国际经济学第十版课后答案 (萨尔瓦多、杨冰译)

国际经济学第十版答案

国际经济学第十版答案【篇一:国际经济学复习课后答案】1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案:是4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用y商品的过剩供给曲线(b国)和过剩需求曲线(a国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是px/py,而y商品的价格是py/px.7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 x、y的单位产出所需的劳动投入x y表2 x、y的单位产出所需的劳动投入ab 5 5a 6 2b 15 12x 10 y4答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容) 2.假设a、b两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 x、y的单位产出所需的劳动投入x ya 4 2b 8 4答案提示:从绝对优势来看,两国当中a国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗?答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5.假设某一国家拥有20,000万单位的劳动,x、y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

国际经济学的课后答案及选择

第一章绪论(一) 选择题1.国际经济学在研究资源配置时,是以〔D.政府〕作为根本的经济单位来划分的。

2.国际经济学研究的对象是〔D 各国之间的经济活动和经济关系〕3.从国际间经济资源流动的难易度看,〔C人员〕流动最容易〔二〕问答题1.试述国际经济学和国内经济学的关系。

答案提示:〔1〕联络:国际经济学与国内经济学研究的经济活动是相似的,面临的主要问题也是相似的;〔2〕最主要的区别是国际经济的民族国家性。

第二章古典的国际贸易理论〔一〕选择题本国消费A、B、C、D四种产品的单位劳动投入分别为1、2、4、15,外国消费这四种产品的单位劳动投入分别为12、18、24、30,根据李嘉图模型,本国在哪种产品上拥有最大比拟优势?在哪种产品上拥有最大比拟优势?〔〔c〕A、D〕答案:C〔二〕问答题1.亚当·斯密对国际贸易理论的主要奉献有哪些?答案提示:亚当·斯密的主要奉献是:〔1〕鞭挞了重商主义;〔2〕提出了绝对优势之一概念;〔3〕强调国际分工是使国民财富增加的最重要手段。

2.绝对优势理论和比拟优势理论的区别是什么?答案提示:〔1〕绝对优势理论强调,国与国之间劳动消费率的绝对差异导致的技术程度的差异是产生国际贸易的主要原因;〔2〕比拟优势理论强调,劳动消费率的相对差异导致的技术程度的差异是产生国际贸易的主要原因。

第二章问答题2.假设A、B两国的消费技术条件如下所示,那么两国还有进展贸易的动机吗?解释原因。

答案提示:从绝对优势来看,两国当中A国在两种产品中都有绝对优势;从比拟优势来看,两国不存在相对技术差异。

所以,两国没有进展国际贸易的动机。

3.证明即使一国在某一商品上具有绝对优势,也未必具有比拟优势。

答案提示:假如ax>bx,那么称A国在X消费上具有绝对优势;假如ax/ay>bx/by,那么称A国在X消费上具有比拟优势。

当 ay=by或者ay<by的时候,由ax>bx可以推出ax/ay>bx/by,但是,当ay>by的时候,ax>bx不能保证。

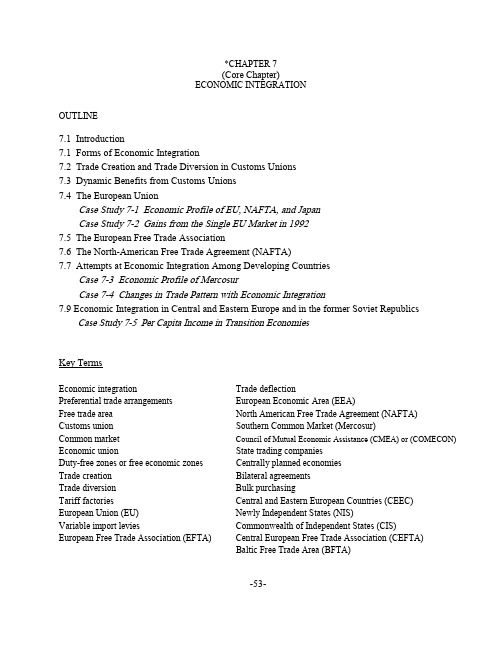

ch07 国际经济学课后答案与习题(萨尔瓦多)

*CHAPTER 7(Core Chapter)INTEGRATIONECONOMICOUTLINE7.1 Introduction7.1 Forms of Economic Integration7.2 Trade Creation and Trade Diversion in Customs Unions7.3 Dynamic Benefits from Customs Unions7.4 The European UnionCase Study 7-1 Economic Profile of EU, NAFTA, and JapanCase Study 7-2 Gains from the Single EU Market in 19927.5 The European Free Trade Association7.6 The North-American Free Trade Agreement (NAFTA)7.7 Attempts at Economic Integration Among Developing CountriesCase 7-3 Economic Profile of MercosurCase 7-4 Changes in Trade Pattern with Economic Integration7.9 Economic Integration in Central and Eastern Europe and in the former Soviet RepublicsCase Study 7-5 Per Capita Income in Transition EconomiesKey TermsdeflectionTradeEconomicintegrationPreferential trade arrangements European Economic Area (EEA)Free trade area North American Free Trade Agreement (NAFTA)MarketCommon(Mercosur)SouthernCustomsunionmarket Council of Mutual Economic Assistance (CMEA) or (COMECON) Commoncompaniestradingunion StateEconomicDuty-free zones or free economic zones Centrally planned economiesagreementsBilateralTradecreationBulkpurchasingdiversionTradeandEastern European Countries (CEEC) factoriesCentralTariffNewly Independent States (NIS)(EU)EuropeanUnionVariable import levies Commonwealth of Independent States (CIS)European Free Trade Association (EFTA) Central European Free Trade Association (CEFTA)(BFTA)AreaBalticTradeFree-53-Lecture Guide:1. This is not a core chapter and I would skip it, except for sections 7-4 to 7-8 dealing with theEuropean Union (EU), The European Free Trade Association, the North American FreeTrade Agreement (NAFTA), and the Southern Common Market (Mercosur).2. I would take two classes to cover the material. Case Studies 7-1 to 7-4 can be used for a very stimulating class discussion.Answers to Problems:1. If Nation A imposes a 100 percent ad valorem tariff on imports of commodity X fromNation B and Nation C, Nation A will produce commodity X domestically because thedomestic price of commodity X is $10 as compared with the tariff-inclusive price of$16 if Nation A imported commodity X from Nation B and $12 if Nation A importedcommodity X from nation C.2. a. If Nation A forms a customs union with Nation B, Nation A will import commodityX from Nation B at the price of $8 instead of producing it itself at $10 or importing itfrom Nation C at the tariff-inclusive price of $12.b. The formation by Nation A of a customs union with Nation B leads to trade creationonly because Nation A replaces the domestic production of commodity X at Px=$10with tariff-free imports of commodity X from Nation B at Px=$8.3. If Nation A imposes a 50 percent ad valorem tariff on imports of commodity X fromNation B and Nation C, Nation A will import commodity X from nation C at the tariff-inclusive price of $9 instead of producing commodity X itself or importing it fromNation B at the tariff-inclusive price of $12.4. a. If Nation A forms a customs union with Nation B, Nation A will import commodityX from Nation B at the price of $8 instead of importing it from Nation C at the tariff- inclusive price of $9.b. The formation by Nation A of a customs union with Nation B leads not only to tradecreation but also to trade diversion because it replaces lower-cost imports of commodity X of $6 (from the point of view of Nation A as a whole) with higher priced imports of Commodity X from Nation B at $8.Specifically, Nation A's importers do not import commodity X from Nation C becausethe tariff-inclusive price of commodity X from Nation C is $9 as compared with theno-tariff price of $8 for imports of commodity X from Nation B. However, since thegovernment of Nation A collects the $3 tariff per unit on imports of commodity Xfrom Nation C, the net effective price for imports of commodity X from Nation C isreally $6 for Nation A as a whole.-54-5. a. See Figure 1 below.b. The net gain from the trade-diverting customs union shown in Figure 1 is given byC'JJ'+B'HH'-MJ'H'N. As contrasted with the case in Figure 7-1 in the text, however,the sum of the areas of the two triangles (measuring gains) is here greater than the area the rectangle (measuring the loss). Thus, the nation would now gain from the formation of a custom union. Had we drawn the figure on graph paper, we would have been able to measure the net gain in monetary terms also.6. A customs union that leads to both trade creation and trade diversion is more likely to lead to a net positive welfare gain of the nation joining the union (1) the smaller is the relative inefficiency of the union member in relation to the non-union member and (2) the higher is the level of the tariff imposed by the customs union on the non-union member.7. The dynamic benefits resulting from the formation of a customs union are (1) increasedcompetition, (2) economies of scale, (3) stimulus to investment, and (4) better utilizationof economic resources. These are likely to be much more significant than the static benefits.8. See Figure 2 below. The formation of the customs union has no effect.9. NAFTA created much more controversy because the very low wages in Mexico led togreat fears of large job losses in the U. S.10. The possible cost to the U.S. from EU92 arose from the increased efficiency andcompetitiveness of the E.U. The benefit arose because a more rapid growth in the EUspills into a greater demand for American products, which benefits the U. S.Fig 7.1xPFig 7.2xP-55-Multiple-choice Questions:1. Which of the following statements is correct?*a. in a customs union, member nations apply a uniform external tariffb. in a free-trade area, member nations harmonize their monetary and fiscal policiesc. within a customs union there is unrestricted factor movementd. a customs union is a higher form of economic integration than a common market2. A customs union that allows for the free movement of labor and capital among itsmember nations is called a:a. preferential trade arrangementb. free-trade area*c. common marketd. all of the above3. A customs union creates trade when:a. lower-cost imports from outside the customs union are replaced by higher-costimports from a union member*b. some domestic production in a member nation is replaced by lower-cost imports from another member nationc. trade among members increases but trade with nonmembers decreasesd. trade among members decreases while trade with nonmembers increases4. Trade diversion arises in a customs union if it:a. increases trade among union members and with nonmember nationsb. reduces trade among union members and with nonmember nations*c. increases trade among members but reduces trade with non-membersd. reduces trade among union members but increases it with nonmembers5. Customs union usually results in:a. trade diversion onlyb. trade creation only*c. both trade creation and trade diversiond. we cannot say-56-6. The formation of a customs union that leads only to trade creation and all economic resources of member nations are fully employed before and after the formation of the customs union leads to an:*a. increase in the welfare of member and nonmember nationsb. increase in the welfare of member nations onlyc. increase in the welfare of nonmember nations onlyd. increase or decrease in the welfare of member and nonmember nations7. A customs union that leads to both trade creation and trade diversion:a. increases the welfare of member and nonmember nationsb. reduces the welfare of member and nonmember nationsc. increases the welfare of member nations but reduces that of nonmembers*d. reduces the welfare of nonmembers and may increase or reduce that of members8. A customs union is more likely to lead to trade creation:a. the lower are the pre-union trade barriers of the member countries*b. the lower are the customs union's barriers on trade with the rest of the worldc. the smaller is the number of countries forming the customs union and the smallertheir sized. the more complementary rather than competitive are the economies of the nationsforming the customs union9. Which is not a dynamic benefit from the formation of a customs union?a. increased competitionb. economies of scalec. stimulus to investment*d. trade creation10. The formation of the EU resulted in:a. trade creation in industrial and agricultural productsb. trade diversion in industrial and agricultural products*c. trade creation in industrial products and trade diversion in agricultural productsd. trade diversion in industrial products and trade creation in agricultural products11. The benefit that the United States receives from NAFTA:*a. increasing competition in product and resource marketsb. greater technical innovationc. improvements in its terms of traded. all of the above-57-12. The benefit that Mexico is likely to receive from NAFTA:a. greater export-led growthb. encouraging the return of flight capitalc. more rapid structural change*d. all of the above13. Which is a stumbling block to successful economic integration among groups ofdeveloping nations?a. benefits are not evenly distributed among nationsb. many developing nations are not willing to relinquish part of their newly-acquiredsovereignty to a supranational community body, as required for successful economicintegrationc. the complementary nature of their economies and competition for the same worldmarkets for their agricultural exports*d. all of the above14. The formation of a free trade area among the countries of Eastern Europe is advocatedin order to:a. restore trade trading*b. retain the traditional trade links that can be justified on market principlesc. reduce the need for structural changed. none of the above15. The Members of Mercosur are:a. Brazil, Mexico, Argentina, and venezuelab. Argentina, Brazil, the United States and Peru*c. Brazil, Argentina, Paraguay, and Uruguayd. Brazil, Chile, Peru and Canada-58-。

国际经济学第十版答案

国际经济学第十版答案【篇一:国际经济学复习课后答案】1.为什么说生产和消费只取决于相对价格?答:经济主体的经济行为考虑的是所有商品的价格,而不是单一价格因素。

3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案:是4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用y商品的过剩供给曲线(b国)和过剩需求曲线(a国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?答案提示:不一定一致,x商品的价格是px/py,而y商品的价格是py/px.7.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

8.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

第二章答案1.根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 x、y的单位产出所需的劳动投入x y表2 x、y的单位产出所需的劳动投入ab 5 5a 6 2b 15 12x 10 y4答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a)和表2-2(b)部分的内容) 2.假设a、b两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 x、y的单位产出所需的劳动投入x ya 4 2b 8 4答案提示:从绝对优势来看,两国当中a国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3.如果一国在某一商品上具有绝对优势,那么也必具有比较优势吗?答案提示:不一定,比较优势的确定原则是两优取最优,两劣取最劣。

5.假设某一国家拥有20,000万单位的劳动,x、y的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

萨尔瓦多《国际经济学》(第10版)课后习题详解-第18章 开放经济宏观经济学:调整政策【圣才出品】

第18章 开放经济宏观经济学:调整政策一、概念题1.曲线( curve)BP BP答:曲线是在其他参数变量固定的前提下,以利率为纵坐标,国民收入为横坐标BP表示的国际收支均衡的曲线。

曲线包含三方面含义:①对于曲线上任何一点均代表BP BP国际收支平衡;而在曲线之下或之上的区域内任何一点,与曲线上的均衡点相比,BP BP则表示国际收支处于逆差或顺差状态。

②在通常情况下,曲线向上倾斜,即斜率为正,BP这代表利率与实际国民收入同方向变动。

③国际收支平衡的曲线的形状存在两种极端BP情况:没有资本流动情况下的垂直线和资本完全自由流动下的水平线。

2.直接控制(direct controls)答:直接控制也称直接管制,是指政府直接对国际经济交易进行行政干预,以使国际收支达到平衡的政策措施,包括贸易控制、外汇控制和其他控制。

直接管制通常能起到迅速改善国际收支的效果,能按照本国的不同需要,对进出口贸易和资本流动区别对待。

但是,它并不能真正解决国际收支平衡问题,只是将显性国际收支赤字变为隐性国际收支赤字;一旦取消管制,国际收支赤字仍会重新出现。

此外,实行管制政策,既为国际经济组织所反对,又会引起他国的反抗和报复。

3.外汇控制(exchange controls)答:外汇控制是指一国政府为平衡国际收支和维持本国货币汇率而对外汇进出实行的限制性措施,在中国又称外汇管理。

它是一国政府通过法令对国际结算和外汇买卖进行限制的一种限制进口的国际贸易政策。

外汇控制分为数量控制和成本控制。

前者是指国家外汇管理机构对外汇买卖的数量直接进行限制和分配,通过控制外汇总量达到限制出口的目的;后者是指,国家外汇管理机构对外汇买卖实行复汇率制,利用外汇买卖成本的差异,调节进口商品结构。

4.支出—改变政策(expenditure-changing policies)答:支出—改变政策是指政府通过财政政策来改变经济中对商品和劳务的总需求水平,从而实现内外均衡的政策。

ch05 国际经济学课后答案与习题(萨尔瓦多)

*CHAPTER 5(Core Chapter)TRADE RESTRICTIONS: TARIFFSOUTLINE5.1 Introduction5.2 Types of TariffsCase Study 5-1 Average Tariff on Industrial Products in Major Developed CountriesCase Study 5-2 Average Tariff on Industrial Products in Some Major Developing Countries 5.3 Effects of a Tariff in a Small Nation5.4 Effect of a Tariff on Consumer and Producer Surplus5.5 Costs and Benefits of a Tariff in a Small NationCase Study 5-3 The Welfare Effects of Liberalizing Trade in Some U.S. ProductsCase Study 5-4 The Welfare Effects of Liberalizing Trade in Some EU Products5.6 Costs and Benefits of a Tariff in a Large Nation5.7 The Optimum Tariff and Retaliation5.8 Theory of Tariff StructureCase Study 5-5 Rising Tariff Rates with Degree of Domestic ProcessingCase Study 5-6 Structure of Tariffs in the United States, EU, and CanadaAppendix: Optimum Tariff and Retaliation with Offer CurvesKey TermsTrade or commercial policies Revenue effect of a tariffsurplustariff ConsumerImportExport tariff Rent or producer surplustariff Protectioncost or deadweight loss of a tariff valoremAdSpecific tariff Terms of trade effect of the tarifftarifftariff OptimumCompoundConsumption effect of a tariff Prohibitive tariffProduction effect of a tariff Rate of effective protectionTrade effect of a tariffLecture Guide1. I would cover sections 1-4 in the first lecture. The most difficult part is Section 4 on themeaning and measurement of consumer and producer surplus. Since a clear understanding of the meaning and measurement of consumer and producer surplus is crucial in measuring the welfare effect of tariffs, I would explain these concepts very carefully.2. I would cover sections 5 and 6 in the second lecture. These are the most difficult sections inthe chapter and also the most important.3. The theory of tariff structure is also difficult and important. I found that the best way toexplain it is by using the simple example in the text on the suit with and without imported inputs. This section is likely to generate a great deal of discussion about the trade relations between developed and developing nations. If you do not plan to cover optional Chapter 8 on growth and development, you could spend a bit more time on this topic here , even though it will come up again in Chapter 6.Answer to Problems1. a. See Figure 1 on the next page.b. Consumption is 70X, production is 50X and imports are 20X.c. The consumption effect is –30X, the production effect is +30X, the trade effectis –60X, and the revenue effect is $30 (see Figure 1).2. a. The consumer surplus is $250 without and $l22.50 with the tariff (see Figure 1).b. Of the increase in the revenue of producers with the tariff (as compared with theirrevenues under free trade), $22.50 represents the increase in production costs andanother $22.50 represents the increase in rent or producer surplus (see Figure 1).c. The dollar value or the protection cost of the tariff is $45 (see Figure 1).3. The dollar value or the protection cost of the tariff is $45 (see Figure 2).4. The dollar value or the protection cost of the tariff is $45 (see Figure 3).5. The optimum tariff is the tariff that maximizes the net benefit resulting from theimprovement in the nation’s terms of trade against the negative effect resulting fromreduction in the volume of trade.X Fig 5.1X Fig 5.2XFig 5.36. a. When a nation imposes an optimum tariff, the trade partner’s welfare declines because ofthe lower volume of trade and the deterioration in its terms of trade.b. The trade partner is likely to retaliate and in the end both nations are likely to lose becauseof the reduction in the volume of trade.7. Even when the trade partner does not retaliate when one nation imposes the optimum tariff,the gains of the tariff-imposing nation are less than the losses of the trade partner, so that theworld as a whole is worse off than under free trade. It is in this sense that free trade maximizesworld welfare.8. a. The nominal tariff is calculated on the market price of the product or service. The rate ofeffective protection, on the other hand, is calculated on the value added in the nation. It isequal to the value of the price of the commodity or service minus the value of the importedinputs used in the production of the commodity or service.b. The nominal tariff is important to consumers because it determines by how much the priceof the imported commodity increases. The rate of effective protection is important fordomestic producers because it determines the actual rate of protection provided by thetariff to domestic processing.9. a. Rates of effective protection in industrial nations are generally much higher than thecorresponding nominal rates and increase with the degree of processing.b. The tariff structure of developed nations is of great concern for developing nationsbecause it discourages manufacturing production in developing nations.10. If a nation reduces the nominal tariff on the importation of the raw materials required toproduce a commodity but does not reduce the tariff on the importation of the finalcommodity produced with the imported raw material, then the effective tariff rates willincrease relative to the nominal tariff rate on the commodity.Multiple-choice Questions1. Which of the following statements is incorrect?a. an ad valorem tariff is expressed as a percentage of the price of the traded commodity.b. a specific tariff is expressed as a fixed sum of the value of the traded commodity.c. export tariffs are prohibited by the U.S. Constitution*d. the U.S. uses exclusively the specific tariff2. A small nation is one:a. which does not affect world price by its tradingb. which faces an infinitely elastic world supply curve for its import commodityc. whose consumers will pay a price that exceeds the world price by the amount of the tariff *d. all of the above3. If a small nation increases the tariff on its import commodity, its:a. consumption of the commodity increasesb. production of the commodity decreasesc. imports of the commodity increase*d. none of the above4. The increase in producer surplus when a small nation imposes a tariff is measured by the area: *a. to the left of the supply curve between the commodity price with and without the tariffb. under the supply curve between the quantity produced with and without the tariffc. under the demand curve between the commodity price with and without the tariffd. none of the above.5. If a small nation increases the tariff on its import commodity:*a. the rent of domestic producers of the commodity increasesb. the protection cost of the tariff decreasesc. the deadweight loss decreasesd. all of the above6. The imposition of an optimum tariff by a small nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. non of the above7. The optimum tariff for a small nation is:a. 100%b. 50%*c. 0d. depends on the elasticity of demand and supply for the import commodity in the nation8. The imposition of an optimum tariff by a large nation:a. improves its terms of tradeb. reduces the volume of tradec. increases the nation's welfare*d. all of the above9. The imposition of an optimum tariff by a large nation:a. improves the terms of trade of the trade partner*b. reduces the volume of tradec. increases the trade partner’s welfared. all of the above10. If two large countries impose an optimum tariff*a. the welfare of the both nations decreaseb. the welfare of the both nations increasec. the welfare of the larger nation will increase and that of the other nation decreasesd. the welfare of the larger nation will decrease and that of the other nation increases11. If one nation imposes an optimum tariff and the other nation does not retaliate*a. the welfare of the first nation increases and that of the welfare of the second nation fallsb. the welfare of the second nation increases and that of the welfare of the second nation fallsc. the welfare of both nations falld. the welfare of both nations increase12. If one nation imposes an optimum tariff and the other nation does not retaliatea. the welfare of the first nation increases more than the fall in the welfare of the secondnation*b. the welfare of the first nation increases more than the fall in the welfare of the secondnationc. the welfare of the second nation increases less than the fall in the welfare of the firstnationd. the welfare of the first nation increases by the same amount as the fall in the welfare of the second nation13. The nominal tariff is the tariff calculated on thea. price of the input used in the production of the commodity*b. price of the commodity or servicec. value addedd. all of the above14. The effective tariff rate is the tariff calculated on thea. price of the input used in the production of the commodityb. commodity or service*c. value added in the nationd. all of the above15. If the nominal tariff on a commodity is higher than the nominal tariff on the imported input used in the production of the commodity, then the rate of effective protection is*a. higher on the commodity than on the inputb. lower on the commodity than on the imported inputc. equal on the commodity and on the imported inputd. any of the above。

(完整word版)《国际经济学》课后思考题(纯文字答案题目)

《国际经济学》课后思考题(纯文字答案题目)第二章一:名词解释1、机会成本:机会成本是指当把一定的经济资源用于生产某种产品时放弃的另一些产品生产上最大的收益。

2、比较优势:如果一个国家在本国生产一种产品的机会成本低于在其他国家生产该产品的机会成本的话,则这个国家在生产该种产品上就拥有比较优势。

3、提供曲线:提供曲线反映的是一国为了进口其某一数量的商品而愿意出口的商品数量。

二:简答简述对绝对优势理论的评价。

答:(1)意义:①主张自由经济,为自由贸易奠定了基础;②解释了贸易产生的部分原因;③首次论证了贸易双方都有益。

(2)缺陷:不具有普遍性。

(比如:一国在两种产品上都具有绝对优势或者劣势)4、对比较优势理论有哪些误解?答:①劳动生产率和竞争优势。

只有当一个国家的劳动生产率达到足以在国际竞争中立足的水平时,它才能从自由贸易中获利;②贫民劳动论。

如果来自外国的竞争是建立在低工资的基础上,那么这种竞争是不公平的,而且会损害其他参与竞争的国家;③剥削。

如果一个国家的工人比其他国家工人工资低,那么贸易就会使得这个国家受到剥削,使其福利恶化;6、专业化分工会进行的那么彻底吗?为什么?答:不会。

原因:①多种要素存在会减弱分工的趋势;②国家保护民族产业;③运输费用的存在(会导致非贸易品)。

7、试述李嘉图比较优势理论的局限性。

答:①预测了极端的专业化分工,而现实中不存在;②忽略了国际贸易对国内分工的影响,并据此认为一个国家始终能从国际贸易中获利;③忽略了各国资源不同也是产生国际贸易的重要原因;(仅认为技术不同导致劳动生产率不同,从而导致比较优势不同)④忽略了规模经济也可能是产生国际贸易的原因。

8、简述穆勒的相互需求原理。

答:商品的价格是由供求双方的力量共同决定的,市场行情也会自行调整,以使供求相等。

因此,商品的国际交换比率就是由两国相互的需求来决定的,并且将确定在双方各自对对方产品需求相等的水平上,这就是相互需求原理。

萨尔瓦多《国际经济学》课后习题详解(国际货币体系:过去、现在与未来)【圣才出品】

第21章国际货币体系:过去、现在与未来一、概念题1.调整(adjustment)答:调整是评价国际货币体系好坏的标准之一,是指国际货币体系纠正国际收支失衡的过程。

一个好的国际货币体系应该使调整成本和所需时间最小。

2.善意忽视(benign neglect)答:善意忽视是指在浮动汇率制度中,货币当局对汇率采取的一种相对放任的态度,较少地对外汇市场进行干预,而由货币本身价值的变化自动调节国际收支状况。

3.布雷顿森林体系(Bretton Woods System)答:布雷顿森林体系是第二次世界大战即将结束时创立的国际货币体系。

该体系是根据《国际货币基金协定》创立的。

主要特点是:规定美元与黄金挂钩,确认美国1934年1月规定的1美元含金量为0.888671克,即35美元=1盎司黄金;规定其他各国货币按含金量同美元挂钩;市场汇率的波动幅度若超过平价上下1%,各国政府有义务进行市场干预;平价变动幅度如超过10%时则须得到国际货币基金组织的同意,由此形成了固定汇率制度,促进了国际贸易与金融关系的发展。

20世纪60年代频繁爆发的美元危机削弱了布雷顿森林体系,并迫使美国政府于1971年8月15日宣布停止美元兑换黄金。

1973年3月起,主要西方国家相继实行浮动汇率制,布雷顿森林体系正式宣告瓦解。

4.可靠性(confidence)答:可靠性是评价国际货币体系好坏的标准之一,是指国际货币体系调节机制具有正常运行的自动机制,能够保持国际储备的绝对价值和相对价值。

5.信用份额(credit tranches)答:信用份额是指国际货币基金组织为其成员国提供不受任何限制或附加条件约束的贷款的额度。

一般来说,一个成员国一年内的借款不得超过其配额的25%,每5年的借款总额不得超过其配额的125%,在此范围内,这些借款可自动获得。

当一国的借款超过所设定的信用份额时,国际货币基金组织就要收取越来越高的利息,而且进行越来越严格的监督,附加越来越多的条件,以确保该逆差国正在采取正确的措施以消除其赤字。