税收词汇

税收英语词汇

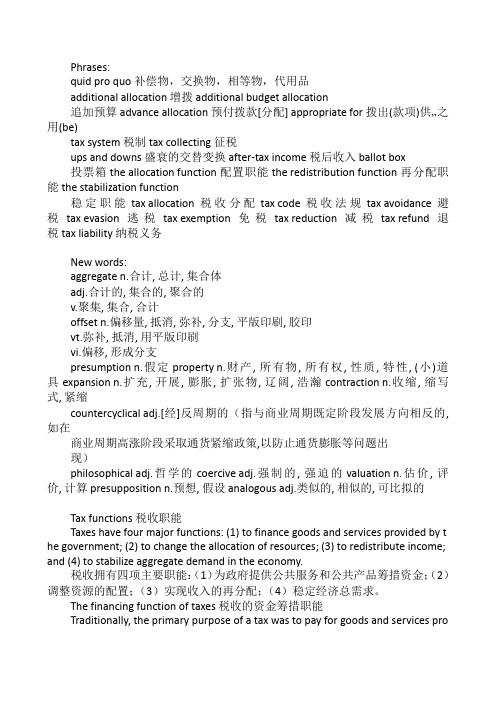

Phrases:quid pro quo补偿物,交换物,相等物,代用品additional allocation增拨additional budget allocation追加预算advance allocation预付拨款[分配]appropriate for拨出(款项)供…之用(be)tax system税制tax collecting征税ups and downs盛衰的交替变换after-tax income税后收入ballot box投票箱the allocation function配置职能the redistribution function再分配职能the stabilization function稳定职能tax allocation税收分配tax code税收法规tax avoidance避税tax evasion逃税tax exemption免税tax reduction减税tax refund退税tax liability纳税义务New words:aggregate n.合计,总计,集合体adj.合计的,集合的,聚合的v.聚集,集合,合计offset n.偏移量,抵消,弥补,分支,平版印刷,胶印vt.弥补,抵消,用平版印刷vi.偏移,形成分支presumption n.假定property n.财产,所有物,所有权,性质,特性,(小)道具expansion n.扩充,开展,膨胀,扩张物,辽阔,浩瀚contraction n.收缩,缩写式,紧缩countercyclical adj.[经]反周期的(指与商业周期既定阶段发展方向相反的,如在商业周期高涨阶段采取通货紧缩政策,以防止通货膨胀等问题出现)philosophical adj.哲学的coercive adj.强制的,强迫的valuation n.估价,评价,计算presupposition n.预想,假设analogous adj.类似的,相似的,可比拟的Tax functions税收职能Taxes have four major functions:(1)to finance goods and services provided by t he government;(2)to change the allocation of resources;(3)to redistribute income; and(4)to stabilize aggregate demand in the economy.税收拥有四项主要职能:(1)为政府提供公共服务和公共产品筹措资金;(2)调整资源的配置;(3)实现收入的再分配;(4)稳定经济总需求。

常用税收词汇中英文对照

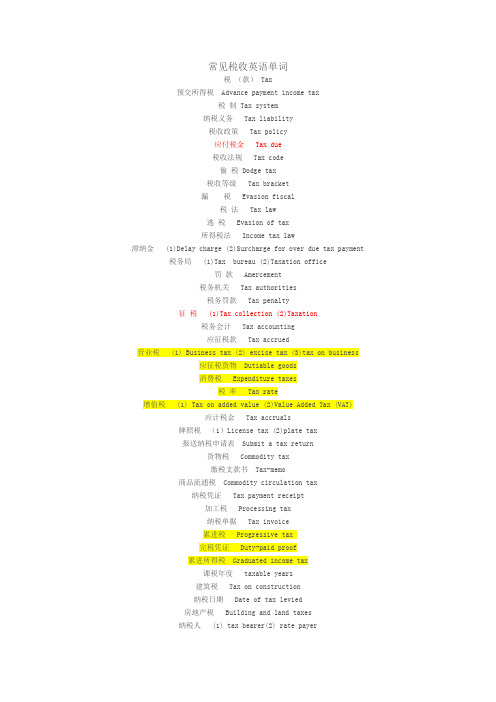

常见税收英语单词税(款) Tax预交所得税Advance payment income tax税制 Tax system纳税义务 Tax liability税收政策 Tax policy应付税金 Tax due税收法规 Tax code偷税 Dodge tax税收等级 Tax bracket漏税 Evasion fiscal税法 Tax law逃税 Evasion of tax所得税法 Income tax law滞纳金 (1)Delay charge (2)Surcharge for over due tax payment 税务局 (1)Tax bureau (2)Taxation office罚款 Amercement税务机关 Tax authorities税务罚款 Tax penalty征税 (1)Tax collection (2)Taxation税务会计 Tax accounting应征税款 Tax accrued营业税 (1) Business tax (2) excise tax (3)tax on business应征税货物Dutiable goods消费税 Expenditure taxes税率 Tax rate增值税 (1) Tax on added value (2)Value Added Tax (VAT)应计税金 Tax accruals牌照税(1)License tax (2)plate tax报送纳税申请表Submit a tax return货物税 Commodity tax缴税支款书Tax-memo商品流通税Commodity circulation tax纳税凭证 Tax payment receipt加工税 Processing tax纳税单据 Tax invoice累进税 Progressive tax完税凭证 Duty-paid proof累进所得税Graduated income tax课税年度 taxable years建筑税 Tax on construction纳税日期 Date of tax levied房地产税 Building and land taxes纳税人 (1) tax bearer(2) rate payer城市建设税City planning tax多缴税款 Tax overpaid所得税 Income tax退税 (1)drawback from duties paid(2)refund of关税(海关)Customs申请退还税金Application for drawback附加税 Additional tax应退税款 Refundable tax资源税 Resource tax退税通知书Notice of refund采掘税 Severance tax减税 (1) tax reduction (2)tax cut养路税 Highway maintenance tax免税品 Non-dutiable goods销售税 Tax on sales减免税 Tax reliefs消费税 Tax on consumption免税 (1)tax free (2)duty free资产税 Tax on captital免收税款 Waive duty财产税 Property tax税收减让 (1) tax concession(2)tax abatement固定资产税Fix assets tax免税货物 Duty free goods奢侈税 Tax on superfluity进口免税 Exemption from duty个所得税Personal incom人e tax免税期 Tax holiday应缴所得税Income tax payable印花税票 Adhesive revenue stamp应纳税工资额taxable salary贴用印花 Affix revenue stamps暂定税金 Tentative tax保税货物 Goods in bonds税务员(1)tax staff (2)tax gather[/hide]。

税收专业英语词汇

ambit of charges 征税范围,收费范围annual allowance 每年免税额,年度津贴annual balance 年度余额assessable income 应评税收入,可估计收入assessable loss 应评税亏损assessable profit 应评税利润assessed profit 估定利润assessment 评税;评定;估价;评税单assessor 评议员;估税员asset 资产asset-liability management 资产负债管理asset-liability ratio 资产负债比asset price 资产价格asset out of book 账外资产assets account 资产账户assets accounting 资产会计assets allocation fund 资产分配基金assets appraisal 资产重估价assets cover 资产担保assets coverage ratio 资产担保率assets i nventory s hortage 资产盘亏assets inventory surplus 资产盘盈assets management 资产管理assets motive 资产动机assets play 资产隙assets r atio 资产比率assets redeployment 资产重新配置assets reserve 资产准备assets r etirement 资产报废assets r evaluation 资产重估assets settlement 资产决算,资产清算assets specificity 资产专用性assets stripping 资产剥离assets swap 资产互换assets turnover 资产周转率assets valuation 资产估值back duty 补缴税款base year 基年basic allowance 基本免税额capital levy 资本税;资产税capital tax 资本税child allowance 子女免税额confirmation o f p ayment 已缴税证明书council tax 地方税customs d eclaration 报关单customs d rawback 关税退还customs entry 进口报关customs quota 海关配额customs union 关税同盟tariff 关税;关税表;税率;税则;对… 征税tariff association 保险费税率同盟;关税同盟tariff barrier 关税壁垒tariff c ontrol 收费管制tariff rate 保险协定费税率,关税率tariff wall 关税壁垒tax 税;税款taxable 可征税的;应征税的taxable bracket 应课税组别taxable c apacity 纳税能力taxable i ncome 应税收入taxable payroll emolument 应课税薪酬总额taxable profit 应课税利润taxable value 应课税价值tax agent 税务代理人tax assessment 征税估值taxation 征税;税款taxation bureau 税务局taxation o ffice 税务署taxation payment 税款tax a voidance 避税tax b and 税阶tax base 计税基数,税基tax benefit 税收利益tax break 减税,赋税减免tax burden 税务负担,税项负担tax c ollector 税务员tax concession 税项宽减tax c redit 税收减免tax-deductible 可减税的tax d efaulter 欠税者tax d ischarged 注销税款tax dodging 逃税tax d ue 到期应缴税款tax element 税收成分tax e vasion 逃税tax exemption 免税tax farmer 税款包收人,包税商tax heaven 避税安乐窝tax h eldover 延缓缴纳税款tax h oliday 免税期tax i n d efault 拖欠税款tax inspector 税务稽查员tax investigation 税务调查tax liability 纳税责任,税务负担tax loophole 税制漏洞tax net 税网tax payable 应缴税款taxpayer 纳税人tax position 课税情况tax p roposal 税收建议tax rebate 出口退税tax r egime 税制tax relief 税项宽免tax r eserve c ertificate 储税券tax return 纳税申报单tax selling 纳税抛售tax shelter 合法避税手段tax stamp 印花税票tax stoodover 延缓缴纳税款tax system 课税制度,税制tax threshold 起征点tax undercharge 短征税款tax year 税务年度发票invoice;receipt发票登记簿invoice r egister发票金额invoice a mount发票联invoice c opy税单号码charge number税额限定rate-capping税后净运营利润NOPAT(net operating profit a fter t ax )税后利润率after tax profit margin税后收益earnings after tax税款tax;taxation; taxation payment税前收入before-tax income税收revenue税收抵免合格性eligibility for tax credit 税项宽减tax concession税项宽免tax relief所得税income tax所得税减免marginal relief所得税预扣法pay-as-you-earn; pay-as-you-go征收collection征收额levy征收年度year of assessment征税levy;put;taxation征税范围ambit of charges征税估值tax assessment。

税收英语词汇

税务专用英语词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Forei gn Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区tax exemption 免税Tax Exemption Certificate 免税证明书tax heldover 延缓缴纳的税款tax holiday 免税期tax in default 拖欠税款tax investigation税务调查tax liability 纳税责任;税务负担tax payable应缴税款body corporate 法团;法人团体保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口退税(Export Rebates)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税配额(Tariff Quota)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty)优惠税率(Preferential Rate)标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledge about the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

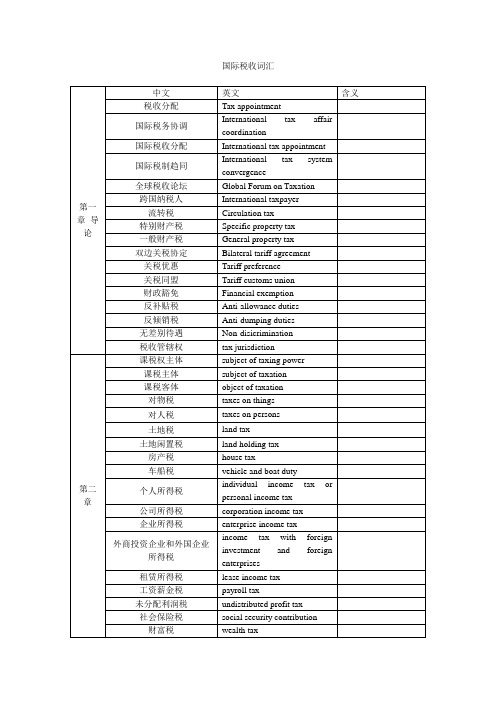

国际税收词汇

ModelDouble Taxation Convention between Developed and DevelopingCountries

常设机构

standing body

营业存在

businesspresence

应税收益或所得

taxable income

综合税制

general or comprehensive tax system

分类税制

classified tax system

跨国一般经常所得

international general constant income

跨国超额所得

international excess income

标准销售利润率法

method of standard profit rate of sales

超额利润税

excess profit tax

跨国资本利得

international capital gains

跨国一般动态财产价值

international general propertyvalueondynamism

跨国退休金所得

international income from pensions

跨国政府服务所得

international income from governmental services

跨国董事费所得

international income from directors fees

跨国表演家和运动员所得

安全港规则

safe haven rule

第十五章涉外税收负担

税收优惠待遇

the preferential treatment of taxation

国际税收英文词汇

国际税收英文词汇经合组织:OECD联合国:UN入境交易:Inbound transactions出境交易:Outbound transactions营业税:Business tax消费税:Excise tax财产税:Property tax死亡税:Death duty技术贸易壁垒:TBT居民管辖权:Domiciliary tax jurisdiction地域管辖权:Regional tax jurisdiction住所:Domicile居所:Residence居民纳税人:Resident tax payer税收流亡者:Tax refuges法律住所:Legal domicile财政住所:Fiscal domicile管理机构所在地:Place of effective management总机构所在地:Place of head office营业利润:Business profit子公司:Subsidiary company常设机构:Permanent establishment实际所得原则:Attribution principle引力原则:Force of attraction principle(非)独立劳务所得:Income from(in)dependent personal services 股息:Dividend专利权:Patent right专有技术:Know-how有(无)线纳税义务:(Un)limited tax liability推迟课税:Tax deferral法律性重复征税:Juridical double taxation经济性重复征税:Economic double taxation长期性住所:Permanent home重要利益中心:Center of vital interests习惯性住所:Habitual abode国籍:Nationality扣除法:Deduction method免税法:Exemption method全部免税法:Full exemption累进免税法:Exemption with progression抵免法:Credit method全额抵免:Full credit普通抵免:ordinary credit抵免限额:Ceiling in credit分国抵免:Tax credit on a country by country basis分项抵免:Tax credit on an item by item basis分国分项抵免:Tax credit on a source by source basis 分国不分项抵免:Overall credit on a per-country basis 分项不分国抵免:Overall credit on a per-item basis综合抵免:Overall credit直(间)接抵免:(in)Direct tax credit归属抵免制:Imputation system汇率:Exchange rate税收饶让抵免:Tax sparing credit避税(偷税):Tax evasion跨境:Cross abroad滥用国际税收协定:Treaty shopping国际避税地:Tax heavens美国国内收入署:Internal Revenue Service(IRS)离岸中心:Offshore center自由港:Free port基地公司:Base company转让定价:Transfer pricing转让价格:Transfer price滥用转让定价:Transfer pricing abuse信托:Trust内部保险公司:Captive insurance company资本弱化:Thin capitalization公平交易原则:the arm’s length可比非受控价格法:Compared uncontrolled price method 工业制成品:Manufactured goods再销售价格法:Resell price method成本加成法:Cost plus method净(总)利润率:Net(Gross)profit margin预约定价协议:Advance pricing agreements(APA)反避税地法规:Anti-tax haven legislation受控外国公司法规:CFC legislation消极投资所得:Passive income税收情报交换方式:a.根据要求交换:Exchange on requestb.自动交换:automatic exchangec.自发交换:Spontaneous exchanged.同时检查:Simultaneous examination条约:Convention股息收益人:Beneficial owner of the dividends。

(整理)国际税收常用英语词汇.

国际税收常用英语词汇abuse of tax treaties 滥用税收协定active income 主动收入advance pricing agreement (APA) 预约定价协议 area jurisdiction 地域管辖权arm's length principle 独立交易原则associated enterprise 关联企业base company rule 基地公司规定best method rule 最佳方法规定bilateral 双边blocked income 滞留收入bounded area 保税区branch 分公司/分支机构branch rule 分支机构规定burden of proof 举证责任cancellation of debt (COD) 取消债务carried back 向前结转carried forward 结转(向后期)charitable foundation 慈善基金charitable trust 公益/慈善信托"check-the-box" rule “打勾选择”规定citizen jurisdiction 公民管辖权comparable profit method (CPM) 可比利润法comparable uncontrolled price method (CUP) 可比非受控价格法comparative profit method(CPM)可比利润法conduit company 中介/导管公司consolidate 合并contribution analysis 贡献分析controlled foreign company (CFC) 受控外国子公司controlling company 控股公司cost plus method (CP) 成本加利润法current rule 现行规则current tax 本期税额deduction 扣除deemed dividend 认定的红利deferral 递延device 工具domicile 住所标准dual residence 双重居民earnings stripping 收益剥离excess credit position 超额抵扣情况excess interest expense 超额利息支出exemption 免除force of attraction 吸引力规定foreign direct investment (FDI) 国际直接投资foreign indirect investment 国际间接投资formula apportionment 公式分配法freeport 自由港group 跨国企业集团holding company 持股公司income所得interest expense利息支出Internal Revenue Code(IRC) (美国)联邦税法典 Internal Revenue Service (IRS) (美国)联邦税务局 internal taxes 国内税jurisdiction 管辖权legal tax savings 合法节税limited liability company (LLC) 有限责任公司mobile 流动性(指可在世界各地作公司业务)multilateral多边off-shore center 离岸中心parent company 母公司partnership 合伙人制passive income 被动收入phantom income 虚幻收入physical presence 实际存在(居住)pooling of interest 股权联营法portfolio exemption 组合投资免税profit split 利润分割profit split method(PSM)利润分割法purchasing method 盘购法recognition 确认(会计)resale price method (RPM) 再销售价格法residence 居所标准residence of individuals 自然人居民residence of legal entities 法人居民身份的判定标准 resident jurisdiction 居民管辖权residual analysis 余额分析royalty 使用费source 来源subsidiary/affiliate company 子公司/附属公司 substance over form 实质重于形式super royalty rule 超级使用费规定tax audit 税务审计tax avoidance 避税tax credit 税收抵扣tax evasion 偷/逃税tax haven 避税港tax holiday 减税期tax jurisdiction 税收管辖权tax planning 税收筹划tax return 纳税申报tax sparing 税收抵扣限制the abstinence approach 禁止法the bona fide approach 真实法the channel approach 渠道法the exclusion approach 排除法the look-through approach 受益所有人法the number of days of presence 停留时间标准the subject-to-tax approach 纳税义务法thin capitalization 资本弱化threshold 下限trade or business 业务或经营transactional net margin method(TNMM)交易净利润率法transactional profit methods 交易利润法transfer pricing 转让定价treaty (双边税务)协议treaty override 协议优先treaty shopping 协议寻找 withholding tax 预提税。

税收英语词汇

税务专用英语词汇State Administration for Taxation 国家税务总局Local Taxation bureau 地方税务局Business Tax 营业税Individual Income Tax 个人所得税Income Tax for Enterprises企业所得税Income Tax for Enterprises with Foreign Investment and Foreign Enterprises外商投资企业和外国企业所得税tax returns filing 纳税申报taxes payable 应交税金the assessable period for tax payment 纳税期限the timing of tax liability arising 纳税义务发生时间consolidate reporting 合并申报the local competent tax authority 当地主管税务机关the outbound business activity 外出经营活动Tax Inspection Report 纳税检查报告tax avoidance 逃税tax evasion 避税tax base 税基refund after collection 先征后退withhold and remit tax 代扣代缴collect and remit tax 代收代缴income from authors remuneration 稿酬所得income from remuneration for personal service 劳务报酬所得income from lease of property 财产租赁所得income from transfer of property 财产转让所得contingent income 偶然所得resident 居民non-resident 非居民tax year 纳税年度temporary trips out of 临时离境flat rate 比例税率withholding income tax 预提税withholding at source 源泉扣缴State Treasury 国库tax preference 税收优惠the first profit-making year 第一个获利年度refund of the income tax paid on the reinvested amount 再投资退税export-oriented enterprise 出口型企业technologically advanced enterprise 先进技术企业Special Economic Zone 经济特区tax exemption 免税Tax Exemption Certificate 免税证明书tax heldover 延缓缴纳的税款tax holiday 免税期tax in default 拖欠税款tax investigation税务调查tax liability 纳税责任;税务负担tax payable应缴税款body corporate 法团;法人团体保护关税(Protective Tariff)保税制度(Bonded System)布鲁塞尔估价定义(Brussels Definition of Value BDV)差别关税(Differential Duties)差价关税(Variable Import Levies)产品对产品减税方式(Product by Product Reduction of Tariff)超保护贸易政策(Policy of Super-protection)成本(Cost)出厂价格(Cost Price)初级产品(Primary Commodity)初级产品的价格(The Price of Primang Products)出口补贴(Export Subsidies)出口退税(Export Rebates)从量税(Specific Duty)从价(Ad Valorem)从价关税(Ad Valorem Duties)反补贴税(Counter Vailing Duties)反倾销(Anti-Dumping)反倾销税(Anti-dumping Duties)关税(Customs Duty)关税和贸易总协定(The General Agreement On Tariffs And Trade)关税配额(Tariff Quota)自主关税(Autonomous Tariff)最惠国税率(The Most-favoured-nation Rate of Duty)优惠税率(Preferential Rate)标题:能介绍一下营业税的知识吗TOPIC: Would you please give the general introduction of the business tax?对话内容:纳税人:我公司马上就要营业了,能介绍一下营业税的知识吗?Taxpayer: my company will begin business soon, but I have little knowledge about the business tax. Can you introduce it?税务局:尽我所能吧!一般地说,提供应税业务、转让无形资产和出卖不动产都要交纳营业税。

学税法必须知道的50个税收名词

学税法必须知道的50个税收名词1、税收:是国家为实现其职能、凭借政治权力,比例按照税法规定的标准,强制地对社会产品进行分配、无偿地取得财政收入的一种手段。

它体现着以国家为主体的特定分配关系。

2、税收杠杆的作用机制:是指税收杠杆要素相互结合,推动,制约而形成的具体作用方式或机理。

从微观来说,它是经济主体的外在约束机制;从宏观来说,它是对整个国民经济实行间接的调节机制。

3、税收原则:又称税制建立的原则,它是在一定的社会经济条件下,指导税收制度的重要准则,是税务稽征管理所应遵循的重要依据。

4、税收分类:是按某一标准把性质相同或相近的税种划归一类,以示同其它税种的区别。

5、分税制:就是在划分中央与地方政府事权的基础上,按税种划分中央与地方的财政收。

6、税法的解释:就是对适用税法时产生的疑义进行阐释,以明确税法的立法真意,并要恰当地表述这种立法真意,使之能有效地适用于实际发生的事项.7、税务纠纷:是指税务机关,因实施税务管理采取行政措施,作出税务行政处理而与纳税人,代征人,代缴义务人,直接责任人之间引起的争议.8、税收法律责任:是指税法主体(主要是纳税主体)违反税法规定的义务而应对承担的法律后果.9、税负转嫁:是纳税人将缴纳的税款,通过各种途径和方式由他人负担的过程,是税负运动的一种方式,是伴随在税收活动中的一种经济现象.10、流转税:是以商品流转额和非商品流转额为征税对象的各种税收的统称.11、资源税:是对在中国境内从事开采税法规定的应税矿产品或者生产盐的单位和个人征收的一种税.12、销售不动产:是指销售房屋等建筑物及其他土地附着物的业务.13、转让无形资产:是指有偿转让不具备实物形态,但能带来经济利益的土地使用权,专利权,非专利技术,商标权,著作权,商誉的业务.14、混合销售行为:是指一项销售行为如果既涉及营业税的应税劳务,又涉及增值税的应税货物,为混合销售行为.15、兼营行为:纳税人如果经营货物销售,又提供营业税应税劳务,为兼营行为.即指纳税人同时经营属于营业税征税范围的项目和属于增值税范围项目.16、企业所得税:是国家按照税法规定,对在中华人民共和国境内的企业(外商投资企业和外国企业除外)就其从境内,境外取得的生产经营所得和其他所得征收的一种税。

税收专业英语词汇

ambit of charges征税范围,收费范围annual allowance每年免税额,年度津贴annual balance年度余额assessable income应评税收入,可估计收入assessable loss应评税亏损assessable profit应评税利润assessed profit估定利润assessment评税;评定;估价;评税单assessor评议员;估税员asset资产asset-liability management资产负债管理asset-liability ratio资产负债比asset price资产价格asset out of book账外资产assets account资产账户assets accounting 资产会计assets allocation fund资产分配基金assets appraisal 资产重估价assets cover 资产担保assets coverage ratio 资产担保率assets inventory shortage 资产盘亏assets inventory surplus资产盘盈assets management 资产管理assets motive 资产动机assets play 资产隙assets ratio 资产比率assets redeployment 资产重新配置assets reserve 资产准备assets retirement 资产报废assets revaluation 资产重估assets settlement 资产决算,资产清算assets specificity 资产专用性assets stripping资产剥离assets swap 资产互换assets turnover 资产周转率assets valuation 资产估值back duty 补缴税款base year 基年basic allowance 基本免税额capital levy 资本税;资产税capital tax 资本税child allowance 子女免税额confirmation of payment 已缴税证明书council tax 地方税customs declaration 报关单customs drawback 关税退还customs entry 进口报关customs quota 海关配额customs union 关税同盟tariff 关税;关税表;税率;税则;对…征税tariff association 保险费税率同盟;关税同盟tariff barrier 关税壁垒tariff control 收费管制tariff rate 保险协定费税率,关税率tariff wall 关税壁垒tax 税;税款taxable 可征税的;应征税的taxable bracket 应课税组别taxable capacity 纳税能力taxable income 应税收入taxable payroll emolument 应课税薪酬总额taxable profit 应课税利润taxable value 应课税价值tax agent 税务代理人tax assessment 征税估值taxation 征税;税款taxation bureau 税务局taxation office 税务署taxation payment 税款tax avoidance 避税tax band 税阶tax base 计税基数,税基tax benefit 税收利益tax break 减税,赋税减免tax burden 税务负担,税项负担tax collector 税务员tax concession 税项宽减tax credit 税收减免tax-deductible 可减税的tax defaulter 欠税者tax discharged 注销税款tax dodging 逃税tax due 到期应缴税款tax element 税收成分tax evasion 逃税tax exemption 免税tax farmer 税款包收人,包税商tax heaven 避税安乐窝tax heldover 延缓缴纳税款tax holiday 免税期tax in default 拖欠税款tax inspector 税务稽查员tax investigation 税务调查tax liability 纳税责任,税务负担tax loophole 税制漏洞tax net 税网tax payable 应缴税款taxpayer 纳税人tax position 课税情况tax proposal 税收建议tax rebate 出口退税tax regime 税制tax relief 税项宽免tax reserve certificate 储税券tax return 纳税申报单tax selling纳税抛售tax shelter 合法避税手段tax stamp 印花税票tax stoodover 延缓缴纳税款tax system 课税制度,税制tax threshold 起征点tax undercharge 短征税款tax year 税务年度发票invoice;receipt发票登记簿invoice register发票金额invoice amount发票联invoice copy税单号码charge number税额限定rate-capping税后净运营利润NOPAT(net operating profit after tax)税后利润率after tax profit margin税后收益earnings after tax税款tax;taxation; taxation payment税前收入before-tax income税收revenue税收抵免合格性eligibility for tax credit 税项宽减tax concession税项宽免tax relief所得税income tax所得税减免marginal relief所得税预扣法pay-as-you-earn; pay-as-you-go征收collection征收额levy征收年度year of assessment征税levy;put;taxation征税范围ambit of charges征税估值tax assessment。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

farmlandoccupationtax

土地增值税

land appreciation tax

印花税

stamp duty

个人所得税

personal income tax (PIT)

企业所得税

corporate/enterprise income tax (CIT/EIT)

车辆购置税

vehicle acquisition tax

(Losses/credits) be carried forward without limitation

股息/利息预提税

DIRR

股息、利息、特许权使用费、租金

gift tax

赠与税

estate tax

遗产税(总遗产税)

inheritance tax

继承税(分遗产税)

earnings before/after taxes

税前/后收益

earned/active income

积极所得(包括经营所得operating income和劳务所得service income)

经合组织/联合国税收协定范本

permanent establishment

常设机构

business presence

营业存在

可比非受控价格法

comparable uncontrolled price method (CUP)

再销售价格法

resale price method (RPM)

成本加成法

cost-plus method

契税

deed tax

燃油税

fuel tax

证券交易税

securities transaction tax

房地产税

real estate tax

营业税

business tax

货劳税

goods and services tax

特别消费税

excise

关税

customs duty

社会保证税/费

social security tax/contributions

免税法

exemption method

抵免法

credit method

减免法

reduction method

扣除法

deduction method

自由港

free port

tax haven

避税地

tax planning

税收筹划

税式支出

tax expenditures

节税

tax saving

延期纳税

deferral payment

普通合伙企业

limitedpartnership(LP)

有限合伙企业

limited liabilitypartnership(LLP)

有限责任合伙企业

credit limit

抵免限额

Chinese/foreign-sourced income

中国/外国来源所得

offset/credit

n.vt冲抵、抵免

sth exceeding a certain level

超出的部分

governing authority of the jurisdiction

当地主管部门

a levy on sth

对..的课税

assess the value of the property

对财产进行估值

assessed value

应纳税额

tax liability

应纳税额

taxable income

应纳税所得额

tax rate

税率

tax base

税基

basis of taxation

计税依据

tax burden

税负

tax gap

税收缺口/税收流失

minimize the tax gap

尽量做到应收尽收

file a consolidated return

internationalincomefrom artists and athletes

跨国教师和研究人员所得

international income from teachers and researchers

跨国学生、学徒和实习生所得

international income from students, apprentices and interns

税前列支、税前扣除

write-off = deduction

列支、扣除额

tax credits = tax offsets

抵免额

salvage value

残值

face value

账面价值

expected useful life

预计使用年限

report one’s income

报税

tax resident=resident for tax purposes

避税

tax evasion

偷逃税

先征后退

refund after collection

代扣代缴

withhold and remit

代收代缴

collect and remit

income

所得

earnings

收入

profit

利润

cost

成本

劳务报酬所得

income from personal services

纳税年度

calendar year

日历年度

place of incorporation

注册地

place of management (includingplace of central management and control & place of effective management)

管理机构所在地(包括管理和控制中心机构所在地和实际管理机构所在地)

passive income

消极所得(投资所得investment income)

territoriality/nationality principle

属地/属人原则

tax jurisdiction

税收管辖权

residence/source basis of taxation

居民/地域管辖权

tax sb on worldwide/China-sourced income

估值

tax is assessed in proportion to the value

根据该值,按一定比例进行核税

property tax

财产税

wealth tax

财富税

ad valorem tax

从价税

withholding tax

预提税

withholding tax on payment of dividends/interest

对某人的国内外/来源于中国的所得征税

depreciation expense

折旧费用、折旧额(单个会计期)

allowance for depreciation = accumulated depreciation = reserve for depreciation

累计折旧

write sth off/sth be charged to expense/be deducted as the expense/be tax-deductible

税收管辖权

taxjurisdiction

课税主体/课题

subject/object of taxation

征税权

taxing power

对人/物税

taxes on people/things

withholding

预提

withholding tax

预提税

withholdingtax on dividends/interest

place of business

业务活动所在地

annual general meeting (AGM)

股东大会

board of directors

董事会

place of head office

总机构所在地

assume tax obligations

承担纳税义务

general partnership (GP)

税

tax

费

fee

土地闲置税

unused land tax

遗产税

estate tax

继承税

inheritance tax

赠与税

gift tax

payroll tax

工资薪金税

wealth tax

财富税

capital gains tax

资本利得税

property tax

财产税

流转税

turnover tax

跨国退休金所得

international income from pensions

跨国政府服务所得

international income from government services

跨国董事费所得

international income from directors’fees

跨国表演艺术家和运动员所得

基金公司

trust

信托公司

transfer pricing

转让定价

transfer price

转让价格

arm’s length price

正常交易价格/竞争价格

arm’s length principle

独立交易原则

safe harbor