accaF8实质性审计程序总结大全

ACCA考试《审计与认证业务F8》知识点(4)

ACCA考试《审计与认证业务F8》知识点(4)本文由高顿ACCA整理发布,转载请注明出处ELEVANT TO CAT QUALIFICATION PAPER 8 AND ACCA QUALIFICATIONPAPERS F8 AND P7SPECIFIC ASPECTS OF AUDITING IN ACOMPUTER-BASED ENVIRONMENTInformation technology (IT)is integral to modern accounting and management information systems. It is, therefore, imperative that auditors should be fullyaware of the impact of IT on the audit of a client’s financial statements, both in the context of how it is used by a client to gather, process and report financial information in its financial statements, and how the auditor can use IT in theprocess of auditing the financial statements.The purpose of this article is to provide guidance on following aspects ofauditing in a computer-based accounting environment:? Application controls, comprising input, processing, output and masterfile controls established by an audit client, over its computer-basedaccounting system and? Computer-assisted audit techniques (CAATs)that may be employed byauditors to test and conclude on the integrity of a client’scomputer-based accounting system.Exam questions on each of the aspects identified above are often answered to an inadequate standard by a significant number of students – hence the reason for this article.Dealing with application controls and CAATs in turn:APPLICATION CONTROLSApplication controls are those controls (manual and computerised)that relate to the transaction and standing data pertaining to a computer-based accounting system. They are specific to a given application and their objectives are to ensure the completeness and accuracy of the accounting records andthe validity of entries made in those records. An effective computer-based system will ensure that there are adequate controls existing at the point of input, processing and output stages of the computer processing cycle and over standing data contained in master files. Application controls need to be ascertained, recorded and evaluated by the auditor as part of the process of determining the risk of material misstatement in the audit client’s financial statements.Input controlsControl activities designed to ensure that input is authorised, complete,accurate and timely are referred to as input controls. Dependent on the complexity of the application program in question, such controls will vary in terms of quantity and sophistication. Factors to be considered in determining these variables include cost considerations, and confidentiality requirements with regard to the data input. Input controls common to most effective application programs include on-screen prompt facilities (for example, are quest for an authorised user to ‘log-in’)and a facility to produce an audit 2SPECIFIC ASPECTS OF AUDITING IN A COMPUTER-BASED ENVIRONMENTJANUARY 2011trail allowing a user to trace a transaction from its origin to disposition in the system.Specific input validation checks may include:Format checksThese ensure that information is input in the correct form. For example, the requirement that the date of a sales invoice be input in numeric format only –not numeric and alphanumeric.Range checksThese ensure that information input is reasonable in line with expectations. For example, where an entity rarely, if ever, makes bulk-buy purchases with a value in excess of $50,000, a purchase invoice with an input value in excess of $50,000 is rejected for review and follow-up.Compatibility checksThese ensure that data input from two or more fields is compatible. For example, a sales invoice value should be compatible with the amount of sales tax charged on the invoice.Validity checksThese ensure that the data input is valid. For example, where an entity operates a job costing system – costs input to a previously completed job should be rejected as invalid.Exception checksThese ensure that an exception report is produced highlighting unusual situations that have arisen following the input of a specific item. For example, the carry forward of a negative value for inventory held.Sequence checksThese facilitate completeness of processing by ensuring that documents processed out of sequence are rejected. For example, where pre-numberedgoods received notes are issued to acknowledge the receipt of goods intophysical inventory, any input of notes out of sequence should be rejected.Control totalsThese also facilitate completeness of processing by ensure that pre-input,manually prepared control totals are compared to control totals input. For example, non-matching tota ls of a ‘batch’ of purchase invoices should result inan on-screen user prompt, or the production of an exception report forfollow-up. The use of control totals in this way are also commonly referred toas output controls (see below)。

【ACCA考前辅导】F8 考点分析(审计风险+风险评估程序)

【ACCA考前辅导】F8 考点分析(审计风险+风险评估程序)“定义和评估审计风险是审计程序中非常重要的一个部分,在F8历年的考试中,主要以两种形式出现,第一简答题,要求解释一些基本的概念,第二案例题,会给一些具体的案例来给予分析,要求学生写出风险点,以及审计师的应对,本文基于考官的文章,主要讲述了以下几方面的内容:”一:什么是审计风险,如何定义的?二:风险评估程序(Risk assessment procedures)(一)什么是审计风险。

The risk that the auditor expresses an inappropriate audit opinion when the financial statements are materially misstated. Audit risk is a function of material misstatement and detection risk.所谓的审计风险,是指审计师在客户的财务报告存在着重要的错报时,发表了不恰当的审计意见,它主要包括了两块的内容,1.财务报表本身的错报和漏报,2.在检查时出现的风险。

定义的内容在2008年12月的考试里,作为直接的简答题出现了,在之后的考试里,再没有出现过简答题,但作为Syllabus里所要求的一个的重要知识,依旧要求学生熟练的背诵,了解这句话的具体定义,这有助于帮助他们理解审计风险,并且应用到具体的案例题里面。

(二)风险评估程序(Risk assessment procedures)1. ISA 315 requires auditors to perform the following procedures to obtain an understanding of the entity and its environment, including its internal control:。

(最新整理)ACCAF8备考Tips:审计各阶段及流程详解

ACCAF8备考Tips:审计各阶段及流程详解编辑整理:尊敬的读者朋友们:这里是精品文档编辑中心,本文档内容是由我和我的同事精心编辑整理后发布的,发布之前我们对文中内容进行仔细校对,但是难免会有疏漏的地方,但是任然希望(ACCAF8备考Tips:审计各阶段及流程详解)的内容能够给您的工作和学习带来便利。

同时也真诚的希望收到您的建议和反馈,这将是我们进步的源泉,前进的动力。

本文可编辑可修改,如果觉得对您有帮助请收藏以便随时查阅,最后祝您生活愉快业绩进步,以下为ACCAF8备考Tips:审计各阶段及流程详解的全部内容。

ACCA F8备考Tips:审计各阶段及流程详解F8(Audit and Assurance)是一门实务性很强的课程,要求大家熟悉审计工作流程,应用会计知识判断被审计单位的财务报告编制过程及结果是否有误。

自2016年9月开始实施的新考试题型包括Section A和Section B两大部分,Section A(Objective Test Cases)共有三道Case,每个Case有五道选择题,每题两分,涉及范围包括大纲的方方面面;Section B共有三道大题,第一题30分,第二题和第三题各自20分,常见的题型包括auditrisk & auditor's response,internal controldeficiencies/strengths & TOCs,以及substantive procedures等。

大题对大家书面表达的要求比较高,所以理解审计逻辑,勤加练习并学会总结对于大部分没有实务经验的同学们而言非常必要。

我们先来看一下完整的审计工作需要经过哪些阶段,具体又有哪些流程.上图是完整的审计工作循环,始于engagement letter(业务约定书),终于audit report(审计报告),历经audit planning、auditperformance和completion三个阶段.1.Beforeaudit process为了签订最开始的engagementletter,审计师在接受业务委托时需要先“自我反省”,看看注册会计师是否符合职业道德准则(Code of Ethics)的要求,如果有一些情况产生了对独立性(independence)的威胁(具体包括self—interest, self-review,familiarity, advocacy& intimidation threats),则应该考虑适用相对应的保卫措施(常见的safeguards包括dispose of interests/shares,independent/quality control partner review,remove the one from the engagementteam等).2.Audit planning process接受业务之后,首先进入审计计划阶段,在计划阶段最主要做的一项工作就风险评估(risk assessment),具体说来风险评估通过建立对被审计单位及其所处环境的了解(understand the entity& its environment/KOB)来进行评估,主要使用的程序包括(Enquiry, inspect,observe[1] & Analytical procedures).[[1]这三个审计程序使用范围极广,适用每一个阶段,本文之后简写为EIO风险评估中的风险指的是auditrisk(the risk that auditors express an inappropriateopinion)。

2019年ACCA F8核心考点知识内容总结

2019年ACCA F8核心考点知识内容总结

考试结束后又是一轮新考季的开始,很多学员已经开始为9月份考试做准备了,今天高顿ACCA研究院为大家带来关于F8审计的核心内容。

再送大家一个2019ACCA资料包,可以分享给小伙伴,自提,戳:ACCA资料【新手指南】+内部讲义+解析音频

F8课程是ACCA基础课程阶段唯一的一门关于审计的课程,它详细介绍了对财务报表的整个审计流程。

F8的考试时长是3小时,考试题型由原来5道简答题改为12个单选6道长题,单选题由8道两分选择题和4道一分选择题组成,长题由4道十分长题和2道二十分的长题组成。

F8《审计与鉴证》分为4个部分:

1.介绍鉴证服务的特性、目的和范围,包括法定审计、规范环境以及和审计与鉴证相关的职业道德;

2.介绍内部审计,包括内部审计的范围和内部审计与外部审计的差异;

3.大部分内容都是在绍如何对财务报表进行审计。

这些包括计划、风险评估、评价内部控制、手机审计证据以及财务报表的复审;

4.最后是对报告的处理,包括法定审计报告、管理报告和内部审计报告。

以上是给大家汇总的ACCA F8部分大纲核心内容,希望有助于大家接下来的复习备考。

急速通关计划 ACCA全球私播课大学生雇主直通车计划周末面授班寒暑假冲刺班其他课程。

(最新整理)ACCAF8大神带你全面复习+重难点梳理+必考知识点讲解

ACCAF8大神带你全面复习+重难点梳理+必考知识点讲解编辑整理:尊敬的读者朋友们:这里是精品文档编辑中心,本文档内容是由我和我的同事精心编辑整理后发布的,发布之前我们对文中内容进行仔细校对,但是难免会有疏漏的地方,但是任然希望(ACCAF8大神带你全面复习+重难点梳理+必考知识点讲解)的内容能够给您的工作和学习带来便利。

同时也真诚的希望收到您的建议和反馈,这将是我们进步的源泉,前进的动力。

本文可编辑可修改,如果觉得对您有帮助请收藏以便随时查阅,最后祝您生活愉快业绩进步,以下为ACCAF8大神带你全面复习+重难点梳理+必考知识点讲解的全部内容。

下面我将按照Syllabus的五部分,进行分块总结.1、Part A部分,Audit framework and regulation主要是关于审计基本概念、理论和原理的介绍,主要包括了Audit,Assurance Engagement ,Corporate Governance,Professional Ethics ,Conceptual Framework,Internal Audit的相关内容。

这部分内容比较零散,相互之间比较独立,算是记忆性的内容,主要是对后面章节系统化的内容做好知识铺垫,其中Professional Ethics知识点较固定,较简单,容易掌握,因此也是同学们势在必得的分数。

2、Part B部分,Planning and risk assessment主要是审计计划阶段和风险评估,这部分出题的几率和分值都是较高的,需要掌握审计的工作流程(才好做Planning),了解工作流程的过程也是对F8的学习和考核内容的梳理,主要分为:●初次了解企业(Understanding)、●初次进行风险评估(Risk assessment)、●接受业务(Accepting an engagement)、●详细了解企业并进行详尽的风险评估(Assessing risk of materialmisstatement)、●风险应对措施(实时进行,不是单独的一个阶段)、●实施审计程序(Test of control和Substantive procedure)、●收集审计证据(Audit evidence)、●形成审计意见(Audit opinion)、●出具审计报告(Audit report)。

accaF8实质性审计程序总结大全

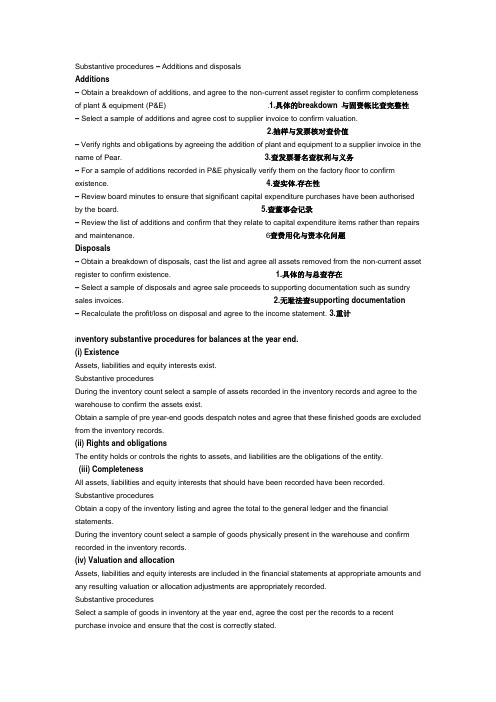

Substantive procedures – Additions and disposalsAdditions– Obtain a breakdown of additions, and agree to the non-current asset register to confirm completeness of plant & equipment (P&E) .1.具体的breakdown 与固资帐比查完整性– Select a sample of additions and agree cost to supplier invoice to confirm valuation.2.抽样与发票核对查价值– Verify rights and obligations by agreeing the addition of plant and equipment to a supplier invoice in the name of Pear. 3.查发票署名查权利与义务– For a sample of additions recorded in P&E physically verify them on the factory floor to confirm existence. 4.查实体.存在性– Review board minutes to ensure that significant capital expenditure purchases have been authorised by the board. 5.查董事会记录– Review the list of additions and confirm that they relate to capital expenditure items rather than repairs and maintenance. 6查费用化与资本化问题Disposals– Obtain a breakdown of disposals, cast the list and agree all assets removed from the non-current asset register to confirm existence. 1.具体的与总查存在– Select a sample of disposals and agree sale proceeds to supporting documentation such as sundry sales invoices. 2.无耻法查supporting documentation– Recalculate the profit/loss on disposal and agree to the income statement. 3.重计i nventory substantive procedures for balances at the year end.(i) ExistenceAssets, liabilities and equity interests exist.Substantive proceduresDuring the inventory count select a sample of assets recorded in the inventory records and agree to the warehouse to confirm the assets exist.Obtain a sample of pre year-end goods despatch notes and agree that these finished goods are excluded from the inventory records.(ii) Rights and obligationsThe entity holds or controls the rights to assets, and liabilities are the obligations of the entity.(iii) CompletenessAll assets, liabilities and equity interests that should have been recorded have been recorded. Substantive proceduresObtain a copy of the inventory listing and agree the total to the general ledger and the financial statements.During the inventory count select a sample of goods physically present in the warehouse and confirm recorded in the inventory records.(iv) Valuation and allocationAssets, liabilities and equity interests are included in the financial statements at appropriate amounts and any resulting valuation or allocation adjustments are appropriately recorded.Substantive proceduresSelect a sample of goods in inventory at the year end, agree the cost per the records to a recent purchase invoice and ensure that the cost is correctly stated.Select a sample of year-end goods and review post year-end sales invoices to ascertain if net realisable value is above cost or if an adjustment is required.Substantive proceduresDepreciation– Review the reasonableness of the depreciation rates applied to the new leisure facilities and compare to industry averages. depreciation rates与同行业比较– Perform a proof in total calculation for the depreciation charged on the equipment, discuss with management if significant fluctuations arise. a proof in total AP– Select a sample of leisure equipment and recalculate the depreciation charge to ensure that thenon-current asset register is correct. Recalculate the depreciation charge 为accuracy– Review the disclosure of the depreciation charges and policies in the draft financial statements.ACCURACY– Review profits and losses on disposal of assets disposed of in the year, to assess the reasonableness of the depreciation policies. profits and losses on disposal of assets 是否合理Food poisoning1– Review the correspondence from the customers claiming food poisoning to assess whether Pineapple has a present obligation as a result of a past event. 存在1– Send an enquiry letter to the lawyers of Pineapple to obtain their view as to the probability of the claim being successful.1– Review board minutes to understand whether the directors believe that the claim will be successful or not.2– Review the post year-end period to assess whether any payments have been made to any of the claimants. 数字2– Discuss with management as to whether they propose to include a contingent liability disclosure or not, consider the reasonableness of this.3 Obtain a written management representation confirming management’s view that the lawsuit is unlikely to be successful and hence no provision is required. 发誓3– Review the adequacy of any disclosures made in the financial statements.Substantive procedures over year-end trade payables– Obtain a listing of trade payables from the purchase ledger and agree to the general ledger and the financial statements. 1账户比数字– Review the list of trade payables against prior years to identify any significant omissions.1与去年比数字–Calculate the trade payable days for Greystone and compare to prior years, investigate any significant differences. 1计算payable days比数字– Select a sample of goods received notes before the year-end and follow through to inclusion in the year-end payables balance, to ensure correct cut-off.– Review after date payments, if they relate to the current year 2 cutoff– Obtain supplier statements and reconcile these to the purchase ledger balances, and investigate any reconciling items. 与供货方比较信息accuracy–Enquire of management their process for identifying goods received but not invoiced or logged in the purchase ledger and ensure that it is reasonable to ensure completeness of payables.询问对收到货但是未收到发票情况的处理方法– Review the purchase ledger for any debit balances, for any significant amounts discuss with management and consider reclassification as current assets. 数据出现异常与管理层讨论原因– Ensure payables included in financial statements as current liabilities. 无耻法正确做账directors’ bonus and remuneration– Obtain a schedule of the directors’ remuneration including the bonus paid and cast the addition of the schedule.– Agree the individual bonus payments to the payroll records. 12都是账实对照查准确性– Confirm the amount of each bonus paid by agreeing to the cash book and bank statements.– Review the board minutes to confirm whether any additional bonus payments relating to this year have been agreed. 董事会记录–Obtain a written representation from management confirming the completeness of directors’ remuneration including the bonus. 书面– Review any disclosures made of the bonus and assess whether these are in compliance with local legislation. 查是否合法合规Audit procedures regarding non-depreciation of buildings– Review audit file to ensure that sufficient appropriate audit evidence has been collected in respect of this matter.– Ensure that GAAP does apply to the specific buildings owned by Galartha Co and that a departure from GAAP is not needed in order for the financial statements to show a true and fair view.– Meet with the directors to confirm their reasons for not depreciating buildings.– Warn the directors that in your opinion buildings should be depreciated and that failure to provide depreciation will result in a modified audit report.– Determine the effect of the disagreement on the audit report in terms of the modified opinion being material or of pervasive materiality to the financial statements.– Draft the appropriate sections of the modified audit report.– Obtain a letter of representation from the directors confirming that depreciation will not be charged on buildings.Procedures to confirm i nventory held at third party locations– Send a letter requesting direct confirmation of inventory balances held at year end from the third party warehouse 函证providers used by Abrahams Co regarding quantities and condition.– Attend the inventory count (if one is to be performed) at the third party warehouses to review the controls in operation to ensure the completeness and existence of inventory. 参与盘点– Inspect any reports produced by the auditors of the warehouses in relation to the adequacy of controls over inventory. 检查报告– Inspect any documentation in respect of third party inventory. 检查第三方仓储文件(ii) Procedures to confirm use of standard costs for inventory valuation–Discuss with management of Abrahams Co the basis of the standard costs applied to the inventoryvaluation, and how often these are reviewed and updated. 与管理层讨论– Review the level of variances between standard and actual costs and discuss with management how these are treated. 与管理层讨论差别– Obtain a breakdown of the standard costs and agree a sample of these costs to actual invoices or wage records to assess their reasonableness. 明细检查差错Going concern procedures–Obtain the company’s cash flow forecast and review the cash in and out flows. Assess the assumptions for reasonableness and discuss the findings with management to understand if the company will have sufficient cash flows.–Review the company’s post year-end sales and order book to assess if the levels of trade are likely to increase and if the revenue figures in the cash flow forecast are reasonable.– Review the loan agreement and recalculate the covenant which has been breached. Confirm the timing and amount of the loan repayment.– Review any agreements with the bank to determine whether any other covenants have been breached, especially in relation to the overdraft.– Discuss with the directors whether they have contacted any alternative banks for finance to assess whether they have any other means of repaying the loan of $4·8m.– Review any correspondence with shareholders to assess whether any of these are likely to increasetheir equity investment in the company. 财务– Review post year-end correspondence with suppliers to identify if any others have threatened legal action or refused to supply goods.– Discuss with the finance director whether the sales director has yet been replaced and whether anynew customers have been obtained to replace the one lost. 运营– Enquire of the lawyers of Strawberry as to the existence of any additional litigation and request theirassessment of the likely amounts payable to the suppliers. 法律– Perform audit tests in relation to subsequent events to identify any items that might indicate or mitigate the risk of going concern not being appropriate.– Review the post year-end bo ard minutes to identify any other issues that might indicate further financial difficulties for the company.– Consider whether the g oing concern basi s is appropriate for the preparation of the financial statements.– Obtain a written representation c onfirming the director’s vi ew that Strawberry is a going concern.其他Procedures the auditor should adopt in respect of auditing accounting estimates include:–Enquire of management how t he accounting estimate is made and the d ata on which it is based.–Determine whether events occurring up to the date of the auditor’s report (after the reporting period) provide audit evidence regarding the accounting estimate.–Review the method of measurement used and assess the r easonableness o f assumptions made.– Test the operating effectiveness of the controls over how management made the accounting estimate.– Evaluate overall whether the accounting estimates in the financial statements are either reasonable or misstated.–Obtain sufficient appropriate audit evidence about whether the disclosures in the financial statements related to accounting estimates and estimation uncertainty are reasonable.–Obtain written representations from management and, where appropriate, those charged with governance whether they believe significant assumptions used in making accounting estimates are reasonable.Procedures during the inventory count–Observe the counting teams of Lily to confirm whether the inventory count instructions are being followed correctly.–observe the procedures for identifying and segregating damaged goods are operating correctly.–Observe the procedures for movements of inventory during the count, to confirm that no raw materials or finished goods have been omitted or counted twice.– Select a sample and perform test counts from inventory sheets to warehouse aisle and from warehouse aisle to inventory sheets.– Select a sample of damaged items as noted on the inventory sheets and inspect these windows to confirm whether the level of damage is correctly noted.– Obtain a photocopy of the completed sequentially numbered inventory sheets for follow up testing on the final audit.– Discuss with the warehouse manager how he has estimated the raw materials quantities. To the extent that it is possible, re-perform the procedures adopted by the warehouse manager.– Identify and record any inventory held fo r third parties (if any) and confirm that it is excluded from the count.Audit procedures using CAATSThe audit team can use audit software to calculate inventory days for the year-to-date to compare against the prior year to identify whether inventory is turning over slower, as this may be an indication that it is overvalued.Audit software can be utilised to produce an aged inventory analysis to identify any slow moving goods, which may require write down or an allowance.Cast the inventory listing to confirm the completeness and accuracy of inventory.Audit software can be used to select a representative sample of items for testing to confirm net realisable value and/or cost.Audit software can be utilised to recalculate cost and net realisable value for a sample of inventory. CAATs can be used to verify cut-off by testing whether the dates of the last GRNs and GDNs recorded relate to pre year end; and that any with a date of 1 January 2013 onwards have been excluded from the inventory records.CAATs can be used to confirm whether any inventory adjustments noted during the count have been correctly updated into final inventory records.Procedures the auditor should adopt in respect of auditing this accrual include:–Agree the year-end income tax payable accrual to the payroll records to confirm accuracy.– Agree the subsequent payment to the post year-end cash book and bank statements to confirm completeness.–Recalculation of the accrual to confirm accuracy.– Review any disclosures made of the income tax accrual and assess whether these are in compliance with accounting standards and legislation.Audit procedures for continuous (perpetual) inventory counts– The audit team should attend at least one of the c ontinuous (perpetual) inventory counts t o review whether the controls over the inventory count are adequate.– C onsider attending the inventory count at the year end to undertake test counts of inventory from records to floor and from floor to records in order to confirm the existence and completeness of inventory.– Review the adjustments made to the inventory records on a monthly basis to gain an understanding of the level of differences arising on a month by month basis.– If significant differences consistently arise, this could indicate that the inventory records are not adequately maintained. D iscuss with manageme nt how they will ensure that year-end inventory will not be under or overstated.Procedures to undertake in relation to the uncorrected misstatement– The extent of the potential misstatement should be considered and therefore a large sample of inventory items should be tested to identify the possible size of the misstatement.– The potential misstatement should be d iscussed with Clarinet Co’s management in order to understand why these inventory differences are occurring.– The misstatement should be compared to materiality to assess if the error is materia l individually.– If not, then it should be added to other errors noted during the audit to assess if in aggregate the uncorrected errors are now material.– If material, the auditors should ask the directors to adjust the inventory balances to correct the misstatements identified in the 2014 year end.– Request a written representation from the directors about the uncorrected misstatements including the inventory errors.– Consider the implication for the audit report if the inventory errors are material and the directorsr efuses to make adjustments.Receivables circularisation– procedures 步骤– Obtain a list of receivables balances, cast this and agree it to the receivables control account total at the end of theyear. Ageing of receivables may also be verified at this time.–Determine an appropriate sampling method (cumulative monetary amount, value-weighted selection, random, etc.)–Select the balances to be tested, with specific reference to the categories of receivable noted below. – Extract details of each receivable selected from the ledger and prepare circularisation letters.– Ask the chief accountant at Seeley Co (or other responsible official) to sign the letters.– The auditor posts or faxes the letters to the individual receivables.Substantive procedures to confirm valuation of inventory– Select a representative sample of goods in inventory at the year end, agree the cost per the records to a recent purchase invoice and ensure that the cost is correctly stated.– Select a sample of year end goods and review post year end sales invoices to ascertain if NRV is above cost or if an adjustment is required.– For a sample of manufactured items obtain cost sheets and confirm:–raw material costs to recent purchase invoices–labour costs to time sheets or wage records–overheads allocated are of a production nature.– Review aged inventory reports and identify any slow moving goods, discuss with management why these items have not been written down.– Review the inventory records to identify the level of adjustments made throughout the year for damaged/obsolete items. If significant consider whether the year end records require further adjustments and discuss with management whether any further write downs/provision may be required. – Follow up any damaged/obsolete items noted by the auditor at the inventory counts attended, to ensure that the inventory records have been updated correctly.– Perform a review of the average inventory days for the current year and compare to prior year inventory days. Discuss any significant variations with management.Substantive procedures to confirm completeness of provisions or contingent liability– Discuss with management the nature of the dispute between Smoothbrush and the former finance director (FD), to ensure that a full understanding of the issue is obtained and to assess whether an obligation exists.–Write to the company’s lawyers to obtain their views as to the probability of the FD’s claim being successful.– Review board minutes and any company correspondence to assess whether there is any evidence to support the former FD’s claims of unfair dismissal.– Obtain a written representation from the directors of Smoothbrush confirming their view that the former FD’s chances of a successful claim are remote, and hence no provision or contingent liability is required.Substantive procedures over bank balance:–Obtain the company’s bank reconciliatio n and c heck the additions t o e nsure arithmeticalaccuracy.– Obtain a b ank confi rmation lett er from the company’s bankers.– Verify the balance per the bank statement to an original year end bank statement and also to the bank confi rmation letter.– Verify the rec onciliation’s balanc e per the cash book t o the year end cash book.– Trace all of the outstanding lodgement s to the pre year end cash book, post year end bank statement and also to paying-in-book pre year end.– Trace all u npresented cheques through to a pre year end cash book and post year end statement. For any unusual amounts or signifi cant delays obtain explanations from management.– Review the cash book and bank statements for any u nusual items or large transfers around the year end, as this could be evidence of window dressing.– Examine the bank confi rmation letter for details of any security provided by the company or any legal right of set-off as this may require disclosure.Appropriate procedures to determine that net realisable value of book inventory is above cost would include:(1) Assessment of estimated proceeds from the sale of items of inventory. Sales price in the period following the year-end is one important element of net realisable value. Procedures to determine sales prices include:– Obtain actual sales prices by reference to invoices issued after the year-end and determine that the sales were genuine by vouching sales invoices to orders, despatch notes and subsequent receipt of cash.– If actual sales prices are not available, the auditor should obtain estimated sales prices from management. It would be necessary to assess how reasonable these estimated prices were. The auditor might be aided in this respect by reviewing the reports from sales staff backed up by discussions with management.– Particular attention should be paid to sales prices of books identifi ed as slow-moving. (Tutorial note: Slowmoving books might be identifi ed by obtaining lists of sales made in the preceding (say) six months and reviewing reports from sales staff. The sales statistics would also be useful in this respect.)– For damaged books disposal price may be nil or very low and the auditor should examine records of disposal of such books in the past. (Tutorial note: Damaged books should have been identifi ed during the inventory count.)(2) Determine estimated costs to completion. These costs represent another important element of net realisable value.Relevant procedures include:– Some books may still be in production and will initially be included in inventory at cost to date; for example, they may have been printed but not bound. The auditor should examine production budgets and actual costs (for binding, for example) to determine actual costs to completion. (Tutorial note: It is not uncommon for publishers to print books but leave them unbound until sales in the immediate future are expected.)– Books returned may incur extra costs before they can be made ready for resale and the auditor should examine cost records to obtain a reasonable estimate of such costs.(3) Determine costs to be incurred in marketing, selling and distributing directly related to theitems in question.– In general terms the auditor may determine the percentage relationship between sales and selling and distribution expenses.– However, the distribution costs of heavy books are likely to be higher than for (say) light paperback books and the auditor should assess whether the cost weighting is reasonable.(4) All of the above matters should be discussed with management bearing in mind that, although they represent an internal source of evidence, they are the most informed people regarding the saleability of books on hand and regarding determination of the various elements of net realisable value.(5) Discuss with management the need for an inventory provision for slow moving and/or obsolete books.Audit procedures adopted in the examination of the cash fl ow forecast would include:(1) Check that the opening balance of the cash forecast is in agreement with the closing balance of the cash book, to ensure the opening balance of the forecast is accurate.(2) Consider how accurate company forecasts have been in the past by comparing past forecasts with actual outcomes. If forecasts have been reasonably accurate in the past, this would make it more likely that the current forecast is reliable.(3) Determine the assumptions that have been made in the preparation of the cash fl ow forecast. For example, the company is experiencing a poor economic climate, so you would not expect cash fl ows from sales and realisation of receivables to increase, but either to decrease or remain stable. You are also aware that costs are rising so you would expect cost increases to be refl ected in the cash forecasts.(4) Examine the sales department detailed budgets for the two years ahead and, in particular, discuss with them the outlets that they will be targeting. This would help the auditor determine whether the cash derived from sales is soundly based.(5) Examine the pr oduction department’s assessment of the non-current assets required to increase the production of white bread to the level required by the sales projections. Obtain an assessment of estimated cost of non-current assets, reviewing bids from suppliers, if available. This would provide evidence on material cash outfl ows.(6) Consider the adequacy of the increased working capital that will be required as a result of the expansion. Increased working capital would result in cash outfl ows and it would be important to establish its adequacy.(7) If relevant review the post year end period to compare the actual performance against the forecast fi gures.(8) Recalculate and cast the cash fl ow forecast balances.(9) Review board minutes for any other relevant issues which should be included within the forecast.(10) Review the work of the internal audit department in preparing the cash fl ow forecast.Fire at warehouse(i) Audit procedures– Discuss the matter with the directors checking whether the company has sufficient inventory to continue trading in the short term.– Enquire that the directors are satisfied that the company can continue to trade in the longer term. Ask the directors to sign an additional letter of representation to this effect.– Obtain a schedule showing the inventory destroyed and if possible check this is reasonable given past production records and inventory valuations.– Enquire that the insurers have been informed. Review correspondence from the insurers confirming theamount of the insurance claim.– Consider whether or not EastVale can continue as a going concern, given the loss of inventory and potential damage to the company’s reputation if customer orders cannot be fulfilled.Batch of cheese(i) Audit procedures– Discuss the matter with the directors, determining specifically whether there was any fault in the production process.– Obtain a copy of the damages claim and again discuss with the directors the effect on EastVale and the possibility of success of the claim.–Obtain independent legal advice on the claim from EastVale’s lawyers. Attempt to determine the extent of damages that may have to be paid.– Review any press reports about the contaminated cheese. Consider the impact on the reputation of EastVale and whether the company can continue as a going concern.– Discuss the going concern issue with the directors. Obtain an additional letter of representation on the directors’ opinion of the going concern status of EastVale.Substantive procedures to confi rm Tinkerbell’s revenue:– Compare the overall level of revenue against prior years and budget and investigate any significant fluctuations.– Obtain a schedule of sales for the year broken down into the major categories of toys manufactured and compare this to the prior year breakdown and for any unusual movements discuss with management.– Calculate the gross margin for Tinkerbell and compare this to the prior year and investigate any significant fluctuations.– Select a sample of sales invoices for larger customers and recalculate the discounts allowed to ensure that these are accurate.– Recalculate for a sample of invoices that the sales tax has been correctly applied to the sales invoice. – Select a sample of customer orders and agree these to the despatch notes and sales invoices through to inclusion in the sales ledger to ensure completeness of revenue.– Select a sample of despatch notes both pre and post the year end, follow these through to sales invoices in the correct accounting period to ensure that cut-off has been correctly applied.– Select a sample of credit notes issued after the year end and follow through to sales invoice to ensure the returns were recorded in the proper period.。

ACCA考试考纲要点整理之F8

ACCA考试考纲要点整理之F8本文由高顿ACCA整理发布,转载请注明出处2015年ACCA F8科目考试重点解读第一步:Acceptance of a clientLowballing的概念Client screening的概念Engagement letter:written form,terms of responsibilities of mgt and auditors, known by mgt and auditors.基础的概念要了解是什么意思,会写定义,对于审计鉴证业务约定书,要明确这个约定书的内容以及签订的目的第二步:Understanding the business需要掌握的知识点有:Fraud:区别fraud与human error的,明确mgt和external auditors对于fraud的不同责任interim audit与final audit的区别Business risk与audit riskmateriality:定义,计算基准,benchmarkDocumentation: permanent和current audit files的区别这部分知识点经常在历年考题的Q3中出现,给你一个情景,让你找到这个被审计客户的audit risk并且写出审计人员的应对方案,我们说凡是涉及到企业的新的改变,比如上马一套新的应用系统,制定一个新的策略,都是我们审计需要关注的地方,都是audit risk容易产生的地方,尤其要对涉及到的相应的会计准则的处理非常熟悉。

第三步:内控测试,考试题型分为两种:给予一个情景,让你分析内控环节的缺陷,并且提出相应的改进意见针对一个健全的内控体系,做内控测试,写出内控测试的流程考试时,要牢记凡是让写内控相关测试,你用的方法一般就是general的审计流程,具体的有:inquire,inspect,review,re-perform,re-calculate, analytical procedure第四步:实质性测试重点掌握sales, procedure, PPE, inventory, cash and bank, payroll,liabilities的实质性测试流程第五步:考虑期后事项(分为调整事项和非调整事项)持续经营假设(持续经营的概念;影响持续经营的因素针对持续经营假设出现问题的客户,相应的审计流程是什么)这里要牢记期后事项的概念以及对于期后事项审计师的主动义务,还有判断期后事项是否需要调整的一个方法,考试中,经常出现的场景判断就是对于火灾(非调整的期后事项),诉讼(需要调整的期后事项,因为事实是年前就已经发生,只不过年后才诉讼)要学会判断第六步:对财务报表做最后的复合(了解概念就可以)第七步:发表审计意见重点掌握审计报告的类型,各种审计意见的类型及表达本文由高顿ACCA整理发布,转载请注明出处,更多ACCA资讯请关注高顿ACCA官网:。

ACCA考试《审计与认证业务F8》知识点总结

ACCA考试《审计与认证业务F8》知识点总结本文由高顿ACCA整理发布,转载请注明出处ISA 315 (REVISED),IDENTIFYING AND ASSESSING THE RISKS OF MATERIAL MISSTATEMENT THROUGH UNDERSTANDING THE ENTITY AND ITS ENVIRONMENTOne of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal controlThe International Auditing and Assurance Standards Board (IAASB)issues International Standard on Auditing (ISA)for international use. From time to time, ISAs are revised to provide updated standards to auditors. In order to enhance the overall quality of audit, IAASB published a consultation draft on a proposed revision to ISA 315. The objective in revising ISA 315 is to enhance the performance of external auditors by applying the knowledge and findings of an entity’s internal audit function in the risk assessment process, and to strengthen the framework for evaluating the use of internal auditors work to obtain audit evidence.In March 2012, ISA 315 (Revised)was approved and released. One of the major revisions of ISA 315 relates to the inquiries made by external auditors of the internal audit function since internal auditors have better knowledge and understanding of the organisation and its internal control. This article addresses and highlights the components of internal control.OBJECTIVES IN ESTABLISHING INTERNAL CONTROLSGenerally speaking, internal control systems are designed, implemented and maintained by the management and personnel in order to provide reasonable assurance to fulfil the objectives – that is, reliability of financial reporting, efficiency and effectiveness of operations, compliance with laws and regulations and risk assessment of material misstatement. The manner in which the internal control system is designed, implemented and maintained may vary with the entity’s business nature, size an d complexity, etc. Auditors focus on both the audit of financial statements and internal controls that relates to the three objectives that may materially affect financial reporting.In order to identify the types of potential misstatements and to determine the nature, timing and extent of audit testing, auditors should obtain an understanding of relevant internal controls, evaluate the design of the controls, and ascertain whether the controls are implemented and maintained properly.The major comp onents of internal control include control environment, entity’s risk assessment process, information system (including the related business processes, control activities relevant to the audit, relevant to financial reporting, and communication)and monitoring of controls.ACCACONTROL ENVIRONMENTThe control environment consists of the governance and management functions and the attitudes, awareness and actions of the management about the internal control. Auditors may obtain an understanding of the control environments through the following elements.1. Communication and enforcement of integrity and ethical values It is important for the management to create and maintain honest, legal and ethical culture, and to communicate the entity’s eth ical and behavioral standards to its employees through policy statements and codes of conduct, etc.2. Commitment to competence It is important that the management recruits competent staff who possess the required knowledge and skills at competent level to accomplish tasks.3. Participation by those charged with governance An entity’s control consciousness is influenced significantly by those charged with governance; therefore, their independence from management, experience and stature, extent of their involvement, as well as the appropriateness of their actions are extremely important.4. Management’s philosophy and operating style Management’s philosophy and operating style consists of a broad range of characteristics, such as management’s atti tude to response to business risks, financial reporting, information processing, and accounting functions and personnel, etc. For example, does the targeted earning realistic? Does themanagement apply aggressive approach where alternative accounting principles or estimates are available? These management’s philosophy and operating style provide a picture to auditors about the management’s attitude about the internal control.5. Organisational structure The organisational structure provides the framework on how the entity’s activities are planned, implemented, controlled and reviewed.6. Assignment of authority and responsibility With the established organisational structure or framework, key areas of authority andreporting lines should then be defined. The assignment of authority and responsibility include the personnel that make appropriate policies and assign resources to staff to carry out the duties. Auditors may perceive the implementation of internal controls through the understanding of the organisational structure and the reporting relationships.7. Human resources policies and practices Human resources policies and practices generally refer to recruitment, orientation, training, evaluation, counselling, promotion, compensation and remedial actions. For example, an entity should establish policies to recruit individuals based on their educational background, previous work experience, and other relevant attributes. Next, classroom and on-the-job training should be provided to the newly recruited staff. Appropriate training is also available to existing staff to keep themselves updated. Performance evaluation should be conducted periodically to review the staff performance and provide comments and feedback to staff on how to improve themselves and further develop their potential and promote to the next level by accepting more responsibilities and, in turn, receiving competitive compensation and benefits.With the ISA 315 (Revised),external auditors are now required to make inquiries of the internal audit function to identify and assess risks of material misstatement. Auditors may refer to the management’s responses of the identified deficiencies of the internal controls and determine whether the management has taken appropriate actions to tackle the problems properly. Besides inquiries of the internal audit function, auditors may collect audit evidence of the control environment through observation on how the employees perform their duties, inspection of the documents, and analytical procedures. After obtaining the audit evidence of the control environment, auditors may then assess the risks of material misstatement.ENTITY’S RISK ASSESSMENT PROCESSAuditors should assess whether the entity has a process to identify the business risks relevant to financial reporting objectives, estimate the significance of them, assess the likelihood of the risks occurrence, and decide actions to address the risks. If auditors have identified such risks, then auditors should evaluate the reasons why the risk assessment process failed to identify the risks, determine whether there is significant deficiency in internal controls in identifying the risks, and discuss with the management.THE INFORMATION SYSTEM, INCLUDING THE RELEVANT BUSINESS PROCESSES, RELEVANT TO FINANCIAL REPORTING AND COMMUNICATIONAuditors should also obtain an understanding of the information system, including the related business processes, relevant to financial reporting, including the following areas:? The classes of transactions in the entity’s operations that are significant to the financial statements. The procedures that transactions are initiated, recorded, processed, corrected as necessary, transferred to the general ledger and reported in the financial statements.? How the information system captures events and conditions that are significant to the financial statements.? The financial reporting process used to prepare the entity’s financial statements.? Controls surrounding journal entries.? Understand how the entity communicates financial reporting roles, responsibilities and significant matters to those charged with governance and external – regulatory authorities.CONTROL ACTIVITIES RELEVANT TO THE AUDITAuditors should obtain a sufficient understanding of control activities relevant to the audit in order to assess the risks of material misstatement at the assertion level, and to design further audit procedures to respond to those risks. Control activities, such as proper authorisation of transactions and activities, performance reviews, information processing, physical control over assets and records, and segregation of duties, are policies and procedures that address the risks to achieve the management directives are carried out.MONITORING OF CONTROLSIn addition, auditors should obtain an understanding of major types of activities that the entity uses to monitor internal controls relevant to financial reporting and how the entity initiates corrective actions to its controls. For instance, auditors should obtain an understanding of the sources and reliability of the information that the entity used in monitoring the activities. Sources of information include internal auditor report, and report from regulators.LIMITATIONS OF INTERNAL CONTROL SYSTEMSEffective internal control systems can only provide reasonable, not absolute, assurance to achieve the entity’s financial reporting objective due to the inherent limitations of internal control – for example, management override of internal controls. Therefore, auditors should identify and assess the risks of material misstatement at the financial statement level and assertion level for classes of transactions, account balances and disclosures.CONCLUSIONAs internal auditors have better understanding of the organisation and expertise in its risk and control, the proposed requirement for the external auditors to make enquiries of internal audit function in ISA 315 (Revised)will enhance the effectiveness and efficiency of audit engagements. External auditors should pay attention to the components of internal control mentioned above in order to make effective andefficient enquiries. An increase in the work of internal audit functions is also expected because of such proposed requirement.Raymond Wong, School of Accountancy, The Chinese University of Hong Kong, and Dr Helen Wong, Hong Kong Community College, Hong Kong Polytechnic UniversityReference ISA 315 (Revised),Identifying and Assessing the Risks of Material Misstatement Through Understanding the Entity and Its Environment更多ACCA资讯请关注高顿ACCA官网:。

ACCA知识点:F8理解审计战略和审计计划

ACCA知识点:F8理解审计战略和审计计划在ACCA考试中,F8当中理解审计战略和审计计划一直是大纲中最为重要,也是难点最多的一部分知识点。

那么今天就为同学们总结一下F8当中理解审计战略和审计计划的习题讲解,这部分内容体系比较复杂重要,所以帮助大家做些题目逐渐了解这章内容。

Audit is a subject where sharp minds can excel. What is really demanded of us is understanding ‘materiality’. As simple as it sounds, it can be the reason why many students might fail paper F8. The first question was about Audit Strategy. And ‘materiality’ was definitely a part of it. Do you know the role of the audit strategy and audit plan in defining materiality?Audit strategy and materialityAn audit strategy outlines the OBJECTIVES of the audit that is to be performed – like crafting the skeleton of a body. The details are yet to be filled in.Once the internal control environment and the risk assessment system of the entity is understood, the independent auditor then needs to define an OVERALL materiality level. This consists of two important components:Performance Materiality, andTolerable Misstatement ErrorThe auditor defines each of the two components. The performance materiality aswell as the tolerable misstatement error differs from organisation to organisation, market to market and economy to economy.Audit plan and materialityThe audit plan is an important document. ISA 300 is the governing standard here. The audit plan provides guidance on:The directionThe supervision, andThe review of audit proceduresWhile going through ISA 320 – Audit Materiality in the study text, I ran a few searches online, discovering that the US regulates its audit procedures under Statements on Auditing Standards (SAS). These are a collection of Generally Accepted Auditing Standards (GAAS).I opened SAS 122, section 320, which was titled Materiality in Planning and Performing an Audit. There, I found what I was looking for – the audit plan:Helps give the auditor insight regarding the effect of the nature of an organisation in defining materiality.Helps outline situation-based factors influencing the materiality.Allows the auditor to take in account several other factors to establisheffective materiality levels.Lets the auditor document any changes/revisions in the materiality level initially defined by the auditor if crucial evidence is found later on at the performance stage.Takes into account any possible changes to the performance materiality level following any change/revision in the overall materiality level.As part of the ACCA student network, we all need to understand the basics of audit firmly to excel in our careers. I believe ACCA studies do not just keep you confined to one book in your bag, but demand you to research on your own.I would love to hear your thoughts on this. Let me know if this article has helped you on your path to success in Paper F8.获取更多ACCA考试知识点可关注永和九年,岁在癸丑,暮春之初,会于会稽山阴之兰亭,修禊事也。

2021注册会计师《审计》知识点-实质性程序

2021注册会计师《审计》知识点:实质性程序自己整理的2021注册会计师《审计》知识点:实质性程序相关文档,希望能对大家有所帮助,谢谢阅读!实质性程序[部分]第八章风险应对[知识点]实质性程序实质性程序一、实质性程序的含义和要求(一)实质性程序和强制性的目的实质性程序用于发现认知层面的重大错报。

无论评估的重大错报风险结果如何,应对所有类型的交易、账户余额和所有主要类别的披露实施实质性程序[重大强制性]。

(2)特殊风险的实质性程序如果针对特殊风险实施的程序只是实质性程序[没有控制测试],这些程序应包括详细的测试。

仅仅进行实质性分析【既不是控制测试,也不是细节测试】不足以获得关于特殊风险的充分和适当的审计证据。

注册会计师应专门针对特殊风险设计和实施实质性程序。

例如,如果认为管理层可能在实现利润的压力下提前确认收入【欺诈、特殊风险】,确认函不仅要考虑确认应收账款的账户余额【常规程序】,还要考虑【不可预见程序】:1.对照交货、结算和退货条款,查询并核实销售协议的详细条款;2.向非财务人员询问销售协议及其变更。

附件:特殊风险概述1.识别特殊风险时,不能考虑内部控制的抵消作用;2.在理解与特殊风险相关的控制时,不仅要理解常规控制,还要理解专门设计和实施的有针对性的控制;3.在测试与特殊风险相关的控制时,不能依靠往年进行的控制测试来形成结论,必须在此期间实施控制测试;4.在处理特殊风险时,不仅要实施常规的实质性程序,还要针对特殊风险设计和实施特殊的实质性程序;特殊程序不能只是实质性分析程序:要么是实质性分析与控制测试相结合,要么是实质性分析与细节测试相结合,要么是完全实施细节测试,要么是控制测试与细节测试相结合。

二.实质性程序的性质(a)实质性程序的类型1.实体程序的性质是指实体程序的类型和组合。

比如库存监控就是由查询、观察、实物检查组成的程序。

2.具体类型的实质性程序包括:(1)明细测试【单项业务检查、查询、观察、确认、重算】;(2)实质性分析程序[批处理程序。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

Substantive procedures – Additions and disposalsAdditions– Obtain a breakdown of additions, and agree to the non-current asset register to confirm completeness of plant & equipment (P&E) .1.具体的breakdown 与固资帐比查完整性– Select a sample of additions and agree cost to supplier invoice to confirm valuation.2.抽样与发票核对查价值– Verify rights and obligations by agreeing the addition of plant and equipment to a supplier invoice in the name of Pear. 3.查发票署名查权利与义务– For a sample of additions recorded in P&E physically verify them on the factory floor to confirm existence. 4.查实体.存在性– Review board minutes to ensure that significant capital expenditure purchases have been authorised by the board. 5.查董事会记录– Review the list of additions and confirm that they relate to capital expenditure items rather than repairs and maintenance. 6查费用化与资本化问题Disposals– Obtain a breakdown of disposals, cast the list and agree all assets removed from the non-current asset register to confirm existence. 1.具体的与总查存在– Select a sample of disposals and agree sale proceeds to supporting documentation such as sundry sales invoices. 2.无耻法查supporting documentation– Recalculate the profit/loss on disposal and agree to the income statement. 3.重计i nventory substantive procedures for balances at the year end.(i) ExistenceAssets, liabilities and equity interests exist.Substantive proceduresDuring the inventory count select a sample of assets recorded in the inventory records and agree to the warehouse to confirm the assets exist.Obtain a sample of pre year-end goods despatch notes and agree that these finished goods are excluded from the inventory records.(ii) Rights and obligationsThe entity holds or controls the rights to assets, and liabilities are the obligations of the entity.(iii) CompletenessAll assets, liabilities and equity interests that should have been recorded have been recorded. Substantive proceduresObtain a copy of the inventory listing and agree the total to the general ledger and the financial statements.During the inventory count select a sample of goods physically present in the warehouse and confirm recorded in the inventory records.(iv) Valuation and allocationAssets, liabilities and equity interests are included in the financial statements at appropriate amounts and any resulting valuation or allocation adjustments are appropriately recorded.Substantive proceduresSelect a sample of goods in inventory at the year end, agree the cost per the records to a recent purchase invoice and ensure that the cost is correctly stated.Select a sample of year-end goods and review post year-end sales invoices to ascertain if net realisable value is above cost or if an adjustment is required.Substantive proceduresDepreciation– Review the reasonableness of the depreciation rates applied to the new leisure facilities and compare to industry averages. depreciation rates与同行业比较– Perform a proof in total calculation for the depreciation charged on the equipment, discuss with management if significant fluctuations arise. a proof in total AP– Select a sample of leisure equipment and recalculate the depreciation charge to ensure that thenon-current asset register is correct. Recalculate the depreciation charge 为accuracy– Review the disclosure of the depreciation charges and policies in the draft financial statements.ACCURACY– Review profits and losses on disposal of assets disposed of in the year, to assess the reasonableness of the depreciation policies. profits and losses on disposal of assets 是否合理Food poisoning1– Review the correspondence from the customers claiming food poisoning to assess whether Pineapple has a present obligation as a result of a past event. 存在1– Send an enquiry letter to the lawyers of Pineapple to obtain their view as to the probability of the claim being successful.1– Review board minutes to understand whether the directors believe that the claim will be successful or not.2– Review the post year-end period to assess whether any payments have been made to any of the claimants. 数字2– Discuss with management as to whether they propose to include a contingent liability disclosure or not, consider the reasonableness of this.3 Obtain a written management representation confirming management’s view that the lawsuit is unlikely to be successful and hence no provision is required. 发誓3– Review the adequacy of any disclosures made in the financial statements.Substantive procedures over year-end trade payables– Obtain a listing of trade payables from the purchase ledger and agree to the general ledger and the financial statements. 1账户比数字– Review the list of trade payables against prior years to identify any significant omissions.1与去年比数字–Calculate the trade payable days for Greystone and compare to prior years, investigate any significant differences. 1计算payable days比数字– Select a sample of goods received notes before the year-end and follow through to inclusion in the year-end payables balance, to ensure correct cut-off.– Review after date payments, if they relate to the current year 2 cutoff– Obtain supplier statements and reconcile these to the purchase ledger balances, and investigate any reconciling items. 与供货方比较信息accuracy–Enquire of management their process for identifying goods received but not invoiced or logged in the purchase ledger and ensure that it is reasonable to ensure completeness of payables.询问对收到货但是未收到发票情况的处理方法– Review the purchase ledger for any debit balances, for any significant amounts discuss with management and consider reclassification as current assets. 数据出现异常与管理层讨论原因– Ensure payables included in financial statements as current liabilities. 无耻法正确做账directors’ bonus and remuneration– Obtain a schedule of the directors’ remuneration including the bonus paid and cast the addition of the schedule.– Agree the individual bonus payments to the payroll records. 12都是账实对照查准确性– Confirm the amount of each bonus paid by agreeing to the cash book and bank statements.– Review the board minutes to confirm whether any additional bonus payments relating to this year have been agreed. 董事会记录–Obtain a written representation from management confirming the completeness of directors’ remuneration including the bonus. 书面– Review any disclosures made of the bonus and assess whether these are in compliance with local legislation. 查是否合法合规Audit procedures regarding non-depreciation of buildings– Review audit file to ensure that sufficient appropriate audit evidence has been collected in respect of this matter.– Ensure that GAAP does apply to the specific buildings owned by Galartha Co and that a departure from GAAP is not needed in order for the financial statements to show a true and fair view.– Meet with the directors to confirm their reasons for not depreciating buildings.– Warn the directors that in your opinion buildings should be depreciated and that failure to provide depreciation will result in a modified audit report.– Determine the effect of the disagreement on the audit report in terms of the modified opinion being material or of pervasive materiality to the financial statements.– Draft the appropriate sections of the modified audit report.– Obtain a letter of representation from the directors confirming that depreciation will not be charged on buildings.Procedures to confirm i nventory held at third party locations– Send a letter requesting direct confirmation of inventory balances held at year end from the third party warehouse 函证providers used by Abrahams Co regarding quantities and condition.– Attend the inventory count (if one is to be performed) at the third party warehouses to review the controls in operation to ensure the completeness and existence of inventory. 参与盘点– Inspect any reports produced by the auditors of the warehouses in relation to the adequacy of controls over inventory. 检查报告– Inspect any documentation in respect of third party inventory. 检查第三方仓储文件(ii) Procedures to confirm use of standard costs for inventory valuation–Discuss with management of Abrahams Co the basis of the standard costs applied to the inventoryvaluation, and how often these are reviewed and updated. 与管理层讨论– Review the level of variances between standard and actual costs and discuss with management how these are treated. 与管理层讨论差别– Obtain a breakdown of the standard costs and agree a sample of these costs to actual invoices or wage records to assess their reasonableness. 明细检查差错Going concern procedures–Obtain the company’s cash flow forecast and review the cash in and out flows. Assess the assumptions for reasonableness and discuss the findings with management to understand if the company will have sufficient cash flows.–Review the company’s post year-end sales and order book to assess if the levels of trade are likely to increase and if the revenue figures in the cash flow forecast are reasonable.– Review the loan agreement and recalculate the covenant which has been breached. Confirm the timing and amount of the loan repayment.– Review any agreements with the bank to determine whether any other covenants have been breached, especially in relation to the overdraft.– Discuss with the directors whether they have contacted any alternative banks for finance to assess whether they have any other means of repaying the loan of $4·8m.– Review any correspondence with shareholders to assess whether any of these are likely to increasetheir equity investment in the company. 财务– Review post year-end correspondence with suppliers to identify if any others have threatened legal action or refused to supply goods.– Discuss with the finance director whether the sales director has yet been replaced and whether anynew customers have been obtained to replace the one lost. 运营– Enquire of the lawyers of Strawberry as to the existence of any additional litigation and request theirassessment of the likely amounts payable to the suppliers. 法律– Perform audit tests in relation to subsequent events to identify any items that might indicate or mitigate the risk of going concern not being appropriate.– Review the post year-end bo ard minutes to identify any other issues that might indicate further financial difficulties for the company.– Consider whether the g oing concern basi s is appropriate for the preparation of the financial statements.– Obtain a written representation c onfirming the director’s vi ew that Strawberry is a going concern.其他Procedures the auditor should adopt in respect of auditing accounting estimates include:–Enquire of management how t he accounting estimate is made and the d ata on which it is based.–Determine whether events occurring up to the date of the auditor’s report (after the reporting period) provide audit evidence regarding the accounting estimate.–Review the method of measurement used and assess the r easonableness o f assumptions made.– Test the operating effectiveness of the controls over how management made the accounting estimate.– Evaluate overall whether the accounting estimates in the financial statements are either reasonable or misstated.–Obtain sufficient appropriate audit evidence about whether the disclosures in the financial statements related to accounting estimates and estimation uncertainty are reasonable.–Obtain written representations from management and, where appropriate, those charged with governance whether they believe significant assumptions used in making accounting estimates are reasonable.Procedures during the inventory count–Observe the counting teams of Lily to confirm whether the inventory count instructions are being followed correctly.–observe the procedures for identifying and segregating damaged goods are operating correctly.–Observe the procedures for movements of inventory during the count, to confirm that no raw materials or finished goods have been omitted or counted twice.– Select a sample and perform test counts from inventory sheets to warehouse aisle and from warehouse aisle to inventory sheets.– Select a sample of damaged items as noted on the inventory sheets and inspect these windows to confirm whether the level of damage is correctly noted.– Obtain a photocopy of the completed sequentially numbered inventory sheets for follow up testing on the final audit.– Discuss with the warehouse manager how he has estimated the raw materials quantities. To the extent that it is possible, re-perform the procedures adopted by the warehouse manager.– Identify and record any inventory held fo r third parties (if any) and confirm that it is excluded from the count.Audit procedures using CAATSThe audit team can use audit software to calculate inventory days for the year-to-date to compare against the prior year to identify whether inventory is turning over slower, as this may be an indication that it is overvalued.Audit software can be utilised to produce an aged inventory analysis to identify any slow moving goods, which may require write down or an allowance.Cast the inventory listing to confirm the completeness and accuracy of inventory.Audit software can be used to select a representative sample of items for testing to confirm net realisable value and/or cost.Audit software can be utilised to recalculate cost and net realisable value for a sample of inventory. CAATs can be used to verify cut-off by testing whether the dates of the last GRNs and GDNs recorded relate to pre year end; and that any with a date of 1 January 2013 onwards have been excluded from the inventory records.CAATs can be used to confirm whether any inventory adjustments noted during the count have been correctly updated into final inventory records.Procedures the auditor should adopt in respect of auditing this accrual include:–Agree the year-end income tax payable accrual to the payroll records to confirm accuracy.– Agree the subsequent payment to the post year-end cash book and bank statements to confirm completeness.–Recalculation of the accrual to confirm accuracy.– Review any disclosures made of the income tax accrual and assess whether these are in compliance with accounting standards and legislation.Audit procedures for continuous (perpetual) inventory counts– The audit team should attend at least one of the c ontinuous (perpetual) inventory counts t o review whether the controls over the inventory count are adequate.– C onsider attending the inventory count at the year end to undertake test counts of inventory from records to floor and from floor to records in order to confirm the existence and completeness of inventory.– Review the adjustments made to the inventory records on a monthly basis to gain an understanding of the level of differences arising on a month by month basis.– If significant differences consistently arise, this could indicate that the inventory records are not adequately maintained. D iscuss with manageme nt how they will ensure that year-end inventory will not be under or overstated.Procedures to undertake in relation to the uncorrected misstatement– The extent of the potential misstatement should be considered and therefore a large sample of inventory items should be tested to identify the possible size of the misstatement.– The potential misstatement should be d iscussed with Clarinet Co’s management in order to understand why these inventory differences are occurring.– The misstatement should be compared to materiality to assess if the error is materia l individually.– If not, then it should be added to other errors noted during the audit to assess if in aggregate the uncorrected errors are now material.– If material, the auditors should ask the directors to adjust the inventory balances to correct the misstatements identified in the 2014 year end.– Request a written representation from the directors about the uncorrected misstatements including the inventory errors.– Consider the implication for the audit report if the inventory errors are material and the directorsr efuses to make adjustments.Receivables circularisation– procedures 步骤– Obtain a list of receivables balances, cast this and agree it to the receivables control account total at the end of theyear. Ageing of receivables may also be verified at this time.–Determine an appropriate sampling method (cumulative monetary amount, value-weighted selection, random, etc.)–Select the balances to be tested, with specific reference to the categories of receivable noted below. – Extract details of each receivable selected from the ledger and prepare circularisation letters.– Ask the chief accountant at Seeley Co (or other responsible official) to sign the letters.– The auditor posts or faxes the letters to the individual receivables.Substantive procedures to confirm valuation of inventory– Select a representative sample of goods in inventory at the year end, agree the cost per the records to a recent purchase invoice and ensure that the cost is correctly stated.– Select a sample of year end goods and review post year end sales invoices to ascertain if NRV is above cost or if an adjustment is required.– For a sample of manufactured items obtain cost sheets and confirm:–raw material costs to recent purchase invoices–labour costs to time sheets or wage records–overheads allocated are of a production nature.– Review aged inventory reports and identify any slow moving goods, discuss with management why these items have not been written down.– Review the inventory records to identify the level of adjustments made throughout the year for damaged/obsolete items. If significant consider whether the year end records require further adjustments and discuss with management whether any further write downs/provision may be required. – Follow up any damaged/obsolete items noted by the auditor at the inventory counts attended, to ensure that the inventory records have been updated correctly.– Perform a review of the average inventory days for the current year and compare to prior year inventory days. Discuss any significant variations with management.Substantive procedures to confirm completeness of provisions or contingent liability– Discuss with management the nature of the dispute between Smoothbrush and the former finance director (FD), to ensure that a full understanding of the issue is obtained and to assess whether an obligation exists.–Write to the company’s lawyers to obtain their views as to the probability of the FD’s claim being successful.– Review board minutes and any company correspondence to assess whether there is any evidence to support the former FD’s claims of unfair dismissal.– Obtain a written representation from the directors of Smoothbrush confirming their view that the former FD’s chances of a successful claim are remote, and hence no provision or contingent liability is required.Substantive procedures over bank balance:–Obtain the company’s bank reconciliatio n and c heck the additions t o e nsure arithmeticalaccuracy.– Obtain a b ank confi rmation lett er from the company’s bankers.– Verify the balance per the bank statement to an original year end bank statement and also to the bank confi rmation letter.– Verify the rec onciliation’s balanc e per the cash book t o the year end cash book.– Trace all of the outstanding lodgement s to the pre year end cash book, post year end bank statement and also to paying-in-book pre year end.– Trace all u npresented cheques through to a pre year end cash book and post year end statement. For any unusual amounts or signifi cant delays obtain explanations from management.– Review the cash book and bank statements for any u nusual items or large transfers around the year end, as this could be evidence of window dressing.– Examine the bank confi rmation letter for details of any security provided by the company or any legal right of set-off as this may require disclosure.Appropriate procedures to determine that net realisable value of book inventory is above cost would include:(1) Assessment of estimated proceeds from the sale of items of inventory. Sales price in the period following the year-end is one important element of net realisable value. Procedures to determine sales prices include:– Obtain actual sales prices by reference to invoices issued after the year-end and determine that the sales were genuine by vouching sales invoices to orders, despatch notes and subsequent receipt of cash.– If actual sales prices are not available, the auditor should obtain estimated sales prices from management. It would be necessary to assess how reasonable these estimated prices were. The auditor might be aided in this respect by reviewing the reports from sales staff backed up by discussions with management.– Particular attention should be paid to sales prices of books identifi ed as slow-moving. (Tutorial note: Slowmoving books might be identifi ed by obtaining lists of sales made in the preceding (say) six months and reviewing reports from sales staff. The sales statistics would also be useful in this respect.)– For damaged books disposal price may be nil or very low and the auditor should examine records of disposal of such books in the past. (Tutorial note: Damaged books should have been identifi ed during the inventory count.)(2) Determine estimated costs to completion. These costs represent another important element of net realisable value.Relevant procedures include:– Some books may still be in production and will initially be included in inventory at cost to date; for example, they may have been printed but not bound. The auditor should examine production budgets and actual costs (for binding, for example) to determine actual costs to completion. (Tutorial note: It is not uncommon for publishers to print books but leave them unbound until sales in the immediate future are expected.)– Books returned may incur extra costs before they can be made ready for resale and the auditor should examine cost records to obtain a reasonable estimate of such costs.(3) Determine costs to be incurred in marketing, selling and distributing directly related to theitems in question.– In general terms the auditor may determine the percentage relationship between sales and selling and distribution expenses.– However, the distribution costs of heavy books are likely to be higher than for (say) light paperback books and the auditor should assess whether the cost weighting is reasonable.(4) All of the above matters should be discussed with management bearing in mind that, although they represent an internal source of evidence, they are the most informed people regarding the saleability of books on hand and regarding determination of the various elements of net realisable value.(5) Discuss with management the need for an inventory provision for slow moving and/or obsolete books.Audit procedures adopted in the examination of the cash fl ow forecast would include:(1) Check that the opening balance of the cash forecast is in agreement with the closing balance of the cash book, to ensure the opening balance of the forecast is accurate.(2) Consider how accurate company forecasts have been in the past by comparing past forecasts with actual outcomes. If forecasts have been reasonably accurate in the past, this would make it more likely that the current forecast is reliable.(3) Determine the assumptions that have been made in the preparation of the cash fl ow forecast. For example, the company is experiencing a poor economic climate, so you would not expect cash fl ows from sales and realisation of receivables to increase, but either to decrease or remain stable. You are also aware that costs are rising so you would expect cost increases to be refl ected in the cash forecasts.(4) Examine the sales department detailed budgets for the two years ahead and, in particular, discuss with them the outlets that they will be targeting. This would help the auditor determine whether the cash derived from sales is soundly based.(5) Examine the pr oduction department’s assessment of the non-current assets required to increase the production of white bread to the level required by the sales projections. Obtain an assessment of estimated cost of non-current assets, reviewing bids from suppliers, if available. This would provide evidence on material cash outfl ows.(6) Consider the adequacy of the increased working capital that will be required as a result of the expansion. Increased working capital would result in cash outfl ows and it would be important to establish its adequacy.(7) If relevant review the post year end period to compare the actual performance against the forecast fi gures.(8) Recalculate and cast the cash fl ow forecast balances.(9) Review board minutes for any other relevant issues which should be included within the forecast.(10) Review the work of the internal audit department in preparing the cash fl ow forecast.Fire at warehouse(i) Audit procedures– Discuss the matter with the directors checking whether the company has sufficient inventory to continue trading in the short term.– Enquire that the directors are satisfied that the company can continue to trade in the longer term. Ask the directors to sign an additional letter of representation to this effect.– Obtain a schedule showing the inventory destroyed and if possible check this is reasonable given past production records and inventory valuations.– Enquire that the insurers have been informed. Review correspondence from the insurers confirming theamount of the insurance claim.– Consider whether or not EastVale can continue as a going concern, given the loss of inventory and potential damage to the company’s reputation if customer orders cannot be fulfilled.Batch of cheese(i) Audit procedures– Discuss the matter with the directors, determining specifically whether there was any fault in the production process.– Obtain a copy of the damages claim and again discuss with the directors the effect on EastVale and the possibility of success of the claim.–Obtain independent legal advice on the claim from EastVale’s lawyers. Attempt to determine the extent of damages that may have to be paid.– Review any press reports about the contaminated cheese. Consider the impact on the reputation of EastVale and whether the company can continue as a going concern.– Discuss the going concern issue with the directors. Obtain an additional letter of representation on the directors’ opinion of the going concern status of EastVale.Substantive procedures to confi rm Tinkerbell’s revenue:– Compare the overall level of revenue against prior years and budget and investigate any significant fluctuations.– Obtain a schedule of sales for the year broken down into the major categories of toys manufactured and compare this to the prior year breakdown and for any unusual movements discuss with management.– Calculate the gross margin for Tinkerbell and compare this to the prior year and investigate any significant fluctuations.– Select a sample of sales invoices for larger customers and recalculate the discounts allowed to ensure that these are accurate.– Recalculate for a sample of invoices that the sales tax has been correctly applied to the sales invoice. – Select a sample of customer orders and agree these to the despatch notes and sales invoices through to inclusion in the sales ledger to ensure completeness of revenue.– Select a sample of despatch notes both pre and post the year end, follow these through to sales invoices in the correct accounting period to ensure that cut-off has been correctly applied.– Select a sample of credit notes issued after the year end and follow through to sales invoice to ensure the returns were recorded in the proper period.。