2009精益生产年报

制造部2009年度报告-9

D>塑胶原料部份有与08年相比降價5%左右. D>塑胶原料部份有与08年相比降價5%左右.

制造部2010工作計劃-采購

2010年 2010年Cost Down實施計劃 Down實施計劃

2010年度Cost Down目标5% 2010年度Cost Down目标5% 交期達成率100%改善措施 1>所有采购,通过及时的掌握 1>所有采购,通过及时的掌握 3>針對目前訂單狀況,小批多 3>針對目前訂單狀況, 原料市场行情,每天結合铜、 樣,需結合生管後續每月作訂 金、镍的國際收盘价, 金、镍的國際收盘价,在目前有 單組合, 單組合,集中採購降低供應商 色重金屬價錢上漲的情況下, 色重金屬價錢上漲的情況下,做 間接成本. 間接成本. 到五金材料類、外發電鍍、五 4>.主料廠商做到集團公司內 4>.主料廠商做到集團公司內 金沖壓件外購、外買外買連接 供應商資源共享. 供應商資源共享.多與兄弟廠 器、等部份能够见缝插针把握 採購作交流. 採購作交流. 最好的降價时机作好降价動作 。 5>及時臨活與生管作有效溝通, 5>及時臨活與生管作有效溝通, 2>原臺北衝壓五金件模具已轉 2>原臺北衝壓五金件模具已轉 確保廠商來料交期達成率 移大陸鉅寶生產以降低運輸成 100%做到不因材料問題出現 100%做到不因材料問題出現 本. 生產停線,力爭做到零庫存. 生產停線,力爭做到零庫存.

制造部2009年度报告-采購

2009年的工作目標制定(采購) 2009年的工作目標制定(采購)

• 2009年采購交期達成 2009年采購交期達成 率100% • 2009年采購平均交貨 2009年采購平均交貨 周期7 周期7天 • 2009年采購成本每季 2009年采購成本每季 度Cost Down5%

2009双酚A年报

1 / 522009年双酚A 年度报告(目录)第一章:双酚A 产品介绍 (2)1.1产品定义 (2)1.2生产工艺简介 (3)1.3用途简介 (3)第二章 双酚A 的生产工艺与质量指标 (3)2.1双酚A 生产工艺 (3)2.2双酚A 质量指标 (3)第三章 2009国内双酚A 市场回顾. (4)3.1、2009年市场行情分阶段回顾 (4)3.2、2009年市场走势及特点分析 (6)第四章 国际市场:东北亚市场走势回顾 (6)4.1、2009年国际市场行情回顾 (6)4.2、2008年国际市场走势特点分析 (7)第五章 中国地区双酚A 供需现状分析 (8)5.1、中国主要双酚A 生产企业及运行状况 (8)5.1.1 开工率对比分析 (8)5.1.2竞争态势分析展望 (9)5.2、中国地区供需现状分析 (9)5.3、双酚A 新增和拟建项目 (9)第六章 世界双酚A 供需状况分析 (10)6.1、世界双酚A 产能及分布状况 (10)6.2 世界地区供需现状分析 (16)6.3 2007-2010年世界双酚A 装置新增产能表 (17)第七章 双酚A 进出口统计与分析 (18)7.1、2008年双酚A 进口市场统计分析 (18)7.1.1、2008-2009年双酚A 进口总量和均价对比表 (21)7.1.2、2009年双酚A 进口及价格分析 (22)7.2、2008年双酚A 出口市场统计分析 (25)7.2.1 2008-2009年双酚A 出口统计 (26)7.2.2 2009年双酚A 出口及价格分析 (26)第八章 2009年双酚A 主要下游市场分析 (27)8.1、环氧树脂产能及消费状况 (27)8.2、我国环氧树脂新增产能状况 (28)8.2.1环氧树脂进出口统计情况 (29)8.3、我国聚碳酸酯产能及需求状况 (33)8.4、双酚A 在其他领域的消费状况 (36)第九章 2009年双酚A 上游及相关产品市场分析 (37)2 / 529.1上游苯酚市场年度总结概述 (37)9.2上游丙酮市场年度总结概述 (38)9.3相关产品环氧氯丙烷年度总结概述 (39)第十章 2009国内外双酚A 市场供需状况分析 (41)10.1中国双酚A 市场供需状况分析 (41)10.2世界双酚A 市场供需状况简述 (42)第十一章 2009年影响双酚A 市场供求关系的因素分析 (43)11.1、2009年世界经济经济分析 (43)11.2、2009年中国经济运行分析 (43)11.3、2009年国际原油市场分析 (44)11.4 市场其他因素分析 (49)第十二章:2010年双酚A 市场展望 (49)12.1 2010年国内供需变化分析 (49)12.2 2010年上游原料以及下游市场分析 (50)12.3 2010 年双酚A 市场行情展望及价格预测 (51)第一章:双酚A 产品介绍1.1产品定义双酚A 是 bisphenol A 2,2-双(对羟基苯基)丙烷的简称。

精益生产资料汇编

精益生产及其产生2003-09-18 10:01 /(e-works)精益生产(Lean Production,LP),又称精良生产,其中“精”表示精良、精确、精美;“益”表示利益、效益等等。

精益生产就是及时制造,消灭故障,消除一切浪费,向零缺陷、零库存进军。

它是美国麻省理工学院在一项名为“国际汽车计划”的研究工程中提出来的。

它们在做了大量的调查和对比后,认为日本丰田汽车公司的生产方式是最适用于现代制造企业的一种生产组织经管方式,称之为精益生产,以针对美国大量生产方式过干臃肿的弊病。

精益生产综合了大量生产与单件生产方式的优点,力求在大量生产中实现多品种和高质量产品的低成本生产。

一、精益生产的产生与推广20世纪初,从美国福特汽车公司创立第一条汽车生产流水线以来,大规模的生产流水线一直是现代工业生产的主要特征。

大规模生产方式是以规范化、大批量生产来降低生产成本,提高生产效率的。

这种方式适应了美国当时的国情,汽车生产流水线的产生,一举把汽车从少数富翁的奢侈品变成了大众化的交通工具,美国汽车工业也由此迅速成长为美国的一大支往产业,并带动和促进了包括钢铁、玻璃、橡胶、机电以至交通服务业等在内的一大批产业的发展。

大规模流水生产在生产技术以及生产经管史上具有极为重要的意义。

但是第二次世界大依以后,社会进入了一个市场需求向多样化发展的新阶段,相应地要求工业生产向多品种、小批量的方向发展,单品种、大批量的流水生产方式的弱点就日渐明显了。

为了顺应这样的时代要求,由日本丰田汽车公司首创的精益生产,作为多品种、小批量混合生产条件下的高质量、低消耗进行生产的方式在实践中摸索、创造出来了。

1950年,日本的丰田英二考察了美国底持律的福特公司的轿车厂。

当时这个厂每天能生产7000辆轿车,比日本丰田公司一年的产量还要多。

但丰田在他的考察报告中却写道:“那里的生产体制还有改进的可能”。

战后的日本经济萧条,缺少资金和外汇。

怎样建立日本的汽车工业?照搬美国的大量生产方式,还是按照日本的国情,另谋出路,丰田选择了后者。

财务报表分析案例--潍柴动力2009

潍柴动力财务分析报告(2007-2008)代码:000338 2009年12月目录一、公司基本情况-------------------------------------------------------------2二、行业基本情况-------------------------------------------------------------7三、财务分析说明-------------------------------------------------------------9四、主要财务数据分析-------------------------------------------------------9五、会计报表结构分析------------------------------------------------------ 17六、公司经营状况评述------------------------------------------------------ 26七、公司2009-2010经营预测--------------------------------------------- 27八、附表------------------------------------------------------------------------- 30一、公司基本情况(一)公司简介1、公司法定中文名称:潍柴动力股份有限公司公司法定中文名称缩写:潍柴动力公司法定英文名称: Weichai Power Co.,Ltd.2、法定代表人:谭旭光3、公司董事会秘书:戴立新董事会证券事务代表:刘加红联系地址:山东省潍坊市民生东街26 号电话:0536-*******,2297056传真:0536-*******电子信箱:weichai@4、公司注册地址:山东省潍坊市高新技术产业开发区福寿东街197 号甲公司办公地址:山东省潍坊市民生东街26 号邮政编码:261001互联网网址:电子信箱:weichai@5、公司选定的信息披露报纸名称:《中国证券报》、《证券时报》、《上海证券报》、《证券日报》登载年度报告的中国证监会指定网站的网址:公司年度报告备置地点:公司证券部6、公司A 股上市证券交易所:深圳证券交易所公司A 股简称:潍柴动力公司A 股代码:000338公司H 股上市证券交易所:香港联合交易所公司H 股简称:潍柴动力公司H 股代码:23387、其他有关材料:公司首次注册登记日期、地点:2002 年12 月23 日山东省工商行政管理局公司最近一次变更注册登记日期、地点:2007 年10 月17 日山东省工商行政管理局企业法人营业执照注册号:370000400003581税务登记号码:370705745676590组织机构代码:74567659-0(二)公司股东情况3.公司控股股东情况控股股东名称:潍柴控股集团有限公司法定代表人:谭旭光成立日期:1989 年12 月11 日注册资本:人民币壹拾贰亿元公司类别:有限责任公司经营范围:省政府授权范围内的国有资产经营;对外投资;企业经济担保;投资咨询;规划组织、协调管理集团所属企业的生产经营活动(以上范围不含国家法律法规禁止或限制性项目,需资质证书的凭资质证书开展经营)。

阿尔斯通2009年报

GROUP ACTIVITYOverview• Group general organisation• Main events of fiscal year 2008/09• General comments on activity and results• OutlookSector review• Power Sectors• Transport Sector• Corporate & OthersOperating and financial review• Income statement• Balance sheet• Liquidity and capital resources• Use of non-GAAP financial indicatorsOverviewGROUP GENERAL ORGANISATIONAlstom serves the power generation market through its Power Sectors, and the rail transport market through its Transport Sector. Alstom designs, supplies and services a complete range of technologically advanced products and systems for its customers, and possesses a unique expertise in systems integration and through-life maintenance and service. In fiscal year 2008/09, orders amounted to €24.6 billion and sales to €18.7 billion. On 31 March 2009, the backlog amounted to €45.7 billion.Alstom believes the power and transport markets in which the Group operates are sound, offering:• solid long-term growth prospects based on customers’ needs to expand essential infrastructure systems in developing economies and to replace or modernise them in the developed world; and• attractive opportunities to serve the existing installed base.Alstom believes it can capitalise on its long-standing expertise in these two markets to achieve competitive differentiation. Alstom is strategically well positioned for the following reasons: • Alstom has global reach, with a presence in around 70 countries worldwide;• Alstom is a recognised technology leader in most of its fields of activity, providing best-in-class technology; and• the Group benefits from one of the largest installed bases of equipment in power generation and rolling stock, which enables it to develop its service activities.An international network coordinates the presence of Alstom throughout the world. This network supports the Sectors in their business development and sales.On 31 March 2009, Alstom had a total of approximately 81,500 employees worldwide.MAIN EVENTS OF FISCAL YEAR 2008/09Alstom pursues its growth and improves once again its profitabilityIn fiscal year 2008/09, Alstom achieved very good results, driven by commercial successes on the dynamic power and transport markets and by an overall proper execution of the projects in backlog. The Group set a new record in orders intake at €24.6 billion, a 5% increase on an actual basis (6% on an organic basis) compared to last year. Fuelled by these commercial successes, the backlog reached €45.7 billion at the end of March 2009 (an increase of 16% on an actual and an organic basis), the equivalent of 29 months of sales.Sales also grew to €18.7 billion, representing an annual increase of 11% an actual basis (10% on an organic basis) as a result of the execution of the Group’s large backlog.Continuously improving since 2004/05, operating income increased by 19% at €1,536 million during fiscal year 2008/09 (18% on an organic basis). Translating both the quality of the orders received and the attention paid to project execution, operating margin rose to 8.2% (7.7% in 2007/08).During fiscal year 2008/09, net profit (Group share) after a 25% tax expense, increased 30% at €1,109 million due to an improved operational performance and a turned positive financial income. Earnings per share (basic) reached €3.9 versus €3.0 last year.During the past fiscal year, Alstom generated €1,479 million of free cash flow, a notable performance – including the high capital expenditure programmes launched in 2007/08 – which results from a good operational performance and a favourable evolution of the Group’s working capital.Strong assets to face the challenging environmentLong-term market drivers remain promisingFrom liquidity shortages, the financial crisis rapidly turned into a global economic downturn bringing companies new challenges. A base of financially sound customers, a wide portfolio of activities and a broad geographic coverage are in this context, among the Group’s strongest assets.Regarding Power, Alstom’s long-term market drivers remain positive. In the emerging markets, the need for power generation infrastructure together with the search for energy independence should continue to fuel an already large demand whereas in the industrialised countries, the ageing fleet should support the service and retrofit markets. In addition, more and more stringent environmental regulations should sustain the development of clean energy solutions such as hydro, wind and nuclear, foster the demand for higher technological contents to ensure a better efficiency of the thermal power plants and drive the need for replacement. In the short term, the financing constraints as well as a downward revision of end markets may drive a decrease of the demand for new power market as some new projects may be postponed. The service market should however be less volatile.Regarding Transport, fast-growing urbanisation and the need for environment-friendly mobility should continue to pledge mass transportation means such as metros, tramways, inter city andhigh speed trains. In addition, short-term demand is expected to be supported by stimulus packages put in place in a number of countries.A secured backlog in volume and in qualityAt 31 March 2009, the Group backlog reached €45.7 billion, representing 29 months of sales. The high volume and quality of this backlog give Alstom strong visibility to prepare for and face, if necessary, an extended slowdown in demand.State-owned and large utilities account today for 80% of Alstom Power Sectors customer base, and 90% of Transport Sector’s. This proportion should minimise the Group’s sensitivity to financial risks impacting its customer base. In this respect, no project cancellation or deferral has been recorded so far.A sound financial performanceAt the end of fiscal year 2008/09, Alstom showed a steady liquidity position with net cash strengthened at €2.1 billion and gross cash amounting to €2.9 billion, after the reimbursement, during the period either at maturity or in anticipation of €559 million of bonds. As of 31 March 2009, the total outstanding bonds amounted to €275 million in nominal value (vs. €834 million at 31 March 2008). In terms of bonds and guarantees, Alstom also benefits from an €8 billion committed syndicated line and €13.5 billion of bilateral lines (€2.4 billion and €5.1 billion being respectively undrawn).Preparing the futureInitiatives taken in an uncertain global contextUncertainties created by the recent economic downturn have prompted Alstom to take the following specific actions:- a programme focusing on the strict control of S&A (Selling & Administrative) expenses was set up in December 2008, and actions deployed at the Group’s unit level. Short-term specific actions have also been taken to limit IT, travel and consulting expenses. Lastly, specific attention will continue to be paid to the efficiency of support functions;- future capital expenditures will be strictly prioritised, without questioning the ongoing major projects aiming at developing and reinforcing the industrial base in key markets (Wuhan Boiler Company new factory in China, Chattanooga steam turbines facility in the United States or Elblag foundry in Poland).Streamlining of Power organisationIn March 2009, Alstom announced a reorganisation of its activities related to power generation consisting in the merger of the two Sectors, Power Systems (plants, equipments and retrofit) and Power Service (after-sales, from service to renovation and spare parts). The set-up of a single Power Sector will improve the commercial performance of the Group and optimise its engineering and production means. This new Sector will be organised around six activities (Thermal Systems, Thermal Products, Thermal Services, Hydro, Wind and Energy Management).A strong and optimised industrial baseThe Group’s capital expenditures for the fiscal year 2008/09 (excluding capitalised development costs) amounted to €499 million, an increase of 33% year on year.Market oriented, major ongoing Power capital expenditure projects include:- to address the American market, the construction of a new facility in Chattanooga (Tennessee, United States of America) to manufacture steam turbines for nuclear and thermal applications, gas turbines, generators and related equipments;- to address the Chinese and export markets, the construction in Wuhan city outskirts (Hubei Province, China) of a new facility following the acquisition of 51% of Wuhan Boiler Company in 2007. This factory will be Alstom’s largest utility boilers manufacturing site and should be operational by the end of 2009;- the building of a foundry in Elblag (Poland), aiming at increasing the production capacity of key components for turbines.In Transport Sector, the capital expenditure programmes were focused on the upgrade and expansion of the European manufacturing base for rolling stock (very high speed trains, tramways and components). The main investments have been made in France, Germany, Italy and Poland.Joint ventures and partnerships to reinforce the strategic positioningIn 2008/09, Alstom continued to deploy its growth strategy by finalising joint venture agreements and entering into promising partnerships.- during the first half of 2008/09, Alstom finalised the creation of a joint venture with JSC Atomenergomash, part of the Russian Federal Agency for Atomic Energy responsible for the development of the national nuclear programme, to provide the turbine islands of Russian nuclear power plants based on Alstom’s half-speed technology ARABELLE™. In September 2008, Alstom Atomenergomash LLC signed an agreement with Atomenergoproekt for the engineering of the turbine generator package and turbine hall equipment for the Seversk nuclear power plant in Siberia, recording a first success on the Russian market;- in November 2008, Alstom and Bharat Forge Ltd (BFL), a global leader in manufacturing and metal forming, signed a shareholders’ agreement to create a joint venture company based in India (the agreement is subject to Government and regulatory approvals). The new company will manage the whole process from engineering and manufacturing to selling and commissioning state-of-the-art 600 MW to 800 MW supercritical steam turbine islands in India;- in March 2009, Alstom and Transmashholding (TMH), the main rolling stock manufacturer in Russia, signed a strategic agreement. This agreement follows a Letter of Intent announced inOctober 2008, according to which Alstom Transport will support the modernisation of TMH manufacturing sites and the development of a new generation of rolling stock equipment adapted to the Russian market. Alstom and TMH have also committed to creating a joint venture, held in equal parts, for the development of new models of rolling stock which will be based on Alstom Transport and TMH’s latest technologies. Finally, Alstom will acquire 25% (+ 1 share) of the capital of TMH holding company at a price that will be defined according to the financial results of TMH over the 2008-2011 period.Shaping the future through innovationResearch & DevelopmentIn order to maintain its technological leadership, Alstom pursued the acceleration of its Research and Development (R&D) programmes over the last fiscal year. R&D expenditures (gross costs) amounted to €621 million versus €561 million in 2007/08. After capitalisation and amortisation of development costs, R&D expenditures as per the income statement, reached €586 million compared to €554 million last year, representing 3.1% of sales. Alstom’s flagship R&D programmes - for Power, the development of CO2 capture technologies and for Transport the AGV TM, the last generation of very high speed trains - accomplished significant progresses in 2008/09.In 2008/09, Alstom continued to pave the way for CO2 capture solutions, focusing on oxy-combustion and post-combustion processes. During fiscal year 2008/09, the Group entered the following technological partnerships:- an agreement with TransAlta Corporation, a Canadian power generation company, to develop a large scale CO2 capture and storage facility in Alberta, Canada;- a Memorandum of Understanding (MoU) with PGE Elektrownia Belchatow S.A. for the development and implementation of Carbon Capture and Storage (CCS) technology at the Belchatow power plant in Poland;- a joint development and commercialisation agreement with the Dow Chemical Company to develop advanced amine technology for CO2 capture that will be used in the design and construction of a pilot plant in West Virginia, USA.In addition, Alstom became this year a founding member of the Global Carbon Capture and Storage Institute (GCCSI), created under the initiative of the Australian government. This framework will allow Alstom to promote research in this field and set up demonstration projects.To date, Alstom has started operation at three CO2 capture pilot projects, with EPRI and We Energies in Wisconsin, USA, E.ON in Sweden and Vattenfall in Germany.Inaugurated in September 2009, Vattenfall’s Schwarze Pumpe is the first pilot plant based on Alstom’s oxy-combustion technology in the world.Other initiatives contributed to strengthen the competitive edge of Alstom’s Power products:- the creation of a Global Technology Centre for hydroelectricity in Vadodara (India), will secure together with Hydro’s Global Technology Centre in Grenoble (France), Alstom Hydro’s leadership on the entire range of hydro turbines;- R&D efforts in wind business have been focused on the development of the new 3 MW wind turbine, put in operation this year;- performance improvement of GT13TM and GT26TM gas turbines, as well as the upgrade of GT24TM remained a focus point;- lastly, Alstom Power Energy Management Business (EMB) announced its collaboration with Microsoft to deliver the next generation of high-performance information technology (IT) solutions for the power industry.While promoting environment-friendly solutions, the Transport Sector continued to develop its advanced technology in its product range:- the AGV TM ran dynamic tests in the Czech Republic before its first dynamic tests in France at 360 kph, the commercial speed it has been designed for. The AGV TM technology is based on articulated carriages and a distributed drive system. The first trains will be delivered starting from 2010;- in tramways, the prototype for a new platform aiming at broadening the CITADIS TM range will complete testing phase in Germany end of April 2009;- regarding regional trains, the first 24 CORADIA TM CONTINENTAL trains have been delivered to their customers and the CORADIA TM NORDIC X61, a product for regional traffic in Northern Europe, successfully completed its first test runs in Salzgitter (Germany);- in signalling, the Group delivered its state-of-the-art URBALIS TM evolution system on the Beijing Line 2 and the Beijing Airport Link, right on time for the Olympic Games;- finally, Alstom dedicated significant part of its Research and Development efforts to promote sustainable rail transport by developing trains featuring low energy consumption, reduced weight, hybrid or bi-modes traction and low noise pollution.“I Nove You” programmeAs a must to differentiate from the competition and to optimise processes, innovation is at the heart of Alstom’s strategy. At Group level, the “I Nove You” programme initiated last year aims at three major objectives: create a favorable environment for innovation and innovative people within the Alstom community, enhance cross-fertilisation and support ongoing efforts to leverage innovations developed outside of the Group.A reinforced Corporate ResponsibilityA caring Human Resources managementDuring fiscal year 2008/09, the Group continued to drive its headcount increase. At the end of March 2009, total headcount reached 81,500 people, including 11,000 new recruitments over the period to support the Group’s development on key markets and to ensure the execution of its growing backlog. Alstom focused its recruitment particularly in Europe (57%) and Asia/Pacific (22%). This policy may be adapted pending future market development.Care for people remained a key factor as the Group further developed its training programmes. The number of “Alstom University” training sessions delivered has doubled compared to last year, and five “Alstom University” regional campuses are operational around the world.“Environment, Health and Safety” (EHS) continuous improvementThrough continuous efforts to improve employees’ health and safety, the number of work-related incidents has been greatly reduced (-35% for 2008/09 compared to the same period a year before). The Group is committed to pursuing its efforts on training and communication to improve employees’ awareness and to minimise risks. In addition, as part of EHS policy, a new emphasis has been put on CO2 reduction on Alstom sites.Employee Sharing ProgrammeFollowing the success met by the previous programmes, a third employee stock purchase scheme was announced in January 2009 in 22 countries with the same objectives: encouraging employees’ contribution to the Group’s performance while enlarging and stabilising the shareholding base. In line with past references, close to 30% of the employees participated into this programme. The number of additional shares represented around 0.4% of the Group’s share capital.The Board of Directors also approved a new Long Term Incentive Plan based on the grant of conditional stock options and the free attribution of performance shares, depending on the Group’s performance in 2010/11; this plan could represent approximately 0.4% of the share capital.Alstom Foundation for the EnvironmentThe Alstom Foundation, created in November 2007, will devote €1 million per year to support projects in the field of environmental protection. The Foundation has rewarded the first eleven projects this year. One of the most significant initiatives rewarded will establish a new conservation programme protecting the biodiversity in a national park of China’s Yunnan Province. Other selected projects promoted actions in Argentina, North Korea, India, Switzerland, USA, Indonesia, Malaysia, Philippines, South Africa and France.GENERAL COMMENTS ON ACTIVITY AND RESULTSConsolidated Key Financial FiguresThe following table sets out, on a consolidated basis, some of the key financial and operating figures:General comments on activityver fiscal year 2008/09, power and transport markets showed a very strong activity creating nd observed in 2007/08 was confirmed this year with a he transport market has been very dynamic in 2008/09. With fast-growing urbanisation, the Orders received and backlogenefiting from favourable markets, Alstom achieved a strong commercial performance in fiscal O numerous opportunities for Alstom.Regarding Power, the favorable tre balanced demand for all technologies, both for the installed and the new base markets. Thermal continued to lead the market, not only supported by the high demand for coal in Asia and Europe, but also by an active gas market bringing new projects namely in Europe, Africa and the Middle East. Rising environmental concerns and enforcement of green regulations continued to call for the development of clean sources of energy and their substitution for polluting equipment. Consequently, demand for renewables such as hydro and wind kept on growing, and nuclear confirmed its strong potential. The market for retrofit and upgrade solutions was also fostered by a continuing demand for energy efficiency.T need for mobility and respect for the environment were again the key leading factors of a high demand for transportation means. The market for very high speed, regional trains and metros remained strong while demand for tramways continued to progress.B year 2008/09, booking a record level of €24.6 billion orders, a 5% increase compared to last year on an actual basis and 6% on an organic basis. At the end of March 2009, the Group’s backlogamounted to €45.7 billion, a 16% increase year on year, representing the equivalent of 29 months of sales.The combined Power Sectors booked €16.5 billion orders over fiscal year 2008/09, recording a 3% customers’ confidence in Alstom technology and know-how, Power Systems recorded stom confirmed its position as a leading supplier by booking an order for the Alstom continued to strengthen its global presence in renewables. In ncy as well as ageing of the installed base brought also successes eizing the opportunities of the growing service market, Power Service booked €4.6 billion orders fiscal year 2008/09, Transport realised major commercial achievements across its product the rise over the high level of the previous year on an actual basis (4% on an organic basis). Power Systems orders intake reached a new peak level with €11.9 billion, an increase of 3 % compared to previous year (on actual and organic bases), representing 48% of the Group’s total orders received.Illustrating major successes for coal and gas-fuelled power plants turnkey contracts including GT26TM -based combined-cycle power plants in Africa (the first on the continent), the Netherlands, Spain and Indonesia. Orders for equipment supply (turbines and generators) to oil or coal-based power plants were received, including key contracts in Saudi Arabia, South Africa, the Netherlands and Germany, where Alstom will supply the most advanced clean coal technology to an existing power plant.In nuclear, Al engineering and procurement of the complete turbine island for the first nuclear power plant in China to use the EPR technology. Orders for nuclear equipment retrofit were also recorded in South Africa and France.Over the last fiscal year, hydro business, the Group booked large projects in South and Central America (Brazil, Panama), Europe (Portugal, Turkey) and Asia (India, China). Eighteen months after the acquisition of Ecotècnia and the creation of its Wind business activity, Alstom smoothly pursues its expansion on the European wind market.Lastly, search for energy efficie for Alstom with hydro power plant upgrades in Africa and Norway, boiler repowering in Germany and modernisation of equipment for a gas-fuelled plant in the Netherlands.S in 2008/09, a 4% increase compared to last year on an actual basis (5% on an organic basis). The main Operation and Maintenance (O&M) contracts included projects in Algeria, Tunisia, the United Arab Emirates, the Netherlands and Spain. In addition to a record number of small and medium sized orders, Power Service signed contracts for power plants upgrade in Turkey, Hungary and France.In range, booking orders at €8.1 billion, an increase of 9% (11% on an organic basis) compared to last year, which was already an exceptional year. Historic markets (France, the United Kingdom, Germany) with new products (CORADIA TM CONTINENTAL, AGV TM ) and maintenance contracts (the United Kingdom, Italy) have driven the increase. In new markets, tramway turnkey solutions have been sold, demonstrating the continuous success of Alstom’s CITADIS TM product range. Alstom’s leading position in very high speed was confirmed with the first order received for AGV TM in Italy, whereas in high speed Alstom continued to demonstrate its know-how, booking several orders in Europe including a record contract for the extension of a PENDOLINO TM fleet and associated maintenance for the line between London and Glasgow in the United Kingdom. Alstom also benefited from the modernisation of European networks and fleets, winning severalprojects for regional trains in Germany, Sweden, France and Luxemburg as well as for locomotives in France, the Netherlands and Germany.Alstom was served by a the strong demand in mass transit, booking numerous turnkey projects Sales upported by the smooth execution of a growing backlog, the Group’s sales once again ower Systems achieved €9.2 billion sales, accounting for 49% of the Group’s total sales in ower Service generated €3.8 billion sales in fiscal year 2008/09, increasing by 6% the previous fiscal year 2008/09, Transport recorded sales at €5.7 billion, a 3% growth year on year on an Income from operationscome from operations reached €1,536 million in fiscal year 2008/09, representing a 19% ll Sectors contributed to the Group’s income from operations and operating margin growth. Power Systems commercial performance drove an increase of income from operations by 45% on based on the Group’s CITADIS TM tramway products in North Africa and Middle East, and recoding metro contracts in Asia, South and Central America and North America, where the New York Municipality confirmed option for additional subway cars. Signalling projects, namely for Santiago de Chile and Sao Paulo metros, as well as orders for infrastructure (Romania) and maintenance for main lines fleets (Switzerland) also contributed to Transport Sector’s high level of orders intake in 2008/09.S established a record at €18.7 billion, showing an 11% increase year on year on an actual basis (10% on an organic basis).P 2008/09, and representing a 19% increase year on year on an actual basis (16% on an organic basis). Main contracts contributing to sales over the period included gas-based power plant projects in Europe (the United Kingdom, Ireland, the Netherlands, France), the United Arab Emirates, Algeria, Brazil and Australia, boilers projects in Poland, Bulgaria and Germany as well as hydro projects in India and Brazil.P figure on an actual basis and by 8% on an organic basis.In actual basis (5% on organic). Significant main lines contracts traded during the year included high speed trains (TGV 1) in France, regional trains in France, Spain and Germany, several projects for locomotives in France and Germany as well as a maintenance contract in the United Kingdom and signalling projects executed in Belgium and Italy. Traded mass transit contracts covered metro projects in the USA (New York City, Atlanta), Spain (Barcelona), Brazil (Sao Paulo), Hungary (Budapest) and Singapore and the delivery of a tramway turnkey system in Algeria (Algiers).In increase compared to last year on an actual basis (18% on an organic basis). The operating margin rose from 7.7% to 8.2%, driven by the good quality of the orders in hand, a proper execution of the backlog and continuous cost controlling.A1TGV is a trademark of the SNCFan actual basis (42% on an organic basis) from €415 million in 2007/08 to €600 million in 2008/09, Power Service improved income from operations to €648 million from €592 million a year earlier (9% on an actual basis and 7% on an organic basis), representing 17.0% of sales in fiscal year 2008/09. Transport’s income from operations was €408 million, stable versus last year, at 7.2% of sales.Net profit (Group share) N grew from €852 million to €1,109 million year-on-year. This 30% crease in one year mainly stemmed from a strong increase of income from operations. Free cash flow (as defined in paragraph “Use of non-GAAP financial indicators”) reached 1,479 million in fiscal year 2008/09, compared to €1,635 million for the previous year. Switching from net debt to net cash in 2007/08, the Group’s net cash position increased by more an €1 billion over last fiscal year to €2,051 million. This record surge includes €233 million rders by region of destinationT ders received by region of destination: e total orders booked by the Group over the period (48% in 2008/09 compared to 50% last year). he Transport Sector achieved major commercial successes booking the first order for the supplyet profit (Group share)inFree cash flow€Supported by the increase of net income and a further improvement of working capital, the large free cash flow generation includes the Group’s continuous investment efforts in R&D and capital expenditures.Net cashth dividends paid during the year (vs. €117 million last year).Key geographical figuresGeographical analysis of ohe table below sets out the geographical breakdown of orWith €11.7 billion for the year ended at 31 March 2009, Europe still accounted for almost half of th T and maintenance of the AGV TM in Italy for an Italian private operator, the supply and maintenance of PENDOLINO TM trains in the United Kingdom and regional trains in Germany and。

精益生产(经典版)

精益生产方式

品种多样化、系列化 柔性高、效率高 较粗略、 多技能、丰富

产品特点 设备和工装 作业分工 与作业内容

对操作工人 要求

库存水平 制造成本 产品质量 所适应的 市场时代

懂设计制造 有较高操作技能

高 高 低 极少量需求

不需要专业技能

高 低 高 物资缺乏、供不应求

多技能

低 更低 更高 买方市场

精益生产(Lean Production)

一种浪费通常能够导致另外一种浪费

发现浪费和认识浪费的能力很重要

精益生产(Lean Production)

3、企业常见的八种浪费

国内企业之现状: ☆ 现场混乱,插不进脚 ☆ 员工仪容不整,两眼无光 ☆ 物料混放,标识不清 ☆ 设备故障不断,苟延残喘 ☆ 人海战术,加班加点但还是要待工待料

精益生产(Lean Production)

★ 有必要减少设备故障和调整时间, 以提高设备可动率

精益生产(Lean Production)

运转率并非越高越好

设备1 设备2 设备3

例:市场需求1000件/天, 设备满负荷运转能力1500件/天, 设备可动率81.25%

100%运转 生产 1218件产品

82.1%运转 生产 1000件产品

浪费性运转

TPS, Toyota Production System 三个重要人物:丰田佐吉、丰田喜 一郎、大野耐一(丰田英二) 多品种、小批量 拉式(Pull)生产系统:准时生产 (JIT),看板管理、员工参与 1990年,改变世界的机器(The Machine that changed the World) 以用户为“上帝”、以“人”为 中心、以“精简”为手段、团队工 作和并行设计、准时供货方式

某公司精益生产总结(PPT 83页)

2

2400

110-6通风罩

5:00—6:00 200 切边→钳工打眼

1

200

16T4号 白班 雾灯毕冲孔 4×35×140 8:30—12:00 2000

冲孔→电剪子

1

2000

吉货挡泥板冲二孔 230×190 13:20—14:10 2000

冲孔→压型

1

2000

尾灯板冲二孔 1米—2米 14:20—17:10

六月

设定目标 分析原因 确定要因 制定对策 实施对策

七月

效果验证 标准化

向后计划

涂装流挂QC

严格执行 公司QC 管理标准

流挂改善前后缺陷率 215

71

改善前

改善后

PPM

数据来源:车厢QC报告

直接降低的返修成本

5000

数据来源:车厢QC报告

取得的成绩

QC课题改善成果奖

500元

QC改善前后对比

改善先锋奖

改善先锋奖

5S

车厢部5S组织结构图

车厢车间5S检查标准

项目

整理

整顿

清扫

清洁

素养

123456789111小123456789111小1234567小1234小123456789小

,,,,,,,,, 0 1 2 计 ,,,,,、,,, 0 1 2 计 ,,,,,,, 计 、、、、 计 、、、,,,,、、 计

提高白皮车厢当班交付准时化率

降低1.7米车厢纵梁在制品量

95%

99.5%

5.18T

3.24T

降低标牌孔错位不良率

53.2%

23.7%

数据来源:车厢QC报告

QC改善前后对比

降低降低涂装杂质QC

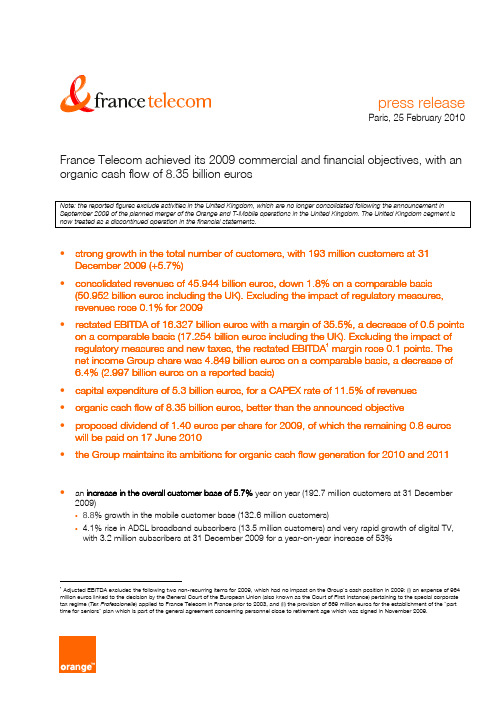

FT2009年年报

press releaseParis, 25 February 2010France Telecom achieved its 2009 commercial and financial objectives, with an organic cash flow of 8.35 billion eurosNote: the reported figures exclude activities in the United Kingdom, which are no longer consolidated following the announcement in September 2009 of the planned merger of the Orange and T-Mobile operations in the United Kingdom. The United Kingdom segment is now treated as a discontinued operation in the financial statements.• •193 strong growth in the total number of customers, with 193 million customers at 31 December 2009 (+5.7%) consolidated revenues of 45.944 billion euros, down 1.8% on a comparable basis UK). measures, (50.952 billion euros including the UK). Excluding the impact of regulatory measures, revenues revenues rose 0.1% for 2009 restated EBITDA of 16.327 billion euros with a margin of 35.5%, a decrease of 0.5 points points UK). on a comparable basis (17.254 billion euros including the UK). Excluding the impact of 1 margin points regulatory measures and new taxes, the restated EBITDA margin rose 0.1 points. The net income Group share was 4.849 billion euros on a comparable basis, a decrease of 6.4% (2.997 billion euros on a reported basis) capital expenditure of 5.3 billion euros, for a CAPEX rate of 11.5% of revenues organic cash flow of 8.35 billion euros, better than the announced objective 2009, proposed dividend of 1.40 euros per share for 2009, of which the remaining 0.8 euros will be paid on 17 June 2010 2011 the Group maintains its ambitions for organic cash flow generation for 2010 and 2011•• • • • •an increase in the overall customer base of 5.7% year on year (192.7 million customers at 31 December 2009) 8.8% growth in the mobile customer base (132.6 million customers) 4.1% rise in ADSL broadband subscribers (13.5 million customers) and very rapid growth of digital TV, with 3.2 million subscribers at 31 December 2009 for a year-on-year increase of 53%1 Adjusted EBITDA excludes the following two non-recurring items for 2009, which had no impact on the Group’s cash position in 2009: (i) an expense of 964 million euros linked to the decision by the General Court of the European Union (also known as the Court of First Instance) pertaining to the special corporate tax regime (Tax Professionelle) applied to France Telecom in France prior to 2003, and (ii) the provision of 569 million euros for the establishment of the “part time for seniors” plan which is part of the general agreement concerning personnel close to retirement age which was signed in November 2009.•revenue growth of 0.1%, excluding regulatory impact: 1.6% growth of operations in France, including a 5.0% increase in mobile services revenues 5.8% growth in Africa and the Middle East 3.1% growth in Western Europe, driven by Belgium other operations continued to be affected by the deterioration in the economic environment, particularly Romania where revenues were down 16.7% and the Enterprise segment which was down 3.5% th revenues improved in the 4 quarter of 2009, driven by Western Europe, Spain, Africa and the Middle East 35.5% 5%, restated EBITDA margin of 35.5% a 0.5-point decrease compared with 2008, reflecting the impact of regulatory measures and new taxes excluding the provision for the “part time for seniors” plan, EBITDA margins for France and the Enterprise segment are stable significantly improved profitability of mobile services in Spain (+1.1 points) the EBITDA margin trend for the Rest of World was impacted both by new operations and the economic environment in Central Europe (-2.5 points)••revenues), capital expenditure was 5.3 billion euros (11.5% of revenues) compared with 6.3 billion euros in 2008 (13.4% of revenues) on a comparable basis. (CAPEX including the United Kingdom was 5.66 billion euros versus 6.87 billion euros in 2008). This reduction related to: - the non-recurrence of real estate investments of 163 million euros in 2008 - CAPEX optimization and adjustment to reflect business volumes, particularly relating to 2G networks, IT and fixed legacy services th CAPEX for the 4 quarter was significantly higher than the average level for the first three quarters of the year, in line with seasonal trends seen in previous years•euros, 4.2% growth in organic cash flow, to 8.35 billion euros compared with 8.016 billion euros in 2008 This increase in organic cash flow reflects the improvement of the financial results, the decrease in corporate taxes paid, as well as the decline in expenses related to the acquisition of telecommunications licenses•net financial debt down to 33.9 billion euros at 31 December 2009 (for a net debt to restated EBITDA ratio of 1.97), compared with 35.9 billion euros at 31 December 2008 (a ratio of 1.96). Excluding the impact of the public offer for ECMS shares currently underway (1.082 billion euros), net financial debt was 32.9 billion euros at 31 December 2009, for a net debt to restated EBITDA ratio of 1.90, in line with the Group’s financial policy•net income Group share (attributable to equity holders of France Telecom) declined 6.4% on a comparable share (attributable Telecom) 2 basis , to 4.849 billion euros; on a reported basis, it fell to 2.997 billion euros, compared with 4.069 billion euros in 20082 The main non-recurring items used to establish net income attributable to equity holders of France Telecom in comparable terms are indicated on page 9 under the heading “Net income”.2Commenting on the Group’s 2009 consolidated results, Didier Lombard Chairman and Chief Executive Officer of France Lombard, Telecom, said: “The Group’s performance in 2009 confirms the strategy undertaken in 2005 to position the company as an integrated operator. Since then, the Group has significantly increased its customer base and its geographical footprint while capitalizing on new technologies, thus enabling the Group to look to the future with confidence. As I hand over to Stéphane Richard, I would like to express my gratitude towards all of the Group’s employees for this shared success.” Richard, Stéphane Richard Chief Executive Officer designate of France Telecom, added: “I would first like to thank Didier Lombard for leading the Group’s transformation from being a national monopoly to a robust multi-national group that can boast more than 190 million customers and 180,000 employees in 32 countries, all while keeping a tight reign on its financial performance. It is an outstanding group blessed with many excellent qualities, even as it faces a crisis of confidence in France. We are working to recenter the business to provide a renewed outlook for the Group as a whole. This new project, which will be announced before the summer, aims to reposition both customers and employees firmly at the heart of the executive management’s priorities in a way that balances economic performance with social considerations while retaining our leadership position in innovation. This is the exciting task that lies ahead for me and the new management team.”additional information The Board of Directors of France Telecom SA met on 24 February 2010 and examined the Group’s consolidated and non-consolidated financial statements. The Group’s statutory auditors carried out their audit of these financial statements and the audit reports pertaining to their certification are in the process of being issued. More information is available on France Telecom's websites: 3key figures3•full year data2009 2008 comparable basis(unaudited)in millions of euros2008 historical basischange comparable basis (in %)change historical basis (in %)impact of change in exchange rates(in %)impact of change in consolidated group (in %)Consolidated revenuesFrance United Kingdom Spain Poland Rest of World Enterprise International Carriers and Shared ServicesEliminations Revenues including United Kingdom23 639 5 108 3 887 3 831 8 308 7 559 1 388-2 76823 627 5 289 4 067 4 202 8 409 7 834 1 345-2 81623 726 5 926 4 067 5 184 8 322 7 785 1 349-2 8710.1 -3.4 -4.4 -8.8 -1.2 -3.5 3.2--0.4 -13.8 -4.4 -26.1 -0.2 -2.9 2.9--10.7 -18.9 1.3 0.6 --0.4 -0.2 -0.3-50 95251 95753 488-1.9-4.7-2.7-0.1Consolidated Consolidated revenuesexcluding United Kingdom4 Restated EBITDA 445 94446 80047 699-1.8-3.7-1.7-0.2France4 United Kingdom Spain Poland Rest of World Entreprise4 International Carriers and Shared services4Eliminations9 713 939 729 1 462 3 237 1 529 -355-9 781 1 080 614 1 740 3 491 1 578 -371-9 854 1 204 614 2 146 3 446 1 508 -444--0.7 -13.1 18.8 -16.0 -7.3 -3.1 -4.3--1.4 -22.0 18.8 -31.9 -6.0 1.4 -20.0--13.7 -19.0 1.4 4.7 -4.1--0.7 3.4 0.1 -12.0-EBITDA4 including the UnitedKingdom in % of revenues17 25433.9%17 91334.5%18 32834.3%-3.7-0.6 pt-5.9-0.4 pt-2.40.1Consolidated EBITDA4(excluding United Kingdom) in % of revenues16 32735.5%16 83236.0%17 08335.8%-3.0-0.5 pt-4.4-0.3 pt-1.60.1Operating income Net income Group share Net income Group shareComparable basis CAPEX (excluding licenses)7 859 2 997 849 4 849 5 30411.5%9 9109 945 4 069 181 5 181 6 41413.4%283 6 28313.4%At 31 Dec. 20095-15.6-1.9 pt-17.3-1.9 pt-2.10.0in % of revenuesOrganic cash flow8 350At 31 Dec. 20098 016At 31 Dec. 20084.2Net financial debtRatio of net financial debt / restated EBITDA including United Kingdom33 9411.9732 8591.9035 8591.963 Following the announcement in September 2009 of the merger of the Orange and T-Mobile operations in the United Kingdom, the United Kingdom segment is treated as a discontinued operation in the financial statements. However, it is still presented as a business segment in the business segment report of the consolidated financial statements (see review by business segment, page 17). 4 Restated EBITDA for 2009 excludes (i) the provision linked to the “part time for seniors” plan of 461 million euros for France, 28 million euros for Enterprise and 80 million euros for Operators and Shared Services, and (ii) expense of 964 million euros linked to the dispute pertaining to the special corporate tax regime applied to France Telecom in France prior to 2003 borne by the Operators and Shared Services segment. 5 Excluding the impact of the public offer for ECMS shares currently underway for 1.082 billion euros.4•quarterly data64th quarter 20094th quarter 2008 comparable basis(unaudited)4th quarter 2008 historical basisChange comparable basis(in %)change historical basis(in %)impact of change in exchange rates(in %)impact of change in consolidated group(in %)in millions of eurosConsolidated revenuesFrance United Kingdom Spain Poland Rest of World Enterprise International Carriers and Shared ServicesEliminations5 919 1 290 961 961 2 118 1 900 349-6896 013 1 305 994 1 097 2 140 2 010 380-7356 056 1 410 994 1 218 2 287 2 042 375-748-1.6 -1.2 -3.3 -12.4 -1.0 -5.5 -8.3--2.3 -8.5 -3.3 -21.1 -7.4 -6.9 -7.2--7.4 -10.0 -2.7 -1.4 -0.4--0.7 -3.8 -0.1 1.6-Revenues including United KingdomConsolidated revenues(excluding United Kingdom)12 80813 20413 634-3.0-6.1-2.3-0.911 540 3 67431.8%11 929 3 70731.1%12 254 3 72230.4%-3.3 -0.90.7 pt-5.8 -1.31.4 pt-1.7 -1.2-0.9 0.8Consolidated 7 restated EBITDA :in % of revenuesCAPEX (excluding licenses)France Spain Poland Rest of World Enterprise International Carriers and Shared Services 747 153 232 485 102 99 711 173 193 607 116 235 708 173 221 642 117 238 4.9 -11.6 20.1 -20.0 -12.4 -57.9 5.4 -11.6 5.1 -24.4 -12.9 -58.5 -12.5 -2.6 -0.5 -0.1 0.5 -2.8 -1.4CAPEX (excluding licenses)in % of revenues7 Restated EBITDA – CAPEX 71 81715.7%2 03517.1%2 09917.1%-10.7-1.4 pt-13.4-1.4 pt-2.2-0.81 8561 6711 62411.114.36 7Quarterly data unaudited Consolidated restated EBITDA excludes (i) the impact of the expense related to the special corporate tax regime applied to France Telecom in France prior to 2003 (964 million euros), and (ii) the provision pertaining to the “part time for seniors” plan (569 million euros).5figures comments on key Group figuresrevenuesfullfull-year 2009 Consolidated revenues for the France Telecom group (excluding the United Kingdom) were 45.944 billion euros in 2009, a decrease of 1.8% on a comparable basis and 3.7% on an historical basis. Excluding the impact of regulatory measures (-924 million euros), revenues increased 0.1%. 8 Including the United Kingdom, consolidated revenues were 50.952 billion euros, a 1.9% decline compared with the previous year on a comparable basis. Excluding the impact of regulatory measures (-1.116 billion euros), revenues increased 0.2%. Excluding regulatory measures: - France was up 1.6%: mobile services were up 5.0%, while fixed services were steady with a decline limited to -0.4%; - Africa and the Middle East posted strong growth (+5.8%), driven in particular by Egypt (+8.2%) and new 9 operations in Africa (+23.1%); 10 - Western Europe rose 3.1%, driven by Belgium (+4.2%) and Luxembourg (+16.1%); th - the United Kingdom regained positive annual growth (+0.2%), due to a particularly buoyant 4 quarter in mobile services; th - in Spain, 4 quarter business was more on track, which limited the annual decline to 0.1%, compared with a decrease of 0.7% for the first nine months of the year; - in Poland, the decline for the year was 3.3%, reflecting the downward trend in fixed services and, to a lesser extent, the leveling-off of prepaid mobile services offers; - the Enterprise segment recorded a 2.3% decline (excluding network equipment sales), reflecting the widespread economic slowdown; and - in Central Europe, the 9.7% decline was primarily tied to the deterioration of the economic environment in Romania (-16.7%). On an historical basis, revenues fell 4.7% (including the United Kingdom). More than half of this decline (2.7 points) was from the unfavorable impact of exchange rates, reflecting in particular the depreciation of the Polish zloty (-1.8 points) and the pound sterling (-1.2 points), partially offset by an increase in value of other currencies (+0.3 point). On an historical basis, the change also includes the impact of changes in the scope of consolidation (-0.1 point), in particular the discontinuation of e-commerce operations in France (TopAchat and Alapage).th 4 quarter 2009 Consolidated revenues for the France Telecom group (excluding the United Kingdom) were 11.540 billion euros th in the 4 quarter of 2009, a decrease of 3.3% on a comparable basis and 5.8% on an historical basis. th Including the United Kingdom, consolidated revenues were 12.808 billion euros, a 3.0% decline versus the 4 quarter of 2008 on a comparable basis. Excluding regulatory measures (-364 million euros), the decrease was limited to -0.2%, a 0.7-point improvement compared with the previous quarter (-0.9%). This concerns: th rd - Western Europe, which increased 6.4% in the 4 quarter after gaining 1.7% in the 3 quarter, related to growth in Belgium (sales growth for mobile handsets and improvement in voice services); rd - the United Kingdom with 3.7% growth after a 2.4% decline in the 3 quarter; th rd - Spain, which reported 4 quarter growth of 1.9% after a 0.2% decline in the 3 quarter, due to the increase in the customer base (contract and prepaid) and strong growth in data services; and th rd - Africa and the Middle East, with 4 quarter growth of 6.0% (following 3 quarter growth of 4.8%) reflecting a stronger upturn in Senegal and Côte d’Ivoire, while Egypt, Mali and new operations in Africa continued to climb. th8 Before deconsolidation of companies in the United Kingdom that will be contributed to the joint venture with Deutsche Telekom and which, in the 2009 financial statements, are treated as discontinued operations. 9 New operations in Africa: Kenya, Guinea, Guinea-Bissau, Niger, Central African Republic and Uganda. 10 Western Europe: Belgium, Luxembourg and Switzerland.6In France, operations remained on track with a 2.7% upturn in revenues from mobile services (excluding regulatory measures), driven by growth in the customer base and the development of data services. th The Enterprise segment fell 4.2% in the 4 quarter (excluding equipment sales), which was comparable to the rd 3.9% decline in the 3 quarter. th In Poland, the 6.1% decline in the 4 quarter (excluding regulatory measures) reflected slower growth in ADSL 11 broadband services and the leveling-off of ARPU in mobile services. Central Europe was down substantially (-13.1%, excluding regulatory measures) due to the trend in operations in Romania (-20.5%) and, to a lesser extent, in Slovakia (-5.3%).customer base growthThe Group had 192.7 million customers at 31 December 2009 (excluding MVNOs), with 10.4 million additional customers year on year (net of terminations), an increase of 5.7% compared to 31 December 2008. The number of mobile customers continued to rise reaching 132.6 million customers at 31 December 2009 th (excluding MVNOs), a year-on-year increase of 8.8% or 10.8 million customers (net of terminations). The 4 quarter continued to be very active, with 3.8 million mobile customers added. The MVNO customer base in Europe rose 25% to 4.0 million customers at 31 December 2009 (including 2.4 million customers in France), compared with 3.2 million customers a year earlier (including 1.8 million customers in France). 13 ADSL broadband services continued to grow, reaching 13.5 million customers at 31 December 2009, a year-on-year increase of 4.1%. Broadband usage rose sharply. At 31 December 2009, there were: 3.2 million digital TV (IPTV and satellite) subscribers, a 53% increase in one year; 7.6 million Voice over IP subscribers, a year-on-year increase of 17%; and 8.8 million Livebox subscribers, a 12% increase in one year.12EBITDAfullfull-year 2009 EBITDA (excluding the United Kingdom) was 14.794 billion euros. It included the following non-recurring items, th recognized in the 4 quarter: - an expense of 964 million euros related to the dispute concerning France Telecom’s special corporate tax regime in France prior to 2003; and 15 - a provision of 569 million euros for the establishment of the “part time for seniors” plan . Adjusted for these two items, EBITDA was 16.327 billion euros in 2009, for a restated EBITDA margin of 35.5%, compared with 36.0% in 2008 on a comparable basis. The 0.5-point decline between the two years reflects: - the impact of regulatory measures equal to -392 million euros (excluding the United Kingdom); and - the impact of the telecommunications tax instituted on 7 March 2009 (French audiovisual law) and, as of 1 June 2008, of the Chatel law (for a total impact of -178 million euros). On a comparable basis, the ratios of operating expenses (based on restated EBITDA) to revenues are as follows: - the ratio of labor expenses was 18.6%, a 0.6-point increase compared with 2008 (18.0%); - the ratio of service fees and inter-operator costs was 13.5%, a 0.3-point improvement. The decline in call termination fees (favorable impact of 532 million euros) was partially offset by growth in unlimited off-net mobile services offers; - the ratio of other network expenses and IT expenses was stable at 5.8%;See glossary. Including the United Kingdom Including FTTH, satellite and Wimax services 14 EBITDA: Earnings Before Interest, Taxes, Depreciation and Amortization. See glossary. 15 As part of the agreement concerning personnel close to retirement age signed on 26 November 2009 between France Telecom and its social partners, the “part time for seniors” plan allows employees eligible for retirement within three years to choose part time employment until they retire, without loss of benefits.12 13 11147the ratio of combined property, overhead and other expenses improved 0.2 points to 11.9%. The impact of cost savings programs, lower restructuring costs and increased income from associated companies were partially offset by the impact of the new telecommunications tax and the Chatel law; - before commercial expenses and content purchases, the EBITDA margin was 50.2%, a 0.2-point improvement compared with 2008; and - the ratio of commercial expenses and content purchases (14.7%) was up 0.2 points. The growth in content purchases, in particular for the sports TV and Orange cinema series channels that began operating in the second half of 2008, was offset to a large extent by the decline in commercial expenses linked to the business slowdown.th 4 quarter 2009 Restated EBITDA (excluding the United Kingdom) was 3.674 billion euros, a decrease of only 0.9% compared with the th th 4 quarter of 2008 on a comparable basis. The EBITDA margin for the 4 quarter (31.8%) improved by 0.7 points. This favorable change is related to: 17 th - the impact in 2008 of the impairment of Sonaecom shares, which reduced 4 quarter 2008 EBITDA by 199 million euros; - the effect in 2009 of cost reduction programs, particularly with respect to overheads and IT; and - optimization of commercial expenses and content purchases. These items were partially offset by the impact of regulatory measures (-121 million euros) and new taxes (-49 million euros). th16operating incomeFrance Telecom group’s operating income was 7.859 billion euros in 2009, compared with 9.945 billion euros in 2008 (on an historical basis), a decline of 2.086 billion euros between the two periods. About three-fourths of this decline corresponds to two previously mentioned non-recurring items: - a 964 million euro expense linked to the dispute pertaining to the special corporate tax regime prior to 2003; and - a 569 million euro provision for the establishment of the “part time for seniors” plan in France. Excluding these two items, there was a 553 million euro decrease between the two years, corresponding to the following changes: - a 756 million euro decline in EBITDA, adjusted for non-recurring items (including -272 million from changes in exchange rates); - a 442 million euro decrease in depreciation and amortization, particularly related to a favorable impact from exchange rates of 216 million euros; - a 179 million euro increase in goodwill impairment, mainly related to depreciation in Poland in 2009; and - a 60 million euro increase in impairment of non-current assets.net incomeConsolidated net income after tax for the France Telecom group was 3.465 billion euros in 2009, compared with 4.492 billion euros in 2008, a decrease of 1.027 billion euros. This reflects: - a 2.086 billion euro decrease in operating income; - a 658 million euro improvement in net financial income generated by (i) a 381 million euro expense in 2008 related to the liquidity mechanism, which was tied to the price guarantee given to minority shareholders of FT España and (ii) by the sharp reduction in the cost of net financial debt and a decline in the average cost of debt; - a 604 million euro decrease in corporate tax, related to a reduction in the level of deferred taxes in Spain and France; and - a 203 million euro decline in net income from discontinued operations (United Kingdom).16 17See glossary. Portuguese mobile telephone company.8Net income attributable to non-controlling interests (minority interests) rose to 468 million euros in 2009 from 423 million euros in 2008, an increase of 45 million euros year on year. Net income attributable to equity holders of France Telecom was 2.997 billion euros in 2009, compared with 4.069 billion euros in 2008, a decrease of 1.072 billion euros. In comparable terms, after adjustment for the main non-recurring items, this figure was 4.849 billion euros in 2009, compared with 5.181 billion euros in 2008, a decline of 6.4% (-332 million euros). The main non-recurring items taken into account concern: - a 964 million euro expense linked to the dispute pertaining to the special corporate tax regime prior to 2003; - the establishment of the “part time for seniors” plan in France, with an impact of 367 million euros (net of deferred tax); - the impact of the liquidity arrangement tied to the price guarantee given to the minority shareholders of FT España of 381 million euros in 2008; - certain non-recurring deferred income tax expenses of 181 million euros in 2008; - an impairment of loans granted to certain associates of 35 million euros in 2009; - a provision related to the free shares program of 41 million euros in 2009, compared with 57 million euros in 2008; and - gains on disposals and net income from discontinued operations of 4 million euros in 2009, compared with -11 million euros in 2008.capital expenditure on tangible and intangible assets (CAPEX)fullfull-year 2009 Capital expenditure on tangible and intangible assets (excluding the United Kingdom) were down 17.3% on an historical basis to 5.304 billion euros, including an unfavorable impact of 2.1% from exchange rates. On a comparable basis, and excluding the transaction to purchase operating premises in France in 2008 (163 million euros), CAPEX fell 13.3% while the comparable CAPEX to revenues ratio was 11.5% in 2009 compared with 13.1% in 2008, a decline of 1.6 points year on year. The decline in CAPEX reflects the slowdown in investments related to the expansion of 2G and 3G mobile network capacity and slower growth in fixed broadband services in the European countries. Investment in 3G was nonetheless strong in France, resulting in Orange having the best mobile broadband coverage according to the latest ARCEP report. Similarly, programs to roll out ADSL in Poland were accelerated in 2009. Added to this was increased investment in new operations (network deployment in Uganda and Armenia) and in undersea cables (Africa and Indian Ocean). In addition, CAPEX plans implemented in 2009 focused on sustaining investments related to strengthening transmission networks to support the growth in traffic in fixed and mobile data services (particularly in France and in Poland), to innovation and to new services (particularly content aggregation platforms).th 4 quarter 2009 CAPEX (excluding the United Kingdom) was 1.817 billion euros, 56% more than the quarterly average for the first nine months of the year (1.162 billion euros), reflecting seasonality comparable to that of previous years. Compared th with the 4 quarter of 2008, CAPEX was down 10.7% on a comparable basis (-13.4% on an historical basis) and the CAPEX to revenues rate (15.7%) was down 1.4 points. In addition to continued network deployment in Uganda and Armenia, capital expenditures were particularly focused on France (mobile services) and Poland (fixed and mobile services). thorganic cash flowOrganic cash flow for the Group was 8.350 billion euros in 2009, compared with 8.016 billion euros in 2008, an increase of 334 million euros. The organic cash flow Group share (attributable to equity holders of the Group) was 7.617 billion euros (a 364 million euro increase), whereas cash flow attributable to non-controlling interests (minority interests) was 733 million euros (down 30 million euros). The growth in the Group’s organic cash flow is primarily due to:9。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

2009年精益生产项目年度总结报告

2009年7月至12月精益项目分别从前期调研、项目启动、项目执行、项目总结分阶段开展。

在整个时间段中的工作得到了公司领导多次指引、协作部门有积极支持,使我从中不断地学习及创新,更顺利的开展各项工作。

2009年精益项目从公司中高层思维转变到实体活动开展的过程、是整个项目的一个重要的奠基石;通过不断的培训及实精益工作人员扎实负责的工作态度、协作部门的积极配合、上级领导的正确指引下,精益活动在注塑、SMT、插件等车间的现场改善及产品评审、替代料的选用等体系流程上取得了可喜的效果。

时至新的一年已经来临、为了更好的开展下一步工作,特将2009年度精益项的开展具体情况逐一总结如下:

1、精益前期调研及项目准备:

A、前期调研:

同生产、品质、PIE、研发、注塑、工模、PMC等职能部门主管负责人学习公司的现有运作流程并了解其对精益生产的的

理念及意识;深入车间现场、物料及成品仓库的观察分析,对

现有的生产、品质、物流系统的充分学习及了解,对精益活动

在全公司开展有了前期的准备及目标.

B、项目前期准备:

1、 引荐顾问老师同部门负责人了解部门情况、部门成员对

精益生产的认识、探讨品胜精益生产的方向及目标。

2、 同顾问老师对精益项目可量化指标的计算方式方法的起

稿、定稿,交部门负责人研讨后交于公司高层批阅;

3、 精益项目指标部门达成责任权重制定。

4、 精益项目部门责任状初稿、定稿、研讨;

5、 各可量化指标的基础数据收集、分析、上报;

2、精益项目执行主体计划及结果输出:

A、项目执行主体计划:

1、精益项目启动大会;

2、精益前期思维的宣导、活动规则的形成;

3、精益项目各项应用技能及现场改善培训;

4、5S体系+实战与设备TPM保养维护活动开展并运行;

5、SMT、插件、注塑、丝印、五金冲压车间现场效率改

善提升;

6、车间小时产量看板管理计划及实施;

7、 新产品开发及生产输出之设计过程及替代料导入评审

流程规则形成及运行;

8、供应商交期与品质提升辅导。

9、 PMC与协作部门关联问题收集汇总;

10、 PMC订单运行BOM异常反馈及异常源沟通处理;

11、 PMC与采购间生产计划加急物料看板知会、运行。

B、项目活动结果输出:

1、项目培训课程:

1)10大课培训分别为:精益生产的基本理念、TPS现场的7大浪费、问题理解与改善的基本精神、5S的有效理解

与改善技术、全面生产性维护TPM的概念、时间测量

法、SMED快速转模、设备保养基本知识与三级保养指

导书、Design 评审工程实务、工程设计理念.

2)汪老师3节,严老师2节,魏老师2节,张老师一节(汪

补一次),熊老师2节

2、SMT车间改善:

1)SMT车间重新布局清走不用的拉台、规范区域。

2)产品PPM状态统计分析、落实改善结果,建立改善进度一览表,持续分析并改善。

3)整合部分设备、调整设备将半自动印刷机投用于生产中;将贴片机、回流焊连接为一个流方式、减少员工取放板作业引发的元件偏移不良。

4)人机工程配合分析,分清操作员的作业范围及事项、已将现有的41款机型从1人操作一台机改为0.5人操作两台

机,从而每班次2台机减少1人作业。

5)贴片机取料就近原刚扩出料程序时间优化,已将14款机型不同程度的提升效率5%-40%.

3、插件车间改善:

1)对所的产品的锡点进行分析找出制造、设计、工艺不良并进行分析,同生产、生工程、研发共同商议出改善方案。

2)对不同产品的前加工元件制作免剪脚标准、从而使炉后执锡线减少手工剪脚作业,细化执锡线剪脚指引(标注剪脚点及质控点)。

3)对各产产品采用外壳实装、进行结构分析合理制定元件剪脚、元件贴板(浮高)标准,细分执锡区域、明确作业标准,减少执锡作业人数及提升产品品质。

4)调整一个流生产方式,将执锡段作业直接移至波峰焊炉后面、直接波峰焊接效果进行监控,做到及时发现及时改善问题。

5)制作物料周转车、放置架、换料架等物料搬运放置工装设备、减少物料搬运工时及降低作业劳动强度,初步制

作出多板测试夹具、减少测试时取放板时间及降低作业劳动强度。

6)作流程梳理、工时分析、动作分析及综全车间各项改善,现已将10款常生产之机型作了不同程度的效率提升及人员减少。

4、注塑丝印车间改善:

1) 对所有生产机型进行工时梳理、工时测量建立机型工时基础数据表。

2) 对生产机型作样板测试及作业动作现场分析、对29款机型因批峰、水口太多的模具同工模、注塑、生产工

程一同商议后进行修改及改良。

3) 进行SMED快速转模培训、演练,现场将转模时间划分出内及外转模,提前准备、将转模时间减少2-3分钟。

4) 制作物料周转搬运车及产成品放置架、规范作业区域及人作台面,实行产量小时看板管理。

5)丝印车间增加移动物料车架方便物料及产品搬运,根据机台高度及员工劳动强度计算制作升降凳、降低因

人机匹配不适带来的浪费及效率降低,从规范作业手

法、明确作业标准、工时分析等方面进行了流程梳

理,产能重排。

6) 通过系列改善活动注塑车间共52款机型分别从人力减少、产能提升方面作了产出效率7%-50%不等的改善。

7) 丝印车间对圆珠笔(笔帽/主身)、摄充/数码充面壳、便携充电器面壳、车易充面底壳等5款机型进行了流程梳

理,单机型工时效率提升15%-35%,人力平均减少0.5

人。

5、五金冲压车间改善:

1)结合PMC达成报表及IE标准工时现场查找问题存在点及改善方向。

2)在现场进行DV摄像达两小时(生产状况、换模、换

料、异常过程)并记录问题产生点及关键异常时间,结合DV列出两台机的过程产生不同点,召集相关部门对

所存在的问题点作商讨改善。

3)对现有的作业环境、休息时间、机台配置、员工考核、作业标准,由各负责人落实改善,最终形成各项制度及体系文件。

4)过程中将现有的机台脚踏式开关由设备改为自动点动式开关、改善作业过程中员工长时间工作强度及停机检查产品现象。

5)规范员工定时休息制度及绩效方案、换模换料流程。

6)活动将原有的冲压工时利用率50-70%提升为现有的90%以上。

6、研发工程改善:

1)进行了部门设计思维及理念培训、讲解设计通用标准,并运用到实际的设计工作中,根据近段时间的开发样品反应已经运用通用标准。

2)制定讲解新产品开发评审输出表,并试运行新产品评审活动,形成产品评审体系文件并执行。

3)组织生产工程、生产、品质、PMC、采购作替代料选用流程及评审细则培训,根据培训内容制定执行替代料评审体系文件及各种评审表格。

4)参于生产及生产工程对产品锡点、结构的改良讨论并实施。

7、PMC改善:

1)由PMC助理对订单运行中的因BOM异常引起的无法计算的列出来,由精益办找研发了解异常过程,回复主要为部门负责人开会没有及时审批、外单BOM与使用

PCB板同品胜,品胜PCB前期已升版,而此外单一直未

有订单从而导致未及时更新及发放BOM时胶壳未最终

确认合格,并同时回复改善OK, 运行到12月中旬后

PMC没有提出异常原因。

2)由PMC部MC每周提供材料进料异常、同时由IQC对主要不良供应供商(变压器、电芯)作8D改善回复。

3)同采购共同商讨生产计划物料需求状态及通知主式,确定由精益办制作通知看板挂于办公区后由PMC提供生

产计划中加急物料动态状况,由采购专项人员填写进度

及异常原因。

8、供应商管理改善:

4)制定并修改供应商评审项目输出表。

5)参与现场评审供应商、由品质落实评审结果、针对不良点进行回复改善并确认。

6)根据MC提报的进料异常作分类处理、从规范规格资料及供应商作8D改善回复,加大来料抽检力度方面作来

料品质改善,前期主要对变压器及PCB板的供应商作改

善跟踪,效果较为明显。

9、5S+TPM改善:

7)制定生产车间、办公室5S检查评分表,并运行修正。

8)对车间及办公室作5S阶段性评比并作奖项颁发并总结。

9)进行车间三定、区域规范、红牌管理活动及车间专项辅导改善。

10)设备保养基本知识与三级保养指导书专项培训。

11)编写并试运行各种设备的三级保养作业指导书。

C、 总体总结:

2009年度精益生产再次在全公司全面推行、从项目开始至今,公司各部门逐步改变对精益项目的认识,从最初的观望到现在的主动完成及要求各项工作,这是取得最大的成绩,也是精益带来的思维革新;在公司各级领导的英明决策、各协作部门的通力合作下,精益生产如期开展并在部分项目上取得了突

破性的收获。

因此我们不得不相信,个人思维的转变是第一位的,公司各部门通力合作,才能实现公司与个人双赢的

局面。

报告人:梅红建

2010年1月15日。