董事监事及高级管理人员责任保险条款

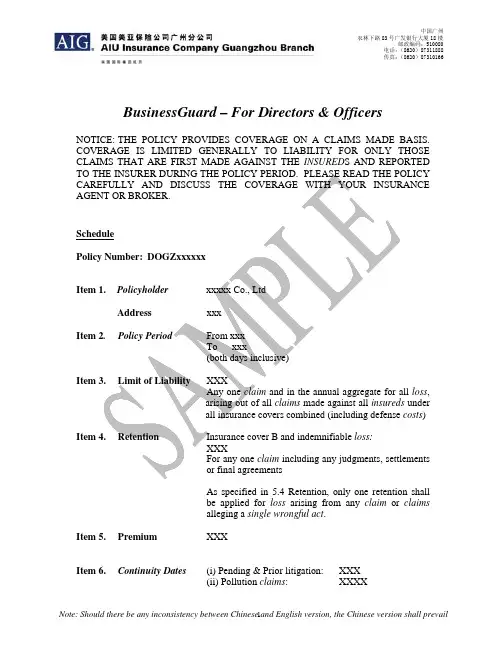

董监事及高级职员责任保险保单样本(英文)

中国广州农林下路83号广发银行大厦18楼邮政编码:510080电话:(8620)87311888传真:(8620)87310166BusinessGuard – For Directors & OfficersNOTICE: THE POLICY PROVIDES COVERAGE ON A CLAIMS MADE BASIS. COVERAGE IS LIMITED GENERALLY TO LIABILITY FOR ONLY THOSE CLAIMS THAT ARE FIRST MADE AGAINST THE INSURED S AND REPORTED TO THE INSURER DURING THE POLICY PERIOD. PLEASE READ THE POLICY CAREFULLY AND DISCUSS THE COVERAGE WITH YOUR INSURANCE AGENT OR BROKER.SchedulePolicy Number: DOGZxxxxxxItem 1. Policyholder xxxxx Co., LtdAddress xxxItem 2. Policy Period From xxxTo xxx(bothdaysinclusive)Item 3. Limit of Liability XXXA ny one claim and in the annual aggregate for all loss,arising out of all claims made against all insureds underall insurance covers combined (including defense costs) Item 4. Retention Insurance cover B and indemnifiable loss:XXXFor any one claim including any judgments, settlementsor final agreementsAs specified in 5.4 Retention, only one retention shallbe applied for loss arising from any claim or claimsalleging a single wrongful act.Item 5. Premium XXXItem 6. Continuity Dates(i) Pending & Prior litigation: XXX(ii)Pollutionclaims: XXXXItem 7. New Subsidiary XX% of the policyholder’s total assets CoverItem 8. Territorial Scope/ Worldwide including U.S.A./Canada JurisdictionSIGNED FOR AND ON BEHALF OF THE INSURERBY AUTHORIZED REPRESENTATIVE:AMERICAN INTERNATIONAL UNDERWRITERS, LIMITED DATE: XXDIRECTORS & OFFICERS LIABILITY INSURANCEIn consideration of the payment of the premium, the Insurer agrees as follows:Cover1. InsuranceA: Directors and Officers LiabilityInsurer shall pay the Loss of each Insured resulting from any Claim first made against Thethe Insured during the policy period for any Wrongful Act in the Insured’s capacity as a director, officer or employee of the Company except for and to the extent that the Company has indemnified the Insured.B: CorporateReimbursementThe Insurer shall pay the Loss of the Company resulting from any Claim first made against the Insured during the policy period for any Wrongful Act in the Insured’s capacity as a director, officer or employee of the Company but only when and to the extent that the Company has indemnified the Insured for the Loss.Subject to the terms and conditions of this Policy, the Insurer shall advance defense costs resulting from any Claim before its final resolution.2. Definitions2.1 Associated Company means any Company of which the policyholder owns on or before theinception of the policy period more than 20 percent but less than or equal to 50 percent of the issued and outstanding voting shares either directly or indirectly through one or more of its subsidiaries.2.2 Claim means:(i) any suit or proceeding brought by any person or organization against an Insured formonetary damages or other relief, including non-pecuniary relief;(ii) any written demand from any person or organization that it is the intention of the person or organization to hold an Insured responsible for the results of any specifiedWrongful Act;(iii) any criminal prosecution brought against an Insured;(iv) any administrative or regulatory proceeding or official investigation regarding any specified Wrongful Act of an Insured;Any Claim or Claim s arising out of, based upon or attributable to a single Wrongful Act shall be considered to be a single Claim for the purposes of this Policy.2.3 Company means the policyholder specified in Item 1 of the Schedule and any subsidiary,division, sector, region, product group or other internal company structure or segment detailed in an organization chart or similar document and which has been granted this status by the policyholder or any subsidiary before the date of the Wrongful Act.2.4 Continuity date(s)means the date(s) specified in Item 6 of the Schedule. The pending andprior litigation continuity date shall be the date from which the policyholder has maintained uninterrupted cover with the Insurer, or with any other Insurer if the initial proposal form submitted to such Insurer is provided to and accepted by the Insurer at the inception of this policy, or such other date(s) as agreed with the Insurer.2.5 Defense costs means reasonable and necessary fees, costs and expenses incurred with thewritten consent of the Insurer (including premiums for any appeal bond, attachment bond or similar bond, but without obligation to apply for or furnish any bond) resulting solely from the investigation, adjustment, defense and appeal of any Claim but shall not include the salary of any Insured.2.6 Director or officer means any natural person duly appointed or elected as a director or officerof the Company.2.7 Discovery period means the period of time specified in Extension 4.3, immediately followingthe termination of this Policy during which written notice may be given to the Insurer of any Claim first made against the Insured during such period of time for any Wrongful Act occurring prior to the end of the policy period and otherwise covered by this Policy.2.8 Employment Practice Claim means any Claim or series of related Claim s relating to a past,present or prospective employee of the Company and arising out of any actual or alleged unfair or wrongful dismissal, discharge or termination, either actual or constructive, of employment, employment-related misrepresentation, wrongful failure to employ or promote, wrongful deprivation of career opportunities, wrongful discipline; failure to furnish accurate job references; failure to grant tenure or negligent employee evaluation; or sexual or workplace or racial or disability harassment of any kind (including the alleged creation of a harassing workplace environment); or unlawful discrimination, whether direct, indirect, intentional or unintentional, or failure to provide adequate employee policies and procedures.2.9 Full annual premium means the annual premium level in effect immediately prior to the endof the policy period.2.10 Insured means any natural person who was, is, or shall become a director or officer of theCompany, or any natural person who is a trustee of a pension, retirement or provident benefit fund established for the benefit of the employees of the Company.Cover will automatically apply to any natural person who becomes a director or officer after the inception date of this Policy. Insured shall include any employee of the Company, but only for a Claim or Claim s alleging Wrongful Act(s) committed by the employee in a managerial or supervisory capacity. With respect to an Employment Practice Claim only, Insured shall include any past, present or future employee of the Company.2.11 Insurer means AIU Insurance Company Guangzhou Branch.2.12 Loss means damages, judgments, settlements and defense costs; however, Loss shall notinclude civil or criminal fines or penalties imposed by law, non-compensatory damages including punitive or exemplary damages, taxes, any amount for which the Insured is not legally liable or matters which may be considered uninsurable under the law pursuant to which this policy shall be construed. Damages, judgments, settlements and defense costs incurred in more than one Claim against the Insured but resulting from a single Wrongful Act shall constitute a single Loss.2.13 No liability means:(i) a final judgment of no liability obtained prior to trial in favor of all Insured s by reasonof a motion to dismiss or a motion for summary judgment after the exhaustion of allappeals; or(ii) a final judgment of no liability obtained after trial in favor of all Insured s, after the exhaustion of all appeals.In no event shall the term no liability apply to a Claim made against an Insured for which a settlement has occurred.2.14 Not-for-profit entity means an entity registered with the Registrar of Companies underSection 21(1) of the Companies Ordinance (Cap.32) or any similar entity organized under the laws of any other jurisdiction, or a trade association which for the purposes of this policy shall mean a body of persons, whether incorporated or not, which is formed for the purpose of furthering the trade interests of its members, or of persons represented by its members.2.15 Outside entity means any associated Company, any not-for-profit entity or any othercorporation, partnership, joint venture or other organization which has been listed by endorsement to this policy.2.16 Policyholder means the organization specified in Item 1 of the Schedule.2.17 Policy period means the period of time from the inception date to the expiry date specified inItem 2 of the Schedule.2.18 Pollutants include (but are not limited to) any solid, liquid, gaseous or thermal irritant orcontaminant, including smoke, vapor, soot, fumes, acids, alkalis, chemicals and waste. Waste includes (but is not limited to) material to be recycled, reconditioned or reclaimed.2.19 Security means any note, stock, bond, debenture, evidence of indebtedness, share or otherequity or debt security of the Company, and shall include any certificate of interest or participation in, receipt for, warrant or other right to subscribe to or purchase, voting trust certificate relating to, certificate of deposit for, or other interest in any of the foregoing.2.20 Single Wrongful Act means a Wrongful Act or any related, continuous or repeated WrongfulAct s, whether committed by the Insured individually or by more than one Insured and whether directed to or affecting one or more than one person or legal entity.2.21 Subsidiary means companies in which the policyholder, either directly or indirectly throughone or more of its subsidiaries;(i) controls the composition of the board of directors; or(ii) controls more than half of the voting power; or(iii) holds more than half of the issued share capital.Cover for any Claim against any of the director s, officer s and employees of any subsidiary shall apply only for Wrongful Act(s) committed while such company is a subsidiary of the policyholder. However, upon written request by the policyholder, the Insurer shall consider, after assessment and evaluation of the increased exposure, granting cover for Wrongful Act(s) committed prior to the acquisition of the subsidiary by the policyholder.2.22 Transaction means anyone of the following events:policyholder consolidates with or merges into or sells all or substantially all of its (i) theassets to any other person or entity or group of persons and/or entities acting inconcert; or(ii) any person or entity, whether individually or together with any other person or persons, entity or entities acquires an amount of the outstanding shares representingmore than 50 percent of the voting power for the election of director s of thepolicyholder, or acquires the voting rights for such an amount of the shares.2.23 Wrongful Act means any actual or alleged breach of duty, breach of trust, neglect, error,misstatement, misleading statement, omission, breach of warranty of authority or other act by the director s, officer s or employees in their respective capacities as a director, officer or employee of the company or as a director, or officer of any outside entity, or any matterClaim ed against them solely because of their status as a director , officer or employee of the Company .3. ExclusionsThe Insurer shall not be liable to make any payment for Loss in connection with any Claim made against the Insured :3.1 arising out of, based upon or attributable to:(i) the gaining in fact of any personal profit or advantage to which the Insured was notlegally entitled;(ii) profits in fact made from the purchase or sale by the Insured of securities of theCompany within the meaning of Section 16(b) of the Securities Exchange Act of 1934(USA) and any amendments thereto or similar provisions of any state statutory law;(iii) the committing in fact of any dishonest or fraudulent act.For the purpose of determining the applicability of these exclusions, the Wrongful Act of anyInsured shall not be imputed to any other Insured . These exclusions shall only apply if it is established through a judgment, or any other final adjudication adverse to the Insured , or any admission by an Insured that the relevant conduct did in fact occur;3.2 arising out of, based upon or attributable to the facts alleged or to the same or relatedWrongful Act (s) alleged or contained in any Claim which has been reported or in any circumstances of which notice has been given under any policy of which this policy is a renewal or replacement or which it may succeed in time;3.3 arising out of, based upon or attributable to any pending or prior litigation as of the pendingand prior litigation continuity date specified in Item 6(i) of the Schedule, or alleging or deriving from the same or essentially the same facts as alleged in the pending or prior litigation;3.4 which are brought by or on behalf of any Insured or the Company ; provided, however, thatthis exclusion shall not apply to:(i) any Employment Practice C laim brought by any Insured ;(ii) any Claim brought or maintained by an Insured for contribution or indemnity, if theClaim directly results from another Claim otherwise covered under this Policy;(iii) any shareholder derivative action brought or maintained on behalf of the Company without the solicitation, assistance or participation of any Insured or the Company;Claim brought or maintained by a liquidator, receiver or administrative receiver any(iv)either directly or derivatively on behalf of the Company without the solicitation,assistance or participation of any Insured or the Company;anyClaim brought by an Insured or employee of the Company in their capacities as (v)members or beneficiaries of any pension, retirement or provident benefit fundestablished for the benefit of any director, secretary, executive officer or employee ofthe Company;Claim brought or maintained by any former director, officer or employee of the (vi)anyCompany.3.5 arising out of, based upon or attributable to or in any way involving, directly or indirectly, theactual, alleged or threatened discharge, dispersal, release or escape of pollutants; or any direction or request to test for, monitor, clean up, remove, contain, treat, detoxify or neutralize pollutants, nuclear material or nuclear waste.Provided, however, that the exclusion shall not apply to any Claim made against the Insured by any shareholder of the Company either directly or derivatively, alleging damage to the Company or its shareholders, unless on or before the pollution continuity date specified in item 6(ii) of the Schedule, the Company, the Insured or any employee of the Company with managerial responsibilities over environmental affairs, control or compliance, knew or could have reasonably foreseen that there existed any situation, circumstance or Wrongful Act which could have given rise to a Claim against the Company, or the Insured.3.6 arising from the actual or alleged violation of any responsibilities, obligations or dutiesimposed by the Employee Retirement Income Security Act of 1974 (USA) or any amendment thereto;3.7 arising out of, based upon or attributable to any act or omission in the Insured’s capacity as adirector or officer of any entity other than the Company, or by reason of the Insured’s status as a director, officer or employee of the other entity, other than as provided in Extension 4.2;3.8 for bodily injury, sickness, disease, death or emotional distress of any person, or damage to ordestruction of any tangible property, including Loss of use thereof; provided, however, that any Claim for emotional distress shall not be excluded with respect to an Employment Practice C laim.4. ExtensionsSubject to all of the terms and conditions of this policy, cover is extended as follows:4.1 New SubsidiariesCover under this policy is extended to any subsidiary which the policyholder acquires or creates after the inception date of this policy provided that the subsidiary has total gross assets which are less than the amount specified in Item 7 of the Schedule(i) either in the United States of America or Canada; and(ii) does not have a listing of any of its securities on any exchange in the United States of America or Canada.If a newly acquired or created subsidiary fails to meet conditions (i) and (ii) above, the policyholder may request an extension of this policy for such subsidiary provided that the policyholder shall give the Insurer sufficient details to permit the Insurer to assess and evaluate the Insurer’s potential increase in exposure. The Insurer shall be entitled to amend the policy terms and conditions, during the policy period, including by the charging of a reasonable additional premium.Unless otherwise agreed, cover as is afforded to the director s, officer s or employees of any subsidiary by virtue of this extension shall only apply for Wrongful Act(s) committed while such company is or was a subsidiary of the policyholder.4.2 Outside DirectorshipsCover includes Loss arising from any Claim made against any Insured who was, is or may become, at the specific request of the Company, a director or officer of any outside entity for any Wrongful Act in the Insured’s capacity as a director or officer of the outside entity.This cover shall be specifically excess of any insurance in force in respect of the outside entity as well as any indemnification provided by the outside entity. If the other insurance is provided by the Insurer or any member company of American International Group (or would be provided except for the application of the retention amount or the exhaustion of the limit of liability), then the total aggregate limit of liability for all Loss covered by virtue of this extension shall be reduced by the limit of liability specified in the schedule of the other American International Group insurance provided to the outside entity.The cover provided by this clause shall not apply in connection with any Claim made against any Insured by the outside entity, any of its director s or officer s or any shareholder of the outside entity holding more than 20 percent of the issued and outstanding voting share capital of the outside entity.4.3 Discovery PeriodIf the policyholder refuses to renew this policy, then the policyholder shall have the right, upon payment of an additional premium of 50 percent of the full annual premium to a discovery period of 12 months following the effective date of non-renewal.If the Insurer refuses to offer any terms or conditions to renew this policy, then the policyholder shall have the right to purchase a discovery period of 12 months for 25 percent of the full annual premium.The Insured shall be entitled to a 30 day discovery period at no additional premium if this policy is not renewed by either the policyholder or the Insurer. If the policyholder elects to purchase a discovery period, this 30-day discovery period shall be part of and not in addition to the purchased discovery period.To purchase the discovery period, the policyholder must request its purchase in writing within15 days of the termination date of the policy and must tender the additional premium within30 days of the termination date. The additional premium is not refundable and the discoveryperiod is not cancelable.If a transaction takes place, then the policyholder shall not have the right to purchase a discovery period as set out above. However, the policyholder shall have the right within 30 days of the end of the policy period to request an offer from the Insurer of a discovery period for up to 72 months. The Insurer shall offer a discovery period with terms, conditions and premium as the Insurer may reasonably decide.4.4. Heirs, Estates and Legal RepresentativesIf an Insured dies, becomes incompetent, insolvent or bankrupt, this policy shall cover Loss arising from any Claim made against the estate, heirs, or legal representatives of the Insured for any Wrongful Act of such Insured.4.5 Joint Property LiabilityThis Policy shall cover Loss arising from any Claim made against the lawful spouse (whether that status is derived by reason of the statutory law, common law or otherwise of any applicable jurisdiction in the world) of an Insured for any Claim arising out of his or her status as the spouse of an Insured including any Claim that seeks damages recoverable from marital community property or property jointly held by the Insured and the spouse; provided, however, that this extension shall not afford cover for any Claim for any Wrongful Act of the spouse and that this policy shall apply only to Wrongful Act(s) of an Insured.Provisions5. General5.1 Representation and SeverabilityIn granting cover to any one Insured, the Insurer has relied upon the material statements and particulars in the proposal together with its attachments and other information supplied.These statements, attachments and information are the basis of cover and shall be considered incorporated and constituting part of this policy.The proposal shall be construed as a separate proposal by each of the Insured s. With respect to statements and particulars in the proposal, no statements made or knowledge possessed by any Insured shall be imputed to any other Insured to determine whether cover is available for any Claim made against such other Insured.5.2 Changes in Risk During Policy period(i) If during the policy period a transaction takes place, then the cover provided underthis policy is amended to apply only to Wrongful Act(s) committed prior to theeffective date of the transaction.policy period, the Company decides to make an initial offering of itsthe(ii) Ifduringsecurities in any jurisdiction, whether its securities are already traded or not, by anymeans, public or private, then as soon as the information is publicly available, theCompany shall provide the Insurer with any prospectus or offering statement for theInsurer’s evaluation and assessment of the increased exposure of the Insured and theInsurer shall be entitled to amend the terms and conditions of this policy and/orcharge a reasonable additional premium reflecting the increase in exposure. At thepolicyholder’s request, prior to the public announcement of such securities offering,the Insurer shall evaluate and assess the increased exposure and advise of allnecessary amendments to the terms and conditions of this policy and additionalpremium. In this event and at the request of the policyholder, the Insurer will enterinto a confidentiality agreement with the policyholder relating to any informationprovided regarding the proposed securities offering.5.3 Limit of LiabilityThe limit of liability specified in Item 3 of the Schedule is the total aggregate limit of the Insurer’s liability for all Loss, arising out of all Claims made against all Insured s under all insurance covers under this policy combined. The limit of liability for the discovery period shall be part of and not in addition to the total aggregate limit of liability for the policy period.Loss arising from any Claim which is made subsequent to the policy period or discovery period which pursuant to General Provision 5.5 is considered made during the policy period or discovery period shall also be subject to the same total aggregate limit of liability. Defense costs are not payable by the Insurer in addition to the total aggregate limit of liability.Defense costs are part of Loss and are subject to the total aggregate limit of liability for Loss.5.4 RetentionThe Insurer shall only be liable for the amount of Loss arising from a Claim which is in excess of the retention amount specified in Item 4 of the Schedule with regard to all Loss under all insurance covers under this policy for which the Company has indemnified or is permitted or required to indemnify the Insured. The retention amount is to be borne by the Company and shall remain unInsured. A single retention amount shall apply to Loss arising from all Claim s alleging a single Wrongful Act.Provided, however, that no retention shall apply and the Insurer shall thereupon reimburse any defense costs paid by the Company, in the event of:(i) a determination of no liability of all Insured s, or(ii) a dismissal or a stipulation to dismiss the Claim without prejudice and without the payment of any consideration by any Insured.Provided, however, that in the case of (ii) above, such reimbursement shall occur 90 days after the date of dismissal or stipulation as long as the Claim is not re-brought (or any other Claim which is subject to the same single retention by virtue of this General provision 5.4 is not brought) within that time, and further subject to an undertaking by the Company in a form acceptable to the Insurer that such reimbursement shall be paid back by the Company to the Insurer in the event the Claim (or any other Claim which is subject to the same single retention by virtue of this General Provision 5.4) is brought after such 90 day period.5.5 How to Give Notice and Report a Claim(i) Notice of a Claim or of circumstances which may result in a Claim shall be given inwriting to Financial Lines Claims, at the head office of the Insurer as shown on thedeclarations page. If posted the date of posting shall constitute the date that noticewas given, and proof of posting shall be sufficient proof of notice.Company or the Insured shall, as a condition precedent to the obligations of the (ii) TheInsurer under this policy, give written notice to the Insurer of any Claim made againstan Insured as soon as practicable and either:(a) any time during the policy period or during the discovery period; or(b) within 30 days after the end of the policy period or the discovery period, aslong as such Claim(s) is reported no later than 30 days after the date suchClaim was first made against an Insured.(iii) If, during the policy period or during the discovery period written notice of a Claim against an Insured has been given to the Insurer pursuant to the terms and conditionsof this policy, then any Claim arising out of, based upon or attributable to the factsalleged in the Claim previously notified to the Insurer or alleging a single WrongfulAct which is the same as or related to any Wrongful Act alleged in the previouslynotified Claim, shall be considered made against the Insured and reported to theInsurer at the time the first notice was given.(iv) If during the policy period or during the discovery period, the Company or the Insured shall become aware of any circumstances which may reasonably be expected to giverise to a Claim being made against an Insured and shall give written notice to theInsurer of the circumstances and the reasons for anticipating a Claim, with fullparticulars as to dates and persons involved, then any Claim which is subsequentlymade against an Insured and reported to the Insurer arising out of, based upon orattributable to the circumstances or alleging any Wrongful Act which is the same as orrelated to any Wrongful Act alleged or contained in those circumstances, shall beconsidered made against the Insured and reported to the Insurer at the time the noticeof the circumstances was first given.5.6 Advancement of CostsThe Insurer shall advance to the Insured or the Company defense costs under all insurance covers under this policy before the final disposition of the Claim. The advance payments by the Insurer shall be repaid to the Insurer by the Company or the Insured, severally according to their respective interests, in the event and to the extent that the Company or the Insured shall not be entitled to payment of the Loss under the terms and conditions of this policy.In the event and to the extent that the Company is permitted or required to indemnify the Insured but for whatever reason fails to do so, the Insurer will advance all defense costs to the Insured on behalf of the Company. In this case, however, the retention amount specified in Item 4 of the Schedule shall be repaid by the Company to the Insurer, unless the Company is insolvent.5.7 How Defense Will Be ConductedThe Insured shall have the right and duly to defend and contest any Claim. The Insurer shall have the right to effectively associate with the Insured and the Company in the defense and settlement of any Claim that appears reasonably likely to involve the Insurer, including but not limited to effectively associating in the negotiation of any settlement.The Insured shall not admit or assume any liability, enter into any settlement agreement, stipulate to any judgment or incur any defense costs without the prior written consent of the Insurer as a condition precedent to the Insurer’s liability for Loss arising out of the Claim.Only those settlements, stipulated judgments and defense costs which have been consented to by the Insurer shall be recoverable as Loss under the terms of this policy. The Insurer’s consent shall not be unreasonably withheld, provided that the Insurer shall be entitled to effectively associate in the defense and the negotiation of any settlement of any Claim in order to reach a decision as to reasonableness.。

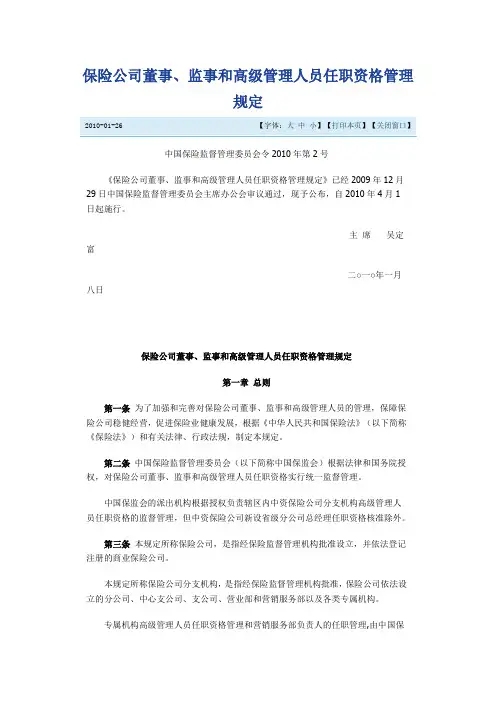

中国保险监督管理委员会令2010年第2号《保险公司董事、监事和高级管理人员任职资格管理规定》

保险公司董事、监事和高级管理人员任职资格管理规定2010-01-26 【字体:大中小】【打印本页】【关闭窗口】中国保险监督管理委员会令2010年第2号《保险公司董事、监事和高级管理人员任职资格管理规定》已经2009年12月29日中国保险监督管理委员会主席办公会审议通过,现予公布,自2010年4月1日起施行。

主席吴定富二○一○年一月八日保险公司董事、监事和高级管理人员任职资格管理规定第一章总则第一条为了加强和完善对保险公司董事、监事和高级管理人员的管理,保障保险公司稳健经营,促进保险业健康发展,根据《中华人民共和国保险法》(以下简称《保险法》)和有关法律、行政法规,制定本规定。

第二条中国保险监督管理委员会(以下简称中国保监会)根据法律和国务院授权,对保险公司董事、监事和高级管理人员任职资格实行统一监督管理。

中国保监会的派出机构根据授权负责辖区内中资保险公司分支机构高级管理人员任职资格的监督管理,但中资保险公司新设省级分公司总经理任职资格核准除外。

第三条本规定所称保险公司,是指经保险监督管理机构批准设立,并依法登记注册的商业保险公司。

本规定所称保险公司分支机构,是指经保险监督管理机构批准,保险公司依法设立的分公司、中心支公司、支公司、营业部和营销服务部以及各类专属机构。

专属机构高级管理人员任职资格管理和营销服务部负责人的任职管理,由中国保监会另行规定。

本规定所称保险机构,是指保险公司及其分支机构。

第四条本规定所称高级管理人员,是指对保险机构经营管理活动和风险控制具有决策权或者重大影响的下列人员:(一)总公司总经理、副总经理和总经理助理;(二)总公司董事会秘书、合规负责人、总精算师、财务负责人和审计责任人;(三)分公司、中心支公司总经理、副总经理和总经理助理;(四)支公司、营业部经理;(五)与上述高级管理人员具有相同职权的管理人员。

第五条保险机构董事、监事和高级管理人员,应当在任职前取得中国保监会核准的任职资格。

董事责任保险制度

董事责任保险制度全文共四篇示例,供读者参考第一篇示例:董事责任保险制度是指公司为了保护董事和高管人员的利益,减少其在履行职责过程中可能面临的法律风险而购买的一种商业保险制度。

董事责任保险覆盖的范围广泛,主要包括董事、监事、高管及其他管理人员在履行职责时可能面临的法律诉讼、调查、罚款和赔偿问题等。

董事责任保险制度的出现主要是因为在当今商业环境中,董事和高管人员所面临的法律责任越来越严重。

在公司经营过程中,由于管理不善、决策失误或违反法律法规等原因,董事和高管人员往往会面临诉讼、调查或惩罚等风险。

一旦公司陷入诉讼或调查,董事和高管人员往往要承担个人的法律责任和赔偿责任,对其个人和家庭造成巨大的经济和心理压力。

董事责任保险制度的作用是为董事和高管人员提供必要的保障,使其在履行职责时更加放心。

通过购买董事责任保险,董事和高管人员可以获得专业的法律支持和赔偿保护,帮助他们应对可能面临的法律风险。

同时,董事责任保险也可以保护公司的声誉和财产,减少公司因董事和高管人员个人行为而导致的法律纠纷带来的损失。

董事责任保险制度的建立和运作需要公司管理层高度重视。

首先,公司应该了解董事和高管人员的风险暴露情况,确定购买董事责任保险的必要性和范围。

其次,公司应选择合适的保险公司和产品,确保董事责任保险的覆盖范围和保障条款能够满足公司和高管人员的需求。

最后,公司应建立健全的董事责任保险管理制度,及时更新保险合同和保单,确保董事和高管人员在面临法律风险时能够得到及时的赔偿和支持。

总之,董事责任保险制度对于保护董事和高管人员的利益,减少其在履行职责过程中可能面临的法律风险,维护公司的声誉和财产具有重要意义。

公司管理层应该高度重视董事责任保险制度的建立和运作,确保公司及董事和高管人员在面对法律风险时能够得到有效的保障和支持。

【字数:458】第二篇示例:董事责任保险制度是一种为董事提供保障和保护的保险制度,旨在减轻董事个人在公司经营中可能面临的风险和责任。

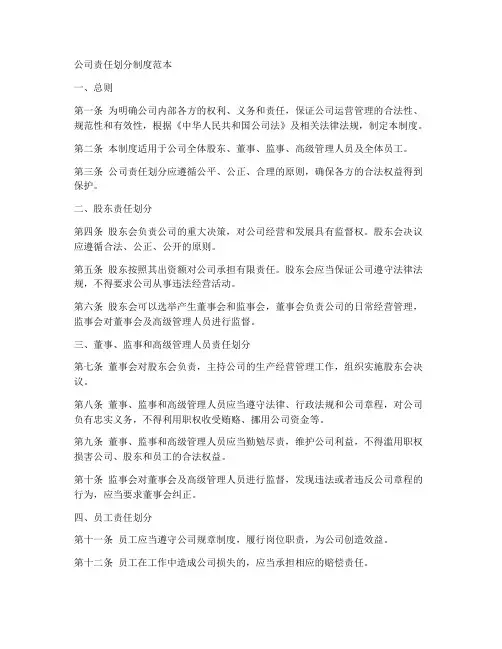

公司责任划分制度范本

公司责任划分制度范本一、总则第一条为明确公司内部各方的权利、义务和责任,保证公司运营管理的合法性、规范性和有效性,根据《中华人民共和国公司法》及相关法律法规,制定本制度。

第二条本制度适用于公司全体股东、董事、监事、高级管理人员及全体员工。

第三条公司责任划分应遵循公平、公正、合理的原则,确保各方的合法权益得到保护。

二、股东责任划分第四条股东会负责公司的重大决策,对公司经营和发展具有监督权。

股东会决议应遵循合法、公正、公开的原则。

第五条股东按照其出资额对公司承担有限责任。

股东会应当保证公司遵守法律法规,不得要求公司从事违法经营活动。

第六条股东会可以选举产生董事会和监事会,董事会负责公司的日常经营管理,监事会对董事会及高级管理人员进行监督。

三、董事、监事和高级管理人员责任划分第七条董事会对股东会负责,主持公司的生产经营管理工作,组织实施股东会决议。

第八条董事、监事和高级管理人员应当遵守法律、行政法规和公司章程,对公司负有忠实义务,不得利用职权收受贿赂、挪用公司资金等。

第九条董事、监事和高级管理人员应当勤勉尽责,维护公司利益,不得滥用职权损害公司、股东和员工的合法权益。

第十条监事会对董事会及高级管理人员进行监督,发现违法或者违反公司章程的行为,应当要求董事会纠正。

四、员工责任划分第十一条员工应当遵守公司规章制度,履行岗位职责,为公司创造效益。

第十二条员工在工作中造成公司损失的,应当承担相应的赔偿责任。

第十三条员工有权依法参加和组织工会,维护自身的合法权益。

五、责任追究第十四条对违反本制度的股东、董事、监事、高级管理人员和员工,公司应当依法追究其责任。

第十五条责任追究方式包括但不限于:批评教育、罚款、降职、撤职、解除劳动合同等。

六、附则第十六条本制度自股东会通过之日起生效,修改时亦同。

第十七条本制度未尽事宜,按照法律法规和公司章程执行。

第十八条本制度由公司董事会负责解释。

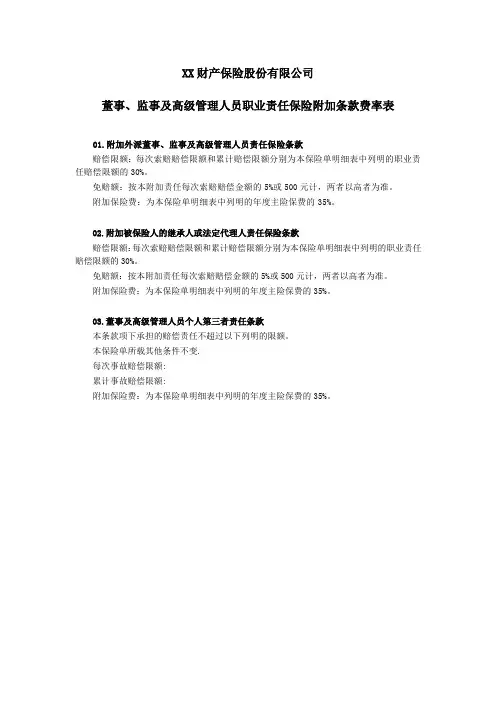

-董事、监事及高级管理人员职业责任保险条款附加险的费率 保险基础知识学习资料 条款产品开发

XX财产保险股份有限公司

董事、监事及高级管理人员职业责任保险附加条款费率表

01.附加外派董事、监事及高级管理人员责任保险条款

赔偿限额:每次索赔赔偿限额和累计赔偿限额分别为本保险单明细表中列明的职业责任赔偿限额的30%。

免赔额:按本附加责任每次索赔赔偿金额的5%或500元计,两者以高者为准。

附加保险费:为本保险单明细表中列明的年度主险保费的35%。

02.附加被保险人的继承人或法定代理人责任保险条款

赔偿限额:每次索赔赔偿限额和累计赔偿限额分别为本保险单明细表中列明的职业责任赔偿限额的30%。

免赔额:按本附加责任每次索赔赔偿金额的5%或500元计,两者以高者为准。

附加保险费:为本保险单明细表中列明的年度主险保费的35%。

03.董事及高级管理人员个人第三者责任条款

本条款项下承担的赔偿责任不超过以下列明的限额。

本保险单所载其他条件不变.

每次事故赔偿限额:

累计事故赔偿限额:

附加保险费:为本保险单明细表中列明的年度主险保费的35%。

保险公司董事、监事、高级管理人员职业道德准则

保险公司董事、监事、高级管理人员职业道德准则保险公司董事、监事、高级管理人员职业道德准则一、勤勉尽责1.认真履行职责,保证公司运营符合法律法规和业务要求;2.积极推动公司商业计划和业绩目标的制定和实施;3.发挥好公司治理的核心作用,加强管理,提高公司的竞争力;4.确保员工的安全,维护公司品牌的形象。

二、保守企业机密、不泄露客户信息1.保守公司商业机密、技术秘密和其他机密信息;2.不向未经授权的第三方披露客户信息;3.坚决打击内外部人员泄露客户信息的行为,确保客户隐私安全。

三、遵守职业道德规范1.严格遵守保险法律法规,诚信经营;2.不以欺诈、虚假宣传、欺骗等手段取得商业利益;3.维护与客户之间的诚信合作关系,不得假借客户之名进行非法活动;4.尊重市场规律,不通过不正当手段谋取不当利益;5.不参与黄赌毒等违法犯罪活动。

四、追求公正平等1.推进公司的内部公正透明及透明化改革,防止不公平、不透明及存在的招投标腐败行为;2.保障公司中各职能部门的公正合法权益;3.对外开发合作时坚持平等原则,打破传统行业间的不平等格局,推动市场竞争的合理有序发展。

五、关注员工发展1.关心和尊重员工的意见和感受,建立和谐、稳定的劳动关系;2.努力提高公司员工的整体素质和工作技能,为员工的职业发展创造良好的机会和环境;3.树立正确的评价员工的激励办法,打造吸引人才的企业文化。

六、维护企业形象1.自觉践行社会责任,积极参与社会公益活动;2.确保公司的财务状况真实可信,遵守国家相关财务规定;3.建立良好的企业文化,塑造有益于公司发展和维护公司形象的员工思想、形象和信誉。

以上是保险公司董事、监事、高级管理人员职业道德准则,我们应该严格遵守,为公司和行业的健康发展作出自己的贡献。

美亚财产保险有限公司董监事跟高级管理人员责任保险条款

美亚财产保险有限公司董监事及高级管理人员责任保险条款第一条承保范围一. 董事与高级管理人员责任保险本公司对任何被保险人因履行被保险公司董事、高级管理人员或雇员职责时的不当行为而在保险期间内首次遭受赔偿请求所导致的损失负责赔偿,但被保险公司已经补偿被保险人损失的金额除外。

二. 公司补偿保险本公司对被保险公司因被保险人履行被保险公司董事、高级管理人员或雇员职责时的不当行为而在保险期间内首次遭受赔偿请求所导致的被保险公司的损失负责赔偿,但应以被保险公司已经补偿被保险人损失的金额为限。

本公司依照本保险合同的规定,在赔偿请求最终解决前,预付因此所产生的抗辩费用。

第二条定义本保险合同内所使用的名词,其定义如下:一、“关联企业”:指在保险期间起始日或之前,其已发行的有表决权的股份中超过百分之二十但少于或等于百分之五十的股份, 为投保人直接持有或经由其一间或多间子公司间接持有的公司。

二、“赔偿请求”:指1.任何个人或组织因请求给予金钱赔偿或其他救济(包括非金钱的救济)对被保险人所提起的诉讼或其他法律程序;2.任何个人或组织要求被保险人对特定不当行为的结果承担责任的书面请求;3.任何针对被保险人提起的刑事诉讼;4.任何针对被保险人的特定不当行为提起的行政程序、监管程序或官方调查。

可归因于单一不当行为,或由其所产生,或以其为基础的任何单次或多次的赔偿请求,在本保险合同下应被视为单一赔偿请求。

三、“被保险公司”:指保险单的第一项所载的投保人及在不当行为发生日前,在公司组织结构图或类似文件中详细载明并经投保人或其子公司认可的子公司、分部、部门、区域性机构、生产群体或其他的公司内部单位。

四、“连续承保日”:指保险单第六项所记载的日期。

待决及以前的诉讼的连续承保日是指投保人连续向本公司或其它保险公司投保本类保险的首日,或其它经本公司同意的日期。

如按向其它保险公司连续投保之首日计算,投保人应在本保险合同起始日时向本公司提供其向该保险公司提交的首份投保书,且以本公司接受为条件。

中国保险监督管理委员会关于印发《保险公司董事、监事及高级管理人员培训管理暂行办法》的通知

中国保险监督管理委员会关于印发《保险公司董事、监事及高级管理人员培训管理暂行办法》的通知文章属性•【制定机关】中国保险监督管理委员会(已撤销)•【公布日期】2008.04.15•【文号】保监发[2008]27号•【施行日期】2008.04.15•【效力等级】部门规范性文件•【时效性】现行有效•【主题分类】保险正文中国保险监督管理委员会关于印发《保险公司董事、监事及高级管理人员培训管理暂行办法》的通知(保监发〔2008〕27号)各保险公司、保险资产管理公司,各保险中介机构:为加强保险公司董事、监事及高级管理人员队伍建设,规范保险公司董事、监事及高级管理人员行为,强化风险意识、创新意识和诚信意识,推动保险公司规范运作,依据《中华人民共和国公司法》、《中华人民共和国保险法》及中国保监会有关规章制度,我会制定了《保险公司董事、监事及高级管理人员培训管理暂行办法》,现印发给你们,请遵照执行。

二○○八年四月十五日保险公司董事、监事及高级管理人员培训管理暂行办法第一章总则第一条为加强保险公司董事、监事及高级管理人员队伍建设,规范保险公司董事、监事及高级管理人员行为,强化风险意识、创新意识和诚信意识,推动保险公司规范运作,依据《中华人民共和国公司法》、《中华人民共和国保险法》及中国保监会有关规章制度,制定本办法。

第二条本办法所称保险公司高级管理人员是指:(一)保险公司总公司总经理、副总经理、总经理助理;(二)保险公司总公司财务负责人、合规负责人、总精算师、董事会秘书;(三)保险公司分支机构负责人;(四)中国保监会认为应当参加培训的其他高级管理人员。

保险资产管理公司及保险中介机构的董事、监事及高级管理人员的培训参照本办法执行。

第三条保险公司董事、监事及高级管理人员培训工作应当遵循以下原则:(一)分类培训,按需施教。

根据培训对象职务和工作性质的不同,分级分类地开展培训,增强培训的针对性和实效性。

(二)联系实际,学以致用。

公司法第一百五十条的内容、主旨及释义

公司法第一百五十条的内容、主旨及释义

一、条文内容:

董事、监事、高级管理人员执行公司职务时违反法律、行政法规或者公司章程的规定,给公司造成损失的,应当承担赔偿责任。

二、主旨:

本条是关于董事、监事、高级管理人员赔偿责任的规足。

三、条文释义:

董事、监事、高级管理人员享有法律和公司章程授予的参与管理、监督公司事务的职权,同时负有对公司忠实和勤勉的义务,在执行公司职务时,应当依照法律和公司章程行使职权,履行义务,维护公司的利益。

为促使董事、监事、高级管理人员依法为公司利益行使权力、履行义务,使公司的合法权益在受到侵害时能得到恢复或补偿,应当明确董事、监事、高级管理人员违法执行职务给公司造成损害所应承担的法律责任。

本条是对董事、监事、高级管理人员给公司造成损害所应承担的民事赔偿责任的规定。

根据这一规定,董事、监事、高级管理人员承担赔偿责任应当具备以下条件:一是必须有公司受到损害的事实存在。

二是损害行为必须是行为人违反法律、行政法规或者公司章程执行公司职务的行为。

因本法明确规定公司的董事、监事、高级管理人员对公司负有忠实义务和勤勉义务,因此,上述人员不履行忠实义务和勤勉义务的,也是违反法律的行为。

三是违法行为与损害事实之间必须有因果关系。

四是行为人必须有过错,也就是必须有过失或者故意。

承担责任的方式,可以根据受侵害的公司权益的性质、

具体情况的不同,采取不同的办法,主要是赔偿公司财产损失。

银保监保险机构管理规定(3篇)

第1篇第一章总则第一条为了规范保险机构的行为,维护保险市场秩序,保护投保人、被保险人和受益人的合法权益,促进保险业的健康发展,根据《中华人民共和国保险法》等法律法规,制定本规定。

第二条本规定所称保险机构,包括保险公司、保险经纪公司、保险代理公司、保险公估公司、保险资产管理公司、保险兼业代理机构等。

第三条保险机构从事保险业务,应当遵守法律、行政法规和本规定,遵循自愿、平等、公平、诚实信用的原则。

第四条中国银行业监督管理委员会(以下简称银保监会)负责对保险机构实施监督管理,维护保险市场秩序。

第五条保险机构应当加强内部控制,建立健全风险管理体系,确保保险业务稳健运行。

第二章保险机构设立第六条设立保险机构,应当符合以下条件:(一)有符合法律、行政法规规定的章程;(二)有符合任职资格条件的董事、监事、高级管理人员;(三)有符合要求的营业场所、办公设施和信息系统;(四)有健全的组织机构和管理制度;(五)有符合法律、行政法规规定的最低注册资本;(六)国务院保险监督管理机构规定的其他条件。

第七条申请设立保险机构,应当向国务院保险监督管理机构提交下列文件:(一)设立保险机构的申请书;(二)可行性研究报告;(三)章程草案;(四)董事、监事、高级管理人员的任职资格证明;(五)营业场所、办公设施和信息系统的情况说明;(六)国务院保险监督管理机构规定的其他文件。

第八条国务院保险监督管理机构应当自收到申请文件之日起六十日内,对申请材料进行审查,并作出批准或者不予批准的决定。

决定不予批准的,应当说明理由。

第九条保险机构设立分支机构,应当符合以下条件:(一)符合保险机构业务发展需要;(二)有符合任职资格条件的分支机构负责人;(三)有符合要求的营业场所和办公设施;(四)有健全的分支机构管理制度;(五)国务院保险监督管理机构规定的其他条件。

第十条保险机构设立分支机构,应当向国务院保险监督管理机构提交下列文件:(一)设立分支机构的申请书;(二)分支机构的章程草案;(三)分支机构负责人的任职资格证明;(四)营业场所和办公设施的情况说明;(五)国务院保险监督管理机构规定的其他文件。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

承保明细表S-1S-2S-3目录页数内容1 1. 保险责任2. 附加赔付1 2.1 无法获得补偿之损失的额外超赔限额2 2.2 子公司2 2.3 紧急抗辩费用及法律代理费用2 2.4 退休董事、监事及高级管理人员3 2.5 收购及合并3 2.6 外派董事、监事及高级管理人员3 2.7 管理层收购3 2.8 税收3 2.9 保释费用、危机处理费用、公共关系费用及名誉保护费用3 2.10 引渡程序4 2.11 起诉费用4 2.12 罚款及罚金4 2.13 职业卫生及安全4 2.14 生活保障费用4 2.15 继续承保特别约定5 3. 定义10 4. 除外责任5. 条件11 5.1 赔偿限额12 5.2 免赔额12 5.3 、调查以及可能导致赔偿请求的情形的通知赔偿请求12 5.4 程序的进行13 5.5 抗辩费用的预付以及损失的分摊13 5.6 重大变更14 5.7 其他保险14 5.8 代位求偿14 5.9 不可转让14 5.10 保险合同解释及争议的解决14 5.11 赔付顺序14 6. 发现期157.可分性都邦财产保险股份有限公司董事、监事及高级管理人员责任保险条款号)(主)19(保监会备案编号:都邦(备-责任)[2015](索赔发生制条款)鉴于投保人已向保险人提交投保书并同意在约定时间内缴纳明细表第九项所载的保险费,保险人将依本保险合同的约定,同意:1. 保险责任若被保险机构不代表被保险人向第三者如被保险人在保险期间内遭受赔偿请求, A.赔偿该赔偿请求所造成的损失,则保险人根据本保险合同的有关约定代表被保但对于被保险人在本保险合同险人向第三者赔偿因该赔偿请求所造成的损失,生效前已遭受的赔偿请求,保险人不负任何赔偿责任。

B., 如被保险人在保险期间内遭受赔偿请求若被保险机构已经代表被保险人向第三者赔偿了该赔偿请求所造成的损失,则保险人根据本保险合同的有关约定向被但对于被保险人在本保险合同生效前保险机构赔偿该赔偿请求所造成的损失,已遭受的赔偿请求,保险人不负任何赔偿责任。

C.如被保险人在保险期间内遭受调查,保险人将根据本保险合同的有关约定向被保险人支付因调查所造成的法律代理费用。

若被保险机构代表被保险人支付了法律代理费用的,则保险人将根据本保险合同的有关约定向被保险机构支付因调查所造成的法律代理费用。

附加赔付2.无法获得补偿之损失的额外赔偿限额2.1当:本保险合同的赔偿限额;及(i)1(ii) 任何其他董事、监事及高级管理人员责任保险的赔偿限额;及(iii) 任何董事或监事能获得的其他补偿,均已耗尽,投保人的每一位董事或监事将能享有只适用于无法获得补偿之损失的额外赔偿。

本附加条款项下适用于每一位董事或监事的赔偿限额不多于明细表第十四(a)项中所列的金额。

明细表第十四(a)项所列的个人赔偿限额是明细表第十四(b)项所列累计赔偿限额的一部分,而不是额外的限额。

无论本保险合同下的赔偿请求的数量、赔偿请求的金额或提出索赔的董事或监项所列的累计赔偿限额是保险人在本附加条款下对事的人数,明细表第十四(b)项所列的累计赔偿限额是独明细表第十四(b)所有董事或监事的最大赔偿限额。

立于本保险合同其他赔偿限额外的额外赔偿限额。

2.2 子公司(i) 如果被保险机构在保险期间内收购符合以下条件的实体作为子公司:其总资产少于明细表第七项所列的收购限额;及(a)其证券未在美国境内的任何交易所交易;(b)则投保人无需就该收购通知保险人,也无需支付额外的保险费,本保险合同将扩展承保自该收购完成日起该子公司的被保险人实施的不当行为或作为。

(ii) 如果被保险机构在保险期间内收购的子公司不符合上述第(i)项中的条件,自该收购生效日起的60天内,本保险合同将扩展承保自该收购生效日起60天内该子公司的被保险人实施的不当行为或作为。

经保险人书面同意及以额外保险费、修订的条款和条件为前提,此期限可得以延长超过60天。

(iii) 如果被保险机构出售或解散某一子公司,本保险合同将继续保障该子公司的被保险人,但仅限于该出售或解散完成日之前其实施的不当行为或作为。

保险人仅对子公司的被保险人实施的不当行为或作为所造成的损失承担赔(iv)如实施不当行为或作为时,所属的公司未成为或不属于子公司,偿责任。

则保险人对其不当行为所造成的损失不负任何赔偿责任。

2.3 紧急抗辩费用及法律代理费用如果被保险机构或被保险人无法在产生抗辩费用、法律代理费用、保释费用、危机处理费用或公共关系费用之前取得保险人的同意,投保人或被保险人只要在产生上述费用之日起30天内取得保险人的同意,即可免除事先取得保险人同意的义务。

除非另有约定,本附加条款项下紧急抗辩费用、法律代理费用、保释费用、危机处理费用及公共关系费用的分项限额为累计赔偿限额的10%。

2.4 退休董事、监事或高级管理人员2如果本保险合同不续保及没有被董事、监事及高级管理人员责任保险的其他保险所取代,且在没有行使发现期的情况下,则本保险合同在不续保之日后10年内扩展承保对任何退休董事、监事或高级管理人员提起的赔偿请求或调查。

2.5 收购及合并如果在保险期间发生本保险合同定义中之重大变更,在满足保险人要求的附加条款、条件和额外保险费的前提下,保险人可以将保险期间延长至本保险合同届满后的84个月内,承保第三者向被保险人提起的赔偿请求或调查,但对于被保险人在本保险合同生效前已遭受的赔偿请求或调查,保险人不负任何赔偿责任。

2.6 外派董事、监事及高级管理人员(i)本保险合同扩展承保受被保险机构指派担任任何外部组织的董事、监事、高级管理人员、受托人、总监或类似职务的被保险人。

(ii) 本附加条款仅承保外部组织对上述被保险人提供的补偿及外部组织持有任何有效的董事、监事及高级管理人员责任保险所提供的赔偿的超出部分。

(iii) 如果外部组织持有的董事、监事及高级管理人员责任保险为保险人所提供,则适用于本附加条款项下所有损失的最大赔偿应为减去前述保险已赔偿给予任何被保险人的金额后的余额。

2.7 管理层收购如果某一子公司因被其现任管理层收购而不再属于被保险机构的子公司,本保险合同将扩展承保自该收购生效日起30天内该子公司的被保险人实施的不当行为,但如果已经有其他重复保险保障的,则本附加条款不适用。

2.8 税收若被保险机构破产,本保险合同将扩展承保被保险人因被保险机构未缴纳税款而需要承担的个人责任给第三者所造成的损失,但被保险人有意违反任何法定纳税义务的,则保险人不承担任何赔偿责任。

本附加条款以明细表第十三项所列的分项限额为限。

2.9 保释费用、危机处理费用、公共关系费用及名誉保护费用本保险合同扩展承保:(i)保释费用;(ii) 危机处理费用;(iii) 公共关系费用;(iv) 名誉保护费用。

引渡程序2.10本保险合同扩展承保与引渡程序有关的:3(i) 抗辩费用;(ii) 保释费用;(iii) 危机处理费用;(iv) 公共关系费用;(v)名誉保护费用。

引渡程序的保障不以不当行为的存在为前提。

2.11 起诉费用本保险合同扩展承保在保险期间因第三者提起的赔偿请求或调查导致被保险人所产生的起诉费用,但对于在本保险合同生效前提起的赔偿请求或调查导致被保险人所产生的起诉费用,保险人不负任何赔偿责任。

2.12 罚款及罚金本保险合同扩展承保在保险期间因第三者提起的赔偿请求或调查依法对被保险人作出的民事罚款或行政罚款,但对于本保险合同的适用法律不允许承保的民事罚款或行政罚款,保险人不负任何赔偿责任。

本附加条款项下适用于每一被保险人的分项限额为人民币250,000元。

且无论本保险合同项下的赔偿请求的数量、赔偿请求的数额或在本附加条款项下遭受索赔的被保险人的人数,本附加条款项下保险人的累计赔偿责任不多于人民币1,000,000元。

2.13 职业卫生及安全尽管存在本保险合同除外责任第4.1和4.7条的约定,本保险合同扩展承保被保险人因被第三者指控违反职业卫生及安全法律(包括但不限于任何关于工伤或企业误杀的法律)而遭受的赔偿请求或调查所造成的任何抗辩费用和法律代理费用。

2.14 生活保障费用本保险合同扩展承保被保险人因赔偿请求或调查造成的生活保障费用,但保险人不负责赔偿被保险人因本保险合同生效前已遭受的赔偿请求或因本保险合同生效前已进行的调查所造成的生活保障费用。

本附加条款项下适用于每一被保险人的分项限额为人民币500,000元。

且无论本保险合同项下的赔偿请求的数量、赔偿请求的数额或在本附加条款项下遭受索赔的被保险人的人数,本附加条款项下保险人的累计赔偿责任不多于人民币2,000,000元。

2.15 继续承保特别约定本保险合同的被保险人在此前投保的董事、监事及高级管理人员责任保险中可以通知保险人且在本保险合同的保险期间或发现期内通知保险人的赔偿请求或调查,但前提是:4(i) 不存在与该等赔偿请求或调查有关的欺诈不告知或欺诈的不实陈述;及(ii) 被保险人在不迟于其首次获悉该等赔偿请求或调查之日至本保险合同生效之日之间,无中断地持有保险人签发的董事、监事及高级管理人员责任保险;及(iii) 保险人将根据被保险人首次获悉该等赔偿请求或调查时持有的保险合同的条款、条件、除外责任和限制(包括其保险责任、明细表、赔偿限额和免)承担赔偿责任,但只限于该此前保险合同对赔偿请求提供的保障范赔额围不超过本保险合同所提供的范围。

3. 定义3.1 投保人指明细表第一项所列的实体。

3.2 保释费用指获取保释金或其他金融工具的合理费用,但保释费用不是指保释金或其他金融工具本身,亦不是指任何担保物,且前述保释金或其他金融工具须为法院就赔偿请求所要求的,用于担保被保险人的或有保释义务或其他等同义务。

3.3 赔偿请求指:在保险期间对被保险人提起的:(i)指控其不当行为的任何书面求偿;或(ii) 指控其不当行为的任何民事诉讼、仲裁或调解;或指控其不当行为的任何刑事诉讼;或(iii)(iv) 指控其不当行为的任何正式的行政或监管程序;或任何引渡程序。

(v)被保险机构指投保人及其子公司3.4 。

3.5 危机处理费用指被保险人为应付任何赔偿请求而聘请任何持有专业资格证书的:(i)税务顾问;或其他专业顾问,(ii)所产生的任何合理专业服务费用或开支。

危机处理费用的支付必须事先获得保危机处理费用的分险人的书面同意,但保险人不得无理拒绝或拖延有关同意。

项限额为明细表第十五项所列的金额。

3.6 抗辩费用指被保险人对赔偿请求进行抗辩或上诉而必需产生的合理的法律及其他专业费用及开支(包括获取上诉保证金的费用,但保险人没有义务代表被保5险人申请和提供此等保证金)。

抗辩费用的支付必须事先获得保险人的书面同意,但保险人不得无理拒绝或拖延有关同意。

3.7 生活保障费用指被保险人在保险期间内因遭受临时的或诉讼期间的司法命令,致使其不动产或个人财产的拥有权被没收、被第三方控制、被取消或被冻结;或对其不动产或个人财产的拥有权提出诉讼,被保险人因此需要向以下供应商直接支付的:(i)学费;住宿费;(ii)(iii) 与公用事业有关的费用;(iv) 与个人保险有关的费用,但仅限于法院因上述情况而指示给予被保险人个人补助以支付上述费用,且该个人补助已完全耗尽。