国际经济学克鲁格曼课后习题答案章完整版

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章

克鲁格曼《国际经济学》(国际金融部分)课后习题答案(英文版)第一章CHAPTER 1INTRODUCTIONChapter OrganizationWhat is International Economics About?The Gains from TradeThe Pattern of TradeProtectionismThe Balance of PaymentsExchange-Rate DeterminationInternational Policy CoordinationThe International Capital MarketInternational Economics: Trade and MoneyCHAPTER OVERVIEWThe intent of this chapter is to provide both an overview of the subject matter of international economics and to provide a guide to the organization of the text. It is relatively easy for an instructor to motivate the study of international trade and finance. The front pages of newspapers, the covers of magazines, and the lead reports of television news broadcasts herald the interdependence of the U.S. economy with the rest of the world. This interdependence may also be recognized by students through their purchases of imports of all sorts of goods, their personal observations of the effects of dislocations due to international competition, and their experience through travel abroad.The study of the theory of international economics generates an understanding of many key events that shape our domesticand international environment. In recent history, these events include the causes and consequences of the large current account deficits of the United States; the dramatic appreciation of the dollar during the first half of the 1980s followed by its rapid depreciation in the second half of the 1980s; the Latin American debt crisis of the 1980s and the Mexico crisis in late 1994; and the increased pressures for industry protection against foreign competition broadly voiced in the late 1980s and more vocally espoused in the first half of the 1990s. Most recently, the financial crisis that began in East Asia in 1997 andspread to many countries around the globe and the Economic and Monetary Union in Europe have highlighted the way in which various national economies are linked and how important it is for us to understand these connections. At the same time, protests at global economic meetings have highlighted opposition to globalization. The text material will enable students to understand the economic context in which such events occur.Chapter 1 of the text presents data demonstrating the growth in trade and increasing importance of international economics. This chapter also highlights and briefly discusses seven themes which arise throughout the book. These themes include: 1) the gains from trade;2) the pattern of trade; 3) protectionism; 4), the balance of payments; 5) exchange rate determination; 6) international policy coordination; and 7) the international capital market. Students will recognize that many of the central policy debates occurring today come under the rubric of one of these themes. Indeed, it is often a fruitful heuristic to use current events to illustrate the force of the key themes and arguments which are presentedthroughout the text.。

克鲁格曼《国际经济学》(第8版)课后习题详解(第11章贸易政策中的争议)【圣才出品】

克鲁格曼《国际经济学》(第8版)课后习题详解(第11章贸易政策中的争议)【圣才出品】第11章贸易政策中的争议一、概念题1.以邻为壑的政策(beggar-thy-neighbor policies)答:以邻为壑的政策是指以牺牲别国的利益来提高本国福利的政策,即当一个国家采取某种政策或行动的时候,事实上其得到的好处来自于另一个国家的损失,一个国家所得到的,最终会是另一个国家所失去的。

从货币角度来说,本国货币扩张会引起汇率贬值,净出口增加,从而增加产出与就业,但是本国增加净出口对应着国外贸易余额的恶化。

本国货币贬值使需求从国外商品转移到本国商品上,国外的产出与就业会因此下降。

正是由于这个原因,由贬值引起的贸易余额的变动就是以邻为壑的政策,它是输出失业,或以损害其他国家来创造本国就业的一种方式。

本国福利的提高是以牺牲别国利益为代价的,因此这一政策很容易引起别国的报复和贸易战的爆发,最终损害各方的利益。

从国际贸易角度来说,战略性贸易政策就是一种以邻为壑的政策。

战略性贸易政策通过鼓励国内特定产品的出口和限制国外特定产品的进口,来保持本国在世界市场上的竞争优势,虽然使本国受益,但使外国受到了损失,本国也面临着受到外国报复的问题。

反之,如果外国的净出口增加,相当于本国消费者购买了很多外国的商品。

这样,对本国该产业的产品需求的下降就是对本国的该产业的一个冲击。

这种冲击会阻碍对其进行的投资和经营,从而使得这个产业的状况变坏,进而影响本国经济。

总之,以邻为壑的政策将引发贸易战从而使得各方均受到损害。

2.外部性(externalities)答:外部性是指当某个企业的经济行为(或者某个人的消费行为),经过非价格手段,直接地、不可避免地影响了其他企业的生产(或者其他人的效用),并且成为后者自己所不能加以控制的情况时,对前者来说就存在着外部性问题。

外部性可以分为正外部性和负外部性。

正外部性是指某个经济行为主体的行为使他人或者整个社会受益,而受益者无须花费代价;负外部性是指某经济行为主体的行为引起他人成本的增加或者效用的减少。

克鲁格曼-国际经济学理论与政策 (第七版)Chapter 12 课后习题答案

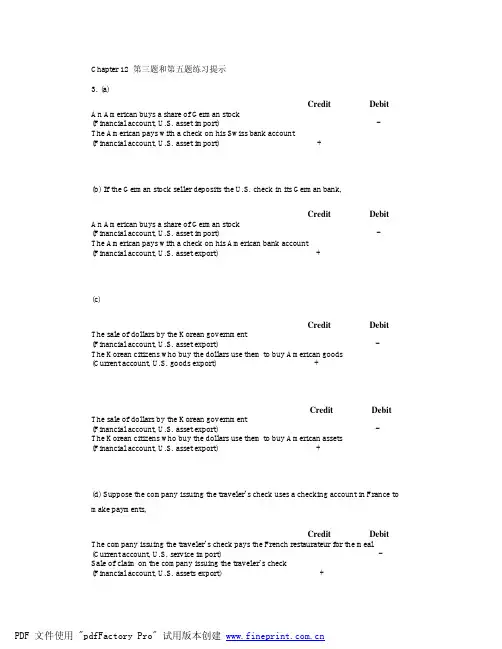

Chapter 12 第三题和第五题练习提示3. (a)Credit Debit An American buys a share of German stock(Financial account, U.S. asset import) -The American pays with a check on his Swiss bank account(Financial account, U.S. asset import) +(b) If the German stock seller deposits the U.S. check in its German bank,Credit Debit An American buys a share of German stock(Financial account, U.S. asset import) -The American pays with a check on his American bank account(Financial account, U.S. asset export) +(c)Credit Debit The sale of dollars by the Korean government(Financial account, U.S. asset export) -The Korean citizens who buy the dollars use them to buy American goods(Current account, U.S. goods export) +Credit Debit The sale of dollars by the Korean government(Financial account, U.S. asset export) -The Korean citizens who buy the dollars use them to buy American assets(Financial account, U.S. asset export) +(d) Suppose the company issuing the traveler’s check uses a checking account in France to make payments,Credit Debit The company issuing the traveler’s check pays the French restaurateur for the meal (Current account, U.S. service import) - Sale of claim on the company issuing the traveler’s check(Financial account, U.S. assets export) +(e)Credit Debit The California winemaker contributes a case of cabernet sauvignon abroad(Current account, U.S. unilateral current transfers) - Receivable of the California winemaker(Current account, U.S. goods export) +Credit Debit Receivable of the California winemaker(Current account, U.S. goods export) -The California winemaker contributes a case of cabernet sauvignon abroad(Current account, U.S. unilateral current transfers) +(f)Credit Debit The U.S. owned factory in Britain makes local earning(Current account, U.S. income receipts) +The U.S. owned factory in Britain deposits its local earning in a British bank(Financial account, U.S. asset import) -Credit Debit The U.S. owned factory in Britain uses its local earning to reinvest(Current account, U.S. income receipts) -The U.S. owned factory in Britain makes the payment for reinvestment(Financial account, U.S. asset import) +5.(a) Since Pecunia had a current account deficit of $1b and a nonreserve financial account surplus of $500m in 2002, the balance of Pecunia’s official reserve transaction should be +$500m as follow:Pecunia international transactionCredit Debit Current account -$1b Financial accountThe balance of Pecunia’s official reserve transaction +$500mThe balance of nonreserve assets +$500mThe balance of payment of Pecunia = the negative value of the balance of Pecunia’s official reserve transaction= -$500m.Pecunia had a financial account surplus of $1b in 2002; it implies Pecunia’s net foreign assets decreased by $1b in 2002.(b) Pecunian central bank had to sell $500m, so Pecunian central bank’s foreign reserves decreased by $500m:Pecunia international transactionCredit Debit Current account -$1b Financial accountPecunian official reserve assets +$500mForeign official reserve assets 0 0The balance of nonreserve assets +$500m(c) There was no need for Pecunian central bank to sell dollar, and Pecunian central bank’s foreign reserves increased by $100m as shown below:Pecunia international transactionCredit Debit Current account -$1b Financial accountPecunian official reserve assets -$100m Foreign official reserve assets + $600mThe balance of nonreserve assets +$500m(d)Pecunia international transactionCredit Debit Current account -$1b Financial accountPecunian official reserve assets -$100m Foreign official reserve assets + $600mThe balance of nonreserve assets +$500mThe following is for your reference:3.(a) The purchase of the German stock is a debit in the U.S. financial account. There is acorresponding credit in the U.S. financial account when the American pays witha check on his Swiss bank account because his claims on Switzerland fall by theamount of the check. This is a case in which an American trades one foreign assetfor another.(b) Again, there is a U.S. financial account debit as a result of the purchase of a Germanstock by an American. T he corresponding credit in this case occurs when theGerman seller deposits the U.S. check in its German bank and that bank lends themoney to a German importer (in which case the credit will be in the U.S. currentaccount) o r to an individual or corporation that purchases a U.S. asset (in whichcase the credit will be in the U.S. financial account). Ultimately, there will be someaction taken by the bank which results in a credit in the U.S. balance of payments.(c) The foreign exchange intervention by the French government involves the sale of aU.S. asset, the dollars it holds in the United States, and thus represents a debititem in the U.S. financial account. The French citizens who buy the dollars mayuse them to buy American goods, which would be an American current accountcredit,or an American asset, which would be an American financial accountcredit.(d) Suppose the company issuing the traveler’s check uses a checking account inFrance to make payments. When this company pays the French restaurateur for themeal, its payment represents a debit in the U.S. current account.The company issuing the traveler’s check must sell assets (deplete its checking account in France) to make this payment. This reduction in the French assetsowned by that company represents a credit in the American financial account.(e) There is no credit or debit in either the financial or the current account sincethere has been no market transaction.(f) There is no recording in the U.S. Balance of Payments of this offshore transaction.5.(a) Since non-central bank financial inflows fell short of the current-account deficit by$500 million, the balance of payments of Pecunia (official settlements balance) was–$500 million. The country as a whole somehow had to finance its $1 billioncurrent-account deficit, so Pecunia’s net foreign assets fell by $1 billion.(b) By dipping into its foreign reserves, the central bank of Pecunia financed theportion of the country’s current-account deficit not covered by private financialinflows. Only if foreign central banks had acquired Pecunian assets could thePecunian central bank have avoided using$500 million in reserves to complete the financing of the current account. Thus,Pecunia’s central bank lost $500 million in reserves, which would appear as anofficial financial inflow (of the same magnitude) in the country’s balance ofpayments accounts.(c) If foreign official capital inflows to Pecunia were $600 million, the Central Banknow increased its foreign assets by $100 million. Put another way, the countryneeded only $1 billion to cover its current-account deficit, but $1.1 billion flowed into the country (500 million private and600 million from foreign central banks). The Pecunian central bank must, therefore, have used the extra $100 million in foreign borrowing to increase its reserves. The balance of payments is still –500 million, but this is now comprised of 600 million in foreign Central Banks purchasing Pecunia assets and 100 million of Pecunia’s Central Bank purchasing foreign assets, as opposed to Pecunia selling 500 million in assets. Purchases of Pecunian assets by foreign central banks enter their countries’balance of payments accounts as outflows, which are debit items. The rationale is that the transactions result in foreign payments to the Pecunians who sell the assets.(d) Along with non-central bank transactions, the accounts would show an increase inforeign official reserve assets held in Pecunia of $600 million (a financial account credit, or inflow) and an increase Pecunian official reserve assets held abroad of $100 million (a financial account debit, or outflow). Of course, total net financial inflows of $1 billion just cover the current-account deficit.。

克鲁格曼国际经济学课后答案

克鲁格曼国际经济学课后答案【篇一:克鲁格曼《国际经济学》(国际金融)习题答案要点】lass=txt>第12章国民收入核算和国际收支1、如问题所述,gnp仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从gnp中减去,出口的中间品价值加到gnp中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的gnp中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的gnp,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的gnp中减去,并加入美国的gnp。

2、(1)等式12-2可以写成ca?(sp?i)?(t?g)。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

最后,银行采取的各项行为将导致记入美国国际收支表的贷方。

克鲁格曼《国际经济学》(国际金融)习题答案要点

克鲁格曼《国际经济学》(国际金融)习题答案要点赤字。

因此,1982-1985年美国资本流入超过了其经常项目的赤字。

第13章 汇率与外汇市场:资产方法 1、汇率为每欧元1.5美元时,一条德国香肠bratwurst 等于三条hot dog 。

其他不变时,当美元升值至1.25$per Euro, 一条德国香肠bratwurst 等价于2.5个hot dog 。

相对于初始阶段,hot dog 变得更贵。

2、63、25%;20%;2%。

4、分别为:15%、10%、-8%。

5、(1)由于利率相等,根据利率平价条件,美元对英镑的预期贬值率为零,即当前汇率与预期汇率相等。

(2)1.579$per pound6、如果美元利率不久将会下调,市场会形成美元贬值的预期,即e E 值变大,从而使欧元存款的美元预期收益率增加,图13-1中的曲线I 移到I ',导致美元对欧元贬值,汇率从0E 升高到1E 。

131-图 7、(1)如图13-2,当欧元利率从0i 提高到1i 时,汇率从0E 调整到1E ,欧元相对于美元升值。

I 'IE 1E $/euroE图13-2(2)如图13-3,当欧元对美元预期升值时,美元存款的欧元预期收益率提高,美元存款的欧元收益曲线从I '上升到I ,欧元对美元的汇率从E '提高到E ,欧元对美元贬值。

133-图8、(a)如果美联储降低利率,在预期不变的情况下,根据利率平价条件,美元将贬值。

如图13-4,利率从i 下降到i ' ,美元对外国货币的汇价从E 提高到E ',美元贬值。

如果软着陆,并且美联储没有降低利率,则美元不会贬值。

即使美联储稍微降低利率,假如从i 降低到*i (如图13-5),这比人们开始相信会发生的还要小。

同时,由于软着陆所产生的乐观因素,使美元预期升值,即e E 值变小,使国外资产的美元预期收益率降低(曲线I 向下移动到I '),曲线移动反映了对美国软着陆引起的乐观预期,同时由乐观因素引起的预期表明:在没有预期变化的情况下,由利I 'E E 'euro/$E IiE 1E euro/$E rate of return(in euro)0i 1i率i 下降到*i 引起美元贬值程度(从E 贬值到*E )将大于存在预期变化引起的美元贬值程度(从E 到E '')。

克鲁格曼《国际经济学》(国际金融)习题标准答案要点

克鲁格曼《国际经济学》(国际金融)习题答案要点————————————————————————————————作者:————————————————————————————————日期:23 《国际经济学》(国际金融)习题答案要点第12章 国民收入核算与国际收支1、如问题所述,GNP 仅仅包括最终产品和服务的价值是为了避免重复计算的问题。

在国民收入账户中,如果进口的中间品价值从GNP 中减去,出口的中间品价值加到GNP 中,重复计算的问题将不会发生。

例如:美国分别销售钢材给日本的丰田公司和美国的通用汽车公司。

其中出售给通用公司的钢材,作为中间品其价值不被计算到美国的GNP 中。

出售给日本丰田公司的钢材,钢材价值通过丰田公司进入日本的GNP ,而最终没有进入美国的国民收入账户。

所以这部分由美国生产要素创造的中间品价值应该从日本的GNP 中减去,并加入美国的GNP 。

2、(1)等式12-2可以写成()()p CA S I T G =-+-。

美国更高的进口壁垒对私人储蓄、投资和政府赤字有比较小或没有影响。

(2)既然强制性的关税和配额对这些变量没有影响,所以贸易壁垒不能减少经常账户赤字。

不同情况对经常账户产生不同的影响。

例如,关税保护能提高被保护行业的投资,从而使经常账户恶化。

(当然,使幼稚产业有一个设备现代化机会的关税保护是合理的。

)同时,当对投资中间品实行关税保护时,由于受保护行业成本的提高可能使该行业投资下降,从而改善经常项目。

一般地,永久性和临时性的关税保护有不同的效果。

这个问题的要点是:政策影响经常账户方式需要进行一般均衡、宏观分析。

3、(1)、购买德国股票反映在美国金融项目的借方。

相应地,当美国人通过他的瑞士银行账户用支票支付时,因为他对瑞士请求权减少,故记入美国金融项目的贷方。

这是美国用一个外国资产交易另外一种外国资产的案例。

(2)、同样,购买德国股票反映在美国金融项目的借方。

当德国销售商将美国支票存入德国银行并且银行将这笔资金贷给德国进口商(此时,记入美国经常项目的贷方)或贷给个人或公司购买美国资产(此时,记入美国金融项目的贷方)。

《国际经济学》克鲁格曼(第六版)习题答案imsect3

OVERVIEW OF SECTION III: EXCHANGE RATES AND OPEN ECONOMY MACROECONOMICSSection III of the textbook is comprised of six chapters:Chapter 12 National Income Accounting and the Balance of PaymentsChapter 13 Exchange Rates and the Foreign Exchange Market: An Asset Approach Chapter 14 Money, Interest Rates, and Exchange RatesChapter 15 Price Levels and the Exchange Rate in the Long RunChapter 16 Output and the Exchange Rate in the Short RunChapter 17 Fixed Exchange Rates and Foreign Exchange InterventionSECTION III OVERVIEWThe presentation of international finance theory proceeds by building up an integrated model of exchange rate and output determination. Successive chapters in Part III construct this model step by step so students acquire a firm understanding of each component as well as the manner in which these components fit together. The resulting model presents a single unifying framework admitting the entire range of exchange rate regimes from pure float to managed float to fixed rates. The model may be used to analyze both comparative static and dynamic time path results arising from temporary or permanent policy or exogenous shocks in an open economy.The primacy given to asset markets in the model is reflected in the discussion of national income and balance of payments accounting in the first chapter of this section. Chapter 12 begins with a discussion of the focus of international finance. The discussion then proceeds to national income accounting in an open economy. The chapter points out, in the discussion on the balance of payments account, that current account transactions must be financed by financial account flows from either central bank or noncentral bank transactions. A case study uses national income accounting identities to consider the link between government budget deficits and the current account.Observed behavior of the exchange rate favors modeling it as an asset price rather than as a goods price. Thus, the core relationship for short-run exchange-rate determination in the model developed in Part III is uncovered interest parity. Chapter 13 presents a model inwhich the exchange rate adjusts to equate expected returns on interest-bearing assets denominated in different currencies given expectations about exchange rates, and the domestic and foreign interest rate. This first building block of the model lays the foundation for subsequent chapters that explore the determination of domestic interest rates and output, the basis for expectations of future exchange rates and richer specifications of the foreign-exchange market that include risk. An appendix to this chapter explains the determination of forward exchange rates.Chapter 14 introduces the domestic money market, linking monetary factors to short-run exchange-rate determination through the domestic interest rate. The chapter begins with a discussion of the determination of the domestic interest rate. Interest parity links the domestic interest rate to the exchange rate, a relationship captured in a two-quadrant diagram. Comparative statics employing this diagram demonstrate the effects of monetary expansion and contraction on the exchange rate in the short run. Dynamic considerations are introduced through an appeal to the long run neutrality of money that identifies a long-run steady-state value toward which the exchange rate evolves. The dynamic time path of the model exhibits overshooting of the exchange-rate in response to monetary changes.Chapter 15 develops a model of the long run exchange rate. The long-run exchange rate plays a role in a complete short-run macroeconomic model since one variable in that model is the expected future exchange rate. The chapter begins with a discussion of the law of one price and purchasing power parity. A model of the exchange rate in the long-run based upon purchasing power parity is developed. A review of the empirical evidence, however, casts doubt on this model. The chapter then goes on to develop a general model of exchange rates in the long run in which the neutrality of monetary shocks emerges as a special case. In contrast, shocks to the output market or changes in fiscal policy alter the long run real exchange rate. This chapter also discusses the real interest parity relationship that links the real interest rate differential to the expected change in the real exchange rate. An appendix examines the relationship of the interest rate and exchange rate under a flexible-price monetary approach.Chapter 16 presents a macroeconomic model of output and exchange-rate determination in the short run. The chapter introduces aggregate demand in a setting of short-run price stickiness to construct a model of the goods market. The exchange-rate analysis presented in previous chapters provides a model of the asset market. The resulting model is, in spirit, very close to the classic Mundell-Fleming model. This model is used to examine the effects of avariety of policies. The analysis allows a distinction to be drawn between permanent and temporary policy shifts through the pedagogic device that permanent policy shifts alter long-run expectations while temporary policy shifts do not. This distinction highlights the importance of exchange-rate expectations on macroeconomic outcomes. A case study of U.S. fiscal and monetary policy between 1979 and 1983 utilizes the model to explain notable historical events. The chapter concludes with a discussion of the links between exchange rate and import price movements which focuses on the J-curve and exchange-rate pass-through. An appendix to the chapter compares the IS-LM model to the model developed in this chapter. A second appendix considers intertemporal trade and consumption demand. A third appendix discusses the Marshall-Lerner condition and estimates of trade elasticities.The final chapter of this section discusses intervention by the central bank and the relationship of this policy to the money supply. This analysis is blended with the previous chapter's short-run macroeconomic model to analyze policy under fixed rates. The balance sheet of the central bank is used to keep track of the effects of foreign exchange intervention on the money supply. The model developed in previous chapters is extended by relaxing the interest parity condition and allowing exchange-rate risk to influence agents' decisions. This allows a discussion of sterilized intervention. Another topic discussed in this chapter is capital flight and balance of payments crises with an introduction to different models of how a balance of payments or currency crisis can occur. The analysis also is extended to a two-country framework to discuss alternative systems for fixing the exchange-rate as a prelude to Part IV. An appendix to Chapter 17 develops a model of the foreign-exchange market in which risk factors make domestic-currency and foreign-currency assets imperfect substitutes.A second appendix explores the monetary approach to the balance of payments. The third appendix discusses the timing of a balance of payments crisis.。

克鲁格曼《国际经济学》笔记和课后习题详解(国民收入核算与国际收支平衡)【圣才出品】

克鲁格曼《国际经济学》笔记和课后习题详解(国民收⼊核算与国际收⽀平衡)【圣才出品】⼗万种考研考证电⼦书、题库、视频学习平台第12章国民收⼊核算与国际收⽀平衡12.1 复习笔记1.国民收⼊账户(1)GNP宏观经济分析的主要着眼点是⼀国的国民⽣产总值(GNP),它是⼀国的⽣产要素在⼀定时期内所⽣产并在市场上卖出的最终商品和服务的价值总量。

GNP是宏观经济学家研究⼀国产出时所⽤的基本度量⼿段,由花费在最终产品上的⽀出的市场价值量加总⽽得到。

GNP的⽀出与劳动、资本以及其他⽣产要素紧密相连。

根据购买最终产品的四种可能⽤途,GNP可以分解为以下四个部分:消费(国内居民私⼈消费的数额)、投资(私⼈企业为进⾏再⽣产⽽留下的⽤于购买⼚房设备的数额)、政府购买(政府使⽤的数额)和经常项⽬余额(对外净出⼝的商品和服务的数额)。

(2)国民收⼊国民收⼊等于GNP减去折旧,加上净单边转移⽀付,再减去间接商业税。

即:国民收⼊=GNP-折旧+净单边转移⽀付-间接商业税在实际经济中,要使GNP和国民收⼊的恒等关系完全成⽴,必须对GNP的定义作⼀定调整:①GNP不考虑机器和建筑物在使⽤过程中由于磨损⽽引起的经济损失。

这部分经济损失称为折旧,折旧减少了资本所有者的收⼊。

为了计算⼀定时期的国民收⼊,必须从GNP 中减去这⼀时期资本的折旧。

GNP减去折旧后称为国民⽣产净值(NNP)。

⼗万种考研考证电⼦书、题库、视频学习平台②⼀国的收⼊可能会包括外国居民的赠与,这种赠与称为单边转移⽀付。

单边转移⽀付的例⼦包括向居住在国外的退休公民⽀付养⽼⾦、赔偿⽀付和对遭受旱灾国家的救济援助等。

净单边转移⽀付是⼀国收⼊的⼀部分,但不是⼀国产出的⼀部分,因此,净单边转移⽀付,必须加到NNP中以计算国民收⼊。

③国民收⼊取决于⽣产者获得的产品价格,GNP则取决于购买者所⽀付的价格。

但是,这两组价格并不是完全⼀致的,例如,销售税会使得购买者的⽀付⼤于销售者的收⼊,导致GNP被⾼估,超过了国民收⼊。

克鲁格曼《国际经济学》第八版课后答案

Chapter 18The International Monetary System, 1870–1973?Chapter OrganizationMacroeconomic Policy Goals in an Open EconomyInternal Balance: Full Employment and Price-Level StabilityExternal Balance: The Optimal Level of the Current Account International Macroeconomic Policy under the Gold Standard, 1870–1914 Origins of the Gold StandardExternal Balance under the Gold StandardThe Price-Specie-Flow MechanismThe Gold Standard “Rules of the Game”: Myth and RealityBox: Hume v. the MercantilistsInternal Balance under the Gold StandardCase Study: The Political Economy of Exchange Rate Regimes:Conflict over America’s Monetary Standard During the 1890s The Interwar Years, 1918–1939The Fleeting Return to GoldInternational Economic DisintegrationCase Study: The International Gold Standard and the Great Depression The Bretton Woods System and the International Monetary Fund Goals and Structure of the IMFConvertibility and the Expansion of Private Capital FlowsSpeculative Capital Flows and CrisesAnalyzing Policy Options under the Bretton Woods SystemMaintaining Internal BalanceMaintaining External BalanceExpenditure-Changing and Expenditure-Switching PoliciesThe External-Balance Problem of the United StatesCase Study: The Decline and Fall of the Bretton Woods SystemWorldwide Inflation and the Transition to Floating Rates Summary?Chapter OverviewThis is the first of five international monetary policy chapters. These chapters complement the preceding theory chapters in several ways. They provide the historical and institutional background students require to place their theoretical knowledge in a useful context. The chapters also allow students, through study of historical and current events, to sharpen their grasp of the theoretical models and to develop the intuition those models can provide. (Application of the theory to events of current interest will hopefully motivate students to return to earlier chapters and master points that may have been missed on the first pass.)Chapter 18 chronicles the evolution of the international monetary system from the gold standard of1870–1914, through the interwar years, and up to and including the post-World War II Bretton Woods regime that ended in March 1973. The central focus of the chapter is the manner in which each system addressed, or failed to address, the requirements of internal and external balance for its participants.A country is in internal balance when its resources are fully employed and there is price level stability. External balance implies an optimal time path of the current account subject to its being balanced over the long run. Other factors have been important in the definition of external balance at various times, and these are discussed in the text. The basic definition of external balance as an appropriate current-account level, however, seems to capture a goal that most policy-makers share regardless of the particular circumstances.The price-specie-flow mechanism described by David Hume shows how the gold standard could ensure convergence to external balance. You may want to present the following model of the price-specie-flow mechanism. This model is based upon three equations: 1. The balance sheet of the central bank. At the most simple level, this is justgold holdings equals the money supply: G ? M.2. The quantity theory. With velocity and output assumed constant and bothnormalized to 1, this yields the simple equation M ? P.3. A balance of payments equation where the current account is a function of thereal exchange rate and there are no private capital flows: CA ? f(E ? P*/P)These equations can be combined in a figure like the one below. The 45? line represents the quantity theory, and the vertical line is the price level where the real exchange rate results in a balanced current account. The economy moves along the 45? line back towards the equilibrium Point 0 whenever it is out of equilibrium. For example, the loss of four-fifths of a country’s gold would put that country at Point a with lower prices and a lower money supply. The resulting real exchange rate depreciation causes a current account surplus which restores money balances as the country proceeds up the 45? line froma to 0.FigureThe automatic adjustment process described by the price-specie-flow mechanism is expedited by following “rules of the game” under which governments contract the domestic source components oftheir monetary bases when gold reserves are falling (corresponding to a current-account deficit) and expand when gold reserves are rising (the surplus case).In practice, there was little incentive for countries with expanding gold reserves to follow the “rules of the game.” This increased the contractionary burden shouldered by countries with persistent current account deficits. The gold standard also subjugated internal balance to the demands of external balance. Research suggests price-level stability and high employment were attained less consistently under the gold standard than in the post-1945 period.The interwar years were marked by severe economic instability. The monetization of war debt and of reparation payments led to episodes of hyperinflation in Europe. Anill-fated attempt to return to thepre-war gold parity for the pound led to stagnation in Britain. Competitive devaluations and protectionism were pursued in a futile effort to stimulate domestic economic growth during the Great Depression.These beggar-thy-neighbor policies provoked foreign retaliation and led to the disintegration of the world economy. As one of the case studies shows, strict adherence to the Gold Standard appears to have hurt many countries during the Great Depression.Determined to avoid repeating the mistakes of the interwar years, Allied economic policy-makers metat Bretton Woods in 1944 to forge a new international monetary system for the postwar world. The exchange-rate regime that emerged from this conference had at its center the . dollar. All other currencies had fixed exchange rates against the dollar, which itself had a fixed value in terms of gold.An International Monetary Fund was set up to oversee the system and facilitate its functioning by lending to countries with temporary balance of payments problems.A formal discussion of internal and external balance introduces the concepts of expenditure-switching and expenditure-changing policies. The Bretton Woods system, with its emphasis on infrequent adjustmentof fixed parities, restricted the use of expenditure-switching policies. Increases in U.S. monetary growth to finance fiscal expenditures after the mid-1960s led to a loss of confidence in the dollar and the termination of the dollar’s convertibility into gold. The analysis presented in the text demonstrateshow the Bretton Woods system forced countries to “import” inflation from the United States and shows that the breakdown of the system occurred when countries were no longer willing to accept this burden.?Answers to Textbook Problems1. a. Since it takes considerable investment to develop uranium mines, you wouldwant a larger current account deficit to allow your country to finance some of the investment with foreign savings.b. A permanent increase in the world price of copper would cause a short-termcurrent account deficit if the price rise leads you to invest more in coppermining. If there are no investment effects, you would not change yourexternal balance target because it would be optimal simply to spend youradditional income.c. A temporary increase in the world price of copper would cause a currentaccount surplus. You would want to smooth out your country’s consumption bysaving some of its temporarily higher income.d. A temporary rise in the world price of oil would cause a current accountdeficit if you were an importer of oil, but a surplus if you were an exporter of oil.2. Because the marginal propensity to consume out of income is less than 1, atransfer of income from B to A increases savings in A and decreases savings in B.Therefore, A has a current account surplus and B has a corresponding deficit.This corresponds to a balance of payments disequilibrium in Hume’s world, which must be financed by gold flows from B to A. These gold flows increase A’s money supply and decrease B’s money supply, pushing up prices in A and depressingprices in B. These price changes cease once balance of payments equilibrium has been restored.3. Changes in parities reflected both initial misalignments and balance of paymentscrises. Attempts to return to the parities of the prewar period after the war ignored the changes in underlying economic fundamentals that the war caused. This made some exchange rates less than fully credible and encouraged balance ofpayments crises. Central bank commitments to the gold parities were also less than credible after the wartime suspension of the gold standard, and as a result of the increasing concern of governments with internal economic conditions.4. A monetary contraction, under the gold standard, will lead to an increase in thegold holdings of the contracting country’s central bank if other countries do not pursue a similar policy. All countries cannot succeed in doing thissimultaneously since the total stock of gold reserves is fixed in the short run.Under a reserve currency system, however, a monetary contraction causes anincipient rise in the domestic interest rate, which attracts foreign capital. The central bank must accommodate the inflow of foreign capital to preserve theexchange rate parity. There is thus an increase in the central bank’s holdings of foreign reserves equal to the fall in its holdings of domestic assets. There is no obstacle to a simultaneous increase in reserves by all central banksbecause central banks acquire more claims on the reserve currency country while their citizens end up with correspondingly greater liabilities.5. The increase in domestic prices makes home exports less attractive and causes acurrent account deficit. This diminishes the money supply and causescontractionary pressures in the economywhich serve to mitigate and ultimately reverse wage demands and price increases.6. A “demand determined” increase in dollar reserve holdings would not affect theworld supply of money as central banks merely attempt to trade their holdings of domestic assets for dollar rese rves. A “supply determined” increase in reserve holdings, however, would result from expansionary monetary policy in the United States (the reserve center). At least at the end of the Bretton Woods era the increase in world dollar reserves arose in part because of an expansionarymonetary policyin the United States rather than a desire by other central banks to increasetheir holdings of dollar assets. Only the “supply determined” increase indollar reserves is relevant for analyzing the relationship between world holdings of dollar reserves by central banks and inflation.7. An increase in the world interest rate leads to a fall in a central bank’sholdings of foreign reserves as domestic residents trade in their cash forforeign bonds. This leads to a d ecline in the home country’s money supply. The central bank of a “small” country cannot offset these effects sinceit cannot alter the world interest rate. An attempt to sterilize the reserve loss through open market purchases would fail unless bonds are imperfect substitutes.8. Capital account restrictions insulate the domestic interest rate from the worldinterest rate. Monetary policy, as well as fiscal policy, can be used to achieve internal balance. Because there are no offsetting capital flows, monetary policy, as well as fiscal policy, can be used to achieve internal balance. The costs of capital controls include the inefficiency which is introduced when the domestic interest rate differs from the world rate and the high costs of enforcing the controls.9. Yes, it does seem that the external balance problem of a deficit country is moresevere. While the macroeconomic imbalance may be equally problematic in the long run regardless of whether it is a deficit or surplus, large external deficits involve the risk that the market will fix the problem quickly by ceasing to fund the external deficit. In this case, there may have to be rapid adjustment that could be disruptive. Surplus countries are rarely forced into rapid adjustments, making the problems less risky.10. An inflow attack is different from capital flight, but many parallels exist. Inan “outflow” attack, speculators sell the home currency and drain the central bank of its foreign assets. The central bank could always defend if it so chooses (they can raise interest rates to improbably high levels), but if it is unwilling to cripple the economy with tight monetary policy, it must relent. An “inflow”attack is similar in that the central bank can always maintain the peg, it is just that the consequences of doing so may be more unpalatable than breaking the peg. If money flows in, the central bank must buy foreign assets to keep thecurrency from appreciating. If the central bank cannot sterilize all the inflows (eventually they may run out of domestic assets to sell to sterilize thetransactions where they are buying foreign assets), it will have to either let the currency appreciate or let the money supply rise. If it is unwilling to allow and increase in inflation due to a rising money supply, breaking the peg may be preferable.11. a. We know that China has a very large current account surplus, placing them highabove the XX line. They also have moderate inflationary pressures (describedas “gathering” in the question, implying they are not yet very strong). This suggests that China is above the II line, but not too far above it. It wouldbe placed in Zone 1 (see below).b. China needs to appreciate the exchange rate to move down on the graph towardsbalance. (Shown on the graph with the dashed line down)c. China would need to expand government spending to move to the right and hitthe overall balance point. Such a policy would help cushion the negativeaggregate demand pressurethat the appreciation might generate.。

克鲁格曼《国际经济学》(第8版)课后习题详解(第7章国际要素流动)【圣才出品】

克鲁格曼《国际经济学》(第8版)课后习题详解(第7章国际要素流动)【圣才出品】第7章国际要素流动⼀、概念题1.外国直接投资(direct foreign investment)答:外国直接投资⼜称“海外直接投资”,是指⼀个国家或地区的投资者对另⼀国家或地区所进⾏的、以控制或参与经营管理为特征的跨国投资⾏为,是国际资本流动的⼀种重要形式。

跨国公司是最主要的直接投资主体之⼀。

外国直接投资有多种具体形式,常见的有直接在国外投资设⽴⼦公司或分公司、购买国外某公司全部或⼀定⽐例的股份并获得⼀定的控制权、通过与东道国企业签订各种合约或合同取得对该企业的某种控制权等。

2.跨国公司的分布及内部化动机(location and internalization motives of multinationals)答:内部化是指在企业内部建⽴市场,以企业的内部市场代替外部市场,从⽽解决由于市场不完全⽽带来的不能保证供需交换正常进⾏的问题的⾏为过程。

内部化理论认为,由于市场存在不完全性和交易成本上升,因此企业通过外部市场的买卖关系不能保证企业获利,并导致许多附加成本。

因此,建⽴企业内部市场即通过跨国公司内部形成的公司内市场,就能克服外部市场和市场不完全所造成的风险和损失,给技术转移和垂直⼀体化带来好处。

3.要素流动(factor movements)答:要素流动是指⽣产要素在不同国家之间的流动。

具体包括劳动⼒流动、国际借贷和证券投资等形式的短期资本流动,以及跨国公司进⾏的长期投资等。

就经济本⾝⽽⾔,⽣产要素的国际流动和商品的国际流动(国际贸易)没有本质的不同,⼆者在⼀定程度上是可以相互替代的;但在现实⽣活中,由于社会、政治和⽂化传统等⽅⾯的差异,⽣产要素的国际流动远⽐商品的国际流动困难和复杂。

如今,商品的国际流动越来越便捷,但⽣产要素的国际流动还有很多限制:⼤多数国家仍对移民做出严格的限制,东道国对国际资本短期流动的投机性和冲击⼒提⾼了警惕,⼤多数国家对跨国公司进⾏直接投资的领域和股权⽐例做出了限制性规定等。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

国际经济学克鲁格曼课后习题答案章集团标准化办公室:[VV986T-J682P28-JP266L8-68PNN]第一章练习与答案1.为什么说在决定生产和消费时,相对价格比绝对价格更重要?答案提示:当生产处于生产边界线上,资源则得到了充分利用,这时,要想增加某一产品的生产,必须降低另一产品的生产,也就是说,增加某一产品的生产是有机会机本(或社会成本)的。

生产可能性边界上任何一点都表示生产效率和充分就业得以实现,但究竟选择哪一点,则还要看两个商品的相对价格,即它们在市场上的交换比率。

相对价格等于机会成本时,生产点在生产可能性边界上的位置也就确定了。

所以,在决定生产和消费时,相对价格比绝对价格更重要。

2.仿效图1—6和图1—7,试推导出Y商品的国民供给曲线和国民需求曲线。

答案提示:3.在只有两种商品的情况下,当一个商品达到均衡时,另外一个商品是否也同时达到均衡?试解释原因。

答案提示:4.如果生产可能性边界是一条直线,试确定过剩供给(或需求)曲线。

答案提示:5.如果改用Y商品的过剩供给曲线(B国)和过剩需求曲线(A国)来确定国际均衡价格,那么所得出的结果与图1—13中的结果是否一致?6.答案提示:国际均衡价格将依旧处于贸易前两国相对价格的中间某点。

7.说明贸易条件变化如何影响国际贸易利益在两国间的分配。

答案提示:一国出口产品价格的相对上升意味着此国可以用较少的出口换得较多的进口产品,有利于此国贸易利益的获得,不过,出口价格上升将不利于出口数量的增加,有损于出口国的贸易利益;与此类似,出口商品价格的下降有利于出口商品数量的增加,但是这意味着此国用较多的出口换得较少的进口产品。

对于进口国来讲,贸易条件变化对国际贸易利益的影响是相反的。

8.如果国际贸易发生在一个大国和一个小国之间,那么贸易后,国际相对价格更接近于哪一个国家在封闭下的相对价格水平?答案提示:贸易后,国际相对价格将更接近于大国在封闭下的相对价格水平。

9.根据上一题的答案,你认为哪个国家在国际贸易中福利改善程度更为明显些?答案提示:小国。

9*.为什么说两个部门要素使用比例的不同会导致生产可能性边界曲线向外凸?答案提示:第二章答案1. 根据下面两个表中的数据,确定(1)贸易前的相对价格;(2)比较优势型态。

表1 X 、Y 的单位产出所需的劳动投入A B XY 6 2 15 12表2 X 、Y 的单位产出所需的劳动投入AB X Y10 4 5 5 答案提示:首先将劳动投入转化为劳动生产率,然后应用与本章正文中一样的方法进行比较。

(表2-2(a )和表2-2(b )部分的内容)2. 假设A 、B 两国的生产技术条件如下所示,那么两国还有进行贸易的动机吗?解释原因。

表3 X 、Y 的单位产出所需的劳动投入A B XY 4 2 8 4答案提示:从绝对优势来看,两国当中A 国在两种产品中都有绝对优势;从比较优势来看,两国不存在相对技术差异。

所以,两国没有进行国际贸易的动机。

3. 证明如果一国在某一商品上具有绝对优势,那么也必具有比较优势。

——题出错了证明即使一国在某一商品上具有绝对优势,也未必具有比较优势。

答案提示:如果X X b a 〉,则称A 国在X 生产上具有绝对优势;如果Y X Y X b b a a //〉,则称A 国在X 生产上具有比较优势。

当Y Y b a =或者Y Y b a 〈的时候,由X X b a 〉可以推出Y X Y X b b a a //〉,但是,当Y Y b a 〉的时候,X X b a 〉不能保证Y X Y X b b a a //〉。

所以,即使一国在某一商品上具有绝对优势,也未必具有比较优势。

4. 根据书中第二个例子的做法,如果按照比较劣势的原则进行国际分工,那么会对世界生产带来什么净影响答案提示:5. 假设某一国家拥有20,000万单位的劳动,X 、Y 的单位产出所要求的劳动投入分别为5个单位和4个单位,试确定生产可能性边界方程。

答案提示:2000000004151=+Y X L L ;X L X 51=;Y L Y 41= 6. 根据上一题的条件,再加上以下几个条件,试确定该国的出口量,并在图中画出贸易三角形。

(1) X 的国际相对价格为2;(2) 进口为2,000个单位。

答案提示:封闭条件下,此国生产可能性边界的斜率是YX P P =-=-455141。

因为X 的国际相对价格为2,所以此国出口X 进口Y 。

出口1,000个单位的X 可以换得2,000个单位的Y 。

贸易三角是C A DA ’(见图2-5(a ))。

7. 在图2—2(b )中,过剩供给曲线两端是否有界限?试解释原因。

答案提示:过剩供给曲线两端是有界限的,因为一国生产能力和消费需求是有界限的。

8*. 仿照图2—4,你能否画出这样一种情形:两条曲线的交点所决定的国际均衡价格与某一国封闭下的相对价格完全相同如何解释这种结果答案提示:从大国、小国的角度考虑。

9.试对下列说法加以评价:(1) 由于发达国家工资水平高于发展中国家,所以发达国家与发展中国家进行贸易会无利可图;(2)因为美国的工资水平很高,所以美国产品在世界市场缺乏竞争力;(3) 发展中国家的工资水平比较低是因为国际贸易的缘故。

答案提示:以上三种观点都不正确。

10*.试根据李嘉图模型证明:如果A 国在两种产品上都具有绝对优势,那么贸易后A 国的名义工资水平肯定高于B 国。

答案提示:比较w x a p w 与w x b p w 之间的大小。

第三章答案 1. 根据下面的两个表,试判断:(1)哪个国家是资本相对丰富的;(2)哪个国家是劳动相对丰富的;(3)如果X 是资本密集型产品,Y 是劳动密集型产品,那么两国的比较优势如何?表1要素禀赋A B 劳动 资本45 15 20 10 表2要素禀赋A B 劳动 资本 12 48 30 60答案提示:表1中A 国劳动相对丰裕,A 国在生产Y 产品上有比较优势。

表2中A 国资本相对丰裕,A 国在生产X 产品上有比较优势。

2. 如果A 国的资本、劳动总量均高于B 国,但资本相对更多些,试仿照图3—3和图3—4的做法,确定两国生产可能性边界线的位置关系。

答案提示:3. 根据上一题,试在图中画出两国在封闭和开放下的一般均衡。

答案提示: 4. 如果两个部门的要素密度完全相同,那么要素禀赋差异还会引发国际贸易吗如果贸 易发生的话,那么国际分工与贸易型态如何试将你得出的结果与李嘉图模型加以比较。

5. 答案提示:如果两个部门的要素密度完全相同,那么要素禀赋差异将不会引发国际贸易。

不过,国际贸易还可能存在,这时候的国际分工将有更多的偶然性质。

5*.试证明在图3—7中,两国的消费点共同位于从原点出发的一条直线上。

答案提示:根据两国的消费结构来判断6*. 如果两国存在技术差异,那么贸易后两国要素价格是否均等,为什么答案提示:如果两国存在技术差异,那么贸易后两国要素价格将不均等。

可采用图3—8的方式来解释7. 需求逆转是否会影响要素价格均等为什么B O Y X A / B / A E a K E b O L (X=a X )(X=b X) (Y=b Y ) (Y=a Y ) B O YX A / B / A E b p a p b E a Q a C a C b B O Y X A / B / A O b O a Q b p w p w答案提示:需求逆转导致两个国家相同产品的价格不一样,使得要素价格无法均等。

8.如何根据罗伯津斯基定理,来解释要素禀赋不同的两个国家生产可能性边界之间的差别?答案提示:罗伯津斯基定理是,在商品相对价格不变的前提下,某一要素的增加会导致密集使用该要素部门的生产增加,而另一部门的生产则下降。

如果两个国家的要素禀赋不一样,则某种要素多的国家,会生产更多密集使用该要素的产品,反之亦然。

所以,两个国家的生产可能性边界就出现了差别。

9.如果一国的资本与劳动同时增加,那么在下列情况下,两种产品的生产以及该国的贸易条件如何变化?(1)资本、劳动同比例增加;(2)资本增加的比例大于劳动增加的比例;(3)资本增加的比例小于劳动增加的比例。

答案提示:(1)两种产品的产量同比例增加,贸易条件没有变化。

(2)资本密集型产品的生产增加更快,资本密集型产品的价格有下降的压力。

(3)劳动密集型产品的生产增加更快,劳动密集型产品的价格有下降的压力。

10.对小国来说,经济增长后福利如何变化?答案提示:对于小国来说,经济增长以后,不对国际价格形成影响,其贸易条件不会变化,所以福利将上升。

11.在战后几十年间,日本、韩国等东亚的一些国家或地区的国际贸易商品结构发生了,明显变化,主要出口产品由初级产品到劳动密集型产品,再到资本密集型产品,试对此变化加以解释。

答案提示:随着国际贸易的开展,日本、韩国等东亚国家发挥了比较优势,促进了生产,提高了福利。

随着资本的不断积累,日本、韩国等国家的比较优势由起初的初级产品和劳动密集型产品的生产变成了资本密集型产品的生产,所以贸易结构也就相应地发生了变化。

12.试析外资流入对东道国贸易条件和比较优势的影响。

答案提示:外资流入可以从一定程度上改变东道国的要素禀赋,比如,使得原来资本相对稀缺的国家变成资本相对丰裕的国家。

当要素禀赋改变以后,东道国可以发挥新形成的比较优势进行国际贸易,提高福利水平。

如果外资流入的东道国在资本密集型产品的生产上增加特别多,以至于影响到国际价格,这将使得此国此种产品的出口价格有下降的压力,不利于贸易条件的维持和改善。

第四章习题答案提示1.如果劳动不是同质的话,那么劳动技能的差别是否会造成特定要素的存在?试举例说明。

答案提示:会的。

2.如果短期内资本和劳动都不能自由流动,那么国际贸易对要素实际收入会产生什么影响?答案提示:出口产品密集使用的要素,其价格将上升;进口竞争产品密集使用的要素,其价格将下降。

3.根据本章所建立的特定要素模型,试析劳动增加对要素实际收入和两个部门的生产会产生什么影响(提示:将图4—1中的纵坐标由原点Ox 或Oy向外平行移动,然后比较一下新旧均衡点)。

答案提示:劳动增加并且完全就业,则整个经济的资本-劳动比例下降,劳动力价格将下降。

劳动力增加将增加密集使用劳动力产品的产量;资本密集型产品的产量下降。

4.如果是某一特定要素增加,那么要素实际收入和两个部门的生产又将如何变化(提示:考虑一下劳动需求曲线的变动)。

答案提示:某一特定要素增加,将导致密集使用该要素产品的产量上升,同时由于另一个部门释放出了一部分共同要素,使得另一个部门的产量下降了。

共同生产要素的收入将上升。

5.根据你对3和4题的回答,试判断在上述两种情况下,罗伯津斯基定理是否依然有效?答案提示:依然有效。