第三方物流企业的作业成本法【外文翻译】

经济与管理专业外文翻译--运用作业成本法和经济增加值的具体应用

A FIELD STUDY:SMALL MANUFACTURINGCOMPANIESIn this section, the implementation of the proposed Integrated ABC-EVA System at two small manufacturing companies is presented. The managers of the companies wished for their company names to remain anonymous. T herefore, they will be referred to as “Company X” and “Company Y” from here on.Prior to the field study, both companies were using traditional costing systems. The overhead was allocated to product lines based on direct labor hours. In both companies, managers felt that their traditional costing systems were not able to provide reliable cost information.1 Company XCompany X, located in Pittsburgh, Pennsylvania, was a small manufacturing company with approximately 30 employees. Company X’s main products l ines were Overlays、Membranes、Laser、Roll Labels and N’Caps. In the mid 1990’s, a group of investors purchased the company from the previous owner-manager who had retired. At the time of the study, the company was managed by its former vice-president, who was supported by a three-person management group. Investors were primarily concerned with financial performance rather than daily decision-making. The management group was very eager to participate in the field study for two reasons. First, the management was under pressure from their new investors who were not satisfied with the current return from existing product lines; Second, management was trying to identify the most lucrative product line in order to initiate a marketing campaign with the biggest impact on overall profits.2 Company YCompany Y, also located in Pittsburgh, Pennsylvania, was owned and managed by three owner-managers who bought the company from a large corporation in the mid 1990’s, Company Y employed approximately 40 people. The majority of this compa ny’s business was in the area of manufacturing electrical devices and their main product lines were Motors and Motor Parts、Breakers、and Control Parts. Company Y sold its products in the domestic market as well as abroad. A portion of the company’s output was sold directly to end-users, while the remainder was sold with the help of independent distributors. The management of Company Y wasinterested in using the Integrated ABC-EVA System for the purpose of cost control and profit planning.3 Comparison of the costing systemsDuring the field study, three costing systems (TCA, ABC and the Integrated ABC-EVA System) were used to obtain cost information for each company in order to identify factors which may lead to distortions through arbitrary allocation of capital costs. In a comparison, capital costs were only able to be traced by the Integrated ABC-EVA System. The nature of the TCA and ABC systems resulted in arbitrary allocations of capital costs.4 RESULTSThe main objective of the data analysis presented in this section is to investigate which factors most often distort information provided by the ABC system. As mentioned in the methodology section, factors such as diversity in production volume、product size、product complexity、material consumption, and setups often distort cost information. These factors are examined closely for possible allocation errors.4.1 Data Analysis for Company XThe data analysis for Company X began with an examination of its cost structure. Company X’s overall costs for 1998 were evaluated by comparing the percentages of direct costs (direct labor and direct material)、operating costs (overhead) and capital costs as shown in Exhibit 1.Exhibit 1. Cost Analysis for Company X in Thousands of DollarsCapital costs, at 11.6 percent, represented a notable portion of Company X’s total costs. This relatively high capital costs could be explained by high investments in special equipment and fixed assets. In addition, Company X required a relatively large amount of working capital to support its wide variety of products.The next step was to calculate product cost information and examine changes across six product lines and three costing systems. Exhibit 2 and Exhibit 3 present the results.Exhibit 2. Product Cost Information in Thousands of DollarsThe Integrated ABC-EVA System, taking into account capital costs, revealed that the overall product cost was actually 13.1 percent higher than either TCA or ABC estimated. The difference in product cost, however, was not uniform across all product lines. After adding capital costs to the product cost obtained from the ABC system, the greatest difference in product cost was observed in the Overlays product line (+ 16.6 %) while the least difference was registered in the N’Caps product line (+ 4.9 %). From this, it can be concluded that an arbit rary allocation of capital costs to the product cost obtained by using the ABC system would produce inexact product cost information. For example, adding 13.1 percent to all product lines would distort the product costs for Company X.Company X’s managemen t was surprised when presented with the results of using the Integrated ABC-EVA System. Familiarized with the calculations used, the managers agreed that the results were correct. Knowing that the Overlays product line was the only product line which created economic value, they considered extending marketing efforts for this product line. In contrast, for the Laser product line (considered to be profitable according to the TCA and ABC systems, but revealed to be destructive to shareholder value by the Integrated ABC-EVA System), the managers announced changes in their pricing policies, as well as additional cost reduction efforts. Furthermore, they considered new outsourcing policies for unprofitable low volume product lines (such as N’Caps and Miscellaneou s Parts).4.2 Data Analysis for Company YThe data analysis for Company Y also began with an examination of its cost structure. As in Company X’s analysis, Company Y’s costs for 1998 were evaluated by comparing the percentages of direct costs (direct labor and direct material)、operating costs (overhead) and capital costs as shown in Exhibit 4.Exhibit 4. Cost Analysis for Company Y in Thousands of DollarsOperating costs, at approximately 42 percent, represented a notable portion of Company Y’s total costs. Company Y’s business, with its customized products (such as motors and generators) required a relatively high amount of effort in engineering design、product specification and supervision. Therefore, a highly qualified work force was essential. The high salaries paid to these employees were the reason for Company Y’s relatively high operating costs.Next, as in Company X, product cost information for four product lines, obtained by the three costing systems, was investigated and presented to the managers. Exhibit 5 and Exhibit 6 present results of this analysis.Exhibit 5. Product Cost Information in Thousands of DollarsAgain, the Integrated ABC-EVA System taking into account capital costs, revealed that the overall product cost was higher than TCA or ABC estimated, this time by 7.6 percent. This difference in product cost, once again, was not uniform across product lines. The greatestdifference (compared to ABC) was registered in the Breakers product line (+ 8.5 %), while the least difference was registered in the Control Parts product line (+ 6.5 %). Once again, it can be concluded that an arbitrary allocation of capital costs to the product cost obtained by the ABC system will distort, though not substantially, the product cost.Company Y’s management was especially surprised by the fact that the Motors and Motor Parts product line, which was believed to be highly profitable under both the TCA calculation and the ABC, was not actually able to create any economic value. This assumption of profitability was contradicted by the Integrated ABC-and-EVA System. Because the Economic Value Added for Motors and Motor Parts product line was only slightly negative, the managers believed a slight increase in price would make the Motors and Motor Parts product line a value creator. In their opinion, this price increase was feasible since the company had an especially strong market position in this particular product line.4.3 Summary of the ResultsThis analysis shows that the ability of the Integrated ABC-EVA System to provide reliable cost information increases especially in cases where products are dissimilar、manufacturing technologies and equipment are diverse and capital cost is high. Of the companies studied, Company X had not only the higher capital costs, but also the greatest product diversity, As a result, the analysis showed a relatively high distortion in product cost between the ABC and ABC- EVA systems;The highest distortion in product cost between the TCA and ABC-EVA systems was observed in Company Y, which had the higher operating costs. In the case of Company Y, the ABC component of the Integrated ABC- EVA System was able to trace operating cost accurately, compared to the TCA system which simply allocated operating cost based on direct labor hours.5 CONCLUSIONSThe findings for both companies are highly similar. These findings confirm that traditional accounting systems often provide inaccurate、incomplete and unreliable cost information. Arbitrary allocation of operating and capital costs may often lead to distortions in product cost.Furthermore, the results suggest that the ABC system alone, though able to manage operating expenses and shows deficiencies, especially when capital investments are substantially diverse. When capital investments are substantially diverse (because of variation in productionvolume, technology, setups, materials or product complexity, for example), the ABC system is no longer a reliable strategic management tool for successful decision–making.The managers of each company in the field study expressed great satisfaction with the reliability and completeness of the Integrated ABC-EVA System. They regarded the System as a very useful strategic managerial tool. As a result of this implementation, the managers also changed certain corporate policies. These changes included adjustments in product costing、marketing strategies and perception of customer profitability. Overall, this field study demonstrated that the integration of a costing system with a financial performance measure in the form of Integrated ABC-EVA System will help manufacturing companies make an effective long-term business strategy.原文来源:The Integrated Activity-Based Costing and Economic Value Added Systemas a Strategic Management Tool: A Field Study[J]. Engineering Management Journal, 2000运用作业成本法和经济增加值的具体应用:小制造企业本部分将阐述两家小制造企业中,被建议使用的ABC-EVA整合系统的实施情况。

作业成本法(ABC)在物流系统中的应用

作业成本法(ABC)在物流系统中的应用一、ABC概述ABC即Activity-based Costing System--基于活动的成本核算系统,成本核算是企业会计工作的重要内容,正确的成本信息是企业制定决策的重要依据。

在我国企业目前实施ABC方法的基本情况是,作业成本计算法几乎未被企业运用,作业管理思想在一些企业局部性管理经验中有所体现,但有意识在作业成本管理理论指导下的需用几乎没有。

作业管理及类似经验大多产生于局部性或专门性的管理当中,如产品、工艺设计、质量管理等,而非全局性的、贯穿于各个方面的管理当中。

二、ABC在物流系统中的应用1)物流系统中实施ABC的意义当今状况下,在物流系统中实施ABC方法比以往任何时候都更加重要。

首先,物流已经形成一个巨大的产业。

在中国专业化物流服务需求已初露端倪、专业化物流企业开始涌现、多样化物流服务有一定程度的发展、物流基础设施和装备发展初具规模、物流产业发展正在引起各级政府的高度重视。

在物流系统的传统会计实践中还有一个重要的缺陷:未能特别指明和分配库存成本。

第一,并未确认和分配有关库存维持和全部成本,诸如保险以及税收,因此导致了库存成本的低估或模糊。

第二,对于投入到原料、在产品、产成品库存上的资金的财务成本,并未从企业发生的其他形式的财务费用中被确认、测量和分离。

2)物流系统中实施ABC的关键对物流系统而言,两项重要的成本因素是:库存和运输。

就库存而言,全部的库存成本包括所有有关库存运行成本和客户订货的所有费用。

库存运行费用,包括税费、存储、资本成本、保险和过时淘汰。

订货成本包括全部的库存控制费用、订货准备、交易等费用。

典型的物流成本分成三大类:直接成本、间接成本和日常费用。

直接成本容易确认,运输、仓储、原料管理以及订货处理这些直接费用可以从传统的成本会计中提取出来。

三、ABC应用实例分析国际某知名饮料公司在中国的业务广泛地采用了ABC方法。

特别是在其分销体系中采用ABC方法,可以得到与传统会计不同的结论,具有良好的经济效益。

第三方物流成本中英文对照外文翻译文献

中英文对照外文翻译The application of third party logistics to implement theJust-In-Time system with minimum cost under a global environmentAbstractThe integration of the Just-In-Time (JIT) system with supply chain management has been attracting more and more attention recently. Within the processes of the JIT system, the upstream manufacturer is required to deliver products using smaller delivery lot sizes, at a higher delivery frequency. For the upstream manufacturer who adopts sea transportation to deliver products, a collaborative third party logistics (3PL) can act as an interface between the upstream manufacturer and the downstream partner so that the products can be delivered globally at a lower cost to meet the JIT needs of the downstream partner. In this study, a quantitative JIT cost modelassociated with the application of third party logistics is developed to investigate the optimal production lot size and delivery lot size at the minimum total cost. Finally, a Taiwanese optical drive manufacturer is used as an illustrative case study to demonstrate the feasibility and rationality of the model.1. IntroductionWith the globalization of businesses, the on-time delivery of products through the support of a logistics system has become more and more important. Global corporations must constantly investigate their production systems, distribution systems, and logistics strategies to provide the best customer service at the lowest possible cost.Goetschalckx, Vidal, and Dogan (2002) stated that long-range survival for international corporations will be very difficult without a highly optimized, strategic, and tactical global logistics plan. Stadtler (2005) mentions that the activities and processes should be coordinated along a supply chain to capture decisions in procurement, transportation, production and distribution adequately, and many applications of supplychain management can be found in the literature (e.g. Ha and Krishnan, 2008, Li and Kuo, 2008 and Wang and Sang, 2005). Recently, the study of the Just-In-Time (JIT) system under a global environment has attracted more attention in the Personal Computer (PC) related industries because of the tendency towards vertical disintegration. The JIT system can be implemented to achieve numerous goals such as cost reduction, lead-time reduction, quality assurance, and respect for humanity (Monden, 2002). Owing to the short product life cycle of the personal computer industry, downstream companies usually ask their upstream suppliers to execute the JIT system, so that the benefits, like the risk reduction of price loss incurred from inventory, lead times reduction, on-time delivery, delivery reliability, quality improvement, and lowered cost could be obtained (Shin, Collier, & Wilson, 2000). According to the JIT policy, the manufacturer must deliver the right amount of components, at the right time, and to the right place (Kim & Kim, 2002). The downstream assembler usually asks for higher delivery frequency and smaller delivery lot sizes so as to reduce his inventory cost in the JIT system (Kelle, khateeb, & Miller, 2003). However, large volume products are conveyed using sea transportation, using larger delivery lotsizes to reduce transportation cost during transnational transportation. In these circumstances, corporations often choose specialized service providers to outsource their logistics activities for productivity achievement and/or service enhancements (La Londe & Maltz, 1992). The collaboration of third party logistics (3PL) which is globally connected to the upstream manufacturer and the downstream assembler will be a feasible alternative when the products have to be delivered to the downstream assembler through the JIT system. In this study, the interaction between the manufacturer and the 3PL will be discussed to figure out the related decisions such as the optimal production lot size of the manufacturer and the delivery lot size from the manufacturer to the 3PL, based on its contribution towards obtaining the minimum total cost. In addition, the related assumptions and restrictions are deliberated as well so that the proposed model is implemented successfully. Finally, a Taiwanese PC-related company which practices the JIT system under a global environment is used to illustrate the optimal production lot size and delivery lot size of the proposed cost model.2. Literature reviewThe globalization of the network economy has resulted in a whole new perspective of the traditional JIT system with the fixed quantity-period delivery policy (Khan & Sarker, 2002). The fixed quantity-period delivery policy with smaller quantities and shorter periods is suitable to be executed among those companies that are close to each other. However, it would be hard for the manufacturer to implement the JIT system under a global environment, especially when its products are conveyed by transnational sea transportation globally. Therefore, many corporations are trying to outsource their global logistics activities strategically in order to obtain the numerous benefits such as cost reduction and service improvement. Hertz and Alfredsson (2003) have stated that the 3PL, which involves a firm acting as a middleman not taking title to the products, but to whom logistics activities are outsourced, has been playing a very important role in the global distribution network. Wang and Sang (2005) also mention that a 3PL firm is a professional logistics company profiting by taking charge of a part or the total logistics in the supply chain of a focal enterprise. 3PL also connects the suppliers, manufacturers, and the distributors in supply chains and provide substance movement andlogistics information flow. The core competitive advantage of a 3PL firm comes from its ability to integrate services to help its customers optimize their logistics management strategies, build up and operate their logistics systems, and even manage their whole distribution systems (Wang & Sang, 2005). Zimmer (2001) states that production depends deeply on the on-time delivery of components, which can drastically reduce buffer inventories, when JIT purchasing is implemented. When the manufacturer has to comply with the assembler under the JIT system, the inventories of the manufacturer will be increased to offset the reduction of the assembler’s inventories (David and Chaime, 2003, Khan and Sarker, 2002 and Sarker and Parija, 1996).The Economic Order Quantity (EOQ) model is widely used to calculate the optimal lot size to reduce the total cost, which is composed of ordering cost, setup cost, and inventory holding cost for raw materials and manufactured products (David and Chaime, 2003, Kelle et al., 2003, Khan and Sarker, 2002 and Sarker and Parija, 1996). However, some issues such as the integration of collaborative 3PL and the restrictions on the delivery lot size by sea transportation are not discussedfurther in their studies. For the above involved costs, David and Chaime (2003) further discuss a vendor–buyer relationship to include two-sided transportation costs in the JIT system. Koulamas, 1995 and Otake et al., 1999 describe that the annual setup cost is equal to the individual setup cost times the total number of orders in a year. McCann, 1996 and Tyworth and Zeng, 1998 both state that the transportation cost can be affected by freight rate, annual demand, and the products’ weight. Compared to the above studies which assume that the transportation rate is constant per unit, Swenseth and Godfrey (2002) assumed that the transportation rate is constant per shipment, which will result in economies of scale for transportation. Besides, McCann (1996) presented that the total logistics costs are the sum of ordering costs, holding costs, and transportation costs. A Syarif, Yun, and Gen (2002) mention that the cost incurred from a distribution center includes transportation cost and operation cost. Taniguchi, Noritake, Yamada, and Izumitani (1999) states that the costs of pickup/delivery and land-haul trucks should be included in the cost of the distribution center as well. The numerous costs involved will be formulated in different ways when the manufacturer operates the JIT system associatedwith a collaborative 3PL under a global environment. Kreng and Wang (2005) presented a cost model, which can be implemented in the JIT system under a global environment, to investigate the most appropriate mode of product delivery strategy. They discussed the adaptability of different transportation means for different kinds of products. In this study, the implementation of sea transportation from the manufacturer to the 3PL provider will be particularized, and the corresponding cost model will also be presented to obtain the minimum total cost, the optimal production lot size, and the optimal delivery lot size from the manufacturer to the 3PL provider. Finally, a Taiwanese company is used for the case study to illustrate and explore the feasibility of the model.3. The formulation of a JIT cost model associated with the 3PL Before developing the JIT cost model, the symbols and notations used throughout this study are defined below:B3PL’s pickup cost per unit product (amount per unit)Cj3PL’s cost of the j th transportation container type, where j= 1, 2, 3,…,n (amount per year)DP annual demand rate of the product (units per year)Dr annual demand of raw materials (units per year)D customers’ demand at a specific interval (units per shipment)E annual inventory holding cost of 3PL (amount per year)F transportation cost of the j th transportation containertype from the manufacturer to the 3PL, where j= 1, 2, 3, …, n (amount per lot)F freight rate from the 3PL provider to the assembler (amount per kilogram)Hp inventory holding cost of a unit of the product (amount per year)Hr inventory holding cost of raw materials per unit (amount per year)Ij average product inventory of the j th transportation container type in the manufacturer, where j= 1, 2,3, …, n (amount per year)I annual profit margin of 3PL (%)K ordering cost (amount per order)Kj number of shipments from the 3PL provider to the assembler when the delivery lot size from the manufacturer to the 3PL provider is Qj with the j th transportation container type, where j= 1, 2, 3, …, n(kj=Qj/d)M∗ optimal number of shipments that manufacturer delivers with the optimal total costactual number of shipments of the j th transportation container type with the minimum total cost, where j= 1, 2, 3, …, nMj number of shipments of the j th transportation container type, where j= 1, 2, 3, …, nnumber of shipments of the j th transportation container type with the minimum total cost, where j= 1, 2, 3, …, nN∗ optimal production lot size of the manufacturer (units per lot)optimal production lot size of the j th transportation container type, where j= 1, 2, 3, …, n(units per lot)Nj production lot size of the j th transportation container type, where j= 1, 2, 3, …, n (units per lot)Nr ordering quantity of raw material (units per order)P production rate of product (units per year)maximum delivery lot size of the j th transportation container type, where j= 1, 2, 3, …, n(units per lot)q∗ optimal delivery lot size of the manufacturer (units per lot)qj actual delivery lot size of the j th transportation container type, where j= 1, 2, 3, …,n (units per lot)Rj loading percentage of the j th transportation container type, where j= 1, 2, 3, …,n(Rj=qj/Qj)Rj real number of shipments from the 3PL provider to the assembler when the delivery lot size from the manufacturer to the 3PL provider is qj with the j th transportation container type, where j= 1, 2, 3, …,n(rj=qj/d)S setup cost (amount per setup)W weight of product (kilogram per unit)Λ quantity of raw materials required in producing one unit of a product (units)Tomas and Griffin (1996) considered that a complete supply chain should consist of five participants, including the raw materials supplier, the manufacturer, the assembler, the warehouse operator, and the consumer. This study mainly focuses on the relationships among the manufacturer, the 3PL provider and the assembler within the JIT system under a global environment. In order to achieve the fixed quantity-period JIT delivery policy, which implies that the actual delivery lot size has to be determined by identifying the downstream assembler’s needs instead of the upstream manufacture’s economical delivery lot size, higher transportation costs with higher delivery frequency are necessary. Since the JIT system are more appropriately executed among those companies that are close to each other, a collaborative 3PL connected the upstream manufacture with the downstream assembler is necessary when the products have to be delivered from the upstream manufacture to the downstream assembler by sea transportation over a long distance. This study proposes a JIT cost model to obtain the optimal production lot size, the actual delivery lot size, the most suitable transportation container type, and the exact number of shipments from the manufacturer to the 3PL provider at the minimum total cost.This study makes assumptions of the JIT system as follows: (1) There is only one assembler and only one manufacturer for each product.(2) The production rate of the manufacturer is uniform,finite, and higher than the demand rate of the assembler.(3) There is no shortage and the quality is consistent in both raw materials and products.(4) The demand for products that the assembler receives is fixed and is at regular intervals.(5) Qj is much greater than demand at a regular interval,d.(6) The transportation rates from the manufacturer to the 3PL and from the 3PL to the assembler are computed by the number of shipments and the product’s weight, respectively, and, (7) The space of the manufacturer’s warehouse is sufficient for keeping all inventories of products that the manufacturer produces.According to the above assumptions from (1), (2), (3) and (4), Fig. 1 illustrates the relationships among the manufacturer, the 3PL provider, and the assembler, where the Fig. 1 represents the inventory of manufacturer’s raw materials, the inventoryof products inside the manufacturer, the inventory of the 3PL provider, and the inventory of the assembler from top to bottom (Kreng & Wang, 2005). This study also adopts the Fig. 1 to demonstrate the collaboration of the 3PL provider which will be an interface connecting the manufacturer and the assembler. During the period T1, the inventory of products with the manufacturer will be increased gradually because the production quantity is larger than the demand quantity. However, during the period T2, the inventory of products will be decreased because the production has been stopped.中文翻译:在全球环境下第三方物流以最小的成本实现了Just-In-Time系统的应用摘要:JUST-IN-TIME(JIT)系统,供应链管理的整合,最近已经吸引了越来越多的关注。

基于作业成本法的第三方物流企业成本核算及决策研究

作业成本法是一 种基于作业的成 本核算方法,通 过确认和计量企 业所有作业活动, 将成本分配到作 业中,再由作业 分配到产品或服 务中。

作业成本法的基 本原理是“作业 消耗资源,产品 消耗作业”,通 过建立作业成本 库,归集资源成 本到作业中心, 再从作业中心分 配到产品或服务 中。

作业成本法能够 更准确地反映产 品或服务的真实 成本,帮助企业 识别非增值作业 和低效作业,优 化资源配置和提 高经营决策水平。

单击此处添加标题

虽然作业成本法能够更准确地核算第三方物流企业的成本,但在实际应用中 仍存在一些局限性,例如数据收集的难度和成本核算的复杂性。

单击此处添加标题

当前研究主要关注作业成本法在第三方物流企业成本核算中的应用,但未来 可以进一步探讨如何将其应用于决策制定和其他管理领域。

单击此处添加标题

未来研究可以进一步优化作业成本法,提高其准确性和可操作性,以更好地 服务于第三方物流企业的成本核算和决策制定。

,a click to unlimited possibilities

汇报人:

01 02 03 04 05

06

Part One

Part Two

作业成本法是一种基于作业的成本核算方法,通过确认和计量企业生产经营过程中所发生的所有作业,将成本分 配到作业中,再根据作业动因将作业成本追溯到产品或服务中,从而得出最终的产品或服务成本。

作业成本法在第三 方物流企业成本核 算中的应用,有助 于提高成本核算的 准确性和决策的科 学性。

第三方物流企业应 关注作业成本法的 实施细节,结合企 业实际情况进行合 理调整,以实现最 佳的成本核算效果。

案例分析中提到的 第三方物流企业在 成本核算方面的成 功经验,可以为其 他企业提供有益的 参考和借鉴。

供应链物流管理专业词汇整理

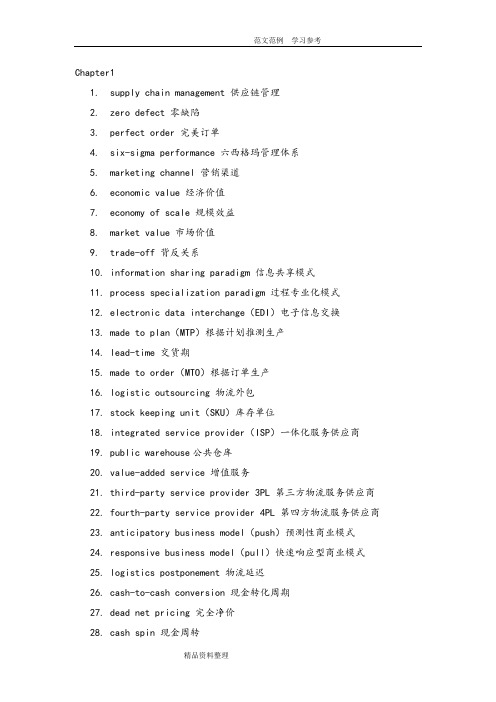

Chapter11.supply chain management 供应链管理2.zero defect 零缺陷3.perfect order 完美订单4.six-sigma performance 六西格玛管理体系5.marketing channel 营销渠道6.economic value 经济价值7.economy of scale 规模效益8.market value 市场价值9.trade-off 背反关系rmation sharing paradigm 信息共享模式11.process specialization paradigm 过程专业化模式12.electronic data interchange(EDI)电子信息交换13.made to plan(MTP)根据计划推测生产14.lead-time 交货期15.made to order(MTO)根据订单生产16.logistic outsourcing 物流外包17.stock keeping unit(SKU)库存单位18.integrated service provider(ISP)一体化服务供应商19.public warehouse公共仓库20.value-added service 增值服务21.third-party service provider 3PL 第三方物流服务供应商22.fourth-party service provider 4PL 第四方物流服务供应商23.anticipatory business model(push)预测性商业模式24.responsive business model(pull)快速响应型商业模式25.logistics postponement 物流延迟26.cash-to-cash conversion 现金转化周期27.dead net pricing 完全净价28.cash spin 现金周转29.operational performance 运作绩效30.order processing 订单处理31.customer accommodation 市场分销Chapter2 Inbound logistics 采购运筹,进口物流1.Procurement perspective and strategies 采购远景和策略2.continuous supply 持续供应3.minimize inventory investment 减少存货投资-JIT4.quality improvement 质量改进5.lowest total cost of ownership-TCO 所有权总成本最低6.supplier-buyer integration 供方买方整合7.value management 价值管理8.sales synergy 销售协同9.Manufacturing perspective and strategies 生产远景和策略10.brand power 品牌力11.Lead time 备货期12.Make-to-stock(MTS)备货型生产13.Make-to-order(MTO)订货型生产14.Assemble-to-order(ATO)面向订单装配15.Material Requirement Planning(MRP) 物料需求计划Chapter3 Outbound Logistics 出货物流1.Supply chain service output 供应链营运功率2.Spatial convenience 空间便利性3.Lot size 批量4.Waiting time 等待时间5.Stock out frequency 缺货率6.Fill rate 供应比率7. Sales and operations planning 销售和运作计划8.Order shipped complete 订货完成率9.Operation Performance 运行性能:10.Service Reliability 服务可靠性11.Customer Satisfaction 顾客满意度:12.Value added service 增值业务:13.Customer-focused services顾客导向之服务14.Promotion-focused services促销导向之服务15.Manufacturing-focused services 生产导向之服务16.Time-based services 基于时间的服务17.Distribution Resource Planning (DRP) 配送资源计划18.Total Quality Management全面质量管理19.customer relationship management(CRM)客户关系管理20.International Organization for Standardization(ISO)国际标准化组织21.European Article Numbering(EAN)欧洲物品编码22.Total Cost of Ownership所有权的总成本23.Economic Order Quantity(EOQ)经济订货量24.authorized economic operator授权经济运营25.make-to-plan(MTP)计划型生产26.Assemble-to-order面向订单装配27.materials requirements planning(MRP)物料需求计划28.performance-based logistics基于性能的物流29.Master Production Schedule主生产计划30.Bill of Materials 物料清单31.Distribution Resource Planning分销资源计划32.Supply chain information systems 供应链信息系统33.Enterprise Resource Planning(ERP)企业资源规划34.transportation management system运输管理系统35.Warehouse management system存货管理系统36.Yard management system堆场管理系统Advanced Planning and Scheduling(APS) 高级计划与排程系统37. available to promise 可行性承诺38.Collaborative Planning, Forecasting and Replenishment(CPFR)协同规划,预测和补货39.bills of lading提单40. proof of delivery交货证明Chapter4Geographical specialization 地域专门化Decoupling 库存的“分离”作用Balancing supply and demand 平衡供需Buffering uncertainty 降低不确定性因素Service lever 服务水平Average inventory 平均库存Inventory policy 存货政策Cycle inventory, or base stock 周转库存Safety stock inventory 安全库存Transit inventory 在途库存Order quantity 订购数量Transit inventory 已中转存货Obsolete inventory陈旧存货Speculative inventory投机性存货Safety stock 安全储备Reorder point 再订货点Inventory turns库存周转次数performance cycle or lead time绩效循环Inventory carrying cost 库存持有成本Volume Transportation Rates体积运输率Free On board (FOB) 船上交货价Quantity Discount大批量折扣Other EOQ Adjustments其他存货调整Demand uncertainty 需求的不确定性Performance cycle uncertainty 运行周期的不确定性Standard deviation 标准差Poisson distribution 泊松分布Safety Stock with Combined Uncertainty安全库存结合的不确定性Numerical compounding 精确合成Estimating Fill Rate估计填充率Dependent Demand Replenishment相关需求补给Safety time 安全时间Over planning top-level demand 对高水平需求的超额预测Inventory control 库存控制Perpetual Review 永续盘存Periodic Review 定期盘存Reactive inventory system 反应式库存系统Pull inventory system 拉动式库存系统Fair Share Allocation 公平份额分配法Distribution Requirements Planning (DRP) 配送需求计划Collaborate Inventory Replenishment 联合库存补充Vendor-Managed Inventory (VMI) 供应商管理存货Profile Replenishment (PR) 系列补货Product Classification Analysis (ABC) 产品分类分析Product/Market Classification 产品/市场分类Segment Strategy Definition 战略定义Policies and Parameters 政策和参数Chapter5,6(第八、九、十章)第八章Transportation InfrastructureIn-transit inventory在途库存Diversion转移Economy of scale规模经济 economy of distance 距离经济Tapering principle 远距离递减原则Consignor 发货人 consignee 收货人United States Postal Service (USPS)美国邮政服务Department of Transportation(DOT)运输部门Interstate Commerce Commission (ICC) 洲际商会Surface Transportation Board (STB) 陆地运输局Rights-of-way 通行权Ton-mile 吨英里Truckload(TL) 整车运输less—than—truckload(LTL) 零担运输specialty 专项运输North America Free Trade Agreement (NAFTA) 北美自由贸易协定Central America Free Trade Act (CAFTA) 中美洲自由贸易法United Parcel Service (UPS) 联合包裹运输服务公司Piggyback service 驼背式运输服务Land bridge 大陆桥Freight forwarders 货运代理人第九章Transportation OperationsStowability 装载能力Hundredweight (CWT) 英担Transport lane 运输通道Back-haul 可带回去Deadheaded 空车返回Variable costs 可变成本Fixed costs 固定成本Joint costs 连带成本Common costs公共成本Cost-of-service 服务成本策略Value-of-service 服务价值策略Combination pricing strategy 组合定价策略Net-rate pricing 净费率定价策略Tariff 费率表Class rate 费率类别Minimum charges and surcharges最低收费和附加费Commodity rate 商品费率Exception rates 特价费率Aggregate tender rate累计费率Limited service rate 有限服务费率Shipper load and count rate 发货人装载和清点费率Released value rate 免责价值费率Freight-all-kind (FAK) rates 均价费率Local rate 地方费率Single-line rate单线费率Joint rate 联合费率Proportional rate比例费率Transit service 转运服务Diversion and reconsignment 转移并变更收货人Split delivery 分票交付Demurrage 滞期费Detention 滞留费用Special or accessorial service 特别的或者附属的费用Special equipment charges 特殊设备使用费Transportation management system (TMS)运输管理系统Core carrier strategy 核心承运人战略Integrated service providers (ISPs)Reactive and proactive反应性和主动性Market area 市场范围法Scheduled area delivery 定期运送Pooled delivery集中运送Preorder planning 预订计划Multi-vendor consolidation 多卖主集拼Expediting 加急Hours of service(HOS) 服务时间Federal Motor Carrier Safety Administration联邦汽车运输安全管理局Loss or damage 货物丢失和损伤Overcharge/undercharge索价过低Preaudit 事前审核Post audit 事后审核Bill of lading 提货单Order-notified 待命提单Freight bill运费账单Prepaid or collect 预付或到付Shipment manifest装货清单Free on board船上交货Freight on board 离岸价格F.O.B. Origin FOB原产地价格F.O.B. Destination pricing FOB交货地价格F.O.B. 离岸价Delivered pricing 交货价Single-zone delivered pricing单地区定价Multiple-zone delivered pricing多地区定价Base—point pricing system基点定价系统Phantom freight在售价上加计的运费Freight absorption 运费免收Substantially lessen competition 大大减少竞争Forward-buy 提前购买Every Day Low Pricing(EDLP)天天低价Activity-based costing 作业成本法Total cost-to-serve model总成本与服务模型第十章 WarehousingDistribution center 分销中心Just-in-time (JIT)准时制生产Cross-docking 越库式转运Mixing组合作业Assembly 装配作业Lead suppliers or tier one suppliers 主供应商或一级供应商Environmental Protection Agency(EPA)环境保护机构Food and Drug Administration(FDA)食品药物监管会Occupational Safety and Health Administration(OSHA)职业安全与卫生管理局Spot-stocked 定点储存Value-added services(VAS)增值服务Transfer and selection 货物的转移和分拣作业Flow-through or cross-dock distribution通过式配送或越库式转运Extended storage 长期储存Contract warehousing 合同仓储Selection or picking area 分拣作业的区域Discrete selection and wave selection 单独分拣和区域分拣Batch selection 批次挑选Chapter 7 Integrated Operations PlanningSupply Chain Planning供应链计划Supply chain visibility供应链的可见性Simultaneous resource consideration资源的同步考虑Resource utilization资源的利用率Supply Chain Planning Applications供应链计划应用系统Demand Planning需求计划Product Planning生产计划Logistics Planning 物流计划Sales and Operations Planning (S&OP)销售和作业计划系统Maximize production产量最大化Stable schedule稳定的生产进度Long lead times长的提前期Lower margins较低的利润Aggregate forecasts总体预测Rapid response 快速响应Maximize revenue 利润最大化Collaborative planning协同计划Exponential smoothing指数平滑法extended exponential smoothing扩展平滑法Adaptive smoothing调节性平滑法Multiple regression多元回归Chapter 8 Global Supply ChainGlobal Supply Chain Integration全球供应链一体化Stages of international development国际化发展的阶段Use restriction使用限制Price surcharges价格附加费Local presence本地经营Global Sourcing 国际采购Rationale for Low-Cost-Country sourcing低成本国家采购的理由Guidelines for sourcing采购的指导方针Achieve economies of scale实现规模经济Reduce direct cost减少直接成本Reduce market access uncertainty减少市场准入的不确定性Enhance sustainability增强可持续性Combined transport document联运单据Commercial invoice商业发票Insurance certificate保险证书Certificate of origin原产地证书Logistics Performance Index(LPI)物流绩效指数Chapter 9 Chapter 10(第十五、十六章)SDWT--self-directed work teams 自我指导工作小组Balanced scorecards 平衡计分卡Balance sheet 资产负债表Income statement 利润表The great divide 严重断层Reliability-based trust 以可靠性为基础的信任Character-based trust 以特性为基础的信任Average order cycle time 平均订货周期时间Order cycle consistency 订货周期一致性On-time delivery 准时交货Downtime 停工期Inventory turnover rate 库存周转率ROA---return on assets 资产回报率ROI---return on investment 投资回报率RONW---return on net worth 净值回报率Contribution approach 贡献毛利法Net profit approach 净利润法SPM---Strategic Profit Model 战略盈利模型CMROI---contribution margin return on inventory investment库存投资利润贡献率。

作业成本法在第三方物流企业成本核算中应用

三、作业成本法在第三方物流成本核算中 的应用

步骤:(1) 界定企业物流系统涉及的各项作业,归集同类作 业到作业中心。 (2) 确认物流系统涉及的资源。 (3) 确认资源动因,将资源分配到作业。 (4) 确认成本动因,计算作业成本动因率,将作业成本分配 到成本对象(产品或服务)中。 (5) 计算成本对象的总成本。

五、基于作业成本核算的作业成本管理

作业成本管理可运用在企业的以下几个层面: (1) 企业的作业链-价值链优化 作业成本管理深入到作业水平,以作业为核心,进行作业分析。通过作 业分析,消除不增值的作业,把企业有限的资源用于能为企业最终产品增 加价值的作业上,提高作业效率与效益,从而促进企业价值链的优化。 (2) 企业作业成本控制 物流企业在获得准确成本信息基础上,通过界定作业的增值性,保留增 值性作业并提高其效率,根据作业的增值性高低分配资源,成本控制只能 最大限度地

分配成本

作业动 因数

分配成本

运输次数

报关次数

装卸货物 数量

1 1

30000

3750 500

6000

3 3

30000

11250 1500

6000

仓储货物 数量

配送次数 合同数 合计

1000

10 1

15000

9500 1500 36250

1000

30 1

15000

28500 1500 63750

表1 作业成本法与传统成本法核算结果比较

基于作业成本法的第三方物流企业成 本核算与管理研究

杨兵

10076120203

主要内容

➢ 一、引言 ➢ 二、作业成本法的基本原理 ➢ 三、作业成本法在第三方物流成本核算中的应用 ➢ 四、应用实例 ➢ 五、基于作业成本核算的作业成本管理 ➢ 六、结论

基于作业成本法的企业成本核算体系研究第三方物流企业的成本核算

基于作业成本法的企业成本核算体系研究第三方物流企业的成本核算基于作业成本法的企业成本核算体系研究——第三方物流企业的成本核算摘要本文一开始叙述了有关作业成本法成本核算的理论,接着把作业成本法与传统成本法进行比照,讨论了第三方物流企业采取作业成本法的可行性;随后又引入了有关第三方物流企业的案例,证实了在第三方物流企业采用作业成本法进行成本核算的优越性,在具体核算中需要企业确认主要的作业,成立作业成本库、确定各项资源动因、确定各项作业的成本动因等一系列确认方式,这能够使得第三方物流企业更确切的计算出产品的成本;文章结尾还总结了中国第三方物流企业运用作业成本法进行核算时所出现的问题而且对此提出了相应的解决对策。

关键词:作业成本法第三方物流企业成本核算This article first expounds the homework cost method of cost accounting related theory, and the homework cost method were compared with the traditional cost method, discusses the third party logistics enterprises to adopt the necessity and feasibility of homework cost method; Secondly introduced the third party logistics enterprise case, proves the homework cost method in the advantages of the third party logistics enterprise cost accounting, in a specific accounting companies want to make sure the main job first, establish cost pools, each resource agent, determine the operating way of cost drivers and a series of confirmation, can accurately calculate the third party logistics enterprise the cost of the product; Finally summed up the implementation of activity-based costing method in our country and put forward the corresponding countermeasures for the problems.Keywords:Activity based costing;Third party logistics;Cost accounting摘要......................................................................................... 错误!未定义书签。

作业成本法在第三方物流企业成本管理中的应用研究

作业成本法在第三方物流企业成本管理中的应用研究一、本文概述Overview of this article随着全球经济一体化和市场竞争的日益激烈,第三方物流企业面临着越来越大的成本压力。

如何在保证服务质量的有效降低成本,成为这些企业亟待解决的问题。

作业成本法(Activity-Based Costing,简称ABC)作为一种先进的成本管理方法,近年来在各类企业中得到了广泛应用。

本文旨在探讨作业成本法在第三方物流企业成本管理中的应用,分析其实施步骤、优势及可能遇到的挑战,并提出相应的实施策略和建议。

With the increasing global economic integration and market competition, third-party logistics enterprises are facing increasing cost pressures. How to effectively reduce costs while ensuring service quality has become an urgent issue for these enterprises. Activity Based Costing (ABC), as an advanced cost management method, has been widely applied in various enterprises in recent years. This article aims to explore theapplication of activity-based costing in cost management of third-party logistics enterprises, analyze its implementation steps, advantages, and potential challenges, and propose corresponding implementation strategies and suggestions.本文将简要介绍作业成本法的基本原理和特点,为后续研究奠定理论基础。

第三方物流成本的管理外文翻译(适用于毕业论文外文翻译+中英文对照)

The application of third party logistics to implement the Just-In-Time system with minimum cost under a global environmentAbstractThe integration of the Just-In-Time (JIT) system with supply chain management has been attracting more and more attention recently. Within the processes of the JIT system, the upstream manufacturer is required to deliver products using smaller delivery lot sizes, at a higher delivery frequency. For the upstream manufacturer who adopts sea transportation to deliver products, a collaborative third party logistics (3PL) can act as an interface between the upstream manufacturer and the downstream partner so that the products can be delivered globally at a lower cost to meet the JIT needs of the downstream partner. In this study, a quantitative JIT cost model associated with the application of third party logistics is developed to investigate the optimal production lot size and delivery lot size at the minimum total cost. Finally, a Taiwanese optical drive manufacturer is used as an illustrative case study to demonstrate the feasibility and rationality of the model.1. IntroductionWith the globalization of businesses, the on-time delivery of products through the support of a logistics system has become more and more important. Global corporations must constantly investigate their production systems, distribution systems, and logistics strategies to provide the best customer service at the lowest possible cost.Goetschalckx, Vidal, and Dogan (2002)stated that long-range survival for international corporations will be very difficult without a highly optimized, strategic, and tactical global logistics plan. Stadtler (2005) mentions that the activities and processes should be coordinated along a supply chain to capturedecisions in procurement, transportation, production and distribution adequately, and many applications of supply chain management can be found in the literature (e.g. Ha and Krishnan, 2008, Li and Kuo, 2008and Wang and Sang, 2005).Recently, the study of the Just-In-Time (JIT) system under a global environment has attracted more attention in the Personal Computer (PC) related industries because of the tendency towards vertical disintegration. The JIT system can be implemented to achieve numerous goals such as cost reduction, lead-time reduction, quality assurance, and respect for humanity (Monden, 2002). Owing to the short product life cycle of the personal computer industry, downstream companies usually ask their upstream suppliers to execute the JIT system, so that the benefits, like the risk reduction of price loss incurred from inventory, lead times reduction, on-time delivery, delivery reliability, quality improvement, and lowered cost could be obtained (Shin, Collier, & Wilson, 2000). According to the JIT policy, the manufacturer must deliver the right amount of components, at the right time, and to the right place (Kim & Kim, 2002). The downstream assembler usually asks for higher delivery frequency and smaller delivery lot sizes so as to reduce his inventory cost in the JIT system (Kelle, khateeb, & Miller, 2003). However, large volume products are conveyed using sea transportation, using larger delivery lot sizes to reduce transportation cost during transnational transportation. In these circumstances, corporations often choose specialized service providers to outsource their logistics activities for productivity achievement and/or service enhancements (La Londe & Maltz, 1992). The collaboration of third party logistics (3PL) which is globally connected to the upstream manufacturer and the downstream assembler will be a feasible alternative when the products have to be delivered to the downstream assembler through the JIT system. In this study, the interaction between the manufacturer and the 3PL will be discussed to figure out the related decisions such as the optimal production lot size of the manufacturer and the delivery lot size from the manufacturer to the 3PL, based on its contribution towards obtaining the minimum total cost. In addition, the related assumptions and restrictions aredeliberated as well so that the proposed model is implemented successfully. Finally, a Taiwanese PC-related company which practices the JIT system under a global environment is used to illustrate the optimal production lot size and delivery lot size of the proposed cost model.2. Literature reviewThe globalization of the network economy has resulted in a whole new perspective of the traditional JIT system with the fixed quantity-period delivery policy (Khan & Sarker, 2002). The fixed quantity-period delivery policy with smaller quantities and shorter periods is suitable to be executed among those companies that are close to each other. However, it would be hard for the manufacturer to implement the JIT system under a global environment, especially when its products are conveyed by transnational sea transportation globally. Therefore, many corporations are trying to outsource their global logistics activities strategically in order to obtain the numerous benefits such as cost reduction and service improvement. Hertz and Alfredsson (2003) have stated that the 3PL, which involves a firm acting as a middleman not taking title to the products, but to whom logistics activities are outsourced, has been playing a very important role in the global distribution network. Wang and Sang (2005)also mention that a 3PL firm is a professional logistics company profiting by taking charge of a part or the total logistics in the supply chain of a focal enterprise. 3PL also connects the suppliers, manufacturers, and the distributors in supply chains and provide substance movement andlogistics information flow. The core competitive advantage of a 3PL firm comes from its ability to integrate services to help its customers optimize their logistics management strategies, build up and operate their logistics systems, and even manage their whole distribution systems (Wang & Sang, 2005).Zimmer (2001) states that production depends deeply on the on-time delivery of components, which can drastically reduce buffer inventories, when JIT purchasingis implemented. When the manufacturer has to comply with the assembler under the JIT system, the inventories of the manufacturer will be increased to offset the reduction of the assembler’s inventories (David and Chaime, 2003, Khan and Sarker, 2002and Sarker and Parija, 1996).The Economic Order Quantity (EOQ) model is widely used to calculate the optimal lot size to reduce the total cost, which is composed of ordering cost, setup cost, and inventory holding cost for raw materials and manufactured products (David and Chaime, 2003, Kelle et al., 2003, Khan and Sarker, 2002and Sarker and Parija, 1996). However, some issues such as the integration of collaborative 3PL and the restrictions on the delivery lot size by sea transportation are not discussed further in their studies. For the above involved costs, David and Chaime (2003) further discuss a vendor–buyer relationship to include two-sided transportation costs in the JIT system. Koulamas, 1995and Otake et al., 1999 describe that the annual setup cost is equal to the individual setup cost times the total number of orders in a year. McCann, 1996and Tyworth and Zeng, 1998both state that the transportation cost can be affected by freight rate, annual demand, and the products’ weight. Compared to the above studies which assume that the transportation rate is constant per unit, Swenseth and Godfrey (2002)assumed that the transportation rate is constant per shipment, which will result in economies of scale for transportation. Besides, McCann (1996)presented that the total logistics costs are the sum of ordering costs, holding costs, and transportation costs. A Syarif, Yun, and Gen (2002)mention that the cost incurred from a distribution center includes transportation cost and operation cost. Taniguchi, Noritake, Yamada, and Izumitani (1999)states that the costs of pickup/delivery and land-haul trucks should be included in the cost of the distribution center as well.The numerous costs involved will be formulated in different ways when the manufacturer operates the JIT system associated with a collaborative 3PL under a global environment. Kreng and Wang (2005) presented a cost model, which can beimplemented in the JIT system under a global environment, to investigate the most appropriate mode of product delivery strategy. They discussed the adaptability of different transportation means for different kinds of products. In this study, the implementation of sea transportation from the manufacturer to the 3PL provider will be particularized, and the corresponding cost model will also be presented to obtain the minimum total cost, the optimal production lot size, and the optimal delivery lot size from the manufacturer to the 3PL provider. Finally, a Taiwanese company is used for the case study to illustrate and explore the feasibility of the model.3. The formulation of a JIT cost model associated with the 3PLBefore developing the JIT cost model, the symbols and notations used throughout this study are defined below:B3PL’s pickup cost per unit product (amount per unit)Cj3PL’s cost of the j th transportation container type, where j= 1, 2, 3,…,n (amount per year)DP annual demand rate of the product (units per year)Dr annual demand of raw materials (units per year)D customers’ demand at a specific interval (units per shipment)E annual inventory holding cost of 3PL (amount per year)F transportation cost of the j th transportation container type from themanufacturer to the 3PL, where j= 1, 2, 3, …, n (amount per lot)F freight rate from the 3PL provider to the assembler (amount per kilogram)Hp inventory holding cost of a unit of the product (amount per year)Hr inventory holding cost of raw materials per unit (amount per year)Ij average product inventory of the j th transportation container type in the manufacturer, where j= 1, 2, 3, …, n (amount per year)I annual profit margin of 3PL (%)K ordering cost (amount per order)Kj number of shipments from the 3PL provider to the assembler when the delivery lot size from the manufacturer to the 3PL provider is Qj with the j th transportation container type, where j= 1, 2, 3, …, n(kj=Qj/d)M∗ optimal number of shipments that manufacturer delivers with the optimal total costactual number of shipments of the j th transportation container type with the minimum total cost, where j= 1, 2, 3, …, nMj number of shipments of the j th transportation container type, where j= 1, 2, 3, …, nnumber of shipments of the j th transportation container type with the minimum total cost, where j= 1, 2, 3, …, nN∗ optimal production lot size of the manufacturer (units per lot)optimal production lot size of the j th transportation container type, where j= 1, 2, 3, …, n (units per lot)Nj production lot size of the j th transportation container type, where j= 1, 2, 3, …, n (units per lot)Nr ordering quantity of raw material (units per order)P production rate of product (units per year)maximum delivery lot size of the j th transportation container type, where j= 1, 2, 3, …, n (units per lot)q∗ optimal delivery lot size of the manufacturer (units per lot)qj actual delivery lot size of the j th transportation container type, where j= 1, 2, 3, …,n (units per lot)Rj loading percentage of the j th transportation container type, where j= 1, 2, 3, …,n(Rj=qj/Qj)Rj real number of shipments from the 3PL provider to the assembler when the delivery lot size from the manufacturer to the 3PL provider is qj with the j th transportation container type, where j= 1, 2, 3, …,n(rj=qj/d)S setup cost (amount per setup)W weight of product (kilogram per unit)Λ quantity of raw materials required in producing one unit of a product (units)Tomas and Griffin (1996)considered that a complete supply chain should consist of five participants, including the raw materials supplier, the manufacturer, the assembler, the warehouse operator, and the consumer. This study mainly focuses on the relationships among the manufacturer, the 3PL provider and the assembler within the JIT system under a global environment. In order to achieve the fixed quantity-period JIT delivery policy, which implies that the actual delivery lot size has to be determined by identifying the downstream assembler’s needs instead of the upstream manufact ure’s economical delivery lot size, higher transportation costs with higher delivery frequency are necessary. Since the JIT system are more appropriately executed among those companies that are close to each other, a collaborative 3PL connected the upstream manufacture with the downstream assembler is necessary when the products have to be delivered from the upstream manufacture to the downstream assembler by sea transportation over a long distance. This study proposes a JIT cost model to obtain the optimal production lot size, the actual delivery lot size, the most suitable transportation container type, and the exact number of shipments from the manufacturer to the 3PL provider at the minimum total cost.This study makes assumptions of the JIT system as follows:(1) There is only one assembler and only one manufacturer for each product.(2) The production rate of the manufacturer is uniform, finite, and higher thanthe demand rate of the assembler.(3) There is no shortage and the quality is consistent in both raw materials and products.(4) The demand for products that the assembler receives is fixed and is at regular intervals.(5) Qj is much greater than demand at a regular interval,d.(6) The transportation rates from the manufacturer to the 3PL and from the 3PL to the assembler are computed by the number of shipments and the product’s weight, respectively, and,(7) The space of th e manufacturer’s warehouse is sufficient for keeping all inventories of products that the manufacturer produces.According to the above assumptions from (1), (2), (3)and (4), Fig. 1illustrates the relationships among the manufacturer, the 3PL provider, and the assembler, where the Fig. 1represents the inventory of manufacturer’s raw materials, the inventory of products inside the manufacturer, the inventory of the 3PL provider, and the inventory of the assembler from top to bottom (Kreng & Wang, 2005). This study also adopts the Fig. 1 to demonstrate the collaboration of the 3PL provider which will be an interface connecting the manufacturer and the assembler. During the period T1, the inventory of products with the manufacturer will be increased gradually because the production quantity is larger than the demand quantity. However, during the period T2, the inventory of products will be decreased because the production has been stopped.中文翻译:在全球环境下第三方物流以最小的成本实现了Just-In-Time系统的应用摘要:JUST-IN-TIME(JIT)系统,供应链管理的整合,最近已经吸引了越来越多的关注。

作业成本法在第三方物流企业成本核算中的应用

作业成本法在第三方物流企业成本核算中的应用肖冰【期刊名称】《沈阳理工大学学报》【年(卷),期】2012(031)001【摘要】作业成本法的理论和应用在企业成本核算工作中越来越得到重视,但在第三方物流企业中的具体应用还不够广泛和深入.文章首先简要介绍了作业成本法的理论,分析了当前第三方物流企业成本核算工作中的现状和存在的问题,在此基础上提出了第三方物流企业应用作业成本法开展成本核算的思路,并结合某企业实际开展了具体分析的过程、方法等的研究.文章对第三方物流企业开展成本核算工作有较好的参考和借鉴意义.%The theory and application of Activity-Based Costing in project cost accounting for enterprise is paid more and more attention, but in third party logistics enterprises the concrete application is not wide and deep enough. This paper briefly introduces the activity-based costing theory, analysis of the current third party logistics enterprises in cost accounting of the status quo and existing problems, puts forward the third party logistics enterprise operation cost method used to carry out the train of thought of cost accounting, and combined with a practical enterprise carried out a specific analysis of the process, method and so on. Article on the third party logistics enterprises cost accounting has a good reference.【总页数】4页(P62-65)【作者】肖冰【作者单位】福建工程学院交通运输系,福建福州350108【正文语种】中文【中图分类】F275.3【相关文献】1.第三方物流企业成本核算应用作业成本法研究 [J], 张爽;2.作业成本法在第三方物流企业成本核算体系中的应用研究 [J], 任凤香3.作业成本法在第三方物流企业成本核算中的应用 [J], 李思伟4.作业成本法在第三方物流企业成本核算中的应用 [J], 刘伟;5.作业成本法在第三方物流企业成本核算中的应用∗ [J], 刘伟因版权原因,仅展示原文概要,查看原文内容请购买。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

第三方物流企业的作业成本法【外文翻译】本科毕业论文(设计)外文翻译外文出处 International Advances in Economic Research, 2001,7(1): 133-146.外文作者Carles Gríful-Miquela原文:Activity-Based Costing Methodology for Third-Party LogisticsCompaniesThis paper will analyze the main costs that third-party logistics companies are facing and develops an activity-based costing methodology useful for this kind of company. It will examine the most important activities carried out by third-party distributors in both warehousing and transporting activities. However, the focus is mainly on theactivity of distributing the product to the final receiver when this final receiver is not the customer of the third-party logistics company. IntroductionIn the last decade, development of third-party logistics companies has been very important. There are several reasons for such development, the most important being the trend to concentrate in the core business by manufacturing companies and new technological advances, In this context, conventional approaches to costing might generate distorted information, This can result in making wrong decisions. When companiesrealize this potential danger, the use of activity-based costing (ABC) methodologies increases within third-party logistics.Costing Methodology: Definition of the Cost Model and Critique ofthe Conventional ApproachDefinition of the Cost ModelIt is first necessary to define what a cost model is. This can be done through analysis of the main functions that any cost model should perform [Kaplan and Cooper, 1998]:1) valuation of inventory and measurement of the cost of goods and services sold for financial purposes;2) estimation of the cost of activities, products, services, and customers; and3) provide economic feedback to managers and staff in general about process efficiency.From this definition, a cost model might be analyzed as the toolthat companies use in order to have a proper understanding about the cost to run their businesses. One of the purposes of a cost model is to gather and analyze data generated in the company in order to gain useful information for making decisions. Therefore, the usefulness of a cost model may be evaluated depending on its capacity to generate the right information to make the right managerial decisions.Evolution of Cost ModelsThe evolution of cost systems has not been a linear and continuous process [Johnson and Kaplan, 1987]. Indeed, by the 1920s, companies haddeveloped almost all the management accounting procedures that have been used up to the present day. Furthermore, between 1925 and 1980,virtually no new ideas have affected the design and use of cost management systems. The same concepts always appear: break-even analysis, cost-volume-profit analysis, direct costing, and fixed and variable cost estimates. The idea that conventional accounts are only finance oriented and simply describe historical inputs is shared among other authors of costing methodology [Bellis- Jones and Develin, 1995].Problems with Conventional ApproachesAs a result of the described evolution of cost models, the situation at the beginning of the 1980s was that the actual management accounting systems provided few benefits to organizations. Normally, the reported information not only inhibited good decision making by managers, but actually encouraged bad decisions [Johnson and Kaplan, 1987]. The main reason was the use of an obsolete tool in an extremely different and more complex and competitive environment.The main problem that conventional cost models faced was theallocation of overhead by products on the basis of either direct laboror machine hour content in the1manufacturing environment. This problem was growing at the same time that direct labor and machine hour contents of many products andservices fell, while overhead costs increased. Conventional costing ignores important differences between products and services, markets andcustomers, which incur different overhead costs. This was the starting point in carefully analyzing the conventional cost models and in criticizing them because of their uselessness in accurately explaining the cost of products. Lately, the fact that the same issues apply to the service sector has been noticed.Traditional methods of cost accounting showed some other weaknesses [Bellis-Jones and Develin, 1995]. That is, companies do not know whether their products or services are profitable and they cannot distinguish profitable from unprofitable customers. In addition, traditional methods focus on the short term at the expense of the long term.A Description of ABC MethodologyThe problems that conventional costing methodologies raised were the main reason for developing a new theoretical approach to this subject. Johnson and Kaplan are considered the inventors of ABC, although they do not use this terminology at the beginning of their studies [Johnson and Kaplan, 1987]. The first time the concept of ABC appears is in a later article [Cooper and Kaplan, 1988]. The analysis of cost andprofitability of individual products, services, and customers represents a critical issue that companies were concerned with and one where ABC tries to help. The primary focus was to ask what is important for the organization, and what information is needed for management planning and control functions. Finally, useful information for managerial purposes should not be extracted only from a system designed primarily to satisfy external reporting and auditing requirements (financial information). Itis necessary to design systems consistent with the technology of the organization, its product strategy, and its organizational structure. Definition of ABCIn literature there are several definitions of ABC. The definition here shows the ABC philosophy [Hicks, 1992] briefly and clearly:2"Activity-based costing is a cost accounting concept based on the premise that products (and/or services) require an organization to perform activities and that those activities require an organization to incur costs. In activity-based costing, systems are designed so that any costs that cannot be attributed directly to a product, flow into the activities that make them necessary. The cost of each activity thenflows to the product(s) that make the activity necessary based on their respective consumption of that activity."Main Differences Between Conventional Cost Models and ABCThe most important difference between conventional cost models and ABC is the treatment of non-volume-related overhead costs. The use of direct labor-based overhead allocation methods were appropriate in the past when direct labor was the principal component of manufacturing cost, but not today. In the ABC approach, many overheads are related tospecific activities to avoid distortions in product and service costs.Another difference is the treatment of unused capacity. ABCdescribes resources that are used by activities, but conventional accounts describe resources that are supplied. The difference betweenthe two is excess capacity. If excess capacity is allocated to products, services, or customers, there is risk of a "dead spiral," as defined by Bellis-Jones and Develin [1995]. This means that the company should be aware of which costs their customers really generate and not allocate the excess of capacity to avoid the risk of overpricing its products or services. Advantages and Benefits of the ABC ApproachSeveral authors have described the main advantages and benefits of using ABC [Innes and Mitchell, 1990; Bellis-Jones and Develin, 1995; Malmi, 1997]. The most important are as follows:1) ABC provides more accurate product and service costing,particularly where non- volume-related overheads are significant.2) By using ABC, it is possible to analyze costs by areas of managerial responsibility and customers. ABC helps to recognize the way in which customers directly affect the cost structure of the business and therefore helps to analyze3customer profitability.3) ABC provides a better understanding of cost behavior as well as identifying the costs of complexity, variety, and change inherent in both the kind of service offered and customer-specific requirements.4) ABC focuses on the activities that add value, which are those activities that create value from the customer's point of view. On the other hand, the company should focus on those non-value-added activitiesand try to eliminate them, although some of the non-value-addedactivities are necessary to enable value-adding activities to occur.5) ABC is useful in performing capacity analysis. ABC measures the costs of resources used rather than the costs of resources supplied, the difference being excess capacity. It would be wrong to allocate unused capacity to the customers. To perform this analysis, the use ofpractical capacity is suggested, which means the capacity reflecting the maximum level at which the organization can operate efficiently.6) ABC reduces uncertainty and provides a more solid basis for strategic decisions. Therefore, the success of ABC might not depend only on the results of the analysis, but on its ability to provide a correct diagnosis of the company's situation. Disadvantages and Problems of the ABC ApproachThe disadvantages extracted from a study based on the answers of several companies after one year of using ABC [Cobb et al., 1992] regarded the amount of work involved, difficulties in collecting accurate data, and the fact that cost management was difficult because several activities cross department boundaries. Additionally, implementation is very time consuming, requiring not only gathering and processing of data, but also interpreting the results. Even though all of the former problems have been overcome with the development of ABC methodology and the increase in using ABC models by companies in different manufacturing and service industries, it is always necessary to be aware of these problems when developing such a model.ABC for LogisticsEven though literature mentions that ABC applies to all types of business4organizations in the service industry, including warehousing and distribution providers [Hicks, 1992], the author could not specifically find the case of a third-party logistics provider as far as thetransport operations are concerned. The main issue is to properly allocate the transport operations costs to the consignors, which are the real customers of the company.4 Furthermore, in the literature about transportation costs [Sussams, 1992], the customer is always the final consignee, and the costs are always an external variable.In recent years and because of the increasing importance oflogistics costs within companies, the first studies analyzing theutility of the activity-based approach on logistics were undertaken [Pohlen and LaLonde, 1994; LaLonde and Ginter, 1996; LaLonde and Pohlen, 1996]. The main benefits and difficulties related to the implementation of ABC for logistics departments are almost the same as those described earlier.Analysis of OverheadsThe analysis of overheads is the least obvious and the most complicated to perform. Normally, overheads are related to several activities (or nonactivities), and it is necessary to carry out in-depth studies during long periods of time in order to find out the right linksbetween overheads and products, services, or customers. For this reason, the recommendation is to be as accurate as possible in order to link overheads with consignors, avoiding the traditional approach to link, in the first instance, overheads with activities. This is very important when there is an important lack of time for developing such a costing methodology, despite the fact that this is not a pure ABC approach. The need to cope with overheads appears on both the warehouse and transport side of the model.ConclusionIt is very difficult (and not always recommended) to develop a pure ABC model because the particular characteristics of a single third-party logistics company entailed the use of slightly different ways toallocate several costs in some instances, which a purely ABC approach would not be able to do. Despite this fact, the final model for both sides of the third-party company operations (warehouse and transport operations)5has been mainly described by taking ABC analysis into account. Only when ABC does not present an answer to a specific problem should another way be considered to allocate the costs.It is recommended that such a model should be developed by using a spreadsheet because it fulfills the needs of the company, it is a very powerful tool, and it is also very user-friendly. Furthermore, the model developed may be capable of performing what-if analysis in order tosimulate actual or potential situations the third-party company might face. These what-if analyses may be used in different ways such as in the analysis of potential consignors, in the requirement of different service levels by the current consignors, and to perform the analysis of structural changes in the third-party logistics company.Finally, note that the costs of the model should not exceed its benefits. In other words, it is necessary to cope with the trade-off between a model that is so simple that it fails toprovide enough information to support the company's decisions and a model that is excessively costly to design, implement, and operate [Brimson, 1991]. This should always be taken into account, trying to achieve a happy medium between simplicity and excessive sophistication.Source: Carles Gríful-Miquela.Activity-based costing methodology for third-party logistics companies[J].International Advances in EconomicResearch, 2001,7(1): 133-146.6译文:第三方物流企业的作业成本法本文将分析第三方物流企业面临的主要成本问题并开发出适合于这一类企业的成本计算方法。