非居民企业所得税季度和年度纳税申报表中英文版

企业所得税纳税申报表英译模板

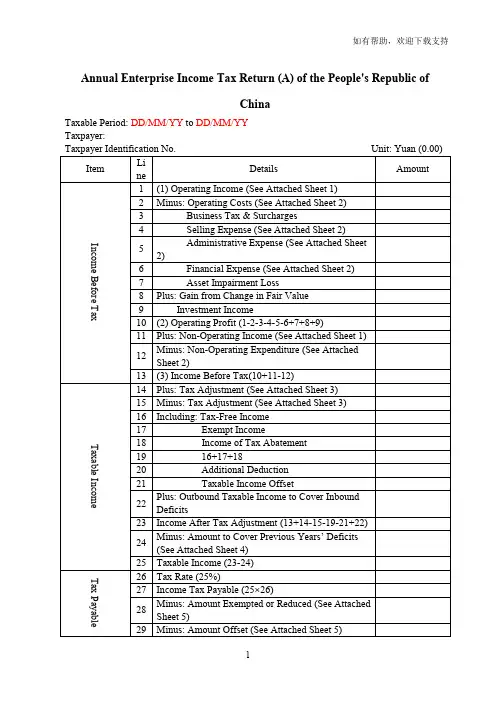

Annual Enterprise Income Tax Return (A) of the People's Republic ofChinaTaxable Period: DD/MM/YY to DD/MM/YYTaxpayer:Monthly(Quarterly)Enterprise Income Tax Return (A) of the People's Republicof ChinaTaxation Period: DD/MM/YY to DD/MM/YYTaxpayer ID:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (seal): Date: Taxpayer’s Official Seal:Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of TaxationThe People’s Republic of ChinaMonthly (Quarterly) Enterprise Income Tax Return (B)Tax Belongs to DD/MM/YY to DD/MM/YYTaxpayer Identification No.:Taxpayer:Unit: RMB Yuan (0.00)I hereby state that this form is true, reliable and complete, filled in accordance with the Law on Enterprise Income Tax of the People’s Republic of China, the Implementation Ordinance of the Law on Enterprise Income Tax of the People’s Republic of China and the State’s related taxation provisions.Legal Representative (signature): Date: Taxpayer’s Official Seal: Agency’s Official Seal:Tax Authority’s Acceptance Seal:Accounting Supervisor: Undertaker:Undertaker: License No.:Date: Date: Date:Under the supervision of the State Administration of Taxation。

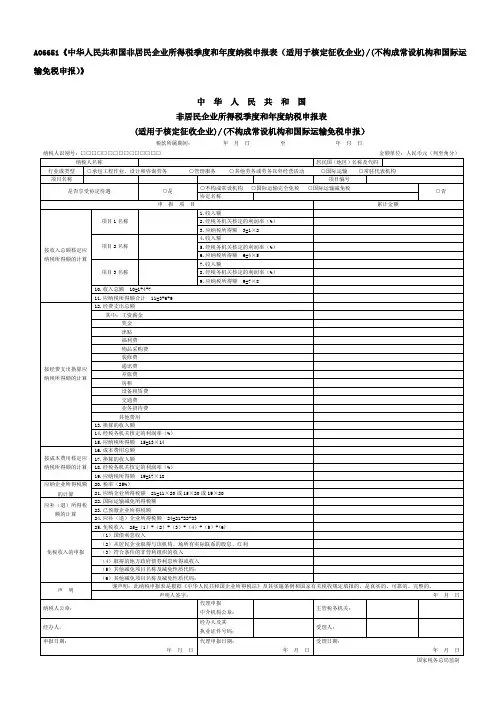

A06651《中华人民共和国非居民企业所得税季度和年度纳税

A06651《中华人民共和国非居民企业所得税季度和年度纳税申报表(适用于核定征收企业)/(不构成常设机构和国际运输免税申报)》中华人民共和国非居民企业所得税季度和年度纳税申报表(适用于核定征收企业)/(不构成常设机构和国际运输免税申报)税款所属期间:年月日至年月日纳税人识别号:□□□□□□□□□□□□□□□金额单位:人民币元(列至角分)纳税人名称居民国(地区)名称及代码行业或类型○承包工程作业、设计和咨询劳务○管理服务○其他劳务或劳务以外经营活动○国际运输○常驻代表机构项目名称项目编号是否享受协定待遇○是○不构成常设机构○国际运输完全免税○国际运输减免税○否协定名称申报项目累计金额按收入总额核定应纳税所得额的计算项目1名称1.收入额2.经税务机关核定的利润率(%)3.应纳税所得额3=1×2项目2名称4.收入额5.经税务机关核定的利润率(%)6.应纳税所得额6=4×5项目3名称7.收入额8.经税务机关核定的利润率(%)9.应纳税所得额9=7×810.收入总额10=1+4+711.应纳税所得额合计11=3+6+9按经费支出换算应纳税所得额的计算12.经费支出总额其中:工资薪金奖金津贴福利费物品采购费装修费通讯费差旅费房租设备租赁费交通费业务招待费其他费用13.换算的收入额14.经税务机关核定的利润率(%)15.应纳税所得额15=13×14按成本费用核定应纳税所得额的计算16.成本费用总额17.换算的收入额18.经税务机关核定的利润率(%)19.应纳税所得额19=17×18应纳企业所得税额的计算20.税率(25%)21.应纳企业所得税额21=11×20或15×20或19×20应补(退)所得税额的计算22.国际运输减免所得税额23.已预缴企业所得税额24.应补(退)企业所得税额24=21-22-23免税收入的申报25.免税收入 25=(1)+(2)+(3)+(4)+(5)+(6)(1)国债利息收入(2)从居民企业取得与该机构、场所有实际联系的股息、红利(3)符合条件的非营利组织的收入(4)取得的地方政府债券利息所得或收入(5)其他减免项目名称及减免性质代码:(6)其他减免项目名称及减免性质代码:声明谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》及其实施条例和国家有关税收规定填报的,是真实的、可靠的、完整的。

非居民企业所得税年度纳税申报表

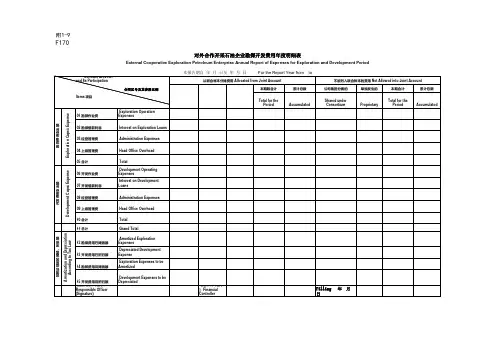

12 勘探费用已摊销额 13 开发费用已折旧额 14 勘探费用待摊销额

15 开发费用待折旧额

企业负责人(签字〕Responsible Officer (Signature)

填表日期 Date of Filling

年

月

日

Contract Area No. and Its Participation Percentage 合同区号及其参股比例 Items 项目 Total for the Period Exploration Capex Expense 01 勘探作业费 02 勘探借款利息 03 经营管理费 04 上级管理费 05 合计 Development Capex Expense 06 开发作业费 07 开发借款利息 08 经营管理费 09 上级管理费 10 合计 11 总计 Amortization and Depreciation According to Tax Law 按税法规定的摊销,折旧额 Exploration Operation Expenses Accumulated Shared under Consortium Proprietary Total for the Period Accumulated

For the Report Year from

to

不能列入联合帐本的费用 Not Allowed into Joint Account

从联合帐本分摊费用 Allocated from JoiБайду номын сангаасt Account 本期数合计 累计总数

公司集团分摊的

单独发生的

本期合计

累计总数

勘探费用支出额

Interest on Exploration Loans

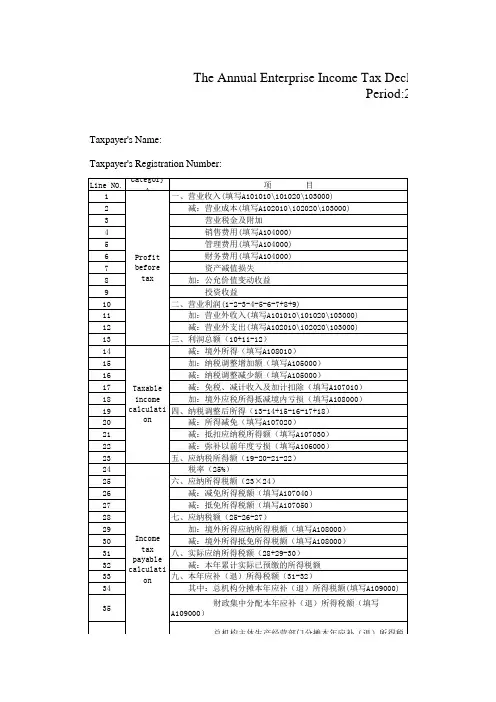

版企业所得税年度纳税申报表 A类 中英文版

2

减:营业成本(填写A102010\102020\103000)

3

营业税金及附加

4

销售费用(填写A104000)

5

管理费用(填写A104000)

6

Profit

财务费用(填写A104000)

7

before

8

tax

资产减值损失 加:公允价值变动收益

9

投资收益

10

二、营业利润(1-2-3-4-5-6-7+8+9)

The Annual Enterprise Income Tax Declaration Returns( Period:2015.01.01-2015.

Taxpayer's Name:

Taxpayer's Registration Number:

Line NO.

Category A

项

目

1

一、营业收入(填写A101010\101020\103000)

G&A expense

Finance expense

Impairment loss of assets Add:The profits and losses on the changes in fair value

Investment Income

2.Profit from operation Add:Non-operating income Less:Non-operating expense 3.Profit before tax Less:Foreign income Add:Additional for tax adjustment Less:Deduction for tax adjustment Less:Tax-exempt Income&Less Accured Income&Additional deduction Add:Foreign Taxable Income to Cover the Territory of Loss 4.Profit after adjustment Less:Income reduction Less:Deductible Taxable Income Less:Prior Year Loss 5.Taxable Income Tax rate(25%)

申报表中英文对照

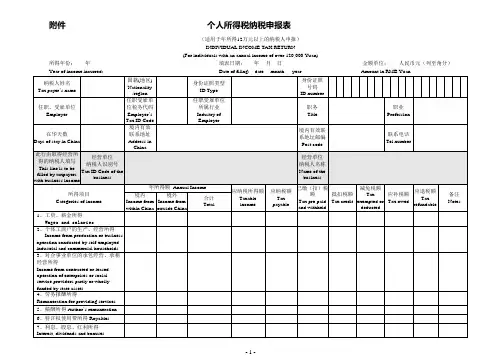

附件个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUAL INCOME TAX RETURN(For individuals with an annual income of over 120,000 Yuan)所得年份: 年填表日期:年月日金额单位:人民币元(列至角分)Year of income incurred: Date of filing: date month year Amount in RMB YuanSignature of responsible tax officer : Filing date: Time: Year/Month/Date Responsible tax office填表须知一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。

二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。

不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。

三、填写本表应当使用中文,也可以同时用中、外两种文字填写。

四、本表各栏的填写说明如下:1、所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。

3、身份证照号码:填写中国居民纳税人的有效身份证照上的号码。

4、任职、受雇单位:填写纳税人的任职、受雇单位名称。

纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。

5、任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。

6、任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。

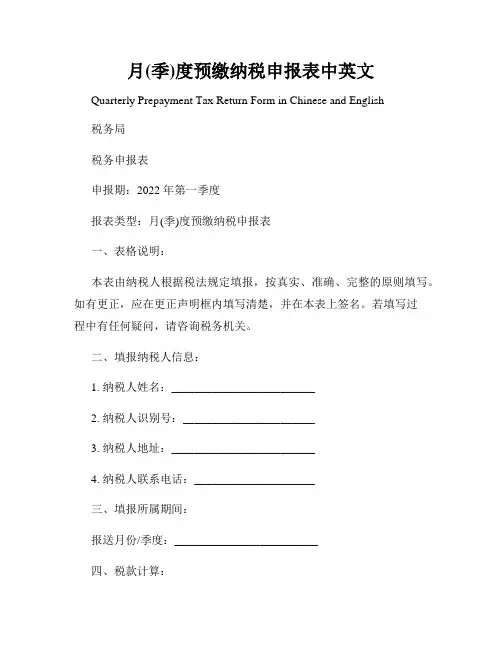

月(季)度预缴纳税申报表中英文

月(季)度预缴纳税申报表中英文Quarterly Prepayment Tax Return Form in Chinese and English税务局税务申报表申报期:2022 年第一季度报表类型:月(季)度预缴纳税申报表一、表格说明:本表由纳税人根据税法规定填报,按真实、准确、完整的原则填写。

如有更正,应在更正声明框内填写清楚,并在本表上签名。

若填写过程中有任何疑问,请咨询税务机关。

二、填报纳税人信息:1. 纳税人姓名:_________________________2. 纳税人识别号:_______________________3. 纳税人地址:_________________________4. 纳税人联系电话:_____________________三、填报所属期间:报送月份/季度:_________________________四、税款计算:1. 全年预计销售额:_______________________(填报单位:人民币)2. 税率适用情况:- 增值税率:___________________________(填报百分比)- 企业所得税率:________________________(填报百分比) - 个人所得税率:________________________(填报百分比)3. 销售额应纳税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)4. 实际预缴税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)5. 本期应补(退)税款:- 增值税:_____________________________(填报金额)- 企业所得税:__________________________(填报金额)- 个人所得税:__________________________(填报金额)五、附注:填写附注以说明填报表格中出现的特殊情况或异常情形。

中华人民共和国《非居民企业所得税季度纳税申报表》(适用于据实申报企业)

声明人签字:

年 月 日

纳税人公章:

代理申报 中介机构公章: 经办人及其 执业证件号码: 年 月 日 代理申报日期:

主管税务机关:

经办人:

受理人:

申报日期:

Байду номын сангаас

年 月 日 受理日期:

年 月 日 国家税务总局监制

附件2

中 华 人 民 共 和 国 非居民企业所得税季度纳税申报表

(适用于据实申报企业) 税款所属期间: 纳税人识别号: 纳税人名称 行次 1 2 3 4 5 6 7 8 9 营业收入 营业成本 本季度利润(亏损)额 按规定可弥补的以前季度亏损额 按规定可弥补的以前年度亏损额 应纳税所得额 法定税率(25%) 应纳企业所得税额 8=6×7 实际征收率(%) 项 目 账载金额 年 月 日 至 年 月 日 金额单位:人民币元(列至角分) 居民国(地区) 名称及代码 依法申报金额 备 注

□□□□□□□□□□□□□□□

10 实际应纳企业所得税额 10=6×9 11 减(免)企业所得税额 11=8-10 12 本季度前已预缴企业所得税额 13 本年度已预缴企业所得税额 13=10+12 谨声明:此纳税申报表是根据《中华人民共和国企业所得税法》及其实施条例和国家有关税收规定填报的,是真 实的、可靠的、完整的。

企业所得税申报表(英文版)

TotalLine No.Amount (Filled by theEnterprise)Amount (Confirmed byAgent)11,703,344.801,703,344.802604,422.73604,422.73385,167.2485,167.2440.000.0054,306,190.254,306,190.256(9,296.03)(9,296.03)70.0080.0090.0010(3,283,139.39)(3,283,139.39)111,538.461,538.46120.000.0013(3,281,600.93)(3,281,600.93)14438,210.70438,210.70150.000.00160.000.00170.000.00180.000.00190.000.00200.000.00210.000.00220.000.0023(2,843,390.23)(2,843,390.23)240.000.00250.000.002625.00%25.00%2728293031323334353637383940414220 May 2009Seal of tax authority:Received by:Date: Date/Month/YearBusiness Income (filling in the Schedule 1)Less: Business Costs (filling in the Schedule 2)Amount Offsetted by the Surplus of Income Tax Paid in in Preceding YearsIncome Tax Payable Carried forward from the Preceding Tax YearLoss Arising from Asset Devaluation Plus: Profits from the Changes of Fair Values Investment Income Operating ProfitsBusiness Tax and addtions Sales Costs (filling in the Schedule 2) Management Costs (filling in the Schedule 2) Financial Costs ( filling in the Schedule 2 )Income Tax PayableIncome Tax Payable on Overseas IncomeAmount of Income Tax Offsetted by Overseas Income Plus: Non-business Income (filling in the Schedule 1)Less: Non-business Expenditure (filling in the Schedule 2)Total Operating Profits (10+11-12)Adjustment for Additional Tax Payment Adjustment for Tax Reduction Thereinto: non-taxable income tax-free incomeThe Actual Payable Income TaxThe Actual Aggregate Prepaid Income Tax in the YearThereinto: prepaid tax apportioned to tax-consolidating headquartersincome tax paid in by tax-consolidating headquarters as government budgetary leverage additional deduction deducted taxable incomePlus: Taxable Overseas Income Offsetting Domestic Losses Taxable IncomeReduced or Exempt Income Tax Offsetted Income Tax Payable Date return receive: Date/Month/YearSignature of Legal Representative:Date:Date/Month/Yearpaid income tax apportioned to the branches of the tax-consolidating headquartersproportion of income tax prepaid by members of consolidated tax-paying entity group (in the form of parent-subsidiary)income tax prepaid by a consolidated taxpaying enterprise Income Tax to be Made up (or to be returned)Taxable income (23-24)Tax Rate Calculation of Taxable IncomeTaxpayer Identification No.: 110108675053143Annual Tax Return Form for Enterprise Income Tax of the People's Republic of China (Category A)Period Covered by the Return: from Jan 1 2008 to Dec 31 2008Unit: RMB YuanName of Taxpayer: ANSCHUTZ ENTERTAINMENT GROUP (BEIJING) STADIUM MANAGEMENT CO., LTD income entitled to tax reductionall income that is entitled to tax reduction or exemption Calculation of Tax PayableTaxpayer's unit's seal: Income entitled to tax reduction Responsible person: Registered number of responsible person:SupplementsI declare that this return is filled out in accordance with FOREIGN INVESTMENT BUSINESS INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA.I believe that this return is true, correct and complete.ItemCalculation of Total ProfitPost-tax-adjustment Income (13+14-15+22)Less: Offsetting Losses of Preceding Years (filling in the Schedule 4)。

非居民企业季度与年度纳税申报表

踏实肯干,努力奋斗。2021年3月23日 上午10时33分 21.3.2321.3.23

追求至善凭技术开拓市场,凭管理增 创效益 ,凭服 务树立 形象。2021年3月23日 星期二 上午10时33分 21秒10:33:2121.3.23

严格把控质量关,让生产更加有保障 。2021年3月上 午10时 33分21.3.2310:33Mar ch 23, 2021

作业标准记得牢,驾轻就熟除烦恼。2021年3月23日 星期二 10时33分21秒 10:33:2123 March 2021

好的事情马上就会到来,一切都是最 好的安 排。上 午10时33分21秒上午10时33分10:33:2121.3.23

一马当先,全员举绩,梅开二度,业 绩保底 。21.3.2321.3.2310:3310:33:2110:33:21Mar- 21

季报与年报申报表均使用中文填写

申报表必填栏目

税款所属时期 纳税人识别号 纳税人名称 居民国(地区)名称及代码 经费支出总额 换算的收入额 声明人签字及日期 纳税人公章、经办人及申报日期 若代理申报、填列代理机构相关信息

税款所属时期

填写公历年度。 季度申报表:自公历每季度1日起至该季度末止。

纳税人识别号

填写税务登记证上所注明的“纳税人识别号” 或主管税务机关颁发的临时纳税人纳税识别 号。

纳税人名称

填写企业税务登记证上的中文名称或临时税 务登记的中文名称。

金额单位

精确到小数点后两位,四舍五入。

居民国(地区)名称及代码

填写设立常驻代表机构的外国企业或来华承 包工程、提高劳务等的外国企业的居民国 (地区)的名称和代码。

外国企业常驻代表机构 企业所得税季度与年度纳税申报表

------填报说明

非居民企业所得税季度和年度纳税申报表(2015)

中 华 人 民 共 和 国 非居民企业所得税季度和年度纳税申报表

(适用于核定征收企业)/(不构成常设机构和国际运输免税申报)

年 月 日 纳税人识别号:□□□□□□□□□□□□□□□ 税款所属期间: 纳税人名称 行业或类 ○承包工程作业、设计和咨询劳务 ○管理服务 型 运输 ○常驻代表机构 项目名称 ○不构成常设机构 ○国际运输完全免税 是否享受协定待遇 ○是 协定名称 申 报 项 目 1.收入额 项目1名 2.经税务机关核定的利润率(%) 称 3.应纳税所得额 3=1×2 4.收入额 按收入总 项目2名 5.经税务机关核定的利润率(%) 额核定应 称 6.应纳税所得额 6=4×5 纳税所得 7.收入额 额的计算 项目3名 8.经税务机关核定的利润率(%) 称 9.应纳税所得额 9=7×8 10.收入总额 10=1+4+7 11.应纳税所得额合计 11=3+6+9 12.经费支出总额 其中:工资薪金 奖金 津贴 福利费 物品采购费 装修费 按经费支 通讯费 出换算应 差旅费 纳税所得 房租 额的计算 设备租赁费 交通费 业务招待费 其他费用 13.换算的收入额 14.经税务机关核定的利润率(%) 15.应纳税所得额 15=13×14 按成本费 16.成本费用总额 用核定应 17.换算的收入额 纳税所得 18.经税务机关核定的利润率(%) 额的计算 19.应纳税所得额 19=17×18 应纳企业 20.税率(25%) 所得税额 21.应纳企业所得税额 21=11×20或15×20或19×20 的计算 应补 22.国际运输减免所得税额 (退)所 得税额的 至 年 月 日

报表

税申报)

金额单位:人民币元(列至角分)

或劳务以外经营活动

○国际

运输减免税 累计金额

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Cost-plus Basis Calculation

Calculation of Taxable Income Approved on the Basis of Expense

Calculation of Income Tax Payable Supplementary (Refundable) Income Tax Calculation

10.Total Revenue 10=1+4+7 11. Total Taxable Income 11=3+6+9 12. Total Operating Expense 0.00 including:Wages and Salaries 0.00 Bonus 0.00 Allowance 0.00 Welfare Expense 0.00 Purchasing Expense 0.00 Fit-out Expense 0.00 Communication Expense 0.00 Travel Expense 0.00 Rental Fee 0.00 Equipment Leasing Expense 0.00 Transportation Expense 0.00 Business Entertainment Expense 0.00 Others 0.00 13. Deemed Revenue on Cost-plus Basis 0.00 14. Deemed Profit Rate(%) 0.15 15. Taxable Income 15=13×14 0.00 16. Total Cost 17. Deemed Revenue on Cost-plus Basis 18. Deemed Profit Rate(%) 19. Taxable Income 19=17×18 20. Applicable Tax Rate(25%) 0.25 21. Income Tax Payable 21=11×20 or 15×20 or 19×20 0.00 22.Amount of Tax Reduction for International Transport 23.Prepaid Income Tax 18,850.98 24.Supplementary (Refundable) Income Tax 24=21-22-23 -18,850.98 25.Tax-exempted Income 25= (1)+(2)+(3)+(4)+(5)+(6) (1)Interests Income from Government Bond (2)Dividend, Bonus Income from Resident Enterprises (3)Income from Qualified Non-profit Organizations (4)Proceeds or Income from Acquisition of Local Government Bond Interest (5)Other Tax-exempt Item and Code (6)Other Tax-exempt Item and Code I declare that this return is filled out in accordance with ENTERPRISE INCOME TAX LAW OF THE PEOPLE'S REPUBLIC OF CHINA, and is true ,correct and complete. signature of statement maker Seal of Tax Payer: Responsible Person: Date: Seal of Agent's Company: Name and Registered Number of Responsible Person: Date: Seal of Tax Authority: Received by: Date: year month date

Deemed Income Calculation

Name of Item 2

5. Deemed Profit Rate (%) 6. Taxable Income 6=4×5 7. Revenue Amount

Name of Item 3

8. Deemed Profit Rate (%) 9. Taxable Income 9=7×8

○Contracting Project, Designing and Consulting Services ●Representative Office

○Management Services

○Othncome

Name of Item

Code of Item ○No permanent establishment ○International transport with tax exemption ○ International transport with tax reduction

Tax-exempt income

Declaration

Tax Period: Taxpayer's ID number: Taxpayer's Name

Form of Incorporation Name and Code of Residence Country (Region)

2015-4-1

to

2015-6-30 Currency Unit:RMB Yuan 124-Canada ○International Transport

Applicable to Treaty Benefit

○Yes Name of Double Taxation Agreement Items 1. Revenue Amount Accumulated Amount

●No

Name of Item 1

2. Deemed Profit Rate (%) 3. Taxable Income 3=1×2 4. Revenue Amount

People's Republic Of China Income Tax on Non-Resident Enterprises Annual Tax Return

(Apply to enterprises under deemed income taxation basis)/(No permanent establishment and exemption claim for international transport )