财政学(第七版)习题参考答案

陈共《财政学》(第7版)配套题库【课后习题(1-4章)】【圣才出品】

第一部分名校考研真题一、选择题1.在电力、煤气、自来水等行业可采用的公共定价方法是()。

[中央财经大学2008研]A.平均成本定价法B.二部定价法C.边际成本定价法D.负荷定价法【答案】D【解析】负荷定价法是指按不同时间段或时期的需求制定不同的价格。

在电力、煤气、自来水、电话等行业,按需求的季节、月份、时区的高峰和非高峰的不同,有系统地制定不同的价格,以平衡需求状况。

在需求处于最高峰时,收费最高;而处于最低谷时,收费最低。

2.《经济学中的灯塔》一文是1974年由()发表的,研究的是公共物品的私人供给问题。

[中央财经大学2009研]A.科斯B.诺斯C.马斯格雷夫D.斯密【答案】A【解析】科斯在1974年发表《经济学中的灯塔》一文,在文中提出了著名的科斯定理,该定理研究的是公共物品的私人供给问题。

3.财政支出增长的替代一规模效应理论由()经济学家提出。

[中央财经大学2008研]A.阿道夫·瓦格纳B.马斯格雷夫C.皮科克和威斯曼D.马斯格雷夫和罗斯托【答案】C【解析】皮科克和威斯曼提出财政支出增长的替代一规模效应理论,在瓦格纳分析的基础上,根据他们对1890-1955年间英国的公共部门成长情况的研究,提出了导致财政支出增长的内在因素与外在因素,并认为外在因素是说明财政支出增长速度超过GDP增长速度的主要原因。

此即替代-规模效应理论。

马斯格雷夫和罗斯托提出经济发展阶段论。

阿道夫·瓦格纳提出了“财政支出扩张论”,即瓦格纳法则。

4.财政支出效益分析的方法不包括()。

[中央财经大学2010研]A.成本——效益法B.最低费用法C.公共劳务收费法D.因素分析评分法【答案】C【解析】)财政支出效益分析的方法一般有成本——效益分析法、成本效用分析法、最低成本法和因素分析评价法。

5.实现社会资源的最佳配置需满足的条件是()[中央财经大学2010研]A.公共物品支出的边际效益=私人物品支出的边际效益B.公共物品支出的边际效益>私人物品支出的边际效益C.公共物品支出的边际效益<私人物品支出的边际效益D.公共物品支出的边际效益与私人物品支出的边际效益之和最大【答案】A【解析】当公共物品支出的边际效益等于私人物品支出的边际效益时,不可能通过社会资源的再分配而使得一方收益不减少的情况下而增加另一方的收益,即此时已经达到了帕累托最优效率状态,实现了社会资源的最佳配置。

陈共《财政学》(第7版)配套题库 课后习题(第十六章 财政政策)【圣才出品】

第十六章财政政策一、概念题1.财政政策答:概括来说,财政政策是指一国政府为实现一定的宏观经济目标,而调整财政收支规模和收支平衡的指导原则及其相应的措施。

财政政策贯穿于财政工作的全过程,体现在收入、支出、预算平衡和国家债务等各个方面。

因此,财政政策是由支出政策、税收政策、预算平衡政策、国债政策等构成的一个完整的政策体系。

在市场经济条件下财政功能的正常发挥,主要取决于财政政策的适当运用。

财政政策运用得当,就可以保证经济的持续、稳定、协调发展,财政政策运用失当,也会引起经济的失衡和波动。

2.财政政策目标答:财政政策目标就是财政政策所要实现的期望值,它有以下几点含义:(1)这个期望值受政策作用范围和作用强度的制约,超出政策功能所能起作用的范围取值是政策功能的强度所不能达到的,目标也无法实现。

(2)这个期望值在时间上具有连续性,在空间上具有一致性要求。

通常基本财政政策是一个在较长时期内发挥作用的财政政策,也称其为长期性财政政策。

一般性财政政策则是在一个特定时期内发挥作用的政策。

(3)政策目标作为一种期望值,它的取值受社会、政治、经济、文化等环境与条件的限制,并且取决于民众的偏好与政府的行为。

因此,政策目标的确定不是一个随心所欲的过程,而是一个科学的、民主的选择或决策过程。

3.财政政策工具答:财政政策工具,是财政政策主体所选择的用以达到政策目标的各种财政手段,主要有税收、公共支出(包括财政补贴)、政府投资、国债等。

(1)税收作为一种政策工具,它具有形式上的强制性、无偿性和固定性特征,这些特征使税收调节具有权威性。

税收调节作用,主要通过宏观税率和具体税率的确定、税种选择、税负分配以及税收优惠和税收惩罚等规定体现出来。

(2)公共支出主要是指政府满足纯公共需要的一般性支出,它包括购买性支出和转移性支出两大部分。

购买性支出包括商品和劳务的购买,它是一种政府的直接消费支出。

转移性支出通过“财政收入—国库—财政支付”过程将货币收入从一方转移到另一方,此时,民间的消费并不因此而发生变化。

陈共《财政学》(第7版)配套题库 课后习题(第四章 经常性支出)【圣才出品】

第四章经常性支出一、概念题1.经常性支出答:经常性支出是维持公共部门正常运转或保障人们基本生活所必需的支出,主要包括人员经费、公用经费及社会保障支出。

经常性支出所提供的产品和服务是为全体公民共同无偿享受的,具有明显的外部效应,因为具有这一特点,满足这种公共需要以及为此而需要的资金的筹措,就要遵循与一般商品交换有所不同的另外一种原则,即由政府无偿提供。

经常性支出和资本性支出同属于购买性支出,但与资本投资性支出存在着明显的差异,最大的区别在于前者是非生产的消耗性支出,它的使用并不形成任何资产。

两者的共同之处是,在必要的限度内,它们都是社会再生产的正常运行所必需的社会公共需要;而且,就其本质来说,经常性支出满足的是纯社会公共需要,正是这种支出构成了财政这一经济现象存在的主要依据。

2.一般公共服务支出答:广义的行政管理支出包括现行《政府收支分类科目》中的以一般公共服务为主的三类科目:一是一般公共服务;二是公共安全;三是外交。

一般公共服务,包括人民代表大会、政协、党派团体、政府各部门等。

一般公共服务支出主要用于保障机关事业单位正常运转,支持各机关单位履行职能,保障各机关部门的项目支出需要,以及支持地方落实自主择业军转干部退役金等。

3.国防支出答:我国国防支出项目包括人员生活费、训练维持费和装备费,其构成基本上是各占三分之一的态势。

国防费的保障范围,包括现役部队、预备役部队、民兵以及国防科研事业和国防动员,并负担部分退役军官供养、军人子女教育、支援国家经济建设等方面的社会性支出。

每年增加的国防费主要是用于改善军人工资待遇和部队生活条件,加大武器装备和基础设施建设投入,支持军事人才建设,平抑物价上涨因素,增加非传统安全领域国际合作费用。

我国国防费始终坚持严格控制、严格管理、严格监督的原则,建立完善的管理体制和法规制度。

政府依据《中华人民共和国国防法》,保证国防事业的必要经费,将国防费全部纳入国家预算安排,实行财政拨款制度,按《预算法》实施管理,国防费预、决算由全国人民代表大会审批,由国家和军队的审计机构实施严格的审计和监督。

罗森财政学第七版(英文版)配套习题及答案Chap012

罗森财政学第七版(英文版)配套习题及答案Chap012CHAPTER 12 - Taxation and Income DistributionMultiple-Choice Questions1. Statutory incidence of a tax deals witha) the amount of revenue left over after taxes.b) the amount of taxes paid after accounting for inflation.c) the person(s) legally responsible for paying the tax.d) the amount of tax revenue generated after a tax is imposed.e) none of the above.2. Taxesa) are mandatory payments.b) are necessary for financing government expenditures.c) do not directly relate to the benefit of government goods and services received.d) are all of the above.3. General equilibrium refers toa) examining markets without specific information.b) finding equilibrium from general information.c) pricing goods at their shadow price.d) all of the above.e) none of the above.4. A demand curve that is perfectly inelastic isa) horizontal.b) vertical.c) at a 45 degree angle.d) parallel to the X-axis.5. In 2002, the top 1% of all income earners paid _________ percent of federal taxes.a) 1.0b) 4.1c) 20.6d) 24.9e) 33.36. A tax on suppliers will cause the supply curve to shifta) up.b) down.c) right.d) left.e) in none of the above directions.7. A monopoly has ______ seller(s) in the market.a) 0b) 1c) 3d) manye) all of the above8. An ad valorem tax isa) given as a proportion of the price.b) Latin for “buyer beware.”c) identical to a unit tax.d) computed using the “inverse taxation rule.”9. An industry where the capital-labor ratio is relatively high is characterized asa) capital intensive.b) labor intensive.c) income intensive.d) market intensive.e) none of the above.10. Demand for cigarettes isa) relatively elastic.b) relatively inelastic.c) constant over time.d) greater among wealthier people.11. When marginal tax rates are constant,a) the change in taxes paid is the same as the change in income.b) the change in taxes paid is greater than the change in income.c) the change in taxes paid is less than the change in income.d) there are no taxes.e) none of the above.12. The tax-induced difference between the price paid by consumers and the price receivedby producers isa) the tax difference.b) the tax wedge.c) the statutory incidence.d) the supply side effect.e) the substitution effect.13. An oligopoly has ______ sellers in the market.a) 0b) 1c) 3d) manye) all of the above14. A tax on consumers will cause the demand curve to shifta) right.b) left.c) up.d) down.e) in none of the above directions.15. Partial equilibrium isa) exactly like general equilibrium.b) studying only the supply side of the market.c) studying individual markets.d) examining the demand side of the market.Discussion Questions1. Consider a monopolist who has a total cost curve of: TC=7X+(1/2)X2. The marketdemand equation is X d=386-(1/2)P.a) What are the equilibrium quantity, equilibrium price, and profits in this market?b) Suppose that a unit tax of $1 is placed on the monopolist. What happens to theequilibrium quantity, equilibrium price, and profits? How much tax revenue doesthe government generate?c) Suppose that the same unit tax of $1 is placed on consumers. What happens tothe equilibrium quantity, equilibrium price, and profits? How much tax revenuedoes the government generate?d) What can be said about the taxes?2. Refer to Figure 12.2 in your textbook. Suppose the original before-tax demand curve isX d = 49 – P/2. Suppose further that supply is X = P/2 – 1. Now suppose a $3 unit tax is imposed on consumers.a) What is the before-tax equilibrium price and quantity?b) What is the after-tax equilibrium quantity?c) How much tax revenue is raised?3. From Question 2 above, calculate the economic incidence incurred by producers and theeconomic incidence incurred by consumers.4. Suppose that demand is perfectly elastic. Supply is normal and upward sloping. What isthe economic incidence of a unit tax placed on suppliers?5. Suppose there is a market that has market demand characterized as X = 30 –P/3.Suppose further that market supply can be written as X = P/2 – 2.a) Find the equilibrium price and quantity in this market.b) If a unit tax of $16 is imposed on good X, what are the equilibrium price, quantity,and tax revenue in the market?c) Suppose an ad valorem tax of 30 percent is imposed on good X. The after-taxdemand equation would be X = 30 –P/2. Now find the equilibrium price,quantity, and tax revenue in the market.d) What can be said about the amount of tax revenue generated under each taxingscheme, and why?True/False/Uncertain Questions1. A unit tax is a fixed amount per unit of a commodity sold.2. Regressive tax systems are bad.3. In a general equilibrium model, a tax on a single factor in its use only in a particularsector can affect returns to all factors in all sectors.4. Due to capitalization, the burden of future taxes may be borne by current owners of aninelastically-supplied, durable commodity such as land.5. Even with a tax, the price that consumers pay will be higher than what producers receive.6. Ad valorem taxes create tax wedges just like unit taxes.7. After a price change, the substitution effect will be the same as the income effect.8. Marginal tax rates supply reliable measures of tax progressiveness.9. Unit taxes cause shifts, while ad valorem taxes cause pivots.10. A lump sum tax is one for which the individual’s liability does not depend on behavior. Essay Questions1. In the press, there has been a considerable amount of attention given to the notion ofcorporations being taxed. Explain how it is that a tax on a business could be borne entirely by consumers.2. Why is it the case that a commodity tax on goods like food and shelter is sometimes seenas being regressive?3. What types of goods might have demand curves that are vertical, and why?Answers to CHAPTER 12 - Taxation and Income Distribution Answers to Multiple-Choice Questions1. c2. a3. e4. b5. d6. d7. b8. a9. a10. b11. e12. b13. c14. b15. cAnswers to Discussion Questions1. a) X* = 153, P* = $466, π = $58522.5b) X* = 152.8, P* = $466.4, π = $58,369.6, Tax Rev. = $152.8c) X* = 152.8, P* = $465.4, π = $58,369.6, Tax Rev. = $152.8d) The tax revenue generated is the same, whether it is levied on the buyers or sellers.2. a) Setting before-tax demand equal to supply gives X* = 24, with P* = $50.b) The after-tax demand curve is now P = 95 –2X. Setting the after-tax demandcurve equal to supply gives X* = 23 ?.c) Tax revenue is the after-tax equilibrium quantity multiplied by the tax rate.Therefore, 3(23 ?) = 69 ?.3. The after-tax consumer price is now $51.5. The after-tax producer price is now $48.5.The before-tax price was $50. The economic incidence for consumers is 1.5(23.25) = $34.875. For producers, it is 1.5(23.25) = $34.875.4. The economic incidence of the tax is paid entirely by thesuppliers.5. a) Setting supply equal to demand and solving yields P* = $38.4 and X* = 17.2.b) The after-tax demand curve is now P = 74 –3X. Setting after-tax demand equal tosupply yields X* = 14, P* = $32 for suppliers, and P* = $48 for consumers. Tax revenue is $224.c) Setting the given after-tax demand equal to supply yields P* = $32 for suppliersand P* = $48 for consumers. Tax revenue is $224.d) The tax revenue and prices are the same using either taxing scheme.Answers to True/False/Uncertain Questions1. T2. U3. T4. T5. F6. T7. U8. F9. T10. TAnswers to Essay Questions1. Elasticities play a key role in determining exactly how much of a tax is borne byconsumers and producers.2. Items like food and shelter require a larger percentage of discretionary income for thosein the lower income brackets than for those in higherbrackets.3. A demand curve that is vertical is one that is perfectly inelastic. This means that changesin the price do not affect the quantity demanded. Examples of this are certain medical supplies and, to a lesser extent, cigarettes, which have demand curves that are nearly inelastic.。

罗森 财政学 第七版(英文版) 配套习题及答案Chap002

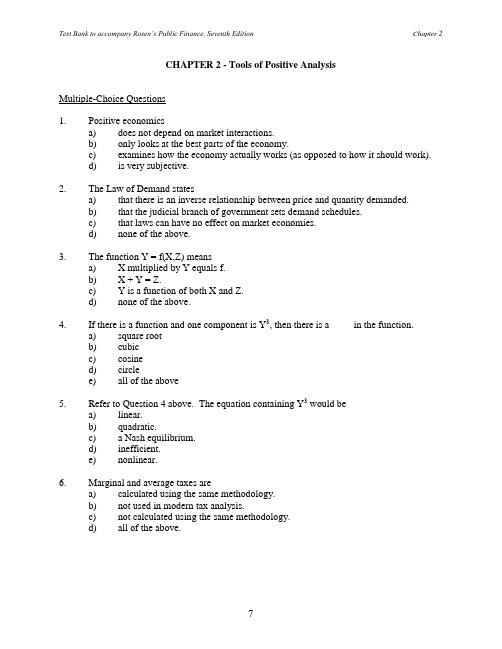

CHAPTER 2 - Tools of Positive AnalysisMultiple-Choice Questions1. Positive economicsa) does not depend on market interactions.b) only looks at the best parts of the economy.c) examines how the economy actually works (as opposed to how it should work).d) is very subjective.2. The Law of Demand statesa) that there is an inverse relationship between price and quantity demanded.b) that the judicial branch of government sets demand schedules.c) that laws can have no effect on market economies.d) none of the above.3. The function Y = f(X,Z) meansa) X multiplied by Y equals f.b) X + Y = Z.c) Y is a function of both X and Z.d) none of the above.4. If there is a function and one component is Y3, then there is a ____ in the function.a) square rootb) cubicc) cosined) circlee) all of the above5. Refer to Question 4 above. The equation containing Y3 would bea) linear.b) quadratic.c) a Nash equilibrium.d) inefficient.e) nonlinear.6. Marginal and average taxes area) calculated using the same methodology.b) not used in modern tax analysis.c) not calculated using the same methodology.d) all of the above.7. The slope of a regression line is calculated by dividinga) the intercept by the change in horizontal distance.b) the change in horizontal distance by the change in vertical distance.c) the change in horizontal distance by the intercept term.d) the change in vertical distance by the change in horizontal distance.e) none of the above.8. Unobserved influences on a regression are captured in thea) error term.b) parameters.c) regression line.d) significance term.e) regression coefficient.9. The following can be analyzed using econometrics:a) labor supply.b) market demand.c) tax-setting behavior.d) poverty.e) all of the above.10. Normative economicsa) does not depend on market interactions.b) only looks at the best parts of the economy.c) examines how the economy actually works (as opposed to how it should work).d) embodies value judgments.11. The Latin phrase ceteris paribus meansa) let the buyer beware.b) other things being the same.c) swim at your own risk.d) whatever will be will be.12. The substitution effecta) is when individuals consume more of one good and less of another.b) is associated with changes in relative prices.c) will have no effect if goods are unrelated.d) is all of the above.13. Self-selection bias affects empirical estimation bya) leading to samples that are not representative of the entire population.b) making estimators improved.c) increasing the accuracy of test results.d) doing none of the above.14. When different bundles of commodities give the same level of satisfaction, you area) said to be indifferent between the bundles.b) said to be confused.c) not able to make a decision.d) unhappy with any combination.e) none of the above.15. The marginal rate of substitution isa) the slope of the utility curve.b) the slope of the contract curve.c) the slope of the utility possibilities curve.d) none of the above.Discussion Questions1. Suppose that a competitive firm’s marginal cost of producing output q is given byMC=2+2q. Assume that the market price of the firm’s product is $13.a) What level of output will the firm produce?b) What is the firm’s producer surplus?2. Use the following function for elasticity: = -(1/s)(P/X), where s is the slope of thedemand curve, P is the price, and X is the quantity demanded, to find elasticity when demand is X d= 22-(1/4)P when the price of good X is 20.3. Imagine that the demand for concert tickets can be characterized by the equation X d = 7 –P/5. The supply of tickets can be written as X d = -2 + P/5. Find the equilibrium price and quantity of concert tickets.True/False/Uncertain Questions1. Empirical analysis generally deals with theory and little data.2. Economists attempt, with moderate success, to perform controlled experiments makingpolicy analysis helpful.3. Regression coefficients are indicators of the impact of independent variables ondependent variables.4. Primary data sources include information gathered from interviews and experiments.5. Multiple regression analysis typically requires several computers.6. Econometrics is the statistical analysis of economic data.7. Theory is always necessary for empirical research.8. The demand for a good is not affected by the demand for a related good.9. Equilibrium in the market is where supply is equal to demand.10. A model is a simplified description of some aspect of the economy.Essay Questions1. “Since the social sciences are not like the natural sciences, experiments are a waste oftime.” Comment on the above statement.2. Discuss the concept in econometrics that states, “garbage in . . . garbage out.”3. It is possible that two different economists can examine the same situation, such asschool funding, and reach entirely different conclusions. Why is this so?。

财政学 哈维罗森 第七版 课后习题答案(英文)(2)

Chapter 7 – Income Redistribution: Conceptual Issues1. Utilitarianism suggests that social welfare is a function of individuals’ utilities. Whetherthe rich are vulgar is irrelevant, so this part of the statement is inconsistent with utilitarianism. O n the other hand, Stein’s assertion that inequality per se is unimportant is inconsistent with utilitarianism.2. a. To maximize W, set marginal utilities equal; the constraint is I s + I c = 100.So,400 - 2I s = 400 - 6I c.substituting I c = 100 - I s gives us 2I s = 6 (100 - I s ).Therefore, I s = 75, I c = 25.b.If only Charity matters, then give money to Charity until MU c = 0 (unless all themoney in the economy is exhausted first).So,400-6 I c = 0; hence, I c = 66.67.Giving any more money to Charity causes her marginal utility to become negative,which is not optimal. Note that we don’t care if the remaining money ($33.33) isgiven to Simon or not.If only Simon matters, then, proceeding as above, MU s. 0 if I s = 100; hence, givingall the money to Simon is optimal. (In fact, we would like to give him up to $200.)c.MU s = MU c for all levels of income. Hence, society is indifferent among alldistributions of income.3. The main conceptual problem with the poverty gap is that it doesn’t account fo r theincome effect on labor force participation rates. The poverty gap is calculated assuming there are no behavioral responses; e.g., that labor income would remain unchanged even after the income was transferred to the poor population, but economic theory predicts that this will not be so. In fact, if the poor household were given enough income to bring it out of poverty, we would believe that the household would work less as a result of receiving this transfer. This complicates the analysis, of course, because once the household works less, then it will generate less labor income, thus lowering its overall income. This means that the poverty gap actually understates the amount of money necessary to alleviate poverty in the United States. In addition, the poverty gap is based on the official poverty line, which is thought to be an ad-hoc measure of the true “needs”of a family.4. A day care center is an example of an in-kind compensation. The figure below is similarto Figure 8.2 in the text. The original budget line is G1 H1 If the employee received $5,000 cash, the budget line moves to G2 H2 . An employee who uses the day care center may not be $5,000 better off. The employee consumes at point A, but would be better off at point B, which represents consumption after a cash transfer of $5,000.5. a. This would increase the incomes of the providers of computer equipment and theindividuals who maintain the equipment. In the long run, this might also increasethe incomes of the students who use the equipment. Moreover, giving a laptop toall seventh graders (rather than poor seventh graders) may simply “crowd-out”computer transfers from parents to children. One could imagine that nowadaysmany children do have a computer at home, paid for by the parents. Thisgovernment transfer may simply result in less parental transfer to the child.b.Providing free after-school programs for children in impoverished families largelyacts as an in-kind transfer for poor, working households. The program is of littlevalue for unemployed households, as the alternative would be childcare at home.For those who are employed, and paying for childcare, this program provides analternative and effectively changes the after-tax, after-working-cost wage. Thisalso may affect work behavior on the extensive margin. The likely “losers” fromsuch a program are childcare providers, who see a reduction in demand for theirservices. In principle, this reduction in demand could lower the hourly childcarecost for all workers with children, though this effect is likely to be modest becausemost impoverished families do not have a very large labor force attachment and,thus, their effect on the childcare market as a whole is likely to be small.6. a. False. Society is indifferent between a util to each individual, not a dollar to eachindividual. Imagine that U L=I and U J=2I. Then each dollar given to Jonathanraises welfare more than the same dollar given to Lynne.b. True. The social welfare function assumes a cardinal interpretation of utility sothat comparisons across people are valid.c. False. Departures from complete equality raise social welfare to the extent thatthey raise the welfare of the person with the minimum level of utility. Forexample, with the utility functions U L=I and U J=2I, the social welfare functionW=min[U L,U J] would allocate twice as much income to Lynne than Jonathan.7. Initially the price of food was $2 and the price of other goods was $1. The black marketfor food stamps changes the price of food sold to $1. In Figure 7.2 of the textbook, as one moves to the “northwest” from point F, the segment will now have a slope (in absolute value) of 1 rather than 2. The black market may make the individual better off if the best point on her budget constraint AFD was initially at the corner solution of point F, and the black market certainly does not make her worse off. It is important to note that the black market does not always make the recipient better off. If the (absolute value) of the marginal rate of substitution (MRS) were between 1 and 2, the indifference curve would not “cut” into the new part of the budget constraint with the black market.If the MRS were less than (or equal to) 1 in absolute value, the person would be made better off and would reduce food consumption by selling the food stamps on the black market.Food StampGuarantee Food8. Pareto efficient redistribution is a reallocation of income that increases (or does notdecrease) the utility of all consumers. With these two consumers, Marsha’s utility increases as Sherry’s utility increases. Thus, it may be possible to reallocate income from Marsha to Sherry and raise both of their utility. With Sherry’s initial utility function of U S=100Y S1/2, her utility with $100 of income is U S=100($100)1/2, or U S=1,000. With Marsha’s initial utility function of U M=100Y M1/2+0.8U S, her utility with $100 of income is U M=100($100)1/2+0.8(1,000), or U M=1,800. If the social welfare function is additive, then initial welfare is W=U S+U M=1,000+1,800=2,800. If $36 is reallocated from Marsha to Sherry, then Sherry’s income is now $136 and Marsha’s is now $64. With Sherry’s utility function, her utility with $136 of income is U S=100($136)1/2, or U S=1,166.190.With Marsha’s utility function, her utility with $64 of income is U M=100($64)1/2+0.8(1,166.190), or U M=800+932.952=1,732.952. In this case, Sherry’s utility increases from 1,000 to 1,166.190, while Marsha’s utility falls from 1,800 to 1,732.952. Social welfare increases with this redistribution, going from 2,800 to 2,899.142. Thus, this redistribution increases social welfare, but is not Pareto efficient redistribution.Chapter 8 – Expenditure Programs for the Poor1. a. Note that the figure below shows the correct shape of the budget constraint, butthe numbers themselves are outdated. With a wage rate of $10 per hour,Elizabeth earns $100. Because the deduction in California is $225, none of herearnings are counted against the $645 welfare benefit. Thus, her total income is$745 (=$100+$645).b.The actual welfare benefits collected by a person equals B=G-t(Earnings-D),where B=actual benefits, G=welfare grant, t=tax rate on earned income, andD=standard deduction. Thus, (Earnings-D) is the net earnings that are taxed awayin the form of reduced benefits. When benefits equal zero (B=0), the expressionbecomes 0=G-t(Earnings-D), which collapses to: Earnings=G/t+D. This is knownas the “breakeven formula.” In the California context here, the expressionbecomes Earnings=$645/0.5 + 225, or Earnings=$1,515. With a wage rate of $10per hour, this corresponds to 151.5 hours of work per month.c.The diagram shows the correct shape of the budget constraint, but the “577” figureshould be r eplaced with “645” and the “9” hours should be replaced with “22.5”.d.The diagram above shows one possibility – in this case, Elizabeth is both workingand on welfare – but she collects a reduced welfare benefit in this case.2. One could gather data on the earnings of those in the program, as well as earnings datafrom nonparticipants. Regress the earnings variable on demographic variables and other factors that determine earnings (such as education and experience), and a variable that indicates whether the individual participated in the training program. Factors that affect local employment conditions, such as unemployment levels, may help explain earnings, but they may also explain participation in the program. The econometric strategy should be chosen carefully to account for this.3. If the quantity of leisure consumed by X appears as an argument in the utility function ofY, then X’s consumption of leisure creates an externality. If the externality is negative(i.e., Y likes X to work), then a wage subsidy of X might induce him to work the efficientnumber of hours. Alternatively, a workfare program might achieve the same goal by simply forcing X to work. However, to the extent that the feasible quantity of labor supply is determined less through market incentives now, workfare would be less efficient.4. He participates in the public housing program as long as P1P2ca cef.5. As illustrated below, the budget constraint with food stamps has a “notch” in it, similar tothe analysis of Medicaid in Figure 8.9 of the textbook. At the notch, the marginal tax rate is greater than 100%. One key difference from the figure in the textbook is that the marginal tax rate on earned income for Medicaid is 0% until the “Medicaid notch,” while the marginal tax rate on earned income for food stamps is 24% until the “food stamp notch.” The reason the food stamp notch exists at all is that there is a “gross income test,” where a recipient is ineligible if income is higher than the limit. The characterization in the Rosen textbook on page 189 that “at some point near the poverty line, food stamps worth about $1,250 are suddenly lost” implicitly assumes that childcare costs are quite high. This is likely to be true for many households. In the year 2004, this monthly (annual) gross income limit was $1,994 per month ($23,928 per year) for a family of four, while the monthly guarantee was $471 ($5,652 per year). Assuming the family had earnings at the limit of $1,994 of earnings during the month, and after applying a 20% earnings deduction and a $134 monthly standard deduction, the household would receive a monthly (annual) benefit of $32 ($384). We arrive at this number using the equation B=G-t(E-.2E-D)=471-.3(.8*1994-134)=$471-$438.36=$32.64, which is then rounded down to $32. In this case, B=actual benefits received, G=food stamp guarantee, t=tax rate, E=earnings, and D=standard deduction. Increasing annualearnings by $1 from $23,928 to $23,929 would reduce food stamp benefits from $384 to $0; hence the “food stamp notch.” This notch would be even higher if the household qualified for a childcare deduction, child support deduction, or shelter deduction. The childcare deduction ranges between $175 and $200 per child per month. Assuming this family of four consisted of a mother and three children, each with $175 of monthly childcare costs, then B=G-t(E-.2E-D-C)=471-.3(.8*1994-134-525)=$471-$280.86=$190.14, which is then rounded down to $190. The modification here is that C=childcare costs. This amount corresponds to an annual food stamp benefit of $2,280. Figure 8.5 below draws the budget constraint using annual levels for the food stamp program, using 2004 rules and assumes no childcare expenses.6. For an individual who is not working while on welfare, in this case the highestindifference curve touches the budget constraint on the right vertical axis. Note that the marginal rate of substitution (MRS) does not necessarily equal the after-tax wage rate at the time endowment – rather, it is possible that the person would want to consume more leisure than the time endowment but is obviously constrained from doing so.Leisure$23,928Leisure7.In all cases, the demand curve for housing slopes downward. a. If the price of low income housing gets bid up but there is no increase in the stock of housing, then the supply curve is perfectly inelastic, e.g., vertical.Q 0Q HOUSINGFIGURE 8.7a – Demand curve shiftsb.If there is no increase in the price of housing, but there is an increase in the stockof housing, then the supply curve is perfectly elastic, e.g., horizontal.Q 0Q HOUSINGFIGURE 8.7b – Demand curve shifts Q 1c.If there is an increase in both the price and quantity of housing, then the supplycurve slopes upward.According to Sinai and Waldfogel, there is partial crowding out, consistent with case cabove. Although the underlying housing stock itself is probably quite inelastic in the short-run, the number of rental homes can be more elastic as (potential) landlords convert vacation homes or vacant homes into rental units.8. a.When Eleanor’s hours (earnings) go from 0 to 1,000 ($0 to $8,000), she qualifiesfor an additional earned income tax credit (EITC) worth $3,200 (=0.4*8,000).Thus, her income goes up from $0 to $11,200. Note to instructors – thedistinction between earnings and income may cause confusion in the students’answers. b.When Eleanor’s hours (earnings) go from 1,000 to 1,500 ($8,000 to $12,000), shequalifies for the maximum EITC (according to Figure 8.8 in the textbook). Shereceives the full EITC when her earnings exceed $10,510, at which time the creditequals $4,204 (=0.4*$10,510). The earnings between $10,510 and $12,000 face neither a subsidy nor phase-out from the EITC. Thus, her income goes up from $11,200 to $16,204.c. When Eleanor’s hours (earnings) go from 1,500 to 2,000 ($12,000 to $16,000),she moves into the range where the EITC is phased out. According to Figure 8.8 Q 0Q HOUSINGFIGURE 8.7c – Demand curve shifts outward,Q 1in the textbook, she receives the maximum subsidy of $4,204 until her earningsexceed $14,730. For the marginal earnings between $14,730 and $16,000, theEITC is reduced at a 21.06% tax rate. Thus, her EITC falls by $267.46 from$4,204 to $3,936.54 (=4,204-0.2106*(16,000-14,730)). Her income rises from$16,204 to $19,936.54.Chapter 9 – Social Insurance I: Social Security and Unemployment Insurance1. With adverse selection, insurance contracts with more comprehensive coverage arechosen by people with higher unobserved accident probabilities. To make up for the fact that a benefit is more likely to be paid to such individuals, the insurer charges a higher premium per unit of insurance coverage.2. There are many possible implications of a voluntary Social Security system. Onepossibility is that people would save less for retirement, betting that society would not put up with having great numbers of elderly poor. Part of the effect of the Friedman program, then, would depend on the government's credibility when it promises not to bail out people who do not save enough to survive during retirement.3. Use the basic formula for balance in a pay-as-you-go social security system:t =(N b/N w)*(B/w).Call 1990 year 1 and 2050 year 2. Thent1 = .267*(B/w)1t2 = .458*(B/w)2It follows that to keep (B/w)1=(B/w)2 we require t2/t1=.458/.267=1.71. That is, tax rates would have to increase by 71 percent. Similarly, to keep the initial tax rate constant, we would require (B/w)2/(B/w)1=.267/.458=0.58. Benefits would have to fall almost by half.4. If Social Security benefits are partially taxed for those who have other income over acertain level, then there is an implicit means test in receiving full, untaxed benefits.However, there is no explicit means test for eligibility for the program. Everyone receives benefits, though some recipients must pay some tax on them. Thus, the two statements are somewhat inconsistent with each other.5. Austen’s quote seems like it could relate adverse selection, but perhaps more likely, tomoral hazard. The q uote “If you observe, people always live forever when there is any annuity to be paid them” in a sense sounds like they act differently (e.g., better diet, more exercise, etc.) when an annuity is to be paid –the idea of moral hazard. In contrast, adverse selection suggests that people who expect to live a long time to be the ones who purchase annuities. A recent paper by Finkelstein and Poterba (NBER working paper, December 2000) found that “mortality patterns are consistent with models of asymmetric inf ormation” and that annuity “insurance markets may be characterized by adverse selection.”6. Equation (9.1) relates taxes paid into the Social Security system to the dependency ratioand the replacement ratio, that is, t=(N b/ N w)*(B/w). If the goal of public policy is to maintain a constant level of benefits, B, rather than a constant replacement ratio, (B/w), then taxes may not need to be raised. If there is wage growth (through productivity), then it is possible to maintain B at a constant level, even if the dependency ratio is growing.By rearranging the equation, we can see that B=t*w*(N b/ N w)-1. That is, increases in wage rates (the second term) offset increases in the dependency ratio (the third term).Thus, constant benefits do not necessarily imply higher tax rates.7. The statement about how the different rates of return in the stock market and governmentbond market affect the solvency of the trust fund is false. If the trust fund buys stocks, someone else has to buy the government bonds that it was holding. So, there is no new saving and no new capacity to take care of future retirees.8. Diamond and Gruber’s calculations suggest that the additional year of work (and delayedretirement) lowers the present discounted value of expected Social Security wealth by $4,833. If the adjustment were actuarially fair, Social Security wealth would neither rise nor fall. Since wealth falls, the adjustment is actuarially unfair.9. For those who argue that the scheme for financing Social Security is unfair becausepeople with low earnings are taxed at a higher rate than those with high earnings, the key issue is that the cumulative payroll tax of 12.4 percent is capped for each person, after which the payroll tax is zero (this ignores the 2.9 percent uncapped Medicare tax, however). The earnings ceiling in 2004 is $87,900. Hence, Social Security payroll taxes as a share of earnings fall after the ceiling is passed – thus, the Social Security payroll tax may be thought of as regressive. The opponents to this view note that the above analysis only focuses on taxes paid, not benefits received. As shown in Table 9.3, Social Security redistributes from high earners to low earners, and the formula for the primary insurance amount offers extremely high replacement rates to very low earners, and much lower replacement rates to high earners. Thus, the net tax payment(taxes minus benefits) is likely to be progressive, not regressive. One critical assumption in this kind of analysis is how one computes lifetime benefits –e.g., do we assume that low earners and high earners live the same number of years?10. Let G stand for the individual’s gross earnings. The question assumes that the personfaces a marginal tax rate of 15% and a payroll tax of 7.45%. Thus, the person’s after-tax earnings (denoted by N) are N=(1-t earn-t payroll)G, or N=(1-0.15-0.0745)G, or N=0.7755G.It is assumed that the gross unemployment benefits, U, are equal to 50 percent of before-tax earnings, or U=0.5G. Net unemployment benefits, B, take out income taxes, so B=(1-t earn)U=(1-t earn)0.5G=(1-0.15)0.5G=0.425G. The percentage of the individual’s after-tax income that is replaced by UI is therefore equal to B/N, or 0.425G/0.7755G, which is approximately 54.8%.Unemployment benefits are about 55% of the individual’s previous after-tax income. The effects of unemployment insurance on unemployment area matter of considerable debate. While the high replacement rates from UI may increasethe duration of unemployment, the longer search time may reduce recurrence of unemployment by allowing time for a worker to find a better job match. Empiricalstudies seem to show that the hazard rate into employment spikes up around the time that benefits run out – perhaps suggesting that job matches are not really improving.Chapter 10 – Social Insurance II: Health Care1. The quotation contains several serious errors. First, concern with health care costs doesnot mean that health care is not a “good.” Economists do not care about the cost of health care per se. Rather, the issue is whether there are distortions in the market that lead to more than an efficient amount being consumed. Second, it makes a lot of difference how money is spent. One can create employment by hiring people to dig ditches and then fill them up, but this produces nothing useful in the way of goods and services. Thus, employment in the health care sector is not desirable in itself. It is desirable to the extent that it is associated with the production of an efficient quantity of health care services.2. a. Those who have a relatively high probability of needing the insurance are the oneswho are most likely to buy it. This raises the premium, which in turn, leads toselection by people who have an even higher probability of using it. The cyclecontinues until the price is so high that virtually no one purchases the policy.b.Employer-provided health insurance is deductible to the employer and not taxed tothe employee.c.Because of the tax subsidy, individuals may purchase more than the efficientamount of health insurance. That is, they “over-insure.” An interesting exampleof how the tax system leads to overinsurance is given in a recent Wall StreetJournal (January 19, 2004) article by Martin Feldstein. He gives an example oftwo different California Blue Cross health plans – identical in all respects exceptfor the deductible and annual premiums. The low-deductible plan (the “generous”plan) has a deductible of $500 per family member, up to a maximum of two andan annual premium of $8,460. Thus, the maximum out-of-pocket expense is$1,000. The high-deductible plan (the “less generous” plan) has a deductible of$2,500 per family member, up to a maximum of two, and an annual premium of$3,936. Thus, the maximum out-of-pocket expense is $5,000. Note that thepremium savings of $4,524 actually exceeds the maximum incremental deductiblepayment of $4,000 (which would only occur if the family had very high healthexpenses). In principle, the high deductible plan is unambiguously better. But thetraditional tax rules could lead an employer to choose the low deductible policy.If the employee faced a marginal tax rate of 45% (the sum of federal, state, andpayroll tax rates), then if the $4,524 premium saving was turned into taxablesalary, the individual’s net income would only rise by $2,488. Thus, families withhigh expected medical expenses do better with the “generous” plan, even though itis more costly in terms of premiums.3. a. D d=4.22–(0.044)(50)=2 visits per year.Total expenditure =(2)(50)=$100b.Now the individual pays only $5 per visit.D d = 4.22 – (0.044)(5) = 4 visits, with out-of-pocket costs of $20.Insurance company pays ($45)(4) = $180Total expenditure = $200, double its previous level.4. Examining Figure 10.1, we can see why health care costs increased for the state ofTennessee. As insurance coverage increases, this lowers the cost of medical expenses for those who were previously did not have insurance, which increases the overall amount of medical services they consume. Before receiving insurance, these people demand M o units of medical services, and the amount they pay is represented by the area OP o aM o.But after receiving insurance coverage, they demand M1amounts of medical services, paying only OjhM1, while their insurance pays jP o bh. The increase in insurance payments is sizable for two reasons – first, by providing coverage, it pays for the majority of the already sizable medical expenses incurred by this group, and second, the introduction of insurance makes the group consume even more medical services. In short, if the people who designed the Tennessee program had realized that the demand curve for medical services is downward sloping, they would not have been surprised at the consequences of their program.To explain why HMOs have been unable to contain long-run health care costs, it is necessary to consider the effect of technology on health care costs in the long-term. The inherent problem is that the market for medical care places a large premium on using the latest and most-developed medicines and machinery for treating patients. These technologies tend to be expensive. Hence, while introducing HMOs can lead to a once and for all decrease in the rate of change in health care costs, there is nothing that an HMO can do to lower the cost of continually providing the latest in medical treatments. 5. The goal of making the Medicare prescription drug benefit a one-time, permanentdecision is to reduce the adverse selection problem (no te: the current “Medigap”program operates in this manner to some extent – a senior citizen has choice over all 10 of the Medigap plans for only a short period of time after they turn 65, after which they may be denied based on their health). Imagine a cohort of people turning age 65 and becoming eligible for the Medicare drug benefit. If the decision to enter (or exit) could be made every year, then healthy senior citizens would have a strong incentive to wait until they became unhealthy and needed drugs, and then enter the prescription drug program (presumably resulting in economic losses for the program). Similarly, when people who were collecting the prescription drug benefit became healthy, they would have a strong incentive to “opt-out” of the prog ram. By making the decision opt-in at the beginning or not at all, the healthy younger seniors are likely initially cross-subsidizing the older seniors. Note that this “opt-in at the beginning” works because bad health and older age are positively correlated with each other. If, for example, younger seniors used more drugs (and perhaps older seniors used more inpatient care, etc.), then older seniors could simply stop paying annual premiums and give up their option of being in the program. If this scenario held empirically, this would exacerbate the adverse selection problem and the opt-in scenario would not completely solve the adverse selection problem.6. The budget constraint initially has units of Medigap on the x-axis, and other goods on they-axis. Given initial prices of $1 per unit for each good, and $30,000 of income, the budget constraint has a slope of -1, and the intercepts on both axes are at 30,000 units. It is assumed that the initial utility maximizing bundle consumes 5,000 units of Medigap, hence the indifference curve is tangent at (5000,25000). All of this is illustrated in the figure below.Medigapefficiency units30,000 5,000After the “minimum Medigap” mandate, the consumer can either choose 0 units of Medigap or 8,000 or more units of Medigap. Thus, part of the budget constraint is eliminated (though the overall shape remains the same as before). After the mandate, the point (0,30000) is available, as well as all of the points to the southeast of the point (8000,22000). Clearly, the person’s utility must fall since the preferred choice, (5000,25000) is no longer available. If the person attains a higher level of utility as (0,30000) compared with (8000,22000), the person chooses to not purchase Medigap. In this case, the marginal rate of substitution is no longer equal to the price ratio. This is illustrated below.Medigapefficiency units30,000 5,000 8,000。

财政学第七版陈共

第一章财政概念和财政职能一、单项选择题1. “自由放任”时期的国家财政具有以下哪种特征?( A )A.财政支出占国民收入的比重较小B.税收以直接税为主C.政府较大程度地介入收入再分配D.政府支出以转移支付为主2.古典财政学的创始人是:( C )A.威廉·配第B.魁奈C.亚当·斯密D.大卫·李嘉图3.完全竞争市场隐含的特征有:( A )A.消费者和生产者都具有完全信息B.生产和消费中存在外部经济C.进入或退出市场存在障碍D.存在规模经济4.以下哪项不属于斯密所认为的政府该干的事情?( D )A.保护社会不受外国侵略B.保护每一个社会成员不受其他社会成员的不公正对待C.提供某些公共机构和公共工程D.调节社会收入分配的差距5.以下说法中错误的是:( B )A.在完全竞争的条件下,市场运行的结果必定符合帕累托效率B.“自由放任”的经济理论认为政府不应当对经济活动进行任何干预C.任何一种符合帕累托效率的配置状态都能通过完全竞争市场来实现。

D.机械论的伦理基础是个人主义6.( D )为政府介入或干预提供了必要性和合理性的依据。

A.经济波动B.公共产品C.公平分配D.市场失灵7.一般来说,下列哪些物品是纯公共物品( A )。

A.国防B.花园C.教育D.桥梁二、多项选择题1. 一般来说,下列哪些物品是准公共物品?(BCD )A.国防 B.花园 C.教育 D.桥梁2.市场的资源配置功能不是万能的,市场失灵主要表现在( ABCD )。

A.垄断 B.信息不充分或不对称 C.收入分配不公 D.经济波动3.政府干预经济的手段包括(ABC )。

A.立法和行政手段 B.组织公共生产和提供公共物品C.财政手段 D.强制手段4.公共物品的基本特征包括( BC )。

A.历史性 B.非排他性 C.非竞争性 D.单一性5.财政的基本职能是(ABD )。

A.资源配置职能 B.调节收入分配职能C.组织生产和销售职能 D.经济稳定与发展职能6.财政实现收入分配职能的机制和手段有( ABCD )。

罗森 财政学 第七版(英文版) 配套习题及答案Chap004

CHAPTER 4 - Public GoodsMultiple-Choice Questions1. Public goods are characterized bya) nonrivalness.b) excludability.c) the sum of the MRSs equaling MRT.d) all of the above.2. Market mechanisms are unlikely to providea) prices.b) nonrival goods efficiently.c) supply and demand.d) none of the above.3. A pure private good isa) nonrival in consumption and subject to exclusion.b) rival in consumption and subject to exclusion.c) rival in consumption and not subject to exclusion.d) all of the above.4. Commodity egalitarianism refers to commodities thata) are important for most consumers.b) are too dangerous for most consumers.c) should be made available to all consumers.d) are good ideas but never produced.e) are produced in bulk.5. Charging individual prices that are based on consumers’ willingness to pay isa) government price supports.b) will pricing.c) second tier pricing.d) price discrimination.6. Equilibrium for public goods is characterized bya) MSB = MSB.b) MRS = MRT.c) MRS = MRS = MRS=…=MRS = MRT.d) MC = MB.e) MRS – MRT = MSB.7. Summing demand curves horizontally sends market ______________ to individuals,while summing vertically sends market ______________ to individuals.a) price; priceb) quantity; quantityc) quantity; priced) price; quantity8. Public goods can bea) provided privately.b) provided publicly.c) subject to free rider problems.d) all of the above.9. A ________ is a person who wants to enjoy the benefits of a public good withoutcontributing his or her marginal benefit to the cost of financing the amount made.a) free riderb) politicianc) price makerd) price optimizer10. Congestible public goodsa) are nonrival in consumption.b) can not be priced in the market.c) are rival in consumption.d) are never provided by the private sector.11. A private good isa) nonrival in consumption.b) subject to free rider problems.c) subject to exclusion.d) not subject to exclusion.e) none of the above.12. When those that do not contribute to the costs of a public good are denied use, this is acase ofa) exclusion.b) being nonrival.c) price discrimination.d) infeasibility.e) all of the above.13. Which of the following is a public good?a) public defenseb) public televisionc) a libraryd) schoolse) all of the above14. Pure private goods are supplied througha) the market.b) government taxes.c) merit pricing.d) none of the above.15. School vouchers area) provided by the government.b) provided by private organizations.c) public funds to be used for private tuition.d) all of the above.Discussion Questions1. Suppose there are two individuals with identical demand curves characterized by theequation Q = (33/2) – (P/2). What is market demand if these demand curves are added horizontally? Vertically?2. Redo problem 10 of Chapter 4 in your textbook. Assume now that the marginal cost ofgetting snow plowed is now $24.3. Use the answer you found when adding market demand curves vertically in Question 1above to find the market equilibrium quantity if the market supply is constant at 10.4. Suppose you are given the following demand curves: Q = 32 – P and Q = 16 – (P/2).Add these two demand curves vertically and find the market demand curve.5. Suppose there is a public good that has market supply characterized by the equation X =(P/3) – (32/3). Suppose further that market demand for this good can be characterized by the equation X = 25 –P. Find the equilibrium quantity of the public good that will be supplied.True/False/Uncertain Questions1. The free rider problem causes less than optimal production of a public good.2. Pure private goods are nonrival in consumption.3. Most goods that are nonexcludable are pure public goods.4. Vertical summation of demand curves yield results equivalent to those of horizontalsummation.5. Increasing the quantity of a pure public good can be done at zero cost.6. Demand curves for pure public goods satisfy the law of demand.7. Pure public goods involve positive externalities.8. Increases in spending on education will lead to an increase in student performance.9. Privatization means taking services that are supplied by the government and turning themover to the private sector for provision.10. Private goods are always provided by the private sector.Essay Questions1. You have read that the free rider problem affects equilibrium in a public good context.Explain how this situation can be modeled as a prisoner’s dilemma game.2. Discuss and contrast the advantages and disadvantages of public highways versus tollroads.3. Some economists believe that public schools would improve if they were subjected tocompetition. Discuss the pros and cons of this idea.。

陈共《财政学》(第7版)配套题库 课后习题(第八章 税收原理)【圣才出品】

第八章税收原理一、概念题1.税收的强制性答:税收的强制性,指的是征税凭借国家政治权力,通常颁布法令实施,任何单位和个人都不得违抗。

在对社会产品的分配过程中,存在着两种权力:所有者权力和国家政治权力。

前者依据对生产资料和劳动力的所有权取得收入,后者凭借政治权力占有收入。

国家运用税收参与这种分配,就意味着政治权力凌驾于所有权之上,而这种分配之所以能够实现,正是因为它依据的是政治权力,而且依法征收,任何形式的抗税行为都构成违法行为。

征税中的强制性不是绝对的,当企业和个人明了征税的目的并增强纳税观念以后,强制性则可能转化为自愿性;同时,强制性是以国家法律为依据的,政府依法征税,公民依法纳税,公民具有监督政府执行税法和税收使用情况的权利。

2.税收的固定性答:税收的固定性,指的是征税前就以法律形式规定了征税对象以及统一的比例或数额,并只能按预定的标准征税。

一般说来,纳税人只要取得了税法规定的应税收入,发生了纳税行为,拥有了应税财产,就必须按规定标准纳税,不得违反。

同样,政府也只能按预定标准征税,不得随意更改。

税收的固定性不是绝对的,随着社会经济条件的变化,课税标准也会变动。

税收的固定性实质上是指征税有一定的标准,而这个标准又具有相对的稳定性。

3.税收的无偿性答:税收的无偿性,指的是国家征税以后,税款即为国家所有,既不需要偿还,也不需要对纳税人付出任何代价。

针对具体的纳税人来说,纳税后并未获得任何报酬,从这个意义上说,税收是不具有偿还性或返还性的。

但若从财政活动的整体来考察,税收的无偿性与财政支出的无偿性是并存的,这里又反映出有偿性的一面。

4.纳税人答:纳税人,又称纳税主体,是指税法规定的负有纳税义务的单位和个人。

纳税人可以是自然人,也可以是法人。

所谓自然人,一般是指公民或居民个人,如月工资达到应税所得额的我国公民,就是个人所得税的纳税人。

所谓法人,是指依法成立并能独立行使法定权利和承担法定义务的社会组织,主要是各类企业,如我国的国有企业,集体企业和私人企业等都是企业所得税的纳税人。

陈共《财政学》(第7版)配套题库【章节题库(11-17章)】【圣才出品】

第十一章我国现行税制一、概念题1.商品课税答:商品课税是泛指所有以商品为征税对象的税类。

就我国现行税制而言,包括增值税、营业税、消费税、土地增值税、关税及一些地方性工商税种。

同其他税类对比而言,商品课税有下述四方面的特征:课征普遍;以商品和非商品的流转额为计税依据;实行比例税率;计征简便。

商品课税的优点是税源充裕,课征方便,并可以抑制消费,增加储蓄和投资,有利于经济发展。

2.分类所得税答:分类所得税是指对纳税人的各种应纳税所得分为若干类别,不同类别(或来源)的所得适用不同的税率,分别课征所得税的一种税收方法。

例如,把应税所得可分为薪给报酬所得、服务报酬所得、利息所得、财产出租所得、营利所得等,根据这些所得类别,分别规定高低不等的税率,分别依率计征。

分类所得税一般采用比例税率,并以源泉课征方法征收。

分类所得税的优点是征收简便、税源易控,可有效地防止逃税行为,但其缺点是不能按纳税能力原则课征。

该税制首创于英国,但目前实行纯粹分类所得税的国家已不多见。

3.综合所得税答:综合所得税是指对纳税人个人的各种应税所得(如工薪收入、利息、股息、财产所得等)综合征收的所得税。

这种税制多采用累进税率,并以申报法征收。

其优点是能够量能课税,公平税负。

但这种税制需要纳税人纳税意识强、服从程度高,征收机关征管手段先进、工作效率高,因而容易产生偷税漏税现象。

综合所得税最先出现于德国,现为世界各国普遍采用。

4.消费型增值税答:消费型增值税是指准许一次全部抵扣当期购进的用于生产应税产品的固定资产价款的增值税。

在增值税实际征收中,采取先按商品销售收入全额乘以适用税率计算出“销项税额”,再从中扣除掉企业用于销售而购进商品或者为生产商品所购进原材料等投入物所交的增值税税款,余额交纳给政府。

增值税“进项税额”的扣除,主要有两种方式:一是只允许扣除购入的原材料等所含的税金,不允许扣除外购固定资产所含的税金;二是所有外购项目包括原材料、固定资产在内,所含税金都允许扣除。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第一章财政概念和财政职能复习与思考1.学习财政学为什么要从政府与市场的关系说起?答:在市场经济体制下,市场是一种资源配置系统,政府也是一种资源配置系统,二者共同构成社会资源配置体系。

而财政是一种政府的经济行为,是一种政府配置资源的经济活动,所以明确政府与市场的关系是学习财政学和研究财政问题的基本理论前提。

不明确政府与市场的关系,就难以说明为什么有市场配置还要有政府配置,政府配置有什么特殊作用,政府配置的规模多大为宜,政府采取什么方式配置资源等。

什么是市场?完整的市场系统是由家庭、企业和政府三个相对独立的主体组成的。

在市场经济下,政府构成市场系统的一个主体,这是毋庸置疑的。

比如,政府为市场提供诸如基础实施、教育和社会保障之类的公共物品和准公共物品,同时从市场采购大量的投入品和办公用品。

但政府又是一个公共服务和政治权力机构,具有与市场不同的运行机制,因而在市场中又具有特殊功能和特殊的地位,可以通过法律、行政和经济等手段,“凌驾”于市场之上介入和干预市场。

因此,为了说明政府与市场的关系,需要先从没有政府的市场系统说起,这时市场只有两个主体,即家庭和企业。

家庭是社会的基本细胞,是社会生活的基本单位,它为市场提供劳动力、资本和土地(在土地私有的条件下)等生产要素,并通过提供生产要素获取收入,而后用家庭收入到市场上购买生活消费品或从事投资,家庭的基本目标是满足需要和效用水平的最大化。

企业是社会的基本生产单位,它从家庭那里买进生产要素,通过加工转换为商品或劳务,而后将商品或劳务又卖给家庭并获取企业收入和利润,企业的基本目标是利润最大化并实现扩大再生产。

从日常生活来看,市场就是商品(包括生产要素)交易的场所,如百货商场、汽车市场、证券市场等等;但从经济学的角度来看,市场不是指商品交易的场所,而是指在无数个买者与卖者的相互作用下形成的商品交易机制。

市场机制的基本规律就是供求规律:供大于求,价格下降,库存增加,生产低迷;求大于供,价格上涨,库存减少,生产增长;通过价格和产量的不断波动,达到供给和需求的均衡。

市场是一种结构精巧而且具有效率的商品交易机制,这已经为经济发达国家几百年的经济发展史所证实,而且为各种经济学说所论证和肯定。

亚当·斯密将市场规律形容为“看不见的手”,认为不需要任何组织以任何方式的干预,市场就可以自动地达到供给与需求的均衡,而且宣称当每个人在追求私人利益的同时,就会被这只手牵动着去实现社会福利。

马克思同样赞叹市场机制的效率,并将价格规律提升为价值规律,认为商品的价值是由生产商品的社会必要劳动时间决定的,而价格围绕价值上下波动来调节生产和流通,并促进技术进步和经济发展,马克思同时也指出了市场波动是导致经济危机的可能性因素。

福利经济学的代表人物——意大利的经济学家帕累托,提出了一个在学习西方经济学和学习财政学时经常提到的帕累托经济效率标准,又称为帕累托最优状态。

简而言之,帕累托最优状态是指这样一种状态:任何一种改变都不可能使一个人的境况变好而又不使别人的境况变坏。

帕累托还论证了达到帕累托最优所必须满足的条件,包括交换的最优条件、生产的最优条件、交换和生产的最优条件。

帕累托效率标准(或帕累托最优状态)可以作为我们分析经济效率和财政效率的一个规范性参照标准。

2.什么是市场失灵?答:市场失灵是和市场效率对应的。

由于市场效率是以完全的自由竞争作为严格假设条件的,而现实的市场并不具备这种充分条件,所以市场的资源配置功能不是万能的,市场机制本身也存在固有的缺陷,这里统称为“市场失灵”。

市场失灵主要表现在:(1)垄断。

当一个行业被一个企业或几个企业垄断时,垄断者可能通过限制产量来抬高价格,使价格高于其边际成本,获得额外利润,从而丧失市场效率。

(2)信息不充分和不对称。

竞争性市场的生产者和消费者都要求有充分的信息,在市场经济条件下,生产者与消费者的生产、销售、购买都属于个人行为,掌握信息本身也成为激烈竞争的对象,而信息不充分和信息不对称也是影响公平竞争的重要因素。

(3)外部效应与公共物品。

完全竞争市场要求成本和效益内在化,产品生产者要负担全部成本,同时全部收益归生产者所有。

外部效应则是指在市场活动中没有得到补偿的额外成本和额外收益。

当出现正的外部效应时,生产者的成本大于收益,利益外溢,得不到应有的效益补偿;当出现负的外部效应时,生产者的成本小于收益,受损者得不到损失补偿,因而市场竞争就不可能形成理想的效率配置。

(4)收入分配不公。

市场机制效率是以充分竞争为前提的,而激烈的竞争不可能自发地解决收入分配公平问题。

效率和公平是矛盾的统一,效率是前提,首先是把“蛋糕”做大,没有效率,即使是公平的,也是低水平的平均主义;但公平既是经济问题,也是社会问题,收入差距过大,严重不公,会带来社会不安定,反过来又会影响效率。

(5)经济波动。

市场机制是通过价格和产量的自发波动达到需求与供给的均衡,而过度竞争不可避免地导致求大于供与供大于求的不断反复,这是市场经济不可避免的弊端。

3.参考图1—1,思考政府在市场经济体制下的经济作用。

答:西方新凯恩斯主义提出一种新型的政府-市场观,认为现代经济是一种混合经济(指私人经济和公共经济),政府和市场之间不是替代关系,而是互补关系。

图1-1说明了有政府介入的市场,政府与家庭、企业之间的收支循环流程。

图1-1 政府与家庭、企业之间的收支循环流程图我国在明确提出我国经济体制改革的目标是社会主义市场经济体制的时候,曾对社会主义市场经济体制做出一个简明的概括:“就是要使市场在社会主义国家宏观调控下对资源配置起基础性作用……。

”这个简明的概括清楚地说明了市场和政府的关系,也说明了社会主义市场经济体制下政府的经济作用。

其一,所谓使市场在资源配置中起基础性作用,既肯定了市场的配置效率,但又说明只是起基础性作用,而不是所有资源都可以通过市场来配置的,这就要求政府在资源配置中发挥应有的作用,弥补市场的失灵,主要是提供具有外部效应的公共物品;其二,所谓社会主义国家宏观调控,则是指市场机制本身存在固有的缺陷,必然存在收入分配不公和经济波动,要求政府通过宏观政策协调国民经济健康、稳定地运行。

我国目前仍处于经济体制转换过程中,而建成社会主义市场经济体制的核心问题之一,就是正确处理政府和市场的关系,转变政府职能,规范政府行为,其中包括转换财政职能。

4.政府干预手段,为什么会出现政府干预失效?答:政府干预手段可以概括为三个方面。

(1)立法和行政手段。

这主要是指制定市场法规、规范市场行为、制定发展战略和中长期规划、经济政策、实行公共管制、规定垄断产品和公共物品价格等。

(2)组织公共生产和提供公共物品。

公共生产是指由政府出资兴办的所有权归政府所有的工商企业和事业单位,主要是生产由政府提供的公共物品,也可以在垄断部门建立公共生产,并从效率或社会福利角度规定价格。

政府组织公共生产,不仅是出于提供公共物品的目的,而且是出于有效调节市场供求和经济稳定的目的。

(3)财政手段。

应当指出,财政手段既不直接生产也不直接提供公共物品,而是通过征税和税费为政府各部门组织公共生产和提供公共物品筹集经费和资金。

财政的目标是通过为政府各部门组织公共生产和提供公共物品筹集经费和资金,最终满足社会公共需要,同时又通过税收优惠、财政补贴和财政政策等手段调控市场经济的运行。

政府干预失效的原因和表现可能发生在:(1)政府决策失误。

大的方面包括发展战略和经济政策失误,小的方面包括一个投资项目的选择或准公共物品提供方式选择不当等,而政府决策失误会造成难以挽回的巨大损失。

(2)寻租行为。

在市场经济特征下,几乎不可避免地会产生由于滥用权力而发生的寻租行为,也就是公务员(特别是领导人员)凭借人民赋予的政治权力,谋取私利,权钱交易,化公为私,受贿索贿,为“小集体”谋福利,纵容亲属从事非法商业活动等等。

(3)政府提供信息不及时甚至失真,也可视为政府干预失误。

这里且不说政府提供的经济信息有可能失真或不及时,而政府应提供的信息是多方面的,一旦失误,都会带来不可估量的损失。

(4)政府职能的“越位”和“缺位”。

这种政府干预失效,可能主要发生于经济体制转轨国家。

经济体制转轨的一个核心是明确政府与市场的关系,规范政府经济行为,转变政府经济职能,其中包括转变财政职能。

5.区分公共物品与私人物品的基本标准。

答:区分或辨别公共物品和私人物品通常应用两个基本标准:一是排他性和非排他性;二是竞争性和非竞争性。

私人物品具有排他性和竞争性;公共物品具有非排他性和非竞争性。

排他性是指个人可以被排除在消费某种物品和服务的利益之外,当消费者付钱购买私人产品之后,他人就不能享用此种商品和服务所带来的利益,排他性是私人物品的第一个特征;竞争性是指消费者的增加将引起生产成本的增加,每多提供一件或一种私人物品,都要增加生产成本,因而竞争性是私人物品的第二个特征。

非排他性则是公共物品的第一个特征,即一些人享用公共物品带来的利益而不能排除其他一些人同时从公共物品中获得利益。

例如,每个公民都可以无差别地受益于国防所提供的安全保障,每个适龄儿童都有权力和义务接受政府提供的义务教育等等。

有些公共物品虽然经过技术处理可以具有排他性,但有时排除成本太高,因而经济上不可行。

公共物品的非排他性意味着可能形成“免费搭车”现象,即免费享用公共物品的利益。

非竞争性是公共物品的第二个特征,即消费者的增加不引起生产成本的增加,或者说,提供公共物品的边际成本为零。

此外,外部效应和效用的不可分割性,也是区分公共物品与私人物品的重要标准。

6.公共需要的历史性与特殊性。

答:一般来说,公共需要在任何社会形态下都是存在的,不因社会形态的更迭而消失,这是共同性。

公共需要又总是特殊的,即具体地存在于特定的社会形态之中。

对它的历史性可以沿着两条线索去探讨:一是社会生产力发展的线索,研究在一个个具体的经济发展阶段上,社会产生了或可能产生怎样一些公共需要;另一条是生产关系变迁的线索,研究在一个个具体的社会形态下,统治阶级或集团如何以社会公共需要的名义将剩余产品的分配做有利于本阶级或集团的安排。

在经济发展的不同阶段上,除保证执行国家职能那部分需要外,社会公共需要的主要内容是在不断发展变化的。

在传统社会中,农业是国民经济的主导部门,提供农业正常发展的条件,是这一阶段主要的社会公共需要,农田水利建设几乎无一例外地是这一时期的一项重要财政支出。

在经济起飞阶段,工业上升为国民经济的主导部门,人们从工业发展的实践得知,扩大投资是推动经济发展的主要动力,这一认识塑造了经济起飞阶段的社会公共需要的模式。

现在的发展中国家,政府无不把提供工业发展所需要的社会基础设施引为己任,并在主要工业部门直接投入大量资金。

当经济发展进入发达阶段以后,物质财富增长的主要动力则来自科学技术,人们对社会生活福利的评价,亦不再只注意物质财富的数量增长,而是日渐重视质量的提高,因此发展科学教育、提供高质量的生活福利条件、保护生态环境,就构成公共需要的主要内容。