就是销货日记账,购货日记账(发票登记簿),现金收入日记账和现金支出日记账。 A trial balance is prepared from the account balance in the ledger to prove the equality of debits and credits. 根据分类账户的余额编制试算平衡表,借以验证借项和贷项是否相等。 A T-account has a left-hand side and a right-hand side, called respectively the debit side and credit side. 一个T 型账户有左方和右方,分别称做借方和贷方。 After transactions are entered ,account balance (the difference between the sum of its debits and the sum of its credits ) can be computed.

会计专业英语期末考试练习卷(new)

会计专业英语期末考试练习卷(new)

1. The economic resources of a business are called : B A. Owner ’s Equity B. Assets C. Accounting equation D. Liabilities 2. DTK Company has a $3500 accounts receivable from GRS Company. On January 20, GRS Company makes a partial payment of $210 0 to DTK Company. The journal entry made on January 20 by DTK Company to record this transaction includes: D A. A debit to the cash receivable account of $2100. B. A credit to the accounts receivable account of $2100. C. A debit to the cash account of $1400. D. A debit to the accounts receivable account of $1400. 3. In general terms, financial assets appear in the balance sheet at: A A. Face value. 账面价值 B. Current value. 现值 C. Market value. 市场价值 D. Estimated future sales value. 4. Each of the following measures strengthens intern al control over cash receipts except : D A. The use of a voucher system. B. Preparation of a daily listing of all checks received through the mail. C. The deposit of cash receipts intact in the bank on a daily basis. D. The use of cash registers. 5. Which of the following items is the greatest in dollar amount? D A. Beginning inventory B. Cost of goods sold. C. Cost of goods available for sale D. Ending inventory 6. Why do companies prefer the LIFO inventory 后进先出法method during a period of rising prices? B A. Higher reported income B. Lower income taxes C. Lower reported income D. Higher ending inventory 7. Which of the following characteristics would prevent an item from being included in the classification of plant and equipment? D A. Intangible

会计专业英语答案.doc

会计专业英语答案 【篇一:15 春学期《会计专业英语》在线作业满分答 案】 a. an expense account b. a capital account c. a liability account d. an asset account ? 正确答案:d 2. the debt created by a business when it makes a purchase on account is referred to as an a. account payable b. account receivable c. asset d. expense payable ? 正确答案:a 3. when the corporation issuing the bonds has the right to repurchase the bonds prior to the maturity date for a specific price, the bonds are a. convertible bonds b. unsecured bonds c. debenture bonds d. callable bonds ? 正确答案:d 4. which of the items below is not a business organization form? () a. entrepreneurship b. proprietorship c. partnership d. corporation ? 正确答案:a 5. cash investments made by the owner to the business are reported on the statement of cash flows in the a. financing activities section

会计专业英语翻译

. 1. Accounting first is an economic calculation. Economic calculation includes both static phenomenon on the economy's stock of the situation, including the situation of the period of dynamic flow, including both pre-calculated plan, but also after the actual calculation. Accounting is a typical example of economic calculation, calculation of economic calculation in addition to accounting, which includes statistical computing and business computing. 2. Accounting is an economic information systems. It would be a company dispersed into the business activities of a group of objective data, providing the company's performance, problems, and enterprise funds, labor, ownership, income, costs, profits, debt, and other information. Clearly, the accounting is to provide financial information-based economy information systems, business is the licensing of a points, thus accounting has been called "corporate language." 3. Accounting is an economic management.The accounting is social production develops to a certain stage of the product development and production is to meet the needs of the management, especially with the development of the commodity economy and the emergence of competition in the market through demand management on the economy activities strict control and supervision. At the same time, the content and form of accounting constantly improve and change, from a purely accounting, scores, mainly for accounting operations, external submit accounting statements, as in prior operating forecasts, decision-making, on the matter of economic activities control and supervision, in hindsight, check. Clearly, accounting whether past, present or future, it is people's economic management activities.

会计学专业会计英语试题

一、words and phrases 1.残值 scrip value 2.分期付款 installment 3.concern 企业 4.reversing entry 转回分录 5.找零 change 6.报销 turn over 7.past due 过期 8.inflation 通货膨胀 9.on account 赊账 10.miscellaneous expense 其他费用 11.charge 收费 12.汇票 draft 13.权益 equity 14.accrual basis 应计制15.retained earnings 留存收益 16.trad-in 易新,以旧换新 17.in transit 在途 18.collection 托收款项 19.资产 asset 20.proceeds 现值 21.报销 turn over 22.dishonor 拒付 23.utility expenses 水电费 24.outlay 花费 25.IOU 欠条 26.Going-concern concept 持续经营 27.运费 freight 二、Multiple-choice question 1.Which of the following does not describe accounting? ( C ) A. Language of business B. Useful ofr decision making C. Is an end rathe than a means to an end. https://www.360docs.net/doc/ce14580560.html,ed by business, government, nonprofit organizations, and individuals. 2.An objective of financial reporting is to ( B ) A. Assess the adequacy of internal control. B.Provide information useful for investor decisions. C.Evaluate management results compared with standards. D.Provide information on compliance with established procedures. 3.Which of the following statements is(are) correct?( B ) A.Accumulated depreciation represents a cash fund being accumulated for the replacement of plant assets. B.A company may use different depreciation methods in its financial statements and its income tax return. C.The cost of a machine includes the cost of repairing damage to the machine during the installation process. D.The use of an accelerated depreciation method causes an asset to wear out more quickly than does use of the unit-of-product method. 4. Which of the following is(are) correct about a company’s balance sheet? ( B ) A.It displays sources and uses of cash for the period. B.It is an expansion of the basic accounting equation C.It is not sometimes referred to as a statement of financial position. D.It is unnecessary if both an income statement and statement of cash flows are availabe. 5.Objectives of financial reporting to external investors and creditors include preparing information about all of the following except. ( A ) https://www.360docs.net/doc/ce14580560.html,rmation used to determine which products to poduce https://www.360docs.net/doc/ce14580560.html,rmation about economic resources, claims to those resources, and changes in both resources and claims. https://www.360docs.net/doc/ce14580560.html,rmation that is useful in assessing the amount, timing, and uncertainty of future cash flows. https://www.360docs.net/doc/ce14580560.html,rmation that is useful in making ivestment and credit decisions. 6.Each of the following measures strengthens internal control over cash receipts except. ( C ) A.The use of a petty cash fund. B.Preparation of a daily listing of all checks received through the mail. C.The use of cash registers. D.The deposit of cash receipts in the bank on a daily basis. 7.The primary purpose for using an inventory flow assumption is to. ( A )

会计专业英语

会计专业英语 business 企业商业业务 financial risk 财务风险 sole proprietorship 私人业主制企业 partnership 合伙制企业 limited partner 有限责任合伙人 general partner 一般合伙人 separation of ownership and control 所有权与经营权分离 claim 要求主张要求权 management buyout 管理层收 tender offer 要约收购 financial standards 财务准则 initial public offering 首次公开发行股票 private corporation 私募公司未上市公司 closely held corporation 控股公司 board of directors 董事会 executove director 执行董事 non- executove director 非执行董事chairperson 主席 controller 主计长 treasurer 司库 revenue 收入 profit 利润 earnings per share 每股盈余 return 回报 market share 市场份额 social good 社会福利 financial distress 财务困境 stakeholder theory 利益相关者理论 value (wealth) maximization 价值(财富)最大化 common stockholder 普通股股东preferred stockholder 优先股股东 debt holder 债权人 well-being 福利diversity 多样化 going concern 持续的 agency problem 代理问题 free-riding problem 搭便车问题 information asymmetry 信息不对称 retail investor 散户投资者 institutional investor 机构投资者 agency relationship 代理关系 net present value 净现值 creative accounting 创造性会计 stock option 股票期权 agency cost 代理成本bonding cost 契约成本 monitoring costs 监督成本 takeover 接管corporate annual reports 公司年报 balance sheet 资产负债表 income statement 利润表 statement of cash flows 现金流量表 statement of retained earnings 留存收益表 fair market value 公允市场价值marketable securities 油价证券 check 支票 money order 拨款但、汇款单withdrawal 提款 accounts receivable 应收账 credit sale 赊销inventory 存货 property,plant,and equipment 土地、厂房与设备depreciation 折旧 accumulated depreciation 累计折旧

考研会计专业英语试题

考研会计专业英语试题 1.Give a brief explanation for the following terms(10%) (1)Journal entry (2)Going concern (3)Matching principle (4)Working capital (5)Revenue expenditure 2.Please read the following passage carefully and fill in each of the 11 blanks with a word most appropriate to the content (10%) (1)The double-entry system of accounting takes its name from the fact that every business transaction is recorded by (____)types of entries: 1: (_____)entries to one or more accounts and 2credit entries to one or more accounts. In recording any transaction,the total dollar amount of the (______)entries must (_____)the total dollar amount of credit entries. (2)Often a transaction affects revenues or expenses of two or more different periods,in these cases,an (_____)entries are needed to (_____)to each period the appropriate amounts of revenues and expenses. These entries are performed at the (_____)of each accounting period but (_____)to preparing the financial statements. (3)Marketable securities are highly (_____)investments,primarily in share stocks and bounds,(____)can be sold (_____)quoted market prices in organized securities exchanges. 3.Translate the following Chinese statements into English (18%) (1)财务报表反映一个企业的财务状况和经营成果,是根据公认会计准则编制的。这些报表是为许多不同的决策者,许多不同的目的而提供的。 纳税申报单则反映应税收益的计算,是由税法和税则规定的概念。在许多情况下,税法和公认会计准则相似,但两者却存在实质上的不同。 (2)审计师不保证财务报表的准确性,他们仅就财务报表的公允性发表专家意见。然而注册会计师事务所的声誉来自于他们对审计工作的一丝不苟和审计报告的可靠性。