美国会计准则 中国会计准则 中国企业所得税简明对比表 (英文版)

USGAAP美国会计准则与CNGAAP中国会计准则具体差异列表对比

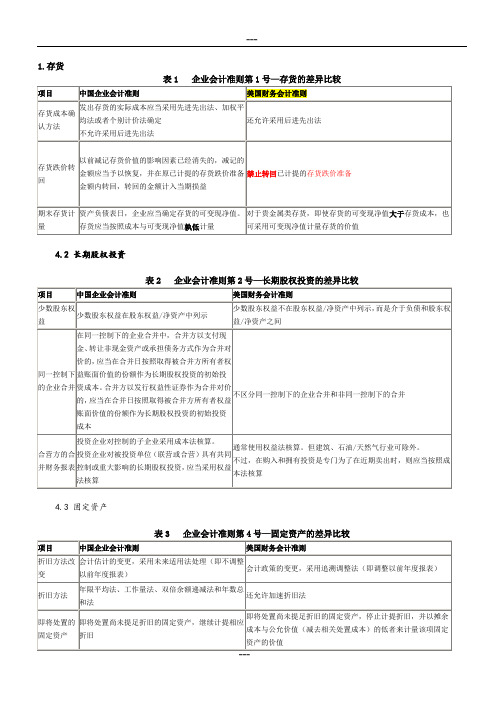

1.存货

表1 企业会计准则第1号—存货的差异比较

4.2 长期股权投资

表2 企业会计准则第2号—长期股权投资的差异比较

4.3 固定资产

表3 企业会计准则第4号—固定资产的差异比较

4.4 无形资产

表4 企业会计准则第6号—无形资产的差异比较

4.5 非货币性资产交换

4.6 雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)

表6 企业会计准则第9/10/11号—雇员薪酬、福利、奖励差异的比较

4.7 收入

表7 企业会计准则第14号—收入的差异比较

4.8 建造合同

表8 企业会计准则第15号—建造合同的差异比较

4.9 政府补助

4.10 所得税

表10 企业会计准则第18号—所得税的差异比较

4.11 企业合并

表11 企业会计准则第20号—企业合并的差异比较

4.12 金融工具

表12 企业会计准则第22/23/24/37号—金融工具确认、计量、转移、套期保值及列报的差异比较

4.13 会计政策、会计估计变更和差错更正

4.14 财务报表列报

表14 企业会计准则第30号—财务报表列报的差异比较

4.15 中期财务报告

4.16 关联方披露。

US GAAP美国会计准则与CN GAAP中国会计准则具体差异 列表对比

1.存货

表1 企业会计准则第1号—存货的差异比较

4.2 长期股权投资

表2 企业会计准则第2号—长期股权投资的差异比较

4.3 固定资产

表3 企业会计准则第4号—固定资产的差异比较

4.4 无形资产

表4 企业会计准则第6号—无形资产的差异比较

4.5 非货币性资产交换

表5 企业会计准则第7号—非货币性资产交换的差异比较

4.6 雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)表6 企业会计准则第9/10/11号—雇员薪酬、福利、奖励差异的比较

4.7 收入

表7 企业会计准则第14号—收入的差异比较

4.8 建造合同

表8 企业会计准则第15号—建造合同的差异比较

4.9 政府补助

表9 企业会计准则第16号—政府补助的差异比较

4.10 所得税

表10 企业会计准则第18号—所得税的差异比较

4.11 企业合并

表11 企业会计准则第20号—企业合并的差异比较

4.12 金融工具

表12 企业会计准则第22/23/24/37号—金融工具确认、计量、转移、套期保值及列报的差异比较

4.13 会计政策、会计估计变更和差错更正

表13 企业会计准则第28号—会计政策、会计估计变更和会计差错更正的差异比较

4.14 财务报表列报

表14 企业会计准则第30号—财务报表列报的差异比较

4.15 中期财务报告

表15 企业会计准则第29号—中期财务报告的差异比较

4.16 关联方披露

表16 企业会计准则第36号—关联方披露的差异比较。

所得税会计最新比较——美国、国际会计准则和中国(共5篇)

所得税会计最新比较——美国、国际会计准则和中国(共5篇)第一篇:所得税会计最新比较——美国、国际会计准则和中国本文简要列示了国际财务报告准则(ifrs)[i]、美国公认会计原则(us gaap)和中国会计准则关于所得税会计之间的一些主要差异。

作者就ias(国际会计准则)、us gaap和中国会计准则截至2006年3月的差异做一些比较。

就这些差异来说,其重要程度会因公司经营的性质、公司所在的行业、所选择的会计政策等因素而有所不同,因此要充分理解这些差异,需要参考相关的会计准则和国家规章。

比较基础:fas109——所得税,及与其相关准则、公告和解释[ii];ias12—所得税, 及与其相关准则和解释[iii]和中国企业会计准则第18号——所得税[iv](简称asb18,下同)。

1.目标比较。

fas109,所得税会计为了达到二个目标:一是确认当期应付税款或返回所得税金额,二是确认由于已在企业财务报表中或纳税申报表中确认的事项对未来纳税影响而产生的递延资产和负债。

ias12,规范所得税的会计处理。

asb18,为了规范企业所得税的确认、计量和相关信息的披露。

在所得税会计目标方面,fas109规定比较具体,而ias12和asb18比较抽象。

2.范围比较。

fas109,规定当前应付所得税和未来纳税影响额的会计核算和报告标准。

fas109规定,未来纳税影响包括三部分内容:早于或迟于会计收益的包含在应税收益中收入、费用,利得或损失;产生税基差异的其他事项;以前年度经营损失或者返回已付所得税贷项和未来应付所得税抵免。

ias12,适用于财务报表中对所得税的会计处理,包括对一个会计期内有关所得税支出或减免金额的确定以及这项金额在财务报表中的列示。

不涉及政府补助金或投资税款抵免的会计处理方法。

下列税款也未考虑包括在范围之内:退还给企业的所得税款(仅限于当据以计税的收益金额以股利形式分配时);企业在分配股利时缴纳的、可抵减企业应交所得税的税款。

中美的会计准则制度差异英语作文

中美的会计准则制度差异英语作文Accounting standards are the backbone of financial reporting, and they vary significantly between China and the United States. In the U.S., the Financial AccountingStandards Board (FASB) sets the Generally Accepted Accounting Principles (GAAP), which are known for their principles-based approach. In contrast, China's Accounting Standards for Business Enterprises (ASBE) are more rules-based, providing more specific guidelines for financial reporting.One notable difference lies in the treatment of revenue recognition. U.S. GAAP requires companies to recognizerevenue when it is earned and realized, whereas Chinese ASBE requires the recognition of revenue when the transaction is completed and the risk and rewards of ownership have been transferred.Another distinction is the approach to asset valuation. Under U.S. GAAP, assets are often carried at fair value,which can fluctuate with market conditions. Chinese ASBE, however, typically requires assets to be carried athistorical cost, providing more stability in financial statements.The differences extend to the treatment of leases as well. U.S. GAAP has recently adopted a new standard that requires most leases to be recognized on the balance sheet, whereas Chinese ASBE has not yet implemented such a requirement,often resulting in off-balance sheet treatment for operating leases.Investors and analysts must be aware of these differences when comparing financial statements of companies from both countries. The varying standards can lead to discrepancies in reported earnings, assets, and liabilities, which can affect investment decisions and financial analysis.In conclusion, while both countries strive for transparency and accuracy in financial reporting, the underlying principles and practices of their accounting standards create a complex landscape for international business and investment. Understanding these differences is crucial for anyone navigating the global financial markets.。

最新usgaap美国会计准则与cngaap中国会计准则具体差异列表对比资料

1.存货表1 企业会计准则第1号一存货的差异比较4.2长期股权投资表2 企业会计准则第2号一长期股权投资的差异比较4.3固定资产表3 企业会计准则第4号一固定资产的差异比较4.4无形资产表4 企业会计准则第6号一无形资产的差异比较4.5非货币性资产交换表5 企业会计准则第7号一非货币性资产交换的差异比较4.6雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)表6 企业会计准则第9/10/11号一雇员薪酬、福利、奖励差异的比较4.7收入表7企业会计准则第14号一收入的差异比较4.8建造合同表8 企业会计准则第15号一建造合同的差异比较4.9政府补助表9 企业会计准则第16号一政府补助的差异比较(二) 财政贴息。

有两种方式:(1)财政将贴息资金直接拨付给受益企业;( 2)财政将贴息资金拨付给贷款银行,由贷款银行以政策性优惠 利率向企业提供贷款(三) 税收返还。

税收返还是政府按照国家有关规定采取先征后返(退)、即征即退等办法 向企业返还的税款,属于以税收优惠形式给予的一 种政府补助。

注:增值税岀口退税不属于政府补助,直接减征、 免征、增加计税抵扣额、抵免部分税额等形式不在 此列未直接向企业无偿提供资金,但并未改变企业获得政府补偿的实 质,因而也属于政府补偿计量 政府补助为货币性资产的,应当按照收到或应收的 金额计量。

政府补助为非货币性资产的,应当按照 公允价值计量;公允价值不能可靠取得的,按照名 义金额计量。

名义金额为 1元与资产相关的政府补助,应当确认为递延收益,并 在相关资产使用寿命内平均分配,计入当期损益。

但是,按照名义金额计量的政府补助,直接计入当 期损益(营业外收入)。

与收益相关的政府补助,应当分别下列情况处理:(1) 用于补偿企业以后期间的相关费用或损失的, 确认为递延收益,并在确认相关费用的期间,计入 当期损益(营业外收入)。

(2) 用于补偿企业已发生的相关费用或损失的, 直接计入当期损益(营业外收入) 已确认的政府补助需要返还的,应当分别下列情况处理: (一) 存在相关递延收益的,冲减相关递延收益账 面余额,超岀部分计入当期损益。

美国和中国的会计准则制度的对比英语作文

美国和中国的会计准则制度的对比英语作文Title: A Comparative Analysis of US GAAP and Chinese Accounting StandardsThe financial reporting landscape across global economies is shaped by the accounting standards adopted by each nation. Among these, the United States Generally Accepted Accounting Principles (US GAAP) and the Chinese Accounting Standards (CAS) stand out as two significant frameworks. This essay aims to compare and contrast the key features of US GAAP and CAS, highlighting their similarities and differences in approach to financial reporting.1. Overview of US GAAP and CASUS GAAP: Developed by the Financial Accounting Standards Board (FASB), US GAAP is a comprehensive set of accounting rules widely used in the United States for preparing and reporting financial statements.CAS: Established by the Ministry of Finance of China, CAS is designed to align with international financial reporting standards while maintaining specific provisions tailored to the Chinese economic environment.2. Convergence and International AlignmentUS GAAP: Has historically been more independent, though recent efforts have been made to converge with International Financial Reporting Standards (IFRS).CAS: Has shown a strong commitment to convergence with IFRS, aiming to enhance comparability and transparency in financial reporting.3. Key Differences in Accounting TreatmentRevenue Recognition: US GAAP provides more detailed guidance on revenue recognition, while CAS follows a principles-based approach similar to IFRS.Inventory Valuation: Under US GAAP, companies can choose between different inventory costing methods, whereas CAS mandates the use of historical cost or market price, whichever is lower.Intangible Assets: US GAAP has stringent criteria for capitalization of intangible assets, while CAS allows for greater flexibility in this area.4. Disclosure RequirementsUS GAAP: Emphasizes extensive disclosures to provide users with a comprehensive understanding of the company's financial health.CAS: While also requiring disclosure of relevant information, may have less detailed requirements compared to US GAAP.5. Regulatory Oversight and EnforcementUS GAAP: Enforced by the Securities and Exchange Commission (SEC) and subject to rigorous auditing standards.CAS: Monitored by the Chinese regulatory authorities, with increasing emphasis on compliance and enforcement in recent years.The comparison between US GAAP and CAS reveals both commonalities and distinctions in their approaches to financial reporting. While both systems strive for accuracy and transparency, they reflect the unique contexts of their respective economies. As the world becomes increasingly interconnected, the trend towards convergence of accounting standards continues, with the potential to simplifycross-border financial analysis and investment decisions. However, it is crucial to recognize the nuances and adapt accordingly when navigating the financial statements prepared under these distinct accounting regimes.。

US-GAAP美国会计准则与CN-GAAP中国会计准则具体差异-列表对比

1.存货

表1 企业会计准则第1号—存货的差异比较

4.2 长期股权投资

表2 企业会计准则第2号—长期股权投资的差异比较

4.3 固定资产

表3 企业会计准则第4号—固定资产的差异比较

4.4 无形资产

表4 企业会计准则第6号—无形资产的差异比较

4.5 非货币性资产交换

表5 企业会计准则第7号—非货币性资产交换的差异比较

4.6 雇员薪酬、福利、奖励(职工薪酬、企业年金基金、股份支付)

4.7 收入

4.8 建造合同

表8 企业会计准则第15号—建造合同的差异比较

4.9 政府补助

4.10 所得税

4.11 企业合并

表11 企业会计准则第20号—企业合并的差异比较

4.12 金融工具

表12 企业会计准则第22/23/24/37号—金融工具确认、计量、转移、套期保值及列报的差异比较

4.13 会计政策、会计估计变更和差错更正

表13 企业会计准则第28号—会计政策、会计估计变更和会计差错更正的差异比较

4.14 财务报表列报

4.15 中期财务报告

表15 企业会计准则第29号—中期财务报告的差异比较

4.16 关联方披露。

中美的会计准则制度的对比英语作文

中美的会计准则制度的对比英语作文A Comparison of Accounting Standards and Systems between China and the United StatesIntroductionIn today's global economy, accounting standards play a crucial role in ensuring the transparency and reliability of financial reporting. China and the United States, as two of the world's largest economies, have their own unique accounting systems and standards. In this paper, we will compare the accounting standards and systems of China and the United States, highlighting the key similarities and differences between the two countries.Accounting Standards in ChinaIn China, the accounting standards are issued by the Ministry of Finance (MoF) and are known as Chinese Accounting Standards (CAS). CAS are based on a mix of international accounting standards (IAS/IFRS) and local regulations. The standards are compulsory for all enterprises in China, including foreign-invested enterprises and listed companies. CAS are aimed at improving the quality and transparency of financialreporting, enhancing the comparability of financial statements, and facilitating the development of the capital markets.One of the key characteristics of CAS is that they are more rules-based than principle-based. This means that the standards provide detailed guidelines and specific rules for financial reporting, leaving less room for interpretation. In addition, Chinese accounting standards place a strong emphasis on prudence and conservatism, which can sometimes lead to more conservative financial reporting practices.Accounting Standards in the United StatesIn the United States, accounting standards are issued by the Financial Accounting Standards Board (FASB) and are known as Generally Accepted Accounting Principles (GAAP). GAAP are considered the gold standard of accounting in the United States and are widely recognized and accepted by investors, regulators, and other stakeholders. GAAP are based on a principles-based approach, which focuses on conceptual frameworks and broad accounting principles rather than detailed rules.One of the key characteristics of GAAP is their flexibility and adaptability. GAAP allows for professional judgment and interpretation in financial reporting, which can result in more subjective accounting practices. In addition, GAAP also place astrong emphasis on fair value accounting, which values assets and liabilities at their current market prices.Comparison of Accounting SystemsWhen comparing the accounting systems of China and the United States, several key differences emerge. One of the main differences is the level of government involvement in setting accounting standards. In China, the government plays a more active role in regulating and enforcing accounting standards, while in the United States, the FASB operates independently of the government.Another difference is the level of enforcement and compliance with accounting standards. In China, there have been concerns about the quality and reliability of financial reporting, with instances of fraud and misrepresentation. In contrast, the United States has a strong regulatory framework and enforcement mechanisms to ensure compliance with GAAP.ConclusionIn conclusion, while both China and the United States have their own unique accounting standards and systems, they share a common goal of enhancing transparency and reliability in financial reporting. The differences between the two countries liein the approach to setting standards, the level of government involvement, and the emphasis on rules-based versus principles-based accounting. By understanding these differences, companies operating in both countries can navigate the complex landscape of global accounting standards and comply with the regulatory requirements of each jurisdiction.。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

[Follow PRC GAAP](CIT Law I/R 56)

Goodwill is recognized only in a business combination and is measured as a residual.

[Similar to US GAAP]CAS 20.13

2. Income Statement

3. Statement of Cash Flows

4. Statement of ShareholderEquity

5. Notes to Financial Statements

[Similar to USGAAP]

CAS 30.2

Annual CorporateIncome Tax Return

For other losses of fixed assets,the taxauthority’sapprovalshall be required for deduction.

(SAT Order [2011] No.25)

Intangible Assets and Goodwill

Intangible assets are measured initially atfair value.

Landaccounted for as a fixed assetisnot depreciated.(CIT Law 11)

Estimates of useful life and residual value, and the method of depreciation are reviewed only when events or changes in circumstancesindicatethatthe current estimates or depreciation method areno longer appropriate.

Anychangesare accounted for prospectively as a change inestimate.

An enterprise shall,at least at the end of each year, have a check onthe useful life, expected netsalvage value, and the depreciation method of thefixed assets.(CAS 4.19)

(CIT Law I/R 67)

Subsequent expenditureson an intangible asset isnotcapitalizedunless it can be demonstrated that the expenditureincreases the utility of the asset.

[Similar to US GAAP. Investment Property–Building is notdepreciated(a HFS asset)]

(CAS 4.14)

Land is not depreciated.(CAS 4.14)

Idlefixedassets(other than buildings) andfixedassets that is not related tobusiness are not depreciated.

Therevaluationof property, plant and equipment isnot permitted.

[Similar to US GAAP](CAS 4.6)

[Follow PRC GAAP](CIT Law I/R 56)

Thegain or loss on disposalis the difference between thenet proceedsreceived and thecarrying amountof the asset.

Property, plant and equipment is recognized initially at cost.

[Similar to US GAAP](CAS 4.7)

[Similar to US GAAP](CIT Law I/R 56)

Property, plant and equipment is depreciated over its usful life.

It only specifies subsequent expenditures on“R&D”projects.[R-expense; D-capitalized](CAS 6.10)

Borrowig cost could be capitalized.

(CIT Law I/R 37)

Both internal research and development expenditureisexpensedas incurred. Special capitalization criteria apply to in-process R&D acquired in a business combination, direct-response advertising, software developed for internal use and softwaredeveloped for sale to third parties.

[Similar to US GAAP](CAS 4.6)

Comprehensive repair costfor fixed assets should becapitalizedand amortized over no less than 3 years.

(CIT Law 13, Байду номын сангаасIT Law I/R 70)

The presentation of financial statements of the current period shall atleast provide thecomparative dataof all items of theprevious comparativeperiod, as well as the explanations on the understanding of the financialstatements of the current period, unless it is otherwise provided for in otheraccounting standards.(CAS 30.8)

[Similar to US GAAP. In addition,relevant tax expensesare also deductible in computing the disposal gain or loss.](CAS 4.6)

Disposal gain is taxable for CIT.

"Reversal" of impairment loss is not allowed.

[Similar to US GAAP]CAS 6.19

[Similar to US GAAP]CAS 8.17

Intangible assets that are not related to business cannot be amortized.

(CIT Law 12)

Intangible assets withfiniteuseful lives areamortizedover their expected useful lives.

[Similar to US GAAP]CAS 6.17

Intangible assets should be amortized bystraight line methodover no less than10 yearsor overcontractual period.

Straight line method

Declining balance method

Sum-of-the-years'-digits method

Depreciation based on use (activity)

[Similar to US GAAP](CAS 4.17)

Only deprecition computed bystraight line methodis deductible for CIT purpose. (CIT Law I/R 59)

Comparison between US GAAP, PRC GAAP and PRC Tax–Part I

March 20, 2012

US GAAP

PRC GAAP

PRC Tax

Form and Components of Financial Statements

1. Balance Sheet

[Similar to US GAAP.The assets and liabilities shall be presented ascurrentandnon-currentassets and liabilities, respectively.](CAS 30.12)

N/A

Property,Plant andEquipment

(13 forms)

Related Party Transaction Forms

(9 Forms)

USGAAPdoes not requirecomparative information. However,SEC registrantsare required to presentbalance sheetsas of the end of thecurrent andprior reporting periodsand allother statementsfor thethree most recent reporting periods.