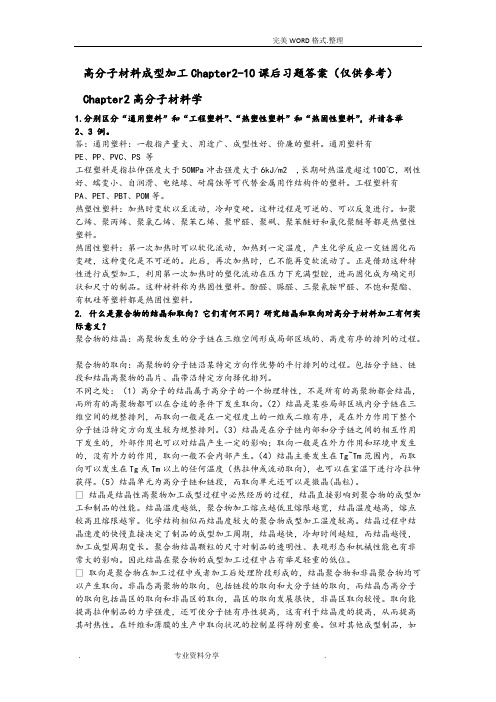

chapter2 习题答案

(完整版)高分子材料成型加工唐颂超第三版第2-10章课后习题答案解析(仅供参考)

1.高分子材料中加入添加剂的目的是什么?添加剂可分为哪些主要类型? ① 满足性能上的要求 ② 满足成型加工上的要求 ③ 满足经济上的要求 添加剂可分为稳定剂、增塑剂、润滑剂、交联剂、填充剂等

2. 什么是热稳定剂?热稳定剂可分为哪些主要类型?其中那些品种可用于食品和医药包装 材料 热稳定剂是一类能防止或减少聚合物在加工使用过程中受热而发生降解或交联,延长复合材 料使用寿命的添加剂。可分为铅盐类、金属皂类、有机锡类、有机锑类、有机辅助、复合 稳定剂和稀土类稳定剂。 食药包装:有机锡类、有机锑类、复合稳定剂和稀土类稳定剂。 3.什么是热稳定剂?哪一类聚合物在成型加工中须使用热稳定剂?对于加有较多增塑剂和 不加增塑剂的两种塑料配方,如何考虑热稳定剂的加入量?请阐明理由。 热稳定剂是指在加工塑料制品时为防止加工时的热降解或者防止制品在长期使用过程中老

滑移越困难,聚合物流动时非牛顿性越强。聚合物分子链刚性增加,分子间作用力愈大, 粘度对剪切速率的敏感性减小,但粘度对温度的敏感性增加,提高这类聚合物的加工温度 可有效改善其流动性。

聚合物分子中支链结构的存在对粘度也有很大的影响。具有短支链的聚合物的粘度低于 具有相同相对分子质量的直链聚合物的粘度;支链长度增加,粘度随之上升,支链长度增 加到一定值,粘度急剧增高。在相对分子质量相同的条件下,支链越多,越短,流动时的 空间位阻越小,粘度越低,越容易流动。较多的长支

晶态聚合物:(1)若聚合物的分子量较小,Tm>Tf,则聚合物达到熔点时已进入粘流态, 则熔融加工温度范围即为 Tm~Td(热分解温度);若聚合物的分子量较大,分子链相互作 用力较大,当晶区熔融时,分子链还需要吸收更多能量克服分子间作用力,才能产生运动, 因此聚合物的 Tm<Tf,则熔融加工温度范围为 Tf~Td。 非晶态聚合物:熔融加工温度范围为 Tf~Td。 比较结晶聚合物和非晶聚合物耐热性的好坏必须在两者化学结构相似的前提下。在两者化 学结构相似时,结晶聚合物由于晶区分子链排列较为规整,聚合物由固态变为熔融状态时, 需要先吸收热量使晶区变为非晶区,然后再进入粘流态,非晶态聚合物由于分子链刚性较 大,链柔顺性较差或者规整度较低,因此结晶聚合物比非晶态聚合物能够耐更高的温度, 作为材料使用时,其耐热性更好些。如结晶的等规聚苯乙烯的耐热性比非晶的无规聚苯乙 烯高 4. 为什么聚合物的结晶温度范围是 Tg~Tm? 答:T>Tm 分子热运动自由能大于内能,难以形成有序结构 T<Tg 大分子链段运动被冻结,不能发生分子重排和形成结晶结构 5. 什么是结晶度?结晶度的大小对聚合物性能有哪些影响 1)力学性能 结晶使塑料变脆(耐冲击强度下降),韧性较强,延展性较差。 2)光学性能 结晶使塑料不透明,因为晶区与非晶区的界面会发生光散射。减小球晶尺寸 到一定程式度,不仅提高了塑料的强度(减小了晶间缺陷)而且提高了透明度,(当球晶尺 寸小于光波长时不会产生散射)。 3)热性能 结晶性塑料在温度升高时不出现高弹态,温度升高至熔融温度 TM 时,呈现粘 流态。因此结晶性塑料的使用温度从 Tg (玻璃化温度)提高到 TM(熔融温度)。 4)耐溶剂性,渗透性等得到提高,因为结晶分排列更加紧密。 6.何谓聚合物的二次结晶和后结晶? 二次结晶:指一次结晶后,在残留的非晶区和结晶不完整的部分区域内,继续结晶并逐步 完善的过程,此过程很缓慢,可能几年甚至几十年。 后结晶:指一部分来不及结晶的区域,在成型后继续结晶的过程,不形成新的结晶区域, 而在球晶界面上使晶体进一步张大,是初结晶的继续。 7. 聚合物在成型过程中为什么会发生取向?成型时的取向产生的原因及形式有哪几种?取 向对高分子材料制品的性能有何影响?

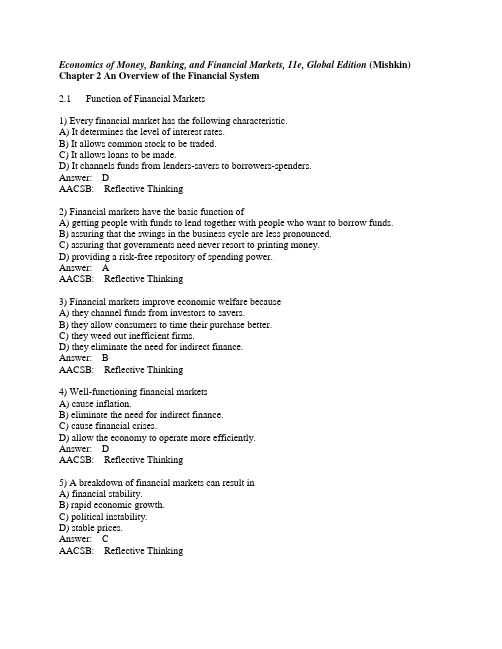

米什金 货币金融学 英文版习题答案chapter 2英文习题

Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 2 An Overview of the Financial System2.1 Function of Financial Markets1) Every financial market has the following characteristic.A) It determines the level of interest rates.B) It allows common stock to be traded.C) It allows loans to be made.D) It channels funds from lenders-savers to borrowers-spenders.Answer: DAACSB: Reflective Thinking2) Financial markets have the basic function ofA) getting people with funds to lend together with people who want to borrow funds.B) assuring that the swings in the business cycle are less pronounced.C) assuring that governments need never resort to printing money.D) providing a risk-free repository of spending power.Answer: AAACSB: Reflective Thinking3) Financial markets improve economic welfare becauseA) they channel funds from investors to savers.B) they allow consumers to time their purchase better.C) they weed out inefficient firms.D) they eliminate the need for indirect finance.Answer: BAACSB: Reflective Thinking4) Well-functioning financial marketsA) cause inflation.B) eliminate the need for indirect finance.C) cause financial crises.D) allow the economy to operate more efficiently.Answer: DAACSB: Reflective Thinking5) A breakdown of financial markets can result inA) financial stability.B) rapid economic growth.C) political instability.D) stable prices.Answer: CAACSB: Reflective Thinking6) The principal lender-savers areA) governments.B) businesses.C) households.D) foreigners.Answer: CAACSB: Application of Knowledge7) Which of the following can be described as direct finance?A) You take out a mortgage from your local bank.B) You borrow $2500 from a friend.C) You buy shares of common stock in the secondary market.D) You buy shares in a mutual fund.Answer: BAACSB: Analytical Thinking8) Assume that you borrow $2000 at 10% annual interest to finance a new business project. For this loan to be profitable, the minimum amount this project must generate in annual earnings isA) $400.B) $201.C) $200.D) $199.Answer: BAACSB: Analytical Thinking9) You can borrow $5000 to finance a new business venture. This new venture will generate annual earnings of $251. The maximum interest rate that you would pay on the borrowed funds and still increase your income isA) 25%.B) 12.5%.C) 10%.D) 5%.Answer: DAACSB: Analytical Thinking10) Which of the following can be described as involving direct finance?A) A corporation issues new shares of stock.B) People buy shares in a mutual fund.C) A pension fund manager buys a short-term corporate security in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets. Answer: AAACSB: Analytical Thinking11) Which of the following can be described as involving direct finance?A) A corporation takes out loans from a bank.B) People buy shares in a mutual fund.C) A corporation buys a short-term corporate security in a secondary market.D) People buy shares of common stock in the primary markets.Answer: DAACSB: Analytical Thinking12) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) A corporation buys a share of common stock issued by another corporation in the primary market.C) You buy a U.S. Treasury bill from the U.S. Treasury at .D) You make a deposit at a bank.Answer: DAACSB: Analytical Thinking13) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) You buy shares in a mutual fund.C) You buy a U.S. Treasury bill from the U.S. Treasury at Treasury .D) You purchase shares in an initial public offering by a corporation in the primary market. Answer: BAACSB: Analytical Thinking14) Securities are ________ for the person who buys them, but are ________ for the individual or firm that issues them.A) assets; liabilitiesB) liabilities; assetsC) negotiable; nonnegotiableD) nonnegotiable; negotiableAnswer: AAACSB: Reflective Thinking15) With ________ finance, borrowers obtain funds from lenders by selling them securities in the financial markets.A) activeB) determinedC) indirectD) directAnswer: DAACSB: Application of Knowledge16) With direct finance, funds are channeled through the financial market from the ________ directly to the ________.A) savers, spendersB) spenders, investorsC) borrowers, saversD) investors, saversAnswer: AAACSB: Reflective Thinking17) Distinguish between direct finance and indirect finance. Which of these is the most important source of funds for corporations in the United States?Answer: With direct finance, funds flow directly from the lender/saver to the borrower. With indirect finance, funds flow from the lender/saver to a financial intermediary who then channels the funds to the borrower/investor. Financial intermediaries (indirect finance) are the major source of funds for corporations in the U.S.AACSB: Reflective Thinking2.2 Structure of Financial Markets1) Which of the following statements about the characteristics of debt and equity is FALSE?A) They can both be long-term financial instruments.B) They can both be short-term financial instruments.C) They both involve a claim on the issuer's income.D) They both enable a corporation to raise funds.Answer: BAACSB: Reflective Thinking2) Which of the following statements about the characteristics of debt and equities is TRUE?A) They can both be long-term financial instruments.B) Bond holders are residual claimants.C) The income from bonds is typically more variable than that from equities.D) Bonds pay dividends.Answer: AAACSB: Reflective Thinking3) Which of the following statements about financial markets and securities is TRUE?A) A bond is a long-term security that promises to make periodic payments called dividends to the firm's residual claimants.B) A debt instrument is intermediate term if its maturity is less than one year.C) A debt instrument is intermediate term if its maturity is ten years or longer.D) The maturity of a debt instrument is the number of years (term) to that instrument's expiration date.Answer: DAACSB: Reflective Thinking4) Which of the following is an example of an intermediate-term debt?A) a fifteen-year mortgageB) a sixty-month car loanC) a six-month loan from a finance companyD) a thirty-year U.S. Treasury bondAnswer: BAACSB: Analytical Thinking5) If the maturity of a debt instrument is less than one year, the debt is calledA) short-term.B) intermediate-term.C) long-term.D) prima-term.Answer: AAACSB: Application of Knowledge6) Long-term debt has a maturity that isA) between one and ten years.B) less than a year.C) between five and ten years.D) ten years or longer.Answer: DAACSB: Application of Knowledge7) When I purchase ________, I own a portion of a firm and have the right to vote on issues important to the firm and to elect its directors.A) bondsB) billsC) notesD) stockAnswer: DAACSB: Application of Knowledge8) Equity holders are a corporation's ________. That means the corporation must pay all of its debt holders before it pays its equity holders.A) debtorsB) brokersC) residual claimantsD) underwritersAnswer: CAACSB: Reflective Thinking9) Which of the following benefits directly from any increase in the corporation's profitability?A) a bond holderB) a commercial paper holderC) a shareholderD) a T-bill holderAnswer: CAACSB: Reflective Thinking10) A financial market in which previously issued securities can be resold is called a ________ market.A) primaryB) secondaryC) tertiaryD) used securitiesAnswer: BAACSB: Application of Knowledge11) An important financial institution that assists in the initial sale of securities in the primary market is theA) investment bank.B) commercial bank.C) stock exchange.D) brokerage house.Answer: AAACSB: Application of Knowledge12) When an investment bank ________ securities, it guarantees a price for a corporation's securities and then sells them to the public.A) underwritesB) undertakesC) overwritesD) overtakesAnswer: AAACSB: Application of Knowledge13) Which of the following is NOT a secondary market?A) foreign exchange marketB) futures marketC) options marketD) IPO marketAnswer: DAACSB: Reflective Thinking14) ________ work in the secondary markets matching buyers with sellers of securities.A) DealersB) UnderwritersC) BrokersD) ClaimantsAnswer: CAACSB: Application of Knowledge15) A corporation acquires new funds only when its securities are sold in theA) primary market by an investment bank.B) primary market by a stock exchange broker.C) secondary market by a securities dealer.D) secondary market by a commercial bank.Answer: AAACSB: Reflective Thinking16) A corporation acquires new funds only when its securities are sold in theA) secondary market by an investment bank.B) primary market by an investment bank.C) secondary market by a stock exchange broker.D) secondary market by a commercial bank.Answer: BAACSB: Reflective Thinking17) An important function of secondary markets is toA) make it easier to sell financial instruments to raise funds.B) raise funds for corporations through the sale of securities.C) make it easier for governments to raise taxes.D) create a market for newly constructed houses.Answer: AAACSB: Reflective Thinking18) Secondary markets make financial instruments moreA) solid.B) vapid.C) liquid.D) risky.Answer: CAACSB: Reflective Thinking19) A liquid asset isA) an asset that can easily and quickly be sold to raise cash.B) a share of an ocean resort.C) difficult to resell.D) always sold in an over-the-counter market.Answer: AAACSB: Reflective Thinking20) The higher a security's price in the secondary market the ________ funds a firm can raise byselling securities in the ________ market.A) more; primaryB) more; secondaryC) less; primaryD) less; secondaryAnswer: AAACSB: Reflective Thinking21) When secondary market buyers and sellers of securities meet in one central location to conduct trades the market is called a(n)A) exchange.B) over-the-counter market.C) common market.D) barter market.Answer: AAACSB: Application of Knowledge22) In a(n) ________ market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices.A) exchangeB) over-the-counterC) commonD) barterAnswer: BAACSB: Application of Knowledge23) Forty or so dealers establish a "market" in these securities by standing ready to buy and sell them.A) secondary stocksB) surplus stocksC) U.S. government bondsD) common stocksAnswer: CAACSB: Application of Knowledge24) Which of the following statements about financial markets and securities is TRUE?A) Many common stocks are traded over-the-counter, although the largest corporations usually have their shares traded at organized stock exchanges such as the New York Stock Exchange. B) As a corporation gets a share of the broker's commission, a corporation acquires new funds whenever its securities are sold.C) Capital market securities are usually more widely traded than shorter-term securities and so tend to be more liquid.D) Prices of capital market securities are usually more stable than prices of money market securities, and so are often used to hold temporary surplus funds of corporations.Answer: AAACSB: Reflective Thinking25) A financial market in which only short-term debt instruments are traded is called the________ market.A) bondB) moneyC) capitalD) stockAnswer: BAACSB: Analytical Thinking26) Equity instruments are traded in the ________ market.A) moneyB) bondC) capitalD) commoditiesAnswer: CAACSB: Analytical Thinking27) Because these securities are more liquid and generally have smaller price fluctuations, corporations and banks use the ________ securities to earn interest on temporary surplus funds.A) money marketB) capital marketC) bond marketD) stock marketAnswer: AAACSB: Reflective Thinking28) Corporations receive funds when their stock is sold in the primary market. Why do corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primary market.AACSB: Reflective Thinking29) Describe the two methods of organizing a secondary market.Answer: A secondary market can be organized as an exchange where buyers and sellers meet in one central location to conduct trades. An example of an exchange is the New York Stock Exchange. A secondary market can also be organized as an over-the-counter market. In this type of market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices. An example of an over-the-counter market is the federal funds market.AACSB: Reflective Thinking2.3 Financial Market Instruments1) Prices of money market instruments undergo the least price fluctuations because ofA) the short terms to maturity for the securities.B) the heavy regulations in the industry.C) the price ceiling imposed by government regulators.D) the lack of competition in the market.Answer: AAACSB: Reflective Thinking2) U.S. Treasury bills pay no interest but are sold at a ________. That is, you will pay a lower purchase price than the amount you receive at maturity.A) premiumB) collateralC) defaultD) discountAnswer: DAACSB: Analytical Thinking3) U.S. Treasury bills are considered the safest of all money market instruments because there isa low probability ofA) defeat.B) default.C) desertion.D) demarcation.Answer: BAACSB: Analytical Thinking4) A debt instrument sold by a bank to its depositors that pays annual interest of a given amount and at maturity pays back the original purchase price is calledA) commercial paper.B) a certificate of deposit.C) a municipal bond.D) federal funds.Answer: BAACSB: Analytical Thinking5) A short-term debt instrument issued by well-known corporations is calledA) commercial paper.B) corporate bonds.C) municipal bonds.D) commercial mortgages.Answer: AAACSB: Analytical Thinking6) ________ are short-term loans in which Treasury bills serve as collateral.A) Repurchase agreementsB) Negotiable certificates of depositC) Federal fundsD) U.S. government agency securitiesAnswer: AAACSB: Analytical Thinking7) Collateral is ________ the lender receives if the borrower does not pay back the loan.A) a liabilityB) an assetC) a presentD) an offeringAnswer: BAACSB: Analytical Thinking8) Federal funds areA) funds raised by the federal government in the bond market.B) loans made by the Federal Reserve System to banks.C) loans made by banks to the Federal Reserve System.D) loans made by banks to each other.Answer: DAACSB: Analytical Thinking9) An important source of short-term funds for commercial banks are ________ which can be resold on the secondary market.A) negotiable CDsB) commercial paperC) mortgage-backed securitiesD) municipal bondsAnswer: AAACSB: Application of Knowledge。

米什金货币金融学英文版习题答案chapter2英文习题

米什金货币金融学英文版习题答案chapter2英文习题Economics of Money, Banking, and Financial Markets, 11e, Global Edition (Mishkin) Chapter 2 An Overview of the Financial System2.1 Function of Financial Markets1) Every financial market has the following characteristic.A) It determines the level of interest rates.B) It allows common stock to be traded.C) It allows loans to be made.D) It channels funds from lenders-savers to borrowers-spenders.Answer: DAACSB: Reflective Thinking2) Financial markets have the basic function ofA) getting people with funds to lend together with people who want to borrow funds.B) assuring that the swings in the business cycle are less pronounced.C) assuring that governments need never resort to printing money.D) providing a risk-free repository of spending power.Answer: AAACSB: Reflective Thinking3) Financial markets improve economic welfare becauseA) they channel funds from investors to savers.B) they allow consumers to time their purchase better.C) they weed out inefficient firms.D) they eliminate the need for indirect finance.Answer: BAACSB: Reflective Thinking4) Well-functioning financial marketsA) cause inflation.B) eliminate the need for indirect finance.C) cause financial crises.D) allow the economy to operate more efficiently. Answer: DAACSB: Reflective Thinking5) A breakdown of financial markets can result inA) financial stability.B) rapid economic growth.C) political instability.D) stable prices.Answer: CAACSB: Reflective Thinking6) The principal lender-savers areA) governments.B) businesses.C) households.D) foreigners.Answer: CAACSB: Application of Knowledge7) Which of the following can be described as direct finance?A) You take out a mortgage from your local bank.B) You borrow $2500 from a friend.C) You buy shares of common stock in the secondary market.D) You buy shares in a mutual fund.Answer: BAACSB: Analytical Thinking8) Assume that you borrow $2000 at 10% annual interest tofinance a new business project. For this loan to be profitable, the minimum amount this project must generate in annual earnings isA) $400.B) $201.C) $200.D) $199.Answer: BAACSB: Analytical Thinking9) You can borrow $5000 to finance a new business venture. This new venture will generate annual earnings of $251. The maximum interest rate that you would pay on the borrowed funds and still increase your income isA) 25%.B) 12.5%.C) 10%.D) 5%.Answer: DAACSB: Analytical Thinking10) Which of the following can be described as involving direct finance?A) A corporation issues new shares of stock.B) People buy shares in a mutual fund.C) A pension fund manager buys a short-term corporate security in the secondary market.D) An insurance company buys shares of common stock in the over-the-counter markets. Answer: AAACSB: Analytical Thinking11) Which of the following can be described as involving direct finance?A) A corporation takes out loans from a bank.B) People buy shares in a mutual fund.C) A corporation buys a short-term corporate security in a secondary market.D) People buy shares of common stock in the primary markets.Answer: DAACSB: Analytical Thinking12) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) A corporation buys a share of common stock issued by another corporation in the primary market.C) You buy a U.S. Treasury bill from the U.S. Treasury at /doc/1f18983379.html,.D) You make a deposit at a bank.Answer: DAACSB: Analytical Thinking13) Which of the following can be described as involving indirect finance?A) You make a loan to your neighbor.B) You buy shares in a mutual fund.C) You buy a U.S. Treasury bill from the U.S. Treasury at Treasury /doc/1f18983379.html,.D) You purchase shares in an initial public offering by a corporation in the primary market. Answer: BAACSB: Analytical Thinking14) Securities are ________ for the person who buys them, but are ________ for the individual or firm that issues them.A) assets; liabilitiesB) liabilities; assetsC) negotiable; nonnegotiableD) nonnegotiable; negotiableAnswer: AAACSB: Reflective Thinking15) With ________ finance, borrowers obtain funds from lenders by selling them securities in the financial markets.A) activeB) determinedC) indirectD) directAnswer: DAACSB: Application of Knowledge16) With direct finance, funds are channeled through the financial market from the ________ directly to the ________.A) savers, spendersB) spenders, investorsC) borrowers, saversD) investors, saversAnswer: AAACSB: Reflective Thinking17) Distinguish between direct finance and indirect finance. Which of these is the most important source of funds for corporations in the United States?Answer: With direct finance, funds flow directly from the lender/saver to the borrower. With indirect finance, funds flow from the lender/saver to a financial intermediary who then channels the funds to the borrower/investor. Financial intermediaries (indirect finance) are the major source of funds for corporations in the U.S.AACSB: Reflective Thinking2.2 Structure of Financial Markets1) Which of the following statements about the characteristics of debt and equity is FALSE?A) They can both be long-term financial instruments.B) They can both be short-term financial instruments.C) They both involve a claim on the issuer's income.D) They both enable a corporation to raise funds.Answer: BAACSB: Reflective Thinking2) Which of the following statements about the characteristics of debt and equities is TRUE?A) They can both be long-term financial instruments.B) Bond holders are residual claimants.C) The income from bonds is typically more variable than that from equities.D) Bonds pay dividends.Answer: AAACSB: Reflective Thinking3) Which of the following statements about financial markets and securities is TRUE?A) A bond is a long-term security that promises to make periodic payments called dividends to the firm's residual claimants.B) A debt instrument is intermediate term if its maturity is less than one year.C) A debt instrument is intermediate term if its maturity is ten years or longer.D) The maturity of a debt instrument is the number of years (term) to that instrument's expiration date.Answer: DAACSB: Reflective Thinking4) Which of the following is an example of an intermediate-term debt?A) a fifteen-year mortgageB) a sixty-month car loanC) a six-month loan from a finance companyD) a thirty-year U.S. Treasury bondAnswer: BAACSB: Analytical Thinking5) If the maturity of a debt instrument is less than one year, the debt is calledA) short-term.B) intermediate-term.C) long-term.D) prima-term.Answer: AAACSB: Application of Knowledge6) Long-term debt has a maturity that isA) between one and ten years.B) less than a year.C) between five and ten years.D) ten years or longer.Answer: DAACSB: Application of Knowledge7) When I purchase ________, I own a portion of a firm and have the right to vote on issues important to the firm and to elect its directors.A) bondsB) billsC) notesD) stockAnswer: DAACSB: Application of Knowledge8) Equity holders are a corporation's ________. That means the corporation must pay all of its debt holders before it pays its equity holders.A) debtorsB) brokersC) residual claimantsD) underwritersAnswer: CAACSB: Reflective Thinking9) Which of the following benefits directly from any increase in the corporation's profitability?A) a bond holderB) a commercial paper holderC) a shareholderD) a T-bill holderAnswer: CAACSB: Reflective Thinking10) A financial market in which previously issued securities can be resold is called a ________ market.A) primaryB) secondaryC) tertiaryD) used securitiesAnswer: BAACSB: Application of Knowledge11) An important financial institution that assists in the initialsale of securities in the primary market is theA) investment bank.B) commercial bank.C) stock exchange.D) brokerage house.Answer: AAACSB: Application of Knowledge12) When an investment bank ________ securities, it guarantees a price for a corporation's securities and then sells them to the public.A) underwritesB) undertakesC) overwritesD) overtakesAnswer: AAACSB: Application of Knowledge13) Which of the following is NOT a secondary market?A) foreign exchange marketB) futures marketC) options marketD) IPO marketAnswer: DAACSB: Reflective Thinking14) ________ work in the secondary markets matching buyers with sellers of securities.A) DealersB) UnderwritersC) BrokersD) ClaimantsAnswer: CAACSB: Application of Knowledge15) A corporation acquires new funds only when its securities are sold in theA) primary market by an investment bank.B) primary market by a stock exchange broker.C) secondary market by a securities dealer.D) secondary market by a commercial bank.Answer: AAACSB: Reflective Thinking16) A corporation acquires new funds only when its securities are sold in theA) secondary market by an investment bank.B) primary market by an investment bank.C) secondary market by a stock exchange broker.D) secondary market by a commercial bank.Answer: BAACSB: Reflective Thinking17) An important function of secondary markets is toA) make it easier to sell financial instruments to raise funds.B) raise funds for corporations through the sale of securities.C) make it easier for governments to raise taxes.D) create a market for newly constructed houses.Answer: AAACSB: Reflective Thinking18) Secondary markets make financial instruments moreA) solid.B) vapid.C) liquid.D) risky.Answer: CAACSB: Reflective Thinking19) A liquid asset isA) an asset that can easily and quickly be sold to raise cash.B) a share of an ocean resort.C) difficult to resell.D) always sold in an over-the-counter market.Answer: AAACSB: Reflective Thinking20) The higher a security's price in the secondary market the ________ funds a firm can raise byselling securities in the ________ market.A) more; primaryB) more; secondaryC) less; primaryD) less; secondaryAnswer: AAACSB: Reflective Thinking21) When secondary market buyers and sellers of securities meet in one central location to conduct trades the market is called a(n)A) exchange.B) over-the-counter market.C) common market.D) barter market.Answer: AAACSB: Application of Knowledge22) In a(n) ________ market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices.A) exchangeB) over-the-counterC) commonD) barterAnswer: BAACSB: Application of Knowledge23) Forty or so dealers establish a "market" in these securities by standing ready to buy and sell them.A) secondary stocksB) surplus stocksC) U.S. government bondsD) common stocksAnswer: CAACSB: Application of Knowledge24) Which of the following statements about financial markets and securities is TRUE?A) Many common stocks are traded over-the-counter, although the largest corporations usually have their shares traded at organized stock exchanges such as the New York Stock Exchange. B) As a corporation gets a share of the broker's commission, a corporation acquires new funds whenever its securities are sold.C) Capital market securities are usually more widely traded than shorter-term securities and so tend to be more liquid.D) Prices of capital market securities are usually more stable than prices of money market securities, and so are often used to hold temporary surplus funds of corporations.Answer: AAACSB: Reflective Thinking25) A financial market in which only short-term debt instruments are traded is called the________ market.A) bondB) moneyC) capitalD) stockAnswer: BAACSB: Analytical Thinking26) Equity instruments are traded in the ________ market.A) moneyB) bondC) capitalD) commoditiesAnswer: CAACSB: Analytical Thinking27) Because these securities are more liquid and generally have smaller price fluctuations, corporations and banks use the ________ securities to earn interest on temporary surplus funds.A) money marketB) capital marketC) bond marketD) stock marketAnswer: AAACSB: Reflective Thinking28) Corporations receive funds when their stock is sold in the primary market. Why do corporations pay attention to what is happening to their stock in the secondary market? Answer: The existence of the secondary market makes their stock more liquid and the price in the secondary market sets the price that the corporation would receive if they choose to sell more stock in the primary market.AACSB: Reflective Thinking29) Describe the two methods of organizing a secondary market.Answer: A secondary market can be organized as an exchange where buyers and sellers meet in one central location to conduct trades. An example of an exchange is the New York Stock Exchange. A secondary market can also be organized as an over-the-counter market. In this type of market, dealers in different locations buy and sell securities to anyone who comes to them and is willing to accept their prices. An example of an over-the-counter market is the federal funds market.AACSB: Reflective Thinking2.3 Financial Market Instruments1) Prices of money market instruments undergo the least price fluctuations because ofA) the short terms to maturity for the securities.B) the heavy regulations in the industry.C) the price ceiling imposed by government regulators.D) the lack of competition in the market.Answer: AAACSB: Reflective Thinking2) U.S. Treasury bills pay no interest but are sold at a ________. That is, you will pay a lower purchase price than the amount you receive at maturity.A) premiumB) collateralC) defaultD) discountAnswer: DAACSB: Analytical Thinking3) U.S. Treasury bills are considered the safest of all money market instruments because there isa low probability ofA) defeat.B) default.C) desertion.D) demarcation.Answer: BAACSB: Analytical Thinking4) A debt instrument sold by a bank to its depositors that pays annual interest of a given amount and at maturity pays back the original purchase price is calledA) commercial paper.B) a certificate of deposit.C) a municipal bond.D) federal funds.Answer: BAACSB: Analytical Thinking5) A short-term debt instrument issued by well-known corporations is calledA) commercial paper.B) corporate bonds.C) municipal bonds.D) commercial mortgages.Answer: AAACSB: Analytical Thinking6) ________ are short-term loans in which Treasury bills serve as collateral.A) Repurchase agreementsB) Negotiable certificates of depositC) Federal fundsD) U.S. government agency securitiesAnswer: AAACSB: Analytical Thinking7) Collateral is ________ the lender receives if the borrower does not pay back the loan.A) a liabilityB) an assetC) a presentD) an offeringAnswer: BAACSB: Analytical Thinking8) Federal funds areA) funds raised by the federal government in the bond market.B) loans made by the Federal Reserve System to banks.C) loans made by banks to the Federal Reserve System.D) loans made by banks to each other.Answer: DAACSB: Analytical Thinking9) An important source of short-term funds for commercial banks are ________ which can be resold on the secondary market.A) negotiable CDsB) commercial paperC) mortgage-backed securitiesD) municipal bondsAnswer: AAACSB: Application of Knowledge10) Which of the following are short-term financial instruments?A) a repurchase agreementB) a share of Walt Disney Corporation stockC) a Treasury note with a maturity of four yearsD) a residential mortgageAnswer: AAACSB: Analytical Thinking11) Which of the following instruments are traded in a money market?A) state and local government bondsB) U.S. Treasury billsC) corporate bondsD) U.S. government agency securitiesAnswer: BAACSB: Analytical Thinking12) Which of the following instruments are traded in a money market?A) bank commercial loansB) commercial paperC) state and local government bondsD) residential mortgagesAnswer: BAACSB: Analytical Thinking13) Which of the following instruments is NOT traded in a money market?A) residential mortgagesB) U.S. Treasury BillsC) negotiable bank certificates of depositD) commercial paperAnswer: AAACSB: Analytical Thinking14) Bonds issued by state and local governments are called ________ bonds.A) corporateB) TreasuryC) municipalD) commercialAnswer: CAACSB: Application of Knowledge15) Equity and debt instruments with maturities greater than one year are called ________ market instruments.A) capitalB) moneyC) federalD) benchmarkAnswer: AAACSB: Application of Knowledge16) Which of the following is a long-term financial instrument?A) a negotiable certificate of depositB) a repurchase agreementC) a U.S. Treasury bondD) a U.S. Treasury billAnswer: CAACSB: Analytical Thinking17) Which of the following instruments are traded in a capital market?A) U.S. Government agency securitiesB) negotiable bank CDsC) repurchase agreementsD) U.S. Treasury billsAnswer: AAACSB: Analytical Thinking18) Which of the following instruments are traded in a capital market?A) corporate bondsB) U.S. Treasury billsC) negotiable bank CDsD) repurchase agreementsAnswer: AAACSB: Analytical Thinking19) Which of the following are NOT traded in a capital market?A) U.S. government agency securitiesB) state and local government bondsC) repurchase agreementsD) corporate bondsAnswer: CAACSB: Analytical Thinking20) The most liquid securities traded in the capital market areA) corporate bonds.B) municipal bonds.C) U.S. Treasury bonds.D) mortgage-backed securities.Answer: CAACSB: Reflective Thinking21) Mortgage-backed securities are similar to ________ but the interest and principal payments are backed by the individual mortgages within the security.A) bondsB) stockC) repurchase agreementsD) negotiable CDsAnswer: AAACSB: Application of Knowledge2.4 Internationalization of Financial Markets1) Equity of U.S. companies can be purchased byA) U.S. citizens only.B) foreign citizens only.C) U.S. citizens and foreign citizens.D) U.S. mutual funds only.Answer: CAACSB: Diverse and multicultural work environments2) One reason for the extraordinary growth of foreign financial markets isA) decreased trade.B) increases in the pool of savings in foreign countries.C) the recent introduction of the foreign bond.D) slower technological innovation in foreign markets.Answer: BAACSB: Diverse and multicultural work environments3) Bonds that are sold in a foreign country and are denominated in the country's currency in which they are sold are known asA) foreign bonds.B) Eurobonds.C) equity bonds.D) country bonds.Answer: AAACSB: Application of Knowledge4) Bonds that are sold in a foreign country and are denominated in a currency other than that of the country inwhich it is sold are known asA) foreign bonds.B) Eurobonds.C) equity bonds.D) country bonds.Answer: BAACSB: Application of Knowledge5) If Microsoft sells a bond in London and it is denominated in dollars, the bond is aA) Eurobond.B) foreign bond.C) British bond.D) currency bond.Answer: AAACSB: Reflective Thinking6) U.S. dollar deposits in foreign banks outside the U.S. or in foreign branches of U.S. banks are calledA) Atlantic dollars.B) Eurodollars.C) foreign dollars.D) outside dollars.Answer: BAACSB: Application of Knowledge7) If Toyota sells a $1000 bond in the United States, the bond is aA) foreign bond.B) Eurobond.C) Tokyo bond.D) currency bond.Answer: A8) Distinguish between a foreign bond and a Eurobond.Answer: A foreign bond is sold in a foreign country and priced in that country's currency. A Eurobond is sold in a foreign country and priced in a currency that is not that country's currency. AACSB: Reflective Thinking2.5 Function of Financial Intermediaries: Indirect Finance1) The process of indirect finance using financial intermediaries is calledA) direct lending.B) financial intermediation.C) resource allocation.D) financial liquidation.Answer: BAACSB: Reflective Thinking2) In the United States, loans from ________ are far ________ important for corporate finance than are securities markets.A) government agencies; moreB) government agencies; lessC) financial intermediaries; moreD) financial intermediaries; lessAnswer: CAACSB: Reflective Thinking3) The time and money spent in carrying out financial transactions are calledA) economies of scale.B) financial intermediation.C) liquidity services.D) transaction costs.Answer: D4) Economies of scale enable financial institutions toA) reduce transactions costs.B) avoid the asymmetric information problem.C) avoid adverse selection problems.D) reduce moral hazard.Answer: AAACSB: Reflective Thinking5) An example of economies of scale in the provision of financial services isA) investing in a diversified collection of assets.B) providing depositors with a variety of savings certificates.C) hiring more support staff so that customers don't have to wait so long for assistance.D) spreading the cost of writing a standardized contract over many borrowers.Answer: DAACSB: Reflective Thinking6) Financial intermediaries provide customers with liquidity services. Liquidity servicesA) make it easier for customers to conduct transactions.B) allow customers to have a cup of coffee while waiting in the lobby.C) are a result of the asymmetric information problem.D) are another term for asset transformation.Answer: AAACSB: Reflective Thinking7) The process where financial intermediaries create and sell low-risk assets and use the proceeds to purchase riskier assets is known asA) risk sharing.B) risk aversion.C) risk neutrality.D) risk selling.Answer: AAACSB: Analytical Thinking8) The process of asset transformation refers to the conversion ofA) safer assets into risky assets.B) safer assets into safer liabilities.C) risky assets into safer assets.D) risky assets into risky liabilities.Answer: CAACSB: Analytical Thinking9) Reducing risk through the purchase of assets whose returns do not always move together isA) diversification.B) intermediation.C) intervention.D) discounting.Answer: AAACSB: Analytical Thinking10) The concept of diversification is captured by the statementA) don't look a gift horse in the mouth.B) don't put all your eggs in one basket.C) it never rains, but it pours.D) make hay while the sun shines.Answer: BAACSB: Reflective Thinking11) Risk sharing is profitable for financial institutions due toA) low transactions costs.B) asymmetric information.C) adverse selection.D) moral hazard.Answer: AAACSB: Reflective Thinking12) Typically, borrowers have superior information relative to lenders about the potential returns and risks associated with an investment project. The difference in information is calledA) moral selection.B) risk sharing.C) asymmetric information.D) adverse hazard.Answer: CAACSB: Analytical Thinking13) If bad credit risks are the ones who most actively seek loans and, therefore, receive them from financial intermediaries, then financial intermediaries face the problem ofA) moral hazard.B) adverse selection.C) free-riding.D) costly state verification.Answer: BAACSB: Reflective Thinking14) The problem created by asymmetric information before the transaction occurs is called________, while the problem created after the transaction occurs is called ________.A) adverse selection; moral hazardB) moral hazard; adverse selectionC) costly state verification; free-ridingD) free-riding; costly state verificationAnswer: AAACSB: Application of Knowledge15) Adverse selection is a problem associated with equity and debt contracts arising fromA) the lender's relative lack of information about the borrower's potential returns and risks of his investment activities.B) the lender's inability to legally require sufficient collateral to cover a 100% loss if the borrower defaults.C) the borrower's lack of incentive to seek a loan for highly risky investments.D) the borrower's lack of good options for obtaining funds.Answer: AAACSB: Reflective Thinking16) An example of the problem of ________ is when a corporation uses the funds raised from selling bonds to fund corporate expansion to pay for Caribbean cruises for all of its employees and their families.A) adverse selectionB) moral hazardC) risk sharingD) credit riskAnswer: BAACSB: Ethical understanding and reasoning abilities17) Banks can lower the cost of information production by applying one information resource to many different services. This process is calledA) economies of scale.B) asset transformation.C) economies of scope.D) asymmetric information.Answer: CAACSB: Application of Knowledge18) Conflicts of interest are a type of ________ problem that can happen when an institution provides multiple services.A) adverse selectionB) free-ridingC) discountingD) moral hazardAnswer: DAACSB: Ethical understanding and reasoning abilities19) Studies of the major developed countries show that when businesses go looking for funds to finance their activities they usually obtain these funds fromA) government agencies.B) equities markets.C) financial intermediaries.D) bond markets.Answer: CAACSB: Application of Knowledge20) The countries that have made the least use of securities markets are ________ and ________; in these two countries finance from financial intermediaries has been almost ten times greater than that from securities markets.A) Germany; JapanB) Germany; Great BritainC) Great Britain; CanadaD) Canada; JapanAnswer: AAACSB: Application of Knowledge21) Although the dominance of ________ over ________ is clear in all countries, the relative importance of bond versus stock markets differs widely.。

chapter 2 课后练习答案ppt1.

three direct links across the Taiwan Straits, namely, the links of trade, travel and post

释义

在今日中国,最引人注目的是农民企业家的出 现。许多昨天还是“面朝黄土背朝天”的农 民,今天成了闻名遐迩的企业家。

(下降)

• name=appoint\nominate(命

• ease=lessen(减轻,缓和) 名,提名)

end=terminate(结束,中止)• nip=defeat(击败)

• flay=criticize(批评)

• slay=murder(谋杀)

• flout=insult(侮辱)

• soar=skyrocket(急剧上升)

• E.g. • 垃圾邮件是最遭人痛恨的因特网产物。

• Spam is the most hated product of the Internet.

• 如今,杂货铺里都不怎么卖猪肉罐头了。

• Nowadays, you can not easily find spam in a grocery.

(禁止)

• check=examine(检查)

bar=prevent(防止,阻 • clash=disagree strongly

止)

(发生分歧,争议)

bare=expose or reveal • curb=control or restrict

(暴露,揭露

(控制)

• dip=decline or decrease • mark=celebrate(庆祝)

百家三资企业调查表明:在华投资大有可为

Survey Shows Growing Confidence of Overseas Investors

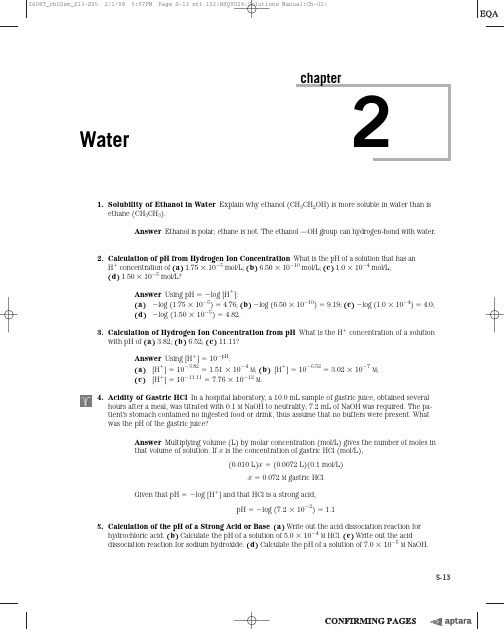

Lehninger Principles of Biochemistry 习题答案chapter 2

2/1/08

5:57PM

Page S-13 ntt 102:WHQY028:Solutions Manual:Ch-02:

chapter

Water

2

Answer Ethanol is polar; ethane is not. The ethanol —OH group can hydrogen-bond with water. Answer Using pH log [H ]: 5 (a) log (1.75 10 ) 4.76; (b) (d) log (1.50 10 5) 4.82. log (6.50 10

0.072 M gastric HCl

log [H ] and that HCl is a strong acid, pH log (7.2 10

2

)

1.1

5. Calculation of the pH of a Strong Acid or Base (a) Write out the acid dissociation reaction for hydrochloric acid. (b) Calculate the pH of a solution of 5.0 10 4 M HCl. (c) Write out the acid dissociation reaction for sodium hydroxide. (d) Calculate the pH of a solution of 7.0 10 5 M NaOH.

2608T_ch02sm_S13-S25

2/1/08

5:57PM

Page S-15 ntt 102:WHQY028:Solutions Manual:Ch-02:

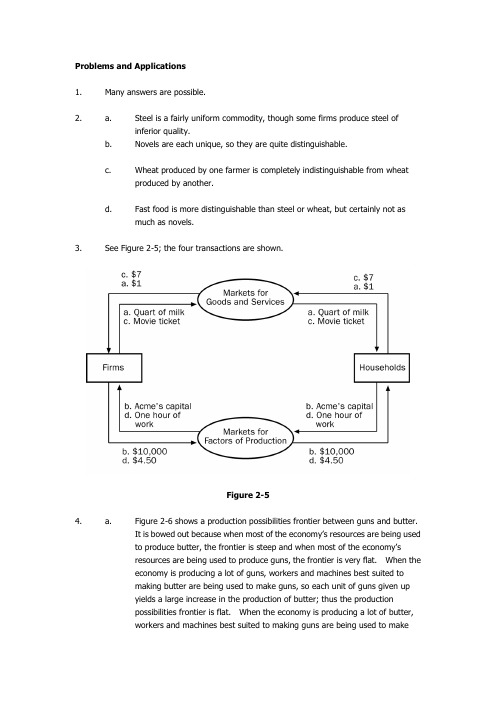

经济学原理 曼昆课后答案 chapter 2

Problems and Applications1. Many answers are possible.2. a. Steel is a fairly uniform commodity, though some firms produce steel ofinferior quality.b. Novels are each unique, so they are quite distinguishable.c. Wheat produced by one farmer is completely indistinguishable from wheatproduced by another.d. Fast food is more distinguishable than steel or wheat, but certainly not asmuch as novels.3. See Figure 2-5; the four transactions are shown.Figure 2-54. a. Figure 2-6 shows a production possibilities frontier between guns and butter.It is bowed out because when most of the economy‟s resources are being usedto produce butter, the frontier is steep and when most of the economy‟sresources are being used to produce guns, the frontier is very flat. When theeconomy is producing a lot of guns, workers and machines best suited tomaking butter are being used to make guns, so each unit of guns given upyields a large increase in the production of butter; thus the productionpossibilities frontier is flat. When the economy is producing a lot of butter,workers and machines best suited to making guns are being used to makebutter, so each unit of guns given up yields a small increase in the productionof butter; thus the production possibilities frontier is steep.b. Point A is impossible for the economy to achieve; it is outside the productionpossibilities frontier. Point B is feasible but inefficient because it‟s inside theproduction possibilities frontier.Figure 2-6c. The Hawks might choose a point like H, with many guns and not much butter.The Doves might choose a point like D, with a lot of butter and few guns.d. If both Hawks and Doves reduced their desired quantity of guns by the sameamount, the Hawks would get a bigger peace dividend because the productionpossibilities frontier is much steeper at point H than at point D. As a result,the reduction of a given number of guns, starting at point H, leads to a muchlarger increase in the quantity of butter produced than when starting at pointD.5. See Figure 2-7. The shape and position of the frontier depend on how costly it is tomaintain a clean environment the productivity of the environmental industry. Gains in environmental productivity, such as the development of a no-emission auto engine, lead to shifts of the production-possibilities frontier, like the shift from PPF1 to PPF2shown in the figure.Figure 2-76. a. A family‟s decision about how much income to save is microeconomics.b. The effect of government regulations on auto emissions is microeconomics.c. The impact of higher saving on economic growth is macroeconomics.d. A firm‟s decision about how many workers to hire is microeconomics.e. The relationship between the inflation rate and changes in the quantity ofmoney is macroeconomics.7. a. The statement that society faces a short-run tradeoff between inflation andunemployment is a positive statement. It deals with how the economy is, nothow it should be. Since economists have examined data and found thatthere‟s a short-run negative relationship between inflation and unemployment,the statement is a fact, thus it‟s a positive statement.b. The statement that a reduction in the rate of growth of money will reduce therate of inflation is a positive statement. Economists have found that moneygrowth and inflation are very closely related. The statement thus tells howthe world is, and so it is a positive statement.c. The statement that the Federal Reserve should reduce the rate of growth ofmoney is a normative statement. It states an opinion about something thatshould be done, not how the world is.d. The statement that society ought to require welfare recipients to look for jobsis a normative statement. It doesn‟t state a fact about how the world is.Instead, it is a statement of how the world should be and is thus a normativestatement.e. The statement that lower tax rates encourage more work and more saving is apositive statement. Economists have studied the relationship between taxrates and work, as well as the relationship between tax rates and saving.They‟ve found a negative relationship in both cases. So the statementreflects how the world is, and is thus a positive statement.8. Two of the statements in Table 2-2 are clearly normative. They are: “5. If thefederal budget is to be balanced, it should be done over the business cycle rather than yearly” and “9. The government should restructure the welfare system along the lines of a …negative income tax.‟” Bot h are suggestions of changes that should be made,rather than statements of fact, so they are clearly normative statements.The other statements in the table are positive. All the statements concern how theworld is, not how the world should be. Note tha t in all cases, even though they‟restatements of fact, fewer than 100 percent of economists agree with them. You could say that positive statements are statements of fact about how the world is, but noteveryone agrees about what the facts are.9. As th e president, you‟d be interested in both the positive and normative views ofeconomists, but you‟d probably be most interested in their positive views. Economists are on your staff to provide their expertise about how the economy works. Theyknow many fa cts about the economy and the interaction of different sectors. So you‟d be most likely to call on them about questions of fact positive analysis. Since you‟re the president, you‟re the one who has the make the normative statements as to what should be done, with an eye to the political consequences. The normative statements made by economists represent their views, not necessarily either your‟s or theelectorate‟s.10. There are many possible answers.11. As of this writing, the chairman of the Federal Reserve is Alan Greenspan, the chair ofthe Council of Economic Advisers is Martin N. Baily, and the secretary of the treasury is Larry Summers.12. There are many possible answers.13. As time goes on, you might expect economists to disagree less about public policybecause they‟ll have opportunities to observe different policies that are put into place. As new policies are tried, their results will become known, and they can be evaluated better. It‟s likely that the disagreement about them will be reduced after they‟ve been tried in practice. For example, many economists thought that wage and price controls would be a good idea for keeping inflation under control, while others thought it was a bad idea. But when the controls were tried in the early 1970s, the results were disastrous. The controls interfered with the invisible hand of the marketplace and shortages developed in many products. As a result, most economists are now convinced that wage and price controls are a bad idea for controlling inflation.But it‟s unlikely that the differences between economists will ever be completely eliminated. Economists differ on too many aspects of how the world works. Plus, even as some policies get tried out and are either accepted or rejected, creative economists keep coming up with new ideas.。

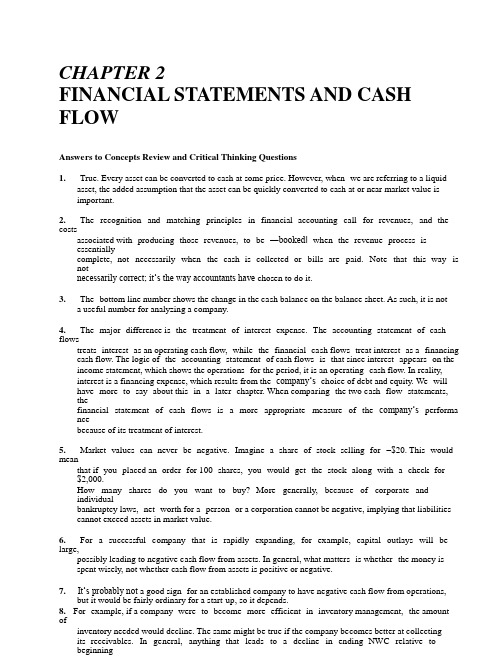

公司理财第九版课后习题答案第二章

CHAPTER 2FINANCIAL STATEMENTS AND CASH FLOWAnswe rs to Concepts Review and Critical Thinking Questions1. True. Every asset can be converted to cash at some price. However, when we are referring to a liquidasset, the added assumption that the asset can be quickly converted to cash at or near market value is important.2. The recognition and matching principles in financial accounting call for revenues, and the costsassociated with producing those revenues, to be ―booked‖when the revenue process isessentiallycomplete, not necessarily when the cash is collected or bills are paid. Note that this way is notnecessarily correct; it‘s the way accountants have chosen to do it.3. The bottom line number shows the change in the ca sh balanc e on the balance sheet. As such, it is nota use ful number for analyzing a company.4. The major difference is the treatment of interest expense. The accounting statement of cash flowstreats interest as an operating ca sh flow, while the financial ca sh flows treat interest as a financing cash flow. The logic of the accounting statement of cash flows is that since interest appears on the income statement, which shows the operations for the period, it is an operating cash flow. In reality, interest is a financing expense, which results from the company‘s choice of debt and equity. We will have more to say about this in a later chapter. When compa ring the two c ash flow statements, thefinancial statement of cash flows is a more appropriate measure of the company‘s performa ncebecause of its treatment of interest.5. Market values can never be negative. Imagine a share of stock selling for –$20. This would meanthat if you placed an order for 100 shares, you would get the stock along with a check for $2,000.How ma ny shares do you want to buy? More generally, because of corpora te andindividualbankruptcy laws, net worth for a person or a corporation cannot be negative, implying that liabilities cannot exceed assets in market value.6. For a successful c ompany that is rapidly expanding, for example, capital outlays will be large,possibly leading to negative c ash flow from assets. In general, what matters is whether the money is spent wisely, not whe ther cash flow from assets is positive or negative.7. It‘s probably not a good sign for an e stablished company to have negative cash flow from operations,but it would be fairly ordinary for a start-up, so it depends.would have this effect. Negative net c apital spending would mea n more long-lived assets wereliquidated than purchased.49.10. If a company raises more money from selling stock than it pays in dividends in a particular period,its cash flow to stockholders will be negative. If a company borrows more than it pays in interest and principal, its cash flow to creditors will be negative.The adjustments discussed were purely accounting changes; they had no cash flow or market value consequences unless the new accounting information caused stockholders to revalue the derivatives.Solutions to Questions and Proble msNOTE: All end-of-chapter problems were solved using a spreadsheet. Many problems require multiplesteps. Due to space and readability constraints, when these intermediate steps are included in thissolutions manual, rounding may appear to have occurred. However, the final answer for each problem is found without rounding during any step in the problem.Basic1. To find owners‘ equity, we must construct a balance sheet as follows:Balance SheetCA $ 5,300 CL $ 3,900NFA 26,000 LTD 14,200OE ??TA $31,300 TL & OE $31,300We know that total liabilities and owners‘ equity (TL & OE) must equal total assets of $31,300. We also know that TL & OE is equal to current liabilities plus long-term debt plus owner‘s equity, soowner‘s equity is:OE = $31,300 –14,200 – 3,900 = $13,200NWC = CA – CL = $5,300 – 3,900 = $1,4002. The income statement for the company is:Income StatementSales $493,000Costs 210,000Depreciation 35,000EBIT $248,000Interest 19,000EBT $229,000Taxes 80,150Net income $148,8503.4.5.6. One equation for net income is:Net income = Dividends + Addition to retained earningsRearranging, we get:Addition to retained earnings = Net income – Divide ndsAddition to retained earnings = $148,850 – 50,000Addition to retained earnings = $98,850To find the book value of current assets, we use: NWC = CA – CL. Rearranging to solve for current assets, we get:CA = NWC + CL = $800,000 + 2,100,000 = $2,900,000The market value of current assets and net fixed assets is given, so:Book value CA= $2,900,000 Market value CA= $2,800,000Book value NFA = $5,000,000 Market value NFA= $6,300,000Book value assets = $7,900,000 Market value assets= $9,100,000Taxes = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($246K – 100K)Taxes = $79,190The average tax ra te is the total tax paid divided by net income, so:Average tax rate = $79,190 / $246,000Average tax rate = 32.19%The marginal tax rate is the tax rate on the next $1 of earnings, so the marginal tax ra te = 39%.To calculate OCF, we first need the income state ment:Income StatementSales $14,900Costs 5,800Depreciation 1,300EBIT $7,800Interest 780Taxable income $7,020Taxes 2,808Net income $4,212OCF = EBIT + Depreciation – TaxesOCF = $7,800 + 1,300 – 2,808OCF = $6,292Net capital spending = $1,730,000 – 1,650,000 + 284,000Net capital spending = $364,0007. The long-term debt account will increase by $10 million, the amount of the new long-term debt issue.Since the company sold 10 million new shares of stock with a $1 par value, the common stockaccount will increase by $10 million. The capital surplus account will increase by $33 million, thevalue of the new stoc k sold above its par value. Since the company had a net income of $9million,and pa id $2 million in dividends, the addition to retained earnings was $7 million, which willinc rease the accumulated retained earnings account. So, the new long-term debt a nd stockholders‘ equity portion of the balance sheet will be:Long-term debt $82,000,000Total long-term debt $82,000,000Shareholders equityPreferred stock $9,000,000Common stock ($1 par value) 30,000,000Ac cumulated retained earnings 104,000,000Capital surplus 76,000,000Total equity $ 219,000,000Total Liabilities & Equity $ 301,000,0008.9. Cash flow to creditors = Interest paid – Net new borrowingCash flow to creditors = $118,000 – ($1,390,000 – 1,340,000)Cash flow to creditors = $118,000 – 50,000Cash flow to creditors = $68,000Cash flow to stockholders = Dividends paid – Net new equityCash flow to stockholders = $385,000 – [(Common+ APIS) – (Common+ APIS)]end end beg beg10. Cash flow to stockholders = $385,000 – [($450,000 + 3,050,000) – ($430,000 + 2,600,000)] Cash flow to stockholders = $385,000 – ($3,500,000 – 3,030,000)Cash flow to stockholders = –$85,000Note, APIS is the additional paid-in surplus.Cash flow from assets= Cash flow to creditors + Cash flow to stockholders= $68,000 – 85,000= –$17,000Cash flow from assets= –$17,000 = OCF – Change in NWC – Net capital spending–$17,000 = OCF – (–$69,000) – 875,000Operating cash flowOperating cash flow= –$17,000 – 69,000 + 875,000= $789,000Cash flow to creditors = $118,000 – (LTD– LTD)11. a. IntermediateThe accounting statement of cash flows explains the change in cash during the year. Theaccounting statement of cash flows will be:Statement of cash flowsOperationsNet income $105Depreciation 90Changes in other current assets (55)Accounts payable (10)Total cash flow from operations $170Investing activitiesAcquisition of fixed assets $(140)Total cash flow from investing activities $(140)Financing activitiesProc eeds of long-term debt $30Dividends (45)Total cash flow from financing activities ($15)Change in cash (on balance sheet) $15b.Change in NWC= NWC e nd– NWC beg= (CA end–CL en d ) – (CA beg–CL be g)c.= [($50 + 155) – 85] – [($35 + 140) – 95)= $120 – 80= $40To find the cash flow generated by the firm‘s assets, we need the operating cash flow, and thecapital spending. So, calculating each of these, we find:Operating cash flowNet income $105Depreciation 90Operating cash flow $195Note that we can calculate OCF in this manner since there a re no taxes.Capital spendingEnding fixed assets Beginning fixed assets DepreciationCapital spending $340 (290)90 $140Now we c an calculate the cash flow gene rated by the firm‘s assets, which is: Cash flow from assetsOperating cash flow Capital spending Change in NWC Cash flow from assets $195 (140) (40) $1512. With the information provided, the cash flows from the firm are the capital spending and the changein net working capital, so:Cash flows from the firmCapital spending $(15,000)Additions to NWC (1,500)Cash flows from the firm $(16,500)And the cash flows to the investors of the firm are:Cash flows to investors of the firmSale of long-term debt (19,000)Sale of common stock (3,000)Dividends paid 19,500Cash flows to investors of the firm $(2,500)13. a.b. The interest expense for the company is the amount of debt times the interest rate on the debt. So, the income statement for the company is:Income StatementSales $1,200,000Cost of goods sold 450,000Selling costs 225,000Depreciation 110,000EBIT $415,000Interest 81,000Taxable income $334,000Taxes 116,900Net income $217,100And the opera ting cash flow is:OCF = EBIT + Depreciation – TaxesOCF = $415,000 + 110,000 – 116,900OCF = $408,10014. To find the OCF, we first calculate net income.Income StatementSales $167,000Costs 91,000Depreciation 8,000Other expe nses 5,400EBIT $62,600Interest 11,000Taxable income $51,600Taxes18,060Net income $33,540Dividends $9,500Additions to RE $24,040a.OCF = EBIT + Depreciation – TaxesOCF = $62,600 + 8,000 – 18,060OCF = $52,540b.CFC = Interest – Net new LTDCFC = $11,000 – (–$7,100)CFC = $18,100Note that the net new long-term debt is negative because the compa ny repaid part of its long-term debt.c.CFS = Dividends – Net new equityCFS = $9,500 – 7,250CFS = $2,250d.We know that CFA = CFC + CFS, so:CFA = $18,100 + 2,250 = $20,350CFA is also equal to OCF – Net capital spending – Change in NWC. We already know OCF.Net capital spending is equal to:Net capital spending = Increase in NFA + De preciationNet capital spending = $22,400 + 8,000Net capital spending = $30,400Now we c an use:CFA = OCF – Net capital spending – Change in NWC$20,350 = $52,540 – 30,400 – Change in NWC.Solving for the change in NWC gives $1,790, me aning the company increased its NWC by$1,790.15. The solution to this question works the income statement backwards. Starting at the bottom:Net income = Dividends + Addition to ret. earningsNet income = $1,530 + 5,300Net income = $6,830Now, looking at the income statement:EBT – (EBT × Tax rate) = Net incomeRecognize that EBT × tax rate is simply the calculation for ta xes. Solving this for EBT yields: EBT = NI / (1– Tax rate)EBT = $6,830 / (1 – 0.65)EBT = $10,507.69Now we can calculate:EBIT = EBT + InterestEBIT = $10,507.69 + 1,900EBIT = $12,407.69The last step is to use:EBIT = Sales – Costs – Depreciation$12,407.69 = $43,000 – 27,500 – DepreciationDepreciation = $3,092.31Solving for depreciation, we find that depreciation = $3,092.3116. The balance sheet for the company looks like this:Balance SheetCash $183,000 Accounts payableAc counts receivable 138,000 Notes payableInventory 297,000 Current liabilitiesCurrent assets $618,000 Long-term debtTotal liabilities Tangible net fixed assets 3,200,000Intangible net fixed assets 695,000 Common stockAccumulated ret. earnings Total assets $4,513,000 Total liab. & owners‘ equity Total liabilities and owners‘ equity is:TL & OE = Total debt + Common stock + Accumulated retained earnings Solving for this equation for equity gives us:Common stock = $4,513,000 – 1,960,000 – 2,160,000Common stock = $393,000$465,000145,000 $610,000 1,550,000 $2,160,000?? 1,960,000 $4,513,00017.18.19. The market value of shareholders‘ equity cannot be negative. A negative market value in this casewould imply that the company would pay you to own the stock. The market value of sha reholders‘ equity can be stated as: Shareholders‘ equity = Max [(TA –TL), 0]. So, if TA is $9,700, equity isequal to $800, and if TA is $6,800, e quity is equal to $0. We should note here that while the market value of equity cannot be negative, the book value of shareholders‘ equity can be negative.a.Taxes Growth= 0.15($50K) + 0.25($25K) + 0.34($3K) = $14,770Taxes Income= 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) + 0.34($7.465M)= $2,652,000b. Each firm has a marginal tax rate of 34% on the next $10,000 of taxa ble income, despite theirdifferent average ta x rates, so both firms will pay an additional $3,400 in taxes.Income State mentSales $740,000COGS 610,000A&S expenses 100,000Depreciation 140,000EBIT ($115,000)Interest 70,000Taxable income ($185,000)Taxes (35%) 0 income ($185,000)b.OCF = EBIT + Depreciation – TaxesOCF = ($115,000) + 140,000 – 0OCF = $25,00020.21. c. Net income was negative because of the tax deductibility of depreciation and interest expense.However, the actual cash flow from operations wa s positive because de preciation is a non-cashexpense and interest is a financing expense, not an operating expense.A firm can still pay out dividends if net income is negative; it just has to be sure there is sufficientcash flow to make the dividend payments.Change in NWC = Net ca pital spending = Net new equity = 0. (Given)Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = $25,000 – 0 – 0 = $25,000Cash flow to stockholders = Divide nds – Net new equityCash flow to stockholders = $30,000 – 0 = $30,000Cash flow to creditors = Cash flow from assets – Cash flow to stockholdersCash flow to creditors = $25,000 – 30,000Cash flow to creditors = –$5,000Cash flow to creditors is also:Cash flow to creditors = Interest – Net new LTDSo:Net new LTD = Interest – Cash flow to creditorsNet new LTD = $70,000 – (–5,000)Net new LTD = $75,000a. The income statement is:Income StatementSales $15,300Cost of good sold 10,900Depreciation 2,100EBIT $ 2,300Interest 520Taxable income $ 1,780Taxes712Net income $1,068b.OCF= EBIT + Depreciation – TaxesOCF = $2,300 + 2,100 – 712OCF = $3,68813c. Change in NWC=NWC end– NWC beg= (CA end–CL en d ) – (CA beg–CL be g)22.= ($3,950 – 1,950) – ($3,400 – 1,900)= $2,000 – 1,500 = $500Ne t capital spending= NFA end– NFA beg+ Depreciation= $12,900 – 11,800 + 2,100= $3,200CFA= OCF – Change in NWC – Net capital spending= $3,688 – 500 – 3,200= –$12The cash flow from assets can be positive or ne gative, since it represents whether the firm raisedfunds or distributed funds on a net basis. In this problem, even though net income and OCF arepositive, the firm invested heavily in both fixed assets and net working capital; it had to raise a net $12 in funds from its stockholders and creditors to make these investments.d. Ca sh flow to creditors= Interest – Net new LTD= $520 – 0= $520Ca sh flow to stoc kholders = Cash flow from assets – Cash flow to creditors= –$12 – 520= –$532We can also calculate the cash flow to stockholders as:Ca sh flow to stoc kholders = Dividends – Ne t new equitySolving for net new equity, we get:Net new equity= $500 – (–532)= $1,032The firm had positive earnings in an accounting sense (NI > 0) and had positive cash flow fromoperations. The firm invested $500 in new net working capital and $3,200 in new fixed assets. The firm had to raise $12 from its stakeholders to support this new inve stment. It accomplished this by raising $1,032 in the form of new equity. After paying out $500 of this in the form of dividends to shareholders and $520 in the form of interest to creditors, $12 was left to meet the firm‘s ca sh flow needs for investment.a. Total assets 2009= $780 + 3,480 = $4,260Total liabilities 2009= $318 + 1,800 = $2,118Owners‘ equity 2009 = $4,260 – 2,118 = $2,142Total assets 2010= $846 + 4,080 = $4,926Total liabilities 2010= $348 + 2,064 = $2,412Owners‘ equity 2010= $4,926 – 2,412 = $2,51414b. NWC 2009NWC 2010Change in NWC = CA09 – CL09 = $780 – 318 = $462= CA10 – CL10 = $846 – 348 = $498= NWC10 – NWC09 = $498 – 462 = $36c.d. We can calculate net capital spe nding as:Net capital spending = Net fixed assets 2010 – Net fixed assets 2009 + Deprec iationNet capital spending = $4,080 – 3,480 + 960Net capital spending = $1,560So, the company had a net capital spending cash flow of $1,560. We also know that net capital spending is:Net capital spending = Fixed assets bought – Fixed assets sold$1,560= $1,800 – Fixed assets soldFixed assets sold= $1,800 – 1,560 = $240To c alculate the cash flow from assets, we must first calculate the operating cash flow. Theoperating cash flow is calculated as follows (you can also prepare a traditional incomestatement):EBIT = Sales – Costs – DepreciationEBIT = $10,320 – 4,980 – 960EBIT = $4,380EBT = EBIT – InterestEBT = $4,380 – 259EBT = $4,121Taxes = EBT ⨯ .35Taxes = $4,121 ⨯ .35Taxes = $1,442OCF = EBIT + Depreciation – TaxesOCF = $4,380 + 960 – 1,442OCF = $3,898Ca sh flow from a ssets = OCF – Change in NWC – Net capital spending.Ca sh flow from a ssets = $3,898 – 36 – 1,560Ca sh flow from a ssets = $2,302Net new borrowing = LTD10 – LTD09Net new borrowing = $2,064 – 1,800Net new borrowing = $264Ca sh flow to creditors = Interest – Net ne w LTDCa sh flow to creditors = $259 – 264Ca sh flow to creditors = –$5Net new borrowing = $264 = Debt issue d – Debt retiredDebt retired = $360 – 264 = $961523.CashAccounts receivable InventoryCurrent assetsNet fixed assets Total assetsCashAccounts receivable InventoryCurrent assetsNet fixed assets Total assets Balance sheet as of Dec. 31, 2009$2,739 Accounts payable3,626 Notes payable6,447 Current liabilities$12,812Long-term debt$22,970 Owners' equity$35,782 Total liab. & equityBalance sheet as of Dec. 31, 2010$2,802Accounts payable4,085 Notes payable6,625Current liabilities$13,512Long-term debt$23,518Owners' equity$37,030Total liab. & equity$2,877529$3,406$9,173$23,203$35,782$2,790497$3,287$10,702$23,041$37,03024.2009 Income StatementSales $5,223.00COGS 1,797.00Othe r expenses 426.00Depreciation 750.00EBIT $2,250.00Interest 350.00EBT $1,900.00Taxes646.00Net income $1,254.00Dividends $637.00Additions to RE 617.00OCF = EBIT + Depreciation – TaxesOCF = $2,459 + 751 – 699.38OCF = $2,510.62Change in NWC = NWC end– NWC beg= (CA – CL)end2010 Income StatementSales $5,606.00COGS 2,040.00Other expense s 356.00Depreciation 751.00EBIT $2,459.00Interest 402.00EBT $2,057.00Taxes699.38Net income $1,357.62Dividends $701.00Additions to RE 656.62– (CA – CL)begChange in NWC = ($13,512 – 3,287) – ($12,812 – 3,406)Change in NWC = $819Net capital spending = $23,518 – 22,970 + 751Net capital spending = $1,29916Net capital spending = NFA– NFA+ Depreciation25. Cash flow from assets = OCF – Change in NWC – Net capital spendingCash flow from assets = $2,510.62 – 819 – 1,299Cash flow from assets = $396.62Cash flow to creditors = Interest – Net new LTDNet new LTD = LTD end– LTD begCash flow to creditors = $402 – ($10,702 – 9,173)Cash flow to creditors = –$1,127Common stock + Retained earnings = Total owners‘ equityNet new equity = (OE – RE)end– (OE – RE)begRE end= RE beg+ Additions to RENet new equity = $23,041 – 23,203 – 656.62 = –$818.62Cash flow to stockholders = Dividends – Net new equityCash flow to stockholders = $701 – (–$818.62)Cash flow to stockholders = $1,519.62As a check, ca sh flow from assets is $396.62.Cash flow from assets = Cash flow from creditors + Cash flow to stockholdersCash flow from assets = –$1,127 + 1,519.62Cash flow from assets = $392.62ChallengeWe will begin by calculating the operating cash flow. First, we need the EBIT, which c an becalculated as:EBIT = Net income + Current taxes + Deferred taxes + Inte restEBIT = $144 + 82 + 16 + 43EBIT = $380Now we can calculate the operating cash flow as:Operating cash flowEarnings before interest and taxes $285Depreciation 78Current taxes (82)Operating cash flow $28117Net new equity = Common stock– Common stockNet new equity = OE– OE+ RE– RE∴ Net new equity= OE– OE+ RE– (RE+ Additions to RE)= OE– OE– Additions to REThe cash flow from assets is found in the investing activities portion of the accounting statement of cash flows, so:Cash flow from assetsAcquisition of fixed a ssets $148Sale of fixed assets (19)Capital spending $129The net working capital cash flows are all found in the operations cash flow section of theaccounting statement of cash flows. However, instead of c alculating the net working capital cashflows as the change in net working capital, we must calculate each item individually. Doing so, wefind:Net working capital cash flowCash $42Accounts receivable 15Inventories (18)Accounts payable (14)Accrued expenses 7Notes payable (5)Other (2)NWC cash flow $25Except for the interest expense and note s payable, the ca sh flow to creditors is found in the financing activities of the accounting statement of cash flows. The inte rest expense from the income statementis given, so:Cash flow to creditorsInterest $43Retirement of debt 135Debt service $178Proceeds from sale of long-term debt (97)Total $81And we can find the cash flow to stockholders in the financing se ction of the accounting stateme nt of cash flows. The cash flow to stockholders was:Cash flow to stockholdersDividends $ 72Repurchase of stock 11Cash to stockholders $ 83Proceeds from new stock issue(37)Total $ 461826. Net capital spending= (NFA– NFA + Depreciation) + (Depreciation + AD) – AD= (NFA+ AD) – (NFA+ ADbeg) =FAbeg– FAend end beg beg end beg27. a.b.c. The tax bubble causes average tax rates to catch up to marginal tax rates, thus eliminating the tax advantage of low marginal rates for high inc ome corporations.Assuming a taxable income of $335,000, the taxes will be:Taxes = 0.15($50K) + 0.25($25K) + 0.34($25K) + 0.39($235K) = $113.9KAverage tax rate = $113.9K / $335K = 34%The marginal tax rate on the next dollar of income is 34 percent.For corporate taxable income levels of $335K to $10M, average tax rates are equal to marginal tax rates.Taxes = 0.34($10M) + 0.35($5M) + 0.38($3.333M) = $6,416,667Average tax rate = $6,416,667 / $18,333,334 = 35%The marginal tax rate on the ne xt dollar of income is 35 percent. For corporate taxable income levels over $18,333,334, ave rage tax rates are again e qual to marginal tax rates.Taxes= 0.34($200K) = $68K = 0.15($50K) + 0.25($25K) + 0.34($25K) + X($100K);X($100K)= $68K – 22.25K = $45.75KX= $45.75K / $100KX= 45.75%19=NFA– NFAend= (NFAbeg– NFA)+ AD– AD。

习题参考解答chapter2、3

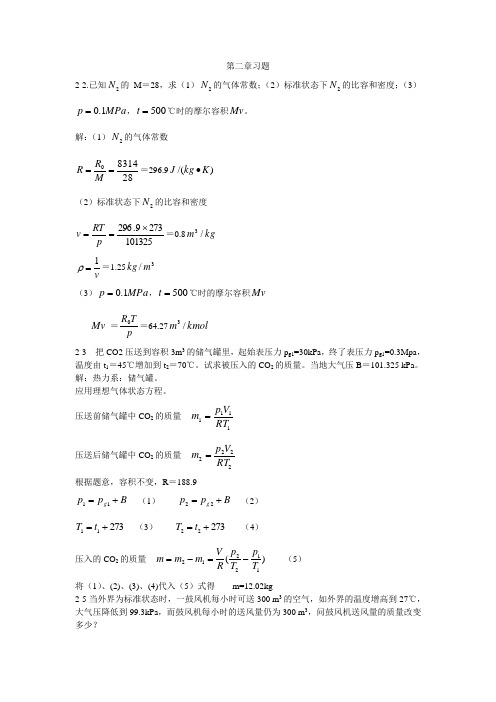

第二章习题2-2.已知2N 的M =28,求(1)2N 的气体常数;(2)标准状态下2N 的比容和密度;(3)MPa p 1.0=,500=t ℃时的摩尔容积Mv 。

解:(1)2N 的气体常数2883140==MR R =296.9)/(K kg J ∙(2)标准状态下2N 的比容和密度1013252739.296⨯==p RT v =0.8kg m /3v1=ρ=1.253/m kg(3)MPa p 1.0=,500=t ℃时的摩尔容积MvMv =pT R 0=64.27kmol m /32-3 把CO2压送到容积3m 3的储气罐里,起始表压力p g1=30kPa ,终了表压力p g1=0.3Mpa ,温度由t 1=45℃增加到t 2=70℃。

试求被压入的CO 2的质量。

当地大气压B =101.325 kPa 。

解:热力系:储气罐。

应用理想气体状态方程。

压送前储气罐中CO 2的质量 1111RT V p m =压送后储气罐中CO 2的质量 2222RT V p m =根据题意,容积不变,R =188.9B p p g +=11 (1) B p p g +=22 (2)27311+=t T (3) 27322+=t T (4)压入的CO 2的质量 )(112212T p T p R Vm m m -=-= (5)将(1)、(2)、(3)、(4)代入(5)式得 m=12.02kg2-5当外界为标准状态时,一鼓风机每小时可送300 m 3的空气,如外界的温度增高到27℃,大气压降低到99.3kPa ,而鼓风机每小时的送风量仍为300 m 3,问鼓风机送风量的质量改变多少?解:同上题1000)273325.1013003.99(287300)1122(21⨯-=-=-=T p T p R v m m m =41.97kg2-6 空气压缩机每分钟自外界吸入温度为15℃、压力为0.1MPa 的空气3 m 3,充入容积8.5m 3的储气罐内。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

一.名词解释

1.假根

是Rhizopus(根霉属)等低等真菌匍匐菌丝与固体基质接触处分化出来的根状结构,具有固着和吸取养料等功能。

2.假菌丝

当酵母菌进行一连串的芽殖后,如果长大的子细胞与母细胞不立即分离,其间仅以狭小的面积相连,则这种藕节状的细胞串就称为假菌丝

3.气生菌丝

伸展到空间的菌丝体,颜色较深、直径较粗的分枝菌丝,其成熟后分化成孢子丝4.子囊果

能产生有性孢子的、结构复杂的子实体称为子囊果

5.生活史

又称生命周期,指上一代生物经一系列生长、发育阶段而产生下一代个体的全部过程为生活史

6、异宗配合:指毛霉在形成接合孢子时,凡是由不同性的菌丝体上形成的性器官结合

而产生有性孢子的则称异宗配合。

7、同宗配合:指毛霉在形成接合孢子时,凡是由同一个菌丝体上形成的配子囊结合而

产生有性孢子的则称同宗配合。

8、锁状联合:指担子菌亚门的次生菌丝的菌丝尖端生长方式。

9Saccharomyces cerevisiae 酿酒酵母

二.填空

1、真菌的无性繁殖方式有裂殖、芽殖、无性孢子繁殖和菌丝体断裂。

2、酵母菌的无性繁殖方式主要有裂殖、芽殖。

3、真菌的有性孢子的种类有:卵孢子、接合孢子、子囊孢子和担孢子四种;真菌的无

性孢子的种类有:游动孢子、子囊孢子、分生孢子、节孢子和厚垣孢子五种。

4、根霉的形态特征是具有假根和匍匐功丝且菌丝无隔;曲霉的形态特征是具顶囊和足

细胞,菌丝有隔;青霉的形态特征是具扫帚状的分生孢子梗。

5.粘菌可分为__细胞粘菌___和_原质团粘菌__两个门.

6.真核微生物细胞质核糖体类型为80S,原核微生物核糖体类型为_70S___.

7.子囊果有闭囊果,_子囊壳_____ 和_____子囊盘________三种类型。

8. 同的酵母菌产生的有性孢子有子囊孢子和_担孢子

9. 类酵母的营养体只能以二倍体形式存在,酿酒酵母的营养体能以单倍体和二倍体形

式存在,八孢酵母的营养体能以单倍体形式存在。

10.根霉属于接合菌门,香菇属于担子菌门。

11.某些原生动物在不利条件下形成的保护结构是孢囊

12.霉菌在有性繁殖中所形成的有性孢子有卵孢子,接合孢子,

子囊孢子和担孢子四种类型。

13属于真核微生物的主要有酵母菌、酶菌、原生动物

14真菌的五个亚门分别是.鞭毛菌亚门、接合菌亚门、子囊菌亚门、担子菌亚门、半知菌亚门

15真菌的菌丝分化成很多特殊的形态结构,如_吸器_、__假根__。

16霉菌的菌丝包括两种类型,毛霉的菌丝属于_无隔菌丝_;曲霉的菌丝属于_有隔菌丝__。

17分生孢子梗状如扫帚是的重要分类特征。

三.判断

1. 子囊菌的双核菌丝通过锁状联合进行分裂和繁殖。

(错误)

2. 担孢子是单核菌丝形成的。

(错误)

3. 粘菌属于真菌。

(正确)

4. 当某些粘菌的变形虫细胞产生A TP 时,其它变形虫细胞便向它们聚集。

(错误)

5.原生动物的鞭毛和纤毛都是9+2型的。

(错误)

6.当环境条件不适时,细胞粘菌的原生质团可分为许多组的原生质(正确)

7.子囊菌亚门产生的有性孢子为孢囊孢子。

(错误)

8.曲霉菌产生的有性孢子是担孢子。

(错误)

9.单细胞藻类和原生动物属于真核微生物。

(正确)

10原核细胞中只含有70S的核糖体,而真核细胞中只含有80S的核糖体。

(错误)

11因为不具吸收营养的功能,所以,将根霉的根称为“假根”。

(错误)

四.选择

1.下述属于真菌有性孢子的是A

A 孢囊孢子B子囊孢子 C 游动孢子 D 节孢子

2.琼脂是从下述那种藻类中提取的:D

A 褐藻

B 红藻C绿藻 D 硅藻

3. 下述是真菌的无性孢子的是____D_____

A 担孢子

B 接合孢子C子囊孢子 D 孢囊孢子

4.种真菌产生孢囊孢子和接合孢子,菌丝中无横隔膜,它属于_C________

A 子囊菌门B担子菌门 C 接合菌门D半知菌类

5.下述对藻类不正确的是_C________

A 可行无性生殖

B 大多数细胞壁中含有纤维素

C 都行光能自养

D 有的有鞭毛

6.一种单细胞藻类有细胞壁,含叶绿素a b, 储藏淀粉,它极可能是___C______

A 褐藻

B 甲藻

C 绿藻

D 红藻

7、下列能产子囊孢子的霉菌是(C)。

A、毛霉和根霉

B、青霉和曲霉

C、赤霉和脉孢霉

D、木霉和腐霉

8、锁状联合是担子菌(D)的生长方式。

A、双核的初生菌丝

B、单核的初生菌丝

C、单核的次生菌丝

D、双核的次生菌丝

9. 真核微生物能量代谢的部位是(A )

A.质膜

B.线粒体

C.高尔基体

D.核糖体

10根霉菌产生的无性孢子类型是(A )

A .接合孢子 B. 分生孢子 C . 子囊孢子 D.节孢子

11真核微生物细胞质中核糖体沉降系数为( C )。

A.70S

B.60S

C.80S

D.90S

12下列多种霉菌孢子中( B )不是无性孢子。

A. 厚垣孢子 C. 节孢子

B.子囊孢子 D. 游动孢子

13下列微生物中( B )不是真核微生物。

A白僵菌 B 链霉菌 C. 酿酒酵母 D. 米曲霉

14根霉的有性孢子和曲霉的无性孢子分别是(B )。

A接合孢子和子囊孢子B接合孢子和分生孢子

C. 孢囊孢子和分生孢子

D. 孢囊孢子和子囊孢子

四.问答

1.真菌的无性孢子和有性孢子分别有那些类型

(1)无性孢子:节孢子,厚垣孢子,分生孢子,孢囊孢子,游动孢子;

(2)有性孢子:卵孢子,接合孢子,子囊孢子,担孢子。

2.举例说明酵母菌生活史的三个类型

1)营养体既能以单倍体也能以二倍体形式存在, 如酿酒酵母;

2)营养体只能以单倍体形式存在, 如八孢裂殖酵母;

3)营养体只能以二倍体形式存在, 如路德类酵母.

3.比较根霉与毛霉的异同

答案:根霉与毛霉同属于毛霉目,菌丝无隔膜,多核.无性繁殖产生不能游动的孢囊孢子,而有性繁殖产生双倍体的接合孢子.主要区别在于,根霉有假根的匍匐菌丝.根霉在培养基或自然基物上生长时,由营养菌丝体产生弧形匍匐向四周蔓延,并由匍匐菌丝生出假根与基物接触.与假根相对处向上生长出孢囊梗,顶端形成孢子囊,内生孢囊孢子.而毛霉和菌丝体呈棉絮状,在基物上或基物内能广泛蔓延.

4.用图表示担子菌锁状联合的过程?

答案;锁状联合是担子菌亚门的次生菌丝的菌丝尖端生长方式,其过程如图;

a双核细胞形成突起b一核进入突起c双核分裂d两个子核在顶端e隔成两个细胞

8细菌,放线菌,酵母菌和霉菌的细胞的菌落特征的比较/

细菌的放线菌是原核微生物,酵母菌和霉菌是真核微生物;细菌和酵母菌是单细胞生物,放线菌和霉菌是菌丝体微生物.而菌落是指在固体培养基上,由一个细菌或孢子生长,繁殖形成的肉眼可见的群体,其他见下表:

5试分析原核细胞和真核细胞的主要区别。

答:原核微生物与真核微生物的主要区别要点如下(每条1.5分):

6细菌、放线菌及霉菌分别采用何种方法制片观察,并简述原因。

答:(3分)细菌:涂片法,由于细菌是单细胞的,其基本形态是球状、杆状、螺旋状,制片观察细菌时应尽可能地涂布使菌体分散,以观察细菌的个体形态。

(3分)放线菌:印片法,由于放线菌呈菌丝状,其菌丝根据功能可分为基质菌丝、气生菌丝、孢子丝,采用常规的制片方法可能观察到基质菌丝和气生菌丝,但要观察孢子丝的完整形态则不能破坏孢子丝的完整,所以采用印片法则可以把孢子丝较完整地印下来。

(4分)霉菌:水浸片,霉菌呈菌丝状,是真核微生物,菌丝直径较粗,从个体上要比原核微生物大一个数量级,所以不必采用很复杂的染色程序,仅用蒸馏水或美兰染料等即可在高倍镜下清楚地看到霉菌菌丝的形态。

7请描述我们学过的四大类细胞型微生物的个体形态和在固体平板上的培养

特征。

(6分)

答:细菌:(0.5分)个体形态:球状、杆状、螺旋状

(1.5分)培养特征:菌落比较小,表面湿润、光滑、菌落颜色十分多样等。

放线菌:(0.5分)个体形态:分枝丝状体

(1.5分)培养特征:放射状菌丝,干燥、致密、不易挑起、菌落较小等。

酵母菌:(0.5分)个体形态:卵圆形等

(1.5分)培养特征:与细菌菌落相似,表面光滑、湿润、乳白色或红色。

有酒香味等。

霉菌:

(0.5分)个体形态:分枝丝状体

(1.5分)培养特征:疏松,绒毛状、絮状或蜘蛛网状,表面和背面颜色往往不一致。