2012春季公司理财专题成绩单

公司理财精要版原书第12版习题库答案Ross12e_Chapter01_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 1 Introduction to Corporate Finance1) Which one of the following functions should be the responsibility of the controller rather than the treasurer?A) Depositing cash receiptsB) Processing cost reportsC) Analyzing equipment purchasesD) Approving credit for a customerE) Paying a vendor2) The treasurer of a corporation generally reports directly to the:A) board of directors.B) chairman of the board.C) chief executive officer.D) president.E) vice president of finance.3) Which one of the following correctly defines the upward chain of command in a typical corporate organizational structure?A) The vice president of finance reports to the chairman of the board.B) The chief executive officer reports to the president.C) The controller reports to the chief financial officer.D) The treasurer reports to the president.E) The chief operations officer reports to the vice president of production.4) An example of a capital budgeting decision is deciding:A) how many shares of stock to issue.B) whether or not to purchase a new machine for the production line.C) how to refinance a debt issue that is maturing.D) how much inventory to keep on hand.E) how much money should be kept in the checking account.5) When evaluating the timing of a project's projected cash flows, a financial manager is analyzing:A) the amount of each expected cash flow.B) only the start-up costs that are expected to require cash resources.C) only the date of the final cash flow related to the project.D) the amount by which cash receipts are expected to exceed cash outflows.E) when each cash flow is expected to occur.6) Capital structure decisions include determining:A) which one of two projects to accept.B) how to allocate investment funds to multiple projects.C) the amount of funds needed to finance customer purchases of a new product.D) how much debt should be assumed to fund a project.E) how much inventory will be needed to support a project.7) The decision to issue additional shares of stock is an example of:A) working capital management.B) a net working capital decision.C) capital budgeting.D) a controller's duties.E) a capital structure decision.8) Which one of the following questions is a working capital management decision?A) Should the company issue new shares of stock or borrow money?B) Should the company update or replace its older equipment?C) How much inventory should be on hand for immediate sale?D) Should the company close one of its current stores?E) How much should the company borrow to buy a new building?9) Which one of the following is a working capital management decision?A) What type(s) of equipment is (are) needed to complete a current project?B) Should the firm pay cash for a purchase or use the credit offered by the supplier?C) What amount of long-term debt is required to complete a project?D) How many shares of stock should the firm issue to fund an acquisition?E) Should a project should be accepted?10) Working capital management decisions include determining:A) the minimum level of cash to be kept in a checking account.B) the best method of producing a product.C) the number of employees needed to work during a particular shift.D) when to replace obsolete equipment.E) if a competitor should be acquired.11) Which one of the following terms is defined as the management of a firm's long-term investments?A) Working capital managementB) Financial allocationC) Agency cost analysisD) Capital budgetingE) Capital structure12) Which one of the following terms is defined as the mixture of a firm's debt and equity financing?A) Working capital managementB) Cash managementC) Cost analysisD) Capital budgetingE) Capital structure13) A firm's short-term assets and its short-term liabilities are referred to as the firm's:A) working capital.B) debt.C) investment capital.D) net capital.E) capital structure.14) Which one of the following questions is least likely to be addressed by financial managers?A) How should a product be marketed?B) Should customers be given 30 or 45 days to pay for their credit purchases?C) Should the firm borrow more money?D) Should the firm acquire new equipment?E) How much cash should the firm keep on hand?15) A business owned by a solitary individual who has unlimited liability for the firm's debt is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.16) A business formed by two or more individuals who each have unlimited liability for all of the firm's business debts is called a:A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) limited liability company.17) A business partner whose potential financial loss in the partnership will not exceed his or her investment in that partnership is called a:A) general partner.B) sole proprietor.C) limited partner.D) corporate shareholder.E) zero partner.18) A business created as a distinct legal entity and treated as a legal "person" is called a(n):A) corporation.B) sole proprietorship.C) general partnership.D) limited partnership.E) unlimited liability company.19) Which one of the following statements concerning a sole proprietorship is correct?A) A sole proprietorship is designed to protect the personal assets of the owner.B) The profits of a sole proprietorship are subject to double taxation.C) The owner of a sole proprietorship is personally responsible for all of the company's debts.D) There are very few sole proprietorships remaining in the U.S. today.E) A sole proprietorship is structured the same as a limited liability company.20) Which one of the following statements concerning a sole proprietorship is correct?A) The life of a sole proprietorship is limited.B) A sole proprietor can generally raise large sums of capital quite easily.C) Transferring ownership of a sole proprietorship is easier than transferring ownership of a corporation.D) A sole proprietorship is taxed the same as a C corporation.E) A sole proprietorship is the most regulated form of organization.21) Which of the following individuals have unlimited liability for a firm's debts based on their ownership interest?A) Only general partnersB) Only sole proprietorsC) All stockholdersD) Both limited and general partnersE) Both general partners and sole proprietors22) The primary advantage of being a limited partner is:A) the receipt of tax-free income.B) the partner's active participation in the firm's activities.C) the lack of any potential financial loss.D) the daily control over the business affairs of the partnership.E) the partner's maximum loss is limited to their capital investment.23) A general partner:A) is personally responsible for all partnership debts.B) has no say over a firm's daily operations.C) faces double taxation whereas a limited partner does not.D) has a maximum loss equal to his or her equity investment.E) receives a salary in lieu of a portion of the profits.24) A limited partnership:A) has an unlimited life.B) can opt to be taxed as a corporation.C) terminates at the death of any one limited partner.D) has at least one partner who has unlimited liability for all of the partnership's debts.E) consists solely of limited partners.25) A partnership with four general partners:A) distributes profits based on percentage of ownership.B) has an unlimited partnership life.C) limits the active involvement in the firm to a single partner.D) limits each partner's personal liability to 25 percent of the partnership's total debt.E) must distribute 25 percent of the profits to each partner.26) One disadvantage of the corporate form of business ownership is the:A) limited liability of its shareholders for the firm's debts.B) double taxation of distributed profits.C) firm's greater ability to raise capital than other forms of ownership.D) firm's potential for an unlimited life.E) firm's ability to issue additional shares of stock.27) Which one of the following statements is correct?A) The majority of firms in the U.S. are structured as corporations.B) Corporate profits are taxable income to the shareholders when earned.C) Corporations can have an unlimited life.D) Shareholders are protected from all potential losses.E) Shareholders directly elect the corporate president.28) Which one of the following statements is correct?A) A general partnership is legally the same as a corporation.B) Income from both sole proprietorships and partnerships that is taxable is treated as individual income.C) Partnerships are the most complicated type of business to form.D) All business organizations have bylaws.E) Only firms organized as sole proprietorships have limited lives.29) The articles of incorporation:A) describe the purpose of the firm and set forth the number of shares of stock that can be issued.B) are amended periodically especially prior to corporate elections.C) explain how corporate directors are to be elected and the length of their terms.D) sets forth the procedures by which a firm regulates itself.E) include only the corporation's name and intended life.30) Corporate bylaws:A) must be amended should a firm decide to increase the number of shares authorized.B) cannot be amended once adopted.C) define the name by which the firm will operate.D) describe the intended life and purpose of the organization.E) determine how a corporation regulates itself.31) A limited liability company:A) can only have a single owner.B) is comprised of limited partners only.C) is taxed similar to a partnership.D) is taxed similar to a C corporation.E) generates totally tax-free income.32) Which business form is best suited to raising large amounts of capital?A) Sole proprietorshipB) Limited liability companyC) CorporationD) General partnershipE) Limited partnership33) A ________ has all the respective rights and privileges of a legal person.A) sole proprietorshipB) general partnershipC) limited partnershipD) corporationE) limited liability company34) Sam, Alfredo, and Juan want to start a small U.S. business. Juan will fund the venture but wants to limit his liability to his initial investment and has no interest in the daily operations. Sam will contribute his full efforts on a daily basis but has limited funds to invest in the business. Alfredo will be involved as an active consultant and manager and will also contribute funds. Sam and Alfredo are willing to accept liability for the firm's debts as they feel they have nothing to lose by doing so. All three individuals will share in the firm's profits and wish to keep the initial organizational costs of the business to a minimum. Which form of business entity should these individuals adopt?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) General partnershipE) Corporation35) Sally and Alicia are equal general partners in a business. They are content with their current management and tax situation but are uncomfortable with their unlimited liability. Which form of business entity should they consider as a replacement to their current arrangement assuming they wish to remain the only two owners of the business?A) Sole proprietorshipB) Joint stock companyC) Limited partnershipD) Limited liability companyE) Corporation36) The growth of both sole proprietorships and partnerships is frequently limited by the firm's:A) double taxation.B) bylaws.C) inability to raise cash.D) limited liability.E) agency problems.37) Corporate dividends are:A) tax-free because the income is taxed at the personal level when earned by the firm.B) tax-free because they are distributions of aftertax income.C) tax-free since the corporation pays tax on that income when it is earned.D) taxed at both the corporate and the personal level when the dividends are paid to shareholders.E) taxable income of the recipient even though that income was previously taxed.38) Financial managers should primarily focus on the interests of:A) stakeholders.B) the vice president of finance.C) their immediate supervisor.D) shareholders.E) the board of directors.39) Which one of the following best states the primary goal of financial management?A) Maximize current dividends per shareB) Maximize the current value per shareC) Increase cash flow and avoid financial distressD) Minimize operational costs while maximizing firm efficiencyE) Maintain steady growth while increasing current profits40) Which one of the following best illustrates that the management of a firm is adhering to the goal of financial management?A) An increase in the amount of the quarterly dividendB) A decrease in the per unit production costsC) An increase in the number of shares outstandingD) A decrease in the net working capitalE) An increase in the market value per share41) Financial managers should strive to maximize the current value per share of the existingstock to:A) guarantee the company will grow in size at the maximum possible rate.B) increase employee salaries.C) best represent the interests of the current shareholders.D) increase the current dividends per share.E) provide managers with shares of stock as part of their compensation.42) Decisions made by financial managers should primarily focus on increasing the:A) size of the firm.B) growth rate of the firm.C) gross profit per unit produced.D) market value per share of outstanding stock.E) total sales.43) The Sarbanes-Oxley Act of 2002 is a governmental response to:A) decreasing corporate profits.B) the terrorist attacks on 9/11/2001.C) a weakening economy.D) deregulation of the stock exchanges.E) management greed and abuses.44) Which one of the following is an unintended result of the Sarbanes-Oxley Act?A) More detailed and accurate financial reportingB) Increased management awareness of internal controlsC) Corporations delisting from major exchangesD) Increased responsibility for corporate officersE) Identification of internal control weaknesses45) A firm which opts to "go dark" in response to the Sarbanes-Oxley Act:A) must continue to provide audited financial statements to the public.B) must continue to provide a detailed list of internal control deficiencies on an annual basis.C) can provide less information to its shareholders than it did prior to "going dark".D) can continue publicly trading its stock but only on the exchange on which it was previously listed.E) ceases to exist.46) The Sarbanes-Oxley Act of 2002 holds a public company's ________ responsible for the accuracy of the company's financial statements.A) managersB) internal auditorsC) external legal counselD) internal legal counselE) Securities and Exchange Commission agent47) Which one of the following actions by a financial manager is most apt to create an agency problem?A) Refusing to borrow money when doing so will create losses for the firmB) Refusing to lower selling prices if doing so will reduce the net profitsC) Refusing to expand the company if doing so will lower the value of the equityD) Agreeing to pay bonuses based on the market value of the company's stock rather than on its level of salesE) Increasing current profits when doing so lowers the value of the company's equity48) Which one of the following is least apt to help convince managers to work in the best interest of the stockholders? Assume there are no golden parachutes.A) Compensation based on the value of the stockB) Stock option plansC) Threat of a company takeoverD) Threat of a proxy fightE) Increasing managers' base salaries49) Agency problems are most associated with:A) sole proprietorships.B) general partnerships.C) limited partnerships.D) corporations.E) limited liability companies.50) Which one of the following is an agency cost?A) Accepting an investment opportunity that will add value to the firmB) Increasing the quarterly dividendC) Investing in a new project that creates firm valueD) Hiring outside accountants to audit the company's financial statementsE) Closing a division of the firm that is operating at a loss51) Which one of the following is a means by which shareholders can replace company management?A) Stock optionsB) PromotionC) Sarbanes-Oxley ActD) Agency playE) Proxy fight52) Which one of the following grants an individual the right to vote on behalf of a shareholder?A) ProxyB) By-lawsC) Indenture agreementD) Stock optionE) Stock audit53) Which one of the following parties has ultimate control of a corporation?A) Chairman of the boardB) Board of directorsC) Chief executive officerD) Chief operating officerE) Shareholders54) Which of the following parties are considered stakeholders of a firm?A) Employees and the governmentB) Long-term creditorsC) Government and common stockholdersD) Common stockholdersE) Long-term creditors and common stockholders55) Which one of the following represents a cash outflow from a corporation?A) Issuance of new securitiesB) Payment of dividendsC) New loan proceedsD) Receipt of tax refundE) Initial sale of common stock56) Which one of the following is a cash flow from a corporation into the financial markets?A) Borrowing of long-term debtB) Payment of government taxesC) Payment of loan interestD) Issuance of corporate debtE) Sale of common stock57) Which one of the following is a primary market transaction?A) Sale of currently outstanding stock by a dealer to an individual investorB) Sale of a new share of stock to an individual investorC) Stock ownership transfer from one shareholder to another shareholderD) Gift of stock from one shareholder to another shareholderE) Gift of stock by a shareholder to a family member58) Shareholder A sold 500 shares of ABC stock on the New York Stock Exchange. This transaction:A) took place in the primary market.B) occurred in a dealer market.C) was facilitated in the secondary market.D) involved a proxy.E) was a private placement.59) Public offerings of debt and equity must be registered with the:A) New York Board of Governors.B) Federal Reserve.C) NYSE Registration Office.D) Securities and Exchange Commission.E) Market Dealers Exchange.60) Which one of the following statements is generally correct?A) Private placements must be registered with the SEC.B) All secondary markets are auction markets.C) Dealer markets have a physical trading floor.D) Auction markets match buy and sell orders.E) Dealers arrange trades but never own the securities traded.61) Which one of the following statements concerning stock exchanges is correct?A) NASDAQ is a broker market.B) The NYSE is a dealer market.C) The exchange with the strictest listing requirements is NASDAQ.D) Some large companies are listed on NASDAQ.E) Most debt securities are traded on the NYSE.62) Shareholder A sold shares of Maplewood Cabinets stock to Shareholder B. The stock is listed on the NYSE. This trade occurred in which one of the following?A) Primary, dealer marketB) Secondary, dealer marketC) Primary, auction marketD) Secondary, auction marketE) Secondary, OTC market63) Which one of the following statements is correct concerning the NYSE?A) The publicly traded shares of a NYSE-listed firm must be worth at least $250 million.B) The NYSE is the largest dealer market for listed securities in the United States.C) The listing requirements for the NYSE are more stringent than those of NASDAQ.D) Any corporation desiring to be listed on the NYSE can do so for a fee.E) The NYSE is an OTC market functioning as both a primary and a secondary market.11。

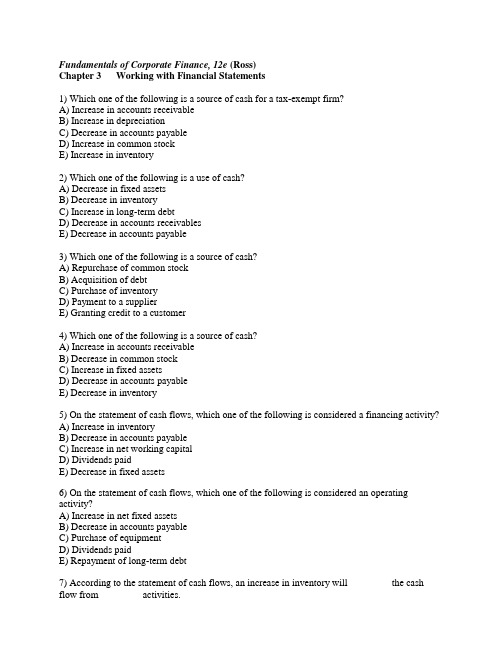

公司理财精要版原书第12版习题库答案Ross12e_Chapter03_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 3 Working with Financial Statements1) Which one of the following is a source of cash for a tax-exempt firm?A) Increase in accounts receivableB) Increase in depreciationC) Decrease in accounts payableD) Increase in common stockE) Increase in inventory2) Which one of the following is a use of cash?A) Decrease in fixed assetsB) Decrease in inventoryC) Increase in long-term debtD) Decrease in accounts receivablesE) Decrease in accounts payable3) Which one of the following is a source of cash?A) Repurchase of common stockB) Acquisition of debtC) Purchase of inventoryD) Payment to a supplierE) Granting credit to a customer4) Which one of the following is a source of cash?A) Increase in accounts receivableB) Decrease in common stockC) Increase in fixed assetsD) Decrease in accounts payableE) Decrease in inventory5) On the statement of cash flows, which one of the following is considered a financing activity?A) Increase in inventoryB) Decrease in accounts payableC) Increase in net working capitalD) Dividends paidE) Decrease in fixed assets6) On the statement of cash flows, which one of the following is considered an operating activity?A) Increase in net fixed assetsB) Decrease in accounts payableC) Purchase of equipmentD) Dividends paidE) Repayment of long-term debt7) According to the statement of cash flows, an increase in inventory will ________ the cash flow from ________ activities.A) increase; operatingB) decrease; financingC) decrease; operatingD) increase; financingE) increase; investment8) According to the statement of cash flows, an increase in interest expense will ________ the cash flow from ________ activities.A) decrease; operatingB) decrease; financingC) increase; operatingD) increase; financingE) Increase; investment9) Activities of a firm that require the spending of cash are known as:A) sources of cash.B) uses of cash.C) cash collections.D) cash receipts.E) cash on hand.10) The sources and uses of cash over a stated period of time are reflected on the:A) income statement.B) balance sheet.C) tax reconciliation statement.D) statement of cash flows.E) statement of operating position.11) A common-size income statement is an accounting statement that expresses all of a firm's expenses as a percentage of:A) total assets.B) total equity.C) net income.D) taxable income.E) sales.12) Which one of the following standardizes items on the income statement and balance sheet relative to their values as of a chosen point in time?A) Statement of standardizationB) Statement of cash flowsC) Common-base year statementD) Common-size statementE) Base reconciliation statement13) On a common-size balance sheet all accounts for the current year are expressed as a percentage of:A) sales for the period.B) the base year sales.C) total equity for the base year.D) total assets for the current year.E) total assets for the base year.14) On a common-base year financial statement, accounts receivables for the current year will be expressed relative to which one of the following?A) Current year salesB) Current year total assetsC) Base-year salesD) Base-year total assetsE) Base-year accounts receivables15) Which one of the following ratios is a measure of a firm's liquidity?A) Cash coverage ratioB) Profit marginC) Debt-equity ratioD) Quick ratioE) NWC turnover16) An increase in current liabilities will have which one of the following effects, all else held constant? Assume all ratios have positive values.A) Increase in the cash ratioB) Increase in the net working capital to total assets ratioC) Decrease in the quick ratioD) Decrease in the cash coverage ratioE) Increase in the current ratio17) An increase in which one of the following will increase a firm's quick ratio without affecting its cash ratio?A) Accounts payableB) CashC) InventoryD) Accounts receivableE) Fixed assets18) A supplier, who requires payment within 10 days, should be most concerned with which one of the following ratios when granting credit?A) CurrentB) CashC) Debt-equityD) QuickE) Total debt19) A firm has an interval measure of 48. This means that the firm has sufficient liquid assets to do which one of the following?A) Pay all of its debts that are due within the next 48 hoursB) Pay all of its debts that are due within the next 48 daysC) Cover its operating costs for the next 48 hoursD) Cover its operating costs for the next 48 daysE) Meet the demands of its customers for the next 48 hours20) Ratios that measure a firm's liquidity are known as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) book value21) Which one of the following statements is correct?A) If the total debt ratio is greater than .50, then the debt-equity ratio must be less than 1.0.B) Long-term creditors would prefer the times interest earned ratio be 1.4 rather than 1.5.C) The debt-equity ratio can be computed as 1 plus the equity multiplier.D) An equity multiplier of 1.2 means a firm has $1.20 in sales for every $1 in equity.E) An increase in the depreciation expense will not affect the cash coverage ratio.22) If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be which one of the following?A) 0B) .5C) 1.0D) 1.5E) 2.023) The cash coverage ratio directly measures the ability of a company to meet its obligation to pay:A) an invoice to a supplier.B) wages to an employee.C) interest to a lender.D) principal to a lender.E) a dividend to a shareholder.24) All-State Moving had sales of $899,000 in 2017 and $967,000 in 2018. The firm's current accounts remained constant. Given this information, which one of the following statements must be true?A) The total asset turnover rate increased.B) The days' sales in receivables increased.C) The net working capital turnover rate increased.D) The fixed asset turnover decreased.E) The receivables turnover rate decreased.25) The Corner Hardware has succeeded in increasing the amount of goods it sells while holding the amount of inventory on hand at a constant level. Assume that both the cost per unit and the selling price per unit also remained constant. This accomplishment will be reflected in the firm's financial ratios in which one of the following ways?A) Decrease in the inventory turnover rateB) Decrease in the net working capital turnover rateC) Increase in the fixed asset turnover rateD) Decrease in the day's sales in inventoryE) Decrease in the total asset turnover rate26) RJ's has a fixed asset turnover rate of 1.26 and a total asset turnover rate of .97. Sam's has a fixed asset turnover rate of 1.31 and a total asset turnover rate of .94. Both companies have similar operations. Based on this information, RJ's must be doing which one of the following?A) Utilizing its fixed assets more efficiently than Sam'sB) Utilizing its total assets more efficiently than Sam'sC) Generating $1 in sales for every $1.26 in net fixed assetsD) Generating $1.26 in net income for every $1 in net fixed assetsE) Maintaining the same level of current assets as Sam's27) Ratios that measure how efficiently a firm manages its assets and operations to generate net income are referred to as ________ ratios.A) asset managementB) long-term solvencyC) short-term solvencyD) profitabilityE) turnover28) If a company produces a return on assets of 14 percent and also a return on equity of 14 percent, then the firm:A) may have short-term, but not long-term debt.B) is using its assets as efficiently as possible.C) has no net working capital.D) has a debt-equity ratio of 1.0.E) has an equity multiplier of 1.0.29) Which one of the following will decrease if a firm can decrease its operating costs, all else constant?A) Return on equityB) Return on assetsC) Profit marginD) Total asset turnoverE) Price-earnings ratio30) Al's has a price-earnings ratio of 18.5. Ben's also has a price-earnings ratio of 18.5. Which one of the following statements must be true if Al's has a higher PEG ratio than Ben's?A) Al's has more net income than Ben's.B) Ben's is increasing its earnings at a faster rate than Al's.C) Al's has a higher market value per share than does Ben's.D) Ben's has a lower market-to-book ratio than Al's.E) Al's has a higher earnings growth rate than Ben's.31) Tobin's Q relates the market value of a firm's assets to which one of the following?A) Initial cost of creating the firmB) Current book value of the firmC) Average asset value of similar firmsD) Average market value of similar firmsE) Today's cost to duplicate those assets32) The price-sales ratio is especially useful when analyzing firms that have:A) volatile market prices.B) negative earnings.C) positive PEG ratios.D) a high Tobin's Q.E) increasing sales.33) Mortgage lenders probably have the most interest in the ________ ratios.A) return on assets and profit marginB) long-term debt and times interest earnedC) price-earnings and debt-equityD) market-to-book and times interest earnedE) return on equity and price-earnings34) Relationships determined from a company's financial information and used for comparison purposes are known as:A) financial ratios.B) identities.C) dimensional analysis.D) scenario analysis.E) solvency analysis.35) DL Farms currently has $600 in debt for every $1,000 in equity. Assume the company uses some of its cash to decrease its debt while maintaining its current equity and net income. Which one of the following will decrease as a result of this action?A) Equity multiplierB) Total asset turnoverC) Profit marginD) Return on assetsE) Return on equity36) Which one of these identifies the relationship between the return on assets and the return on equity?A) Profit marginB) Profitability determinantC) Balance sheet multiplierD) DuPont identityE) Debt-equity ratio37) Which one of the following accurately describes the three parts of the DuPont identity?A) Equity multiplier, profit margin, and total asset turnoverB) Debt-equity ratio, capital intensity ratio, and profit marginC) Operating efficiency, equity multiplier, and profitability ratioD) Return on assets, profit margin, and equity multiplierE) Financial leverage, operating efficiency, and profitability ratio38) An increase in which of the following must increase the return on equity, all else constant?A) Total assets and salesB) Net income and total equityC) Total asset turnover and debt-equity ratioD) Equity multiplier and total equityE) Debt-equity ratio and total debt39) Which one of the following is a correct formula for computing the return on equity?A) Profit margin × ROAB) ROA × Equity multiplierC) Profit margin × Total asset turnover × Debt-equity ratioD) Net income/Total assetsE) Debt-equity ratio × ROA40) The DuPont identity can be used to help managers answer which of the following questions related to a company's operations?I. How many sales dollars are being generated per each dollar of assets?II. How many dollars of assets have been acquired per each dollar in shareholders' equity? III. How much net profit is being generating per dollar of sales?IV. Does the company have the ability to meet its debt obligations in a timely manner?A) I and III onlyB) II and IV onlyC) I, II, and III onlyD) II, III and IV onlyE) I, II, III, and IV41) The U.S. government coding system that classifies a company by the nature of its business operations is known as the:A) Centralized Business Index.B) Peer Grouping codes.C) Standard Industrial Classification codes.D) Governmental ID codes.E) Government Engineered Coding System.42) Which one of the following statements is correct?A) Book values should always be given precedence over market values.B) Financial statements are rarely used as the basis for performance evaluations.C) Historical information is useful when projecting a company's future performance.D) Potential lenders place little value on financial statement information.E) Reviewing financial information over time has very limited value.43) The most acceptable method of evaluating the financial statements is to compare the company's current financial:A) ratios to the company's historical ratios.B) statements to the financial statements of similar companies operating in other countries.C) ratios to the average ratios of all companies located within the same geographic area.D) statements to those of larger companies in unrelated industries.E) statements to the projections that were created based on Tobin's Q.44) All of the following issues represent problems encountered when comparing the financial statements of two separate entities except the issue of the companies:A) being conglomerates with unrelated lines of business.B) having geographically varying operations.C) using differing accounting methods.D) differing seasonal peaks.E) having the same fiscal year.45) Which one of these is the least important factor to consider when comparing the financial situations of utility companies that generate electric power and have the same SIC code?A) Type of ownershipB) Government regulations affecting the firmC) Fiscal year endD) Methods of power generationE) Number of part-time employees46) At the beginning of the year, Brick Makers had cash of $183, accounts receivable of $392, accounts payable of $463, and inventory of $714. At year end, cash was $167, accounts payables was $447, inventory was $682, and accounts receivable was $409. What is the amount of the net source or use of cash by working capital accounts for the year?A) Net use of $16 cashB) Net use of $17 cashC) Net source of $17 cashD) Net source of $15 cashE) Net use of $15 cash47) During the year, Al's Tools decreased its accounts receivable by $160, increased its inventory by $115, and decreased its accounts payable by $70. How did these three accounts affect the sources of uses of cash by the firm?A) Net source of cash of $120B) Net source of cash of $205C) Net source of cash of $45D) Net use of cash of $115E) Net use of cash of $2548) Lani's generated net income of $911, depreciation expense was $47, and dividends paid were $25. Accounts payables increased by $15, accounts receivables increased by $28, inventory decreased by $14, and net fixed assets decreased by $8. There was no interest expense. What was the net cash flow from operating activity?A) $776B) $865C) $959D) $922E) $98549) For the past year, Jenn's Floral Arrangements had taxable income of $198,600, beginning common stock of $68,000, beginning retained earnings of $318,750, ending common stock of $71,500, ending retained earnings of $316,940, interest expense of $11,300, and a tax rate of 21 percent. What is the amount of dividends paid during the year?A) $157,280B) $159,935C) $163,200D) $153,555E) $158,70450) The Floor Store had interest expense of $38,400, depreciation of $28,100, and taxes of $19,600 for the year. At the start of the year, the firm had total assets of $879,400 and current assets of $289,600. By year's end total assets had increased to $911,900 while current assets decreased to $279,300. What is the amount of the cash flow from investment activity for the year?A) −$51,150B) $21,850C) $29,300D) −$70,900E) −$89,40051) Williamsburg Market is an all-equity firm that has net income of $96,200, depreciation expense of $6,300, and an increase in net working capital of $2,800. What is the amount of the net cash from operating activity?A) $91,300B) $99,700C) $93,400D) $105,300E) $113,70052) The accounts payable of a company changed from $136,100 to $104,300 over the course of a year. This change represents a:A) use of $31,800 of cash as investment activity.B) source of $31,800 of cash as an operating activity.C) source of $31,800 of cash as a financing activity.D) source of $31,800 of cash as an investment activity.E) use of $31,800 of cash as an operating activity.53) Oil Creek Auto has sales of $3,340, net income of $274, net fixed assets of $2,600, and current assets of $920. The firm has $430 in inventory. What is the common-size statement value of inventory?A) 12.22 percentB) 44.16 percentC) 16.54 percentD) 13.36 percentE) 46.74 percent54) Pittsburgh Motors has sales of $4,300, net income of $320, total assets of $4,800, and total equity of $2,950. Interest expense is $65. What is the common-size statement value of the interest expense?A) .89 percentB) 1.51 percentC) 1.69 percentD) 2.03 percentE) 1.35 percent55) Last year, which is used as the base year, a firm had cash of $52, accounts receivable of $223, inventory of $509, and net fixed assets of $1,107. This year, the firm has cash of $61,accounts receivable of $204, inventory of $527, and net fixed assets of $1,216. What is this year's common-base-year value of inventory?A) .67B) .91C) .88D) 1.04E) 1.1856) Duke's Garage has cash of $68, accounts receivable of $142, accounts payable of $235, and inventory of $318. What is the value of the quick ratio?A) 2.25B) .53C) .71D) .89E) 1.3557) Uptown Men's Wear has accounts payable of $2,214, inventory of $7,950, cash of $1,263, fixed assets of $8,400, accounts receivable of $3,907, and long-term debt of $4,200. What is the value of the net working capital to total assets ratio?A) .31B) .42C) .47D) .51E) .5658) DJ's has total assets of $310,100 and net fixed assets of $168,500. The average daily operating costs are $2,980. What is the value of the interval measure?A) 31.47 daysB) 47.52 daysC) 56.22 daysD) 68.05 daysE) 104.62 days59) Corner Books has a debt-equity ratio of .57. What is the total debt ratio?A) .36B) .30C) .44D) 2.27E) 2.7560) SS Stores has total debt of $4,910 and a debt-equity ratio of 0.52. What is the value of the total assets?A) $16,128.05B) $7,253.40C) $9,571.95D) $11,034.00E) $14,352.3161) JK Motors has sales of $96,400, costs of $53,800, interest paid of $2,800, and depreciation of $7,100. The tax rate is 21 percent. What is the value of the cash coverage ratio?A) 15.21B) 12.14C) 17.27D) 23.41E) 12.6862) Terry's Pets paid $2,380 in interest and $2,200 in dividends last year. The times interest earned ratio is 2.6 and the depreciation expense is $680. What is the value of the cash coverage ratio?A) 1.42B) 2.72C) 2.94D) 2.89E) 2.4663) The Up-Towner has sales of $913,400, costs of goods sold of $579,300, inventory of $123,900, and accounts receivable of $78,900. How many days, on average, does it take the firm to sell its inventory assuming that all sales are on credit?A) 74.19 daysB) 84.69 daysC) 78.07 daysD) 96.46 daysE) 71.01 days64) Flo's Flowers has accounts receivable of $4,511, inventory of $1,810, sales of $138,609, and cost of goods sold of $64,003. How many days does it take the firm to sell its inventory and collect the payment on the sale assuming that all sales are on credit?A) 11.88 daysB) 22.20 daysC) 16.23 daysD) 14.50 daysE) 18.67 days65) The Harrisburg Store has net working capital of $2,715, net fixed assets of $22,407, sales of $31,350, and current liabilities of $3,908. How many dollars' worth of sales are generated from every $1 in total assets?A) $1.08B) $1.14C) $1.19D) $84E) $9366) TJ's has annual sales of $813,200, total debt of $171,000, total equity of $396,000, and a profit margin of 5.78 percent. What is the return on assets?A) 8.29 percentB) 6.48 percentC) 9.94 percentD) 7.78 percentE) 8.02 percent67) Frank's Used Cars has sales of $807,200, total assets of $768,100, and a profit margin of 6.68 percent. The firm has a total debt ratio of 54 percent. What is the return on equity?A) 13.09 percentB) 12.04 percentC) 11.03 percentD) 8.56 percentE) 15.26 percent68) Bernice's has $823,000 in sales. The profit margin is 4.2 percent and the firm has 7,500 shares of stock outstanding. The market price per share is $16.50. What is the price-earnings ratio?A) 3.58B) 3.98C) 4.32D) 3.51E) 4.2769) Hungry Lunch has net income of $73,402, a price-earnings ratio of 13.7, and earnings per share of $.43. How many shares of stock are outstanding?A) 13,520B) 12,460C) 165,745D) 171,308E) 170,70270) A firm has 160,000 shares of stock outstanding, sales of $1.94 million, net income of $126,400, a price-earnings ratio of 21.3, and a book value per share of $7.92. What is the market-to-book ratio?A) 2.12B) 1.84C) 1.39D) 2.45E) 2.6971) Taylor's Men's Wear has a debt-equity ratio of 48 percent, sales of $829,000, net income of $47,300, and total debt of $206,300. What is the return on equity?A) 19.29 percentB) 11.01 percentC) 15.74 percentD) 18.57 percentE) 14.16 percent72) Nielsen's has inventory of $29,406, accounts receivable of $46,215, net working capital of $4,507, and accounts payable of $48,919. What is the quick ratio?A) 1.55B) .49C) 1.32D) .94E) .9273) The Strong Box has sales of $859,700, cost of goods sold of $648,200, net income of $93,100, and accounts receivable of $102,300. How many days of sales are in receivables?A) 57.60 daysB) 40.32 daysC) 54.53 daysD) 29.41 daysE) 43.43 days74) Corner Books has sales of $687,400, cost of goods sold of $454,200, and a profit margin of 5.5 percent. The balance sheet shows common stock of $324,000 with a par value of $5 a share, and retained earnings of $689,500. What is the price-sales ratio if the market price is $43.20 per share?A) 4.28B) 12.74C) 6.12D) 4.07E) 14.5175) Gem Jewelers has current assets of $687,600, total assets of $1,711,000, net working capital of $223,700, and long-term debt of $450,000. What is the debt-equity ratio?A) .87B) .94C) 1.21D) 1.15E) 1.0676) Russell's has annual sales of $649,200, cost of goods sold of $389,400, interest of $23,650, depreciation of $121,000, and a tax rate of 21 percent. What is the cash coverage ratio for the year?A) 8.43B) 10.99C) 11.64D) 5.87E) 18.2277) Lawn Care, Inc., has sales of $367,400, costs of $183,600, depreciation of $48,600, interest of $39,200, and a tax rate of 25 percent. The firm has total assets of $422,100, long-term debt of $102,000, net fixed assets of $264,500, and net working capital of $22,300. What is the return on equity?A) 24.26 percentB) 15.38 percentC) 38.96 percentD) 29.96 percentE) 17.06 percent78) Frank's Welding has net fixed assets of $36,200, total assets of $51,300, long-term debt of $22,000, and total debt of $29,700. What is the net working capital to total assets ratio?A) 12.18 percentB) 16.82 percentC) 14.42 percentD) 17.79 percentE) 9.90 percent79) The Green Fiddle has current liabilities of $28,000, sales of $156,900, and cost of goods sold of $62,400. The current ratio is 1.22 and the quick ratio is .71. How many days on average does it take to sell the inventory?A) 128.13 daysB) 74.42 daysC) 199.81 daysD) 147.46 daysE) 83.53 days80) Green Yard Care has net income of $62,300, a tax rate of 21 percent, and a profit margin of 6.7 percent. Total assets are $1,100,500 and current assets are $328,200. How many dollars of sales are being generated from every dollar of net fixed assets?A) $2.83B) $1.37C) $.84D) $1.20E) $1.2381) Jensen's Shipping has total assets of $694,800 at year's end. The beginning owners' equity was $362,400. During the year, the company had sales of $711,000, a profit margin of 5.2 percent, a tax rate of 21 percent, and paid $12,500 in dividends. What is the equity multiplier at year-end?A) 1.67B) 1.72C) 1.93D) 1.80E) 1.8682) Western Gear has net income of $12,400, a tax rate of 21 percent, and interest expense of $1,600. What is the times interest earned ratio for the year?A) 9.63B) 7.75C) 10.81D) 14.97E) 10.9783) Big Tree Lumber has earnings per share of $1.36. The firm's earnings have been increasing at an average rate of 2.9 percent annually and are expected to continue doing so. The firm has 21,500 shares of stock outstanding at a price per share of $23.40. What is the firm's PEG ratio?A) 2.27B) 11.21C) 4.85D) 3.94E) 5.9384) Townsend Enterprises has a PEG ratio of 5.3, net income of $49,200, a price-earnings ratio of 17.6, and a profit margin of 7.1 percent. What is the earnings growth rate?A) 2.48 percentB) 1.06 percentC) 3.32 percentD) 5.20 percentE) 10.60 percent85) A firm has total assets with a current book value of $71,600, a current market value of $82,300, and a current replacement cost of $90,400. What is the value of Tobin's Q?A) .85B) .87C) .90D) .94E) .9186) Dixie Supply has total assets with a current book value of $368,900 and a current replacement cost of $486,200. The market value of these assets is $464,800. What is the value of Tobin's Q?A) .79B) .76C) .96D) 1.26E) 1.0587) Dandelion Fields has a Tobin's Q of .96. The replacement cost of the firm's assets is $225,000 and the market value of the firm's debt is $101,000. The firm has 20,000 shares of stock outstanding and a book value per share of $2.09. What is the market-to-book ratio?A) 2.75 timesB) 3.18 timesC) 3.54 timesD) 4.01 timesE) 4.20 times88) The Tech Store has annual sales of $416,000, a price-earnings ratio of 18, and a profit margin of 3.7 percent. There are 12,000 shares of stock outstanding. What is the price-sales ratio?A) .97B) .67C) 1.08D) 1.15E) .8689) Lassiter Industries has annual sales of $328,000 with 8,000 shares of stock outstanding. The firm has a profit margin of 4.5 percent and a price-sales ratio of 1.20. What is the firm's price-earnings ratio?A) 21.9B) 17.4C) 18.6D) 26.7E) 24.390) Drive-Up has sales of $31.4 million, total assets of $27.6 million, and total debt of $14.9 million. The profit margin is 3.7 percent. What is the return on equity?A) 6.85 percentB) 9.15 percentC) 11.08 percentD) 13.31 percentE) 14.21 percent91) Corner Supply has a current accounts receivable balance of $246,000. Credit sales for the year just ended were $2,430,000. How many days on average did it take for credit customers to pay off their accounts during this past year?A) 44.29 daysB) 55.01 daysC) 55.50 daysD) 36.95 daysE) 41.00 days92) BL Industries has ending inventory of $302,800, annual sales of $2.33 million, and annual cost of goods sold of $1.41 million. On average, how long did a unit of inventory sit on the shelf before it was sold?A) 47.43 daysB) 22.18 daysC) 78.38 daysD) 61.78 daysE) 83.13 days93) Billings Inc. has net income of $161,000, a profit margin of 7.6 percent, and an accounts receivable balance of $127,100. Assume that 66 percent of sales are on credit. What is the days' sales in receivables?A) 21.90 daysB) 27.56 daysC) 33.18 daysD) 35.04 daysE) 36.19 days94) Stone Walls has a long-term debt ratio of .6 and a current ratio of 1.2. Current liabilities are $800, sales are $7,800, the profit margin is 6.5 percent, and return on equity is 15.5 percent. What is the amount of the firm's net fixed assets?A) $8,880.15B) $8,017.43C) $7,666.67D) $5,848.15E) $8,977.43。

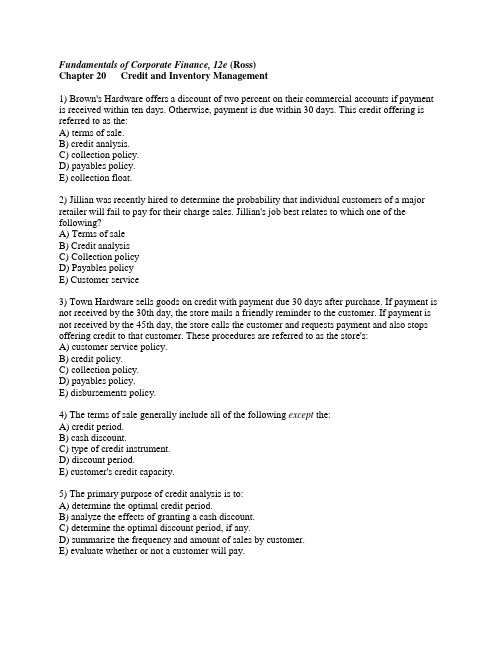

公司理财精要版原书第12版习题库答案Ross12e_Chapter20_TB

Fundamentals of Corporate Finance, 12e (Ross)Chapter 20 Credit and Inventory Management1) Brown's Hardware offers a discount of two percent on their commercial accounts if payment is received within ten days. Otherwise, payment is due within 30 days. This credit offering is referred to as the:A) terms of sale.B) credit analysis.C) collection policy.D) payables policy.E) collection float.2) Jillian was recently hired to determine the probability that individual customers of a major retailer will fail to pay for their charge sales. Jillian's job best relates to which one of the following?A) Terms of saleB) Credit analysisC) Collection policyD) Payables policyE) Customer service3) Town Hardware sells goods on credit with payment due 30 days after purchase. If payment is not received by the 30th day, the store mails a friendly reminder to the customer. If payment is not received by the 45th day, the store calls the customer and requests payment and also stops offering credit to that customer. These procedures are referred to as the store's:A) customer service policy.B) credit policy.C) collection policy.D) payables policy.E) disbursements policy.4) The terms of sale generally include all of the following except the:A) credit period.B) cash discount.C) type of credit instrument.D) discount period.E) customer's credit capacity.5) The primary purpose of credit analysis is to:A) determine the optimal credit period.B) analyze the effects of granting a cash discount.C) determine the optimal discount period, if any.D) summarize the frequency and amount of sales by customer.E) evaluate whether or not a customer will pay.6) The period of time that extends from the day a credit sale is made until the day the bank credits the seller's account with the payment for that sale is known as the ________ period.A) floatB) cash collectionC) salesD) accounts receivableE) discount7) Which one of the following will increase a firm's investment in accounts receivables?A) An increase in the number of days for which credit is grantedB) A decrease in credit salesC) An increase in cash salesD) A decrease in the average collection periodE) A decrease in average daily credit sales8) A firm's total investment in accounts receivables depends primarily on the firm's:A) total sales and cash discount period.B) cash to credit sales ratio.C) bad debt ratio.D) average collection period and amount of credit sales.E) amount of credit sales and cash discount percentage.9) Which one of the following statements is correct if you purchase an item with credit termsof 3/15, net 45?A) If you pay within 3 days, you will receive a discount of 15 percent.B) If you pay within 15 days, you will receive a discount of 3 percent.C) If you do not pay within 15 days, you will be charged interest at a rate of 3 percent per month.D) If you pay 3 percent of your purchases within 15 days, you will have 45 days to pay for the remainder.E) One-third of your purchase is due in 15 days and the rest is due in 45 days.10) Assume you put your purchases on your credit card and then take advantage of any cash discounts offered. Which one of these credit terms do you prefer?A) 1/10, net 20B) 2/5, net 30C) 2/10, net 30D) 1/15, net 45E) 2/15, net 3011) You need to charge your purchases and know that you will not be able to pay within the discount period. Which one of these credit terms is best-suited to you?A) 1/5, net 15B) 2/5, net 30C) 2/5, net 20D) 1/10, net 45E) 2/10, net 3012) Which one of the following statements is correct?A) The credit period begins when the discount period ends.B) The discount period is the length of time granted to a customer to pay for a purchase.C) The credit period begins on the invoice date.D) With terms of 2/10, net 30, the net credit period is 20 days.E) With EOM dating, all sales are assumed to have occurred on the 15th of each month.13) Which one of these is frequently cited as an appropriate upper limit to the credit period offered by a seller?A) The buyer's inventory periodB) The seller's inventory periodC) The seller's operating cycleD) The buyer's operating cycleE) The buyer's receivables period14) Phil's Print Shop grants its customers the right to pay for their print jobs within 30 days of the ROG. Thus, the customers' credit period begins when they:A) review and approve the print order.B) renew their contract on a revolving print order.C) reorder a previously approved print job.D) receive their print jobs.E) request a new job be printed.15) Scott purchased a shovel, a rake, and a wheelbarrow from The Local Hardware Store yesterday. Today, the store issued a bill for these items and mailed it to Scott. What is the name given to this bill?A) Ledger statementB) WarrantyC) IndentureD) ReceiptE) Invoice16) Geoff Industries offers its credit customers a two percent discount if they pay within ten days. This discount is referred to as a ________ discount.A) cashB) purchaseC) collectionD) marketE) receivables17) Any written proof that a customer owes you money for goods or services provided is referred to as a(n):A) account document.B) sales draft.C) credit instrument.D) commercial paper.E) letter of debt.18) Which one of the following factors most supports a longer credit period being offered to customers?A) Higher consumer demandB) Lower priced merchandiseC) Increased credit riskD) More perishable merchandiseE) Increased competition19) Which one of the following statements related to credit periods is correct?A) Longer credit periods are granted for sales of perishable items.B) Inexpensive goods tend to have longer credit periods.C) Smaller accounts tend to have longer credit periods.D) Sellers may offer different credit periods to different customers.E) Newer products tend to have shorter credit periods.20) A trade discount of 2/5th, EOM terms:A) grants customers five days to pay after month end.B) offers no credit to customers.C) means the full amount is due by the 5th of the month following the month of sale.D) means the invoice is overdue only after month-end.E) means the full amount is due the last day of the month following the month of sale.21) Under credit terms of 1/5, net 15, customers should:A) Always pay on the 15th day.B) take the discount and pay immediately.C) take the discount and pay on the day following the day of sale.D) either take the discount or pay on the 15th day.E) both take the discount and pay on the 15th day.22) A 2/10, net 30 credit policy:A) is an expensive form of short-term credit if a buyer forgoes the discount.B) provides cheap financing to the buyer for 30 days.C) is an inexpensive means of reducing the seller's collection period if every customer takes the discount.D) tends to have little effect on the seller's collection period.E) tends to increase the seller's investment in receivables as compared to a straight net 30 policy.23) The Painted House offers credit terms of 2/10th, EOM. Assume you purchase an item on credit from this store on Monday, November 3. When is payment due for this purchase if you do not take the discount?A) November 3B) November 13C) November 30D) December 31E) December 1024) Which one of the following credit instruments is commonly used in international commerce?A) Open accountB) Sight draftC) Time draftD) Banker's acceptanceE) Promissory note25) A conditional sales contract:A) passes title to the goods sold to the buyer at the time the contract is signed.B) normally calls for one lump sum payment on the contract payment date.C) allows the seller to retain ownership of the goods sold until the customer has fully paid for the purchase.D) is payable immediately upon receipt.E) is a formal bid for a project.26) Which one of these statements is correct?A) A firm's cash cycle generally decreases when it switches from a cash to a credit policy, all else equal.B) Most customers will forgo the discount and pay at the end of the credit period.C) Total revenues generally decrease if both the quantity sold and the price per unit increase when credit is granted.D) Only the cost of default should be considered before granting credit.E) A firm may have to increase its long-term borrowing if it decides to grant credit to its customers.27) When considering a switch from an all-cash credit policy to a net 30 credit policy all of the following should be considered except the:A) revenue effects.B) effects on the variable costs.C) cost of the discount.D) probability of default.E) change in the fixed costs.28) The optimal amount of credit equates the incremental costs of carrying the increase in accounts receivable to the incremental:A) decrease in the cash cycle.B) benefit from decreasing the inventory level.C) cash flows from increased sales.D) increase in bad debts.E) gain in net profits.29) Assume you are viewing a graph that compares costs with the amount of credit extended. Both the carrying costs and the opportunity costs of credit are depicted. What is the function called that represents the summation of these carrying and opportunity costs?A) Opportunity cost curveB) Credit extension curveC) Credit cost curveD) Terms of sale graphE) Optimal sales graph30) Assume that RSF is a wholly owned subsidiary of the Rolled Steel Company. RSF provides credit financing solely for large ticket items purchased from the Rolled Steel Company. Which one of the following terms describes RSF?A) Credit departmentB) Parent companyC) Captive finance companyD) Credit unionE) Service unit31) When credit policy is at the optimal point, the:A) total costs of granting credit will be maximized.B) carrying costs of credit will be equal to zero.C) opportunity cost of credit will be equal to zero.D) carrying costs will equal the opportunity costs.E) total costs will equal the opportunity costs.32) Which of the following characteristics are most associated with a firm that adopts a liberal credit policy?A) Mostly one-time customers and excess capacityB) Low carrying costs and full productionC) Low carrying costs and high variable costsD) Low variable costs and predominately repeat customersE) Excess capacity and high variable costs33) If you extend credit for a one-time sale to a new customer, you risk an amount equal to the:A) sales price of the item sold.B) variable cost of the item sold.C) fixed cost of the item sold.D) profit margin on the item sold.E) fixed and variable costs of the item sold.34) Which one of the following statements is correct?A) If the majority of a firm's new customers become repeat customers, then there is a strong argument against extending credit even if the default rate is low.B) A customer's past payment history reveals little information in relation to his or her future tendency to pay.C) A suggested policy for offering credit to new customers is to limit the amount of their initial credit purchase.D) The risk of issuing credit is the same for a new customer as it is for an existing customer.E) The recommended policy for new customers is to extend an offer of a high credit limit as an enticement to get their business.35) When evaluating the creditworthiness of a customer, the term capital refers to the:A) type of goods the customer wishes to obtain.B) customer's financial reserves.C) types of assets the customer wants to pledge as collateral.D) customer's willingness to pay bills in a timely fashion.E) nature of the customer's line of work.36) Which one of the five Cs of credit refers to a customer's willingness to pay its bills?A) CharacterB) CapacityC) CollateralD) ConditionsE) Capital37) Which one of the five Cs of credit refers to the general economic situation in the customer's line of business?A) CapacityB) CharacterC) ConditionsD) CapitalE) Collateral38) The basic factors to be evaluated in the credit evaluation process, the five Cs of credit, are:A) conditions, control, cessation, capital, and capacity.B) conditions, character, capital, control, and capacity.C) capital, collateral, control, character, and capacity.D) character, capacity, control, cessation, and collateral.E) capacity, character, collateral, capital, and conditions.39) Roger's Home Appliances offers credit to customers it deems qualified based on a numerical value that estimates the probability that the customer will default if credit is granted to them. Theprocess of computing this numerical value is referred to as:A) credit scoring.B) Credit capacity.C) receipts assessment.D) conditions for credit.E) consumer analysis.40) You are an accounting intern and today you are compiling a spreadsheet with column headings of: Invoice number; Customer number; < 30 days; 31-60 days; 61-90 days; > 90 days. You will list every unpaid invoice with the amount owed entered into the appropriate column based on the number of days between the sale date and today. Once you have completed that, you will sort the report by customer number and total the amounts listed in each column. What is this report called?A) Credit reportB) Aging scheduleC) Risk assessment reportD) Turnover delineationE) Receivables consolidation report41) Which one of the following statements is correct?A) Firms may opt to refuse additional credit to a delinquent customer.B) Seasonal sales have little, if any, impact on aging schedule percentages.C) Normally, firms call their delinquent customers prior to sending them a past due letter.D) If a firm wishes to sell a delinquent receivable, it must do so prior to the customer filing for bankruptcy.E) Expected decreases in the average collection period are a cause of concern.42) Which one of the following inventory items is probably the least liquid?A) Plywood held in inventory by a home builderB) A wheel barrow held in inventory by a garden centerC) A partially assembled interior for a new vehicleD) A set of tires owned by an automobile manufacturerE) A toy owned by a retail toy store43) Which one of the following inventory items is probably the most liquid?A) A custom made set of kitchen cabinetsB) Metal cabinets for dishwashersC) Wheat stored in a grain siloD) A customized drill pressE) A partially built modular home44) Which one of the following inventory-related costs is considered a shortage cost?A) Storage costsB) Insurance costC) Loss of customer goodwillD) Theft costE) Opportunity cost of capital used for inventory purchases45) The ABC approach to inventory management is based on the concept that:A) inventory should arrive at the time it is needed in the manufacturing process.B) the inventory period should be constant for all inventory items.C) basic inventory items that are essential to production and also inexpensive should be ordered in small quantities only.D) a small percentage of inventory items represents a large percentage of inventory cost.E) one-third of a year's inventory needs should be on hand, another third should be on order, and the last third should be unordered.46) The EOQ model is designed to determine how much:A) total inventory a firm needs during any one year.B) total inventory costs will be for any one given year.C) inventory should be purchased at one time.D) inventory will be sold per day.E) a firm loses in sales per day when an inventory item is depleted.47) A particular inventory manager orders items only in quantities that minimize inventory costs. What is this restocking quantity called?A) Short order quantityB) Refill unit quantityC) Economic order quantityD) Minimum stock levelE) Re-order limit48) Allison has developed a set of procedures for determining the amount of each raw material she needs to have in inventory if she is to keep the assembly lines operating efficiently. These procedures are commonly referred to by which one of the following terms?A) First-in, first-out methodB) The Baumol modelC) Net working capital planningD) Economic order proceduresE) Materials requirements planning49) Which one of the following is a characteristic of a just-in-time inventory system?A) High level of dependence on supplier performanceB) Low inventory turnover ratesC) Long inventory periodsD) Unusually high inventory levelsE) Large, infrequent re-orders of raw materials50) At the optimal order quantity size, the:A) total cost of holding inventory is fully offset by the restocking costs.B) carrying costs are equal to zero.C) restocking costs are equal to zero.D) total costs equal the carrying costs.E) carrying costs equal the restocking costs.51) The EOQ model is designed to minimize:A) production costs.B) inventory obsolescence.C) the carrying costs of inventory.D) the costs of replenishing inventory.E) the total costs of holding inventory.52) Which one of the following items is most likely a derived-demand inventory item?A) Wrenches held in inventory by a hardware storeB) Tires held in inventory by a tractor manufacturerC) Shoes on display in a retail storeD) Toys just received by a toy storeE) Wheat harvested by a farmer53) Inventory needs under a derived-demand inventory system are:A) primarily dependent upon the competitive demands placed on a firm's suppliers.B) based on the anticipated demand for the finished product.C) based on minimizing the cost of restocking inventory.D) held constant over time.E) determined by a Kanban system.54) A just-in-time inventory system:A) eliminates all inventory costs.B) reduces the inventory turnover rate.C) averages long-term inventory needs.D) focuses on immediate production needs.E) maximizes inventory costs.55) The incremental investment in receivables under the accounts receivable approach is equal to:A) P −νQ'.B) PQ'.C) PQ + ν(Q'− Q).D) P(Q'− Q).E) PQ(Q'− Q).56) The accounts receivable approach to credit policy supports the theory that:A) a firm's risk of offering credit to a new customer is limited to the cost of the items sold.B) the best credit policy is an all-cash policy.C) the cost of offering credit to a new customer is the same as the cost of offering credit to an existing customer.D) increasing receivables guarantees increasing profits.E) the default risk of a credit policy is the same as the default risk under an all cash-policy if your customers remain the same.57) Which two of the following are the key elements in determining the break-even default rate on a credit policy?A) Credit price and cash price assuming a zero default rateB) Required rate of return and percentage discount for cash customersC) Variable cost per unit and required rate of returnD) Sales price and variable cost per unit for credit customersE) Credit price and discount rate for cash customers58) On average, CT Motors has daily credit sales of $42,390, an inventory period of 53 days, anda collection period of 26 days. What is the average accounts receivable balance?A) $757,900B) $968,810C) $1,102,140D) $1,015,500E) $896,30059) Music City has an average collection period of 34.6 days and an average daily investment in receivables of $71,407. What are the annual credit sales given a 365-day year?A) $668,407B) $577,109C) $753,282D) $625,893E) $767,12360) Turner's offers credit terms of net 30 with payments received an average of 2.8 days past their due date. Annual credit sales are $2.38 million. What is the average book value of accounts receivable? Assume a 365-day year.A) $213,874B) $223,333C) $211,667D) $215,407E) $223,59361) Winters' just purchased $42,911 of goods from its supplier with credit terms of 1/5, net 25. What is the discounted price?A) $40,765B) $41,209C) $42,482D) $42,911E) $43,30062) Today, October 12, Nadine's Fashions purchased merchandise from a supplier. The credit terms are 2/10, net 30. By what day does Nadine's have to make the payment to receive the discount? Assume a 30-day month.A) October 12B) October 14C) October 22D) October 27E) November 1263) The Green Hornet offers credit terms of 2/5, net 20. Based on experience, 93 percent of all customers will take the discount. The firm sells 487 units each month at a price of $649 each. What is the average book value of accounts receivable? Assume a 365-day year.A) $60,274B) $68,272C) $62,866D) $67,012E) $65,38764) A firm offers credit terms of 2/15, net 45. What effective annual interest rate does the firm earn when a customer forgoes the discount?A) 18.67 percentB) 20.45 percentC) 23.37 percentD) 25.34 percentE) 27.86 percent65) A supplier grants credit terms of 1/5, net 30. What is the effective annual rate of the discount on a purchase of $5,000?A) 17.24 percentB) 15.80 percentC) 18.80 percentD) 19.03 percentE) 12.27 percent66) Cape May Products currently sells 487 units a month at a price of $79 a unit. The firm believes it can increase its sales by an additional 42 units if it switches to a net 30 credit policy. The monthly interest rate is .25 percent and the variable cost per unit is $31.50. What is the incremental cash inflow from the proposed credit policy switch?A) $1,774B) $1,995C) $2,746D) $3,318E) $3,37567) Home Accents currently sells 219 units a month at a price of $46 a unit. If it switches to a net 30 credit policy, monthly sales are expected to increase by 28 units. The monthly interest rateis .57 percent and the variable cost per unit is $21. What is the net present value of the proposed credit policy switch?A) $112,145B) $108,895C) $106,507D) $586,799E) $621,13568) Currently, Glasgow Importers sells 855 units a month at a price of $39 a unit. By switching to a net 30 credit policy, sales should increase to 950 units while the price remains constant. The monthly interest rate is .61 percent and the variable cost per unit is $8. What is the net present value of the proposed credit policy switch?A) $513,360B) $516,892C) $490,200D) $537,520E) $448,68269) Currently, Tanner's sells 69 units a month at an average price of $499 a unit. The company thinks it can increase sales by an additional 32 units a month if it switches to a net 30 credit policy. The monthly interest rate is .48 percent and the variable cost per unit is $216. What is the incremental cash inflow of the proposed credit policy switch?A) $10,120B) $9,056C) $12,760D) $17,810E) $15,96870) New Products currently sells a product with a variable cost per unit of $23 and a unit selling price of $49. At the present time, the firm only sells on a cash basis with monthly sales of 733 units. The monthly interest rate is .48 percent. What is the value of Q' at the switch break-even point if the firm adopted a net 30 credit policy? Assume the selling price per unit and the variable costs per unit remain constant.A) 739.66 unitsB) 736.34 unitsC) 728.47 unitsD) 740.29 unitsE) 743.18 units71) Quest is considering a change in its cash-only sales policy. The new terms of sale would be net one month. The required return is .98 percent per month. Currently, the firm sells 420 units per month at $736 per unit. Under the new policy, the firm expects sales of 475 units also at $736 per unit. The variable cost per unit is $426. What is the NPV of switching?A) $1,228,750B) $1,407,246C) $1,335,021D) $1,238,250E) $1,056,78472) Saucier Co. currently sells 1,208 units a month for total monthly sales of $209,600. The firm is considering replacing its current cash only credit policy with a net 30 policy. The variable cost per unit is $106 and the monthly interest rate is .71 percent. What is the new sales quantity at the switch break-even level of sales? Assume the selling price per unit and the variable costs per unit remain constant.A) 1,143 unitsB) 1,267 unitsC) 1,230 unitsD) 1,306 unitsE) 1,148 units73) The Cellar Door currently sells 1,849 units a month for total monthly sales of $627,800. The company is considering replacing its current cash only credit policy with a net 30 policy. The variable cost per unit is $214 and the monthly interest rate is .87 percent. What is the new sales quantity at the switch break-even level of sales?A) 1,711 unitsB) 1,779 unitsC) 1,814 unitsD) 1,957 unitsE) 1,893 units74) The Dilana Corporation is considering a change in its cash-only policy. The new terms would be net one period. The required return is 1.5 percent per period. The firm has current sales of 3,500 units per month at a price of $71 per unit. The new policy is expected to increase sales to 3,550 units at a price of $71 per unit. The cost per unit is constant at $38. What is the incremental cash inflow of the new policy?A) $1,880B) $1,420C) $1,500D) $1,995E) $1,65075) A new customer has placed an order for a turbine engine that has a variable cost of $1.12 million per unit and a credit sales price of $1.64 million. Credit is extended for one period. Based on historical experience, payment for about 1 out of every 178 such orders is never collected. The required return is 2.1 percent per period. What is the NPV per unit if this is a one-time order?A) $516,407B) $421,819C) $477,244D) $534,290E) $351,05676) You can make a one-time sale if you will grant a new customer 30 days to pay. This customer wants to purchase an item with a sales price of $499 and a variable cost of $287. You estimate the probability of default at 33 percent. The monthly interest rate is .98 percent. Should you grant credit to this customer? Why or why not?A) Yes; because the NPV of the potential sale is $33.05B) Yes; because the NPV of the potential sale is $44.09C) Yes; because the NPV of the potential sale is $13.02D) No; because the NPV of the potential sale is −$13.05E) No; because the NPV of the potential sale is −$2.6577) The Cycle Shoppe has decided to offer credit to its customers during the spring selling season. Sales are expected to be 64 bikes with an average cost of $329 each. Four percent of customers are expected to default. To help identify those individuals, the shop is considering subscribing to a credit agency. The initial charge for their services is $250 with an additional charge of $7.50 per individual report. What is the amount of the net savings from subscribing to the credit agency?A) $108B) $92C) $84D) $112E) $10378) Assume all sales are one-time credit sales with a probability of collection of 96 percent. The variable cost per unit is $1.67, the sales price per unit is $4.99, and the monthly interest rate is1.35 percent. What is the NPV of a credit sale of one item?A) $3.18B) $2.87C) $3.38D) $2.92E) $3.0679) Assume a sales price of $119 per unit, a $76 per unit variable cost, an average default rate of 3 percent, and a monthly interest rate of 1.25 percent. What is the net present value of a new repeat customer who never defaults on his or her payment?A) $5,733B) $3,364C) $2,617D) $8,817E) $9,52080) Assume an average selling price of $547 per unit, a variable cost per unit of $339, a monthly interest rate of 1.1 percent, and a default rate of 3.1 percent. What is the NPV of extending credit for 30 days to all who are expected to become repeat customers?A) $17,984B) $19,787C) $12,304D) $18,662E) $13,60981) Lakeside Market sells 848 units of an item priced at $49 each year. The carrying cost per unit is $2.26 and the fixed costs per order are $46. What is the economic order quantity?A) 192 unitsB) 221 unitsC) 197 unitsD) 186 unitsE) 163 units82) High Mountain consistently sells 2,400 pairs of $189 skates annually. The fixed order costs is $56 and the carrying costs are $3.85 a pair. What is the economic order quantity?A) 246 pairsB) 215 pairsC) 229 pairsD) 264 pairsE) 248 pairs。

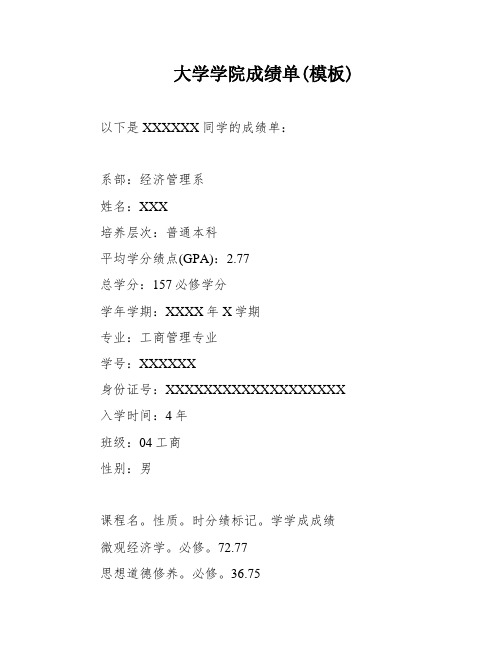

大学学院成绩单(模板)

大学学院成绩单(模板) 以下是XXXXXX同学的成绩单:系部:经济管理系姓名:XXX培养层次:普通本科平均学分绩点(GPA):2.77总学分:157必修学分学年学期:XXXX年X学期专业:工商管理专业学号:XXXXXX身份证号:XXXXXXXXXXXXXXXXXXX 入学时间:4年班级:04工商性别:男课程名。

性质。

时分绩标记。

学学成成绩微观经济学。

必修。

72.77思想道德修养。

必修。

36.75政治经济学。

必修。

36.86马克思主义哲学。

必修。

36.96 法律基础。

必修。

36.85微积分(一)。

必修。

54.62 体育。

必修。

36.97大学英语(一)。

必修。

64.80 军事训练。

必修。

96.良-经济法概论。

必修。

32.80宏观经济学。

必修。

54.81管理学原理。

必修。

72.73概论。

必修。

36.87XXX理论。

必修。

36.81微积分。

必修。

72.69大学英语(二)。

必修。

72.80 计算机应用基础。

任选。

48.83 管理思想发展史。

必修。

54.优其他任选课程。

任选。

54.65 其他任选课程。

任选。

36.76 其他任选课程。

必修。

60.61 其他任选课程。

必修。

79其他任选课程。

任选。

64.64其他任选课程。

必修。

71其他任选课程。

必修。

95其他任选课程。

任选。

85其他任选课程。

任选。

75其他任选课程。

任选。

85其他任选课程。

任选。

92其他任选课程。

任选。

84总学分:157必修学分平均学分绩点(GPA):2.77学制:XXXXX学年学期:XXXX年X学期毕业时间:19XX年X月以上是XXXXXX同学的成绩单。

2005-2006第1学期,我研究了货币银行学、劳动关系学、大学语文、当代世界经济和概率论与数理统计。

在货币银行学中,我研究了货币的本质和货币市场的运作;在劳动关系学中,我了解了劳动力市场和劳动法律;在大学语文中,我提高了我的写作和表达能力;在当代世界经济中,我研究了全球化和贸易的发展;在概率论与数理统计中,我掌握了基本的统计方法和数据分析技巧。

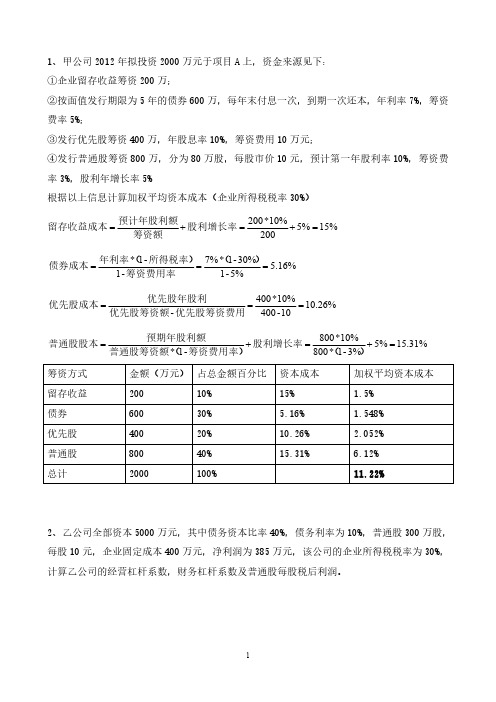

公司理财第二次作业及答案

公司无负债时的价值为:

Vu

Su

EBIT *(1 T ) K su

500*(1 30%) 16%

2187.5(万元)

Ka

EBIT *(1 T ) Vu

500*(1 30%) 2187.5

16%

当公司负债2000万时,价值为:

Vl Vu Tc D 2187.5 30% * 2000 2787.5(万元)

普通股每股税后利润 (EBIT I)* (1 T ) 385 1.283

N

300

3、考察MM公司税模型,丙公司相关财务资料如下: ①目前无负债,全部资本有普通股构成,资本成本为16%; ②公司处于零增长,现在及未来每年息税前利率固定为500万元,且所有盈利均已股利的方式 发放给股东; ③如果公司开始负债,其利率固定等于10%,全部负债用于回购普通股,使得其资本总额不变; ④公司开始负债时,负债总额2000万; 根据上述资料,计算该公司负债前后的价值和加权平均资本成本(公司所得税税率30%)。

3

1

税前利润=385/(1-30%)=550 债务利息=5000*40%*10%=200 EBIT=息税前利润=550+200=750

公司理财精要版原书第12版习题库答案Ross12e_Chapter06_TB