公司理财-金融学案例原题及答案Solution to Case 8-Loan Amortization

公司理财》试题及答案

公司理财》试题及答案公司理财》试题及答案第一章公司理财概述单项选择题:1.在筹资理财阶段,公司理财的重点内容是(B)。

A。

有效运用资金B。

如何设法筹集到所需资金C。

研究投资组合D。

国际融资填空题:1.在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。

2.西方经济学家和企业家以往都以(利润最大化)作为公司的经营目标和理财目标。

3.现代公司的理财目标是(股东财富最大化)。

4.公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿债能力)。

5.公司筹资的渠道主要有两大类,一是(自有资本)的筹集,二是(借入资本)的筹集。

XXX:1.为什么以股东财富最大化作为公司理财目标?答:以股东财富最大化作为公司理财目标,考虑到了货币时间价值和风险价值,体现了对公司资产保值增值的要求,有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。

2.公司理财的具体内容是什么?答:公司理财的具体内容包括筹资决策、投资决策和股利分配决策。

第二章财务报表分析单项选择题:1.资产负债表为(B)。

A。

动态报表B。

静态报表C。

动态与静态相结合的报表D。

既不是动态报表也不是静态报表2.下列负债中属于长期负债的是(D)。

A。

应付账款B。

应交税金C。

预计负债D。

应付债券3.公司流动性最强的资产是(A)。

A。

货币资金B。

短期投资C。

应收账款D。

存货4.下列各项费用中属于财务费用的是(C)。

A。

广告费B。

劳动保险费C。

利息支出D。

坏账损失5.反映公司所得与所占用的比例关系的财务指标是(B)。

A。

资产负债率B。

资产利润率C。

销售利润率D。

成本费用利润率多项选择题:1.与资产负债表中财务状况的计量直接联系的会计要素有(ABC)。

A。

资产B。

负债C。

所有者权益D。

成本费用E。

收入利润2.与利润表中经营成果的计量有直接联系的会计要素有(BCD)。

A。

资产B。

收入C。

成本和费用D。

公司理财第九版罗斯课后案例答案 Case Solutions Corporate Finance

公司理财第九版罗斯课后案例答案 Case Solutions CorporateFinance1. 案例一:公司资金需求分析问题:一家公司需要资金支持其新项目。

通过分析现金流量,推断该公司是否需要向外部借款或筹集其他资金。

解答:为了确定公司是否需要外部资金,我们需要分析公司的现金流量状况。

首先,我们需要计算公司的净现金流量(净收入加上非现金项目)。

然后,我们需要将净现金流量与项目的投资现金流量进行对比。

假设公司预计在项目开始时投资100万美元,并在项目运营期为5年。

预计该项目每年将产生50万美元的净现金流量。

现在,我们需要进行以下计算:净现金流量 = 年度现金流量 - 年度投资现金流量年度投资现金流量 = 100万美元年度现金流量 = 50万美元净现金流量 = 50万美元 - 100万美元 = -50万美元根据计算结果,公司的净现金流量为负数(即净现金流出),意味着公司每年都会亏损50万美元。

因此,公司需要从外部筹集资金以支持项目的运营。

2. 案例二:公司股权融资问题:一家公司正在考虑通过股权融资来筹集资金。

根据公司的财务数据和资本结构分析,我们需要确定公司最佳的股权融资方案。

解答:为了确定最佳的股权融资方案,我们需要参考公司的财务数据和资本结构分析。

首先,我们需要计算公司的资本结构比例,即股本占总资本的比例。

然后,我们将不同的股权融资方案与资本结构比例进行对比,选择最佳的方案。

假设公司当前的资本结构比例为60%的股本和40%的债务,在当前的资本结构下,公司的加权平均资本成本(WACC)为10%。

现在,我们需要进行以下计算:•方案一:以新股发行筹集1000万美元,并将其用于项目投资。

在这种方案下,公司的资本结构比例将发生变化。

假设公司的股本增加至80%,债务比例减少至20%。

根据资本结构比例的变化,WACC也将发生变化。

新的WACC可以通过以下公式计算得出:新的WACC = (股本比例 * 股本成本) + (债务比例 * 债务成本)假设公司的股本成本为12%,债务成本为8%:新的WACC = (0.8 * 12%) + (0.2 * 8%) = 9.6%•方案二:以新股发行筹集5000万美元,并将其用于项目投资。

《公司理财》课后习题与答案

《公司理财》考试围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。

书上例题比较重要,大家记得多多动手练练。

PS:书中课后例题不出,大家可以当习题练练~考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分注:第13章没有答案第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢?”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

《公司理财》课后习题与答案

《公司理财》考试范围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。

书上例题比较重要,大家记得多多动手练练。

PS:书中课后例题不出,大家可以当习题练练~考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分注:第13章没有答案第一章1.在所有权形式的公司中,股东是公司的所有者。

股东选举公司的董事会,董事会任命该公司的管理层。

企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。

管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。

在这种环境下,他们可能因为目标不一致而存在代理问题。

2.非营利公司经常追求社会或政治任务等各种目标。

非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。

3.这句话是不正确的。

管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。

4.有两种结论。

一种极端,在市场经济中所有的东西都被定价。

因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。

另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。

一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。

然而,该公司认为提高产品的安全性只会节省20美元万。

请问公司应该怎么做呢”5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。

6.管理层的目标是最大化股东现有股票的每股价值。

如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。

如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。

然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。

公司理财带答案

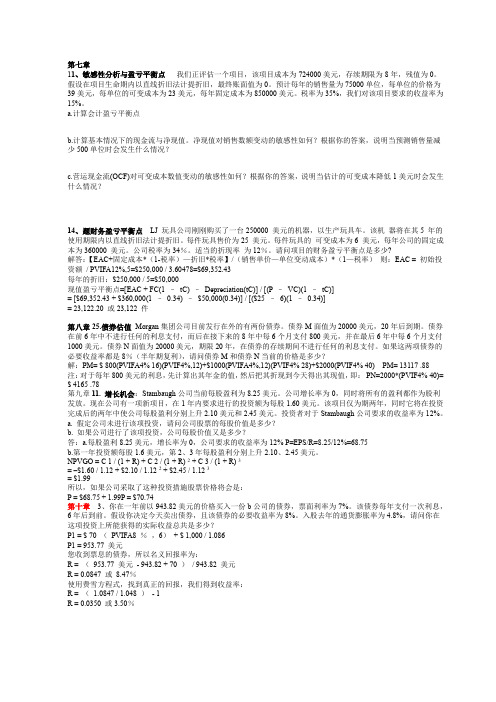

第七章11、敏感性分析与盈亏平衡点我们正评估一个项目,该项目成本为724000美元,存续期限为8年,残值为0。

假设在项目生命期内以直线折旧法计提折旧,最终账面值为0。

预计每年的销售量为75000单位,每单位的价格为39美元,每单位的可变成本为23美元,每年固定成本为850000美元。

税率为35%,我们对该项目要求的收益率为15%。

a.计算会计盈亏平衡点b.计算基本情况下的现金流与净现值。

净现值对销售数额变动的敏感性如何?根据你的答案,说明当预测销售量减少500单位时会发生什么情况?c.营运现金流(OCF)对可变成本数值变动的敏感性如何?根据你的答案,说明当估计的可变成本降低1美元时会发生什么情况?14、题财务盈亏平衡点LJ 玩具公司刚刚购买了一台250000 美元的机器,以生产玩具车。

该机器将在其5 年的使用期限内以直线折旧法计提折旧。

每件玩具售价为25 美元。

每件玩具的可变成本为6 美元,每年公司的固定成本为360000 美元。

公司税率为34%。

适当的折现率为12%。

请问项目的财务盈亏平衡点是多少?解答:【EAC+固定成本*(1-税率)—折旧*税率】/(销售单价—单位变动成本)*(1—税率)则:EAC = 初始投资额/ PVIFA12%,5=$250,000 / 3.60478=$69,352.43每年的折旧:$250,000 / 5=$50,000现值盈亏平衡点=[EAC + FC(1 –tC) –Depreciation(tC)] / [(P –VC)(1 –tC)]= [$69,352.43 + $360,000(1 –0.34) –$50,000(0.34)] / [($25 –6)(1 –0.34)]= 23,122.20 或23,122 件第八章25.债券估值Morgan集团公司目前发行在外的有两份债券。

债券M面值为20000美元,20年后到期。

债券在前6年中不进行任何的利息支付,而后在接下来的8年中每6个月支付800美元,并在最后6年中每6个月支付1000美元。

《公司理财》第九版经典习题及解题步骤

social and environmental

understand how to maintain

business objectives with

responsibility.

sound financial practices

social responsibility and

while making socially

Strategies

Venture Capital

Investment Banking

Portfolio Management

Explore the world of venture

Discover the intricacies of

Maximize returns and

capital investments,

Become fluent in cash flow analysis and

financial statements and ratios like an

valuation to better manage capital

expert.

budgeting and working capital.

R isk Manag em ent and Financial

taxation.

3

Investing in Internatio nal Markets

Expand your horizons with insights into international financial management.

Innovative Financing and Investment

right capital structure for your business.

公司理财Corporate_Finance_第九版_CASE答案(完整资料).doc

【最新整理,下载后即可编辑】Case SolutionsFundamentals of Corporate FinanceRoss, Westerfield, and Jordan9th editionCHAPTER 1THE McGEE CAKE COMPANY1.The advantages to a LLC are: 1) Reduction of personal liability. A soleproprietor has unlimited liability, which can include the potential loss of all personal assets. 2) Taxes. Forming an LLC may mean that more expenses can be considered business expenses and be deducted from the company’s income. 3) Improved credibility. The business may have increased credibility in the business world compared to a sole proprietorship. 4) Ability to attract investment. Corporations, even LLCs, can raise capital through the sale of equity. 5) Continuous life. Sole proprietorships have a limited life, while corporations have a potentially perpetual life. 6) Transfer of ownership. It is easier to transfer ownership in a corporation through the sale of stock.The biggest disadvantage is the potential cost, although the cost of forminga LLC can be relatively small. There are also other potential costs, includingmore expansive record-keeping.2.Forming a corporation has the same advantages as forming a LLC, but thecosts are likely to be higher.3.As a small company, changing to a LLC is probably the most advantageousdecision at the current time. If the company grows, and Doc and Lyn are willing to sell more equity ownership, the company can reorganize as a corporation at a later date. Additionally, forming a LLC is likely to be less expensive than forming a corporation.CHAPTER 2CASH FLOWS AND FINANCIAL STATEMENTS AT SUNSET BOARDS Below are the financial statements that you are asked to prepare.1.The income statement for each year will look like this:Income statement2008 2009Sales $247,259 $301,392Cost of goods sold 126,038 159,143Selling & administrative 24,787 32,352Depreciation 35,581 40,217EBIT $60,853 $69,680Interest 7,735 8,866EBT $53,118 $60,814Taxes 10,624 12,163Net income $42,494 $48,651Dividends $21,247 $24,326Addition to retainedearnings 21,247 24,3262.The balance sheet for each year will be:Balance sheet as of Dec. 31, 2008C-26 CASE SOLUTIONSCash $18,187 Accounts payable $32,143 Accountsreceivable 12,887 Notes payable 14,651 Inventory 27,119 Current liabilities $46,794 Current assets $58,193Long-term debt $79,235 Net fixed assets $156,975 Owners' equity 89,139Total assets $215,168 Total liab. &equity $215,168In the first year, equity is not given. Therefore, we must calculate equity as a plug variable. Since total liabilities & equity is equal to total assets, equity can be calculated as:Equity = $215,168 – 46,794 – 79,235Equity = $89,139CHAPTER 2 C-5Balance sheet as of Dec. 31, 2009Cash $27,478 Accounts payable $36,404 Accountsreceivable 16,717 Notes payable 15,997 Inventory 37,216 Current liabilities $52,401 Current assets $81,411Long-term debt $91,195 Net fixed assets $191,250 Owners' equity 129,065Total assets $272,661 Total liab. &equity $272,661The owner’s equity for 2009 is the beginning of year owner’s equity, plus the addition to retained earnings, plus the new equity, so:Equity = $89,139 + 24,326 + 15,600Equity = $129,065ing the OCF equation:OCF = EBIT + Depreciation – TaxesThe OCF for each year is:OCF2008 = $60,853 + 35,581 – 10,624OCF2008 = $85,180OCF2009 = $69,680 + 40,217 – 12,163OCF2009 = $97,734C-26 CASE SOLUTIONS4.To calculate the cash flow from assets, we need to find the capital spendingand change in net working capital. The capital spending for the year was: Capital spendingEnding net fixed assets $191,250– Beginning net fixedassets 156,975+ Depreciation 40,217Net capital spending $74,492And the change in net working capital was:Change in net working capitalEnding NWC $29,010– Beginning NWC 11,399Change in NWC $17,611CHAPTER 2 C-5 So, the cash flow from assets was:Cash flow from assetsOperating cash flow $97,734– Net capital spending 74,492– Change in NWC 17,611Cash flow from assets $ 5,6315.The cash flow to creditors was:Cash flow to creditorsInterest paid $8,866– Net new borrowing 11,960Cash flow to creditors –$3,0946.The cash flow to stockholders was:Cash flow tostockholdersDividends paid $24,326– Net new equityraised 15,600Cash flow tostockholders $8,726Answers to questions1.The firm had positive earnings in an accounting sense (NI > 0) and hadpositive cash flow from operations. The firm invested $17,611 in new netC-26 CASE SOLUTIONSworking capital and $74,492 in new fixed assets. The firm gave $5,631 to its stakeholders. It raised $3,094 from bondholders, and paid $8,726 to stockholders.2.The expansion plans may be a little risky. The company does have a positivecash flow, but a large portion of the operating cash flow is already going to capital spending. The company has had to raise capital from creditors and stockholders for its current operations. So, the expansion plans may be too aggressive at this time. On the other hand, companies do need capital to grow. Before investing or loaning the company money, you would want to know where the current capital spending is going, and why the company is spending so much in this area already.CHAPTER 3RATIOS ANALYSIS AT S&S AIR1.The calculations for the ratios listed are:Current ratio = $2,186,520 / $2,919,000Current ratio = 0.75 timesQuick ratio = ($2,186,250 – 1,037,120) / $2,919,000Quick ratio = 0.39 timesCash ratio = $441,000 / $2,919,000Cash ratio = 0.15 timesTotal asset turnover = $30,499,420 / $18,308,920Total asset turnover = 1.67 timesInventory turnover = $22,224,580 / $1,037,120Inventory turnover = 21.43 timesReceivables turnover = $30,499,420 / $708,400Receivables turnover = 43.05 timesTotal debt ratio = ($18,308,920 – 10,069,920) / $18,308,920 Total debt ratio = 0.45 timesDebt-equity ratio = ($2,919,000 + 5,320,000) / $10,069,920C-26 CASE SOLUTIONSDebt-equity ratio = 0.82 timesEquity multiplier = $18,308,920 / $10,069,920Equity multiplier = 1.82 timesTimes interest earned = $3,040,660 / $478,240Times interest earned = 6.36 timesCash coverage = ($3,040,660 + 1,366,680) / $478,420 Cash coverage = 9.22 timesProfit margin = $1,537,452 / $30,499,420Profit margin = 5.04%Return on assets = $1,537,452 / $18,308,920Return on assets = 8.40%Return on equity = $1,537,452 / $10,069,920Return on equity = 15.27%CHAPTER 3 C-11 2. Boeing is probably not a good aspirant company. Even though bothcompanies manufacture airplanes, S&S Air manufactures small airplanes, while Boeing manufactures large, commercial aircraft. These are two different markets. Additionally, Boeing is heavily involved in the defense industry, as well as Boeing Capital, which finances airplanes.Bombardier is a Canadian company that builds business jets, short-range airliners and fire-fighting amphibious aircraft and also provides defense-related services. It is the third largest commercial aircraft manufacturer in the world. Embraer is a Brazilian manufacturer than manufactures commercial, military, and corporate airplanes. Additionally, the Brazilian government is a part owner of the company. Bombardier and Embraer are probably not good aspirant companies because of the diverse range of products and manufacture of larger aircraft.Cirrus is the world's second largest manufacturer of single-engine, piston-powered aircraft. Its SR22 is the world's best selling plane in its class. The company is noted for its innovative small aircraft and is a good aspirant company.Cessna is a well known manufacturer of small airplanes. The company produces business jets, freight- and passenger-hauling utility Caravans, personal and small-business single engine pistons. It may be a good aspirant company, however, its products could be considered too broad and diversified since S&S Air produces only small personal airplanes.3. S&S is below the median industry ratios for the current and cash ratios.This implies the company has less liquidity than the industry in general.However, both ratios are above the lower quartile, so there are companiesC-26 CASE SOLUTIONSin the industry with lower liquidity ratios than S&S Air. The company may have more predictable cash flows, or more access to short-term borrowing.If you created an Inventory to Current liabilities ratio, S&S Air would havea ratio that is lower than the industry median. The current ratio is below theindustry median, while the quick ratio is above the industry median. This implies that S&S Air has less inventory to current liabilities than the industry median. S&S Air has less inventory than the industry median, but more accounts receivable than the industry since the cash ratio is lower than the industry median.The turnover ratios are all higher than the industry median; in fact, all three turnover ratios are above the upper quartile. This may mean that S&S Air is more efficient than the industry.The financial leverage ratios are all below the industry median, but above the lower quartile. S&S Air generally has less debt than comparable companies, but still within the normal range.The profit margin, ROA, and ROE are all slightly below the industry median, however, not dramatically lower. The company may want to examine its costs structure to determine if costs can be reduced, or price can be increased.Overall, S&S Air’s performance seems good, although the liquidity ratios indicate that a closer look may be needed in this area.CHAPTER 3 C-11 Below is a list of possible reasons it may be good or bad that each ratio is higher or lower than the industry. Note that the list is not exhaustive, but merely one possible explanation for each ratio.Ratio Good BadCurrent ratio Better at managingcurrent accounts. May be having liquidity problems.Quick ratio Better at managingcurrent accounts. May be having liquidity problems.Cash ratio Better at managingcurrent accounts. May be having liquidity problems.Total asset turnover Better at utilizing assets. Assets may be older anddepreciated, requiringextensive investmentsoon.Inventory turnover Better at inventorymanagement, possibly dueto better procedures.Could be experiencinginventory shortages.Receivables turnover Better at collectingreceivables.May have credit termsthat are too strict.Decreasing receivablesturnover may increasesales.Total debt ratio Less debt than industrymedian means thecompany is less likely toexperience creditproblems. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE.Debt-equity Less debt than industry Increasing the amount ofC-26 CASE SOLUTIONSratio median means thecompany is less likely toexperience creditproblems. debt can increase shareholder returns. Especially notice that it will increase ROE.Equity multiplier Less debt than industrymedian means thecompany is less likely toexperience creditproblems.Increasing the amount ofdebt can increaseshareholder returns.Especially notice that itwill increase ROE.TIE Higher quality materialscould be increasing costs. The company may have more difficulty meeting interest payments in a downturn.Cash coverage Less debt than industrymedian means thecompany is less likely toexperience creditproblems. Increasing the amount of debt can increase shareholder returns. Especially notice that it will increase ROE.Profit margin The PM is slightly belowthe industry median. Itcould be a result of higherquality materials or bettermanufacturing. Company may be having trouble controlling costs.ROA Company may have newerassets than the industry. Company may have newer assets than the industry.ROE Lower profit margin maybe a result of higherquality. Profit margin and EM are lower than industry, which results in the lower ROE.CHAPTER 4PLANNING FOR GROWTH AT S&S AIR1.To calculate the internal growth rate, we first need to find the ROA and theretention ratio, so:ROA = NI / TAROA = $1,537,452 / $18,309,920ROA = .0840 or 8.40%b = Addition to RE / NIb = $977,452 / $1,537,452b = 0.64Now we can use the internal growth rate equation to get:Internal growth rate = (ROA × b) / [1 – (ROA × b)]Internal growth rate = [0.0840(.64)] / [1 – 0.0840(.64)]Internal growth rate = .0564 or 5.64%To find the sustainable growth rate, we need the ROE, which is:ROE = NI / TEROE = $1,537,452 / $10,069,920ROE = .1527 or 15.27%C-26 CASE SOLUTIONSUsing the retention ratio we previously calculated, the sustainable growth rate is:Sustainable growth rate = (ROE × b) / [1 – (ROE × b)]Sustainable growth rate = [0.1527(.64)] / [1 – 0.1527(.64)]Sustainable growth rate = .1075 or 10.75%The internal growth rate is the growth rate the company can achieve with no outside financing of any sort. The sustainable growth rate is the growth rate the company can achieve by raising outside debt based on its retained earnings and current capital structure.CHAPTER 4 C-21 2.Pro forma financial statements for next year at a 12 percent growth rate are:Income statementSales $ 34,159,35COGS 24,891,530 Other expenses 4,331,600 Depreciation 1,366,680EBIT $ 3,569,541Interest 478,240Taxable income $ 3,091,301Taxes (40%) 1,236,520Net income $ 1,854,78Dividends $ 675,583C-26 CASE SOLUTIONSAdd to RE 1,179,197Balance sheetAssets Liabilities & EquityCurrent Assets Current LiabilitiesCash $ 493,92AccountsPayable $ 995,680Accounts rec. 793,408 Notes Payable 2,030,000 Inventory 1,161,574 Total CL $ 3,025,680 Total CA $ 2,448,902Long-term debt $ 5,320,000ShareholderEquityCommon stock $ 350,000Fixed assets Retainedearnings 10,899,117Net PP&E $ 18,057,088 Total Equity $ 11,249,117Total Assets $ 20,505,990 Total L&E $ 19,594,787CHAPTER 4 C-21 So, the EFN is:EFN = Total assets – Total liabilities and equityEFN = $20,505,990 – 19,594,797EFN = $911,193The company can grow at this rate by changing the way it operates. For example, if profit margin increases, say by reducing costs, the ROE increases, it will increase the sustainable growth rate. In general, as long as the company increases the profit margin, total asset turnover, or equity multiplier, the higher growth rate is possible. Note however, that changing any one of these will have the effect of changing the pro forma financial statements.C-26 CASE SOLUTIONS3.Now we are assuming the company can only build in amounts of $5 million.We will assume that the company will go ahead with the fixed asset acquisition. To estimate the new depreciation charge, we will find the current depreciation as a percentage of fixed assets, then, apply this percentage to the new fixed assets. The depreciation as a percentage of assets this year was:Depreciation percentage = $1,366,680 / $16,122,400Depreciation percentage = .0848 or 8.48%The new level of fixed assets with the $5 million purchase will be:New fixed assets = $16,122,400 + 5,000,000 = $21,122,400So, the pro forma depreciation will be:Pro forma depreciation = .0848($21,122,400)Pro forma depreciation = $1,790,525We will use this amount in the pro forma income statement. So, the pro forma income statement will be:Income statementSales $ 34,159,35COGS 24,891,530 Other expensesCHAPTER 4 C-214,331,600Depreciation 1,790,525EBIT $ 3,145,696Interest 478,240Taxable income $ 2,667,456Taxes (40%) 1,066,982Net income $ 1,600,473Dividends $ 582,955Add to RE 1,017,519C-26 CASE SOLUTIONSThe pro forma balance sheet will remain the same except for the fixed asset and equity accounts. The fixed asset account will increase by $5 million, rather than the growth rate of sales.Balance sheetAssets Liabilities & EquityCurrent Assets Current LiabilitiesCash $ 493,92AccountsPayable $ 995,680Accounts rec. 793,408 Notes Payable 2,030,000 Inventory 1,161,574 Total CL $ 3,025,680 Total CA $ 2,448,902Long-term debt $ 5,320,000ShareholderEquityCommon stock $ 350,000Fixed assets Retainedearnings 10,737,439Net PP&E $ 21,122,400 Total Equity $ 11,087,439Total Assets $ 23,571,302 Total L&E $ 19,433,119CHAPTER 4 C-21 So, the EFN is:EFN = Total assets – Total liabilities and equityEFN = $23,581,302 – 19,433,119EFN = $4,138,184Since the fixed assets have increased at a faster percentage than sales, the capacity utilization for next year will decrease.CHAPTER 6THE MBA DECISION1. Age is obviously an important factor. The younger an individual is, the moretime there is for the (hopefully) increased salary to offset the cost of the decision to return to school for an MBA. The cost includes both the explicit costs such as tuition, as well as the opportunity cost of the lost salary.2. Perhaps the most important nonquantifiable factors would be whether ornot he is married and if he has any children. With a spouse and/or children, he may be less inclined to return for an MBA since his family may be less amenable to the time and money constraints imposed by classes. Other factors would include his willingness and desire to pursue an MBA, job satisfaction, and how important the prestige of a job is to him, regardless of the salary.3.He has three choices: remain at his current job, pursue a Wilton MBA, orpursue a Mt. Perry MBA. In this analysis, room and board costs are irrelevant since presumably they will be the same whether he attends college or keeps his current job. We need to find the aftertax value of each, so:Remain at current job:Aftertax salary = $55,000(1 – .26) = $40,700CHAPTER 6 C-27 His salary will grow at 3 percent per year, so the present value of his aftertax salary is:PV = C {1 – [(1 + g)/(1 + r)]t} / (r–g)]PV = $40,700{[1 – [(1 +.065)/(1 + .03)]38} / (.065 – .03)PV = $836,227.34Wilton MBA:Costs:Total direct costs = $63,000 + 2,500 + 3,000 = $68,500PV of direct costs = $68,500 + 68,500 / (1.065) = $132,819.25PV of indirect costs (lost salary) = $40,700 / (1.065) + $40,700(1 + .03) / (1 + .065)2 = $75,176.00Salary:PV of aftertax bonus paid in 2 years = $15,000(1 –.31) / 1.0652= $9,125.17Aftertax salary = $98,000(1 – .31) = $67,620C-26 CASE SOLUTIONSHis salary will grow at 4 percent per year. We must also remember that he will now only work for 36 years, so the present value of his aftertax salary is: PV = C {1 – [(1 + g)/(1 + r)]t} / (r–g)]PV = $67,620{[1 – [(1 +.065)/(1 + .04)]36} / (.065 – .04)PV = $1,554,663.22Since the first salary payment will be received three years from today, so we need to discount this for two years to find the value today, which will be: PV = $1,544,663.22 / 1.0652PV = $1,370,683.26So, the total value of a Wilton MBA is:Value = –$75,160 – 132,819.25 + 9,125.17 + 1,370,683.26 =$1,171,813.18Mount Perry MBA:Costs:Total direct costs = $78,000 + 3,500 + 3,000 = $86,500. Note, this is also the PV of the direct costs since they are all paid today.PV of indirect costs (lost salary) = $40,700 / (1.065) = $38,215.96Salary:CHAPTER 6 C-27 PV of aftertax bonus paid in 1 year = $10,000(1 – .29) / 1.065 = $6,666.67 Aftertax salary = $81,000(1 – .29) = $57,510His salary will grow at 3.5 percent per year. We must also remember that he will now only work for 37 years, so the present value of his aftertax salary is: PV = C {1 – [(1 + g)/(1 + r)]t} / (r–g)]PV = $57,510{[1 – [(1 +.065)/(1 + .035)]37} / (.065 – .035)PV = $1,250,991.81Since the first salary payment will be received two years from today, so we need to discount this for one year to find the value today, which will be:PV = $1,250,991.81 / 1.065PV = $1,174,640.20So, the total value of a Mount Perry MBA is:Value = –$86,500 – 38,215.96 + 6,666.67 + 1,174,640.20 = $1,056,590.90C-26 CASE SOLUTIONS4.He is somewhat correct. Calculating the future value of each decision willresult in the option with the highest present value having the highest future value. Thus, a future value analysis will result in the same decision. However, his statement that a future value analysis is the correct method is wrong since a present value analysis will give the correct answer as well.5. To find the salary offer he would need to make the Wilton MBA asfinancially attractive as the as the current job, we need to take the PV of his current job, add the costs of attending Wilton, and the PV of the bonus on an aftertax basis. So, the necessary PV to make the Wilton MBA the same as his current job will be:PV = $836,227.34 + 132,819.25 + 75,176.00 – 9,125.17 = $1,035,097.42This PV will make his current job exactly equal to the Wilton MBA on a financial basis. Since his salary will still be a growing annuity, the aftertax salary needed is:PV = C {1 – [(1 + g)/(1 + r)]t} / (r–g)]$1,035,097.42 = C {[1 – [(1 +.065)/(1 + .04)]36} / (.065 – .04)C = $45,021.51This is the aftertax salary. So, the pretax salary must be:Pretax salary = $45,021.51 / (1 – .31) = $65,248.576.The cost (interest rate) of the decision depends on the riskiness of the use offunds, not the source of the funds. Therefore, whether he can pay cash orCHAPTER 6 C-27 must borrow is irrelevant. This is an important concept which will be discussed further in capital budgeting and the cost of capital in later chapters.CHAPTER 7FINANCING S&S AIR’S EXPANSION PLANS WITH A BOND ISSUEA rule of thumb with bond provisions is to determine who benefits by theprovision. If the company benefits, the bond will have a higher coupon rate.If the bondholders benefit, the bond will have a lower coupon rate.1. A bond with collateral will have a lower coupon rate. Bondholders have theclaim on the collateral, even in bankruptcy. Collateral provides an asset that bondholders can claim, which lowers their risk in default. The downside of collateral is that the company generally cannot sell the asset used as collateral, and they will generally have to keep the asset in good working order.2.The more senior the bond is, the lower the coupon rate. Senior bonds getfull payment in bankruptcy proceedings before subordinated bonds receive any payment. A potential problem may arise in that the bond covenant may restrict the company from issuing any future bonds senior to the current bonds.3. A sinking fund will reduce the coupon rate because it is a partial guaranteeto bondholders. The problem with a sinking fund is that the company must make the interim payments into a sinking fund or face default. This means the company must be able to generate these cash flows.4. A provision with a specific call date and prices would increase the couponrate. The call provision would only be used when it is to the company’s advantage, thus the bondholder’s disadvantage. The downside is theCHAPTER 7 C-29 higher coupon rate. The company benefits by being able to refinance at a lower rate if interest rates fall significantly, that is, enough to offset the call provision cost.5. A deferred call would reduce the coupon rate relative to a call provision witha deferred call. The bond will still have a higher rate relative to a plain vanillabond. The deferred call means that the company cannot call the bond for a specified period. This offers the bondholders protection for this period. The disadvantage of a deferred call is that the company cannot call the bond during the call protection period. Interest rates could potentially fall to the point where it would be beneficial for the company to call the bond, yet the company is unable to do so.6. A make-whole call provision should lower the coupon rate in comparison toa call provision with specific dates since the make-whole call repays thebondholder the present value of the future cash flows. However, a make-whole call provision should not affect the coupon rate in comparison to a plain vanilla bond. Since the bondholders are made whole, they should be indifferent between a plain vanilla bond and a make-whole bond. If a bond with a make-whole provision is called, bondholders receive the market value of the bond, which they can reinvest in another bond with similar characteristics. If we compare this to a bond with a specific call price, investors rarely receive the full market value of the future cash flows.CASE 3 C-30 7. A positive covenant would reduce the coupon rate. The presence of positivecovenants protects bondholders by forcing the company to undertake actions that benefit bondholders. Examples of positive covenants would be: the company must maintain audited financial statements; the company must maintain a minimum specified level of working capital or a minimum specified current ratio; the company must maintain any collateral in good working order. The negative side of positive covenants is that the company is restricted in its actions. The positive covenant may force the company into actions in the future that it would rather not undertake.8. A negative covenant would reduce the coupon rate. The presence ofnegative covenants protects bondholders from actions by the company that would harm the bondholders. Remember, the goal of a corporation is to maximize shareholder wealth. This says nothing about bondholders.Examples of negative covenants would be: the company cannot increase dividends, or at least increase beyond a specified level; the company cannot issue new bonds senior to the current bond issue; the company cannot sell any collateral. The downside of negative covenants is the restriction of the company’s actions.9.Even though the company is not public, a conversion feature would likelylower the coupon rate. The conversion feature would permit bondholders to benefit if the company does well and also goes public. The downside is that the company may be selling equity at a discounted price.10. The downside of a floating-rate coupon is that if interest rates rise, thecompany has to pay a higher interest rate. However, if interest rates fall, the company pays a lower interest rate.CHAPTER 8STOCK VALUATION AT RAGAN, INC.1.The total dividends paid by the company were $126,000. Since there are100,000 shares outstanding, the total earnings for the company were: Total earnings = 100,000($4.54) = $454,000This means the payout ratio was:Payout ratio = $126,000/$454,000 = 0.28So, the retention ratio was:Retention ratio = 1 – .28 = 0.72Using the retention ratio, the company’s growth rate is:g = ROE × b = 0.25*(.72) = .1806 or 18.06%The dividend per share paid this year was:= $63,000 / 50,000D= $1.26DNow we can find the stock price, which is:C-84 CASE SOLUTIONSP 0 = D 1 / (R – g )P 0 = $1.26(1.1806) / (.20 – .1806)P 0 = $76.752.Since Expert HVAC had a write off which affected its earnings per share, we need to recalculate the industry EPS. So, the industry EPS is:Industry EPS = ($0.79 + 1.38 + 1.06) / 3 = $1.08Using this industry EPS, the industry payout ratio is:Industry payout ratio = $0.40/$1.08 = .3715 or 37.15%So, the industry retention ratio isIndustry retention ratio = 1 – .3715 = .6285 or 62.85%。

《公司理财》习题及答案.doc

《公司理财》习题答案第一章公司理财概论案例:华旗股份公司基本财务状况华旗股份有限公司,其前身是华旗饮料厂,创办于20世纪80年代,当时是当地最大的饮料企业,生产的“华旗汽水”是当地的名牌产品,市场占有率较高。

2003年改组为华旗股份有限公司,总股本2 500万股。

公司章程中规定,公司净利润按以下顺序分配:(1)弥补上一年度亏损;(2) 提取10%的法定公积金;(3)提取15%任意公积金;(4)支付股东股利。

公司实行同股同权的分配政策。

公司董事会在每年会计年度结束后提出分配预案,报股东大会批准实施。

除股东大会另有决议外,股利每年派发一次,在每个会计年度结束后六个月内,按股东持股比例进行分配。

当董事会认为必要时,在提请股东大会讨论通过后,可増派年度屮期股利。

随着市场经济的不断深化,我国饮品市场发展越来越迅猛,全球市场--体化趋势在饮品市场尤为突出,一些国内外知名饮品,如可口可乐、百事可乐、汇源等,不断涌入木地市场,饮品行业竞争日益激烈。

华旗公司的市场占有率不断降低,经营业绩也随之不断下降,公司管理层对此忧心忡忡,认为应该对华旗公司各个方面进行重新定位,其中包括股利政策。

华旗公司于2015年1月15 FI召开董事会会议,要求公司的总会计师对公司目前财务状况做出分析,同时提出新的财务政策方案,以供董事会讨论。

总会计师为此召集有关人员进行了深入细致的调查,获得了以下有关资料:(-)我国饮品行业状况近几年我国饮品行业发展迅速,在国民经济各行业中走在了前列,冃前市场竞争非常激烈,但市场并没有饱和。

从资料看,欧洲每年人均各类饮品消费量为200公斤,我国每年人均消费各种饮料还不到10公斤。

可见,我国饮品仍有着巨大的市场潜力。

果味饮料、碳酸饮料市场日趋畏缩,绿色无污染保健饮品、纯果汁饮品、植物蛋白饮品,以及茶饮品,正在成为饮品家族的新牛力量,在市场上崭露头角,市场潜力巨大。

(-)华旗公司目前经营状况公司目前的主要能力主要用于三大类产品,其中40%的生产能力用于生产传统产品——碳酸饮料和果味饮料;50%的生产能力用于生产第二大类产品——矿泉水和瓶装纯净水,是公司目前利润的主要来源。