内地对原产澳门的进口货物实施零关税的产品清单

海关总署公告2009年第75号--关于发布《2010年1月1日起新增香港享受

海关总署公告2009年第75号--关于发布《2010年1月1日起新增香港享受零关税货物原产地标准表》等的公告【法规类别】关税【发文字号】海关总署公告2009年第75号【发布部门】海关总署【发布日期】2009.11.30【实施日期】2010.01.01【时效性】现行有效【效力级别】XE0303海关总署公告(2009年第75号)根据《内地与香港关于建立更紧密经贸关系的安排》和《内地与澳门关于建立更紧密经贸关系的安排》及其相关补充协议,海关总署制订了《2010年1月1日起新增香港享受零关税货物原产地标准表》(以下简称《香港标准表》,见附件1)和《2010年1月1日起新增澳门享受零关税货物原产地标准表》(以下简称《澳门标准表》,见附件2),修改了部分享受货物贸易优惠措施香港货物的原产地标准(见附件3),并制定了《第四批香港自有品牌手表清单》(见附件4)。

现将有关事宜公告如下:一、《香港标准表》和《澳门标准表》使用了简化的货物名称,其范围与2009年《中华人民共和国进出口税则》中相应税号的货品一致,自2010年1月1日起执行。

二、对海关总署公告2006年第79号附件1《享受货物贸易优惠措施的香港货物原产地标准表》所列的“味精”(税号2103.9010)、“高效减水剂”(税号3824.4010)、“其他水泥、灰泥及混凝土用添加剂”(税号3824.4090)及“精炼铜丝”(税号7408.1900)等货物原产地标准进行了修改。

其中,“高效减水剂”和“其他水泥、灰泥及混凝土用添加剂”在海关总署公告2006年第79号中所列税号为3824.4000,自2009年起拆分为3824.4010及3824.4090两个税号(见海关总署公告2008年第98号)。

修改后的原产地标准自2010年1月1日起执行。

三、根据海关总署公告2005年第54号中有关确认“香港自有品牌”手表名单程序的规定,第四批香港自有品牌手表清单已经有关部门确认。

国务院关税税则委员会关于2017年下半年CEPA项下部分货物实施零关税的通知

国务院关税税则委员会关于2017年下半年CEPA项下部分货

物实施零关税的通知

【法规类别】关税

【发文字号】税委会[2017]10号

【发布部门】国务院关税税则委员会

【发布日期】2017.06.29

【实施日期】2017.07.01

【时效性】现行有效

【效力级别】XE0303

国务院关税税则委员会关于2017年下半年CEPA项下部分货物实施零关税的通知

(税委会〔2017〕10号)

海关总署:

根据《内地与香港关于建立更紧密经贸关系的安排》和《内地与澳门关于建立更紧密经贸关系的安排》及其补充协议的规定,国务院关税税则委员会决定,对新完成原产地标准磋商的6项香港原产商品和27项澳门原产商品,自2017年7月1日起实施零关税。

具体清单分别见附件1、附件2。

附件:1.内地与香港更紧密经贸关系安排2017年下半年已完成原产地标准核准商品税目税率表

2.内地与澳门更紧密经贸关系安排2017年下半年已完成原产地标准核准商品税目税率表

国务院关税税则委员会

2017年6月29日

附件1:

内地与香港更紧密经贸关系安排2017年下半年已完成原产地标准核准商品税目税率表。

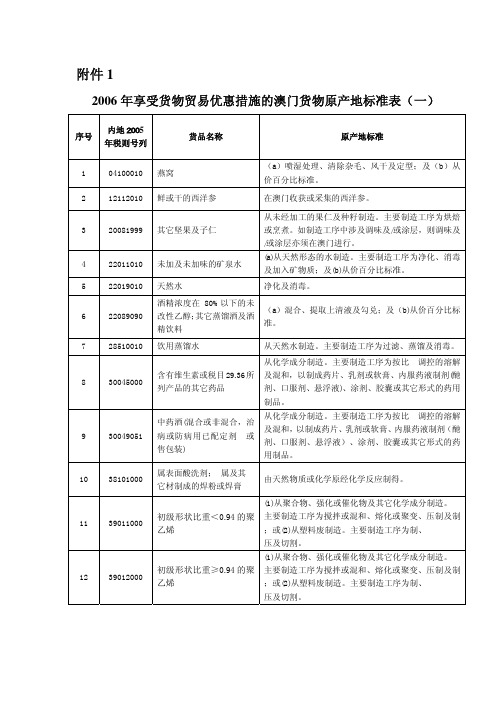

享受货物贸易优惠措施的澳门货物原产地标准表

附件12006年享受货物贸易优惠措施的澳门货物原产地标准表(一)序号内地2005年税则号列货品名称原产地标准1 04100010 燕窝(a )喷湿处理、清除杂毛、风干及定型;及(b )从价百分比标准。

2 12112010 鲜或干的西洋参在澳门收获或采集的西洋参。

3 20081999 其它坚果及子仁 从未经加工的果仁及种籽制造。

主要制造工序为烘焙或烹煮。

如制造工序中涉及调味及/或涂层,则调味及/或涂层亦须在澳门进行。

4 22011010 未加鞲及未加味的矿泉水 (a)从天然形态的水制造。

主要制造工序为净化、消毒及加入矿物质;及(b)从价百分比标准。

5 22019010 天然水净化及消毒。

6 22089090 酒精浓度在80%以下的未改性乙醇;其它蒸馏酒及酒精饮料(a )混合、提取上清液及勾兑;及(b)从价百分比标准。

7 28510010 饮用蒸馏水从天然水制造。

主要制造工序为过滤、蒸馏及消毒。

8 30045000含有维生素或税目29.36所列产品的其它药品从化学成分制造。

主要制造工序为按比缬调控的溶解及混和,以制成药片、乳剂或软膏、内服药液制剂(酏剂、口服剂、悬浮液)、涂剂、胶囊或其它形式的药用制品。

9 30049051 中药酒(混合或非混合,治病或防病用已配定剂逯或缤售包装)从化学成分制造。

主要制造工序为按比缬调控的溶解及混和,以制成药片、乳剂或软膏、内服药液制剂(酏剂、口服剂、悬浮液)、涂剂、胶囊或其它形式的药用制品。

10 38101000 属表面酸洗剂;休属及其它材梓制成的焊粉或焊膏 由天然物质或化学原梓经化学反应制得。

11 39011000初级形状比重<0.94的聚乙烯(1)从聚合物、强化或催化物梓及其它化学成分制造。

主要制造工序为搅拌或混和、熔化或聚变、压制及制恚;或(2)从塑料废梓制造。

主要制造工序为制恚、瑶压及切割。

12 39012000初级形状比重≥0.94的聚乙烯 (1)从聚合物、强化或催化物梓及其它化学成分制造。

CEPA补充协议一附件一原产香港零关税产品清单之拟生产产品

序号 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 内地2004年 税则号列 03033100 03037600 03037700 03041000 03042010 03042090 04021000 04022100 04022900 12112091 12112099 16030000 20094100 22060000 23012010 23012090 28432100 30029090 30059010 30059090 32041200 32061900 35029000 35061000 39073000 39100000 39211310 39211390 41120000 41131000 41132000 42022100 42031000 42032100 42032910 42032990 42033000 42034000 43011000 43013000 43016000 43017000 43018010 43018090 43019010 43019090 43021100 43021300 43021910 43021920 43021990 43022000 43023010 43023090 43040010 43040020 51061000 51121100 货 名 内地2004年 最惠国 税率 10 12 12 15 13.3 13.3 11.3 12.5 12.5 20 20 23.6 10 53.6 2 5 5.5 3 5 5 8.9 10 10 10 10.7 6.5 10.8 6.5 8 14 14 10 10 20 20 20 10 20 15 20 20 20 20 20 20 20 15 20 10 10 10 20 20 20 18 18 5 13.3 内地2005年 《安排》 税率 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0

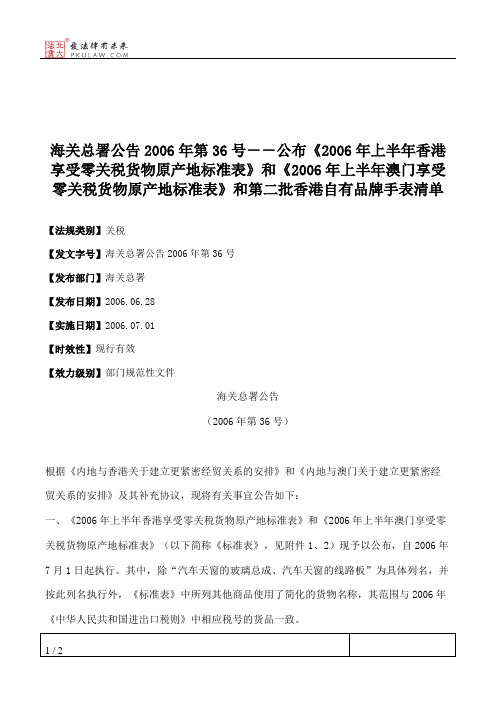

海关总署公告2006年第36号--公布《2006年上半年香港享受零关税货

海关总署公告2006年第36号--公布《2006年上半年香港享受零关税货物原产地标准表》和《2006年上半年澳门享受零关税货物原产地标准表》和第二批香港自有品牌手表清单【法规类别】关税【发文字号】海关总署公告2006年第36号【发布部门】海关总署【发布日期】2006.06.28【实施日期】2006.07.01【时效性】现行有效【效力级别】部门规范性文件海关总署公告(2006年第36号)根据《内地与香港关于建立更紧密经贸关系的安排》和《内地与澳门关于建立更紧密经贸关系的安排》及其补充协议,现将有关事宜公告如下:一、《2006年上半年香港享受零关税货物原产地标准表》和《2006年上半年澳门享受零关税货物原产地标准表》(以下简称《标准表》,见附件1、2)现予以公布,自2006年7月1日起执行。

其中,除“汽车天窗的玻璃总成、汽车天窗的线路板”为具体列名,并按此列名执行外,《标准表》中所列其他商品使用了简化的货物名称,其范围与2006年《中华人民共和国进出口税则》中相应税号的货品一致。

二、经内地与香港、澳门有关部门磋商并同意,修改海关总署2005年第70号公告所公布的《享受货物贸易优惠措施的香港货物原产地标准表》和《享受货物贸易优惠措施的澳门货物原产地标准表》中的“即食或快熟面条”(税号19023030)的原产地标准。

修改后的原产地标准为“(1)从谷类或面粉制造。

主要制造工序为混和、烹煮及塑形。

如制造工序中涉及烘焙,则烘焙亦须在香港进行;或(2)从干面条、肉类及蔬菜制造。

主要制造工序为烹煮、调味、混合及冷冻”。

该标准自2006年7月1日起执行。

三、根据海关总署2005年第54号公告规定的有关确认“香港自有品牌”手表清单的程序,第二批香港自有品牌手表清单(见附件3)已经确认,现予以公布。

特此公告。

附件:1.2006年上半年香港享受零关税货物原产地标准表2.2006年上半年澳门享受零关税货物原产地标准表3.第二批香港自有品牌手表清单二○○六年六月二十八日附件12006年上半年香港享受零关税货物原产地标准表。

中国澳大利亚自贸协议中在澳大利亚可零关税进口中国产品的清单

CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS(Sections 15 and 16 of the Customs Tariff Act 1995)Schedule 12/1Item Heading orsubheading inSchedule 3 Rate #1 1202.41.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free2 1202.42.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free3 2008.20.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free4 2008.40.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free5 2008.50.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free6 2008.70.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free7 2203.00.61 $40.75/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.158 2203.00.62 $47.47/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.159 2203.00.69 $47.47/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1510 2203.00.71 $8.14/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1511 2203.00.72 $25.53/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1512 2203.00.79 $33.43/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.15CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS Schedule 12/2Item Heading orsubheading inSchedule 3 Rate #13 2203.00.91 $80.41/L of alcohol14 2203.00.99 $80.41/L of alcohol15 2204.10.23 $80.41/L of alcohol16 2204.10.29 $80.41/L of alcohol17 2204.10.83 $80.41/L of alcohol18 2204.10.89 $80.41/L of alcohol19 2204.21.30 $80.41/L of alcohol20 2204.21.90 $80.41/L of alcohol21 2204.29.30 $80.41/L of alcohol22 2204.29.90 $80.41/L of alcohol23 2205.10.30 $80.41/L of alcohol24 2205.10.90 $80.41/L of alcohol25 2205.90.30 $80.41/L of alcohol26 2205.90.90 $80.41/L of alcohol27 2206.00.13 $80.41/L of alcohol28 2206.00.14 $80.41/L of alcohol29 2206.00.21 $80.41/L of alcohol30 2206.00.22 $80.41/L of alcohol31 2206.00.23 $80.41/L of alcohol32 2206.00.24 $80.41/L of alcohol33 2206.00.52 $80.41/L of alcohol34 2206.00.59 $80.41/L of alcohol35 2206.00.62 $80.41/L of alcohol36 2206.00.69 $80.41/L of alcohol37 2206.00.74 $40.75/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of the goodsexceeds 1.1538 2206.00.75 $47.47/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.15CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODSSchedule 12/3Item Heading orsubheading inSchedule 3 Rate #39 2206.00.78 $47.47/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1540 2206.00.82 $8.14/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1541 2206.00.83 $25.53/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1542 2206.00.89 $33.43/L of alcohol, calculatedon that alcohol content bywhich the percentage byvolume of alcohol of thegoods exceeds 1.1543 2206.00.92 $80.41/L of alcohol44 2206.00.99 $80.41/L of alcohol45 2207.10.00 $80.41/L of alcohol46 2207.20.10 $0.392/L47 2208.20.10 $75.10/L of alcohol48 2208.20.90 $80.41/L of alcohol49 2208.30.00 $80.41/L of alcohol50 2208.40.00 $80.41/L of alcohol51 2208.50.00 $80.41/L of alcohol52 2208.60.00 $80.41/L of alcohol53 2208.70.00 $80.41/L of alcohol54 2208.90.20 $80.41/L of alcohol55 2208.90.90 $80.41/L of alcohol56 2401.10.00 $663.72/kg57 2401.20.00 $663.72/kg of tobacco content58 2401.30.00 $663.72/kg of tobacco content59 2402.10.20 $0.53096/stick60 2402.10.80 $663.72/kg of tobacco contentCUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS Schedule 12/4Item Heading orsubheading inSchedule 3 Rate #61 2402.20.20 $0.53096/stick62 2402.20.80 $663.72/kg of tobacco content63 2403.11.00 $663.72/kg of tobacco content64 2403.19.10 $0.53096/stick65 2403.19.90 $663.72/kg of tobacco content66 2403.91.00 $663.72/kg of tobacco content67 2403.99.80 $663.72/kg of tobacco content68 2707.10.00 $0.392/L69 2707.20.00 $0.392/L70 2707.30.00 $0.392/L71 2707.50.00 $0.392/L72 2709.00.90 $0.392/L73 2710.12.61 $0.03556/L74 2710.12.62 * (Rate No. 001) $0.392/L of gasolineplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend75 2710.12.69 $0.392/L76 2710.12.70 $0.392/L77 2710.19.16 $0.392/L78 2710.19.22 * (Rate No. 001) $0.392/L of dieselplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend79 2710.19.28 $0.392/L80 2710.19.40 $0.03556/L81 2710.19.51 $0.392/L82 2710.19.52 $0.392/L83 2710.19.53 $0.392/L*For each component of the blend, the Import Declaration is to show the rate number, shown in brackets, the statistical code and the relevant volume in litres. Statistical codesfor each tariff classification are set out in Schedule 3.CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODSSchedule 12/5Item Heading orsubheading inSchedule 3 Rate #84 2710.19.70 $0.392/L85 2710.19.91 $0.085/L86 2710.19.92 $0.085/kg87 2710.20.00 * (Rate No. 001) $0.392/L of biodieselplus(Rate No. 002) $0.392/L of ethanol (if any)plus(Rate No. 003) $0.392/L of other substancesin the blend88 2710.91.16 $0.392/L89 2710.91.22 * (Rate No. 001) $0.392/L of dieselplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend90 2710.91.28 $0.392/L91 2710.91.40 $0.03556/L92 2710.91.51 $0.392/L93 2710.91.52 $0.392/L94 2710.91.53 $0.392/L95 2710.91.61 $0.03556/L96 2710.91.62 * (Rate No. 001) $0.392/L of gasolineplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend97 2710.91.69 $0.392/L98 2710.91.70 $0.392/L99 2710.91.80 * (Rate No. 001) $0.392/L of biodieselplus(Rate No. 002) $0.392/L of ethanol (if any)plus(Rate No. 003) $0.392/L of other substancesin the blend100 2710.91.91 $0.085/L101 2710.91.92 $0.085/kg102 2710.99.16 $0.392/L*For each component of the blend, the Import Declaration is to show the rate number, shown in brackets, the statistical code and the relevant volume in litres. Statistical codesfor each tariff classification are set out in Schedule 3.CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS Schedule 12/6Item Heading orsubheading inSchedule 3 Rate #103 2710.99.22 * (Rate No. 001) $0.392/L of dieselplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend104 2710.99.28 $0.392/L105 2710.99.40 $0.03556/L106 2710.99.51 $0.392/L107 2710.99.52 $0.392/L108 2710.99.53 $0.392/L109 2710.99.61 $0.03556/L110 2710.99.62 * (Rate No. 001) $0.392/L of gasolineplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend111 2710.99.69 $0.392/L112 2710.99.70 $0.392/L113 2710.99.80 * (Rate No. 001) $0.392/L of biodieselplus(Rate No. 002) $0.392/L of ethanol (if any)plus(Rate No. 003) $0.392/L of other substancesin the blend114 2710.99.91 $0.085/L115 2710.99.92 $0.085/kg116 2711.11.00 ** $0.268/kg117 2711.12.10 ** $0.128/L118 2711.13.10 ** $0.128/L119 2711.21.10 ** $0.268/kg120 2902.20.00 $0.392/L121 2902.30.00 $0.392/L122 2902.41.00 $0.392/L*For each component of the blend, the Import Declaration is to show the rate number, shown in brackets, the statistical code and the relevant volume in litres. Statistical codesfor each tariff classification are set out in Schedule 3.**Refer to notes under Chapter 27 Additional Note 2 and Additional Note 6, in Schedule 3, for information on conversion factors relating to LPG and CNG.CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODSSchedule 12/7 Item Heading orsubheading inRate #Schedule 3123 2902.42.00 $0.392/L124 2902.43.00 $0.392/L125 2902.44.00 $0.392/L126 2918.99.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free127 3403.11.10 $0.085/kg128 3403.11.90 $0.085/L129 3403.19.10 $0.085/kg130 3403.19.90 $0.085/L131 3403.91.10 $0.085/kg132 3403.91.90 $0.085/L133 3403.99.10 $0.085/kg134 3403.99.90 $0.085/L135 3808.93.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free136 3811.21.10 $0.085/kg137 3811.21.90 $0.085/L138 3817.00.10 $0.392/L139 3819.00.00 $0.085/L140 3824.90.50 * (Rate No. 001) $0.392/L of gasolineplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend141 3824.90.60 * (Rate No. 001) $0.392/L of dieselplus(Rate No. 002) $0.392/L of ethanolplus(Rate No. 003) $0.392/L of other substances(if any) in the blend*For each component of the blend, the Import Declaration is to show the rate number, shown in brackets, the statistical code and the relevant volume in litres. Statistical codesfor each tariff classification are set out in Schedule 3.CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS Schedule 12/8Item Heading orsubheading inSchedule 3 Rate #142 3826.00.10 $0.392/L143 3826.00.20 * (Rate No. 001) $0.392/L of biodieselplus(Rate No. 002) $0.392/L of ethanol (if any)plus(Rate No. 003) $0.392/L of other substancesin the blend144 3901.10.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free145 3901.20.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free146 3901.30.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free147 3901.90.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free148 3902.10.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free149 3902.30.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free150 3902.90.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free151 3903.11.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free152 3903.19.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free153 3903.20.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free154 3903.30.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free155 3903.90.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free*For each component of the blend, the Import Declaration is to show the rate number, shown in brackets, the statistical code and the relevant volume in litres. Statistical codesfor each tariff classification are set out in Schedule 3.CUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODSSchedule 12/9 Item Heading orRate #subheading inSchedule 3156 3904.10.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free157 3904.21.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free158 3904.22.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free159 3904.30.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free160 3904.40.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free161 3904.50.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free162 3904.60.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free163 3904.69.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free164 3904.90.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free165 3907.10.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free166 3907.20.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free167 3907.30.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free168 3907.40.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 FreeCUSTOMS TARIFFSCHEDULE 12CHINESE ORIGINATING GOODS Schedule 12/10Item Heading orsubheading inSchedule 3 Rate #169 3907.50.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free170 3907.60.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 171 3907.70.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 172 3907.91.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 173 3907.99.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 174 3907.99.90 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 175 3917.21.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 176 3917.22.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 177 3917.23.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 178 3917.32.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 179 3917.33.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 180 3917.39.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 181 3920.10.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 FreeItem Heading orsubheading inRate # Schedule 3182 3920.20.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 183 3920.43.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 184 3920.49.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 185 3920.51.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 186 3920.61.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 187 3920.62.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 188 3920.92.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 189 3920.99.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 190 3926.20.29 From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 191 3926.30.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 192 3926.90.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 193 4009.21.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 194 4009.22.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 FreeItem subheading inSchedule 3 Rate #195 4009.31.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 196 4009.32.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 197 4009.42.10 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 198 4010.32.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 199 4010.33.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 200 4015.90.29 From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 201 4016.91.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 202 4016.99.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 203 4203.10.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 204 4203.40.90 From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 205 4205.00.10 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 206 4802.56.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 FreeItem Heading orsubheading inRate # Schedule 3207 4802.56.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 208 4810.13.90 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 209 4810.19.90 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 210 4810.29.90 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 211 4810.99.00 From 20 December 2015 3.3%From 1 January 2016 1.7%From 1 January 2017 Free 212 4818.10.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 213 5702.31.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 214 5702.32.00 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 215 5702.39.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 216 5702.39.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 217 5702.41.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 FreeItem subheading inSchedule 3 Rate #218 5702.42.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 219 5702.49.10 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 220 5702.49.90From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 221 5702.50.90From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 222 5702.91.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 223 5702.92.90From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 224 5702.99.90From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 225 5703.10.00From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 226 5703.20.00From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 227 5703.30.00From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 FreeItem Heading orsubheading inRate # Schedule 3228 5703.90.90From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 229 5704.10.10From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 230 5704.90.10From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 231 5705.00.10From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 232 5705.00.90 From 20 December 2015 4%From 1 January 2016 3%From 1 January 2017 2%From 1 January 2018 1%From 1 January 2019 Free 233 5802.11.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 234 5802.19.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 235 6001.21.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 236 6101.20.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 237 6101.30.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 238 6101.90.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 239 6102.10.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 FreeItem subheading inSchedule 3 Rate #240 6102.20.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free241 6102.30.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 242 6102.90.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 243 6103.10.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 244 6103.22.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 245 6103.23.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 246 6103.29.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free247 6103.31.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 248 6103.32.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 249 6103.33.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 250 6103.39.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 251 6103.41.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 252 6103.42.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 FreeItem Heading orsubheading inRate # Schedule 3253 6103.43.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 254 6103.49.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 255 6104.13.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 256 6104.19.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 257 6104.22.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 258 6104.23.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 259 6104.29.00From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 260 6104.31.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 261 6104.32.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 262 6104.33.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 263 6104.39.00From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 264 6104.41.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free265 6104.42.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 266 6104.43.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 FreeItem subheading inSchedule 3 Rate #267 6104.44.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free268 6104.49.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 269 6104.51.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 270 6104.52.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 271 6104.53.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 272 6104.59.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 273 6104.61.00 From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 274 6104.62.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 275 6104.63.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 276 6104.69.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 277 6105.10.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 278 6105.20.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 279 6105.90.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 280 6106.10.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 FreeItem Heading orsubheading inRate # Schedule 3281 6106.20.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 282 6106.90.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 283 6107.11.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 284 6107.12.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 285 6107.19.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 286 6107.21.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 287 6107.22.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 288 6107.29.00 From 20 December 2015 8%From 1 January 2016 6%From 1 January 2017 4%From 1 January 2018 2%From 1 January 2019 Free 289 6107.91.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 290 6107.99.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 291 6108.11.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 292 6108.19.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 293 6108.21.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free 294 6108.22.00 From 20 December 2015 6.7%From 1 January 2016 3.3%From 1 January 2017 Free。

内地与香港关于建立更紧密经贸关系的安排

(一)自2005年1月1日起,内地对本协议附件1中列明的原产香港的进口货物实行零关税。本协议附件1是 《安排》附件1表1《内地对原产香港的进口货物实行零关税的产品清单》的补充。

(二)根据《安排》附件2《关于货物贸易的原产地规则》制定的本协议附件1中原产香港的进口货物的原产 地标准载于本协议附件2。本协议附件2是《安排》附件2表1《享受货物贸易优惠措施的香港货物原产地标准表》 的补充。

2018年12月,内地与香港签署了《内地与香港关于建立更紧密经贸关系的安排》(CEPA)框架下的《货物贸 易协议》。《货物贸易协议》是CEPA升级的重要组成部分,2019年1月1日起正式实施。

政策全文协议正文来自补充协议协议正文

内地与香港关于建立更紧密经贸关系的安排 前言 为促进内地和香港特别行政区(以下简称“双方”)经济的共同繁荣与发展,加强双方与其他国家和地区的 经贸联系,双方决定签署《内地与香港关于建立更紧密经贸关系的安排》(以下简称“《安排》”)。 第一章总则 第一条目标 通过采取以下措施,加强内地与香港特别行政区(以下简称“香港”)之间的贸易和投资合作,促进双方的 共同发展: 一、逐步减少或取消双方之间实质上所有货物贸易的关税和非关税壁垒; 二、逐步实现服务贸易自由化,减少或取消双方之间实质上所有歧视性措施; 三、促进贸易投资便利化。 第二条原则

内地与香港关于建立更紧密经 贸关系的安排

行政规章

01 政策全文

03 相关事件

目录

02 内容解读

基本信息

《内地与香港关于建立更紧密经贸关系的安排》是为促进中国内地和中华人民共和国香港特别行政区经济的 共同繁荣与发展,加强双方与其他国家和地区的经贸联系,双方决定签署的框架性协议。由中华人民共和国商务 部和中华人民共和国香港特别行政区财政司于2003年6月29日签署并实施。后期又相继签署补充协议及其他相关 协议。

【最新】 《内地与香港关于建立更紧密经贸关系的安排》补充协议 ... 模板(范本)

《内地与香港关于建立更紧密经贸关系的安排》补充协议颁布日期:20041027 实施日期:20041027 颁布单位:商务部为进一步提高内地(注:《安排》中,内地系指中华人民共和国的全部关税领土)与香港特别行政区(以下简称“香港”)经贸交流与合作的水平,根据于2003年6月29日签署的《内地与香港关于建立更紧密经贸关系的安排》(以下简称“《安排》”)和2003年9月29日签署的《安排》附件的规定,双方决定,就内地在货物贸易领域和服务贸易领域对香港扩大开放签署本协议。

一、货物贸易(一)自2005年1月1日起,内地对本协议附件1中列明的原产香港的进口货物实行零关税。

本协议附件1是《安排》附件1表1《内地对原产香港的进口货物实行零关税的产品清单》的补充。

(二)根据《安排》附件2《关于货物贸易的原产地规则》制定的本协议附件1中原产香港的进口货物的原产地标准载于本协议附件2。

本协议附件2是《安排》附件2表1《享受货物贸易优惠措施的香港货物原产地标准表》的补充。

二、服务贸易(一)自2005年1月1日起,内地在《安排》附件4《关于开放服务贸易领域的具体承诺》的基础上,在法律、会计、医疗、视听、建筑、分销、银行、证券、运输、货运代理等领域对香港服务及服务提供者进一步放宽市场准入的条件,扩大香港永久性居民中的中国公民在内地设立个体工商户的地域和营业范围。

具体内容载于本协议附件3。

(二)自2005年1月1日起,内地在专利代理、商标代理、机场服务、文化娱乐、信息技术、职业介绍、人才中介和专业资格考试等领域对香港服务及服务提供者开放和放宽市场准入的条件。

具体内容载于本协议附件3。

(三)本协议附件3中的建筑领域的承诺和分销领域的部分承诺已自2004年8月28日起实施。

具体见本协议附件3建筑及相关工程服务和分销服务的具体承诺。

本协议附件3中香港银行内地分行从事代理保险业务的承诺自2004年11月1日起实施。

(四)本协议附件3是《安排》附件4表1《内地向香港开放服务贸易的具体承诺》的补充和修正。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

0

127

棉制针织或鈎编套头衫等

14

0

128

化学纤维制针织或鈎编套头衫等

19

0

129

丝及绢丝制针织或鈎编套头衫等

0

130

其他纺织材料制针织或鈎编套头衫等

0

131

棉制针织或鈎编婴儿服装及附件

0

132

合成纤维制针织婴儿服装及附件

19

0

133

合成纤维制针织或鈎编运动服

0

134

棉制针织或鈎编的其他服装

表1

内地对原产澳门的进口货物实施零关税的产品清单

序号

内地2001年税则号列

货品 名 称

内地2003年最惠国税率

内地2004年《安排》税率

1

其他不含可可的糖食

11

0

2

供焙烘面包糕点用的调制品及面团

25

0

3

其他麦精制的其他税号未列名食品

13

0

4

未包馅或未制作的含蛋生面食

0

5

其他未包馅或未制作的生面食

0

6

0

83

非零售纯聚丙烯腈短纤多股纱线

11

0

84

其他纯合成纤维布

0

85

与棉混纺染色的轻质聚酯平纹布

0

86

化学纤维机制花边

0

87

含弹性纱线≧5%的狭幅织物

0

88

机织非绣制纺织材料标签、徽章等

0

89

化学纤维制针织或鈎编起绒织物

16

0

90

宽>30cm其他弹性纺织材料针织、鈎编织物

16

0

91

棉制其他针织或鈎编织物

米粉乾

20

0

7

即食或快熟面条

0

8

其他面食

0

9

甜饼乾;华夫饼乾及圣餐饼

17

0

10

面包乾、吐司及类似的烤面包

21

0

11

其他面包、糕点、饼乾及其焙烘糕饼

21

0

12

未列名制作或保藏的水果、坚果

18

0

13

咖啡浓缩精汁

0

14

冰淇淋及其他冰制食品不论是否含可可

0

15

浓缩蛋白质及人造蛋白物质

17

0

16

制造碳酸饮料的浓缩物

额定容量≦1KVA的其他变压器

0

223

1KVA<额定容量≦16KVA的互感器

0

224

1KVA<额定容量≦16KVA其他变压器

0

225

16KVA<额定容量≦500KVA其他变压器

0

226

额定容量>500KVA的其他变压器

14

0

227

其他未列名静止式变流器

10

0

228

手电筒

17

0

229

其他自供能源手提式电灯

0

244

其他供录制声音等信息未录制媒体

0

245

其他电力控制或分配的装置

0

246

铜制绕组电线

10

0

247

1000V≧耐压>80V有接头电导体

7

0

248

1000V≧耐压>80V无接头电导体

0

249

激光器

6

0

250

放大镜

12

0

251

其他液晶装置及光学仪器

5

0

252

激光器、望远镜等装置的零附件

6

0

253

税号所列其他货品的零附件

35

0

213

其他贱金属制仿首饰

0

214

未列名材料制仿首饰

35

0

215

餐桌、厨房等家用不锈钢器具

12

0

216

有衬背的精炼铜箔

4

0

217

洗涤、漂白或染色机器

0

218

输出功率≦750瓦直流电动机、发电机

12

0

219

电子镇流器

10

0

220

其他放电灯或放电管用镇流器

10

0

221

额定容量≦1KVA的互感器

0

222

0

144

棉制女式大衣、斗篷及类似品等

0

145

化学纤维制女式羽绒服

21

0

146

化学纤维制女式大衣、斗篷及类似品

21

0

147

棉制女式其他羽绒服

0

148

棉制女式带风帽防寒短上衣、防风衣

0

149

化学纤维制女式其他羽绒服

0

150

化学纤维制女式防风衣等

0

151

棉制男式阿拉伯裤

0

152

棉制男式长裤、工装裤等

0

153

0

230

手电筒零件

14

0

231

其他自供能源手提式电灯零件

14

0

232

电吹风机

15

0

233

其他电热理发器具

35

0

234

电热乾手器

35

0

235

电熨斗

35

0

236

电磁炉

0

237

电饭锅

0

238

电炒锅

0

239

其他电热炉

0

240

电热咖啡壶或茶壶

32

0

241

电热烤面包器

32

0

242

其他电热器具

32

0

243

其他用途的空磁盘

0

53

以橡胶或塑料爲基本成分的黏合剂

12

0

54

其他未列名的调制胶、黏合剂

15

0

55

其他未列名的反应引发剂、促进剂

0

56

初级形状的其他聚酯

0

57

初级形状的聚氨基甲酸酯

0

58

其他塑料的废碎料及下脚料

0

59

塑料制盒、箱及类似品

12

0

60

乙烯聚合物制袋及包

12

0

61

其他塑料制的袋及包

12

0

62

供运输或包装货物用其他塑料制品

16

0

263

贱金属制的表壳

14

0

264

贱金属制的表带及其零件

14

0

265

钟、表的其他零件

14

0

266

竖式钢琴

20

0

267

探照灯

0

268

聚光灯

0

269

其他电灯及照明装置

0

270

其他未列名的95章用品及设备

12

0

271

金属制钮扣

17

0

272

装有贱金属齿的拉链

21

0

273

其他拉链

21

0

注:本清单中与税则号列对应的“货品名称”,以《中华人民共和国海关进口税则》( 2001年版 )所列“货品名称”为准。

0

135

化学纤维制针织或鈎编的其他服装

0

136

其他纺织材料针织或鈎编衣着零件

0

137

化学纤维制男式羽绒服

0

138

化学纤维制男式大衣、斗篷及类似品

0

139

棉制男式其他羽绒服

0

140

棉制男式带风帽防寒短上衣、防风衣

0

141

化学纤维制男式其他羽绒服

0

142

化学纤维制男式防寒短上衣、防风衣

0

143

棉制女式羽绒服

0

185

棉制其他餐桌用织物制品

0

186

其他橡胶、塑料短统靴(过踝)

24

0

187

其他橡胶、塑料鞋靴

24

0

188

皮革制鞋面的其他运动鞋靴

17

0

189

皮革条带爲鞋面的皮底鞋

24

0

190

其他皮革制面的短统靴(过踝)

13

0

191

皮革制面的其他鞋靴

13

0

192

纺织材料制鞋面的运动鞋靴

24

0

193

纺织材料制鞋面胶底的其他鞋靴

10

0

41

其他印刷油墨

0

42

提取的油树脂

21

0

43

柑桔属果实的精油脱萜的萜烯副産品

21

0

44

含浓缩精油的脂肪、固定油、蜡等

21

0

45

其他工业用混合香料及香料混合物

0

46

香水及花露水

0

47

唇用化妆品

0

48

眼用化妆品

0

49

指(趾)甲化妆品

0

50

其他美容化妆品

0

51

以聚酰胺爲基本成分的黏合剂

0

52

以环氧树脂爲基本成分的黏合剂

0

110

其他纺织材料制针织或鈎编男衬衫

0

111

棉制针织或鈎编女衬衫

0

112

化学纤维制针织或鈎编女衬衫

0

113

其他纺织材料制针织或鈎编女衬衫

0

114

棉制针织或鈎编男内裤及三角裤

0

115

化学纤维制针织或鈎编男睡衣裤

19

0

116

棉制针织或鈎编女三角裤及短衬裤

0

117

化学纤维制针织或鈎编女三角裤及短衬裤

19