风险管理与金融机构第二版课后习题答案

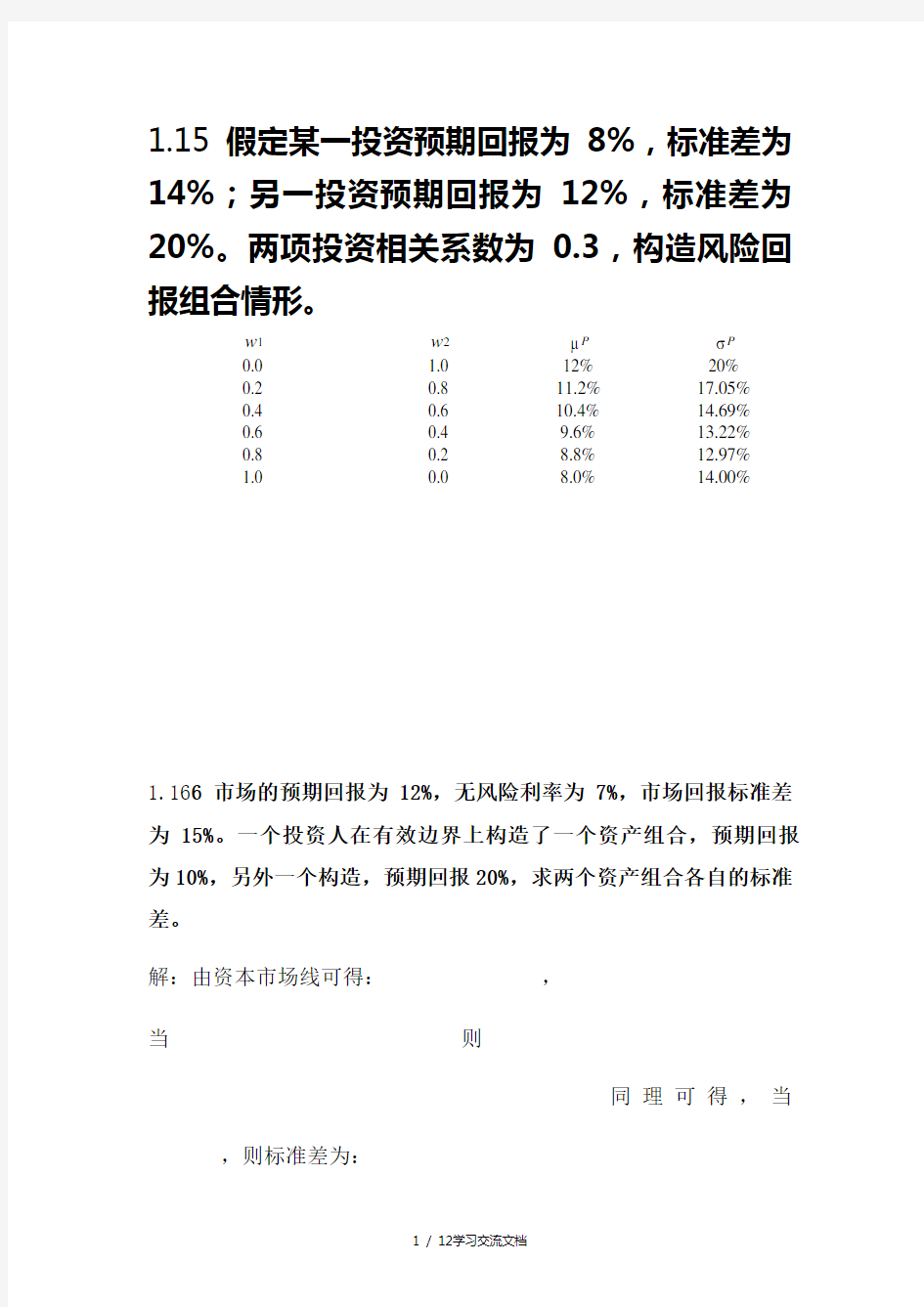

1.15假定某一投资预期回报为8%,标准差为14%;另一投资预期回报为12%,标准差为20%。两项投资相关系数为0.3,构造风险回报组合情形。

w1w2μPσP

0.0 1.0 12% 20%

0.2 0.8 11.2% 17.05%

0.4 0.6 10.4% 14.69%

0.6 0.4 9.6% 13.22%

0.8 0.2 8.8% 12.97%

1.0 0.0 8.0% 14.00%

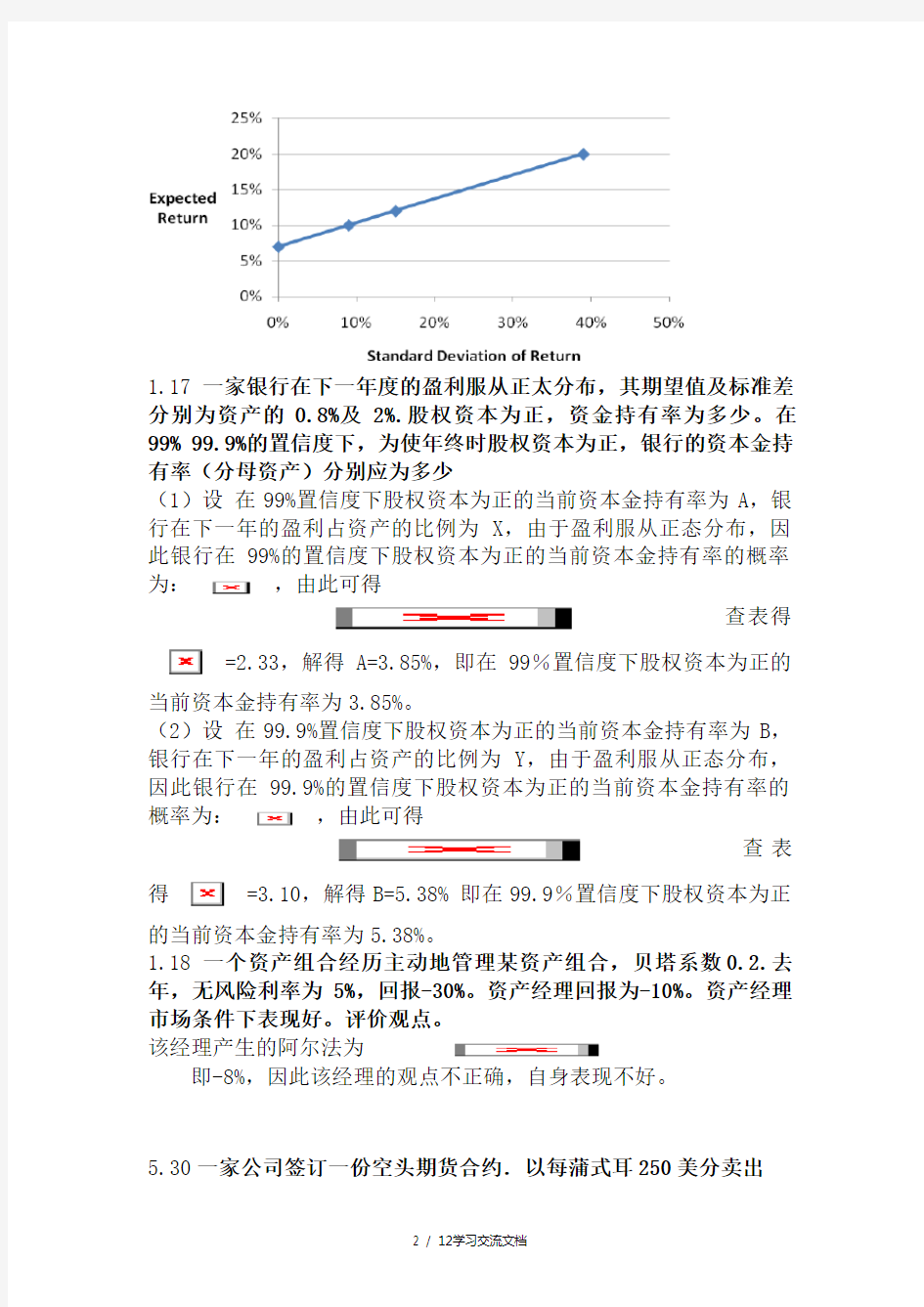

1.166市场的预期回报为12%,无风险利率为7%,市场回报标准差为15%。一个投资人在有效边界上构造了一个资产组合,预期回报为10%,另外一个构造,预期回报20%,求两个资产组合各自的标准差。

解:由资本市场线可得:,

当则

同理可得,当,则标准差为:

1.17一家银行在下一年度的盈利服从正太分布,其期望值及标准差分别为资产的0.8%及2%.股权资本为正,资金持有率为多少。在99% 99.9%的置信度下,为使年终时股权资本为正,银行的资本金持有率(分母资产)分别应为多少

(1)设在99%置信度下股权资本为正的当前资本金持有率为A,银行在下一年的盈利占资产的比例为X,由于盈利服从正态分布,因此银行在99%的置信度下股权资本为正的当前资本金持有率的概率为:,由此可得

查表得=2.33,解得A=3.85%,即在99%置信度下股权资本为正的

当前资本金持有率为3.85%。

(2)设在99.9%置信度下股权资本为正的当前资本金持有率为B,银行在下一年的盈利占资产的比例为Y,由于盈利服从正态分布,因此银行在99.9%的置信度下股权资本为正的当前资本金持有率的概率为:,由此可得

查表得=3.10,解得B=5.38% 即在99.9%置信度下股权资本为正

的当前资本金持有率为5.38%。

1.18一个资产组合经历主动地管理某资产组合,贝塔系数0.

2.去年,无风险利率为5%,回报-30%。资产经理回报为-10%。资产经理市场条件下表现好。评价观点。

该经理产生的阿尔法为

即-8%,因此该经理的观点不正确,自身表现不好。

5.30一家公司签订一份空头期货合约.以每蒲式耳250美分卖出

5000蒲式耳小麦。初始保证金为3000美元,维持保证金为2000美元。价格如何变化会导致保证金催付?在什么情况下,可以从保证金账户中提出1500美元?

There is a margin call when more than $1,000 is lost from the margin account. This happens when the futures price of wheat rises by more than 1,000/5,000 = 0.20. There is a margin call when the futures price of wheat rises above 270 cents. An amount, $1,500, can be withdrawn from the margin account when the futures price of wheat falls by

1,500/5,000 = 0.30. The withdrawal can take place when the futures price falls to 220 cents.

还有,当超过000美元的保证金帐户失去了补仓。发生这种情况时,小麦期货价格上涨超过1000/5000=0.20。还有,当小麦期货价格高于270美分补仓。的量,1,500美元可以从保证金账户被撤销时,小麦的期货价格下降了1500/5000=0.30。停药后可发生时,期货价格下跌至220美分。

5.31 股票的当前市价为94美元,同时一个3个月期的、执行价格为95美元的欧式期权价格为4.70美元,一个投资人认为股票价格会涨,但他并不知道是否应该买入100股股票或者买入2000个(相当于20份合约)期权,这两种投资所需资金均为9400美元。在此你会给出什么建议?股票价格涨到什么水平会使得期权投资盈利更好?

设 3个月以后股票的价格为X美nn’n元(X>94)(1)当

美元时,此时股票价格小于或等于期权执行价格,考虑到购买期权的费用,应投资于股票。

(2)当美元时,投资于期权的收益为:

美元,投资于股票的收益为美元令

解得X= 100美元

给出的投资建议为:若3个月以后的股票价格:美元,

应买入100股股票;若3个月以后的股票价格X=100美元,则两种投资盈利相同;若3个月以后股票的价格:美元,应买入

2000个期权,在这种价格下会使得期权投资盈利更好。

5.35一个投资人进入远期合约买入方,执行价格为K,到期时间为将来某一时刻。同时此投资人又买入一个对应同一期限,执行价格也为K的看跌期权,将这两个交易组合会造成什么样的结果?

假设到期标的资产的价格为S,当S>K,远期合约盈利(S-K),期权不执行,亏损期权费p,组合净损益为S-K-p,当S 5.37 一个交易员在股票价格为20美元时,以保证金形式买入200股股票,初始保证金要求为60%,维持保证金要求为30%,交易员最初需要支付的保证金数量为多少?股票在价格时会产生保证金催付?(1)由题目条件可知,初始股票价格为20美元,购入了200股股票,那么初始股票价值为美元,初始准备金为 美元. (2)设当股票价格跌至X美元时产生准备金催款 当股票价格下跌至X美元时,股票价值为,则股票价值下跌了美元此时保证金余额为美 元,又已知维持保证金为30%,则有:解得美元。 7.1交易组合价值对于S&P500的dalta值为-2100.当前市值1000,。估计上涨到1005时,交易组合价格为多少? 交易组合价值减少10500美元。 7.3一个DeLta中的交易组合Gamma为30,估测两种标的资产变化对交易组合价值的影响(a)的资产突然涨2美元(b)突然跌2美元 两种情形下的增长量均为0.5*30*4=60美元 7.15一个Delta中性交易组合Gamma及Vega分别为50和25.解释当资产价格下跌3美元及波动率增加4%时,交易组合价格变化。 由交易组合价格的泰勒方程展开式得,交易组合的价格变化=25*4%+1/2*50*(-3)(-3)=226(美元),即交易组合的价格增加226美元。 7.17根据表格信息可以得出组合资产的头寸数量为-(1000+500+2000+500)=-4000; 组合的Delta=(-1000) 0.5+(-500) 0.8+(-2000) (-0.4)+(-500) 0.7=-450; 同理可得组合的Gamma=-6000;组合的Vega=-4000; (a)为达到Gamma中性,需要在交易组合中加入 份期权,加入期权后的Delta为,因此,为保证新的交易组合的Delta中性,需要卖出1950份英镑。为使Gamma 中性采用的交易是长头寸,为使Delta中性采用的交易是短头寸。 (b)为达到Vega中性,需要在交易组合中加入份期权,加入期权后的Delta为,因此,为保证新的交易组合的Delta中性,需要卖出2550份英镑。为使Vega中性采用的交易是长头寸,为使Delta中性采用的交易是短头寸。 7.18引入第二种交易所交易期权,假定期权Delta为0.1,Gamma 为0.5,Vega为0.6,采用多少数量的交易可使场外交易组合的Delta,Gamma,Vega为中性。 首先计算交易组合的Delta,Gamma,Vega Delta=(-1000)x0.5+(-500)x0.8+(-2000)x(-0.4)+(-500)x0.7=-450 Gamma=(-1000)x2.2+(-500)x0.6+(-2000)x1.3+(-500)x1.8=-6000 Vega =(-1000)x1.8+(-500)x0.2+(-2000)x0.7+(-500)x1.4=-4000 解得 因此,分别加入3200份和2400份交易所交易期权可使交易组合的Gamma,Vega都为中性。 加入这两种期权后,交易组合的Delta=3200x0.6+2400x0.1-450=1710,因此必须卖出1710份基础资产以保持交易组合的Delta 中性。 8.15假定某银行有100亿美元1年期及300亿美元5年期贷款,支撑这些资产的是分别为350亿美元1年期及50亿美元的5年期存款。假定银行股本为20亿美元,而当前股本回报率为12%。请估计要使下一年股本回报率变为0,利率要如何变化?假定银行税率为30%。 这时利率不匹配为250亿美元,在今后的5年,假定利率变化为t,那么银行的净利息收入每年变化 2.5t亿美元。按照原有的12%的资本收益率有,若银行净利息收入为x,既有x(1-30%)/20=12%,解得净利息收入为x=24/7.最后有 2.5t=24/7,解得1.3714%。即利率要上升1.3714个百分点。 8.16组合A由1年期面值2000美元的零息债券及10年期面值6000美元的零息债券组成。组合B是由5.95年期面值5000年期的债券组成,当前债券年收益率10%(1)证明两个组合有相同的久期 (2)证明如果收益率有0.1%上升两个组合价值百分比变化相等(3)如果收益率上升5% 两个组合价值百分比变化是多少? (1)对于组合A,一年期债券的现值,十年其债券的现值组合A的久期为 由于组合B的久期亦为5.95,因此两个组合的久期相等(2)因为收益率上升了0.1%,上升幅度比较小,因此A,B组合价值的变化可以分别由以下公式表示: 所以有 ; 由(1)可知组合A与组合B的久期相等,因此两个组合价值变化同利率变化的百分比相同。 (3)因为收益率上升了5%,上升幅度较大,因此A,B组合价值的变化可分别表示为: ; 所以有; 可以计算得到组合A的曲率为 组合B的曲率为 分别把数据代入公式,计算得到 因此,如果收益率上升5%,两种组合价值变化同利率变化的百分比分别为-4.565和-5.065. 《商业银行管理学》课后习题及题解 第一章商业银行管理学导论 习题 一、判断题 1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。 2. 政府放松金融管制与加强金融监管是相互矛盾的。 3. 商业银行管理的最终目标是追求利润最大化。 4. 在金融市场上,商业银行等金融中介起着类似于中介经纪人的角色。 5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理如边 际分享原理、投入要素最优组合原理、规模经济原理也适用于商业银行。 6. 金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体 地 位。 7. 企业价值最大化是商业银行管理的基本目 标。 8. 商业银行管理学研究的主要对象是围绕稀缺资源信用资金的优化配置所 展开的各种业务及相关的组织管理问题。 9. 商业银行资金的安全性指的是银行投入的信用资金在不受损失的情况下 能如期收回。 二、简答题 1. 试述商业银行的性质与功能。 2. 如何理解商业银行管理的目标? 3. 现代商业银行经营的特点有哪些? 4. 商业银行管理学的研究对象和内容是什么? 5. 如何看待“三性”平衡之间的关系? 三、论述题 1. 论述商业银行的三性目标是什么,如何处理三者之间的关系。 2. 试结合我国实际论述商业银行在金融体系中的作用。 第一章习题参考答案 一、判断题 1.√ 2.× 3.× 4.√ 5.× 6.√ 7.× 8.√ 9.√ 二、略;三、略。 第二章商业银行资本金管理 习题 一、判断题 1. 新巴塞尔资本协议规定,商业银行的核心资本充足率仍为4%。 2. 巴塞尔协议规定,银行附属资本的合计金额不得超过其核心资本的50%。 3. 新巴塞尔资本协议对银行信用风险提供了两种方法:标准法和内部模型法。 4. 资本充足率反映了商业银行抵御风险的能力。 5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。 6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。 二、单选题 1. 我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的。 A. 20% B. 50% C. 70% D. 100% 2. 商业银行用于弥补尚未识别的可能性损失的准备金是。 A. 一般准备金 B. 专项准备金 C. 特殊准备金 D. 风险准备金 Chapter Nine Interest Rate Risk II Chapter Outline Introduction Duration A General Formula for Duration ?The Duration of Interest Bearing Bonds ?The Duration of a Zero-Coupon Bond ?The Duration of a Consol Bond (Perpetuities) Features of Duration ?Duration and Maturity ?Duration and Yield ?Duration and Coupon Interest The Economic Meaning of Duration ?Semiannual Coupon Bonds Duration and Immunization ?Duration and Immunizing Future Payments ?Immunizing the Whole Balance Sheet of an FI Immunization and Regulatory Considerations Difficulties in Applying the Duration Model ?Duration Matching can be Costly ?Immunization is a Dynamic Problem ?Large Interest Rate Changes and Convexity Summary Appendix 9A: Incorporating Convexity into the Duration Model ?The Problem of the Flat Term Structure ?The Problem of Default Risk ?Floating-Rate Loans and Bonds ?Demand Deposits and Passbook Savings ?Mortgages and Mortgage-Backed Securities ?Futures, Options, Swaps, Caps, and Other Contingent Claims Chapter Fifteen Foreign Exchange Risk Chapter Outline Introduction Sources of Foreign Exchange Risk Exposure ?Foreign Exchange Rate Volatility and FX Exposure Foreign Currency Trading ?FX Trading Activities ?The Profitability of Foreign Currency Trading Foreign Asset and Liability Positions ?The Return and Risk of Foreign Investments ?Risk and Hedging ?Interest Rate Parity Theorem ?Multicurrency Foreign Asset-Liability Positions Summary Solutions for End-of-Chapter Questions and Problems: Chapter Fifteen 1. What are the four FX risks faced by FIs? The four risks include (1) trading in foreign securities, (2) making foreign currency loans, (3) issuing foreign currency-denominated debt, and (4) buying foreign currency-issued securities. 2.What is the spot market for FX? What is the forward market for FX? What is the position of being net long in a currency? The spot market for foreign exchange involves transactions for immediate delivery of a currency, while the forward market involves agreements to deliver a currency at a later time for a price or exchange rate that is determined at the time the agreement is reached. The net exposure of a foreign currency is the net foreign asset position plus the net foreign currency position. Net long in a currency means that the amount of foreign assets exceeds the amount of foreign liabilities. 3.X-IM Bank has ¥14 million in assets and ¥23 million in liabilities and has sold ¥8 million in foreign currency trading. What is the net exposure for X-IM? For what type of exchange rate movement does this exposure put the bank at risk? The net exposure would be ¥14 million – ¥23 million – ¥8 million = -¥17 million. This negative exposure puts the bank at risk of an appreciation of the yen against the dollar. A stronger yen means that repayment of the net position would require more dollars. 4.What two factors directly affect the profitability of an FI’s position in a foreign currency? The profitability is a function of the size of the net exposure and the volatility of the foreign exchange ratio or relationship. 5. The following are the foreign currency positions of an FI, expressed in dollars. Currency Assets Liabilities FX Bought FX Sold Swiss franc (SF) $125,000 $50,000 $10,000 $15,000 British pound (£) 50,000 22,000 15,000 20,000 Japanese yen (¥) 75,000 30,000 12,000 88,000 a. What is the FI’s net exposure in Swiss francs? Net exposure in Swiss francs = $70,000. b. What is the FI’s net exposure in British pounds? Net exposure in British pounds = $23,000. c. What is the FI’s net exposure in Japanese yen? 第一章习题 判断题 1. 《金融服务现代化法案》的核心内容之一就是废除《格拉斯-斯蒂格尔法》。() 2. 政府放松金融管制与加强金融监管是相互矛盾的。() 3. 商业银行管理的最终目标是追求利润最大化。() 4. 在金融市场上,商业银行起着类似于中介经纪人的角色。() 5. 商业银行具有明显的企业性质,所以常用于企业管理的最优化原理,如边际分析原理、投入要素最优组合原理、规模经济原理也适用于商业银行。() 6. 金融市场的交易成本和信息不对称决定了商业银行在金融市场中的主体地位。() 7. 企业价值最大化是商业银行管理的基本目标。() 8. 商业银行管理学研究的主要对象是围绕稀缺资源—信用资金的优化配置所展开的各种业务及相关的组织管理问题。() 9. 商业银行资金的安全性包含两重含义:一是指银行投入的信用资金在不受损失的情况下能按期收回;二是指银行不会出现因贷款本息不能按期收回而影响客户提取存款的情况。() 第一章习题参考答案 1.√ 2.× 3.× 4.√ 5.× 6.√ 7.× 8.√ 9.√ 第二章习题 一、判断题 1.《巴塞尔新资本协议》规定,商业银行的核心资本充足率仍为4%。() 2. 《巴塞尔新资本协议》规定,银行附属资本的合计金额不得超过其核心资本的50%。() 3. 《巴塞尔新资本协议》对银行信用风险计量提供了两种方法:标准法和内部评级法。() 4. 资本充足率反映了商业银行抵御风险的能力。() 5. 我国国有商业银行目前只能通过财政增资的方式增加资本金。() 6. 商业银行计算信用风险加权资产的标准法中的风险权重由监管机关规定。() 二、单选题 1. 我国《商业银行资本充足率管理办法》规定,计入附属资本的长期次级债务不得超过核心资本的()。 A. 20% B. 50% C. 70% D. 100% )。商业银行用于弥补尚未识别的可能性损失的准备金是(2. A. 一般准备金 B. 专项准备金 C. 特殊准备金 D. 风险准备金 3. 《巴塞尔协议》规定商业银行的核心资本与风险加权资产的比例关系()。 A. ≧8% B. ≦8% C. ≧4% D. ≦4% 4. 票据贴现的期限最长不超过()。 A. 6个月 B. 9个月 C. 3个月 D. 1个月 第二章习题参考答案 一、判断题 1.× 2.× 3.√ 4.√ 5.× 6.× 二、单选题 1. B 2. A 3. C 4. A 银行金融机构 单选题 1. 根据《金融租赁公司管理办法》的规定,金融租赁公司的业务主要是:√ A 经营租赁 B 转租赁 C 租赁 D 融资租赁 正确答案: D 2. 根据《银行业监督管理法》规定,以下哪个不属于银行业金融机构:√ A 中国工商银行 B 农村信用合作社 C 北京市农村商业银行 D 金融资产管理公司 正确答案: D 3. 中国进出口银行的业务不包括:√ A 办理出口信贷 B 筹集和引导境内外资金 C 提供对外担保 D 从事人民币同业拆借和债券回购 正确答案: B 4. 新中国第一家全国性的股份制商业银行是:√ A 招商银行 B 交通银行 C 中信银行 D 兴业银行 正确答案: B 5. 按照国家有关规定,村镇银行可代理部分金融机构业务,其中不包括:√ A 政策性银行 B 保险公司 C 证券公司 D 证监会 正确答案: D 6. 中国邮政储蓄银行成立的主要目的是:√ A 发放贷款 B 回笼货币 C 发行纸币 D 经办储蓄 正确答案: B 7. 我国最初成立金融资产管理公司的时间是:√ A 1997年 B 1998年 C 1999年 D 2000年 正确答案: C 8. 以下不属于汽车金融公司业务的是:√ A 为贷款购车提供担保 B 向金融机构借款 C 提供车险业务 D 提供购车贷款 正确答案: C 9. 中国保监会监管的非银行金融机构不包括:√ A 财产保险公司 B 人身保险公司 C 基金管理公司 D 保险中介机构 正确答案: C 10. 我国农村金融机构不包括:√ A 农村信用社 B 农村商业银行 C 农村资金互助社 D 农村邮电局 正确答案: D 11. 中国建设银行整体改制为股份有限公司的时间是:√ A 2004年9月17日 B 2004年9月17日 C 2006年8月26日 D 1954年10月1日 正确答案: A 判断题 12. 1994年,我国成立了国家开发银行、中国进出口银行、中国建设银行三家政策性银行。√ 正确 错误 正确答案:错误 13. 股份制商业银行打破了计划经济体制下国家专业银行的垄断局面,促进了银行体系竞争机制的形成和竞争水平的提高。√ 正确 错误 正确答案:正确 14. 中外合资银行是指一家外国银行与其他外国金融机构共同出资设立的银行。√ 正确 错误 Chapter Twenty Seven Loan Sales and Other Credit Risk Management Techniques Chapter Outline Introduction Loan Sales The Bank Loan Sales Market ?Definition of a Loan Sale ?Types of Loan Sales ?Types of Loan Sales Contracts ?The Buyers and the Sellers Why Banks and Other FIs Sell Loans ?Reserve Requirements ?Fee Income ?Capital Costs ?Liquidity Risk Factors Deterring Loan Sales Growth in the Future ?Access to the Commercial Paper Market ?Customer Relationship Effects ?Legal Concerns Factors Encouraging Loan Sales Growth in the Future ?BIS Capital Requirements ?Market Value Accounting ?Asset Brokerage and Loan Trading ?Government Loan Sales ?Credit Ratings ?Purchase and Sale of Foreign Bank Loans Summary 第8章利率风险I 课后习题答案(1-10) 自己边做题边翻译的,仅供参考…. 1.利率波动程度比1979-1982年采用非借入准备金制度时显著降低。 2. 金融市场一体化加速了利率的变化,以及各个国家利率波动之间的传递;与过去相比,利率水平更难控制,不确定性也更大;另外,由于金融机构越来越全球化,任何利率水平的波动都会更迅速地引起公司额外的利率风险问题。 3. 再定价缺口指在一定时期内,需要再定价的资产价值和负债价值之间的差额,再定价即意味着面临一个新的利率。利率敏感性意味着金融机构的管理者在改变每项资产或负债所公布的利率之前需等待的时间。再定价模型关注净利息收入变量的潜在变化。事实上,当利率变化时,资产和负债将被重新定价,利息收入和利息支出都将发生改变,这就是所谓的“面临一个新的利率”。 4. 期限等级是指衡量资产和负债的时间期,投资组合中的证券是否有利率敏感性取决于其再定价期限时间的长短。再定价期限越长,到期或需要重新定价的证券就越多,利率风险就越大。 5. a. (1)再定价缺口= RSA - RSL = $200 - $100 million = +$100 million. 净利息收入= ($100 million)(.01) = +$1.0 million, 或$1,000,000. (2)再定价缺口= RSA - RSL = $100 - $150 million = -$50 million. 净利息收入= (-$50 million)(.01) = -$0.5 million, 或-$500,000. (3)再定价缺口= RSA - RSL = $150 - $140 million = +$10 million. 净利息收入= ($10 million)(.01) = +$0.1 million, 或$100,000. b. (1)和(3)的情况下的金融机构在利率下降时面临风险(正的再定价缺口),(2)情况下的金融机构在利率上升时面临风险(负的再定价缺口)。(3)中的金融机构面临的利率风险最低,因为其再定价缺口最小,(1)则正好相反。 6. 根据监管要求,(美国)活期存款的显性利率为零。尽管对可转让提款指令之类的交易账户(如NOW账户)支付显性利率,但是金融机构对此所支付的利率不会直接随着利率总水平的变化而变化。然而,活期存款实际上支付了隐含利息,这种隐含利息来源于金融机构并未对其支票服务收取费用。进一步说,如果利率上升了,个人存款者会来提取(或挤兑)他们的活期存款,这回迫使金融机构用高收益、有息、对利率敏感的资金来代替活期存款。零售存折储蓄账户是否应计入利率敏感性负债,也存在十分类似的争论。 7. 缺口比率是累计缺口和总资产之比。缺口比率可以告诉我们:(1)直接的利率风险情况(正的或负的再定价缺口);(2)用金融机构的资产规模去除再定价缺口可以反映风险的大小。 8. √√×√×√√√√√× 9. a. 预期的利息收入:$5m + $3.5m = $8.5m. 预期的利息支出:$4.2m + $1.2m = $5.4m. 预期的净利息收入:$8.5m - $5.4m = $3.1m. b. 利率上升2%后,净利息收入下降为: 50(0.12) + 50(0.07) - 70(0.08) - 20(.06) = $9.5m - $6.8m = $2.7m, 减少了$0.4m. c. WatchoverU储蓄银行的再定价缺口为$50m - $70m = -$20m. 用再定价模型得出的净利息收入变化为(-$20m)(0.02) = -$0.4m. d. 净利息收入变为50(0.12) + 50(0.07) - 70(0.07) - 20(0.06) = $9.5m - $6.1m = $3.4m, 增加了$0.3m. 利率敏感性资产和负债的利率变化通常是一样的,因为市场力量让利率总是同步变化。大多数情况下利率变化都是由政府决策引起的。 Chapter Two The Financial Services Industry: Depository Institutions Chapter Outline Introduction Commercial Banks ?Size, Structure, and Composition of the Industry ?Balance Sheet and Recent Trends ?Other Fee-Generating Activities ?Regulation ?Industry Performance Savings Institutions ?Savings Associations (SAs) ?Savings Banks ?Recent Performance of Savings Associations and Savings Banks Credit Unions ?Size, Structure, and Composition of the Industry and Recent Trends ?Balance Sheets ?Regulation ?Industry Performance Global Issues: Japan, China, and Germany Summary Appendix 2A: Financial Statement Analysis Using a Return on Equity (ROE) Framework Appendix 2B: Depository Institutions and Their Regulators Appendix 3B: Technology in Commercial Banking Chapter Twenty Capital Adequacy Chapter Outline Introduction Capital and Insolvency Risk ?Capital ?The Market Value of Capital ?The Book Value of Capital ?The Discrepancy between the Market and Book Values of Equity ?Arguments against Market Value Accounting Capital Adequacy in the Commercial Banking and Thrift Industry ?Actual Capital Rules ?The Capital-Assets Ratio (or Leverage Ratio) ?Risk-Based Capital Ratios ?Calculating Risk-Based Capital Ratios Capital Requirements for Other Fis ?Securities Firms ?Life Insurance ?Property-Casualty Insurance Summary Appendix 20A: Internal Ratings Based Approach to Measuring Credit Risk-Adjusted Assets Solutions for End-of-Chapter Questions and Problems: Chapter Twenty 1. Identify and briefly discuss the importance of the five functions of an FI’s capital? Capital serves as a primary cushion against operating losses and unexpected losses in the value of assets (such as the failure of a loan). FIs need to hold enough capital to provide confidence to uninsured creditors that they can withstand reasonable shocks to the value of their assets. In addition, the FDIC, which guarantees deposits, is concerned that sufficient capital is held so that their funds are protected, because they are responsible for paying insured depositors in the event of a failure. This protection of the FDIC funds includes the protection of the FI owners against increases in insurance premiums. Finally, capital also serves as a source of financing to purchase and invest in assets. 2. Why are regulators concerned with the levels of capital held by an FI compared to a non- financial institution? Regulators are concerned with the levels of capital held by an FI because of its special role in society. A failure of an FI can have severe repercussions to the local or national economy unlike non-financial institutions. Such externalities impose a burden on regulators to ensure that these failures do not impose major negative externalities on the economy. Higher capital levels will reduce the probability of such failures. 3. What are the differences between the economic definition of capital and the book value definition of capital? The book value definition of capital is the value of assets minus liabilities as found on the balance sheet. This amount often is referred to as accounting net worth. The economic definition of capital is the difference between the market value of assets and the market value of liabilities. a. How does economic value accounting recognize the adverse effects of credit and interest rate risk? The loss in value caused by credit risk and interest rate risk is borne first by the equity holders, and then by the liability holders. In market value accounting, the adjustments to equity value are made simultaneously as the losses due to these risk elements occur. Thus economic insolvency may be revealed before accounting value insolvency occurs. b. How does book value accounting recognize the adverse effects of credit and interest rate risk? Because book value accounting recognizes the value of assets and liabilities at the time they were placed on the books or incurred by the firm, losses are not recognized until the assets are sold or regulatory requirements force the firm to make balance sheet accounting adjustments. In the case of credit risk, these adjustments usually occur after all attempts to Chapter Three The Financial Services Industry: Insurance Companies Chapter Outline Introduction Life Insurance Companies ?Size, Structure, and Composition of the Industry ?Balance Sheet and Recent Trends ?Regulation Property-Casualty Insurance ?Size, Structure, and Composition of the Industry ?Balance Sheet and Recent Trends ?Regulation Global Issues Summary Solutions for End-of-Chapter Questions and Problems: Chapter Three 1. What is the primary function of an insurance company? How does this function compare with the primary function of a depository institution? The primary function of an insurance company is to provide protection from adverse events. The insurance companies accept premium payments in exchange for compensation in the event that certain specified, but undesirable, events occur. The primary function of depository institutions is to provide financial intermediation for individual and corporate savers. By accepting deposits and making loans, depository institutions allow savers with predominantly small, short-term financial assets to benefit from investments in larger, longer-term assets. These long-term assets typically yield a higher rate of return than short-term assets. 2. What is the adverse selection problem? How does adverse selection affect the profitable management of an insurance company? The adverse selection problem occurs because customers who are most in need of insurance are most likely to acquire insurance. However, the premium structure for various types of insurance typically is based on an average population proportionately representing all categories of risk. Thus the existence of a proportionately larger share of high-risk customers may cause the premium revenue received by the insurance provider to underestimate the necessary revenue to cover the insured liabilities and to provide a reasonable profit for the insurance company. 3. What are the similarities and differences among the four basic lines of life insurance products? The four basic lines of life insurance products are (1) ordinary life; (2) group life; (3) industrial life; and (4) credit life. Ordinary life is sold on an individual basis and represents the largest segment (~60%) of the life insurance market. The insurance policy can be structured as p ure life insurance (term life) or may contain a savings component (whole life or universal life). Group policies (~40%) are similar to ordinary life insurance policies except that they are centrally administered, providing cost economies in evaluating, screening, selling, and servicing the policies. Industrial life (<1.0%) has largely been replaced by group life since cost economies have made group life more affordable. Industrial life was historically marketed to individuals who would make small, very frequent payments and would require personal collection services. Credit life (<2.0%) typically is term life sold in conjunction with some debt contract 4. Explain how annuity activities represent the reverse of life insurance activities. A typical life insurance contract requires a periodic payment by one party for a promised payment of either a lump sum or an annuity if a particular event occurs, such as death or an accident. An annuity represents a reverse contract where the party purchases the right to receive periodic payments depending on the market conditions. The contract may be initiated by investing a lump sum or by making periodic payments before the annuity payments begin. Chapter Twenty One Product Diversification Chapter Outline Introduction Risks of Product Segmentation Segmentation in the U.S. Financial Services Industry ?Commercial and Investment Banking Activities ?Banking and Insurance ?Commercial Banking and Commerce ?Nonbank Financial Service Firms and Commerce Activity Restrictions in the United States versus Other Countries Issues Involved in the Diversification of Product Offerings ?Safety and Soundness Concerns ?Economies of Scale and Scope ?Conflicts of Interest ?Deposit Insurance ?Regulatory Oversight ?Competition Summary Solutions for End-of-Chapter Questions and Problems: Chapter Twenty One 1.How does product segmentation reduce the risks of FIs? How does it increase the risks of FIs? Product segmentation reduces the risks of FIs by forcing them to specialize. Specialization generates expertise and access to information, which should enable FIs to more accurately price excessively risky situations. Product segmentation also increases the risk of the FI because the benefits of diversification are reduced. Thus specialization leaves the FI more exposed to downturns in the specific market to which it is confined. 2. In what ways have other FIs taken advantage of the restrictions on product diversification imposed on commercial banks? Money market mutual funds that offer checking account-like deposits services have removed low cost deposits from bank balance sheets. Insurance companies have successfully offered annuities as savings products to compete with bank CDs. The commercial paper market has provided very effective competition for commercial lending activities of banks, and unregulated finance companies continue to make market share gains in the business credit market. 3. How does product segmentation reduce the profitability of FIs? How does product segmentation increase the profitability of FIs? Product segmentation reduces the profitability of FIs by preventing them from exploiting economies of scope across products. Moreover, tie-in sales across markets are restricted. Customers are lost to FIs that could more completely supply all of their customers' financial services needs. Since customer relationships produce information and are profitable, this reduces the profitability of segmented FIs. Product segmentation also increases the profitability of FIs by providing incentives for the FI to develop technology and other innovations to improve production efficiency. 4. What general prohibition regarding the activities of commercial banking and investment banking did the Glass-Steagall Act impose? What investment banking activities have been permitted for U.S. commercial banks? Sections 16 and 21 of the Glass-Steagall Act specifically prohibited banks from engaging in the underwriting, issuing, and distributing of stocks, bonds, and other securities, while specifically prohibiting investment banks from taking deposits and making commercial loans. See Table 21-2 for specific Glass-Steagall language. Commercial banks have been the following securities activities: a) underwriting U.S Treasury and U.S. agency securities, b) underwriting general obligation municipal securities, c) the private placement of bonds and equity securities, d) underwriting and dealing in securities offshore, e) mergers and acquisitions, f) individual trust accounts, g) dividend investment service, h) brokerage services, i) securities swaps, and j) research advice to investors separate from brokerage.《商业银行管理学》课后习题答案及解析

金融机构管理习题答案009

金融机构管理习题答案015

习题商业银行管理学

银行金融机构-课后测试及答案(满分试题)

金融机构管理习题答案027

金融机构管理第八章答案中文版

Chap002金融机构管理课后题答案

金融机构管理习题答案020

Chap003金融机构管理课后题答案

金融机构管理习题答案021