JURONG TOWN CORPORATION ACT新加坡裕廊集团法

案例分析:从新加坡经验看我国化工物流的发展

新加坡裕廊化⼯区是亚洲的⽯化⽣产和物流基地,也是全球第三⼤的⽯油炼制基地。

当前,我国化⼯园区的发展如⽕如荼,项⽬的规划和建设紧锣密⿎,⽽与之相配套的化⼯物流体系也逐渐发展起来。

⽆论是从规划理念,还是从建设经验来看,新加坡裕廊岛⽯化产业的发展,都能为我国新兴化⼯园区的发展和物流园区的配套设施建设提供良好的借鉴。

新加坡⽯化⼯业发展 新加坡的⽯化⼯业的基地是裕廊岛(Jurong Island),它是以填海造陆⽅式衔接⽽成的。

裕廊岛拥有得天独厚的海运条件,造就了新加坡⽯化⼯业在亚洲甚⾄世界不可替代的地位。

在上个世纪60年代,裕廊岛上只有两家外资的炼油⼚。

从90年代中期开始,新加坡政府开始对裕廊岛开始进⾏填⼟⼯程,将七个⼩岛连成⼀⽚,并建成了完善的配套基础设施体系。

经过多年的努⼒,裕廊岛已形成了完整的⽯油和化⼯体系。

2004年实现⼯业总产值约312亿美元,其化⼯业产值占新加坡制造业总产值的⽐例2004年达到28%,是全球重要的⽯油炼制中⼼和⼄烯⽣产中⼼。

裕廊岛通过集中投资,形成了“化⼯簇群” (Chemical Cluster) —— 即上下游产业⼀体化的发展模式。

企业和企业之间形成上下游的关系,物料通过管道在园区内输送,企业之间共享基础设施和公⽤⼯程,在程度上降低了原料和产品的物流成本和企业的投资成本。

⽬前裕廊岛的产业以炼油、⼄烯及下游⽯化产品为主,投资者包括伊斯曼(Eastman)公司、杜邦(DuPont)、帝⼈(Teijin)、塞拉尼斯(Celanese)、埃克森美孚(ExxonMobil)、壳牌(Shell)、三井化学(Mitsui Chemical)等⼤型⽯化企业。

新加坡化⼯物流园区的建设 由于产业的发展和市场分⼯的细化,国际化⼯⽣产型企业本⾝⼏乎很少从事化学品的物流业务,⽽是将业务外包给第三⽅物流服务提供商(3PL)。

第三⽅物流服务提供商包括⽔路、陆路运输经营者,码头和仓储设施经营者,化学品仓库和化⼯储罐和管道经营者。

产业新城:新加坡裕廊工业园案例分析

• 在整个开发过程中,园区的资金筹集、土地运用、招商引资等 均采用一级政府统一支持

集团化的管理模式,扁平化的分工模式

• 扁平化、专业化分工模式,实现高效集约化管理 • 集团旗下有三大专业公司负责不同分工项目

4

新

加

裕

坡

廊

贸

集

工

团

部

腾飞 园区开发与招商

裕廊国际 咨询规划与建设服务

裕廊港 港口与物流运作

裕廊集团隶属新加坡贸工部,获得新加坡政 府土地资源、财 嘚嘚

政和税收等多种优惠支持

• 裕廊集团隶属新加坡贸工部,参与国家长远工 业用地需求

土地安排

• 先由政 府通过贷款或提供税收补贴支付,满足 嘚嘚 先期基础设施项目所需资金

•设立科技园和国际商务区

•配套服务提高园区竞争力

•从服务基地向创新型基地 转型

工业转型推动 区域城市化

区域 配套完善

成熟阶段

1

新加坡裕廊工业园 | 产业升级

裕廊产业发展呈现明显的阶段性特征,起初依托自身港口优势以物流及传统制造加工业启动,中期石化 重工产业驱动发展资本密集型产业,后期带动高科技研发和服务业发展

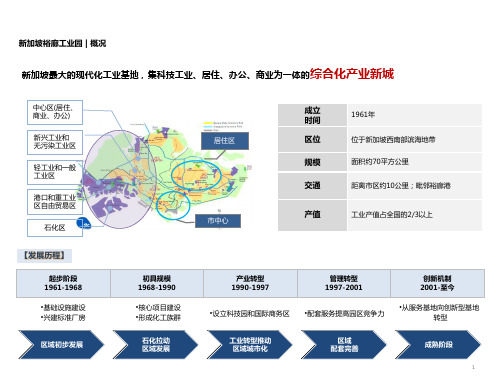

新加坡裕廊工业园 | 概况

新加坡最大的现代化工业基地,集科技工业、居住、办公、商业为一体的综合化产业新城

中心区(居住、 商业、办公)

新兴工业和 无污染工业区

轻工业和一般 工业区

港口和重工业 区自由贸易区

石化区

【发展历程】

起步阶段 1961-1968

•基础设施建设 •兴建标准厂房

区域初步发展

居住区 市中心

• 而后再实施资金揉入主题多元化政策,包括银

行贷 款、发放债 券等

新加坡园区发展经验(裕廊)——下讲解学习

工业园区域拓展

越南新加坡工业园 1995 (500公顷)

一个现代化的综合性工业园区。一流的基 础设施,完善的辅助配套,以满足园区内 员工生活,工作,娱乐和休闲的需求

9

工业园区域拓展

国际高技园区, 班加罗尔, 印度 2000 (27公顷)

班加罗尔国际技术园区是印度高新科技 园区的典范。一流的基础设施,完善的 工作,生活和娱乐配套设施,使园区备 受投资商的欢迎

3

未来五年拨款161亿元的分配

• 70%投入能取得经济成果的研发活动,比上个五年的 65%拨款要高。设立“企业结盟基金”(IAF)帮助 由本地公共研究机构பைடு நூலகம்企业的合作项目。如罗氏药剂 与本地研发机构设立转化医学研究中心

• 19%为未来创新活动开创知识资本。提供有競争性资 金给研究机构,以刺激创新和最佳点子以及鼓励研发 组织进行更多合作。并在产业未形成前进行投资,为 未来创新项目的基础研究提供知识资本。

高素质人力 资源

高技能劳动员工 低缺勤率

战略合作伙伴

• 服务型安商亲商环境 • 能快速地启动项目

- 一站式的准证批示 - 税务优惠政策 - 提供出租熟地,标准厂房,宿舍住

房

13

苏州工业园区招商引资的经验

❖ 明确指导性招商的理念

( ) 以市场导向与战略导向型搜索客户,多种销售手法引进外资

❖ 清晰招商策略

提供临港工业区(约78平方 公里)产业定位、概念性总体规 划和基础设施规划及启动区控制 性规划的规划咨询服务。

新加坡园区发展经验(裕廊)—— 下

新加坡生物科技及医药产业:大士生物医药产业园

规划面积:3.7km2 ,第一家企业进驻园区:1998年 开发模式:产业集群组团的发展模式 招商方向:著名大型制药企业、生物制药企业及各类生物医药公司 已进驻企业数量:11个,批租土地面积介于:4-20公顷 2001年进驻的GSK迄今已投资逾15亿新元在新加坡工厂

新加坡园区发展经验裕廊

Future Xchanges:预留远景产业发展用地

启奥生物医药研究园

发展目标:

工作

1)亚洲世界级的生物医药科学研发中心

55%

居住

33%

2)专业的生物医药国际会展会议中心

教育 7%

纬壹科技城主要功能元素构成

3)生命科学与生物产业的管理中心

4)生命科学与生物产业的风险投资中心

新生水厂 化工污水处理 化工公共管廊

通讯设施 区域冷却系统 地下公共管道

港口

机场

1414 道路

对策五 精细打造产业空间载体:工业园区

经济有效发展的

空间载体

• 推动经济多元化和 工业化

• 吸引投资 • 增加政府收入 • 降低相关基础设施

建设成本 • 促进就业和提升 技

能

合理规划有序开发

• 制定整体规划实现 工业发展和环境保 护的有序平衡

* 科技局的研究院和实验室宗旨是打造新加坡成为 “生物医药科学枢纽” -基因研究,生物信息,生物工程与纳米科技

*科技局的研究院和实验室五年内共有740项专利注册 和6800科学研究出版刊物。

鼓励私人企业重视和拓展研发领域

*吸引跨国公司研发活动和加强私人企业研发领

域及提高企业研发支出

*提高企业研发支出占国家GERD的三分之二

园区共享商务平台:多媒体大礼堂、会议室、公共交流 空间、餐厅、咖啡厅

3

启汇信息传媒科技园

启汇城:一期

公寓住宅

私人公寓

4

工业化和园区开发需要注意的问题

• 战略新兴产业的发展需要政府前瞻主导 • 产业发展必须以战略规划先行 • 工业园是城市经济和产业发展的重要空间平台 • 工业园的规划与设计要适应新兴产业的需要 • 工业园的开发需有序按照规划方针执行

裕廊湖区作为新加坡新商业中心的方案现已公布

新 的规 划 控 制将 取 代 现 有 的 规

划,试图去保护 雅拉 河’ ? f } 岸并且 遏制 雅拉河不恰 的发展 。( 宋怡 /编译 )

控 制周边 建筑高 度和建筑后 退距离 , 强制性 改造 一些 } 1 1 于建筑过 高形成 的

城市东北 部的沃 兰代特 。

境 、农业和 社I 团 控 制 方 案 包括 两个 方 委 员会可 以对政府关于 雅拉河 的所 有

1 2

K CA P建筑与 规划 事务被 市建局 选为 主 顾问来开发新加 坡裕廊湖区 . .

“ 1 于未来高铁 系统 的建立 ,憋 个规 划 的卡 H 关部 门以及湖 区都 将联系起 来 , 用于 联结 马来西 的首都卉 降坡与 新

根据市建局 的规划 ,整个 卒 } } 廊湖 加坡西部 。 区将分 为 3 个 区块 ,除 了裕廊 东地 铁 站附近 的裕廊商 业区 ( J u r o n g G a t e w a y ) 和提供休 闲没施 的湖 畔区 ( L a k e s i d c ) , K C A P 建筑 与规 划事务 所表 示 : “ 位 于新加坡 西部的裕廊 湖I 是市 建

不利于发 展的场地 ;二是 新 整理雅

拉 河景观 走廊 的沿岸土地 ,建造新的

据 a r c h i t e c t u r e a u . c o m讯 近 日,

建筑 ,并且 去除 多余的植物与 低质量

维 多利 政府 L 叶 { 台 了有 关 于 雅拉 河 的 观工程 。新的规 划控制赴 “ 雅 拉

资讯 /

裕廊 湖 区作 为新加坡新 商业 中心 的方 案现 已公布

Ga t e w a y ) 。K C A P建 筑 与 规 划 事 务 所 新加坡 中心 区以外 的娱乐设施 。”被 捉L H 了一 个场地混合使 用 的概 念 ,他 选 为 中标 方 案 的 K C A P团 队也 将 存 们试图让 裕廊湖 Ⅸ进 一步成 为城 市未 2 0 1 7 年进一 步展示他 们的规划细 节。 来 发展的核心 ,并且创 造新加坡 的第 ( 宋怡 / 编洋)

裕廊成功经验总结与介绍

业区建设之路——新加坡裕廊的启示新加坡裕廊工业区,堪称工业区发展的典范,负责工业区建设的裕廊集团,现在也已经成为极具实力的工业园区开发建设的实体。

1961年8月,新加坡国家经济发展局成立,裕廊工业园区建设正式启动。

在初期阶段,主要进行土地拓荒的前期准备工作,并进行基础设施和厂房建设。

在这一过程中,经济发展局负责产业政策、投资、建设、招商、服务等各项相关工作,对投资厂商提供贷款及税收优惠,而对招商对象则没有特定标准,来者不拒。

1968年6月1日,经济发展局的工业园区部独立出来,成立了裕廊镇管理局(JTC),美孚、埃索等大型公司先后入驻园区,化工产业集群初步形成,裕廊工业区进入快速发展阶段。

在这一阶段,工业区加大基础设施建设,政府直接拨款开发,快速提供成熟土地,提升了投资吸引力。

同时,工业区抓住全球产业布局重新调整机会,重点发展化工产业。

1980年,JTC制定了十年总体规划,先后建设新加坡科学园、石油化工产品生产和配售中心。

1984年,JTC在中国投资成立了深圳赤湾石油基地。

此时,裕廊工业区基于新加坡经济发展已较为成熟的特点,抓住“第二次工业革命”的机会,重点发展高科技和资本密集型企业,并开始发展海外业务。

上世纪90年代开始,裕廊工业区持续保持竞争优势,推出一系列创新的举措1991年,JTC被新加坡政府任命为裕廊岛开发项目代理商;1992年,建成新加坡第一个国际商业园区;1994年,推出组合式标准厂房;1995年,芯片制造园区开始建设;1997年,推出“21世纪工业用地计划”。

在土地资源紧张、工业园区竞争日趋激烈的情况下,裕廊工业区通过不断进行创新设计,提高了园区竞争力。

进入新世纪以来,裕廊集团通过强化公司化运作,继续加大业务拓展力度。

2000年,JTC开始公司化运作,精简机构,给予更大自主权,并发行40亿新加坡元的公司债券,建成机场物流园区,提供第三方物流和增值物流服务;2001年,整合裕廊港、裕廊国际、腾飞三个公司,分别负责港口与物流、咨询与建设、园区开发与招商业务;2003年,综合性化工物流园启用;2004年,建设纬壹(one-north)科技城;2007年,裕廊油气储存岩洞动工;2009年,投资8.9亿美元,兴建相关隧道、溶洞设施……经过40多年的发展,裕廊已经成为全球最有影响力的工业园区之一,发展成为全球化学品枢纽之一、世界第三大石油炼制中心、石油转口贸易中心、世界十大石化中心之一,拥有世界第三大散装液体码头,下辖35个子园区、7000多家公司,雇佣全国1/3以上的劳动力,贡献25%的GDP,2008年工业总产值达800亿新元,同时,全球顶级石油、石化公司,如埃克森美孚、壳牌等,以及第三方服务公司,如孚宝、欧德油储等入驻,固定资产投资总额超过310亿新加坡元。

(最新整理)新加坡裕廊工业园区案例@产业园区

2021/7/26

1

新加坡裕廊工业园区

[关键字]: 产业园区

[简介]: 裕廊工业区是新加坡最大的现代化工业基地,工业产值占全国的 三分之二以上,自60年代至今已有40余年的发展历史。目前裕廊 工业园已经发展成为集科技工业、居住、办公、商业为一体的配 套完整的综合工业区。

本报告是严格保密的。

7

通过国际化商务园区的建设吸引电子、生命科学等高 新技术产业

•科技工业 和商务园区

–重点发展电子、生命科学等技术密集型产业

–主要园区包括:国际商务园区(200余家跨国大公司进驻)、 Changi商务区(主要为软件、研发等知识密集型企业)、Onenorth园区(创新基地)和Start-up中心(服务于新生企业)

– 兴建一批标准厂 房

– 由于当时实行进 口替代战略,加 之政局不稳,起 步阶段仅有150多 家企业入驻,且 多为本国资本

– 1968.6设立裕廊 镇管理局(JTC), 专门负责园区的 开发管理

– 从进口替代策略 全面转向出口加 工策略

– 开发区整体布局 基本形成,投资 环境进一步得到 改善

– 国外资本开始大 量涌入,许多知 名厂商选择这里 作为其海外生产 基地

起步阶段 阶段I:19611968

初具规模 阶段II:19681990

产业转型 阶段III:19901997

ቤተ መጻሕፍቲ ባይዱ

管理转型 阶段IV:19972001

创新发展机制 阶段V:2001-至今

– 起步阶段先开发 土地14.5平方公里

– 政府重点建设港 口、码头、铁路、 公路、电力、供 水等各项基础设 施

– 政府为投资者提 供低息贷款及享 受统一税收的优 惠政策

孙国伟(新加坡裕廊国际总规划师中国项目新加坡工业化发展经验

孙国伟:(新加坡裕廊国际总规划师<中国项目>新加坡工业化发展经验提到新加坡这是一个很小的岛国,没有淡水也没有石油,但是取得举世瞩目经济成就,在整个发展中,工业化起到了举足轻重的作用,我们一起来分析一下新加坡工业发展的一些经验。

我的介绍主要分三个部分,第一部分是工业化的历程。

新加坡现在和过去截然不同的风貌,从建国出1965年,经过四十多年的努力发展,才有今天的成就,新加坡的经济经过40年的发展到2008年新加坡总人口484万,创造了国内生产总之1790亿美元的水平,人均达到36390美元,去年金融危机使得经济增长变成负数,但是新加坡已经打造了一个多元化经济体,从建国开始,工业化比例不断增长,最近几年一直保持在20%到25%之间。

新加坡的工业发展历程从上世纪六十年代到九十年代,各个阶段发展重点各不相同,从建国初期的六十年代为了创造就业机会,主要发展以出口为导向的劳动密集型制造业,力求最大限度的解决就业,实行全民就业。

到七十年代注重发展技术密集型制造业,比如电子业和造船业等等。

同时也开发了大量的工业园区和厂房。

到八十年代随着经济基础逐步稳固,政府开始重组经济结构,将制造业朝高附加值,资本密集型方向转型,到了九十年代,开始大力发展高新技术,比如市化工产品、芯片、生物医药产业。

从九十年代后期到2000年,以信息产业为中心的知识密集型经济开始发展起来,为了寻求更高的经济增长政府投下巨资支持研发以及创新。

新加坡工业发展的历程其实就是一个工业不断提升的过程,推动工业主要的部门是新加坡贸易和工业部。

贸工部下面有四件法定机构,其中包括国家科技研究所、国家企业发展局,经济发展局、裕廊集团、标准生产力与创新局,我们裕廊集团主要角色在参加新加坡总体规划、配合经济发展战略,制订国家长远工业发展计划,土地需求以及分配。

我们也负责新加坡所有工业园区以及相关基础设施的规划建设以及管理。

成立四十多年来,裕廊集团在新加坡已经开发了45个工业园区,六千六百公顷的工业地产,以及为七千多家跨国与国内企业建设了工业厂房以及450万平方公里的标准厂房。

- 1、下载文档前请自行甄别文档内容的完整性,平台不提供额外的编辑、内容补充、找答案等附加服务。

- 2、"仅部分预览"的文档,不可在线预览部分如存在完整性等问题,可反馈申请退款(可完整预览的文档不适用该条件!)。

- 3、如文档侵犯您的权益,请联系客服反馈,我们会尽快为您处理(人工客服工作时间:9:00-18:30)。

JURONG TOWN CORPORATION ACT(CHAPTER 150)(Original Enactment: Act 5 of 1968)REVISED EDITION 1998(30th May 1998)An Act to establish the Jurong Town Corporation and for purposes incidental thereto.[1st June 1968]PART IPRELIMINARYShort title1. This Act may be cited as the Jurong Town Corporation Act.Interpretation2. In this Act, unless the context otherwise requires —“authorised occupier” means a person who is named in an application made to the Corporation as the person who intends to reside in the flat, house or building sold or to be sold by the Corporation under Part IV or any person who is authorised in writing by the Corporation to reside therein;“Chairman” means the Chairman of the Corporation appointed under section 4; “commercial property” means any flat, house or building or any part thereof which is permitted to be used pursuant to the Planning Act 1998 (Act 3 of 1998) or any other written law for the purpose of carrying on any business or which is lawfully so used;“common property” m eans so much of the developed land and all parts of the building as are not comprised in the flats in a building;“Corporation” means the Jurong Town Corporation established under section 3; “developed land” means any land of the Corporation upon which a building has been erected;“financial year” means a period of 12 months beginning on 1st April in each year and ending on 31st March in the following year;“flat” means a horizontal stratum of a building or part thereof, whether the stratum is on one or more levels or is partially or wholly below the surface of the ground, which is used or intended to be used as a complete and separate unit for the purpose of human habitation or business or for any other purpose; “lease” includes an agreement for a lease;“officer” includes the Chairman, members and employees of the Corporation;“owner”, in rel ation to immovable property, includes a person who has purchaseda leasehold interest in any property sold by the Corporation and also includes apurchaser under an agreement for lease.PART IIESTABLISHMENT AND INCORPORATIONOF CORPORATIONEstablishment of Jurong Town Corporation3.—(1) There shall be established a body to be called the Jurong Town Corporation.(2) The Corporation shall be a body corporate with perpetual succession anda common seal with power, subject to the provisions of this Act, to acquire, hold or dispose of property, both movable and immovable, to enter into contracts, to sue and be sued in its corporate name and to perform such other acts as bodies corporate may by law perform.Chairman of Corporation4. The Minister, with the President’s concurrence under Article 22A(1)(b) of the Constitution, shall appoint a Chairman of the Corporation who shall, subject to the provisions of this Act, hold office for such period and on such terms as the Minister may determine.[11/91] Constitution of Corporation5.—(1) The Corporation shall consist of —(a)a Chairman; and(b) not fewer than 4 and not more than 11 other members to be appointed by the Minister with the President’s concurrence under Article 22A(1)(b) of the Constitution.[23/95] (1A) The Minister may, with the President’s concurrence, appoint one of the members of the Corporation as Deputy Chairman.[23/95](2) The quorum at all meetings of the Corporation shall be 4.[29/74; 11/78](3) The Chairman or any officer authorised by him to act on his behalf may call a meeting of the Corporation at least once in every 2 months or as often as he thinks fit.[23/95](4) The members of the Corporation, other than the Chairman, shall, unless their appointment is revoked by the Minister under subsection (9)or unless they resign during their period of office, hold office for a period of 3 years or for such shorter period as the Minister may in any case determine.(5) If for any reason the Chairman is absent or unable to act or the office of Chairman is vacant, the Deputy Chairman or, in the absence of both theChairman and the Deputy Chairman, any member of the Corporation duly appointed by the members present at any meeting of the Corporation may exercise all or any of the powers conferred, or perform all or any of the duties imposed, on the Chairman under this Act.[11/78](6) The Chairman or the person lawfully acting as Chairman at any meeting of the Corporation shall have an original as well as a casting vote.(7) A member of the Corporation shall not, at any meeting of the Corporation, participate in any discussion relating to, and shall not vote in respect of, any business in which he is interested, and if he does so his vote shall not be counted nor shall he be counted in the quorum present at such meeting.(8) The members of the Corporation shall be paid out of the funds of the Corporation such salaries, fees or allowances as the President may determine.(9) The Minister with the President’s concurrence under Article 22A(1)(b) of the Constitution may at any time revoke the appointment of the Chairman, the Deputy Chairman or any other member of the Corporation.[11/91] Direction by Minister6.—(1) The Minister may give to the Corporation such directions, not inconsistent with the provisions of this Act, as he considers fit, as to the exercise and performance by the Corporation of its powers, duties and functions under this Act and the Corporation shall give effect to all such directions.(2) The Corporation shall furnish the Minister with such information with respect to its property and activities as he may from time to time require. Appointment of chief executive officer and other employees 7.—(1) After consulting the Public Service Commission, the Corporation may, with the approval of the Minister and the President’s concurrence under Article 22A(1)(b) of the Constitution, appoint a chief executive officer on such terms and conditions as it may determine.[27/86; 23/95](2) The chief executive officer shall —(a) be known by such designation as the Corporation may determine;(b) be responsible to the Corporation for the proper administration and management of the functions and affairs of the Corporation in accordance with the policy laid down by the Corporation; and(c) not be removed from office without the consent of the Minister and the President’s concurrence under Article 22A(1)(b) of the Constitution.[11/91](3) If the chief executive officer is temporarily absent from Singapore, or is temporarily unable to perform his duties by reason of illness or otherwise, another person may be appointed by the Corporation to act in the place of the chief executive officer during any such period of absence from duty.(4) The Corporation may from time to time appoint and employ such other employees and agents as it thinks fit for the effective performance of its functions on such terms and conditions as the Corporation may determine. Appointment of committees and delegation of powers8.—(1) The Corporation may, in its discretion, appoint from among its own members or other persons who are not members of the Corporation such number of committees as it thinks fit consisting of members or other persons or members and other persons for purposes which, in the opinion of the Corporation, would be better regulated and managed by means of those committees.(2) The Corporation may, subject to such conditions or restrictions as it thinks fit, delegate to any such committee or the Chairman all or any of the powers, functions and duties by this Act vested in the Corporation, except the power to borrow money or to raise loans by the issue of bonds and debentures; and any power, function or duty so delegated may be exercised or performed by that committee or the Chairman in the name and on behalf of the Corporation.(3) The Corporation may, subject to such conditions or restrictions as it thinks fit, delegate to any employee thereof all or any of the powers, functions and duties by this Act vested in the Corporation, except the power to borrow money or to raise loans; and any power, function or duty so delegated may be exercised or performed by the employee in the name and on behalf of the Corporation.[11/78](4) The Corporation may continue to exercise any power conferred upon it, or perform any function or duty under this Act, notwithstanding the delegation of such power, function or duty under this section.Protection from personal liability9.—(1) No matter or thing done and no contract of any kind entered into by the Corporation and no matter or thing done by any member of the Corporation or by any employee thereof or any other person whomsoever acting under the direction of the Corporation shall, if the matter or thing was done or the contract was entered into bona fide for the purpose of executing the provisions of this Act, subject any such member or employee or any person acting under the direction of the Corporation personally to any action, liability, claim or demand whatsoever in respect thereof.(2) Any expense incurred by the Corporation or any member, employee or other person so acting under the direction of the Corporation shall be borne by and repaid out of the funds of the Corporation.Members and officers of Corporation deemed to be public servants10. The members of the Corporation and the employees thereof, of every description, shall be deemed to be public servants within the meaning of the Penal Code (Cap. 224).PART IIIPROVISIONS RELATING TO CORPORATIONProvision of working capital11. For the purpose of enabling the Corporation to carry out its objects and to defray expenditure properly chargeable to capital account, including defraying initial expenses, and for the provision of working capital, the Minister may authorise payment to the Corporation of such sums as he may determine.Functions and powers of Corporation12.—(1) The functions of the Corporation are —(a) to develop and manage sites, parks, estates, townships and other premises for industries and businesses in Singapore or elsewhere;(b) to provide facilities to enhance the operations of industries and businesses including social amenities for the advancement and the well-being of persons living and working in such sites, parks, estates and townships or otherwise; and(c) to participate in overseas ventures and developments which the Corporation has the expertise to engage or undertake in.[23/95](2) The Corporation shall have power to do anything for the purpose of the discharge of its functions under this Act or which is incidental or conducive to the discharge of those functions and, in particular, may —(a) act in combination or association with other persons or organisations for the discharge of any of its functions;(b) promote the carrying on of any activities for the discharge of its functions by other persons or organisations;(c) purchase, acquire or lease any land and premises required for the purpose of the discharge of its functions under this Act;(d)sell or lease land and premises for the purpose of the discharge of its functions under this Act upon such terms as the Corporation may determine;(e) provide technical, managerial and other specialist services for industrial, business and other development and build up a corps of engineering, managerial and other specialist staff to provide such services;(f) prepare and execute proposals, plans and projects for the erection, conversion, improvement and extension of any building for sale, lease, rental or other purpose;(g) provide and maintain housing accommodation including convalescent or holiday houses for employees of the Corporation, provide and maintain for those employees clubs and playing fields and provide educational facilities for them;(ga) grant loans to employees or to act as guarantor for loans taken by them, to enable them to purchase their own houses, furniture, fittings, home appliances and vehicles;(gb) award scholarships or give loans to employees to obtain professional, technical or other training;(h) sell or lease flats, houses or other living accommodation and land for the housing of persons living and working in industrial and business sites, parks, estates and townships;(i) provide loans on mortgage at such interest as may be prescribed to enable persons, other than employees of the Corporation, to purchase any flat, house or building which is used or intended to be used solely for the purpose of human habitation;(j) with the written approval of the Minister, form or participate in the formation of a company or companies or enter into any joint venture or partnership in Singapore or elsewhere;(k) with the written approval of the Minister, grant loans to any company in which the Corporation or any of its subsidiary companies holds any shares;(l) with the written approval of the Minister and the President, guarantee the repayment of loans given to any company in which the Corporation or any of its subsidiary companies holds any shares; and(m)provide and maintain adequate and efficient port services and facilities in the Jurong Port.[23/95] Borrowing powers13.—(1) The Corporation may, from time to time, for the purposes of this Act raise loans —(a) from the Government;(b) with the approval of the Minister and subject to the provisions of any written law, by any of the methods set out in section 14; or(c) from such other source as the Minister may direct.(2) The Corporation shall pay interest on those loans at such rate and at such times, and shall make such provisions for the mode and time or times of repayment of principal as may be approved by the Minister.(3) The Corporation may, from time to time, borrow by way of temporary loan or overdraft from a bank or otherwise any sum which it may temporarily require —(a) for the purpose of defraying expenses pending the receipt of revenues receivable by it in respect of the period of account in which those expenses are chargeable; or(b) for the purpose of defraying, pending the receipt of money due in respect of any loan authorised to be raised under subsection (1), expenses intended to be defrayed by any such loan.(4) Bonds and debentures of the Corporation issued before the commencement of subsection (5) shall be guaranteed by the Government as to the repayment of principal and the payment of interest at such rate as may be approved by the Minister.[18/94](5) Bonds and debentures of the Corporation issued on or after the commencement of this subsection shall be guaranteed by the Government as to the repayment of principal and the payment of interest at such rate as may be approved by the Minister if the President, acting in his discretion, concurs with the giving of such guarantee.[18/94](6) For the purposes of subsection (1), the power to raise loans shall include the power to make any financial agreement whereby credit facilities are granted to the Corporation for the purchase of goods, materials or things.Loan conditions14.—(1) Where the Corporation is authorised to borrow money, the Corporation may, subject to the approval or direction of the Minister, raise money in any manner and, in particular, raise it by —(a) mortgage;(b) charge, whether legal or equitable, on any property vested in the Corporation or on any revenue receivable by the Corporation under this Act or any other written law; and(c) debentures, stocks, bonds or other instruments or securities issued by the Corporation.[23/95](2) The Corporation may, with the approval or direction of the Minister, fix such rates of interest and such terms, conditions and periods to secure the repayment of the sums borrowed as it thinks fit.[23/95] Issue of shares, etc.14A. As a consequence of the vesting of any property, rights or liabilities of the Government in the Corporation under this Act, or of any capital injection or other investment by the Government in the Corporation in accordance with any written law, the Corporation shall issue such shares or other securities to the Minister for Finance as that Minister may from time to time direct.[5/2002 wef 15/07/2002] Budget15. The Corporation shall in every financial year cause to be prepared in a form to be approved by the Minister a budget to be forwarded to the Minister not later than 31st January containing estimates of income and expenditure of the Corporation for the ensuing year —(a) on capital account;(b) relating to the management and maintenance of industrial sites, housing and ancillary services; and(c) relating to the execution of its powers, functions and duties.[16[7/71; 11/78; 23/95] Approval of budget by Minister16.—(1) The Minister may approve or disallow any item or portion of any item shown in the budget, and shall return the budget as amended by him to the Chairman.(2) The Corporation shall present the budget which has been approved by the Minister to the President for his approval under Article 22B of the Constitution.[11/91](3) The budget when approved by the President shall be published in the Gazette.[17[11/91] Supplemental budgets17.—(1) The Corporation may at any time cause to be prepared a supplemental budget to provide, subject to section 24(2)(d), for unforeseen or urgently required expenditure containing —(a)a revised estimate of the income for the current financial year;(b) a revised estimate of the expenditure for the current financial year; and(c) a statement showing how provision is therein made to meet additional expenditure.[11/78](2) A supplemental budget shall be dealt with in the manner provided in section 16 for the annual budget.[18 Accounts18.—(1) The accounts of the Corporation shall be kept by a chief financial officer appointed by and responsible to the Corporation.[29/74](2) The chief financial officer shall prepare in respect of each financial yeara statement of accounts in a form approved by the Minister.[11/78](3) The chief financial officer shall keep proper accounts and records of the transactions and affairs of the Corporation and shall do all things necessary to ensure that all payments out of its moneys are correctly made and properly authorised and that adequate control is maintained over the assets of, or in the custody of, the Corporation and over the expenditure incurred by the Corporation.[19 Appointment and powers of Corporation’s auditor19.—(1) The accounts of the Corporation shall be audited by the Auditor-General or by an auditor appointed annually by the Minister in consultation with the Auditor-General.[29/74](2) The Corporation’s auditor shall be paid out of the funds of the Corporation such remuneration, expenses or fees as the Minister, after consultation with the Corporation, shall direct.(3) The Corporation’s auditor s hall be entitled to full and free access to all accounting and other records relating, directly or indirectly, to the financial transactions of the Corporation and may make copies of or extracts from any such accounting or other records.(4) The Corporati on’s auditor or a person authorised by him may require any person to furnish him with such information which that person possesses or has access to as the auditor or the duly authorised person considers necessary for the purposes of the functions of the auditor under this Act.(5) An officer of the Corporation who refuses or fails without any reasonable cause to allow the Corporation’s auditor or a person authorised by him access to any accounting and other records of the Corporation in his custody or power or to give any information possessed by him as and when required or who otherwise hinders, obstructs or delays the Corporation’s auditor or any person authorised by him in the performance of his duties or the exercise of his powers shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $500 and, in the case of a continuing offence, to a further fine not exceeding $100 for every day or part thereof during which the offence continues after conviction.[20 Auditor’s report20.—(1) The chief financial officer of the Corporation shall prepare the financial statements in respect of each preceding financial year and submit them to the Corporation’s auditor who shall audit and report on them to the Minister and the President.[23/95](2) The Corporation’s auditor shall state in his report of his audit whether —(a) the financial statements show fairly the financial transactions and the state of affairs of the Corporation;(b) proper accounting and other records have been kept; and(c) the receipt, expenditure and investment of moneys and the acquisition and disposal of assets by the Corporation during the year have been in accordance with the provisions of this Act and the Constitution.[23/95](3) The Corporation’s auditor shall report on any other matter arising from the audit as he considers necessary.[21[23/95] Presentation of financial statements21.—(1) A copy of the audited financial statements signed by the Chairman, the chief executive officer and the chief financial officer, and certified by the Corporation’s auditor, together with a copy of any report made by the auditor, shall be submitted to the Minister not later than 8th September and to the President not later than 30th September in each year.[29/74; 11/78; 23/95](2) Where the Auditor-General has not been appointed to be the auditor of the Corporation a copy of the audited financial statements and any report made by the auditor shall be forwarded to the Auditor-General at the same time as they are submitted to the Minister.(3) The Minister shall present a copy of the audited financial statements and the report of the Corporation’s auditor to Parliament.(4) The audited financial statements and the auditor’s report referred to in subsection (3) shall be published in the Gazette.[22 Annual report22.—(1) The Corporation shall, not later than 8th September in each year, unless the Minister otherwise authorises in writing, furnish to the Minister a report of its functions during the preceding year.[23/95](2) The Minister shall cause a copy of every such report to be presented to Parliament.[22A[23/95] Bank account and accounting records23.—(1) All moneys paid to the Corporation shall forthwith be paid into such banks as may from time to time be decided by the Corporation.[7/71; 11/78](2) The accounting records of the Corporation shall distinguish between capital and revenue transactions.[7/71](3) Moneys received by way of loans shall be shown separately in the books and accounts and in the balance-sheet of the Corporation.Payments to be made in accordance with budget24.—(1) No payment shall be made by the Corporation unless the expenditure is covered by an item in a budget and a sufficient balance for the item is available.[7/71](2) Notwithstanding the absence of such provision, the Corporation may pay —(a) sums deposited by contractors or other persons whenever by the conditions of the deposit any such sum has become repayable;(b) sums collected and credited to the funds of the Corporation in error;(c) sums payable by the Corporation under any award of the Collector of Land Revenue or under any of the provisions of this Act or of any other written law relating to the acquisition of land for a public purpose or under any judgment or order of any court; and(d) any expenditure incurred to secure the proper execution of the functions and duties of the Corporation under this Act which, in the opinion of the Corporation, cannot be postponed.(3) Provision shall be made in a supplemental budget for any payment made under subsection (2)(c) or (d).Transfer of sums from one item to another25. Notwithstanding any of the provisions of this Act, the Corporation may transfer all or any part of moneys assigned to one item of expenditure to another item under the same head of expenditure in a budget approved by the Minister and the President.[11/91] Power of investment26. The Corporation may invest its moneys in accordance with the standard investment power of statutory bodies as defined in section 33A of the Interpretation Act (Cap. 1).[45/2004 wef 15/12/2004] 27. [Repealed by Act 23/95]Compulsory acquisition of land28.—(1) Where any immovable property, not being State land, is needed for the purposes of the Corporation, the Corporation may request and the President may if he thinks fit direct the acquisition of that property.(2) The property may be acquired in accordance with the provisions of any written law relating to the acquisition of land for a public purpose, and any declaration required under any such written law that the property is so needed may be made (notwithstanding that compensation is to be paid out of the funds of the Corporation) and the declaration shall have effect as if it were a declaration that such property is needed for a public purpose made in accordance with that written law.[7/83]Compulsory acquisition of property before 15th April 1983 not to be called in question29.—(1) No compulsory acquisition of any immovable property before 15th April 1983 shall be called in question in any court on the ground that the acquisition was not in compliance with section 28 as in force before that date.(2) Any action or proceedings pending after 15th April 1983 in any court in respect of any matter to which subsection (1)applies shall be dismissed on application by any party, and the court may make such order as to costs as it thinks fit.30. [Repealed by Act 23/95]Special provisions relating to sale of land by Corporation31. For the purposes of registration of an assurance relating to the sale by the Corporation of any land, the mortgage of such land in favour of the Corporation or the reconveyance or discharge of such mortgage —(a) in the case of land registered under the provisions of the Registration of Deeds Act (Cap. 269), section 11 of that Act shall not apply; and(b) in the case of land registered under the provisions of the Land Titles Act (Cap. 157) where a solicitor is not employed by the Corporation, a certificate of an officer authorised in writing in that behalf by the Corporation shall be sufficient for the purposes of section 59 of that Act.[31/80] Regulations32.—(1) The Minister may, after consultation with the Corporation, make such regulations as he may consider necessary or desirable for the proper conduct of the business of the Corporation and, in particular, for any of the following matters:(a) the convening of meetings of the Corporation and the procedure to be followed thereat;(b) the provision of a common seal and the custody and use thereof;(c) the manner in which documents, cheques and instruments of any description shall be signed or executed on behalf of the Corporation;(d) the manner and terms of issue and redemption of bonds and debentures by the Corporation; and(e) generally for the exercise of the powers of the Corporation under the provisions of this Act.(2) All regulations made under this Act shall be presented to Parliament as soon as possible after publication in the Gazette.Obstruction of officer of Corporation33. Any person who obstructs any officer of the Corporation or any person duly authorised by the Corporation in that behalf in the performance of any thing which the Corporation is by this Act required or empowered to do shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $5,000 or to imprisonment for a term not exceeding 6 months.[11/78] Transfer to Corporation of assets and liabilities of Economic Development Board34. As from 1st June 1968, such of the lands, buildings and other property, movable and immovable of the Economic Development Board constituted under the provisions of the Economic Development Board Act (Cap. 85), including all such assets, powers, rights, interests and privileges as well as such debts, liabilities and obligations in connection therewith or appertaining thereto as may be specified by the Minister by notification in the Gazette shall be deemed to have been transferred to and vested in the Corporation without further assurance.Corporation’s symbols35.—(1) The Corporation shall have the exclusive right to the use of —(a) the symbols which are set out in the Schedule; and(b) such other symbol as it may devise or adopt from time to time and thereafter display or exhibit in connection with its activities or affairs.[23/95](2) The Corporation shall publish the symbol referred to in subsection (1)(b) in the Gazette.[23/95](3) Any person who uses a symbol identical with, or which so resembles, any of the Corporation’s symbols as to or be likely to deceive o r cause confusion, shall be guilty of an offence and shall be liable on conviction to a fine not exceeding $2,000 or to imprisonment for a term not exceeding 6 months or to both.[23/95](4) Nothing in this section shall be construed to authorise the Corporation to use any symbol which any person has acquired the exclusive right to use the same under the Trade Marks Act 1998 or otherwise.[23/95][46/98 wef 15/01/1999PART IV。