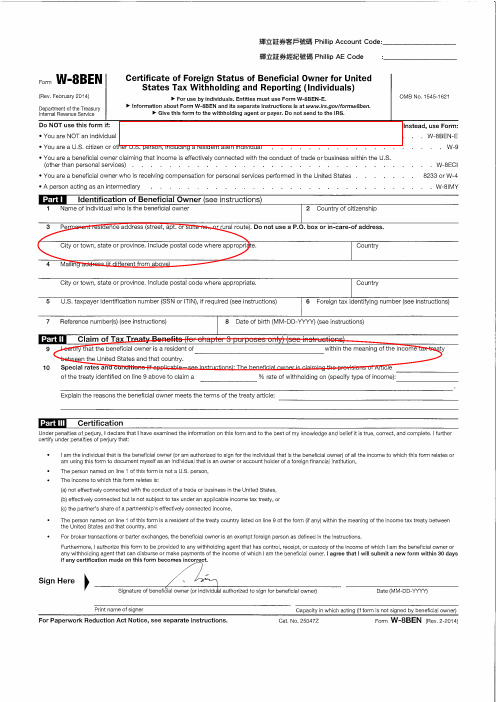

W8Form-sample美股申请表格样本

W8Form-sample美股申请表格样本

W-8BEN塡寫及簽署指引*1. 客戶需填寫永久地址於此欄,若客戶填寫的地址是美國地址,客戶則會被認定為美國人士。

(美國人士應填寫W-9表格)2. 若客戶的的國家與美國是稅務減免互惠國,請在虛線上填寫國家名稱(請勿簡寫),如果客戶的國家與美國並不是稅務減免互惠國^,請不要填寫 Part II 並無需於虛線上填寫。

另外,新開戶口的客戶雖符合以下所有條件才有可能獲得稅務優惠:W-8BEN的郵寄地址及永久地址均符合美國指定之稅務優惠國家;開戶表格及W-8BEN 的地址一致;國藉與郵寄地址及永久地址的國家相同;如未能符合以上任何一項:則客戶要提供證明文件(如稅務優惠國家的護照或身份證)或客戶提供的書面聲明/解釋) 舊有客戶於此欄填寫的地址需要與已登記的地址相一致,才有可能獲得稅務優惠。

以下國藉人士可享有股息稅務優惠: 中華人民共和國﹑日本﹑南韓﹑泰國﹑澳洲﹑印尼及加拿大。

*^以下國藉人士未能享有股息稅務優惠: 香港﹑澳門﹑台灣﹑新加坡。

3. 聯名戶口每人分別填寫一張,另外乎合美國稅務優惠的申請人需要每隔三年#或當於國藉 /居住國家有所更新時重新向證券商提供一份新的 W-8BEN 表格及其他所需文件。

W-8BEN 表格簡要説明個人個人//聯名帳戶Part I,第1 欄 姓名全名 (必須與個人身份證明文件一致)Part I,第2 欄 國家 (公民身份)Part I,第3 欄 永久住址(請勿使用郵政信箱PO Box 或轉寄地址,國家名稱請勿簡寫) Part I,第4 欄 通訊地址(如果與第3欄地址不同,國家名稱請勿簡寫)Part I,第5 欄 美國國稅局稅號、SSN、ITIN號碼(如果沒有則無須填寫)Part I,第6 欄 外國稅號 (如果沒有則無須填寫)Part I,第7 欄 客戶於輝立的帳戶號碼Part I,第8 欄 出生日期 (如客戶出生日期為 1956年4月15日,請填寫 04-15-1956)Part II,第9及10欄 如果客戶的國家與美國是稅務減免互惠國^,請在虛線上填寫國家名稱(請勿簡寫)。

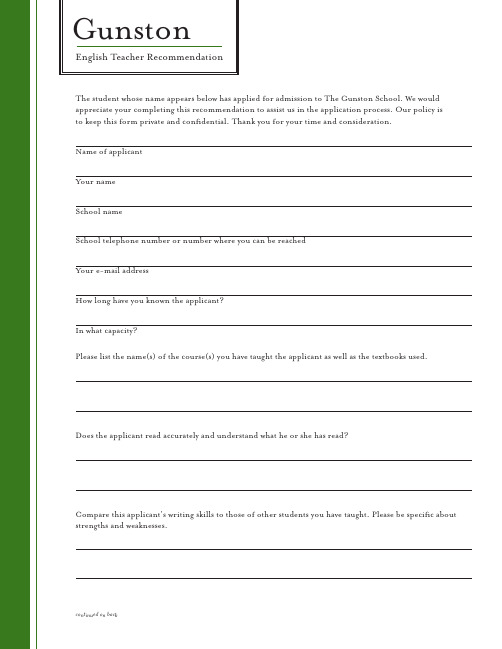

美国高中申请表格样例

The student whose name appears below has applied for admission to The Gunston School. We would appreciate your completing this recommendation to assist us in the application process. Our policy isto keep this form private and confidential. Thank you for your time and consideration.Name of applicantYour nameSchool nameSchool telephone number or number where you can be reachedYour e-mail addressHow long have you known the applicant?In what capacity?Please list the name(s) of the course(s) you have taught the applicant as well as the textbooks used.Does the applicant read accurately and understand what he or she has read?Compare this applicant’s writing skills to those of other students you have taught. Please be specific about strengths and weaknesses.continued on backSummary appraisalPlease circle the word that describes the applicant best in each category:Please feel free to elaborate on any of the categories listed above. (Attach additional sheet, if necessary)I recommend this candidate (please circle one)Enthusiastically Strongly With Mild Enthusiasm Not RecommendedSignature DatePlease send this form directly to:The Gunston SchoolAttn: Admission OfficeP.O. Box 200Centreville, MD 21617Telephone: 410.758.0620 / Fax: 410.758.0628Or send a scanned copy to: admission@The student whose name appears below has applied for admission to The Gunston School. We would appreciate your completing this recommendation to assist us in the application process. Our policy isto keep this form private and confidential. Thank you for your time and consideration.Name of applicantYour nameSchool nameSchool telephone number or number where you can be reachedYour e-mail addressHow long have you known the applicant?In what capacity?Please list the name(s) of the course(s) you have taught the applicant and designate whether the course(s) were accelerated or advanced.How well has the student mastered the material you covered in the course(s) you taught him / her? What were the student’s particular strengths and / or weaknesses as a math student?How would you rate the student’s problem-solving abilities and the student’s ability to deal with abstract concepts? continued on backSummary appraisalPlease circle the word that describes the applicant best in each category:Please feel free to elaborate on any of the categories listed above. (Attach additional sheet, if necessary)I recommend this candidate (please circle one)Enthusiastically Strongly With Mild Enthusiasm Not RecommendedSignature DatePrinted NamePlease send this form directly to:The Gunston SchoolAttn: Admission OfficeP.O. Box 200Centreville, MD 21617Telephone: 410.758.0620 / Fax: 410.758.0628Or send a scanned copy to: admission@This form is to be completed by the Headmaster, Principal, School Registrar,or Secondary School Counselor.The student whose name appears below has applied for admission to The Gunston School. We would appreciate your completing this recommendation and returning it to us to assist us in admission process. Our policy is to keep this form private and confidential.Thank you for your time and consideration.Student current gradeCurrent schoolSchool address city state zipTelephone with area codeGrading/credit systemHas the applicant been given a Wechsler Intelligence Scale for Children (WISC) or other standarizedIf so, please send a copy of the report to The Gunston School. Please describe academic strengths and weaknesses.If yes, please explain.continued on backPersonal / social informationHow long have you known the applicant and in what context?Community spirit Social skills Peer relationships Adult relationships Family relationships Self-confidenceConcern for others IntegrityIf yes, please comment.If yes, please describe.Do you recommend this student for admission to The Gunston School?Strongly Fairly strongly With reservations Not recommended We would appreciate any additional comments you wish to make.Please type or print the following informationName Position/title at schoolTelephone number with area codeSignature DatePlease send this form directly to:The Gunston SchoolAttn: Admission OfficeP.O. Box 200Centreville, MD 21617Telephone: 410.758.0620 / Fax: 410.758.0628Or send a scanned copy to: admission@One of the top few Excellent Good Below No BasisI have encountered (top 10% of this year) (above average) Average Average for Judgement5 4 3 2 1 N/A Please rate the following:To the Parent / Guardian:Please fill out and sign the release statement below so that Gunston will receive a copy of your child’s transcript. This form will need to be taken to your child’s principal or guidance counselor.Applicant’s nameI hereby authorize that my child’s transcript be released to the Admission Office of The Gunston School.Signature of Parent or Guardian dateTo the school:The student named above is applying for admission to The Gunston School.Please send the following information:all progress reports for the current school yearprogress report for the previous school yearstandardized test scoresattendance recordAll information can be sent to:The Gunston SchoolAttn: Admission OfficeP.O. Box 200Centreville, MD 21617Telephone: 410.758.0620 / Fax: 410.758.0628Or send a scanned copy to: admission@Please keep this form on file at your school as it does not need to be returned to us.。

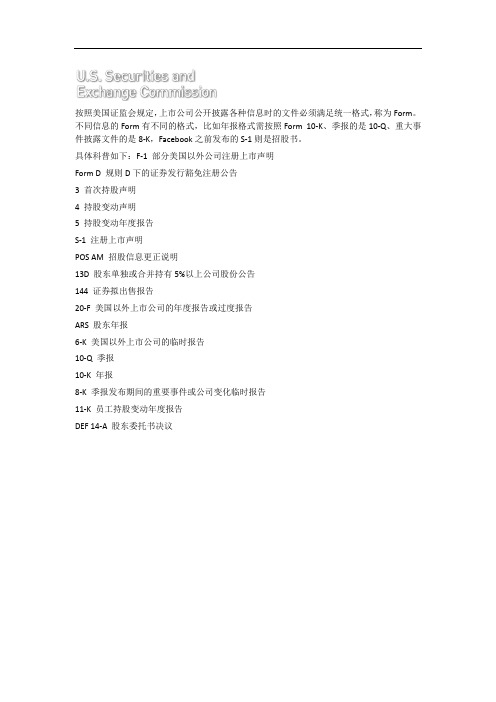

美国证监会信息披露表格名称

按照美国证监会规定,上市公司公开披露各种信息时的文件必须满足统一格式,称为Form。

不同信息的Form有不同的格式,比如年报格式需按照Form 10-K、季报的是10-Q、重大事件披露文件的是8-K,Facebook之前发布的S-1则是招股书。

具体科普如下:F-1 部分美国以外公司注册上市声明

Form D 规则D下的证券发行豁免注册公告

3 首次持股声明

4 持股变动声明

5 持股变动年度报告

S-1 注册上市声明

POS AM 招股信息更正说明

13D 股东单独或合并持有5%以上公司股份公告

144 证券拟出售报告

20-F 美国以外上市公司的年度报告或过度报告

ARS 股东年报

6-K 美国以外上市公司的临时报告

10-Q 季报

10-K 年报

8-K 季报发布期间的重要事件或公司变化临时报告

11-K 员工持股变动年度报告

DEF 14-A 股东委托书决议。

美国移民局常用表格解析

美国移民局常用表格解析[小编按]投资移民简介投资移民的申请者可以采取投资的方式取得投资国永久居留权。

申请人可以投资于目标国政府批准的投资基金或合适的商业项目,投资基金一般都有最短时间限制。

该类申请人必须愿意将资金投资于目标移民国家,以促进目标移民国家经济发展、增加就业机会及丰富文化生活。

而获得的回报是主申请人和全家可以获得投资国身份,从而享受等同于投资国国民的福利和保险待遇。

进而子女也可享受免费或优惠教育的权利,以及全家自由进出该国的便利条件。

美国移民局常用表格解析下面的申请费用可能已经过时,不过表格代号还是可以借鉴的。

移民局常用表格Form Number表格代号Title用途Filing Fee申请费AR-11 Change of Address Form地址变更通知 $0I-90 Application to Replace Permanent Resident Card绿卡补发申请 $110I-102 Application for Replacement/Initial Nonimmigrant Arrival/Departure Record入境记录卡补发申请 $85I-129 Petition for A Nonimmigrant Worker非移民雇员申请 $110 base fee, plus $500 additional for H-1B petitions.I-129F Petition for Alien Fiance(e)未婚夫/妻申请 $95I-129S Nonimmigrant Petition Based on Blanket L PetitionL 类签证申请 $0I-129W Petition for Nonimmigrant Worker Filing Fee Exemption非移民雇员豁免申请费申请 $0I-130 Petition for Alien Relative亲属移民申请 $110I-131 Application for Travel Document旅行证件申请(用于再入境许可证, 回美证, 难民证, 假释入境证等申请) $95I-134 Affidavit of Support经济担保书 / 生活担保书 $0I-140 Immigrant Petition for Alien Worker职业移民申请 $115I-212 Application for Permission to Reapply for Admission into the U.S. After Deportation or Removal递解出境返美申请 $170I-360 Petition for Amerasian, Widow(er), or Special Immigrant美亚裔人, 寡妇或特殊移民申请 $110 (except there is no fee for Amerasians)N-400 Application for Naturalization入籍申请 $225I-485 Application to Register Permanent Residence or to Adjust Status永久居留登记或调整身份申请$220 14 years and older. $160 under 14 years of age.I-485 Supplement A Supplement A to Form I-485, Application to Register Permanent Residence非法居留调整身份申请 $1,000I-526 Immigrant Petition By Alien Entrepreneur投资移民申请 $350I-539 Application to Extend/Change Nonimmigrant Status非移民身份延期 / 转换申请 $120I-589 Application for Asylum庇护申请 $0I-590 Registration for Classification as a Refugee难民申请 $0I-600 Petition to Classify Orphan as an Immediate Relative孤儿移民申请 $405I-600A Application for Advance Processing of Orphan Petition孤儿移民提前受理申请 $405I-601 Application for Waiver of Grounds of Excludability不可入境类豁免申请 $170I-612 Application for Waiver of the Foreign Residence Requirement回国居住豁免申请(用于 J 签证豁免回国) $170I-751 Petition to Remove the Conditions on Residence解除居住调件申请 (用于临时绿卡转为永久绿卡) $125I-765 Application for Employment Authorization工作许可申请 $100I-824 Application for Action on an Approved Application or Petition批件补发申请(用于所有移民和非法移民签证批准通书的补发申请) $120I-847 Report of Complaint 移民局投诉表 $0I-864 Package I-864, I-864A and I-865 生活/经济担保书 $0G-325 Biographic Information 履历表 $0劳工部常用表格ETA-750 Application for Alien Employment Certification劳工证申请ETA-9035 Labor Condition Application for H1-B Nonimmigrant劳工情况申请 (用于向劳工部申报 H-1B 申请)lemon_peel。

美国免税申请表

FormW-8BEN(Rev. February 2006)Department of the Treasury Internal Revenue ServiceCertificate of Foreign Status of Beneficial Ownerfor United States Tax WithholdingᮣSee separate instructions.ᮣGive this form to the withholding agent or payer. Do not send to the IRS.OMB No. 1545-1621Do not use this form for:Instead, use Form:●A foreign partnership, a foreign simple trust, or a foreign grantor trust (see instructions for exceptions)W-8ECI or W-8IMY ●A foreign government, international organization, foreign central bank of issue, foreign tax-exempt organization,foreign private foundation, or government of a U.S. possession that received effectively connected income or that is claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b) (see instructions)W-8ECI or W-8EXP●A person acting as an intermediaryW-8IMY●A person claiming that income is effectively connected with the conduct of a trade or business in the United StatesW-8ECI4567Permanent residence address (street, apt. or suite no., or rural route).Do not use a P.O. box or in-care-of address.City or town, state or province. Include postal code where appropriate.Country (do not abbreviate)U.S. taxpayer identification number, if required (see instructions)Foreign tax identifying number, if any (optional)Mailing address (if different from above)City or town, state or province. Include postal code where appropriate.Country (do not abbreviate)I certify that (check all that apply):The beneficial owner is a resident ofwithin the meaning of the income tax treaty between the United States and that country.If required, the U.S. taxpayer identification number is stated on line 6 (see instructions).The beneficial owner is not an individual, derives the item (or items) of income for which the treaty benefits are claimed, and, if applicable, meets the requirements of the treaty provision dealing with limitation on benefits (see instructions).The beneficial owner is not an individual, is claiming treaty benefits for dividends received from a foreign corporation or interest from a U.S. trade or business of a foreign corporation, and meets qualified resident status (see instructions).The beneficial owner is related to the person obligated to pay the income within the meaning of section 267(b) or 707(b), and will file Form 8833 if the amount subject to withholding received during a calendar year exceeds, in the aggregate, $500,000.further certify under penalties of perjury that:1 I am the beneficial owner (or am authorized to sign for the beneficial owner) of all the income to which this form relates,2 The beneficial owner is not a U.S. person,3 The income to which this form relates is (a) not effectively connected with the conduct of a trade or business in the United States, (b) effectively connected but is not subject to tax under an income tax treaty, or (c) the partner’s share of a partnership’s effectively connected income, and4 For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions.Sign HereᮣSignature of beneficial owner (or individual authorized to sign for beneficial owner)Date (MM-DD-YYYY)For Paperwork Reduction Act Notice, see separate instructions.Cat. No. 25047ZFormW-8BEN(Rev. 2-2006)ᮣSection references are to the Internal Revenue Code.a b c d e SSN or ITINEINCapacity in which acting9Special rates and conditions (if applicable—see instructions): The beneficial owner is claiming the provisions of Article of thetreaty identified on line 9a above to claim a% rate of withholding on (specify type of income):.Explain the reasons the beneficial owner meets the terms of the treaty article:10GovernmentInternational organizationCentral bank of issueTax-exempt organization11I have provided or will provide a statement that identifies those notional principal contracts from which the income is not effectively ●A U.S. citizen or other U.S. person, including a resident alien individual W-9Private foundationNote: These entities should use Form W-8BEN if they are claiming treaty benefits or are providing the form only to claim they are a foreign person exempt from backup withholding.Note: See instructions for additional exceptions.Grantor trustEstateComplex trustFurthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner.8Reference number(s) (see instructions)Printed on Recycled PaperRoom 1818, the villa of Xiangshan Yishu, Xiangshan South Road 88th, Haidian District BeijingChinaChina。

APPLICATIONFORM-INDIVIDUALACCOUNT个人帐户申请表

APPLICATION FORM - INDIVIDUAL ACCOUNT 开户申请表-个人客户Fax传真: ................................................ E-mail邮件地址: ...........................................................................: ..........................................................................................................................................: .............................................................................................................................................Net worth净资产: [ ]$0 - $0.25 million 0-25万美元 [ ]$0.25 - $1 million 25-100万美元[ ]Over $1 million超过100万美元3. INVESTMENT OBJECTIVES AND TRADING RESTRICTIONS 投资目标,目的和限制Length of experience经验时间:[ ]1-3 years 1-3年 [ ]More than 3 years[ ]US Dollars美元 [ ]Euro欧元 [ ]Pound Sterling英镑[ ]Hong Kong Dollars港币[ ]Japanese Ye日元CLIENT ACKNOWLEDEMENT AND DECLARATION:This Application Form is use for by persons who wish to use our services to facilitate dealing in Margin Contracts, CFDs and Options. Subject to you being accepted as a client of Multibank Australia Pty Ltd, you agree to accept the terms and conditions stated in the Client Agreement (CA), Product Disclosure您并非未解除债务的破产人或精神失常的人。

美国证券交易委员会表格说明(SECFormsIndex)

美国证券交易委员会表格说明(SECFormsIndex)3.INDEX TO FORMSAs a filer, you will first need to determine whether you must meet your filing obligation via EDGAR. The SEC Rules, particularly Regulation S-T, General Rules and Regulations for Electronic Filings, outline which filings are mandated as electronic. This means that they must be filed on EDGAR unless there is a case for Temporary or Permanent Hardship. (The rules for each form and hardship exemptions may differ, so please see the regulation for specific information.) Once you determine the form you need to file is electronic, then you need to identify the submission type to use. For each submission type, there are specific tools that you can use.As the EDGAR system has evolved using new technologies, tools have been added, changed, and sometimes updated. There is no longer a single tool for preparing an EDGAR submission. Your guide to the tools is this index. The first index allows you to lookup EDGAR electronic submission types easily if all you know is the submission form type. Included in the last two columns is detailed information about the tools that are used to create and/or assemble the filing. The second index is easiest to use if you are more comfortable looking up your submission type by Act.Before using the indexes, it is important to understand the difference between the Code of Federal Regulations (CFR) Form/Schedule/Rule column reference and the EDGAR Submission Type column. The index entries under the CFR Form/Schedule/Rule column refer to the titles of the actual Form, Schedule or Rule named in the CFR. The Submission Type refersto Form variations filers use on the electronic filing system to fulfill their filing obligation. For example, the paper Form 15 is implemented on EDGAR as a number of different submission types including: 15-12B, 15-12G, and 15-15D. The last three digits represent the sections of the 34 Act under which the filer is registered.Using either Index, find the submission type, check that the description of the form matches your understanding of the purpose of the form, and identify the tool that should be used to create the form. The options in this column are EDGARLink Online, EDGARLite, and the corresponding templates and OnlineForms. There is a section in this manual describing in detail each of these tools. Chapter 7, PREPARING AND TRANSMITTING EDGARLINK ONLINE SUBMISSIONS, describes EDGARLink Online. Chapter 8, PREPARING AND TRANSMITTING EDGARLITE SUBMISSIONS, describes EDGARLite. Chapter 9, PREPARING AND TRANSMITTING ONLINE SUBMISSIONS, describes online submissions using the EDGAR OnlineForms/XML Website. The column entitled Filer-Constructed Technical Specifications should only be used by filers who want to create their submissions without the use of EDGAR tools. These Technical Specifications are available on the SEC’s Public Website. The Technical Specifications are delivered separately and are not part of the Filer Manual.Note: In Section 3.1 for simplicity we include both the initial form and the associated amendment in the Submission Type column.3.1Alpha/Numeric。

表格W-8BEN-E填写说明

表格 W-8BEN-E 填写说明(于 2017 年 7 月修订)美国财政部美国国税局在美纳税与报税受益方身份证明(实体)除非另有说明,请参见《国内税收法》。

未来发展关于表格 W-8BEN-E 及其填写说明的最新进展,例如在该表格和说明发布后颁布的相关法律法规,请访问/ FormW8BENE。

最新进展有限 FFI 和有限分支机构。

有限 FFI 和有限分支机构身份已于 2016 年 12 月 31 日到期,并且已从此表格和填写说明中删除。

获赞助 FFI 和获赞助直接申报 NFFE。

自 2017 年 1 月 1 日起,登记视同遵守 FATCA 的获赞助 FFI 和获赞助直接申报NFFE 必须获得自己的 GIIN 以便在此表格上提供,并且不可再提供赞助实体的 GIIN。

此表格已经更新以反映这一要求。

非申报 IGA FFI。

此表格和这些填写说明已经更新以反映财政部法规中要求预扣款代理人证明非申报 IGA FFI 的要求。

这些填写说明还澄清是获赞助实体的非申报 IGA FFI 应提供自己的 GIIN(如有要求)并且不应提供赞助实体的GIIN。

参见第 12 部分的填写说明。

此外,这些填写说明规定:受托人提供证明文件的信托的外国受托人应提供其登记为参与 FATCA 的 FFI(包括模式 2 申报 FFI)或模式1 申报 FFI 时收到的 GIIN。

外国纳税人身份编号 (TIN)。

这些填写说明已更新以要求在一家金融机构的美国办事处或分支机构持有金融账户的特定外国账户持有人在此表格上提供外国 TIN(某些情况除外)。

请参见第 9b 行的填写说明了解这一要求的例外情况。

提醒注意。

如果您居住于 FATCA 合伙人辖区(即具有互惠的IGA 模式 1 辖区),特定纳税账户信息可提供给居住辖区。

一般说明关于本说明中所用术语的定义,请参阅下文的定义部分内容。

表格用途本表格供外籍实体证明第 3 章、第 4 章及本说明下文中描述的《国内税收法》其他特定条款规定的身份。

美国优先股法律模板之Term Sheet 2013 Clean

This sample document is the work product of a national coalition of attorneys who specialize in venture capital financings, working under the auspices of the NVCA. This document is intended to serve as a starting point only, and should be tailored to meet your specific requirements. This document should not be construed as legal advice for any particular facts or circumstances. Note that this sample document presents an array of (often mutually exclusive) options with respect to particular deal provisions.TERM SHEETThis term sheet maps to the NVCA Model Documents, and for convenience the provisions are grouped according to the particular Model Document in which they may be found. Although this term sheet is perhaps somewhat longer than a "typical" VC Term Sheet, the aim is to provide a level of detail that makes the term sheet useful as both a road map for the document drafters and as a reference source for the business people to quickly find deal terms without the necessity of having to consult the legal documents (assuming of course there have been no changes to the material deal terms prior to execution of the final documents).FOR SERIES A PREFERRED STOCK FINANCING OF[INSERT COMPANY NAME], INC.[ __, 20__]This Term Sheet summarizes the principal terms of the Series A Preferred Stock Financing of [___________], Inc., a [Delawar e] corporation (the “Company”). In consideration of the time and expense devoted and to be devoted by the Investors with respect to this investment, the No Shop/Confidentiality [and Counsel and Expenses] provisions of this Term Sheet shall be binding obligations of the Company whether or not the financing is consummated. No other legally binding obligations will be created until definitive agreements are executed and delivered by all parties. This Term Sheet is not a commitment to invest, and is conditioned on the completion of due diligence, legal review and documentation that is satisfactory to the Investors. This Term Sheet shall be governed in all respects by the laws of [______________the ].1Offering TermsClosing Date: As soon as practicable following the Company’s acceptance of thisTerm Sheet and satisfaction of the Conditions to Closing (the“Closing”). [provide for multiple closings if applicable] Investors: Investor No. 1: [_______] shares ([__]%), $[_________]Investor No. 2: [_______] shares ([__]%), $[_________][as well other investors mutually agreed upon by Investors and theCompany]Amount Raised: $[________], [including $[________] from the conversion ofprincipal [and interest] on bridge notes].2Price Per Share: $[________] per share (based on the capitalization of the Companyset forth below) (the “Original Purchase Price”).1The choice of law governing a term sheet can be important because in some jurisdictions a term sheet that expressly states that it is nonbinding may nonetheless create an enforceable obligation to negotiate the terms set forth inthe term sheet in good faith. Compare SIGA Techs., Inc. v. PharmAthene, Inc., Case No. C.A. 2627 ( (Del. Supreme Court May 24, 2013) (holding that where parties agreed to negotiate in good faith in accordance with a term sheet, thatobligation was enforceable notwithstanding the fact that the term sheet itself was not signed and contained a footer oneach page stating “Non Binding Terms”); EQT Infrastructure Ltd. v. Smith, 861 F. Supp. 2d 220 (S.D.N.Y. 2012);Stanford Hotels Corp. v. Potomac Creek Assocs., L.P., 18 A.3d 725 (D.C. App. 2011)with Rosenfield v. United StatesTrust Co., 5 N.E. 323, 326 (Mass. 1935) (“An agreement to reach an agreement is a contradiction in terms and imposes no obligation on the parties thereo.”); Martin v. Martin, 326 S.W.3d 741 (Tex. App. 2010); Va. Power Energy Mktg. v. EQT Energy, LLC, 2012 WL 2905110 (E.D. Va. July 16, 2012). As such, because a “nonbinding” term sheet governed by thelaw of a jurisdiction such as Delaware, New York or the District of Columbia may in fact create an enforceable obligationto negotiate in good faith to come to agreement on the terms set forth in the term sheet, parties should give considerationto the choice of law selected to govern the term sheet.2Modify this provision to account for staged investments or investments dependent on the achievement of milestones by the Company.Pre-Money Valuation: The Original Purchase Price is based upon a fully-diluted pre-moneyvaluation of $[_____] and a fully-diluted post-money valuation of$[______] (including an employee pool representing [__]% of thefully-diluted post-money capitalization).Capitalization: The Company’s capital structure before and after the Closing is s etforth on Exhibit A.CHARTER3Dividends: [Alternative 1: Dividends will be paid on the Series A Preferred on anas-converted basis when, as, and if paid on the Common Stock][Alternative 2: The Series A Preferred will carry an annual [__]%cumulative dividend [payable upon a liquidation or redemption]. Forany other dividends or distributions, participation with CommonStock on an as-converted basis.] 4[Alternative 3: Non-cumulative dividends will be paid on the SeriesA Preferred in an amount equal to $[_____] per share of Series APreferred when and if declared by the Board.]Liquidation Preference: In the event of any liquidation, dissolution or winding up of theCompany, the proceeds shall be paid as follows:[Alternative 1 (non-participating Preferred Stock): First pay [one]times the Original Purchase Price [plus accrued dividends] [plusdeclared and unpaid dividends] on each share of Series A Preferred(or, if greater, the amount that the Series A Preferred would receiveon an as-converted basis). The balance of any proceeds shall bedistributed pro rata to holders of Common Stock.][Alternative 2 (full participating Preferred Stock): First pay [one]times the Original Purchase Price [plus accrued dividends] [plusdeclared and unpaid dividends] on each share of Series A Preferred.Thereafter, the Series A Preferred participates with the Common3The Charter (Certificate of Incorporation) is a public document, filed with the Secretary of State of the statein which the company is incorporated, that establishes all of the rights, preferences, privileges and restrictions of the Preferred Stock.4In some cases, accrued and unpaid dividends are payable on conversion as well as upon a liquidation event. Most typically, however, dividends are not paid if the preferred is converted. Another alternative is to give the Companythe option to pay accrued and unpaid dividends in cash or in common shares valued at fair market value. The latter are referred to as “PIK” (payment-in-kind) dividends.Stock pro rata on an as-converted basis.][Alternative 3 (cap on Preferred Stock participation rights): First pay[one] times the Original Purchase Price [plus accrued dividends][plus declared and unpaid dividends] on each share of Series APreferred. Thereafter, Series A Preferred participates with CommonStock pro rata on an as-converted basis until the holders of Series APreferred receive an aggregate of[_____] times the Original PurchasePrice (including the amount paid pursuant to the precedingsentence).]A merger or consolidation (other than one in which stockholders ofthe Company own a majority by voting power of the outstandingshares of the surviving or acquiring corporation) and a sale, lease,transfer, exclusive license or other disposition of all or substantiallyall of the assets of the Company will be treated as a liquidation event(a “Deemed Liquidation Event”), thereby triggering payment of theliquidation preferences described above [unless the holders of [___]%of the Series A Preferred elect otherwise]. [The Investors' entitlementto their liquidation preference shall not be abrogated or diminished inthe event part of the consideration is subject to escrow in connectionwith a Deemed Liquidation Event.]5Voting Rights: The Series A Preferred shall vote together with the Common Stock onan as-converted basis, and not as a separate class, except (i) [so longas [insert fixed number, or %, or “any”] shares of Series A Preferredare outstanding,] the Series A Preferred as a class shall be entitled toelect [_______] [(_)] members of the Board (the “Series ADirectors”), and (ii) as required by law. The Company’s Certificateof Incorporation will provide that the number of authorized shares ofCommon Stock may be increased or decreased with the approval of amajority of the Preferred and Common Stock, voting together as asingle class, and without a separate class vote by the Common Stock.6 Protective Provisions: [So long as[insert fixed number, or %, or “any”] shares of Series APreferred are outstanding,] in addition to any other vote or approvalrequired under the Company’s Charter or Bylaws,the Company willnot, without the written consent of the holders of at least [__]% of theCompany’s Series A Preferred, either directly or by amendm ent,merger, consolidation, or otherwise:(i) liquidate, dissolve or wind-up the affairs of the Company, or5See Subsection 2.3.4 of the Model Certificate of Incorporation and the detailed explanation in related footnote 25.6For corporations incorporated in California, one cannot “opt out” of the statutory requirement of a separate class vote by Common Stockholders to authorize shares of Common Stock. The purpose of this provision is to "opt out"of DGL 242(b)(2).effect any merger or consolidation or any other DeemedLiquidation Event; (ii) amend, alter, or repeal any provision of theCertificate of Incorporation or Bylaws [in a manner adverse to theSeries A Preferred];7 (iii) create or authorize the creation of orissue any other security convertible into or exercisable for anyequity security, having rights, preferences or privileges senior toor on parity with the Series A Preferred, or increase the authorizednumber of shares of Series A Preferred; (iv) purchase or redeemor pay any dividend on any capital stock prior to the Series APreferred, [other than stock repurchased from former employeesor consultants in connection with the cessation of theiremployment/services, at the lower of fair market value or cost;][other than as approved by the Board, including the approval of[_____] Series A Director(s)]; or (v) create or authorize thecreation of any d ebt security [if the Company’s aggregateindebtedness would exceed $[____][other than equipment leasesor bank lines of credit][unless such debt security has received theprior approval of the Board of Directors, including the approval of[________] Series A Director(s)]; (vi) create or hold capital stockin any subsidiary that is not a wholly-owned subsidiary or disposeof any subsidiary stock or all or substantially all of any subsidiaryassets; [or (vii) increase or decrease the size of the Board ofDirectors].8Optional Conversion: The Series A Preferred initially converts 1:1 to Common Stock at anytime at option of holder, subject to adjustments for stock dividends,splits, combinations and similar events and as described below under“Anti-dilution Provisions.”Anti-dilution Provisions: In the event that the Company issues additional securities at apurchase price less than the current Series A Preferred conversionprice, such conversion price shall be adjusted in accordance with thefollowing formula:[Alternative 1: “Typical” weighted average:CP2 = CP1 * (A+B) / (A+C)CP2= Series A Conversion Price in effect immediately afternew issueCP1= Series A Conversion Price in effect immediately priorto new issue7Note that as a matter of background law, Section 242(b)(2) of the Delaware General Corporation Law provides that if any proposed charter amendment would adversely alter the rights, preferences and powers of one series of Preferred Stock, but not similarly adversely alter the entire class of all Preferred Stock, then the holders of that series are entitled to a separate series vote on the amendment.8The board size provision may also be addressed in the Voting Agreement; see Section 1.1 of the Model Voting Agreement.A = Number of shares of Common Stock deemed to beoutstanding immediately prior to new issue (includesall shares of outstanding common stock, all shares ofoutstanding preferred stock on an as-converted basis,and all outstanding options on an as-exercised basis;and does not include any convertible securitiesconverting into this round of financing)9B = Aggregate consideration received by the Corporationwith respect to the new issue divided by CP1C = Number of shares of stock issued in the subjecttransaction][Alternative 2: Full-ratchet – the conversion price will be reduced tothe price at which the new shares are issued.][Alternative 3: No price-based anti-dilution protection.]The following issuances shall not trigger anti-dilution adjustment:10(i) securities issuable upon conversion of any of the Series APreferred, or as a dividend or distribution on the Series APreferred; (ii) securities issued upon the conversion of anydebenture, warrant, option, or other convertible security; (iii)Common Stock issuable upon a stock split, stock dividend, or anysubdivision of shares of Common Stock; and (iv) shares ofCommon Stock (or options to purchase such shares of CommonStock) issued or issuable to employees or directors of, orconsultants to, the Company pursuant to any plan approved by theCompany’s Board of Directors [including at least [_______]Series A Director(s)].Mandatory Conversion: Each share of Series A Preferred will automatically be converted intoCommon Stock at the then applicable conversion rate in the event ofthe closing of a [firm commitment] underwritten public offering witha price of [___]times the Original Purchase Price (subject toadjustments for stock dividends, splits, combinations and similarevents) and [net/gross] proceeds to the Company of not less than$[_______] (a “QPO”), or (ii) upon the written consent of the holdersof [__]%of the Series A Preferred.11[Pay-to-Play: [Unless the holders of [__]% of the Series A elect otherwise,] on any9The "broadest" base would include shares reserved in the option pool.10Note that additional exclusions are frequently negotiated, such as issuances in connection with equipment leasing and commercial borrowing. See Subsections 4.4.1(d)(v)-(viii) of the Model Certificate of Incorporation for additional exclusions.11The per share test ensures that the investor achieves a significant return on investment before the Companycan go public. Also consider allowing a non-QPO to become a QPO if an adjustment is made to the Conversion Price forthe benefit of the investor, so that the investor does not have the power to block a public offering.subsequent [down] round all [Major] Investors are required topurchase their pro rata share of the securities set aside by the Boardfor purchase by the [Major] Investors. All shares of Series APreferred12 of any [Major] Investor failing to do so will automatically[lose anti-dilution rights] [lose right to participate in future rounds][convert to Common Stock and lose the right to a Board seat ifapplicable].]13Redemption Rights:14Unless prohibited by Delaware law governing distributions tostockholders, the Series A Preferred shall be redeemable at the optionof holders of at least[__]% of the Series A Preferred commencingany time after [________] at a price equal to the Original PurchasePrice [plus all accrued but unpaid dividends]. Redemption shalloccur in three equal annual portions. Upon a redemption requestfrom the holders of the required percentage of the Series A Preferred,all Series A Preferred shares shall be redeemed [(except for anySeries A holders who affirmatively opt-out)].15STOCK PURCHASE AGREEMENTRepresentations and Warranties: Standard representations and warranties by the Company. [Representations and warranties by Founders regarding technology ownership, etc.].1612Alternatively, this provision could apply on a proportionate basis (e.g., if Investor plays for ½ of pro rata share, receives ½ of anti-dilution adjustment).13If the punishment for failure to participate is losing some but not all rights of the Preferred (e.g., anything other than a forced conversion to common), the Certificate of Incorporation will need to have so-called “blank check preferred” provisions at least to the extent necessary to enable the Board to issue a “shadow” class of preferred with diminished rights in the event an investor fails to participate. Because these provisions flow through the charter, an alternative Model Certificate of Incorporation with “pay-to-play lite” provisions (e.g., shadow Preferred) has been posted. As a drafting matter, it is far easier to simply have (some or all of) the preferred convert to common.14Redemption rights allow Investors to force the Company to redeem their shares at cost (and sometimes investors may also request a small guaranteed rate of return, in the form of a dividend). In practice, redemption rights are not often used; however, they do provide a form of exit and some possible leverage over the Company. While it is possible t hat the right to receive dividends on redemption could give rise to a Code Section 305 “deemed dividend” problem, many tax practitioners take the view that if the liquidation preference provisions in the Charter are drafted to provide that, on conversion, the holder receives the greater of its liquidation preference or its as-converted amount (as provided in the Model Certificate of Incorporation), then there is no Section 305 issue.15Due to statutory restrictions, the Company may not be legally permitted to redeem in the very circumstances where investors most want it (the so-called “sideways situation”). Accordingly, and particulary in light of the Delaware Chancery Court’s ruling in Thoughtworks (see discussion in Model Charter), investors may seek enforcement provisions to give their redemption rights more teeth - e.g., the holders of a majority of the Series A Preferred shall be entitled to elect a majority of the Company’s Board of Directors, or shall have consent rights on Company cash expenditures, until such amounts are paid in full.16Founders’ representations are controversial and may elicit significant resistance as they are found in a minority of venture deals. They are more likely to appear if Founders are receiving liquidity from the transaction, or if there is heightened concern over intellectual property (e.g., the Company is a spin-out from an academic institution or the Founder was formerly with another company whose business could be deemed competitive with the Company), or in internati onal deals. Founders’ representations are even less common in subsequent rounds, where risk is viewed asConditions to Closing: Standard conditions to Closing, which shall include, among otherthings, satisfactory completion of financial and legal due diligence,qualification of the shares under applicable Blue Sky laws, the filingof a Certificate of Incorporation establishing the rights andpreferences of the Series A Preferred, and an opinion of counsel to theCompany.Counsel and Expenses: [Investor/Company] counsel to draft Closing documents. Companyto pay all legal and administrative costs of the financing [at Closing],including reasonable fees (not to exceed $[_____])and expenses ofInvestor counsel[, unless the transaction is not completed because theInvestors withdraw their commitment without cause].17Company Counsel: []Investor Counsel: []INVESTOR S’ RIGHTS AGREEMENTRegistration Rights:Registrable Securities: All shares of Common Stock issuable upon conversion of the SeriesA Preferred [and [any other Common Stock held by the Investors]will be deemed “Registrable Securities.”18Demand Registration: Upon earliest of (i) [three-five] years after the Closing; or (ii) [six]months19following an initial public offering (“IPO”), personsholding [__]% of the Registrable Securities may request [one][two](consummated) registrations by the Company of their shares. Theaggregate offering price for such registration may not be less than$[5-15] million. A registration will count for this purpose only if (i)all Registrable Securities requested to be registered are registered,and (ii) it is closed, or withdrawn at the request of the Investors (other significantly diminished and fairly shared by the investors, rather than being disproportionately borne by the Founders. A sample set of Founders Representations is attached as an Addendum at the end of the Model Stock Purchase Agreement.17The bracketed text should be deleted if this section is not designated in the introductory paragraph as one ofthe sections that is binding upon the Company regardless of whether the financing is consummated.18Note that Founders/management sometimes also seek limited registration rights.19The Company will want the percentage to be high enough so that a significant portion of the investor base is behind the demand. Companies will typically resist allowing a single investor to cause a registration. Experienced investors will want to ensure that less experienced investors do not have the right to cause a demand registration. In some cases, different series of Preferred Stock may request the right for that series to initiate a certain number of demand registrations. Companies will typically resist this due to the cost and diversion of management resources when multiple constituencies have this right.than as a result of a material adverse change to the Company).Registration on Form S-3: The holders of [10-30]% of the Registrable Securities will have theright to require the Company to register on Form S-3, if available foruse by the Company, Registrable Securities for an aggregate offeringprice of at least $[1-5 million]. There will be no limit on theaggregate number of such Form S-3 registrations, provided that thereare no more than [two] per year.Piggyback Registration: The holders of Registrable Securities will be entitled to “piggyback”registration rights on all registration statements of the Company,subject to the right, however, of the Company and its underwriters toreduce the number of shares proposed to be registered to a minimumof [20-30]% on a pro rata basis and to complete reduction on an IPOat the underwriter’s discretion. In all events, the shares to beregistered by holders of Registrable Securities will be reduced onlyafter all other stockholders’ sh ares are reduced.Expenses: The registration expenses (exclusive of stock transfer taxes,underwriting discounts and commissions will be borne by theCompany. The Company will also pay the reasonable fees andexpenses[, not to exceed $______,] of one special counsel torepresent all the participating stockholders.Lock-up: Investors shall agree in connection with the IPO, if requested by themanaging underwriter, not to sell or transfer any shares of CommonStock of the Company [(including/excluding shares acquired in orfollowing the IPO)] for a period of up to 180 days [plus up to anadditional 18 days to the extent necessary to comply with applicableregulatory requirements]20following the IPO (provided all directorsand officers of the Company [and [1 – 5]% stockholders] agree to thesame lock-up). [Such lock-up agreement shall provide that anydiscretionary waiver or termination of the restrictions of suchagreements by the Company or representatives of the underwritersshall apply to Investors, pro rata, based on the number of shares held.Termination: Upon a Deemed Liquidation Event, [and/or] when all shares of anInvestor are eligible to be sold without restriction under Rule 144[and/or] the [____] anniversary of the IPO.No future registration rights may be granted without consent of theholders of a[majority] of the Registrable Securities unlesssubordinate to the Investor’s rights.20See commentary in footnotes 23 and 24 of the Model Investor s’ Rights Agreement regarding possible extensions of lock-up period.Management and Information Rights: A Management Rights letter from the Company, in a form reasonably acceptable to the Investors, will be delivered prior to Closing to each Investor that requests one.21Any [Major] Investor [(who is not a competitor)] will be granted access to Company facilities and personnel during normal business hours and with reasonable advance notification. The Company will deliver to such Major Investor (i) annual, quarterly, [and monthly] financial statements, and other information as determined by the Board; (ii) thirty days prior to the end of each fiscal year, a comprehensive operating budget forecasting the Company’s revenues, expenses, and cash position on a month-to-month basis for the upcoming fiscal year[; and (iii) promptly following the end of each quarter an up-to-date capitalization table. A “Major Investor” means any Investor who purchases at least $[______] of Series A Preferred.Right to Participate Pro Rata in Future Rounds: All [Major] Investors shall have a pro rata right, based on their percentage equity ownership in the Company (assuming the conversion of all outstanding Preferred Stock into Common Stock and the exercise of all options outstanding under the Company’s stock plans), to participate in subsequent issuances of equity securities of the Company (excluding those issuances listed at the end of the “Anti-dilution Provisions” section of this Term Sheet. In addition, should any [Major] Investor choose not to purchase its full pro rata share, the remaining [Major] Investors shall have the right to purchase the remaining pro rata shares.Matters Requiring Investor Director Approval: [So long as the holders of Series A Preferred are entitled to elect a Series A Director,the Company will not, without Board approval, which approval must include the affirmative vote of [one/both] of the Series A Director(s):(i) make any loan or advance to, or own any stock or othersecurities of, any subsidiary or other corporation, partnership, or other entity unless it is wholly owned by the Company; (ii) make any loan or advance to any person, including, any employee or director, except advances and similar expenditures in the ordinary course of business or under the terms of a employee stock or option plan approved by the Board of Directors; (iii) guarantee, any indebtedness except for trade accounts of the Company or any subsidiary arising in the ordinary course of business; (iv) make any investment inconsistent with any investment policy approved by the Board; (v) incur any aggregate indebtedness in excess of $[_____] that is not already included in a Board-approved budget, other than trade credit incurred in the ordinary course of business;21See commentary in introduction to Model Managements Rights Letter, explaining purpose of such letter.(vi) enter into or be a party to any transaction with any director, officer or employee of the Company or any “associate” (as defined in Rule 12b-2 promulgated under the Exchange Act) of any such person [except transactions resulting in payments to or by the Company in an amount less than $[60,000] per year], [or transactions made in the ordinary course of business and pursuant to reasonable requirements of the Company’s b usiness and upon fair and reasonable terms that are approved by a majority of the Board of Directors];22(vii) hire, fire, or change the compensation of the executive officers, including approving any option grants; (viii) change the principal business of the Company, enter new lines of business, or exit the current line of business; (ix) sell, assign, license, pledge or encumber material technology or intellectual property, other than licenses granted in the ordinary course of business; or (x) enter into any corporate strategic relationship involving the payment contribution or assignment by the Company or to the Company of assets greater than [$100,000.00].Non-Competition andNon-Solicitation Agreements:23Each Founder and key employee will enter into a [one] year non-competition and non-solicitation agreement in a form reasonably acceptable to the Investors.Non-Disclosure and Developments Agreement: Each current and former Founder, employee and consultant will enter into a non-disclosure and proprietary rights assignment agreement in a form reasonably acceptable to the Investors.Board Matters: [Each Board Committee shall include at least one Series A Director.]The Board of Directors shall meet at least [monthly][quarterly],unless otherwise agreed by a vote of the majority of Directors.The Company will bind D&O insurance with a carrier and in anamount satisfactory to the Board of Directors. Company to enter intoIndemnification Agreement with each Series A Director [andaffiliated funds] in form acceptable to such director. In the event theCompany merges with another entity and is not the surviving22Note that Section 402 of the Sarbanes-Oxley Act of 2003 would require repayment of any loans in full priorto the Company filing a registration statement for an IPO.23Note that non-compete restrictions (other than in connection with the sale of a business) are prohibited in California, and may not be enforceable in other jurisdictions, as well. In addition, some investors do not require such agreements for fear that employees will request additional consideration in exchange for signing aNon-Compete/Non-Solicit (and indeed the agreement may arguably be invalid absent such additional consideration - although having an employee sign a non-compete contemporaneous with hiring constitutes adequate consideration in jurisdictions where non-competes are generally enforceable). Others take the view that it should be up to the Board on a case-by-case basis to determine whether any particular key employee is required to sign such an agreement.Non-competes typically have a one year duration, although state law may permit up to two years. Note also that some states may require that a new Non-Compete be signed where there is a material change in the employee’sduties/salary/title.。

w8表格填写范本

w8表格填写范本

表格填写简单说明:

第一部分:所得个人资料

第1 点:姓名。

第2 点:国籍。

第3 点:所得单位种类:个人请勾选Individual; 若为共同账户请分别填写W-8BEN。

第4 点:永久居住地址(请勿使用邮政信箱PO Box 或转寄地址,还有国家名称请勿简写。

)

第 5 点:邮寄地址(如果不同于永久地址请另填写,国家名称请勿简写)。

第6 点:美国税号SSN,ITIN 或EIN 号码(如果您需要填写)。

第7 点:外国税号(如果有)。

第8 点:扣缴单位使用的参照号码。

第二部分:税务减免申报(若适用)

第9 点:确认以下勾选的均使用

•勾选 a 项:如果所得期间所得申报人居住在(国家名称),其为美国的税务减免互惠国。

第三部分:申明

本人申明以上所填资料属实而且完整。

•本人(或授权人)为本表格所提及的所有所得申报人。

•所得个人不是美国税法规定的美国申报人(US Person)。

•本人的所得不属美国的贸易或商业行为。

•本人确实符合美国的税务减免互惠的资格。

除此之外,在此申明,预扣税款单位有权预扣我的税款。

签名栏(SIGN HERE):所得个人或授权人签名/日期/(月日年)/授权代理。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

W-8BEN塡寫及簽署指引*

1. 客戶需填寫永久地址於此欄,若客戶填寫的地址是美國地址,客戶則會被認定為美國人士。

(美國人士應填寫W-9表格)

2. 若客戶的的國家與美國是稅務減免互惠國,請在虛線上填寫國家名稱(請勿簡寫),如果客戶

的國家與美國並不是稅務減免互惠國^,請不要填寫 Part II 並無需於虛線上填寫。

另外,新開戶口的客戶雖符合以下所有條件才有可能獲得稅務優惠:

W-8BEN的郵寄地址及永久地址均符合美國指定之稅務優惠國家;

開戶表格及W-8BEN 的地址一致;

國藉與郵寄地址及永久地址的國家相同;如未能符合以上任何一項:

則客戶要提供證明文件(如稅務優惠國家的護照或身份證)或客戶提供的書面聲明/解釋) 舊有客戶於此欄填寫的地址需要與已登記的地址相一致,才有可能獲得稅務優惠。

以下國藉人士可享有股息稅務優惠: 中華人民共和國﹑日本﹑南韓﹑泰國﹑澳洲﹑印尼及加拿大。

*

^以下國藉人士未能享有股息稅務優惠: 香港﹑澳門﹑台灣﹑新加坡。

3. 聯名戶口每人分別填寫一張,另外乎合美國稅務優惠的申請人需要每隔三年#或當於國藉 /

居住國家有所更新時重新向證券商提供一份新的 W-8BEN 表格及其他所需文件。

W-8BEN 表格簡要説明

個人

個人//聯名帳戶

Part I,第1 欄 姓名全名 (必須與個人身份證明文件一致)

Part I,第2 欄 國家 (公民身份)

Part I,第3 欄 永久住址(請勿使用郵政信箱PO Box 或轉寄地址,國家名稱請勿簡寫) Part I,第4 欄 通訊地址(如果與第3欄地址不同,國家名稱請勿簡寫)

Part I,第5 欄 美國國稅局稅號、SSN、ITIN號碼(如果沒有則無須填寫)

Part I,第6 欄 外國稅號 (如果沒有則無須填寫)

Part I,第7 欄 客戶於輝立的帳戶號碼

Part I,第8 欄 出生日期 (如客戶出生日期為 1956年4月15日,請填寫 04-15-1956)

Part II,第9及10欄 如果客戶的國家與美國是稅務減免互惠國^,請在虛線上填寫國家名稱(請勿簡寫)。

如果客戶的國家與美國並不

並不是稅務減免互惠國

是稅務減免互惠國^,請不要填寫

請不要填寫 Part II 並無需於虛線上填寫。

Part III,Sign Here 帳戶持有人

帳戶持有人必需簽署

必需簽署,注意聯名戶口每人分別填寫一張;本公司職員會核對簽名,如確定不符合,此表格將被視為無效。

Date (必需填寫) (MM-DD-YYYY) 填寫當日日期

Print name of signer 英文書寫體姓名

*如有任何更改,恕不另行通告

# 如客戶於2011年3月15日簽署W-8表格,該表格之有效期到2014年12月31日。