金融业中英文对照表

金融词汇中英文对照

Accelerated depreciation AcceptorAccommodation paper Accounts payableAccounts receivable Accredited InvestorsAccredit valueAccreditingAccrual basisAccrued interestACEAcid Test RatioAcquisitionAcross the boardActing in concertActive assetsActive capitalActual marketActual priceActual useful lifeActuaryADBADRADSAd valoremAd valorem stamp duty AdjudicatorAdjustable rate mortgage (ARM) Admitted valueAffiliated companyAfter dateAfter-hours dealingAfter-marketAfter-tax profitsAfternoon sessionAge dependency (ratio)Agency accountAging analysis of accountsAGMAgreementAlert messageAll-or-none orderAllocationAllotteeAllotmentAllowanceAlpha (Market Alpha)Alternative investmentAmerican Chamber of Commerce American Commodities Exchange American Depository Receipt American Depository Share (ADS) American Stock Exchange American style optionAmortizable intangiblesAmortizationAmsterdam Stock ExchangeAnnual General Meeting (AGM) AnnualizedAnnual reportAnticipatory breachAntimonopoly ActAntitrustAPECAppeals panelAppreciationAppropriationArbitrageArbitrationArm's length transactionArrearsArticles of AssociationASEANAsian bank syndication marketAsian Development Bank (ADB)Asian dollar bondsAsian tigersAsia Pacific Economic Cooperation (APEC) Ask (asked) priceAsset AllocationAsset Backed SecuritiesAsset ManagementAsset strippingAsset swapAssignment methodAssociation of South East Asian Nations (ASEAN) ASXAt-the-close orderAt-the-moneyAt-the-money optionAuckland Stock ExchangeAuction marketAusterity measuresAuthorized capitalAuthorized fundAuthorized representativeAustralian Options MarketAustralian Stock ExchangeBack-door listingBack-end loadBack officeBack to back FX agreementBalance of paymentsBalance of tradeBalance sheetBalance sheet dateBalloon maturityBalloon paymentBank, Banker, BankingBank for International Settlements (BIS) BankruptcyBase dayBase rateBasel Capital Accord Basis Point (BP)Basis swapBasket of currencies Basket warrantBear marketBear positionBear raidBearerBearer stockBehind-the-sceneBelow parBenchmarkBenchmark mortgage pool BeneficiaryBermudan optionBest practiceBeta (Market beta)BidBig BandBill of exchangeBills departmentBinaryBinary optionBISBlackout periodBlock tradeBlue chipsBlue SkyBoard of directors Bona fide buyerBond marketBondsBonus issueBonus shareBook close dateBook closure period Book value BookbuildingBookrunnerBoom-bustBOOTBOTBottom lineBottom-upBounced cheque BourseBP (Basis Point) Brand management Break-up feesBreak-up valuation Breakeven point Bretton Woods SystemBridging loanBroad moneyBroker, Broking, Brokerage House Brussels Stock ExchangeBSSMBubble economyBuild, Operate and Transfer (BOT)Build, Own, Operate and Transfer (BOOT) Build/Supply-Service/Maintain (BSSM) Bull marketBulletsBullishBundesbankBusiness dayBusiness managementBusiness studiesButterfly spreadBuy-backBuy-side analystBuyer's creditBuyoutBy-lawC-CorpCACCAGRCalendar yearCall-overCall-spread warrantCall protection/provision Call warrantCallable bond Candlestick chartCapCapacityCAPEXCapital Adequacy Ratio Capital baseCapital expenditure CapitalizationCapital marketsCapital raisingCapped floaterCarry tradeCarrying costCarrying valueCash-settled warrant Cash earnings per share Cash flowCBOCBRCCCASSCDCDOCDSCeilingCeiling-floor agreementCentral Clearing & Settlement SystemCentral transaction logCentralized borrowing and lending systemCEOCEPACertificate of depositCertificate of incumbencyCertified Public Accountant (CPA)CFOChaebolChain debtsChange of domicileChapter 11Chartered financial analyst (CFA)Chicago Board of TradeChicago Board Options ExchangeChicago Mercantile ExchangeChief Executive Officer (CEO)Chief Financial Officer (CFO)Chief Information Officer (CIO)Chief Operations Officer (COO)China bankingChina Banking Regulatory Commission (CBRC) China Capital MarketsChina Development BankChina International Capital Corporation, CICC China privatizationChina restructuringChina Securities Regulatory Commission (CSRC) China Stock MarketsChinese WallCIOClaimClawback notificationClean priceCLOClosed-end fundClosing priceCo-lead managerCode of conductCollarsCollateralized Bond ObligationCollateralized Debt ObligationCollateralized Loan ObligationCollateralized Mortgage ObligationCo-managerComfort letterCommercial loanCommercial paperCommission rebateCommodity Exchange, Inc.Common stockCompany financeComplex cash flowCompound annual growth rateCompound optionConcessionConference callConfidential pre-filing reviewConfidential submissionConfidentiality agreementConglomerateConnected transactionConsiderationConsolidationConstant Maturity Treasury Derivative Constituent stockConstruction in progressConsumer Price Index (CPI)ConsumptionContested takeoverContingent liabilityContingent premiumContinuing obligationContra brokerContractual joint ventureControlling stake/interestConventional capConversion of state assets into state shares Conversion premiumConversion priceConversion ratioConverted net collectionsConvertible bondsConvertible currencyConvexityCOOCopenhagen Stock Exchange Core PCE deflator Corporate bondsCorporate finance Corporate governance Corporate vision CorporatizationCostCost overrun loansCost of carryCounsel's opinion CounterpartyCounterparty credit exposure CouponCoupon frequencyCoupon rateCovenantCovered warrantCPACPICredit Default SwapCredit facilitiesCredit foncia amortization Credit lineCredit-linked notesCredit ratingCredit riskCredit spreadCreditwatchCross currency interest rate swap Cross tradeCSRCCurrency optionCurrency swapCurrent account deficitCurrent asset/liabilityCurrent/liquid ratioCustodianCustoms & usagesCyclicalityDAXDaily marginDay countDay orderDebt equity ratioDebt-equity swapDebt issuing vehiclesDebt service coverage ratio Default fineDefaultingDefault interestDefault riskDefensiveDeferred assetDeferred chargesDeferred taxDefined Contribution Plan DeflationDeflatorDelayed dataDeleveragedDelineation of activitiesDelistDeltaDemutualizationDepreciationDeregulationDerivativesDeutsche Borse AGDeutsche Terminborse DevaluationDifferential reportingDilutionDirect investmentDirect labor costDirectional Movement Index (DMI) Directors' undertakingsDirty priceDisclaimerDisclosureDiscount rateDiscretionary managerDiscretionary orderDiscretionary powerDiscretionary trustDishonoured chequeDisinflationDisinterested shareholderDisposable incomeDistressed securitiesDiversificationDividendDividend in specieDJIADoha RoundDomestic Qualified Institutional Investor (DQII) Double bottom/double dipDow Jones Industries Average Index Downside riskDownstream enterpriseDownturnDQIIDragon bondsDrawing expense in advanceDual currency bondsDue-on-sale clauseDue diligenceDumpingDurationDynamic hedgingE-commerceE-tailersEAFEEASDAQEarning per share (EPS)EBITDAEECEmbedded optionEmerging marketEMUEngagement letterEnvironmental protectionEnvironmental wasteEPSEquity, EquitiesEquity cushionEquity warrantEUEuroEurobondEurodollar bondsEuropean Association of Securities Dealers Automated Quotations (EASDAQ)European Economic Community European Monetary Union (EMU) European Options Exchange European style optionEuropean Union (EU)Ex-couponEx-dateEx-dividend basisEx-rightsExchangeable bondExecutive directorExchange rateExercise priceExit feeExit priceExotic optionExotic warrantExploitation licenseExploitation rightExploration rightExport-oriented economyExposure draftExtendible bondsExternal auditorExternal debtExtraordinary general meeting (EGM) Extraordinary itemFace valueFair market valueFannie MaeFAS 133Feasibility reportFECFederal Deposit Insurance Corporation (FDIC) Federal National Mortgage Association (Fannie Mae)Federal Open Market CommitteeFee-Based ContentFFOFiduciaryFiduciary dutyFIGFinancial AdvisorFinancial Business Operation Permit Financial exposureFinancial forecastFinancial Institutions Group (FIG)Financial leaseFinancial ManagementFinancial Markets, Financial Products Financial ServicesFinancial yearFirst mortgageFiscal policyFiscal yearFixed asset losses in suspenseFixed incomeFlat tradesFloatationFloorFloor brokerFollow-on offeringFOMCForce majeureForeign Direct Investment (FDI)Foreign Exchange (FOREX)Foreign Exchange Business Operation Permit Foreign Exchange CertificateForeign exchange mortgage loanForeign exchange swap centerForeign-funded enterpriseFormulae Based AmortizationForward Rate AgreementFRAFranchiserFranchisorFrankfurt Stock ExchangeFree cash flowFree floatFRNFrontier tradeFTSE IndexFull disclosureFully dilutedFully paid-up capitalFundamentalsFund ManagementFuture marketFuturesFXG&AG7GAAPGatewayGATTGDPGDRGearing ratioGEMGeneral Agreement on Tariffs & Trade (GATT) General & Administrative ExpensesGeneral managementGeneral mandateGeneral offerGenerally Accepted Accounting PrincipleGini IndexGlobal bearer warrantGlobal coordinatorGlobal Depository ReceiptGlobal financeGlobal financial firm/institutionGlobal offeringGNPGoing publicGoods and services tax (GST)Goodwill amortizationGovernment Concessionary & Soft Loan Grace periodGreenshoeGross domestic productGross national productGross profitGross spreadGroup of SevenGrowth Enterprises Market (GEM) Growth FundGun jumpingH-shareHang Seng China Enterprise Index Hang Seng IndexHard currencyHard landingHedge accountingHedge FundHedgingHIBORHidden reservesHKFEHKMAHKSARHKSCCHKSEHolding CompanyHomepageHong Kong Futures Exchange Ltd.Hong Kong Interbank Offer Rate (HIBOR) Hong Kong Monetary AuthorityHong Kong Securities Clearing Co. Ltd. Hong Kong Special Administrative Region Hong Kong Stock ExchangeHot moneyHSCEIHSIHurdle rateHybrid capIASICPIdle fundsIMFIMMImplicit deflatorImplied volatilityImported inflationImport quotaImport tariffIn-the-moneyIncentive siteIncome taxIndemnificationIndexed performanceIndication of interestsIndicative priceIndustrial and Commercial Consolidated Tax InflationInformation memorandumInformation technology (IT)Initial Conversion PremiumInitial Public OfferingInsider tradingInsolventInstitutional investorIntangible assetIntellectual property (IP)Interest Rate Swap (IRS)Interest-bearing assetsIntergovernmental loanInterim reportIntermediaryInternational Accounting Standards (IAS) International FinanceInternational MarketInternational Monetary Fund (IMF) International Monetary Market (IMM) International Organization for Standardization International Trust & Investment Corp. Internet Content Provider (ICP)Internet presenceIntraday liquidityIntraday margin callIntranetIntrinsic valueInventoryInvestment, InvestingInvestment advice, Investment advisor Investment bank, Investment banking Investment gradeInvestment researchInvestor RelationsIPOIrrevocable letter of creditIRSISOIssued (and outstanding) shares IssuerITITICJGBJobberJoint accountJoint and several liabilitiesJoint global coordinatorJoint stock companyJoint ventureJointly operated minesJumbo certificateJunior mortgageJunk bondKorea Composite IndexKorea Stock ExchangeKuala Lumpur Stock ExchangeL/CLabor ArbitrageLagged effectLarge open positionLBOLead managerLegal persons sharesLenderLender of the last resort Letter of creditLevel playing fieldLeverage = level of debt/equity Leveraged Buy Out(LBO) Leveraged rateLIBORLicensed bankLienLIFFELimit orderLimited recourseLimited partnershipLinked Exchange Rate System Liquid investmentLiquid Yield Option Note LiquidityLiquidity ratioLiquidity riskListed companyLitigationLocal toll collecting highway infrastructure index Lock-inLock-outLock-upLock-Up AgreementLondon Commodity ExchangeLondon Interbank Offer RateLondon International Financial Futures and Options ExchangeLondon Metal ExchangeLondon Stock ExchangeLondon Traded Options MarketLong (position)Long callLong forwardLong options contractLong putLong straddleLong strangleLong-term shareholding (loyalty) incentiveLong-term supply agreementLoose bondLow-Budget OperationLoyaltiesLSELTM (Last twelve months)LTOMLYONM0M1M2M3M&AMaastricht TreatyMacroeconomicMadrid Stock ExchangeMain BoardMaintenance marginMakati Stock ExchangeMake-Whole CallMake-Whole ProvisionManagement Best PracticeManagement Buy-Out, MBOManagement feeManagement SeminarManagement ToolsManaging directorMandatory Provident Fund (MPF)Manila Stock ExchangeMarche a Terme International de FranceMarche des Options Negociables de la Bourse de ParisMarginMargin callMark-to-marketMarket accessMarket CapitalizationMarket economyMarket makerMarket shareMarketable securitiesMarketingMatched orderMaterial misstatementMATIFMature marketMaturityMBSMean reversionMedium and long term loansMedium Term NoteMemorandum and Articles of Association Memorandum of associationMemorandum of Regulatory Cooperation (MORC) Memorandum Of UnderstandingMergers & Acquisitions, M&AMezzanine fundMezzanine stageMFNMicro capitalizationMid-cap stockMilan Stock ExchangeMinority interestMisrepresentationModel CodeMonetarismMonetary policyMonetizeMoney-launderingMonopoly EnterpriseMontreal Stock ExchangeMoral hazardMoratoriumMortgage-backed securityMost Favored NationMOUMSCI (Morgan Stanley Capital International) MTNMulti-Lateral NettingMulti-Tranche OfferingMutual FundsNagoya Stock ExchangeNAPSNASDAQNational Association of Securities Dealers Automated QuotationsNational Automated Payment System National Bureau of Economic Research National Bureau of StatisticsNatural resourcesNAVNBICNDPNet book valueNet Domestic Product (NDP) Net incomeNet present valueNetting agreementNew York Cotton Exchange, Inc. New York Futures Exchange New York Mercantile Exchange New York Produce Exchange New York Stock Exchange Nikkei Stock AverageNil-paid rightsNo-load fundNominalNominee accountNon-callableNon-collateralized warrantNon-deliverableNon-farm payroll dataNon-operating incomeNon-performing assetNon-performing LoansNon-tradable shareNotes receivableNotifiable transactionNotional sizeNPLsObligatory rightODOdd lotsOECDOEMOff-balance sheetOff-board tradingOff-budgetaryOffer for saleOligopolyOne-on-oneOne-time mandatory call/put optionOPECOpen-end fundsOperating concessionsOperating profit/marginOperational riskOpportunity costOptionOrganization for Economic Co-operation and DevelopmentOrganization of Petroleum Exporting Countries (OPEC)Original Engineering ManufacturingOsaka Securities ExchangeOslo Stock ExchangeOTCOTC Bulletin BoardOut-of-the-moneyOutsourcingOver Draft/Over DrawOver-allotment optionOver-subscriptionOver-The-CounterOverboughtOverhead costOversoldOwned fund/own fundsP/E multipleP/E ratioPacific Economic Cooperation Council Pacific Stock ExchangePageviewPaid-up capitalPan-European Stock ExchangeParPar bondsParis BoursePartly-paid shareParityPatentPayment in lieu of noticePayoff periodPayoff profilePECCPegged Exchange Rate System Penalty provisionPenny stockPension PlanPer capita incomePerformance bondPerformance buydownsPerforming loanPhiladelphia Stock ExchangePhysical assets reserve specifically authorized Physical deliveryPhysical marketPhysical warrantPit tradingPlantPlain vanilla bondPollutantPollutant chargePortfolioPortfolio insurancePortfolio ManagementPositionPosition squaringPost-dated chequePot namesPotential obligationPower of attorneyPPIPPPPRPraecipiumPRC - People's Republic of ChinaPre-emptive rightPreference shares Preferential treatment PremiumPremium putPremium put structure PrepaymentsPresent valuePress releasePricePrice rampingPrice rangePrice talkPrice/Earning ratio (P/E) Price/Book value ratio Primary debtPrime ratePrincipalPriority Construction Treasury Private BankingPrivate EquityPrivate placementPrivate Wealth Management Privately negotiated options Privately operated mines PrivatizationProducer Price Index (PPI) Profit marginProfit-sharing planProformaProgram arrangerProject approvalProject financePromissory notePromoterProprietary Network System (PNS) ProspectusProtective putProvisional agreementProxyPSEPublic filingPublic ListingPublic RelationsPublic welfare fundPublicity restrictionPurchasing Power Parity (PPP)Pure playPut optionPut writerPutable bondPyramid sellingQ&AQDIIQFIIQualified Domestic Institutional Investor (QDII) Qualified Foreign Institutional Investor (QFII) Qualified Institutional Buyer (QIB)Qualitative analysisQuantitative analysisQuasi-credit financingsQuasi moneyQuick ratioQuoted company (= listed company) RallyRampingRandom assignmentRatingRating AgencyRatio of investmentsRaw materialsReal Estate Investment Trust (REIT) Real timeRealized interest rate RecapitalizationRecognition of incomeRecourseRecoveryRecyclingRed chipRed HerringRedeem/redemptionRefineryRegistered securitiesRegistration statementRegistrarREITRelative strength indexRent-seekingRepackaged asset vehiclesRepresentations and warranties Repurchase agreementResidual assetResidual valueResistance lineResolution Trust Corporation (RTC) Restricted license bankRestricted securities RestructuringResumption of tradingRetail players (= retail investors) Retail Price Index (RPI)Retained earningsReturn on assetReturn on capital employed Return on equityRevenue-sharingRevolving creditRight issueRights to the priority distributions Ring-fencingRisk factorRisk managementRisk premiumRisk rated ratioROARoadshowROCERoller-coaster swapROERound lotsRPIRSIRule 144AS&PS&P 500 IndexSales returnSamurai bondsSEAQSEATSSECSecond junior subordinated debenture Second liner/second line stock Secondary offeringSector FundSecularSecured debtSecuritiesSecurities and Futures Commission Securities Exchange Commission Securities Exchange of Thailand SecuritizationSeed financingSeed stageSell shortSell-side analystSelling concessionSenior debtSeparate listingSettlementSettlement riskSFCShanghai Stock ExchangeShareholders' EquityShareholder valueSharesSharpe RatioShelf CompanyShelf registrationShell companyShenzhen Foreign Exchange Trading Centre Shenzhen Stock ExchangeShort-term revolving letterShort (position)Short and medium term loansShort forwardShort sellingSidelined investorsSidelinerSight draftSIMEXSingapore International Monetary Exchange Singapore Stock ExchangeSingapore Straits Times IndexSinking fundSino-foreign joint ventureSmall CapSMESOEsSoft currencySoft landingSovereign riskSovereign rateSpecial stockSpin-offSponsorSpot marketSpot priceSpreadSprint periodStagflationStaggering maturitiesStakeholderStall speedStandard & PoorStartup financingStartup stageState-owned enterpriseState sharesStatic hedgingSterilizationStochastic processStock BrokerStock Exchange Alternative Trading System Stock Exchange Automated Quotations System Stock incentive schemeStock MarketStock Trader, Stock TradingStockholm Options MarketStocksStop loss limitStop loss strategyStraddleStrangleStrategic InvestmentStrategic InvestorStrategic saleStreet priceStressed securitiesStrike priceStripped securitiesStructure-induced equilibriumStructured bondStructured financingStructured noteSubordinated debtSubordinated debt w/ revenue participation rights SubparSunk costsSupply and marketing cooperativesSwapSwaptionSyndicated loanSynergySynthetic securitiesT/TTaiwan Weighted Stock IndexTake positionTARGET SystemTax benefitsTax haven jurisdictionTax rebateTaxable munisTelegraphic TransferTender bondTenorTerm sheetTerms of ReferenceThird linerTick sizeTight marketTime depositTime horizonTMTTokyo Grain ExchangeTokyo International Financial Futures Exchange Tokyo Stock ExchangeTokyo Sugar ExchangeToll revenue bondTop-downTop-up placingToronto Futures ExchangeToronto Stock ExchangeTracker Fund of Hong Kong (TraHK)Trade balanceTrade deficitTrade surplusTrancheTreasuryTreasury stripsTriangular debtTroughTrustee deedTurnoverTurnover ratioUmbrella fundUNUnappropriated profitsUnconditional and irrevocable letter of credit Uncovered callUncovered optionUnderlyingUnderlying assetUnderwriterUnderwritingUnderwriting syndicateUndistributed profit Unilateral/bilateral agreement Unit trustUnitary board systemUnited NationsUniversal discount rates Unlisted security Unsecured debt Unregulated issuerUpfront payment/fee Upfront premium payment Upside riskUptickUS Financial Firm/Institution US GAAPUS Investment BankUS TreasuryUse of proceedsUseful lifeUser-friendlyUser-pay principle Utilization rateValuationValue added taxValue-at-riskValue fundValue investmentVanilla bondsVariable contribution Variable equity return Variable-rate mortgage VelocityVenture capitalVertical mergerVertical spreadVery substantial acquisitionVeto powerVideo conferenceVolatilityVolatility Scan Range (VSR) VolumeWACCWages payableWarrantWash saleWatch listWeak holdingsWealth managementWeighted Average Cost of Capital Wellington Stock Exchange Whistleblowing policy Whitewash transactionWholly-owned subsidiary Winnipeg Commodities Exchange Wire roomWithdrawal PlanWithholding taxWonWorking capitalWorkoutWorld BankWorld Trade Organization (WTO)WTOX/B (Ex-bonus)X/D (Ex-dividend)X/R (Ex-rights)X/W (Ex-warrants)XeroxYankee bondsYear-end dividendYieldYield curveYield curve swapYield to callYield to crashYield to MaturityYield to putYoYYTMZero cost optionZero coupon bondsZero coupon convertible collateralized securities Zero coupon swapZero-sum gameZurich Stock Exchange资产担保证券(Asset Backed Securities的英文缩写)加速折旧承兑人;受票人;接受人融通票据;担保借据应付帐款应收帐款合资格投资者;受信投资人指符合美国证券交易委员(SEC)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者。

《投资分析与组合管理》金融专业词汇中英文对照表

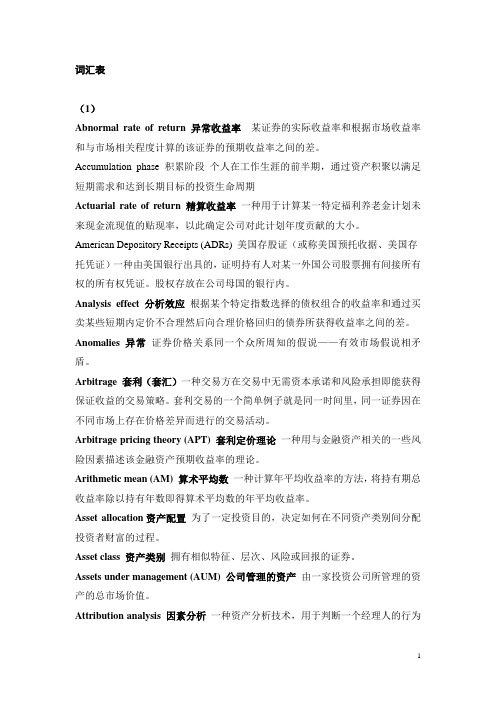

词汇表(1)Abnormal rate of return 异常收益率某证券的实际收益率和根据市场收益率和与市场相关程度计算的该证券的预期收益率之间的差。

Accumulation phase 积累阶段个人在工作生涯的前半期,通过资产积聚以满足短期需求和达到长期目标的投资生命周期Actuarial rate of return 精算收益率一种用于计算某一特定福利养老金计划未来现金流现值的贴现率,以此确定公司对此计划年度贡献的大小。

American Depository Receipts (ADRs) 美国存股证(或称美国预托收据、美国存托凭证)一种由美国银行出具的,证明持有人对某一外国公司股票拥有间接所有权的所有权凭证。

股权存放在公司母国的银行内。

Analysis effect 分析效应根据某个特定指数选择的债权组合的收益率和通过买卖某些短期内定价不合理然后向合理价格回归的债券所获得收益率之间的差。

Anomalies 异常证券价格关系同一个众所周知的假说——有效市场假说相矛盾。

Arbitrage 套利(套汇)一种交易方在交易中无需资本承诺和风险承担即能获得保证收益的交易策略。

套利交易的一个简单例子就是同一时间里,同一证券因在不同市场上存在价格差异而进行的交易活动。

Arbitrage pricing theory (APT) 套利定价理论一种用与金融资产相关的一些风险因素描述该金融资产预期收益率的理论。

Arithmetic mean (AM) 算术平均数一种计算年平均收益率的方法,将持有期总收益率除以持有年数即得算术平均数的年平均收益率。

Asset allocation资产配置为了一定投资目的,决定如何在不同资产类别间分配投资者财富的过程。

Asset class 资产类别拥有相似特征、层次、风险或回报的证券。

Assets under management (AUM) 公司管理的资产由一家投资公司所管理的资产的总市场价值。

经济金融术语中英文对照

经济金融术语中英文对照D (2)E (3)F (3)G (5)J (8)K (10)L (11)M (12)N (13)P (13)Q (14)R (15)W (15)X (16)Y (18)Z (19)D打白条 issue IOU大额存单 certificate of deposit(CD)大额提现 withdraw deposits in large amounts大面积滑坡 wide-spread decline大一统的银行体制(all-in-one)mono-bank system呆账(请见“坏账”) bad loans呆账准备金 loan loss reserves(provisions)呆滞贷款 idle loans贷款沉淀 non-performing loans贷款分类 loan classification贷款限额管理 credit control;to impose credit ceiling贷款约束机制 credit disciplinary(constraint)mechanism代理国库 to act as fiscal agent代理金融机构贷款 make loans on behalf of other institutions 戴帽贷款 ear-marked loans倒逼机制 reversed transmission of the pressure for easing monetary condition道德风险 moral hazard地区差别 regional disparity第一产业 the primary industry第二产业 the secondary industry第三产业 the service industry;the tertiary industry 递延资产 deferrable assets订货不足 insufficient orders定期存款 time deposits定向募集 raising funds from targeted sources东道国(请见“母国”) host country独立核算 independent accounting短期国债 treasury bills对冲操作 sterilization operation;hedging对非金融部门债权 claims on non-financial sector多种所有制形式 diversified ownershipE恶性通货膨胀 hyperinflation二级市场 secondary marketF发行货币 to issue currency发行总股本 total stock issue法定准备金 required reserves;reserve requirement法人股 institutional shares法人股东 institutional shareholders法治 rule of law房地产投资 real estate investment放松银根 to ease monetary policy非现场稽核 off-site surveillance(or monitoring)非银行金融机构 non-bank financial institutions非赢利性机构 non-profit organizations分税制 assignment of central and local taxes;tax assignment system分业经营segregation of financial business (services);division of business scope based on the type of financial institutions风险暴露(风险敞口) risk exposure风险管理 risk management风险意识 risk awareness风险资本比例 risk-weighted capital ratios风险资本标准 risk-based capital standard服务事业收入 public service charges;user's charges扶贫 poverty alleviation负增长 negative growth复式预算制double-entry budgeting;capital and current budgetary accountG改革试点 reform experimentation杠杆率 leverage ratio杠杆收购 leveraged buyout高息集资 to raise funds by offering high interest个人股 non-institutional shares根本扭转 fundamental turnaround(or reversal)公开市场操作 open market operations公款私存 deposit public funds in personal accounts公用事业 public utilities公有经济 the state-owned sector;the public sector公有制 public ownership工业成本利润率 profit-to-cost ratio工业增加值 industrial value added供大于求 supply exceeding demand;excessive supply鼓励措施 incentives股份合作企业 joint-equity cooperative enterprises股份制企业 joint-equity enterprises股份制银行 joint-equity banks固定资产贷款 fixed asset loans关税减免 tariff reduction and exemption关税减让 tariff concessions关税优惠 tariff incentives;preferential tariff treatment规范行为 to regularize(or standardize)…behavior规模效益 economies of scale国计民生 national interest and people's livelihood国家对个人其他支出 other government outlays to individuals 国家风险 country risk国际分工 international division of labor国际收支 balance of payments国有独资商业银行 wholly state-owned commercial banks国有经济(部门) the state-owned(or public)sector国有企业 state-owned enterprises(SOEs)国有制 state-ownership国有资产流失 erosion of state assets国债回购 government securities repurchase国债一级自营商 primary underwriters of government securities 过度竞争 excessive competition过度膨胀 excessive expansionH合理预期 rational expectation核心资本 core capital合资企业 joint-venture enterprises红利 dividend宏观经济运营良好 sound macroeconomic performance宏观经济基本状况 macroeconomic fundamentals宏观调控 macroeconomic management(or adjustment)宏观调控目标 macroeconomic objectives(or targets)坏账 bad debt还本付息 debt service换汇成本unit export cost;local currency cost of export earnings汇兑在途 funds in float汇兑支出 advance payment of remittance by the beneficiary's bank汇率并轨 unification of exchange rates活期存款 demand deposits汇率失调 exchange rate misalignment混合所有制 diversified(mixed)ownership货币政策态势 monetary policy stance货款拖欠 overdue obligations to suppliers过热J基本建设投资 investment in infrastructure基本经济要素 economic fundamentals基本适度 broadly appropriate基准利率 benchmark interest rate机关团体存款 deposits of non-profit institutions机会成本 opportunity cost激励机制 incentive mechanism积压严重 heavy stockpile;excessive inventory挤提存款 run on banks挤占挪用 unwarranted diversion of(financial)resources(from designated uses)技改投资 investment in technological upgrading技术密集型产品 technology-intensive product计划单列市 municipalities with independent planning status 计划经济 planned economy集体经济 the collective sector加大结构调整力度 to intensify structural adjustment加工贸易 processing trade加快态势 accelerating trend加强税收征管稽查 to enhance tax administration加权价 weighted average price价格放开 price liberalization价格形成机制 pricing mechanism减亏 to reduce losses简化手续 to cut red tape;to simplify(streamline)procedures 交投活跃 brisk trading缴存准备金 to deposit required reserves结构扭曲 structural distortion结构失调 structural imbalance结构性矛盾突出 acute structural imbalance结构优化 structural improvement(optimization)结汇、售汇 sale and purchase of foreign exchange金融脆弱 financial fragility金融动荡 financial turbulence金融风波 financial disturbance金融恐慌 financial panic金融危机 financial crisis金融压抑 financial repression金融衍生物 financial derivatives金融诈骗 financial fraud紧缩银根 to tighten monetary policy紧缩政策 austerity policies;tight financial policies经常账户可兑换 current account convertibility经济特区 special economic zones(SEZs)经济体制改革 economic reform经济增长方式的转变 change in the main source of economic growth(from investment expansion to efficiency gains)经济增长减速 economic slowdown;moderation in economic growth 经济制裁 economic sanction经营自主权 autonomy in management景气回升 recovery in business activity境外投资 overseas investment竞争加剧 intensifying competition局部性金融风波 localized(isolated)financial disturbance 迹象 signs of overheatingK开办人民币业务 to engage in RMB business可维持(可持续)经济增长 sustainable economic growth可变成本 variable cost可自由兑换货币 freely convertible currency控制现金投放 control currency issuance扣除物价因素 in real terms;on inflation-adjusted basis库存产品 inventory跨国银行业务 cross-border banking跨年度采购 cross-year procurement会计准则 accounting standardL来料加工 processing of imported materials for export离岸银行业务 off-shore banking(business)理顺外贸体制 to rationalize foreign trade regime利率杠杆的调节作用 the role of interest rates in resource allocation利润驱动 profit-driven利息回收率 interest collection ratio联行清算 inter-bank settlement连锁企业 franchise(businesses);chain businesses良性循环 virtuous cycle两极分化growing income disparity;polarization in income distribution零售物价指数 retail price index(RPI)流动性比例 liquidity ratio流动资产周转率/流通速度 velocity of liquid assets流动资金贷款 working capital loans流通体制 distribution system流通网络 distribution network留购(租赁期满时承租人可购买租赁物) hire purchase垄断行业 monopolized industry(sector)乱集资 irregular(illegal)fund raising乱收费 irregular(illegal)charges乱摊派 unjustified(arbitrary)leviesM买方市场 buyer's market卖方市场 seller's market卖出回购证券 matched sale of repo贸易差额 trade balance民间信用 non-institutionalized credit免二减三 exemption of income tax for the first two years ofmaking profit and 50% tax reduction for thefollowing three years明补 explicit subsidy明亏 explicit loss名牌产品 brand products母国(请见“东道国”) home countryN内部控制 internal control内部审计 internal audit内地与香港 the mainland and Hong Kong内债 domestic debt扭亏为盈 to turn a loss-making enterprise into a profitable one扭曲金融分配 distorted allocation of financial resources 农副产品采购支出 outlays for agricultural procurement农村信用社 rural credit cooperatives(RCCs)P泡沫效应 bubble effect泡沫经济 bubble economy培育新的经济增长点 to tap new sources of economic growth 片面追求发展速度 excessive pursuit of growth平衡发展 balanced development瓶颈制约 bottleneck(constraints)平稳回升 steady recovery铺底流动资金 initial(start-up)working capital普遍回升 broad-based recovery配套改革 concomitant(supporting)reforms配套人民币资金 lQ企业办社会 enterprises burdened with social responsibilities 企业集团战略 corporate group strategy企业兼并重组 company merger and restructuring企业领导班子 enterprise management企业所得税 enterprise(corporate)income tax企业效益 corporate profitability企业资金违规流入股市 irregular flow of enterprise funds into the stock market欠税 tax arrears欠息 overdue interest强化税收征管 to strengthen tax administration强制措施 enforcement action翘尾因素 carryover effect切一刀 partial application清理收回贷款 clean up and recover loans(破产)清算 liquidation倾斜政策 preferential policy区别对待 differential treatment趋势加强 intensifying trend全球化 globalization权益回报率 returns on equity(ROE)缺乏后劲 unsustainable momentumR绕规模贷款 to circumvent credit ceiling人均国内生产总值 per capita GDP人均收入 per capita income人民币升值压力 upward pressure on the Renminbi(exchange rate)认缴资本 subscribed capital软贷款 soft loans软预算约束 soft budget constraint软着陆 soft landingocal currency funding of…W外部审计 external audit外国直接投资 foreign direct investment (FDI)外汇储备 foreign exchange reserves外汇调剂 foreign exchange swap外汇占款 the RMB counterpart of foreign exchange reserves;the RMB equivalent of offcial foreign exchange holdings外向型经济 export-oriented economy外债 external debt外资企业 foreign-funded enterprises完善现代企业制度 to improve the modern enterprise system 完税凭证 tax payment documentation违法经营 illegal business委托存款 entrusted deposits稳步增长 steady growth稳健的银行系统 a sound banking system稳中求进 to make progress while ensuring stability无纸交易 book-entry(or paperless/scriptless)transaction 物价监测 price monitoringX吸纳流动性 to absorb liquidity稀缺经济 scarcity economy洗钱 money laundering系统内调度 fund allocation within a bank系统性金融危机 systemic financial crisis下岗工人 laid-off employees下游企业 down-stream enterprises现场稽核 on-site examination现金滞留(居民手中) cash held outside the banking system 乡镇企业 township and village enterprises(TVEs)消费物价指数 consumer price index(CPI)消费税 excise(consumption)tax消灭财政赤字to balance the budget;to eliminate fiscal deficit销货款回笼 reflow of corporate sales income to the banking system销售平淡 lackluster sales协议外资金额 committed amount of foreign investment新经济增长点 new sources of economic growth新开工项目 new projects;newly started projects新增贷款 incremental credit; loan increment; credit growth; credit expansion新增就业位置 new jobs;new job opportunities信贷规模考核 review the compliance with credit ceilings信号失真 distorted signals信托投资公司 trust and investment companies信息不对称 information asymmetry信息反馈 feedback(information)信息共享系统 information sharing system信息披露 information disclosure信用扩张 credir expansion信用评级 credit rating姓“资”还是姓“社”pertaining to socialism or capitalism;socialist orcaptialist行政措施 administrative measures需求膨胀 demand expansion; excessive demand虚伪存款 window-dressing deposits削减冗员 to shed excess labor force寻租 rent seeking迅速反弹 quick reboundY养老基金 pension fund一刀切universal application;non-discretionary implementation一级市场 primary market应收未收利息 overdue interest银行网点 banking outlets赢利能力 profitability营业税 business tax硬贷款(商业贷款) commercial loans用地审批 to grant land use right有管理的浮动汇率 managed floating exchange rate证券投资 portfolio investment游资(热钱) hot money有市场的产品 marketable products有效供给 effective supply诱发新一轮经济扩张 trigger a new round of economic expansion 逾期贷款 overdue loans;past-due loans与国际惯例接轨to become compatible with internationally accepted与国际市场接轨 to integrate with the world market预算外支出(收入) off-budget (extra-budgetary) expenditure (revenue)预调 pre-emptive adjustment月环比 on a month-on-month basis; on a monthly basisZ再贷款 central bank lending在国际金融机构储备头寸 reserve position in international financial institutions在人行存款 deposits at (with) the central bank在途资金 fund in float增加农业投入 to increase investment in agriculture增势减缓 deceleration of growth;moderation of growthmomentum增收节支措施revenue-enhancing and expenditure control measures增长平稳 steady growth增值税 value-added tax(VAT)涨幅偏高 higher-than-desirable growth rate;excessive growth 账外账 concealed accounts折旧 depreciation整顿 retrenchment;consolidation政策工具 policy instrument政策性业务 policy-related operations政策性银行 policy banks政策组合 policy mix政府干预 government intervention证券交易清算 settlement of securities transactions证券业务占款 funding of securities purchase支付困难 payment difficulty支付能力 payment capacity直接调控方式向 to increase the reliance on indirect policy instruments间接调控方式转变职能转换 transformation of functions职业道德 professional ethics指令性措施 mandatory measures指令性计划 mandatory plan;administered plan制定和实施货币政策 to conduct monetary policy;to formulate and implement monetary policy滞后影响 lagged effect中介机构 intermediaries中央与地方财政 delineation of fiscal responsibilities分灶吃饭重点建设 key construction projects;key investment project周期谷底 bottom(trough)of business cycle周转速度 velocity主办银行 main bank主权风险 sovereign risk注册资本 registered capital逐步到位 to phase in;phased implementation逐步取消 to phase out抓大放小 to seize the big and free the small(to maintain close oversight on the large state-ownedenterprises and subject smaller ones to market competition)专款专用 use of funds as ear-marked转贷 on-lending转轨经济 transition economy转机 turnaround转折关头 turning point准财政赤字 quasi-fiscal deficit准货币 quasi-money资本不足 under-capitalized资本充足率 capital adequacy ratio资本利润率 return on capital资本账户可兑换 capital account convertibility资不抵债 insolvent;insolvency资产负债表 balance sheet资产负债率liability/asset ratio;ratio of liabilities to assets资产集中 asset concentration资产贡献率 asset contribution factor资产利润率 return on assets (ROA)资产质量 asset quality资产组合 asset portfolio资金成本 cost of funding;cost of capital;financing cost资金到位 fully funded (project)资金宽裕 to have sufficient funds资金利用率 fund utilization rate资金缺口 financing gap资金体外循环 financial disintermediation资金占压 funds tied up自筹投资项目 self-financed projects自有资金 equity fund综合国力 overall national strength(often measured by GDP)综合效益指标 overall efficiency indicator综合治理 comprehensive adjustment(retrenchment);over-haul 总成交额 total contract value总交易量 total amount of transactions总成本 total cost最后贷款人 lender of last resort。

金融数学中英文专业词汇对照

金融数学中英文专业词汇对照accumulation function 累积函数American-style option 美式期权amortization method 分期偿还法annuity 年金annuity-due 期初付年金annuity-immediate 期末付年金arbitrage 套利at-the-money option 平价期权base amount 基价base points 基点bear spreads 熊市差价Bermudan-style option 百慕大期权binomial tree 二叉树bond 债券bond with coupons 附息债券box spread 盒式差价brownian motion 布朗运动bull spreads 牛市差价butterfly spreads 蝶式差价buyer 买方call option 看涨期权callable bond 可赎回债券cash flow matching 现金流配比cash-and-carry arbitrage 正向套利Chicago mercantile exchange(CME)芝加哥商业交易所collar 衣领策略collar width 衣领宽度common stock 普通股compound increasing annuity 复递增年金compound interest 复利continuously payable annuity 连续支付年金continuously payable continuously decreasing annuity 连续支付连续递减的年金continuously payable continuously increasing annuity 连续支付连续递增的年金continuously payable decreasing annuity 连续支付的递减年金continuously payable increasing annuity 连续支付的递增年金continuously payable varying annuity 连续支付的变额年金convexity 凸度coupon 息票收入coupon rate 息票率decreasing annuity 递减年金decreasing annuity-due 期初付递减年金decreasing annuity-immediate 期末付递减年金delivery price 交割价格derivative instrument 衍生产品discount function 贴现函数duration 久期effective duration 有效久期effective rate of discount 实际贴现率effective rate of interest 实际利率equation of value 价值方程European-style option 欧式期权exercise price 执行价格face amount 面值fixed interest rate model 固定利率模型force of discount 贴现力force of interest 利息力forward contract 远期合约forward price 远期价格forward rate 远期利率forward rate agreements(FRA)远期利率协议forwards 远期full immunization 完全免疫future value 终值futures 期货futures contracts 期货合约futures price 期货价格hedging 套期保值immunization 免疫increasing annuity 递增年金increasing annuity-due 期初付递增年金increasing annuity-immediate 期末付递增年金initial margin 初始保证金interest 利息interest rate swaps 利率互换interest rate tree 利率树interest-sensitive cash flows 利率敏感型现金流internal rate of return 内涵报酬率in-the-money option 实值期权intrinsic value 内在价值investment year method 投资年度法Ito process 伊藤过程level annuity 等额年金London interbank offered rate 伦敦银行同业拆借利率long position 多头maintenance margin 维持保证金marking to market 盯市modified duration 修正久期mortgage 抵押贷款net present value 净现值nominal rate of discount 名义贴现率nominal rate of interest 名义利率offset 对冲平仓option 期权option price 期权价格out-of-the-money option 虚值期权outstanding balance 未偿还本金余额par yield curve 平价收益率曲线payoff 回收perpetuity 永续年金portfolio method 组合方法preferred stock 优先股premium 期权费premium amortization 溢价分摊present value 现值principle 本金prospective method 将来法pure discount bond 贴现债券put option 看跌期权ratio spread 比率差价redemption value 偿还值retrospective method 过去法reverse cash-and-carry arbitrage 反向套利risk-neutral probability 风险中性概率seller 卖方short position 空头short sale 卖空simple interest 单利sinking fund method 偿债基金法spot price 即期价格spot rate 即期利率spreads 差价stock 股票straddle 跨式策略strap 带式策略strip 条式策略swap 互换swap rate 互换利率term structure of interest rate 利率的期限结构time-weighted rate of return 时间加权收益率underlying asset 标的资产variance rate 方差率varying interest rate model 变动利率模型covered call 有担保的看涨期权covered put 有担保的看跌期权yield rate 收益率yield to maturity 到期收益率zero-cost collar 零成本衣领zero-coupon bond 零息债券。

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

金融业中英文对照

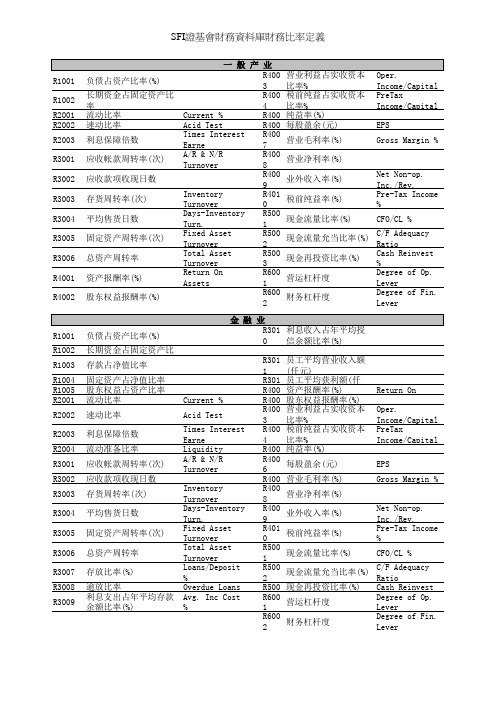

R1001负债占资产比率(%)3比率%Income/Capital R1002长期资金占固定资产比率R4004税前纯益占实收资本比率%PreTaxIncome/Capital R2001流动比率Current %R400纯益率(%)R2002速动比率Acid Test R400每股盈余(元)EPSR2003利息保障倍数Times Interest Earne R4007营业毛利率(%)Gross Margin %R3001应收帐款周转率(次)A/R & N/R Turnover R4008营业净利率(%)R3002应收款项收现日数R4009业外收入率(%)Net Non-op.Inc./Rev.R3003存货周转率(次)Inventory Turnover R4010税前纯益率(%)Pre-Tax Income %R3004平均售货日数Days-Inventory Turn.R5001现金流量比率(%)CFO/CL %R3005固定资产周转率(次)Fixed Asset Turnover R5002现金流量允当比率(%)C/F Adequacy RatioR3006总资产周转率Total Asset Turnover R5003现金再投资比率(%)Cash Reinvest %R4001资产报酬率(%)Return On Assets R6001营运杠杆度Degree of Op.LeverR4002股东权益报酬率(%)R6002财务杠杆度Degree of Fin.LeverR1001负债占资产比率(%)0信余额比率(%)R1002长期资金占固定资产比R1003存款占净值比率R3011员工平均营业收入额(仟元)R1004固定资产占净值比率R301员工平均获利额(仟R1005股东权益占资产比率R400资产报酬率(%)Return On R2001流动比率Current %R400股东权益报酬率(%)R2002速动比率Acid Test R4003营业利益占实收资本比率%Oper.Income/Capital R2003利息保障倍数Times Interest Earne R4004税前纯益占实收资本比率%PreTaxIncome/Capital R2004流动准备比率Liquidity R400纯益率(%)R3001应收帐款周转率(次)A/R & N/R Turnover R4006每股盈余(元)EPSR3002应收款项收现日数R400营业毛利率(%)Gross Margin %R3003存货周转率(次)Inventory TurnoverR4008营业净利率(%)R3004平均售货日数Days-Inventory Turn.R4009业外收入率(%)Net Non-op.Inc./Rev.R3005固定资产周转率(次)Fixed Asset Turnover R4010税前纯益率(%)Pre-Tax Income %R3006总资产周转率Total Asset TurnoverR5001现金流量比率(%)CFO/CL %R3007存放比率(%)Loans/Deposit %R5002现金流量允当比率(%)C/F Adequacy RatioR3008逾放比率Overdue Loans R500现金再投资比率(%)Cash Reinvest R3009利息支出占年平均存款余额比率(%)Avg. Inc Cost %R6001营运杠杆度Degree of Op.LeverR6002财务杠杆度Degree of Fin.LeverR1001负债占资产比率(%)R400每股盈余(元)EPSR1002长期资金占固定资产比R400营业毛利率(%)Gross Margin %R2001流动比率Current %R400营业净利率(%)R2002速动比率Acid TestR4009业外收入率(%)Net Non-op.Inc./Rev.R2003利息保障倍数Times Interest Earne R4010税前纯益率(%)Pre-Tax Income %R3001应收帐款周转率(次)A/R & N/R Turnover R5001现金流量比率(%)CFO/CL %R3002应收款项收现日数R5002现金流量允当比率(%)C/F Adequacy RatioR3003存货周转率(次)Inventory Turnover R5003现金再投资比率(%)Cash Reinvest %R3004平均售货日数Days-Inventory Turn.R6001营运杠杆度Degree of Op.LeverR3005固定资产周转率(次)Fixed Asset Turnover R6002财务杠杆度Degree of Fin.LeverR3006总资产周转率Total Asset R700负债总额占资本净值R4001资产报酬率(%)Assets 2比率(%)R4002股东权益报酬率(%)R7003包销总额占速动资产比率(%)R4003营业利益占实收资本比率%Oper.Income/Capital R7004融资总金额占净值比率(%)R4004税前纯益占实收资本比率%PreTax Income/Capital R7005融券总金额占净值比率(%)R4005纯益率(%)。

经济金融词汇中英文对照表

经济金融术语汉英对照表A安全网safety net按可比口径on comparable basis按轻重缓急to prioritize暗补implicit subsidy暗亏hidden lossB颁发营业执照to license;to grant a licence to 办理存款业务to take deposits保护农民的生产积极性to protect farmers'incentive to produce备付金(超额准备金)excess reserves本外币并账consolidation of domestic and foreign currencyaccounts本外币对冲操作sterilization operation本位利益localized interest;departmentalism 奔小康to strive to prosper;to strive to become well-to-do避税(请见“逃税”)tax avoidance币种搭配不当currency mismatch币种构成currency composition变相社会集资disguised irregular(or illegal)fund raising表外科目(业务)off-balance-sheet items (operation)薄弱环节weaknesses;loopholes不变成本fixed cost不变价at constant price;in real terms不动产real estate不良贷款(资产)problem loans;non-performing loans(assets)C财务公司finance companies财政赤字fiscal deficit财政挤银行fiscal pressure on the central bank (over monetary policy)财政政策与货币政策的配合coordination of fiscal and monetary policies采取循序渐进的方法in a phased and sequenced manner操作弹性operational flexibility操纵汇率to manipulate exchange rate产品构成product composition;product mix产品积压stock pile;excessive inventory产销率current period inventory;(即期库存,不含前期库存)sales/output ratio产销衔接marketability产业政策industrial policy长期国债treasury bonds敞口头寸open position炒股to speculate in the stock market承购包销underwrite(securities)成套机电产品complete sets of equipment;complete plant(s)城市信用社urban credit cooperatives(UCCs)城市合作银行urban cooperative banks;municipal united banks城市商业银行municipal commercial banks城乡居民收入增长超过物价涨幅real growth in household income持续升温persistent overheating重复布点duplicate projects重置成本replacement cost重组计划restructuring plan筹资渠道funding sources;financing channels 初见成效initial success出口统一管理、归口经营canalization of exports出口退税export tax rebate储蓄存款household deposits(不完全等同于西方的savingsdeposits,前者包括活期存款,后者不包括。

经济金融术语英汉对照

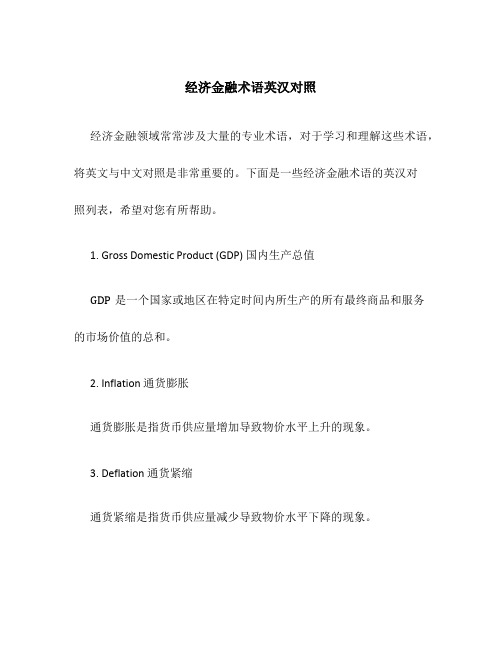

经济金融术语英汉对照经济金融领域常常涉及大量的专业术语,对于学习和理解这些术语,将英文与中文对照是非常重要的。

下面是一些经济金融术语的英汉对照列表,希望对您有所帮助。

1. Gross Domestic Product (GDP) 国内生产总值GDP是一个国家或地区在特定时间内所生产的所有最终商品和服务的市场价值的总和。

2. Inflation 通货膨胀通货膨胀是指货币供应量增加导致物价水平上升的现象。

3. Deflation 通货紧缩通货紧缩是指货币供应量减少导致物价水平下降的现象。

4. Interest Rate 利率利率是指借贷资金所产生的利息与本金之间的比率。

5. Exchange Rate 汇率汇率是指一种货币与另一种货币之间的兑换比率。

6. Stock Market 股票市场股票市场是指买卖股票的场所,也是企业融资的重要途径。

7. Bond 债券债券是一种证券,表示借款人向债权人承诺在一定期限内支付利息和本金。

8. Foreign Direct Investment (FDI) 外商直接投资外商直接投资是指一个国家的企业在另一个国家的企业中进行的长期投资。

9. Taxation 税收税收是政府从个人和企业获得财政收入的一种方式。

10. Budget Deficit 预算赤字预算赤字是指政府支出超过收入的情况,需要通过借贷或印钞等方式来弥补。

11. Trade Surplus/Trade Deficit 贸易顺差/贸易逆差贸易顺差指一个国家的出口额大于进口额,贸易逆差则相反。

12. Monetary Policy 货币政策货币政策是由中央银行制定和执行的调控货币供应量和利率水平的政策。

13. Fiscal Policy 财政政策财政政策是由政府制定和执行的调控财政支出和税收的政策。

14. Central Bank 央行央行是一个国家的货币发行和货币政策的实施机构。

15. Market Economy 市场经济市场经济是一种以市场配置资源和决定价格的经济体制。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2M method 2M法3M method 3M法A scores A值Accounting convention 会计惯例Accounting for acquisitions 购并的会计处理Accounting for debtors 应收账款核算Accounting for depreciation 折旧核算Accounting for foreign currencies 外汇核算Accounting for goodwill 商誉核算Accounting for stocks 存货核算Accounting policies 会计政策Accounting standards 会计准则Accruals concept 权责发生原则Achieving credit control 实现信用控制Acid test ratio 酸性测试比率Actual cash flow 实际现金流量Adjusting company profits 企业利润调整Advance payment guarantee 提前偿还保金Adverse trading 不利交易Advertising budget 广告预算Advising bank 通告银行Age analysis 账龄分析Aged debtors analysis 逾期账款分析Aged debtors'exception report 逾期应收款的特殊报告Aged debtors'exception report 逾期账款特别报告Aged debtors'report 逾期应收款报告Aged debtors'report 逾期账款报告All—monies clause 全额支付条款Amortization 摊销Analytical questionnaire 调查表分析Analytical skills 分析技巧Analyzing financial risk 财务风险分析Analyzing financial statements 财务报表分析Analyzing liquidity 流动性分析Analyzing profitability 盈利能力分析Analyzing working capital 营运资本分析Annual expenditure 年度支出Anticipating future income 预估未来收入Areas of financial ratios 财务比率分析的对象Articles of incorporation 合并条款Asian crisis 亚洲(金融)危机Assessing companies 企业评估Assessing country risk 国家风险评估Assessing credit risks 信用风险评估Assessing strategic power 战略地位评估Assessment of banks 银行的评估Asset conversion lending 资产转换贷款Asset protection lending 资产担保贷款Asset sale 资产出售Asset turnover 资产周转率Assets 资产Association of British Factors and Discounters 英国代理人与贴现商协会Auditor's report 审计报告Aval 物权担保Bad debt 坏账Bad debt level 坏账等级Bad debt risk 坏账风险Bad debts performance 坏账发生情况Bad loans 坏账Balance sheet 资产负债表Balance sheet structure 资产负债表结构Bank credit 银行信贷Bank failures 银行破产Bank loans.availability 银行贷款的可获得性Bank status reports 银行状况报告Bankruptcy 破产Bankruptcy code 破产法Bankruptcy petition 破产申请书Basle agreement 塞尔协议Basle Agreement 《巴塞尔协议》Behavorial scoring 行为评分Bill of exchange 汇票Bill of lading 提单BIS 国际清算银行BIS agreement 国际清算银行协定Blue chip 蓝筹股Bonds 债券Book receivables 账面应收账款Borrowing money 借人资金Borrowing proposition 借款申请Breakthrough products 创新产品Budgets 预算Building company profiles 勾画企业轮廓Bureaux (信用咨询)公司Business development loan 商业开发贷款Business failure 破产Business plan 经营计划Business risk 经营风险Buyer credits 买方信贷Buyer power 购买方力量Buyer risks 买方风险CAMPARI 优质贷款原则Canons of lending 贷款原则Capex 资本支出Capital adequacy 资本充足性Capital adequacy rules 资本充足性原则Capital commitments 资本承付款项Capital expenditure 资本支出Capital funding 资本融资Capital investment 资本投资Capital strength 资本实力Capital structure 资本结构Capitalization of interest 利息资本化Capitalizing development costs 研发费用资本化Capitalizing development expenditures 研发费用资本化Capitalizing interest costs 利息成本资本化Cascade effect 瀑布效应Cash assets 现金资产Cash collection targets 现金托收目标Cash cycle 现金循环周期Cash cycle ratios 现金循环周期比率Cash cycle times 现金循环周期时间Cash deposit 现金储蓄Cash flow adjustments 现金流调整Cash flow analysis 现金流量分析Cash flow crisis 现金流危机Cash flow cycle 现金流量周期Cash flow forecasts 现金流量预测Cash flow lending 现金流贷出Cash flow profile 现金流概况Cash flow projections 现金流预测Cash flow statements 现金流量表Cash flows 现金流量Cash position 现金头寸Cash positive JE现金流量Cash rich companies 现金充足的企业Cash surplus 现金盈余Cash tank 现金水槽Cash-in-advance 预付现金Categorized cash flow 现金流量分类CE 优质贷款原则CEO 首席执行官Chairman 董事长,总裁Chapter 11 rules 第十一章条款Charge 抵押Charged assets 抵押资产Chief executive officer 首席执行官Collateral security 抵押证券Collecting payments 收取付款Collection activitv 收款活动Collection cycle 收款环节Collection procedures 收款程序Collective credit risks 集合信用风险Comfortable liquidity positi9n 适当的流动性水平Commercial mortgage 商业抵押Commercial paper 商业票据Commission 佣金Commitment fees 承诺费Common stock 普通股Common stockholders 普通股股东Company and its industry 企业与所处行业Company assets 企业资产Company liabilities 企业负债Company loans 企业借款Competitive advantage 竞争优势Competitive forces 竞争力Competitive products 竞争产品Complaint procedures 申诉程序Computerized credit information 计算机化信用信息Computerized diaries 计算机化日志Confirmed letter of credit 承兑信用证Confirmed letters of credit 保兑信用证Confirming bank 确认银行Conservatism concept 谨慎原则Consistency concept 一贯性原则Consolidated accounts 合并报表Consolidated balance sheets 合并资产负债表Contingent liabilities 或有负债Continuing security clause 连续抵押条款Contractual payments 合同规定支出Control limits 控制限度Control of credit activities 信用活动控制Controlling credit 控制信贷Controlling credit risk 控制信用风险Corporate credit analysis 企业信用分析Corporate credit controller 企业信用控制人员Corporate credit risk analysis 企业信用风险分析Corporate customer 企业客户Corporate failure prediction models 企业破产预测模型Corporate lending 企业贷款Cost leadership 成本领先型Cost of sales 销售成本Costs 成本Country limit 国家限额Country risk 国家风险Court judgments 法院判决Covenant 贷款保证契约Covenants 保证契约Creative accounting 寻机性会计Credit analysis 信用分析Credit analysis of customers 客户信用分析Credit analysis of suppliers 供应商的信用分析Credit analysis on banks 银行信用分析Credit analysts 信用分析Credit assessment 信用评估Credit bureau reports 信用咨询公司报告Credit bureaux 信用机构Credit control 信贷控制Credit control activities 信贷控制活动Credit control performance reports 信贷控制绩效报告Credit controllers 信贷控制人员Credit cycle 信用循环Credit decisions 信贷决策Credit deterioration 信用恶化Credit exposure 信用敞口Credit granting process 授信程序Credit information 信用信息Credit information agency 信用信息机构Credit insurance 信贷保险Credit insurance advantages 信贷保险的优势Credit insurance brokers 信贷保险经纪人Credit insurance limitations 信贷保险的局限Credit limits 信贷限额Credit limits for currency blocs 货币集团国家信贷限额Credit limits for individual countries 国家信贷限额Credit management 信贷管理Credit managers 信贷经理Credit monitoring 信贷监控Credit notes 欠款单据Credit period 信用期Credit planning 信用计划Credit policy 信用政策Credit policy issues 信用政策发布Credit proposals 信用申请Credit protection 信贷保护Credit quality 信贷质量Credit rating 信用评级Credit rating agencies 信用评级机构Credit rating process 信用评级程序Credit rating system 信用评级系统Credit reference 信用咨询Credit reference agencies 信用评级机构Credit risk 信用风险Credit risk assessment 信用风险评估Credit risk exposure 信用风险敞口Credit risk insurance 信用风险保险Credit risk.individual customers 个体信用风险Credit risk:bank credit 信用风险:银行信用Credit risk:trade credit 信用风险:商业信用Credit scoring 信用风险评分Credit scoring model 信用评分模型Credit scoring system 信用评分系统Credit squeeze 信贷压缩Credit taken ratio 受信比率Credit terms 信贷条款Credit utilization reports 信贷利用报告Credit vetting 信用审查Credit watch 信用观察Credit worthiness 信誉Creditor days 应付账款天数Cross-default clause 交叉违约条款Currency risk 货币风险Current assets 流动资产Current debts 流动负债Current ratio requirement 流动比率要求Current ratios 流动比率Customer care 客户关注Customer credit ratings 客户信用评级Customer liaison 客户联络Customer risks 客户风险Cut-off scores 及格线Cycle of credit monitoring 信用监督循环Cyclical business 周期性行业Daily operating expenses 经营费用Day’s sales outstanding 收回应收账款的平均天数Debentures 债券Debt capital 债务资本Debt collection agency 债务托收机构Debt issuer 债券发行人Debt protection levels 债券保护级别Debt ratio 负债比率Debt securities 债券Debt service ratio 还债率Debtor days 应收账款天数Debtor's assets 债权人的资产Default 违约Deferred payments 延期付款Definition of leverage 财务杠杆率定义Deposit limits 储蓄限额Depositing money 储蓄资金Depreciation 折旧Depreciation policies 折旧政策Development budget 研发预算Differentiation 差别化Direct loss 直接损失Directors salaries 董事薪酬Discretionary cash flows 自决性现金流量Discretionary outflows 自决性现金流出Distribution costs 分销成本Dividend cover 股息保障倍数Dividend payout ratio 股息支付率Dividends 股利Documentary credit 跟单信用证DSO 应收账款的平均回收期Duration of credit risk 信用风险期Eastern bloc countries 东方集团国家EBITDA 扣除利息、税收、折旧和摊销之前的收益ECGD 出口信贷担保局Economic conditions 经济环境Economic cycles 经济周期Economic depression 经济萧条Economic growth 经济增长Economic risk 经济风险Electronic data interchange(EDI) 电子数据交换Environmental factors 环境因素Equity capital 权益资本Equity finance 权益融资Equity stake 股权EU countries 欧盟国家EU directives 欧盟法规EUlaw 欧盟法律Eurobonds 欧洲债券European parliament 欧洲议会European Union 欧盟Evergreen loan 常年贷款Exceptional item 例外项目Excessive capital commitments 过多的资本承付款项Exchange controls 外汇管制Exchange-control regulations 外汇管制条例Exhaust method 排空法Existing competitors 现有竞争对手Existing debt 未清偿债务Export credit agencies 出口信贷代理机构Export credit insurance 出口信贷保险Export factoring 出口代理Export sales 出口额Exports Credit Guarantee Department 出口信贷担保局Extending credit 信贷展期External agency 外部机构External assessment methods 外部评估方式External assessments 外部评估External information sources 外部信息来源Extraordinary items 非经常性项目Extras 附加条件Facility account 便利账户Factoring 代理Factoring debts 代理收账Factoring discounting 代理折扣Factors Chain International 国际代理连锁Failure prediction scores 财务恶化预测分值FASB (美国)财务会计准则委员会Faulty credit analysis 破产信用分析Fees 费用Finance,new business ventures 为新兴业务融资Finance,repay existing debt 为偿还现有债务融资Finance,working capital 为营运资金融资Financial assessment 财务评估Financial cash flows 融资性现金流量Financial collapse 财务危机Financial flexibility 财务弹性Financial forecast 财务预测Financial instability 财务的不稳定性Financial rating analysis 财务评级分析Financial ratios 财务比率Financial risk 财务风险Financial risk ratios 财务风险比率Fitch IBCA 惠誉评级Fitch IBCA ratings 惠誉评级Fixed assets 固定资产Fixed charge 固定费用Fixed charge cover 固定费用保障倍数Fixed costs 固定成本Floating assets 浮动资产Floating charge 浮动抵押Floor planning 底价协议Focus 聚焦Forced sale risk 强制出售风险Foreign exchange markets 外汇市场Forfaiting 福费廷Formal credit rating 正式信用评级Forward rate agreements 远期利率协议FRAs 远期利率协议Fund managers 基金经理FX transaction 外汇交易GAAP 公认会计准则Gearing 财务杠杆率Geographical spread of markets 市场的地理扩展Global target 全球目标Going concern concept 持续经营原则Good lending 优质贷款Good times 良好时期Government agencies 政府机构Government interference 政府干预Gross income 总收入Guarantee of payment 支付担保Guaranteed loans 担保贷款Guarantees 担保High credit quality 高信贷质量High credit risks 高信贷风险High default risk 高违约风险High interest rates 高利率High risk regions 高风险区域Highly speculative 高度投机High-risk loan 高风险贷款High-value loan 高价值贷款Historical accounting 历史会计处理Historical cost 历史成本IAS 国际会计准则IASC 国际会计准则委员会IBTT 息税前利润ICE 优质贷款原则Idealliquidity ratios 理想的流动性比率Implied debt rating 隐含债务评级Importance of credit control 信贷控制的重要性Improved products 改进的产品IImproving reported asset values 改善资产账面价值In house assessment 内部评估In house credit analysis 内部信用分析In house credit assessments 内部信用评估In house credit ratings 内部信用评级Income bonds 收入债券Income statement 损益表Increasing profits 提高利润Increasing reported profits 提高账面利润Indemnity clause 赔偿条款Indicators of credit deterioration 信用恶化征兆Indirect loss 间接损失Individual credit transactions 个人信用交易Individual rating 个体评级Industrial reports 行业报告Industrial unrest 行业动荡Industry limit 行业限额Industry risk 行业风险Industry risk analysis 行业风险分析Inflow 现金流入Information in financial statements 财务报表中的信息In-house credit ratings 内部信用评级Initial payment 初始支付Insolvencies 破产Institutional investors 机构投资者Insured debt 投保债务Intangible fixed asset 无形固定资产Inter-company comparisons 企业间比较Inter-company loans 企业间借款Interest 利息Interest cost 利息成本Interest cover ratio 利息保障倍数Interest cover test 利息保障倍数测试Interest holiday 免息期Interest payments 利息支付Interest rates 利率Interim statements 中报(中期报表)Internal assessment methods 内部评估方法Internal financing ratio 内部融资率Internal Revenue Service 美国国税局International Accounting Standards Committee 国际会计准则委员会International Accounting Standards(IAS) 国际会计准则International Chamber of Commerce 国际商会International credit ratings 国际信用评级International Factoring Association 国际代理商协会International settlements 国际结算Inventory 存货Inverse of current ratio 反转流动比率Investment analysts 投资分析人员Investment policy 投资政策Investment risk 投资风险Investment spending 投资支出In voice discounting 发票贴现Issue of bonds 债券的发行Issued debt capital 发行债务资本Junk bond status 垃圾债券状况Just-in-time system(JIT) 适时系统Key cash flow ratios 主要现金流量指标Labor unrest 劳动力市场动荡Large.scale borrower 大额借贷者Legal guarantee 法律担保Legal insolvency 法律破产Lending agreements 贷款合约Lending covenants 贷款保证契约Lending decisions 贷款决策Lending proposals 贷款申请Lending proposition 贷款申请Lending transactions 贷款交易Letters of credit 信用证Leverage 财务杠杆率LIBOR 伦敦同业拆借利率Lien 留置Liquid assets 速动资产Liquidation 清算Liquidation expenses 清算费Liquidity 流动性Liquidity and working capital 流动性与营运资金Liquidity ratios 流动比率Liquidity run 流动性危机Liquidity shortage 流动性短缺Loan covenants 贷款合约Loan guarantees 贷款担保Loan principal 贷款本金Loan principal repayments 贷款本金偿还Loan review 贷款审查London Inter-bank Offered Rate 伦敦同业拆借利率Long’term debt 长期负债Long-term funding 长期融资Long-term risk 长期风险Management 管理层Marginal lending 边际贷款Marginal trade credit 边际交易信贷Market surveys 市场调查Marketing 市场营销Markets 市场Matching concept 配比原则Material adverse-change clause 重大不利变动条款Maximum leverage level 最高财务杠杆率限制Measurement and judgment 计量与判断Measuring risk 风险计量Medium-term loan 中期贷款Microcomputer modelling 计算机建模Minimum current ratio requirement 最低流动比率要求Minimum leverage ratio 最低举债比率Minimum net worth 最低净值Minimum net-worth requirement 最低净值要求Minimum risk asset ratio 最低风险资产比率Monitoring activity 监管活动Monitoring credit 信用监控Monitoring customer credit limits 监管客户信贷限额Monitoring risks 监管风险Monitoring total credit limits 监管全部信贷限额Monthly reports 月报Moody's debt rating 穆迪债券评级Mortgage 抵押mpr’oving balance sheet 改善资产负债表Multiple discriminate analysis 多元分析National debt 国家债务NCI 无信贷间隔天数Near-cash assets 近似于现金的资产Negative cash flow 负现金流量Negative net cash flow 负净现金流量Negative operational cash flows 负的经营性现金流量Negative pledge 限制抵押Net book value 净账面价值Net cash flow 净现金流量Net worth test 净值测试New entrants 新的市场进人者No credit interval 无信贷间隔天数Non-cash items 非现金项目Non-core business 非核心业务Non-operational items 非经营性项目Obtaining payment 获得支付One-man rule 一人原则Open account terms 无担保条款Operating leases 经营租赁Operating profit 营业利润Operational cash flow 营性现金流量Operational flexibility ~营弹性Optimal credit 最佳信贷Order cycle 订货环节Ordinary dividend payments 普通股股利支付Organization of credit activities 信贷活动的组织Overdue payments 逾期支付Over-trading 过度交易Overview of accounts 财务报表概览·Parent company 母公司PAT 税后利润Payment in advance 提前付款Payment obligations 付款义务Payment records 付款记录Payment score 还款评分PBIT 息税前利润PBT 息后税前利润Percentage change 百分比变动Performance bonds 履约保证Personal guarantees 个人担保Planning systems 计划系统Pledge 典押Points-scoring system 评分系统Policy setting 政策制定Political risk 政治风险Potential bad debt 潜在坏账Potential credit risk 潜在信用风险Potential value 潜在价值Predicting corporate failures 企业破产预测Preference dividends 优先股股息Preferred stockholders 优先股股东Preliminary assessment 预备评估Premiums 溢价Primary ratios 基础比率Prior charge capital 优先偿付资本Priority cash flows 优先性现金流量Priority for creditors 债权人的清偿顺序Priority payments 优先支付Product life cycle 产品生命周期Product market analysis 产品市场分析Product range 产品范围Products 产品Professional fees 专业费用Profit 利润Profit and loss account 损益账户Profit margin 利润率Profitability 盈利能力Profitability management 盈利能力管理Profitability ratios 盈利能力比率Promissory notes 本票Property values 所有权价值Providers of credit 授信者Provision accounting 准备金会计处理Prudence concept 谨慎原则Public information 公共信息Public relations 公共关系Purpose of credit ratings 信用评级的目的Purpose of ratios 计算比率的目的Qualitative covenants 定性条款Quantitative covenants 定量条款Query control 质疑控制Quick ratio 速动比率Rating exercise 评级实践Rating process for a company 企业评级程序Ratio analysis 比率分析Ratio analyst weaknesses ~L率分析的缺陷Real insolvency 真实破产Real sales growth 实际销售收入增长率Realization concept 实现原则Receivables 应收账款Recession 衰退Reducing debtors 冲减应收账款Reducing profits 冲减利润Reducing provisions 冲减准备金Reducing reported profits 冲减账面利润Reducing stocks 减少存货Registrar of Companies 企业监管局Regulatory risk 监管风险Releasing provisions 冲回准备金Relocation expenses 费用再分配Reminder letters 催缴单Repayment on demand clause 即期偿还条款Replacement of principal 偿还本金Report of chairman 总裁/董事长报告Reserve accounting 准备金核算Residual cash flows 剩余现金流量Restricting bad debts 限制坏账Restrictions on secured borrowing 担保借款限制Retention-of-title clauses 所有权保留条款Revenues 总收入Risk analysis reports 风险分析报告Risk and banks 风险与银行Risk and companies 风险与企业Risk and Return 风险与回报Risk capital 风险资本Risk-reward 风险回报Risk-weighted assets 风险加权资产ROCE 资本收益率Romapla clauses “一手交钱一手交货”条款Sales 销售额Secondary ratios 分解比率Secure methods of payment 付款的担保方式Secured assets 担保资产Secured creditors 有担保债权人Secured loans 担保贷款Securities and Exchange Commission (美国)证券交易委员会Security guarantees 抵押担保Security of payment 付款担保Security general principles 担保的一般原则Segmentation 细分Setting and policing credit limits 信用限额的设定与政策制定Settlement discount (提前)结算折扣Settlement terms 结算条款Share price 股价Short-term borrowing 短期借款Short-term creditors 短期负债Short-term liabilities 短期债务Short-termism 短期化SIC 常务诠释委员会Significance of working capital 营运资金的重要性Single credit customer 单一信用客户Single ratio analysis 单一比率分析Size of credit risk 信用风险的大小Slow stock turnover 较低的存货周转率Sources of assessments 评估信息来源Sources of credit information 信用信息来源Sources of risk 风险来源Sovereign rating 主权评级Specialist agencies 专业机构Specific debt issue 特别债券发行Speculative 投机性Speculative grades 投机性评级Split rating 分割评级Spot rate 现价(即期比率)Spreadsheets 电子数据表Staff redundancies 员工遣散费Standard and Poor 标准普尔Standard security clauses 标准担保条款Standard&Poor's 标准普尔Standby credits 备用信用证Standing Interpretations Committee 证券交易委员会Standing starting credit limits 持续更新信用限额Statistical analysis 统计分析Statistical techniques 统计技巧Status reports (企业)状况报告Stock valuations 存货核算Stocks 股票Straight line depreciation method 直线折旧法Strategic positioning 战略定位Suplus assets 盈余资产Suplus rating 盈余评级Supplier power 供应商的力量Supply chain 供应链Support rating 支持评级Swap agreement 换合约Swaps 互换SWOT analysis SWOT分析Symptoms of failure questionnaires 企业破产征兆调查表Takeovers 收购Tax payments 税务支付Technical insolvency 技术破产Technology and change 技术进步Term loan 定期贷款Term of borrowing 借款期限Third party guarantees 第三方担保Tier 1 capital 一类资本Tier 2 capital 二类资本Total credit limit 整体信用限额Total current assets 流动资产总额Trade companies 贸易企业Trade credit 商业信用Trade creditors 应付账款Trade cycle 商业循环Trade cycle times 商业循环周期Trade debt 应收账款Trade debtors 贸易债权人Trade Indemnity 贸易赔偿Trade references 贸易参考Trade-off 协定Trading outlook 交易概况Trading profit 营业利润Traditional cash flow 传统现金流量Triple A 三AUCP 跟单信用证统一惯例Uncovered dividend 未保障的股利Uniform Customs&Practice 跟单信用证统一惯例Unpaid in voice s 未付款发票Unsecured creditors 未担保的债权人Usefulness of liquidity ratios 流动性比率的作用Uses of cash 现金的使用Using bank risk information 使用银行风险信息Using financial assessments 使用财务评估Using ratios 财务比率的运用Using retention-of-title clauses 使用所有权保留条款Value chain 价值链Value of Z scores Z值模型的价值Variable costs 变动成本Variable interest 可变利息Variety of financial ratios 财务比率的种类Vetting procedures 审查程序V olatitle revenue dynamic 收益波动V olume of sales 销售量Warning signs of credit risk 信用风险的警示Working assets 营运资产working capital 营运资本Working capital changes 营运资本变化额Working capital management 营运资本管理working capitalratios 营运资本比率Write-downs 资产减值Write-offs 勾销Z score assessments Z值评估z score models z值模型Z scores z值Z scoring Z值评分系统。