国际结算-翻译

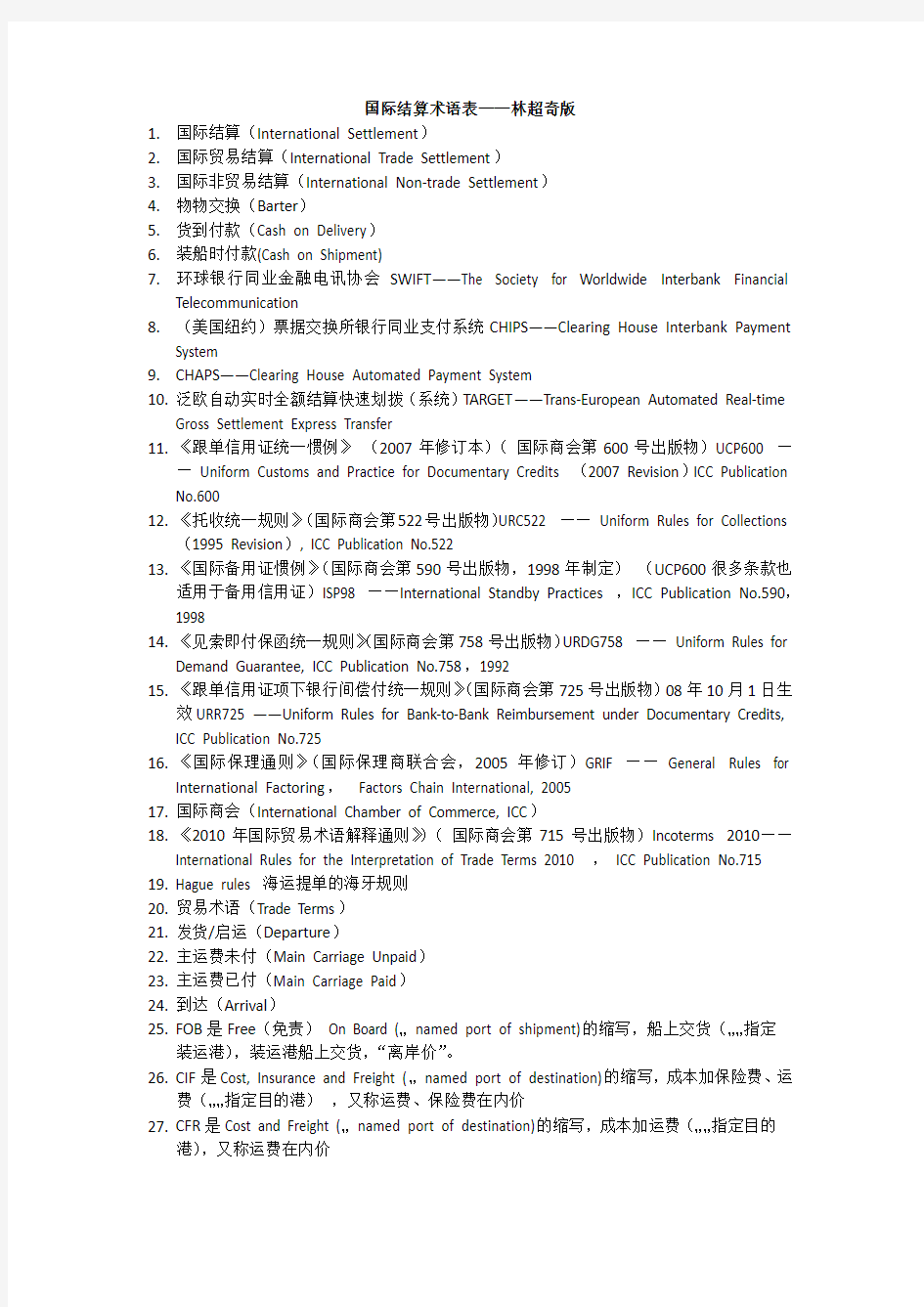

国际结算术语表——林超奇版

1.国际结算(International Settlement)

2.国际贸易结算(International Trade Settlement)

3.国际非贸易结算(International Non-trade Settlement)

4.物物交换(Barter)

5.货到付款(Cash on Delivery)

6.装船时付款(Cash on Shipment)

7.环球银行同业金融电讯协会SWIFT——The Society for Worldwide Interbank Financial

Telecommunication

8.(美国纽约)票据交换所银行同业支付系统CHIPS——Clearing House Interbank Payment

System

9.CHAPS——Clearing House Automated Payment System

10.泛欧自动实时全额结算快速划拨(系统)TARGET——Trans-European Automated Real-time

Gross Settlement Express Transfer

11.《跟单信用证统一惯例》(2007年修订本)(国际商会第600号出版物)UCP600 —

—Uniform Customs and Practice for Documentary Credits (2007 Revision)ICC Publication No.600

12.《托收统一规则》(国际商会第522号出版物)URC522 ——Uniform Rules for Collections

(1995 Revision), ICC Publication No.522

13.《国际备用证惯例》(国际商会第590号出版物,1998年制定)(UCP600很多条款也

适用于备用信用证)ISP98 ——International Standby Practices ,ICC Publication No.590,1998

14.《见索即付保函统一规则》(国际商会第758号出版物)URDG758 ——Uniform Rules for

Demand Guarantee, ICC Publication No.758,1992

15.《跟单信用证项下银行间偿付统一规则》(国际商会第725号出版物)08年10月1日生

效URR725 ——Uniform Rules for Bank-to-Bank Reimbursement under Documentary Credits, ICC Publication No.725

16.《国际保理通则》(国际保理商联合会,2005年修订)GRIF ——General Rules for

International Factoring,Factors Chain International, 2005

17.国际商会(International Chamber of Commerce, ICC)

18.《2010年国际贸易术语解释通则》)(国际商会第715号出版物)Incoterms 2010——

International Rules for the Interpretation of Trade Terms 2010 ,ICC Publication No.715

19.Hague rules 海运提单的海牙规则

20.贸易术语(Trade Terms)

21.发货/启运(Departure)

22.主运费未付(Main Carriage Unpaid)

23.主运费已付(Main Carriage Paid)

24.到达(Arrival)

25.FOB是Free(免责)On Board (…named port of shipment)的缩写,船上交货(……指定

装运港),装运港船上交货,“离岸价”。

26.CIF是Cost, Insurance and Freight (…named port of destination)的缩写,成本加保险费、运

费(……指定目的港),又称运费、保险费在内价

27.CFR是Cost and Freight (…named port of destination)的缩写,成本加运费(……指定目的

港),又称运费在内价

28.FCA是Free Carrier (…named place)的缩写,货交承运人(……指定地点)。采用这一术

语,卖方在出口国指定地点将已办理出口清关手续的货物交给买方指定的承运人,即完成交货义务

29.CPT是Carriage Paid To (…named place of destination)的缩写,运费付至(……指定目的

地)

30.CIP是Carriage and Insurance Paid to (…named place of destination)的缩写,运费、保险费

付至(……指定目的地)

31.EXW是Ex Works (…named place of delivery)的缩写,工厂交货(……指定交货地点)。该

术语代表了在商品产地或所在地交货的各种交货条件

32.FAS是Free Alongside Ship (…named port of shipment)的缩写,船边交货(……指定装运

港),又称装运港船边交货

33.DAT是Delivered At Terminal (…named terminal at port or place of destination)的缩写,运

输终端交货(……指定目的港或目的地运输终端)

34.DAP是Delivered At Place (…named place of destination)的缩写,目的地交货

35.DDP是Delivered Duty Paid (…named place of destination)的缩写,完税后交货(……指定

目的地)

36.分行(Bank Branch)

37.支行(Sub-branch)

38.联行(Sister Bank)

39.经理处(Bank Agency,Agency Office)

40.代表处(Representative Office)

41.子银行(Subsidiary Bank)

42.联营银行(Affiliate Bank)

43.银团银行(Consortium Bank)

44.代理行(Correspondent Bank)

45.印鉴(Specimen of Authorized Signatures)

46.密押(Test Key)

47.费率表(Schedule of Terms and Conditions)

48.账户行(Depositary Correspondent)

49.非账户行(Non-depositary Correspondent)

50.票据(Negotiable Instruments)

51.设权性(Right to Be Paid)

52.要式性(Requisite in Form/Solemnity)

53.文义性(Written Confirmation)

54.金钱性(Pecuniary Benefits)

55.债权性(Rights of Creditor)

56.无因性(Non-causative Nature)

57.流通转让性(Negotiability)

58.提示性(Presentation)

59.返还(缴回)性(Returnability)

60.基本当事人(Immediate Party)

61.出票人(Drawer)

62.受票人(Drawee),又称付款人(Payer)

63.收款人(Payee),又称受款人

64.执票人(Bearer)

65.其他当事人(Remote Party)

66.背书人(Endorser)

67.被背书人(Endorsee)

68.承兑人(Acceptor)

69.参加承兑人(Acceptor for sb.’s Honor)

70.参加付款人(Payer for sb.’s Honor)

71.保证人(Guarantor)

72.持票人(Holder)

73.对价持票人(Holder for Value)

74.善意持票人(Bona-fide Holder)又称正当持票人(Holder in due course)

75.汇票(Bill of Exchange, Draft)

76.装运单据Shipping Document

77.光票(Clean Bill)

78.跟单汇票(Documentary Bill)

79.商业汇票(Commercial Bill/Trade Draft)

80.银行汇票(Banker’s Bill)

81.即期汇票(Sight Bill/Demand Draft)

82.远期汇票(Time Bill/Usance Bill)

83.商业承兑汇票(Trader’s Acceptance Bill)

84.银行承兑汇票(Banker’s Acceptance Bill)

85.国内汇票(Domestic Bill / Inland Bill)

86.国际汇票(International Bill / Foreign Bill)

87.担当付款人(A Person Designated as Payer)

88.预备付款人(Referee in Case of Need)

89.免作拒绝证书(Protest Waived)

90.免发拒付通知(Notice of Dishonor Excused)

91.不得转让(Not Transferable)

92.出票(Issue, To Draw)

93.背书(Endorsement)

94.特别背书(Special Endorsement)

95.空白背书(Blank Endorsement)

96.限制性背书(Restrictive Endorsement)

97.有条件背书(Conditional Endorsement)

98.托收背书(Endorsement for Collection)

99.提示(Presentation)

100.承兑(Acceptance)

101.一般承兑(General Acceptance)

102.限制性承兑(Qualified Acceptance)

103.有条件承兑(Conditional Acceptance)

104.部分承兑(Partial Acceptance)

105.地方性承兑(Local Acceptance)

106.付款(Payment)

107.正当付款(Payment in due course)

108.拒付(Dishonor),又称退票

109.拒绝承兑(Dishonor by Non-Acceptance)

110.拒绝付款(Dishonor by Non-Payment)

111.拒付通知(Notice of Dishonor)

112.拒付证书(Protest)

113.法定公证人(Notary Public)

114.追索(Recourse)

115.保证(Guarantee/Aval)

116.被保证人(the Person Guaranteed)

117.融通汇票(Accommodation Bill)

118.贴现(Discount)

119.本票(Promissory Note)

120.商业本票(Trader’s Promissory Note)

121.银行本票(Banker’s Promissory Note)

122.银行券(Bank Note)、国际小额本票(International Money Order)、旅行支票(Traveller’s Cheque)、国库券(Treasury Bill)、存单(Certificate of Deposit)

123.国际小额本票(International Money Order)

124.旅行支票(Traveller’s Cheque)

125.支票(Cheque/Check)

126.记名支票(Cheque payable to A or order)

127.无记名支票(Cheque payable to bearer)

128.一般支票(General Cheque or Uncrossed Cheque, Open Cheque)

129.划线支票(Crossed Cheque or Transverse Lines Cheque)

130.一般划线支票(Generally Crossed Cheque)

131.特殊划线支票(Specially Crossed Cheque)

132.保付支票(Certified Cheque)

133.保付(Certified to pay)

134.汇款(Remittance)

135.顺汇(Remittance)

136.逆汇(Reverse Remittance)

137.出票法(Honour of Draft)

138.汇款人(Remitter)

139.收款人(Payee or Beneficiary)(受益人)

140.汇出行(Remitting Bank)

141.汇入行(Paying Bank)

142.汇入汇款(Inward Remittance)

143.电汇(Telegraphic Transfer, 简称T/T)

144.信汇(Mail Transfer, 简称M/T)

145.信汇委托书(M/T Advice)

146.支付委托书(Payment Order)

147.票汇(Remittance by Banker’s Demand Draft, 简称D/D)

148.采用中心汇票(Draft on Center)

149.汇款的偿付(Reimbursement of Remittance Cover)

150.汇款的退汇(Return of Remittance)

151.汇款的失效(Expiration of Remittance)

152.预付货款(Payment in advance)

153.定金(Down Payment)

154.货到付款(Payment after arrival of goods)

155.售定(Be sold out)

156.寄售(Consignment)

157.托收(Collection)

158.委托人(Principal)

159.托收行(Remitting Bank)

160.出口托收(Outward Collection)

161.代收行(Collecting Bank)

162.进口代收(Inward Collection)

163.付款人(Drawee)

164.提示行(Presenting Bank)

165.需要时的代理(Principal’s Representative in case of need or Case-of-Need)

166.金融单据(Financial Documents)

167.商业单据(Commercial Documents)

168.光票托收(Clean Collection)

169.跟单托收(Documentary Collection)

170.付款交单(Documents against Payment,简称D/P)

171.即期付款交单(D/P at sight)

172.远期付款交单(D/P at xx days after sight)

173.承兑交单(Documents against Acceptance, 简称D/A)

174.托收申请书(Collection Application)

175.托收出口押汇方式(Loan Secured by Documentary Collection Bills)

176.信托收据(Trust Receipt, 简称T/R)

177.受托人(Trustee)代保管人(Bailee)

178.信托人(Truster)

179.卖方利益险(Seller’s Contingent Interest Risk)

180.短期出口信用保险(Short Term Export Credit Insurance)

181.信用证(Letter of Credit)

182.《商业跟单信用证统一规则》(Uniform Regulations for Commercial Documentary Credits)183.《商业跟单信用证统一惯例》(Uniform Customs and Practice for Commercial Documentary Credits,简称UCP)

184.相符交单(Complying Presentation)

185.准银行实务(International Standard Banking Practice)

186.International Standard Banking Practice for the Examination of Documents under Documentary Credits《审核跟单信用证项下单据的国际标准银行实务》

187.承付(Honour)

188.开证申请人(Applicant),又称开证人(Opener)

189.开证行(Issuing Bank or Opening Bank)

190.通知行(Advising Bank or Notifying Bank)

191.受益人(Beneficiary)

192.议付行(Negotiating Bank)

193.付款行(Paying Bank or Drawee Bank)

194.偿付行(Reimbursing Bank),又称清算银行(Clearing Bank)

195.保兑行(Confirming Bank)

196.指定银行(Nominated Bank)

197.授信额度(Credit Line)

198.信开(to open by airmail/express delivery)

199.电开(to open by telecommunication / teletransmission)

200.简电开(to open by brief telecommunication)

201.Letter of Indemnity赔偿保证书

202.Letter of Guarantee保函

203.索偿通知书(Reimbursement Claim Schedule)

204.跟单信用证(Documentary L/C)

205.光票信用证(Clean Draft L/C)

206.不可撤销信用证(Irrevocable L/C)

207.可撤销信用证(Revocable L/C)

208.保兑信用证(Confirmed L/C)

209.不保兑信用证(Unconfirmed L/C)

210.即期信用证(Sight L/C)

211.带“电汇偿付条款”信用证(L/C with T/T Reimbursement Clause)

212.远期信用证(Usance L/C),又称卖方远期信用证(Seller’s Usance L/C)

213.商业承兑信用证(Trader’s Acceptance L/C)

214.延期付款信用证(Deferred Payment L/C),又称无承兑信用证(Non-Acceptance L/C)215.假远期信用证(Usance Credit Payable at Sight),又称为买方远期信用证(Buyer’s Usance Credit)

216.预支信用证(Anticipatory L/C),又称打包信用证(Packing L/C)

217.可转让信用证(Transferable L/C)

218.转让行(Transferring Bank)

219.转让证(Transferred L/C)

220.让与书(Letter of Assignment)

221.不可转让信用证(Non-Transferable L/C)

222.循环信用证(Revolving L/C)

223.自动循环(Automatic Revolving)

224.半自动循环(Semi-automatic Revolving)

225.非自动循环(Non-automatic Revolving)

226.累积循环(Cumulative Revolving)

227.累积循环(Non-cumulative Revolving)

228.非循环信用证(Non-Revolving L/C)

229.对背信用证(Back-to-Back L/C),又称为从属信用证(Secondary L/C, Subsidiary L/C) 230.对开信用证(Reciprocal L/C)

231.付款信用证(Payment L/C)

232.即期付款信用证(Sight Payment L/C)

233.延期付款信用证(Deferred Payment L/C)

234.承兑信用证(Acceptance L/C)

235.议付信用证(Negotiation L/C)

236.限制议付信用证(Restricted Negotiation L/C)

237.自由议付信用证(Freely Negotiation L/C)

238.备用信用证(Standby L/C)又称商业票据信用证(Commercial Paper L/C),担保信用证(Guarantee L/C),履约信用证(Performance L/C)

239.担保公司(Bonding Company)

240.国际保理(International Factoring)

241.双保理商保理(Two Factors System)

242.单保理商保理(Single Factor System)

243.公开型保理(Disclosed Factoring)

244.隐蔽型保理(Undisclosed Factoring)

245.到期保理(Maturity Factoring)

246.融资保理(Financed Factoring)

247.基本单据(Basic Documents)

248.附属单据(Additional Documents)

249.商业发票(Commercial Invoice)

250.首文(Heading)

251.本文(Body)

252.唛头(Marks & Nos.)

253.结文(Complementary)

254.承运人(Carrier)

255.货物收据(Receipt for the Goods)

256.已装船提单(On Board B/L or Shipped B/L)

257.备运提单(Received for Shipment B/L)

258.清洁提单(Clean B/L)

259.不清洁提单(Unclean B/L or Foul B/L )

260.记名提单(Named/Straight B/L)

261.指示提单(Order B/L)

262.不记名提单(Open /Bearer B/L)

263.直达提单(Direct B/L)

264.转船提单(Transshipment B/L)

265.联运提单(Through B/L)

266.多式联运单据(Multimodal Transport Documents, MTDs; Combined Transport Documents, CTDs)

267.全式提单(Long Form B/L)

268.略式提单(Short Form B/L)

269.托运人(Shipper)

270.收货人(Consignee)

271.被通知方(Notify Party)

272.保险单(Insurance Policy)

273.保险凭证(Insurance Certificate)

274.预约保险单(Open Policy/Open Cover)

275.联合凭证(Combined Certificate)

新编剑桥商务英语(中级)课文翻译[精品文档]

新编剑桥商务英语(中级)课文翻译 BEC课文翻译 1、We wanna hold your hand 我们愿与你携手创业 带着浓厚的经营意识,加上一些进取精神,再来瞧瞧,哈!你拥有了一家连锁店!如果想自己开店、大展身手却又苦于缺乏经验,同时又不想在这个充满风险的昙花一现的独立法人世界中立足,那么开家连锁店不失为一个明智之举。然而你必须明白自己将从事何种性质的经营,这是至关重要的。特许经营就是由一方(授予特许经营者)授权允许另一方(加盟特许经营者)使用其商标或商号,并使用其一揽子经营理念。 那么特许经营背后所隐藏的主要理念是否结合了自己独立开店和为公司打工这两种理念?英国特许经营协会会长丹·阿齐尔回答说:“绝非如此,这是一种可笑的过于简单的看法。其实这还是由你来经营自己的公司,但是避免了一些风险,同时增加了别人的支持。”他指出,相比大多数遭受失败的独立经营者,只有0.9%的特许经营店以失败告终。 尽管如此,成为特许经销商不可能使那些极具冒险精神的人感到满足。它不适合那些不想循规蹈矩的人。达美乐比萨特许经销店的销售经理威廉姆·尤班克这样说道:“如果你充满开创冒险的精神,这种形式不适合于你。它是一种原则规约,一个必须遵守规则的俱乐部。虽说有一定的独立性——我们的特许经销商可以自己制定价格表,但我们对菜单的内容要求非常严格。这是在帮助下经营公司。” 阿丝特丽德·帕狄尔刚刚成为达美乐比萨店的特许经营者,她告别了律师生涯,和她的丈夫合开一家特许经营店。“与其把所有的时间和精力倾注到为别人卖命的工作中,不如投入于自己的公司中。”帕狄尔三十一岁时放弃了薪水可观、受人尊敬的律师职业,转而经营这家比萨店,并获得回报。公司收益颇丰,业务出现了增长。 当然如果你下定决心,白手起家地单干,你随时可以从总店分离出去,另立门户,发展特许经营店。 阿齐尔说,想要设立特许经营店的新公司数目与日俱增。“加入这个队伍的人数多得令人难以置信,他们年龄越来越小,投资越来越少,他们获得回报后进行更大的风险投资。”如果能够募集到起步经费,开设自己的特许经营店,就为冒险家一展身手提供了理想机会 2、Not sold on sales “你好!我在销售部工作。”这话来自一个不善于开场白的人。不是吗?至少听起来不像战斗机飞行员或是无国界医师组织的理事那么神气。不幸的是,在销售部门工作总是摆脱不了乏味的形象,并与无商不奸的概念紧紧相联。这些也是毕业生求职问题之所在。另一方面,营销——一种不那么直接的销售方式,作为职业选择更受青睐,而且在晚餐会上听起来也更体面。原因何在?东芝电器公司的人力资源部经理苏珊·史蒂文斯认为:营销工作“显得很风光”,并且毕业生们“期待从事创造性的活动,参加公关活动,经常旅行,享受免费的娱乐”。然而

国际结算英语翻译

1.汇票的制作10个项目 汇票的内容又分为绝对必要项目和相对必要项目。绝对必要项目:1.有“汇票”的字样。2.无条件支付命令。3.确定金额4.收款人名称5.付款人名称6出票日期7出票人签章 相对必要项目:1.出票地2.付款地3.付款日期 2.支票的种类 按抬头不同分类:1.记名支票2.不记名支票 对付款闲置不同分类:1.普通支票:可取现金。2.划线支票:不可取现金,只能转账。划线支票好处在于可以延缓交易时间,可以便于追踪资金轨迹。划线支票又分为特别划线支票和一般划线支票。特别划线支票平行线会加注付款账号行名称。一般划线无须固定账户。 按是否可以流通分为可流通支票和不可流通支票。 3.提单的总类 按提单收货人的抬头划分:1.记名提单,不记名提单,指示提单。 按货物是否已装船划分:1.已装船提单,收妥备运提单。 按提单上有无批注划分:1.清洁提单2不清洁提单。 按照运输方式的不同划分为:1.直达提单2转船提单3.联运提单4.多式联运提单 按签发提单的时间划分为:1.正常提单2过期提单3.预借提单4.倒签提单 4.信用证的种类 1.不可撤销信用证 2.保兑信用证 3.即期付款信用证,迟期信用证,议付信用证,承兑信用证。 4.假远期信用证 5.红条款信用证 6.循环信用证 7.可转让信用证8背靠背信用证9对开信用证 5.托收的种类 托收根据金融单据是否伴随商业单据分为光票托收和跟单托收。跟单托收又根据票据的期限分为付款交单(D/P)(即期)和承兑交单(D/A)(远期)。付款交单是指付款人对即期汇票付款然后交单。而承兑交单是指付款人对远期汇票承兑而进行交单。 汇票 BILL OF EXCHANGE No. 汇票编号Date: 出票日期 For: 汇票金额 At 付款期限sight of this second of exchange (first of the same tenor and date unpaid) pay to the order of 受款人 the sum of金额 Drawn under 出票条款 L/C No. 信用证号Dated 信用证开征时间 To. 付款人 出票人签章

国际结算英文专业术语词汇18页

国际结算专业词汇 A Acceptance The act of giving a written undertaking on the face of a usance bill of exchange to pay a stated sum on the maturity date indicated by the drawee of the bill, (usually in exchange for documents of title to goods shipped on D/A terms) - see Collections Introduction. Acceptance Credit A documentary credit which requires the beneficiary to draw a usance bill for subsequent acceptance by the issuing bank or the advising bank or any other bank as the credit stipulates - see Documentary Credits. Accommodation Bill In the context of fraud, a bill drawn without a genuine underlying commercial transaction. Accountee Another name for the applicant/opener of a documentary credit i.e. the importer = the person for whose account the transaction is made. Advice of Fate The Collecting Bank informs the Remitting Bank of non- payment/non-acceptance or (for D/A bills) of acceptance and the bill maturity date - see Handling Import Collections. Advising Act of conveying the terms and conditions of a DC to the beneficiary. The advising bank is the issuing bank agent, usually located in the beneficiary country - see Export - DC Advising.

国际结算术语汇总

International Settlements terms Chapter one Brief introduction to international trade transshipmen 转运 capacity容量,生产量 inspection检查,视察,检验,商检 arbitration仲裁,公断 inquiry质询,调查,询盘,问价 quotation价格,报价单,行情表,报价 facilitate便利,使容易 1oan facility贷款便利 domestic家庭的,国内的 domestic product国内生产的产品 consideration体谅,考虑,需要考虑的事项,报酬,因素 dimension尺寸,尺度,维(数),体积 warehouse 仓库v.存仓 premises房屋及周围的土地,这里表示“公司或企业的所在地”amendment改善,改正,修改 update使现代化,使跟上最新的发展 reversal颠倒,逆转,反转,倒转 fulfill履行,实现,完成(计划等) fulfill ones obligation履行(职责) formality拘谨,礼节,正式手续 quay码头 procure获得,取得 to procure marine insurance 办理海上保险 to procure ship租船 breach n.违背,破坏,破裂 breach of the contract毁约 frontier国境,边疆,边境 adjoin邻接,临近,毗邻 adjoining邻接的,隔壁的,临近的 the adjoining room隔壁的房子 adjoining country邻国 furnish供应,提供, deficiency缺乏,不足 jurisdiction权限,司法权,裁判权 fluctuation波动,起伏 variation变更,变化,变异,变种 permutation置换,彻底改变,兑变 commitment委托事项,许诺,承担义务,承诺 domicile住处,法定居住地 currency/foreign exchange fluctuation汇率波动

国际结算词汇中英文14页

《国际结算》课程词汇中英文Acceptance 承兑 Acceptance Bill 承兑汇票 Acceptance for Honor 参加承兑 Acceptance Prohibited 不得提示承兑 Accepting Bank 承兑行 Acceptor for Honor 参加承兑人 Account Payee 入账款入账 Additional Documents 附属单据 Addressee 收件人 Advanced Payment Guarantee 预付款保函 Advance Factoring 预支保理业务 Advise 通知 Advising Bank 通知行 Agency Office 代理处 Airport of Departure 起运地 Airport of Destination 目的地 Airway Bill 航空运单 All Risks(A.R.)一切险 Amount 金额 Amount of Insurance 保险金额 Anti-Date B/L 倒签提单

Applicant 开征申请人、申请人 Assignee 受让人 Assignee of Proceeds 款项让渡 Assured 被保险人 Assurer 保险人 At a Fixed Date 定日 At a Fixed Period after Date 出票后定期At a Fixed Period after Sight 见票后定期At Sight 即期 Average 海损 Banker’s Cheque 银行支票 Banker’s Demand Draft 银行即期汇票Banker’s Promissory Note 银行本票Banker’s Draft 银行汇票 Bank’s Acceptance Credit 银行承兑信用证Bank’s L/C 银行保函 Bank-to-Bank 银行间 Barter Trade 易货 Basic Documents 基本单据 Bearer B/L 不记名提单 Beneficiary 受益人 Be Sold out/up 售定

国际结算-大题

2.提单的抬头有哪几种形式,不同的抬头对提单的流通性有怎样的影响? 3.在票汇、托收和信用证结算方式下使用的汇票的出票人、付款人分别有什么不同? 答:在国际贸易结算中,票汇的汇票如果是银行汇票,则出票人是买方,付款人银行;托收的汇票的出票人是卖方,付款人是买方;信用证项下的汇票的出票人信用证的受益人,付款人是开证行。 4.信用证的基本性质有哪些? 答:①开证行负第一性付款责任,L/C是开证行付款责任。 ②L/C是一项独立文件,是开证行与受益人间存在的契约,一经开立不受合同牵制。 ③L/C是单据业务,而非货物。 5.信用证结算方式下,卖方交单议付,银行发现单据存在不符点,此时卖方可以采取哪些措施? 答:①及时更正和修改。 ②向银行出具一份保函。 ③向开证行拍发要求接受不符点予付款的电传。 ④给托收方式。 7.托收结算方式下,进口商和出口商分别可以怎样贸易融资? 答:出口商:①出口押汇②打包放款③贴现④出口信贷⑤出口发票融资进口商:①进口押汇②提货担保③进口垫款④信托提货 四、案例分析题

1.甲国A公司与乙国B公司就进口钢材达成合同,钢材分两批装运,结算方式为每批分别开立不可撤销即期付款信用证。第一批货物装运后,B公司即向当地银行办理了议付,并随后得到开证行的偿付。但A公司收到货物检验后发现货物品质未达到合同要求,于是要求开证行对第二批货物拒付。这一要求被开证行拒绝。 请问:开证行拒绝A公司的要求是否合理?为什么? 答:开证行拒绝对外拒付是有道理的。因为,在信用证业务中,银行办理的依据是有关单据的情况。而不是货物的情况。在B公司所提交的单据中未能发现有不符合信用证规定的情况,则开证行必须履行自己在信用证中的承诺,向B公司付款。而且,在不可撤销信用证下,未经受益人同意,开证行不能单方面撤销已开立的信用证。鉴于上述情况,A公司只能直接依据有关的证明(包括有关的检验报告等)与B公司交涉,包括从双方协商,到调解、仲裁或司法诉讼。进一步的教训是,在国际贸易中从谈判洽商至签约前,一定要对贸易对方的资信情况有充分的了解和掌握。 2.我方以FCA贸易术语从意大利进口布料一批,双方约定最迟的装运期为4月12日,由于我方业务员疏忽,导致意大利出口商在4月15日才将货物交给我方指定的承运人。当我方收到货物后,发现部分货物有水渍,据查是因为货物交承运人前两天被大雨淋湿所致。据此,我方向意大利出口商提出索赔,但遭拒绝。 请问: (1)本案例情况下,货物风险在何时转移? 答:4月13号之前转移至买方。 (2)我方的索赔是否有理? 答:我方的索赔是无理的。因为本案中,我方收到货物后,所发现的部分货物的水渍,是因我方业务员的疏忽而造成的。所以,责任应由我方承担。因此,我方的索赔是无理的。

国际结算 英文名词翻译 按章整理

英文名词翻译 第一章 国际结算导论 international settlement 美国CHIPS 系统:纽约清算银行同业支付系统 英国CHAPS 系统: 清算所自动支付体系 布鲁塞尔SWIFT 系统: 环球银行金融电讯协会 (Critical Point for Delivery) 交货临界点 (Critical Point for Risk) 风险临界点 (Critical Point for Cost)费用临界点 《国际贸易术语解释通则》 Incoterms2000 visible trade :有(无)形贸易 (representative office) 代表处 ( agency office)代理处 (overseas sister bank /branch,subbranch )海外分/支行 (correspondent bank ) 代理银行 (subsidiary bank )附属银行(子银行) (affiliated banks ) 联营银行 (consortium bank )银团银行 甲行以乙国货币在乙行设立帐户: 甲行是往帐(Nostro a/c),即我行在你行设帐(Our a/c with you ) 乙行以甲国货币在甲行设立帐户 甲行是来帐(V ostro a/c),即你行在我行设帐(Your a/c with us ) 在银行实际业务中,增加使用“贷记”(To Credit ),减少使用“借记”(To Debit ) 第二章 票据Instrument drawer 出票人 drawee/payer 付款人 payee 收款人 endorser 背书人 endorsee 被背书人 holder in due course 善意持票人 acceptor 承兑人 guarantor 保证人 bill of exchange 汇票 mandatory elements issue 出票 endorsement 背书 presentation 提示 acceptance 承兑 payment 付款 dishonor 拒付 recourse 追索 guarantee 保证 限制性抬头 restrictive order (pay E company only)(pay E company not transferable) 指示性抬头 demonstrative order (pay to the order of B company)(pay to B company or order) 持票来人抬头 payable to bearer (pay to bearer)(pay to A company or bearer) UCP600:《跟单信用证统一惯例》 URC 522 ;《托收统一规则》 URDG458:《见索即付保函统一规则》 URR 525:《跟单信用证项下银行间偿付统一规则》 URCB524:《合同保函统一规则》

国际结算英文术语

国际结算英文术语

国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI(Electronic Data Intercharge)电子数据交换, 控制文件(Control Documents) 有权签字人的印鉴(Specimen Signatures) 密押(Test Key) 费率表(Terms and Condition) 货物单据化,履约证书化,( cargo documentation , guarantee certification) 权利单据(document of title) 流通转让性(Negotiability) 让与(Assignment) 转让(Transfer) 流通转让(Negotiation) 汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum

payable at days/ months after stated date) ④板期付款(bills payable on a fixed future date) ⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee) 同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid) 需要时的受托处理人(referee in case of need)出票人(drawer) 收款人(payee) 背书人(endorser) 被背书人(endorsee) 出票(issue) (1)制成汇票并签字(to draw a draft and to sign it); (2)将制成的汇票交付给收款人(to deliver the draft

国际结算翻译

Important Principles Regarding the Role of Banks It is important to note that documentary collection procedures are not infallible. Things can and do go wrong. Since banks act as intermediaries between buyers and sellers, both look to the banks as protectors of their interests. However, while banks have clear cut responsibilities, they are also shielded from certain problems deemed to be out of their control or responsibility. Several instances: 1.Banks act upon specific instructions given by the principal (seller) in the collection order. Seller’s instructions left out of the collection order by mistake or omitted because “we’ve always done it that way” don’t count. The principal, therefore, should take great care in preparing the collection order so that it gives complete and clear instructions. 2.Banks are required to act in good faith and exercise reasonable care to verify that the documents submitted APPEAR to be as listed in the collection order. They are, however, under no obligation to confirm the authenticity of the documents submitted. 3.Banks are not liable nor can they be held accountable for the acts of third parties. Third parties include freight forwarders, forwarding agents, customs authorities, delays or consequences resulting from Acts of God (floods, earthquakes, etc.), riots wars, civil commotions, strikes, lockouts, or other causes beyond their control. 4.Banks also assume no liability or responsibility for loss arising out of delays or loss in transit of messages, letters, documents, etc. 5.Banks assume no responsibility regarding the quantity or quality of goods shipped. They are only concerned that documents presented appear on their face to be consistent with the instructions in the collection order. Any dispute as to quality or quantity of goods delivered must be settled between the buyer and the seller. 6.Without explicit instructions, the collecting bank takes no steps to store or insure the goods. This, of course, can be a problem for both the seller and the buyers. If the seller has not received payment he still has ownership and an insurable interest in the goods. 7.If a collection remains unpaid or a bill of exchange is not accepted and the collecting bank receives no new instructions within 90 days, it may return the documents to the bank from which it received the collection order.

国际结算(英文版)清华大学出版社-答案

KEY OF INTERNATIONAL SETTLEMENT Chapter 1 1.Put the following phrases into English 2.Put the following sentences into English (1)国际结算涉及有形贸易和无形贸易,外国投资,从其他国家借贷资金,等等。 The international settlement involves tangible trades, intangible trades, foreign investments, funds borrowed from or lent to other countries and so on. (2)许多银行注重发展国际结算和贸易融资的业务。 Many banks have focused on their business of international settlement and trade finance. (3)大多数国际间的支付来自于世界贸易。 Most of the international payments originate from transactions in the world trade. (4)一般来说,国际结算的方式分为三类:汇款、托收和信用证。 Usually the international settlement is divided into three broad categories: remittance, collection and letter of credit.

3. True or False 1)International payments and settlements are financial activities conducted in the domestic country. (F) 2)Fund transfers are processed and settled through certain clearing systems.(T) 3)Using the SWIFT network, banks can communicate with both customers and colleagues in a structured, secure, and timely manner.(T) 4)SWIFT can achieve same day transfer.(T) 4.Multiple Choice 1)SWIFT is __B__ A.in the united states B. a kind of communications belonging to TT system for interbank’s fund transfer C.an institution of the United Nations D. a governmental organization 2)SWIFT is an organization based in __A___ A.Brussels B.New York C.London D.Hong Kong 3) A facility in fund arrangement for buyers or sellers is referred to __A___ A.trade finance B.sale contract C.letter of credit D.bill of exchange 4)Fund transfers are processed and settled through __C___

银行部分翻译术语

招商银行:Chi na Mercha nts Bank 中国工商银行:In dustrial and Commercial Bank of Chi na 中国农业银行:Agricultural Ba nk of Chi na 花旗银行:Citiba nk 中信银行:Chi na Citic Bank 交通银行:Bank of Communi cati ons 中国光大银行:Chi na Everbright Bank 中国建设银行:Chi na Con struction Bank 广东发展银行:Guan gdo ng Developme nt Bank 中国银行:Ba nk of Ch ina 中国民生银行:Chi na Min she ng Banking Co., Ltd. 兴业银行:In dustrial Ba nk Co., Ltd. 北京银行:Bank of China

短信费:SMS fee 账户管理费:Acco unt man ageme nt fee 现存/现金存入:Cash deposit 转支:Withdrawal through transfer 结息:Interest settlement 消费:Consumption 网银转账:On li ne tran sfer/ Tran sfer via on li ne bank 现支:Cash withdrawal 手续费:Service fee 利息税:In terest tax ATM跨行取现:Draw cash across ba nk from ATM 转存:Redeposit 委托扣:En trusted deduct ion 基金分红: Fund divide nds 授权结算: Authorized settleme nt 快捷支付:swift payme nt

国际结算知识(中英文对照)

国际结算知识(中英文对照) 不可撤销跟单信用证(公开议付) 公开议付(Unrestricted Negotiation)亦称自由议付。凡公开议付信用证,一般来讲在信用证的议付条款中须注明“公开议付”(Free Negotiation)字样。 但有的信用证不载明此字样,而载明“邀请”(Invitation)或“建议”(Order)公开议付条款。 开证银行开立的信用证是通过其承诺条款(Undertaking Clause)或称保证条款来表达其公开议付的功能。 凡信用证中列有如下承诺条款的,皆为公开议付: 1、本银行(开证银行)向出票人、背书人及正当持票人保证,凡依本信用证所列条款开具的汇票,于提交时承担付款责任。 We (Issuing Bank) hereby engage with the drawers, endorsersand bona - fide holders of draft(s) drawn under and in compliancewith the terms of the credit that such draft(s) shall be duly honoured on due presentation and delivery of documents as specified. 2、凡依本信用证条款开具并提示汇票,本银行保证对其出票人、背书人和正当持票人于交单时承兑付款。 Provided such drafts are drawn and presented in accordance withthe terms of this credit, we hereby engage with the drawers, endorsers and bona - fide holders that the said drafts shall be duly honoured on presentation. 3、本信用证项下签发的汇票并符合信用证所列条款,则其出票人、背书人、及正当持票人于19____年_月_日以前向议付银行提示议付,开证银行保证于提交单据时付清票款。 We hereby agree with the drawers,endorsers and bona-fide holdersof drafts drawn under and in compliance with the terms of this credit that the same shall be duly honoured on due presentation, and negotiated at the Negotiating Bank on or before, 19___。 4、本银行向出票人、背书人及正当持票人表示同意,凡依本信用证所列条款开具的汇票,向本银行提示时。到期即予以付清票款。

商务英语阅读文章翻译

商务英语阅读文章翻译 商务英语题材文章阅读是商务类学生及人士获取知识和信息的重要方式。下面是小编带来的商务英语阅读文章翻译,欢迎阅读! 商务英语阅读文章翻译1 余额宝创收29.6亿:称和银行间绝非零和游戏 余额宝是吸血鬼还是变革者?昨天,阿里巴巴首度就余额宝问题作出回应称,成立以来余额宝为用户创造超过29.6亿元的收益,同时增加了实体经济可用资金总量。 阿里小微金服首席战略官舒明昨天回应称,余额宝不仅不会推高社会融资成本,相反增加了实体经济可用资金总量,为实体经济输血。 阿里数据显示,从2013年6月推出到2014年1月31日,余额宝为用户创造了29.6亿元的收益。余额宝用户在淘宝上消费的总金额超过3400亿元。 阿里表示和银行之间绝非零和游戏。透过余额宝的示范效应,越来越多的金融机构关注到互联网技术的有效应用有利于拓宽传统金融机构理财产品的销售渠道,降低金融机构理财产品销售成本,更贴近用户从而向用户提供更贴合需求的服务。 (以上新闻来源于新京报) 沪江小编:随着余额宝的广告语会赚钱的钱包越来越深入人心,余额宝推高社会融资成本,余额宝是吸血鬼的议论也随之而来。作为

普通百姓,我们只希望生活成本能再低一点,生活品质能再高一点,幸福程度能再好一点。 什么是零和游戏? In game theory and economic theory, a zero-sum game is a mathematical representation of a situation in which a participants gain (or loss) of utility is exactly balanced by the losses (or gains) of the utility of the other participant(s). If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. 零和游戏,是博弈论和经济学中的一个概念。指参与博弈的各方,在严格竞争下,一方的收益必然意味着另一方的损失,博弈各方的收益和损失相加总和永远为零,双方不存在合作的可能。 通俗一点解释,零和游戏就是损人利己,而和零和游戏对应的是双赢(win-win result)概念,即利己不损人,通过谈判、合作达到皆大欢喜的结果。 商务英语阅读文章翻译2 归来吧! 汇丰银行总部或迁回香港 With HSBC threatening to move its headquarters out of London, one city comes to mind as its potential new home: Hong Kong, the H in its name. 就在汇丰银行威胁要将总部搬离伦敦之际,一座城市被人们认为可能会成为它的新家:香港。汇丰银行(HSBC)名字里的H就代表的

国际结算英文术语

国际结算(International settlement) 贸易(Trade Settlement) 非贸易(Non-Trade Settlement) EDI(Electronic Data Intercharge)电子数据交换, 控制文件(Control Documents) 有权签字人的印鉴(Specimen Signatures) 密押(Test Key) 费率表(Terms and Condition) 货物单据化,履约证书化,( cargo documentation , guarantee certification) 权利单据(document of title) 流通转让性(Negotiability) 让与(Assignment) 转让(Transfer) 流通转让(Negotiation) 汇票的定义是:A bill of exchange is an unconditional order in writing, addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time a sum certain in money to the order or specified person or to bearer. “汇票” (bill of exchange,exchange或draft) 无条件支付命令(unconditional order to pay) 出票条款(drawn clause) 利息条款(with interest) 分期付款(by stated instalment) 支付等值其它货币( pay the other currency according to an indicated rate of exchange) 付款人(payer)受票人(drawee) 付款期限(time of payment)或(tenor) 即期(at sight, on demand, on presentation)付款。 远期(at a determinable future time , time/ usance / term bill)付款。 期限远期付款的表现形式: ①见票后若干天(月)付款(bills payable at days/ months after sight) ②出票后若干天(月)付款(bills payable at days/ months after date) ③预定日期后若干天(月)付款(bills payable at days/ months after stated date) ④板期付款(bills payable on a fixed future date) ⑤延期付款(bills payable at days/months after shipment/ the date of B/L) 收款人名称(payee) 同样金额期限的第二张不付款”〔pay this first bill of exchange(second of the same tenor and dated being unpaid) 需要时的受托处理人(referee in case of need) 出票人(drawer) 收款人(payee) 背书人(endorser) 被背书人(endorsee) 出票(issue)

参考资料国际结算相关术语中英文对照与中文名词解释

参考资料:《国际结算》相关术语中英文对照 国际结算 International Settlement 有形贸易 Visible Trade 无形贸易 Invisible Trade 洗钱 Money Laundering 支付协定 Payment Agreement 国际结算制度 System of International Settlement 支付系统 Payment System 代表处 Representative Office 代理处 Agency Office 海外分、支行(境外联行) Overseas Sister Bank/Branch,Subbranch 代理银行 Correspondent Banks 附属银行(子银行) Subsidiary Banks 联营银行 Affiliated Banks 银团银行 Consortium Bank 票据 Instrument 设权性 Right to Be Paid 无因性 Non causative Nature 要式性 Requisite in Form 流通性 Negotiability 可追索性 Recoursement 基本当事人 Immediate Parties 附属当事人 Remote Parties 出票人 Drawer 付款人 Payer,Drawee 收款人 Payee 背书人 Endorser 被背书人 Endorsee 持票人 Holder 承兑人 Acceptor 保证人 Guarantor 汇票 Bill of Exchange 限制性抬头 Restrictive Order 指示性抬头 Demonstrative Order 持票来人抬头 Payable to Bearer 出票日期 Date of Issue 出票人签字 Signature of the Drawer 出票地点 Place of Payment 付款地点 Place of Payment 付款日期 Tenor