国际金融 专业词汇

经济词汇缩写及解释

常见金融经济词汇缩写一、美元指数又称美汇指数(USDX),是衡量美元在国际外汇市场汇率变化的一项综合指标,由美元对六个主要国际货币(欧元、日元、英镑、加拿大元、瑞典克朗和瑞士法郎)的汇率经过加权几何平均数计算获得。

在1973年3月布雷顿森林体系解体后,美元指数开始被选作参照点。

是1973年开始以来最低点。

美元指数全天24小时更新,交易所为美国洲际交易所(Intercontinental Exchange,ICE)。

美联储是美国联邦储备系统简称,负责履行美国的中央银行的职责。

这个系统是根据《联邦储备法》于1913年成立的。

主要职责:制定并负责实施有关的货币政策。

2对银行机构实行监管,并保护消费者合法的信贷权利。

3维持金融系统的稳定。

4向美国政府,公众,金融机构,外国机构等提供可靠的金融服务。

二、GDP即英文(gross domestic product)的缩写,也就是国内生产总值。

它是对一国(地区)经济在核算期内所有常住单位生产的最终产品总量的度量,常常被看成显示一个国家(地区)经济状况的一个重要指标。

生产过程中的新增加值,包括劳动者新创造的价值和固定资产的磨损价值,但不包含生产过程中作为中间投入的价值;在实物构成上,是当期生产的最终产品,包含用于消费、积累及净出口的产品,但不包含各种被其他部门消耗的中间产品。

三、CPI消费者物价指数(Consumer Price Index),英文缩写为CPI,是反映与居民生活有关的商品及劳务价格统计出来的物价变动指标,通常作为观察通货膨胀水平的重要指标。

如果消费者物价指数升幅过大,表明通胀已经成为经济不稳定因素,央行会有紧缩货币政策和财政政策的风险,从而造成经济前景不明朗。

因此,该指数过高的升幅往往不被市场欢迎。

例如,在过去12个月,消费者物价指数上升2.3%,那表示,生活成本比12个月前平均上升2.3%。

当生活成本提高,你的金钱价值便随之下降。

也就是说,一年前收到的一张100元纸币,今日只可以买到价值97.70元的商品或服务。

国际金融词汇

BP曲线(BP schedule):使国际收支差额为零的各种实际收入与名义汇率的组合。

IS-LM-BP框架(IS-LM-BP framework):是分析开放经济运行及财政、货币政策效应的基本工具。

它关注三个市场(产品市场、货币市场和外汇市场)和三个变量(名义利率、实际收入和实际汇率)。

在以实际收入为横轴、以名义利率为纵轴的坐标平面图上,产品市场的均衡条件体现为IS曲线,其斜率为负;货币市场的均衡条件体现为LM曲线,其斜率为正;外汇市场或国际收支的均衡条件体现为BP曲线,它有三种形状(垂直、水平和向右上方倾斜),分别对应不同的资本流动程度。

J曲线效应(J-curve effect):由于短期内进口需求与出口供给均缺乏弹性,在本币发生贬值的初期,贸易收支会恶化,然后慢慢改善,逐渐超过贬值发生前的贸易差额。

从贬值发生到最终贸易差额超过期初水平,这一过程反映在以时间为横轴、贸易差额为纵轴的坐标平面上,形状酷似英文字母“J”,从而被形象地称为J曲线效应。

被消除的风险(covered exposure):通过套期保值而被消除的外汇风险。

冲销(sterilization):在外汇储备发生变动时,中央银行采取政策行动,使国内信贷同等幅度地反方向变化,从而保持基础货币不变。

储备货币(reserve currency):通常用于国际结算及表示其他国家货币的汇率的货币。

贷方科目(credit entry):用来记录导致一国居民从外国取得收入的交易。

弹性分析法(elasticities approach):认为商品和劳务的价格变化是决定一国国际收支状况及汇率水平的主要因素。

低估的货币(undervalued currency):当前市场决定的价值低于经济理论或模型所预测的价值的货币。

掉期(swap):一张合约包含两笔交易,一笔为两种货币之间的即期交易,另一笔为这两种货币之间的相反方向的远期交易(相当于远期购回)。

钉住汇率制(pegged-exchange-rate system):一国货币对外价值钉住另一国货币或某种货币篮子的汇率制度。

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation) 购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hotmoney)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company) 券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products) 原生金融产品:(underlying financial products) 流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase) 回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation) 恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)。

商务英语国际金融词汇

商务英语国际金融词汇为了让大家更好的准备商务英语BEC考试,我给大家整理了商务英语高频词汇,下面我就和大家分享,来欣赏一下吧。

商务英语国际金融词汇:国际收支国际收支Balance of Payments国际货币基金组织International Monetary Fund国际收支平衡Balance of Payments Statement经常项目Current Account贸易收支Goods劳务收支Service单方面转移收支Unilateral Transfer资本项目Capital Account长期资本Direct Investment热钱/游资Hot Money平衡项目(储备项目/结算项目) Balancing or Settlement Account官方储备Official Reserves自主性交易Autonomous Transaction调节性交易Accommodating Transaction事前交易Ex-ante Transaction事后交易Ex-post Transaction国际收支顺差Balance of Payments Surplus国际收支逆差Balance of Payments Deficit贸易差额Trade Balance经常项目差额The Current Account Balance商务英语国际金融词汇:外汇与汇率通汇合约Agency Agreement通汇银行Correspondent Bank商业汇票Commercial Bill of Exchange银行支票Banker’s Check国外汇票Foreign Bill of Exchange关键货币Key Currency汇率Exchange Rate直接标价法DirectQuotation间接标价法IndirectQuotation汇价点Point买入汇率Buying Rate卖出汇率Selling Rate中间汇率Medial Rate现钞汇率Bank Note Rate即期汇率Spot Rate远期汇率Forward Rate基本汇率Basic Rate套算汇率Cross Rate固定汇率Fixed Rate浮动汇率Floating Rate可调整的钉住Adjustable Peg单一汇率Single Rate复汇率Multiple Rate贸易汇率Commercial Rate金融汇率Financial Rate交叉汇率Cross Rate远期差额Forward Margin升水Premium贴水Discount平价At Par固定汇率制度Fixed Exchange Rate System 金本位Gold Standard纸币Paper Money贴现率Discount Rate浮动汇率制度Floating Exchange Rate System 自由浮动汇率Freely Floating Exchange Rate管理浮动汇率Managed Floating Exchange Rate单独浮动汇率Single Floating Exchange Rate联合浮动汇率Joint Floating Exchange Rate钉住汇率制Pegged Exchange Rate区域性货币一体化Regional Monetary Integration欧洲货币体系European Monetary System (EMS)欧洲货币单位European Currency Unit (ECU)欧洲货币联盟European Monetary Union含金量Gold Content铸币平价Mint Par黄金输送点Gold Point官方储备Official Reserve外汇管制Foreign Exchange Control商务英语国际金融词汇:外汇交易即期外汇交易Spot Exchange Transaction远期外汇交易Forward Exchange Transaction交割日固定的远期外汇交易Fixed Maturity Forward Transaction选择交割日的远期交易(择期交易) Optional Forward Transaction掉期交易Swap即期对远期掉期Spot-Forward Swap即期对即期掉期Spot-Spot Swap远期对远期掉期Forward-Forward Swap地点套汇Space Arbitrage直接套汇(两角套汇) Direct Arbitrage (Two Points Arbitrage)间接套汇(三角套汇) Indirect Arbitrage (Three Points Arbitrage)时间套汇Time Arbitrage现代套汇交易Cash Against Currency Future套利Interest Arbitrage非抵补套利Uncovered Arbitrage非抵补利差Uncovered Interest Differential抵补套利Covered Arbitrage期货Futures期货交易Futures Transaction国际货币市场International Monetary Market (IMM)伦敦国际金融期货交易所London International Financial Futures Exchange (LIFFE)“逐日盯市”制度Market-to-Market期权Options外汇期权Foreign Currency Options协议价格Strike Price敲定价格Exercise Price期权费/权力金Premium期权到期日Expiration Date美式期权American Options欧式期权European Options看涨期权(买权,买入期权) Call Options 期权买方Call Buyer期权卖方Call Seller/Writer看跌期权(卖权,卖出期权) Put Options 期权协议价格Strike Price敲定价格(履约价格) Exercise Price期权费(期权权利金,保险费) Premium 期权保证金Margins期权内在价值Intrinsic value价内期权In the Money价外期权Out of the Money平价期权At the Money期权时间价值Time value易变性Volatility商务英语高频词汇:财务与会计损益表:beginning inventory :期初存货cost of goods sold :销货成本depreciation :n.折旧distribution :n.配销freight :n.运费gross margin :毛利income statement :损益表net income :净损益,净收入net sales :销货净额operating expense :营业费用sales revenue :销货收入资产负债表:accumulated depreciation :备抵折旧asset :n.资产balance sheet :资产负债表contributed capital :实缴股本fixed asset :固定资产liability :n.负债notes payable :应付票据prepaid expense :预付款项retained earnings :保留盈余stockholders equity :股东权益商务英语高频词汇:贸易Commerce 贸易1.bid 出价;投标;喊价mercial 商业化;商用的;营利的petitor 竞争者;对手4.consolidate 结合;合并;强化;巩固5.contract 契约;合同6.corporate 全体的;团体的;公司的;法人的7.credible 可信的;可靠的8.debit 借方;借项9.earnings 薪水;工资;收益10.export 输出;出口11.haggle 讨价还价12.import 输入;进口13.invoice 发票;发货清单;完成工作的清单(明列数量和价钱)14.long-range 长期的;远程的15.stock 现货;存货16.payment 支付;付款17.quote 报价18.supply 供应品;供应物;库存19.tariff 关税20.voucher 保证人;凭证;凭单;折价券21.bill of lading 提货单modity 商品;农产品23.consignee 收件人;受托人24.consumer 消费者;顾客25.contractor 立契约人;承包商26.cost-effective 符合成本效益的27.dealer 商人;业者28.due 应付的;到期的;该发生的29.endorse 背书;支持;赞同30.forward 送到,转号31.headquarters 总公司;总部;司令部32.inventory 详细目录;清单;存货33.letter of credit 信用状34.order 汇单;订货;订单;汇票35.patent 专利;取得…的专利36.quota 定量;定额;配额37.shipment 一批货38.surplus (1)过剩的量;盈余(2)过剩的;剩余的39.trademark 注册商标40.warehouse 仓库;货价;大商店。

英文翻译之金融类词汇总结版

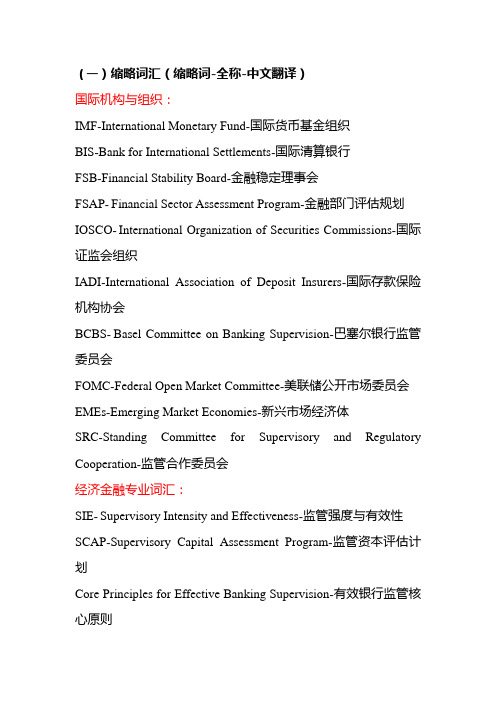

(一)缩略词汇(缩略词-全称-中文翻译)国际机构与组织:IMF-International Monetary Fund-国际货币基金组织BIS-Bank for International Settlements-国际清算银行FSB-Financial Stability Board-金融稳定理事会FSAP-Financial Sector Assessment Program-金融部门评估规划IOSCO-International Organization of Securities Commissions-国际证监会组织IADI-International Association of Deposit Insurers-国际存款保险机构协会BCBS-Basel Committee on Banking Supervision-巴塞尔银行监管委员会FOMC-Federal Open Market Committee-美联储公开市场委员会EMEs-Emerging Market Economies-新兴市场经济体SRC-Standing Committee for Supervisory and Regulatory Cooperation-监管合作委员会经济金融专业词汇:SIE-Supervisory Intensity and Effectiveness-监管强度与有效性SCAP-Supervisory Capital Assessment Program-监管资本评估计划Core Principles for Effective Banking Supervision-有效银行监管核心原则TARP-Troubled Asset Relief Program-问题资产救助计划HAMP-Home Affordable Modification Program-住房可偿付调整计划MMFs-Money Market Funds-货币市场基金FHA-Federal Housing Administration-联邦住房管理局QE-Quantitative Easing-量化宽松货币政策BCPs-Basel Core Principles-巴塞尔核心原则SIFIs-Systemically Important Financial Institutions-系统重要性金融机构(G-SIFIs)-Global Systemically Important Financial Institutions-全球系统重要性金融机构SME-Small and Medium Enterpises-中小型企业(Euro:〈49 小型,〈249 中型;USA:〈99 小型,〈500 中型)QIS-Quantitative Impact Study-定量影响分析(研究),简称“定量测算”。

国际贸易及国际金融英语词汇

主题:国际贸易词汇trade term / price term 价格术语world / international market price 国际市场价格FOB (free on board) 离岸价C&F (cost and freight) 成本加运费价CIF (cost, insurance and freight) 到岸价freight 运费wharfage 码头费landing charges 卸货费customs duty 关税port dues 港口税import surcharge 进口附加税import variable duties 进口差价税commission 佣金return commission 回佣,回扣price including commission 含佣价net price 净价wholesale price 批发价discount / allowance 折扣retail price 零售价spot price 现货价格current price 现行价格/ 时价indicative price 参考价格customs valuation 海关估价price list 价目表total value 总值贸易保险术语All Risks 一切险F.P.A. (Free from Particular Average) 平安险W.A. / W.P.A (With Average or With Particular Average) 水渍险War Risk 战争险F.W.R.D. (Fresh Water Rain Damage) 淡水雨淋险Risk of Intermixture and Contamination 混杂、玷污险Risk of Leakage 渗漏险Risk of Odor 串味险Risk of Rust 锈蚀险Shortage Risk 短缺险T.P.N.D. ( Theft, Pilferage & Non-delivery) 偷窃提货不着险Strikes Risk 罢工险贸易机构词汇WTO (World Trade Organization) 世界贸易组织IMF (International Monetary Fund) 国际货币基金组织CTG (Council for Trade in Goods) 货币贸易理事会EFTA (European Free Trade Association) 欧洲自由贸易联盟AFTA (ASEAN Free Trade Area) 东盟自由贸易区JCCT (China-US Joint Commission on Commerce and Trade) 中美商贸联委会NAFTA (North American Free Trade Area) 北美自由贸易区UNCTAD (United Nations Conference on Trade and Development) 联合国贸易与发展会议GATT (General Agreement on Tariffs and Trade) 关贸总协定贸易方式词汇stocks 存货,库存量cash sale 现货purchase 购买,进货bulk sale 整批销售,趸售distribution channels 销售渠道wholesale 批发retail trade 零售业hire-purchase 分期付款购买fluctuate in line with market conditions 随行就市unfair competition 不合理竞争dumping 商品倾销dumping profit margin 倾销差价,倾销幅度antidumping 反倾销customs bond 海关担保chain debts 三角债freight forwarder 货运代理trade consultation 贸易磋商mediation of dispute 商业纠纷调解partial shipment 分批装运restraint of trade 贸易管制RTA (Regional Trade Arrangements) 区域贸易安排favorable balance of trade 贸易顺差unfavorable balance of trade 贸易逆差special preferences 优惠关税bonded warehouse 保税仓库transit trade 转口贸易tariff barrier 关税壁垒tax rebate 出口退税TBT (Technical Barriers to Trade) 技术性贸易壁垒进出口贸易词汇commerce, trade, trading 贸易inland trade, home trade, domestic trade 国内贸易international trade 国际贸易foreign trade, external trade 对外贸易,外贸import, importation 进口importer 进口商export, exportation 出口exporter 出口商import licence 进口许口证export licence 出口许口证commercial transaction 买卖,交易inquiry 询盘delivery 交货order 订货make a complete entry 正式/完整申报bad account 坏帐Bill of Lading 提单marine bills of lading 海运提单shipping order 托运单blank endorsed 空白背书endorsed 背书cargo receipt 承运货物收据condemned goods 有问题的货物catalogue 商品目录customs liquidation 清关customs clearance 结关贸易伙伴术语trade partner 贸易伙伴manufacturer 制造商,制造厂middleman 中间商,经纪人dealer 经销商wholesaler 批发商retailer, tradesman 零售商merchant 商人,批发商,零售商concessionaire, licensed dealer 受让人,特许权获得者consumer 消费者,用户client, customer 顾客,客户buyer 买主,买方carrier 承运人consignee 收货人I.外汇与汇率通汇合约Agency Agreement通汇银行Correspondent Bank商业汇票Commercial Bill of Exchange银行支票Banker’s Check国外汇票Foreign Bill of Exchange关键货币Key Currency汇率Exchange Rate直接标价法Direct Quotation间接标价法Indirect Quotation汇价点Point买入汇率Buying Rate卖出汇率Selling Rate中间汇率Medial Rate现钞汇率Bank Note Rate即期汇率Spot Rate远期汇率Forward Rate基本汇率Basic Rate套算汇率Cross Rate固定汇率Fixed Rate浮动汇率Floating Rate可调整的钉住Adjustable Peg 单一汇率Single Rate复汇率Multiple Rate贸易汇率Commercial Rate 金融汇率Financial Rate交叉汇率Cross Rate远期差额Forward Margin升水Premium贴水Discount平价At Par固定汇率制度Fixed Exchange Rate System金本位Gold Standard纸币Paper Money贴现率Discount Rate浮动汇率制度Floating Exchange Rate System自由浮动汇率Freely Floating Exchange Rate管理浮动汇率Managed Floating Exchange Rate 单独浮动汇率Single Floating Exchange Rate联合浮动汇率Joint Floating Exchange Rate钉住汇率制Pegged Exchange Rate区域性货币一体化Regional Monetary Integration 欧洲货币体系European Monetary System (EMS) 欧洲货币单位Eutopean Currency Unit (ECU)欧洲货币联盟European Monetary Union含金量Gold Content铸币平价Mint Par黄金输送点Gold Point官方储备Official Reserve外汇管制Foreign Exchange ControlII.外汇交易即期外汇交易Spot Exchange Transaction远期外汇交易Forward Exchange Transaction交割日固定的远期外汇交易Fixed Maturity Forward Transaction 选择交割日的远期交易(择期交易) Optional Forward Transaction 掉期交易Swap即期对远期掉期Spot-Forward Swap即期对即期掉期Spot-Spot Swap远期对远期掉期Forward-Forward Swap地点套汇Space Arbitrage直接套汇(两角套汇) Direct Arbitrage (Two Points Arbitrage)间接套汇(三角套汇) Indirect Arbitrage (Three Points Arbitrage) 时间套汇Time Arbitrage现代套汇交易Cash Against Currency Future套利Interest Arbitrage非抵补套利Uncovered Arbitrage非抵补利差Uncovered Interest Differential抵补套利Covered Arbitrage期货Futures期货交易Futures Transaction国际货币市场International Monetary Market (IMM)伦敦国际金融期货交易所London International Financial Futures Exchange (LIFFE) “逐日盯市”制度Market-to-Market期权Options外汇期权Foreign Currency Options协议价格Strike Price敲定价格Exercise Price期权费/权力金Premium期权到期日Expiration Date美式期权American Options欧式期权European Options看涨期权(买权,买入期权) Call Options期权买方Call Buyer期权卖方Call Seller/Writer看跌期权(卖权,卖出期权) Put Options期权协议价格Strike Price敲定价格(履约价格) Exercise Price期权费(期权权利金,保险费) Premium期权保证金Margins期权内在价值Intrinsic value价内期权In the Money价外期权Out of the Money平价期权At the Money期权时间价值Time value易变性VolatilityIII.国际收支国际收支Balance of Payments国际货币基金组织International Monetary Fund 国际收支平衡Balance of Payments Statement 经常项目Current Account贸易收支Goods劳务收支Service单方面转移收支Unilateral Transfer资本项目Capital Account长期资本Direct Investment热钱/游资Hot Money平衡项目(储备项目/结算项目) Balancing or Settlement Account 官方储备Official Reserves自主性交易Autonomous Transaction调节性交易Accommodating Transaction事前交易Ex-ante Transaction事后交易Ex-post Transaction国际收支顺差Balance of Payments Surplus国际收支逆差Balance of Paymentd Deficit贸易差额Trade Balance经常项目差额The Current Account BalanceIV.外汇风险管理外汇风险foreign Exchange Exposure获得利益Gain遭受损失Loss交易风险Transaction Exposure营业风险Operation Exposure转换风险Translation Exposure经济风险Economic Exposure竞争风险Competitive Exposure借款法Borrowing投资法Investing借款-即期合同-投资法Borrow-Spot-Invest 提前收付-即期合同-投资法Lead-Spot-Invest 提前或延期结汇Leads & Lags资产负债表保值法Balance Sheet Hedge资金部主管Treasury Head首席交易员Chief Dealer交易主任Senior Dealer交易员Dealer助理交易员Assistant Dealer当日平盘Day Trade隔夜敞口Over Night交易单Dealing Slip交易后线Settlement Office汇付Remittance电汇Telegraphic Transfer,T/T信汇Mail Transfer,M/T票汇Demand Draft,D/D托收Collection光票托收Clean Collection跟单托收Documentary Collection付款交单Documents against Payment,D/P承兑交单documents against Acceptance,D/A信托收据Trust Receipt,T/P信用证Credit;Letter of Credit,L/C银行保函Letter of Guarantee,L/G即期保函统一规则Uniform Rules for Demand Guarantee 投标保函Tender Guarantee履约保函Performance Guarantee退款保函Guarantee for Refund of Advance Payment定金Down Payment还款保函Repayment Guarantee保留款保函Retention Money GuaranteeV.国际融资方式商业票据Commercial Paper (CP)短期国库券Treasury Bill (T. Bill/Bill)出价收益率(买入收益率) Bid Yield要价收益率(卖出收益率) Asked Yield大额可转让定期存单Negotiable Certificate of Deposit (CD) 息票率Coupon Rate贴现Discount贴现利息Discount Charges贴现市场Discount Market票据经纪人Bill Broker贴现商Bill Dealer票据商Note Dealer贴现公司Discount Houses承兑公司Acceptance Houses平价发行At Par溢价发行At Premium低价发行At Discount外国债券Foreign Bond扬基债券Yankee Bond欧洲债券Eurobond股票Stock普通股Common Share优先股Preferred Share证券存托凭证Depositary Receipt (DR)美国存托凭证American Depositary Receipt (ADR) 全球存托凭证Global Depositary Receipt (GDR) VI.国际储备与外债国际储备International Reserves黄金储备Monetary Gold外汇储备Foreign Exchange Reserves特别提款权Special Draw Right, SDRVII.国际信货储备部分贷款Reserve Tranche第一档信货部分贷款First Credit Tranche高档信货部分贷款Higher Credit Tranche出口波动补偿信贷Compensatory Financing Facility缓冲库存贷款Buffer Stock Finacing石油贷款Oil Facility中期贷款Extended Facility信托基金Trust Fund补充贷款Supp;ementary维特芬贷款The Witteveen Facility扩大贷款Enlarged Access Policy世界银行World Bank国际复兴开发银行International Bank for Reconstruction and Development,IBRD 国际开发协会International Development Association,IDA信贷Credit国际金融公司International Finance Corporation,IFC政府贷款Government Loan银行间同业拆借Inter-bank Offer伦敦银行同业拆放利率London Inter-Bank Offered Rate,LIBOR新加坡银行间同业拆放利率Singapore Inter-Bank Offered Rate,SIBOR 香港银行间同业拆放利率Hongkong Inter-Bank Offered Rate,HIBOR 出口信贷Export Credit卖方信贷Supplier Credit买方信贷Buyer Credit中长期票据收买业务(福费廷) Forfiting卖断Out-right Sell混合贷款Mixed LoanVIII.国际金融市场货币市场Currency Market国际资本市场International Capital Market银行中长期贷款Bank’s Medium Term and Long Term Loan国际黄金市场Gold MarketⅨ.国际金融电子化银行自动柜员机Automatic Teller Machine, ATM在线网络金融服务Online Financial Services销售点终端Point of Sales, POS电子货币Electronic Money万事达信用卡Master Card电子信用卡Electronic Credit Card电子钱夹Electronic Purse智能卡Intellectual Card, IC卡电子支票Electronic Check电子现金Electronic Cash, E-cash电子钱包Electronic Wallet环球银行间金融电讯系统the Society for World Interbank Financial Telecommunications, SWIFT美国纽约票据交换所银行间支付系统the Clearing House Interbank Payments System, CHIPS伦敦票据交换所自动支付系统the Clearing House Automated Payments System.CHAPS电子商务Electronic Commerce,EC网络银行Internet Bank现金管理系统Cash Management System,CMS增值网value Added Networks, VAN自动付费系统automated Payment System, APSCA中心网站Certificate Authority, CA中心商户对顾客商务模式Business to Customer, B-C商户对商户商务模式business to Business, B-B网上投资Online InvestmentAAA服务Anytime Anywhere Anyway(任何时间,任何地方,任何方式) 三中卡的缩写Europay、Mondexcard、Visa,EMV96SET协议Secure Electronic Transaction。

金融专业词汇

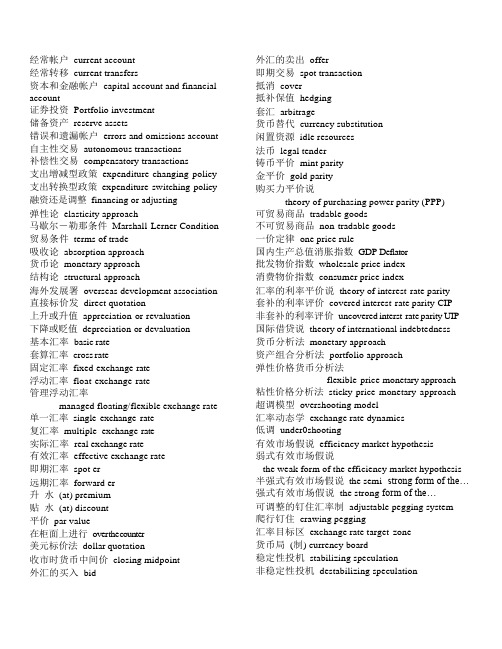

经常帐户current account经常转移current transfers资本和金融帐户capital account and financial account证券投资Portfolio investment储备资产reserve assets错误和遗漏帐户errors and omissions account 自主性交易autonomous transactions补偿性交易compensatory transactions支出增减型政策expenditure-changing policy 支出转换型政策expenditure-switching policy 融资还是调整financing or adjusting弹性论elasticity approach马歇尔-勒那条件Marshall-Lerner Condition 贸易条件terms of trade吸收论absorption approach货币论monetary approach结构论structural approach海外发展署overseas development association 直接标价发direct quotation上升或升值appreciation or revaluation下降或贬值depreciation or devaluation基本汇率basic rate套算汇率cross rate固定汇率fixed exchange rate浮动汇率float exchange rate管理浮动汇率managed floating/flexible exchange rate 单一汇率single exchange rate复汇率multiple exchange rate实际汇率real exchange rate有效汇率effective exchange rate即期汇率spot er远期汇率forward er升水(at) premium贴水(at) discount平价par value在柜面上进行over t he c ounter美元标价法dollar quotation收市时货币中间价closing midpoint外汇的买入bid 外汇的卖出offer即期交易spot transaction抵消cover抵补保值hedging套汇arbitrage货币替代currency substitution闲置资源idle resources法币legal tender铸币平价mint parity金平价gold parity购买力平价说theory of purchasing power parity (PPP)可贸易商品tradable goods不可贸易商品non-tradable goods一价定律one price rule国内生产总值消胀指数GDP Deflator批发物价指数wholesale price index消费物价指数consumer price index汇率的利率平价说theory of interest-rate parity套补的利率评价covered interest-rate parity CIP非套补的利率评价uncovered interst-rate parity UIP 国际借贷说theory of international indebtedness货币分析法monetary appr o ach资产组合分析法portfolio approach弹性价格货币分析法flexible-price monetary approach粘性价格分析法sticky-price monetary approach超调模型overshooting model汇率动态学exchange rate dynamics低调under0shooting有效市场假说efficiency market hypothesis弱式有效市场假说the weak form of the efficiency market hypothesis 半强式有效市场假说the semi- strong form of the… 强式有效市场假说the strong form of the…可调整的钉住汇率制adjustable pegging system爬行钉住crawing pegging汇率目标区exchange rate target-zone货币局(制) currency board稳定性投机stabilizing speculation非稳定性投机destabilizing speculation羊群效应bandwagon/herding effects名义驻锚nominal anchor过分波动excess volatility汇率失调misalignment基本汇率均衡fu ndamental equilibrium exchange rate (FEER)冲销式干预sterilized intervention非冲销式干预unsterilized intervention熨平每日波动型smoothing out daily fluctuation砥柱中流型/逆向型leaning against the wind非官方钉住型unofficial pegging有益的忽视benign neglect广场宣言plaza announcement卢浮宫协定louver accord经济租金rent寻租行为rent seeking重负损失dead weight loss资本逃避capital flight高报进口over-invoicing低报出口under-invoicing货币替代currency substitution调剂汇率swap er复汇率multiple er双重汇率dual er外汇券foreign exchange certificate FEC国际储备international reserve国际清偿力international liquidity特别提款权special drawing right SDR外国金融市场foreign financial market欧洲货币市场European currency market伦敦银行同业拆放率London Inter-bank Offered Rate LIBOR短期国库券treasury bills可转让银行定期存单transferable certificate of deposits CDs银行承兑汇票bank acceptance bills商业承兑汇票commercial bills拍卖auction贴现行discount house再贴现rediscount国际银行业务设施international banking facility IBF 辛迪加贷款syndicated loan银团贷款consortium loan扬基债券yankee bonds武士债券samurai bonds欧洲债券euro-bond操作租赁operating leases金融租赁finan cial leases货币加成租赁money-over-mony leases减税租赁tax credit leases杠杆租赁leveraged leases双重租赁double leases金条bullion黄金互换gold swaps未清算open未清算权益open interest买入期权/看涨期权call option卖出期权/看跌期权put option平均期权average option回顾期权look-back option黄金担保gold warrants黄金杠杆合同gold leverage contracts黄金券Gold certificate黄金存单depository orders首饰回炉的黄金gold scrap下午金价定盘afternoon fixing现货委员会physical committee瑞士信贷银行credit Suisse瑞士联合银行Union Bank of Switzerland瑞士银行Swiss Bank Coperation苏黎世黄金总库Zurich Gold Pool香港金银贸易场Chinese Gold and Silver Society香港交易合同loco—HongKang伦敦交易合同Loco —London新加坡交易合同LocoSingapore温尼伯商品交易所Winnipeg Commodity Exchange 合同的最小价格变化tick size场外期权交易over-the-counter option金融衍生工具financial derivatives远期类forward-based期权类option-based国际货币市场international m onetary m arket IMM伦敦国际金融期货交易所London International Financial Futures Exchange LIFFE互换swap期权option协定价strike price执行价exercise price美式期权American option欧式期权European option保险费premium利率上限interest rate caps利率下限interest rate floors票据发行便利note facilities杠杆比率leverage货币危机currency crisis投机冲击speculative attacks一级资本/第一档资本tier 1 capital核心资本core capital附属资本supplementary capital巴塞尔报告Basle Report金融危机financial crisis蔓延型货币危机contagion currency crisis金融机构发展基金financial institution development fund金融监管委员会Financial supervision council 金融监管局financial supervision bureau证券与期货委员会security and future council 预期自我实现型货币危机expectations self-fulfilling currency crisis 影子浮动汇率shadow floating er多重均衡multiple equilibrium好的均衡good equilibrium黑子现象sunspot phenomenon恶性循环vicious circle金融恐慌financial panic集体性为collective action不利均衡diverse equilibrium触发事件triggering events偿债率debt service ratios可调整的钉住汇率adjustable peg特里芬两难Triffin Dilemma悬突额overhang 互惠信贷协议swap agreement借款总安排general agreement to borrow黄金总库gold pool黄金双价制two-tier gold price system国际货币基金组织international monetary fund IMF 世界银行World bank关贸总协定General Agreement on Tariff and trade GATT 理事会Board of Governors执行董事会Executive Board临时委员会interim committee发展委员会development committee份额quota储备部分贷款Reserve Tranche Drawings信用部分贷款Credit tranche进出口波动补偿贷款Compensatory Financing facility 进出口波动补偿与偶然性收支困难贷款Compensatory and contingency Financing facility 缓冲库存贷款buffer stock financing facility石油贷款oil facility延伸贷款extended f inancing f acility信托基金贷款Trust fund facility补充贷款supplementary financing facility扩大借款政策enlarge access policy结构调整贷款structural adjustment facility加强的结构调整贷款enhanced SAF制度转型贷款systemic transformation facility贷款条件性conditionality货币收益monetary efficient gain经济稳定性损失economic stability loss欧洲货币联盟European monetary union EMU欧洲中央银行体系european system of central bank ESCB欧洲货币单位European currency unit ECU欧洲货币合作基金European monetary cooperation find EMCF 稳定汇率机制Exchange rate mechanism ERM偏离指标the divergence indicator单一银行业市场single banking market欧洲货币局European monetary institute EMI成员国中央银行national central bank NCBs场外交易市场Over the counter market OTC持续合同continuing contract买回条款call provisions偿债基金sinking fund穆迪氏moodys标准普尔standard poor’s长期债券treasury bonds中期国库券treasury notes远期合约forward多头long position空头short position套期保值hedging期货future香港银行间同业拆借率HK Interbank Offered Rate HIBOR基本点base point BP主要市场指数main market index MMI额外费用premium名义本金notional principal NP资本资产定价模型capital asset pricing model CAPM 资本资产套价理论the arbitrage pricing theory APT 证券组合portfolio有效组合efficient set有效边界efficient frontier花旗银行Citibank花旗公司Citicorp旅行者集团travelers group可转让提款单帐户negotiable orders of withdraws account NOW自动转帐服务帐户automated transfer service account ATS股金提款单帐户share d rafts a ccount SDA货币市场存款帐户money market deposit account MMDA消费者存单consumer certificate of deposit货币市场存单money market certificate of deposits MMCs托收collection汇款remittance品德character能力capacity 担保或抵押collateral环境condition货币市场互助基金money market mutual funds MMMF时滞time lag认识时滞recognition lag决策时滞decision l ag内在时滞inside lagQ 项条款regulation Q全球银行间金融电信协会SWIFT征服策略strategy of conquest变革策略strategy of change合并策略strategy of consolidation循环信贷revolving credit票据发行融资note inssuance facility零息债券zero coupon bond资本升值capital appreciation可拆开证券stripped instruments顶盖式定息interest cap分期购买债券the deffered purchase bond多当债券multiple tranche bonds债务互换debt swap资产互换capital swap消费物价指数CPI批发物价指数WPI《对银行的外国机构的监督原则》Principles for the Supervision of Bank’s Foreign Establishment《巴塞尔协议》Basle Concordat母国当局the parent authority东道国the host country外汇暴露foreign exchange exposure。

国际金融词汇

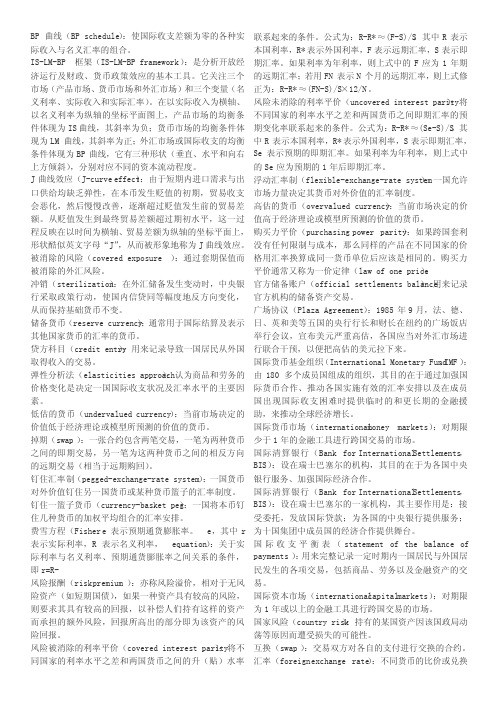

BP曲线(BP schedule):使国际收支差额为零的各种实际收入与名义汇率的组合。

IS-LM-BP框架(IS-LM-BP framework):是分析开放经济运行及财政、货币政策效应的基本工具。

它关注三个市场(产品市场、货币市场和外汇市场)和三个变量(名义利率、实际收入和实际汇率)。

在以实际收入为横轴、以名义利率为纵轴的坐标平面图上,产品市场的均衡条件体现为IS曲线,其斜率为负;货币市场的均衡条件体现为LM曲线,其斜率为正;外汇市场或国际收支的均衡条件体现为BP曲线,它有三种形状(垂直、水平和向右上方倾斜),分别对应不同的资本流动程度。

J曲线效应(J-curve effect):由于短期内进口需求与出口供给均缺乏弹性,在本币发生贬值的初期,贸易收支会恶化,然后慢慢改善,逐渐超过贬值发生前的贸易差额。

从贬值发生到最终贸易差额超过期初水平,这一过程反映在以时间为横轴、贸易差额为纵轴的坐标平面上,形状酷似英文字母“J”,从而被形象地称为J曲线效应。

被消除的风险(covered exposure):通过套期保值而被消除的外汇风险。

冲销(sterilization):在外汇储备发生变动时,中央银行采取政策行动,使国内信贷同等幅度地反方向变化,从而保持基础货币不变。

储备货币(reserve currency):通常用于国际结算及表示其他国家货币的汇率的货币。

贷方科目(credit entry):用来记录导致一国居民从外国取得收入的交易。

弹性分析法(elasticities approach):认为商品和劳务的价格变化是决定一国国际收支状况及汇率水平的主要因素。

低估的货币(undervalued currency):当前市场决定的价值低于经济理论或模型所预测的价值的货币。

掉期(swap):一张合约包含两笔交易,一笔为两种货币之间的即期交易,另一笔为这两种货币之间的相反方向的远期交易(相当于远期购回)。

钉住汇率制(pegged-exchange-rate system):一国货币对外价值钉住另一国货币或某种货币篮子的汇率制度。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

专业词汇第一章国际出入与国际出入平衡表国际货币基金组织 International Monetary Fund,IMF 国际出入 Balance of Payment国际出入平衡表 Balance of Payments Statement国际借贷 Balance of International Indebtedness 顺差 Favorable Balance〔Deficit〕逆差 Unfavorable Balance (Surplus)经常账户 Current Account非货币性黄金 Nonmonetary Gold贸易差额 Trade balance职工报答 Compensation of Employees投资收益 Investment Income无形贸易 Invisible Trade经常转移 Current Transfers单方面转移 Unilateral Transfers无偿转移 Unrequited Transfers本钱和金融账户 Capital and Financial Account平衡工程 Balancing Account直接投资 Direct Investment证券投资 Portfolio Investment调节性工程 Accommodating Transactions官方储藏资产 Official Reserve Assets出格提款权 SDRs (Special Drawing Rights)错误与遗漏 Errors and Omissions贸易差额 Trade Balance经常工程差额 Balance of Current Account根本差额 Basic Balance综合差额 Over-all Balance第二章国际出入掉衡及其调节季节性掉衡 Accidental Disequilibrium周期性掉衡 Cyclical Disequilibrium布局性掉衡 Structure Disequilibrium货币掉衡 Monetary Disequilibrium收入性掉衡 Income Disequilibrium冲击性掉衡 Shock Disequilibrium自动调节机制 Automatic Adjustment Mechanism调节政策 Adjustment Polices自动价风格节机制 Automatic Price Adjustment Mechanism 货币—价格流动机制 Price Specie-Flow Mechanism再贴现率 Rediscount Rate自动收入调节机制 Automatic Income Adjustment Mechanism 自动利率调节机制 Automatic Interest Adjustment Mechanism 支出改变政策 Expenditure-changing policies外汇管制 Foreign exchange control支出转换政策 Expenditure-switching policies内部均衡 Internal balance外汇缓冲政策 Foreign exchange cushion policies 外部均衡 External balance米德冲突Meade’s Conflict弹性论 Elasticities Approach马歇尔—勒纳条件 Marshall-Lerner Condition时滞 Time LagJ曲线效应 J Cure乘数论 Multiplier Approach收入阐发理论 Income Approach小国开放经济 Small Open Economy对外贸易乘数 Foreign Trade Multiplier开放经济乘数 Open Economy Multiplier哈伯格条件 Harberger Condition吸收论 Absorption Approach支出阐发法 Expenditure Approach闲置资源效应 Idle Resource Effect贸易条件效应 Terms of Trade Effect现金余额效应 Real Cash Balance Effect收入再分配效应 Redistribution of Income Effect货币幻觉效应 Money Illution Effect其他直接效应 Miscellaneous direct Absorption Effect 货币论 Monetary Approach一价定律 Law of Price布局论 Structural Approach第三章国际储藏国际储藏 International reserve国际清偿力International liquidity黄金储藏 Gold Reserves货币性黄金Monetary Gold黄金非货币化Demonetization of Gold外汇储藏 Foreign Exchange Reserves储藏货币 Reserve Currency在基金组织的储藏头寸Reserve Position in Fund普通提款权General Drawing Rights出格提款权 Special Drawing Rights,SDRs多种货币储藏体系Multiple Currency Reserve System第四章外汇、汇率和汇率制度外汇Foreign Exchange汇率Exchange Rate黄金输送点Gold Points黄金平价 Gold Parity直接标价法Direct Quotation System间接标价法Indirect Quotation System汇率制度Exchange Rate System法定贬值Devaluation法定升值Revaluation固定汇率制Fixed Rate System浮动汇率制Floating Rate System自由浮动Free Floating办理浮动 Managed Floating不变性投机Stabilizing Speculation非不变性投机 Destabilizing Speculation爬行钉住制 Crawling Pegging System汇率目标区 Exchange Rate Target-zone货币局制 Currency Board System第五章西方汇率理论国际借贷说Theory of International Indebtedness 购置力平价说Theory of Purchasing Power Parity, PPP 利率平价理论T he interest rate parity货币主义的汇率理论 Theory of Currency Exchange Rates资产组合平衡理论Theory of Portfolio Balance Approach第六章外汇交易根底外汇市场Foreign Exchange Market外汇经纪人Foreign Exchange Broker客户市场 Customer Markets同业市场Inter-bank Markets多头Long Position空头Short Position即期外汇交易 Spot Exchange Transaction营业日 Working Day交割日 Delivery Date远期外汇交易 Forward Exchange Transaction直接报价法 Outright Forward Method掉期率 Swap Rate远期套算汇率 Forward Cross Rate按期远期交易 Fixed Date Forwards择期远期交易 Optional Date Forwards买空 Bull卖空 Bear掉期交易 Swap Transaction一日掉期 One-Day Swap即期对远期的掉期交易 Spot Against Forward Swaps远期对远期的掉期交易 Forward Against Forward Swaps套汇 Arbitrage直接套汇 Direct Arbitrage间接套汇 Indirect Arbitrage套利交易 Interest Arbitrage Transaction 抛补套利 Covered Interest Arbitrage非抛补套利 Uncovered Interest Arbitrage第七章外汇期货与期权交易佣金经纪人 Commission Broket开仓 Opening对冲交易 Reversing Transition外汇期货 Foreign exchange futures清算所 Clearing house商业交易者C ommercial trader基差交易者Basic traders差价交易者Spread traders头寸交易者Position traders帽客 Scalpers 当日轧平头寸交易者D ay trader市价定单 Market order限价定单 Limit order到价定单 Spot order跨国套利定单Saddle order换月定单 Switch order 公开叫价 Open outcry包管金制度M M argin system原始包管金Initial margin维持包管金Maintenance margin变更包管金Variation margin逐日盯市制制度M arket to market daily套期保值 Hedge空头套期保值Short hedge多头套期保值Long hedge外汇期权 Currency options期权价格 Option price行使期权 Exercise option看涨期权 Call option看跌期权 Put option美式期权 American option欧式期权 European option协订价格 Strike price内在价值 Intrinsic value时间价值 Time value现汇期权 Option on spot foreign currency外汇期货期权O ption on foreign currency futures 期货式期权Futures style option平均汇率期权Average rate options平均协定汇率期权A verage strike option期权的期权O ption on an option回头期权 Lookback option或有期权 Contingent option被担保的汇率期权Guaranteed exchange rate option互换期权 Swaption买入看涨期权B uy call option卖出看涨期权Sell caIl option买入看跌期权Buy put option卖出看跌期权S ell put option平行贷款 Parallel Loan对等贷款 Back-to-Back loan互换交易 Swap Transaction利率互换 Interest Rate Swaps货币互换 Currency Swaps名义本金 Notional Principal伦敦银行同业拆放利率 LIBOR国债收益率Treasure Note Yield基点 Basic Point利差 Spread比拟优势 The Comparative Advantage 互换仓库 Swap Warehouse市场风险 Market Risk信用风险 Credit Risk第九章外汇风险及其办理外汇风险 Foreign exchange risk,交易风险 Transaction risk会计风险 Translation risk经济风险 Economic risk保值 Hedge应付帐款保值Payables hedge应收帐款保值Receivables hedge远期合约 Forward contract期货合约保值 Future hedge期权交易保值Currency option hedge 硬货币 Hard currency软货币 Soft currency货币市场法Money market hedge 订价 Pricing国际金融市场International financial market国际货币市场International money market国际本钱市场International capital market外汇市场 Foreign exchange market欧洲货币Euro currency欧洲银行 Euro bank欧货币市场Euro currency market离岸金融市场O ff-shore financial market国际银行设施 IBF在岸金融市场On – shore financial market国际债券 International bonds外国债券 Foreign bonds欧洲债券 Euro bonds全球债券 Global bonds浮动利率债券Floating rate bonds与股权联系债券Equity related bonds双币债券Dual-curreny bonds中期单据 Medium-term notes, MTN国际股票市场International stock market美国存托凭证 ADR全球化 Globalization证券化 Securitization金融自由化Financial deregulation第十一章国际融资实务无典质贷款Unsecured loans打包放款 Packing list单据信贷 Bill credit保付代办署理业务International Factoring信贷风险Credit risk预支货款 Advance funds到期保付代办署理业务Maturity Factoring保付代办署理手续费Commission of Factoring卖方信贷Supplier’s credit买方信贷 Buyer’s credit混合贷款 Mixed credit信用限额 Line of Credit银团贷款 Consortium Loan福费廷 Forfeiting无追索权 Non-recourse有限追索权Limited-recourse主办单元 Sponsor工程单元 Project entity设备供给商Supplier托管人 Trustee可行性研究Feasibility study经济可行性Economic viability国际租赁International Lease金融租赁Finance Lease 完全付清租赁Full Pay-Out Lease 经营租赁Operating Lease 杠杆租赁Leverage Lease 回租租赁 Sale and Back Lease第十二章国际本钱流动与国际金融危机国际本钱流动International Capital Flow所有权特定优势Ownership Specific Advantage内部化优势Internalization Advantage区位优势Location Specific Advantage贸易渠道传染Trade Channel Infection发急性传染Panicky Infection抵偿性传染 Compensation Infection外债 International Debt负债率 Liability Ratio债务率 Foreign Debt Ratio偿债率 Debt Service Ratio国际债务危机International Debt Crisis国际货币危机International Monetary Crisis第十三章国际货币体系与国际金融机构国际货币体系International Monetary System金本位制Gold Standard价格-铸币流动机制Price-specie-flow Mechanism布雷顿丛林体系Bretton Woods System特里芬两难Triffin Dilemma黄金总库Gold Pool借款总安排General Agreement to Borrow黄金双价制The System of Dual Price of Gold 牙买加体系Jamaiga System国际货币基金组织International monetary Fund份额Quota信托基金Trust Fund世界银行集团 World Bank Group。