货币时间价值英语

关于财务管理的英文单词

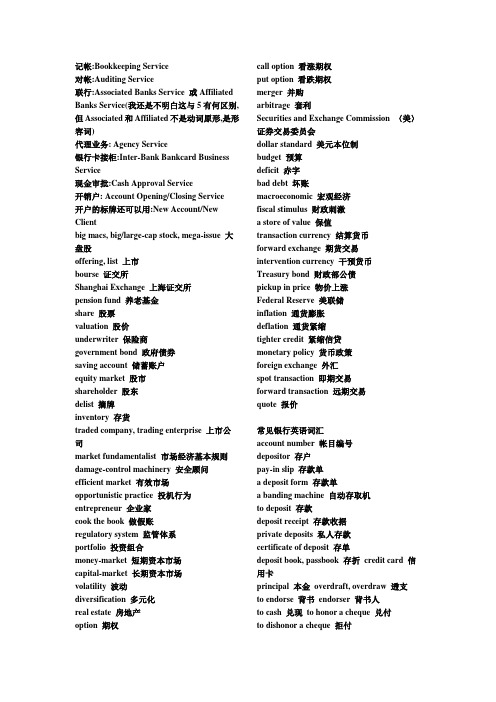

记帐:Bookkeeping Service对帐:Auditing Service联行:Associated Banks Service 或Affiliated Banks Service(我还是不明白这与5有何区别,但Associated和Affiliated不是动词原形,是形容词)代理业务: Agency Service银行卡接柜:Inter-Bank Bankcard Business Service现金审批:Cash Approval Service开销户: Account Opening/Closing Service开户的标牌还可以用:New Account/New Clientbig macs, big/large-cap stock, mega-issue 大盘股offering, list 上市bourse 证交所Shanghai Exchange 上海证交所pension fund 养老基金share 股票valuation 股价underwriter 保险商government bond 政府债券saving account 储蓄账户equity market 股市shareholder 股东delist 摘牌inventory 存货traded company, trading enterprise 上市公司market fundamentalist 市场经济基本规则damage-control machinery 安全顾问efficient market 有效市场opportunistic practice 投机行为entrepreneur 企业家cook the book 做假账regulatory system 监管体系portfolio 投资组合money-market 短期资本市场capital-market 长期资本市场volatility 波动diversification 多元化real estate 房地产option 期权call option 看涨期权put option 看跌期权merger 并购arbitrage 套利Securities and Exchange Commission 〈美〉证券交易委员会dollar standard 美元本位制budget 预算deficit 赤字bad debt 坏账macroeconomic 宏观经济fiscal stimulus 财政刺激a store of value 保值transaction currency 结算货币forward exchange 期货交易intervention currency 干预货币Treasury bond 财政部公债pickup in price 物价上涨Federal Reserve 美联储inflation 通货膨胀deflation 通货紧缩tighter credit 紧缩信贷monetary policy 货币政策foreign exchange 外汇spot transaction 即期交易forward transaction 远期交易quote 报价常见银行英语词汇account number 帐目编号depositor 存户pay-in slip 存款单a deposit form 存款单a banding machine 自动存取机to deposit 存款deposit receipt 存款收据private deposits 私人存款certificate of deposit 存单deposit book, passbook 存折credit card 信用卡principal 本金overdraft, overdraw 透支to endorse 背书endorser 背书人to cash 兑现to honor a cheque 兑付to dishonor a cheque 拒付to suspend payment 止付cheque,check 支票cheque book 支票本crossed cheque 横线支票blank cheque 空白支票rubber cheque 空头支票cheque stub, counterfoil 票根cash cheque 现金支票traveler's cheque 旅行支票cheque for transfer 转帐支票outstanding cheque 未付支票canceled cheque 已付支票forged cheque 伪支票Bandar's note 庄票,银票banker 银行家president 行长savings bank 储蓄银行Chase Bank 大通银行National City Bank of New York 花旗银行Hongkong Shanghai Banking Corporation 汇丰银行Chartered Bank of India, Australia and China 麦加利银行Banque de I'IndoChine 东方汇理银行central bank, national bank, banker's bank 中央银行bank of issue, bank of circulation 发行币银行commercial bank 商业银行,储蓄信贷银行member bank, credit bank 储蓄信贷银行discount bank 贴现银行exchange bank 汇兑银行requesting bank 委托开证银行issuing bank, opening bank 开证银行advising bank, notifying bank 通知银行negotiation bank 议付银行confirming bank 保兑银行paying bank 付款银行associate banker of collection 代收银行consigned banker of collection 委托银行clearing bank 清算银行local bank 本地银行domestic bank 国内银行overseas bank 国外银行unincorporated bank 钱庄branch bank 银行分行trustee savings bank 信托储蓄银行trust company 信托公司financial trust 金融信托公司unit trust 信托投资公司trust institution 银行的信托部credit department 银行的信用部commercial credit company(discount company) 商业信贷公司(贴现公司)neighborhood savings bank, bank of deposit 街道储蓄所credit union 合作银行credit bureau 商业兴信所self-service bank 无人银行land bank 土地银行construction bank 建设银行industrial and commercial bank 工商银行bank of communications 交通银行mutual savings bank 互助储蓄银行post office savings bank 邮局储蓄银行mortgage bank, building society 抵押银行industrial bank 实业银行home loan bank 家宅贷款银行reserve bank 准备银行chartered bank 特许银行corresponding bank 往来银行merchant bank, accepting bank 承兑银行investment bank 投资银行import and export bank (EXIMBANK) 进出口银行joint venture bank 合资银行money shop, native bank 钱庄credit cooperatives 信用社clearing house 票据交换所public accounting 公共会计business accounting 商业会计cost accounting 成本会计depreciation accounting 折旧会计computerized accounting 电脑化会计general ledger 总帐subsidiary ledger 分户帐cash book 现金出纳帐cash account 现金帐journal, day-book 日记帐,流水帐bad debts 坏帐investment 投资surplus 结余idle capital 游资economic cycle 经济周期economic boom 经济繁荣economic recession 经济衰退economic depression 经济萧条economic crisis 经济危机economic recovery 经济复苏inflation 通货膨胀deflation 通货收缩devaluation 货币贬值revaluation 货币增值international balance of payment 国际收支favourable balance 顺差adverse balance 逆差hard currency 硬通货soft currency 软通货international monetary system 国际货币制度the purchasing power of money 货币购买力money in circulation 货币流通量note issue 纸币发行量national budget 国家预算national gross product 国民生产总值public bond 公债stock, share 股票debenture 债券treasury bill 国库券debt chain 债务链direct exchange 直接(对角)套汇indirect exchange 间接(三角)套汇cross rate, arbitrage rate 套汇汇率foreign currency (exchange) reserve 外汇储备foreign exchange fluctuation 外汇波动foreign exchange crisis 外汇危机discount 贴现discount rate, bank rate 贴现率gold reserve 黄金储备money (financial) market 金融市场stock exchange 股票交易所broker 经纪人commission 佣金bookkeeping 簿记bookkeeper 簿记员an application form 申请单bank statement 对帐单letter of credit 信用证strong room, vault 保险库equitable tax system 等价税则specimen signature 签字式样banking hours, business hours 营业时间(Consumer Price Index) 消费者物价指数business 企业商业业务financial risk 财务风险sole proprietorship 私人业主制企业partnership 合伙制企业limited partner 有限责任合伙人general partner 一般合伙人separation of ownership and control 所有权与经营权分离claim 要求主张要求权management buyout 管理层收购tender offer 要约收购financial standards 财务准则initial public offering 首次公开发行股票private corporation 私募公司未上市公司closely held corporation 控股公司board of directors 董事会executove director 执行董事non- executove director 非执行董事chairperson 主席controller 主计长treasurer 司库revenue 收入profit 利润earnings per share 每股盈余return 回报market share 市场份额social good 社会福利financial distress 财务困境stakeholder theory 利益相关者理论value (wealth) maximization 价值(财富)最大化common stockholder 普通股股东preferred stockholder 优先股股东debt holder 债权人well-being 福利diversity 多样化going concern 持续的agency problem 代理问题free-riding problem 搭便车问题information asymmetry 信息不对称retail investor 散户投资者institutional investor 机构投资者agency relationship 代理关系net present value 净现值creative accounting 创造性会计stock option 股票期权agency cost 代理成本bonding cost 契约成本monitoring costs 监督成本takeover 接管corporate annual reports 公司年报balance sheet 资产负债表income statement 利润表statement of cash flows 现金流量表statement of retained earnings 留存收益表fair market value 公允市场价值marketable securities 油价证券check 支票money order 拨款但、汇款单withdrawal 提款accounts receivable 应收账款credit sale 赊销inventory 存货property,plant,and equipment 土地、厂房与设备depreciation 折旧accumulated depreciation 累计折旧liability 负债current liability 流动负债long-term liability 长期负债accounts payout 应付账款note payout 应付票据accrued espense 应计费用deferred tax 递延税款preferred stock 优先股common stock 普通股book value 账面价值capital surplus 资本盈余accumulated retained earnings 累计留存收益hybrid 混合金融工具treasury stock 库藏股historic cost 历史成本current market value 现行市场价值real estate 房地产outstanding 发行在外的a profit and loss statement 损益表net income 净利润operating income 经营收益earnings per share 每股收益simple capital structure 简单资本结构dilutive 冲减每股收益的basic earnings per share 基本每股收益complex capital structures 复杂的每股收益diluted earnings per share 稀释的每股收益convertible securities 可转换证券warrant 认股权证accrual accounting 应计制会计amortization 摊销accelerated methods 加速折旧法straight-line depreciation 直线折旧法statement of changes in shareholders’equity 股东权益变动表source of cash 现金来源use of cash 现金运用operating cash flows 经营现金流cash flow from operations 经营活动现金流direct method 直接法indirect method 间接法bottom-up approach 倒推法investing cash flows 投资现金流cash flow from investing 投资活动现金流joint venture 合资企业affiliate 分支机构financing cash flows 筹资现金流cash flows from financing 筹资活动现金流time value of money 货币时间价值simple interest 单利debt instrument 债务工具annuity 年金future value 终至present value 现值compound interest 复利compounding 复利计算pricipal 本金mortgage 抵押credit card 信用卡terminal value 终值discounting 折现计算discount rate 折现率opportunity cost 机会成本required rate of return 要求的报酬率cost of capital 资本成本ordinary annuity普通年金annuity due 先付年金financial ratio 财务比率deferred annuity 递延年金restrictive covenants 限制性条款perpetuity 永续年金bond indenture 债券契约face value 面值financial analyst 财务分析师coupon rate 息票利率liquidity ratio 流动性比率nominal interest rate 名义利率current ratio 流动比率effective interest rate 有效利率window dressing 账面粉饰going-concern value 持续经营价值marketable securities 短期证券liquidation value 清算价值quick ratio 速动比率book value 账面价值cash ratio 现金比率marker value 市场价值debt management ratios 债务管理比率intrinsic value 内在价值debt ratio 债务比率mispricing 给……错定价格debt-to-equity ratio 债务与权益比率valuation approach 估价方法equity multiplier 权益乘discounted cash flow valuation 折现现金流量模型long-term ratio 长期比率undervaluation 低估debt-to-total-capital 债务与全部资本比率overvaluation 高估leverage ratios 杠杆比率option-pricing model 期权定价模型interest coverage ratio 利息保障比率contingent claim valuation 或有要求权估价earnings before interest and taxes 息税前利润promissory note 本票cash flow coverage ratio 现金流量保障比率contractual provision 契约条款asset management ratios 资产管理比率par value 票面价值accounts receivable turnover ratio 应收账款周转率maturity value 到期价值inventory turnover ratio 存货周转率coupon 息票利息inventory processing period 存货周转期coupon payment 息票利息支付accounts payable turnover ratio 应付账款周转率coupon interest rate 息票利率cash conversion cycle 现金周转期maturity 到期日asset turnover ratio 资产周转率term to maturity 到期时间profitability ratio 盈利比率call provision赎回条款gross profit margin 毛利润call price 赎回价格operating profit margin 经营利润sinking fund provision 偿债基金条款net profit margin 净利润conversion right 转换权return on asset 资产收益率put provision 卖出条款return on total equity ratio 全部权益报酬率indenture 债务契约return on common equity 普通权益报酬率covenant 条款market-to-book value ratio 市场价值与账面价值比率trustee 托管人market value ratios 市场价值比率protective covenant 保护性条款dividend yield 股利收益率negative covenant 消极条款dividend payout 股利支付率positive covenant 积极条款financial statement财务报表secured deht担保借款profitability 盈利能力unsecured deht信用借款viability 生存能力creditworthiness 信誉solvency 偿付能力collateral 抵押品collateral trust bonds 抵押信托契约debenture 信用债券bond rating 债券评级current yield 现行收益yield to maturity 到期收益率default risk 违约风险interest rate risk 利息率风险authorized shares 授权股outstanding shares 发行股treasury share 库藏股repurchase 回购right to proxy 代理权right to vote 投票权independent auditor 独立审计师straight or majority voting 多数投票制cumulative voting 积累投票制liquidation 清算right to transfer ownership 所有权转移权preemptive right 优先认股权dividend discount model 股利折现模型capital asset pricing model 资本资产定价模型constant growth model 固定增长率模型growth perpetuity 增长年金mortgage bonds 抵押债券。

时间的价值英语作文

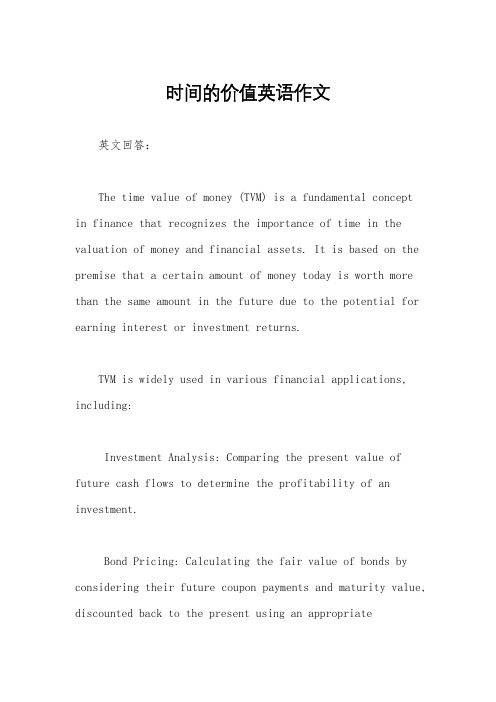

时间的价值英语作文英文回答:The time value of money (TVM) is a fundamental conceptin finance that recognizes the importance of time in the valuation of money and financial assets. It is based on the premise that a certain amount of money today is worth more than the same amount in the future due to the potential for earning interest or investment returns.TVM is widely used in various financial applications, including:Investment Analysis: Comparing the present value of future cash flows to determine the profitability of an investment.Bond Pricing: Calculating the fair value of bonds by considering their future coupon payments and maturity value, discounted back to the present using an appropriateinterest rate.Mortgage Lending: Determining the monthly payments and total cost of a mortgage loan over its term.Retirement Planning: Estimating the future value of savings and investments to ensure a financially secure retirement.Compound Interest and Present/Future Value:Compound interest is the interest earned on both the principal and the accumulated interest, leading to exponential growth over time. The formula for compound interest is:```。

财务管理英语词汇

financial management 财务管理chief financial officer 首席财务官hurdle rate 最低报酬率capital structure 资本结构cash dividend 现金股利dividend-payout ratio 股利支付率financial risk 财务风险earnings per share 每股盈余net present value 净现值stock option 股票期权earnings per share 每股收益time value of money 货币时间价值simple interest 单利annuity 年金future value 终值present value 现值compound interest 复利capital 本金d iscount rate 折现率opportunity cost 机会成本cost of capital 资本成本ordinary annuity 普通年金annuity due 先付年金deferred annuity 递延年金perpetuity 永续年金liquidity ratio 流动性比率nominal interest rate 名义利率marker value 市场价值intrinsic value 内在价值discounted cash flow valuation 折现现金流量模型earnings before interest and taxes 息税前利润par value 票面价值dividend payout 股利支付率dividend discount model 股利折现模型diversifiable risk可分散风险market risk 市场风险expected return 期望收益volatility 流动性权益融资equity financial债务融资debt financial利润最大化profit maximization股东财富最大化shareholders wealth maximization 每股收益最大化maximization of earning per share 11、投资报酬return on investment风险溢价risk premium货币市场money market偿债基金sinking fund1.financial markets 金融市场2.资本结构capital structure3.risk premium 风险报酬4.净现金流量net cash flow5.credit policy 信用政策6.终值future value7.moral hazard 道德风险8.收账政策collection policy1.chief financial officer 首席财务官2.财务管理financial management3.credit standard 信用标准4.流动性liquidity5.earnings before interest and taxes 息税前利润6.市场价值market value7.capital assets pricing model资本资产定价模型8.每股收益earnings per share。

宏观经济学英语词汇通用一篇

宏观经济学英语词汇通用一篇宏观经济学英语词汇 11、Scarcity:稀缺性2、Choice:选择3、opportunity costs:机会成本4、Production possibilities curve:生产可能性曲线5、Production possibilities frontier:生产可能性边界(与生产可能性曲线相同)6、Comparative advantage:相对比较优势7、absolute advantage:绝对比较优势8、specialization:分工9、exchange:交换10、Demand:需求11、Supply:供给12、market equilibrium:市场均衡13、business cycle:经济周期14、unemployment:失业15、inflation:通货膨胀16、growth:增长17、National e accounts:国民收入账户18、Circular flow:经济循环19、Gross domestic product:__生产总值(GDP)20、Real gross domestic product:实际GDP21、Nominal gross domestic product:名义GDP22、Price indices 价格指数23、Nominal:名义的24、real:实际的25、Natural rate of unemployment:自然失业率26、Aggregate demand:总需求27、Multiplier:乘数效应28、crowding―out effects:挤出效应29、Aggregate supply:总供给30、Short―run:短期31、long―run:长期32、Sticky:黏性33、Flexible:__伸缩性34、Stagflation:滞胀35、Actual output:实际产出36、full―employment:充分就业产出37、Economic fluctuations:经济波动38、Money:货币39、stock:股票40、bond:债券41、Bank:银行42、financial markets:金融市场43、Time value of money:货币的时间价值44、money supply:货币供给45、Money demand:货币需求46、creation of money:货币的创造47、Money market:货币市场48、Loanable funds market 可贷资金市场49、Policy:__工具50、Quantity theory of money:货币数量论51、Real interest rate:实际利率52、nominal rate:名义利率53、Fiscal policy:财政__54、Monetary policy:货币__55、Government deficits:财政赤字56、Government debt:__债务57、Demand―pull inflation:需求拉动型通货膨胀58、Cost―push inflation:成本推动型通货膨胀59、The Phillips curve:菲利普斯曲线60、Expectations:期望(预期)61、human capital:人力资本投资62、Investment in human capital:人力资本投资63、Investment in physical capital:物质资本投资64、Research and development:研发65、technological progress:技术进步66、Balance of payments accounts:收支账户平衡67、Balance of trade:贸易平衡68、Current account:经常账户69、Capital account:资本账户70、Foreign exchange market:外汇市场71、Exchange rate:汇率72、Currency appreciation:货币升值73、Currency depreciation:货币贬值74、Net export:净出口75、capital flows:资本流动。

金融学专业词汇(中英文对照)

金融学专业词汇(中英文对照)目录1. 货币与货币制度 (3)2. 国际货币体系与汇率制度 (4)3. 信用、利息与信用形成 (5)4. 金融范畴的形成与发展 (7)5. 金融中介体系 (7)6. 存款货币银行 (9)7. 中央银行 (10)8. 金融市场 (10)9. 资本市场 (13)10. 金融体系结构 (14)11. 金融基础设施 (14)12. 利率的决定作用 (15)13. 货币需求 (16)14. 现代货币的创造机制 (17)15. 货币供给 (17)16. 货币均衡 (18)17. 开放经济的均衡 (18)18. 通货膨胀和通货紧缩 (19)19. 货币政策 (20)20. 货币政策与财政政策的配合 (21)21. 开放条件下的政策搭配与协调 (22)22. 利率的风险结构与期限结构 (22)23. 资产组合与资产定价 (23)24. 商业银行业务与管理 (25)25. 货币经济与实际经济 (26)26. 金融发展与经济增长 (26)27. 金融脆弱性与金融危机 (27)28. 金融监管 (27)1.货币与货币制度货币:(currency)外汇:(foreign exchange)铸币:(coin)银行券:(banknote)纸币:(paper currency)存款货币:(deposit money)价值尺度:(measure of values)货币单位:(currency unit)货币购买力:(purchasing power of money)购买力平价:(purchasing power parity,PPP)流通手段:(means of circulation)购买手段:(means of purchasing)交易的媒介:(media of exchange)支付手段:(means of payment)货币需求:(demand for money)货币流通速度:(velocity of money)保存价值:(store of value)汇率:(exchange rate)一般等价物:(universal equivalent)流动性:(liquidity)通货:(currency)准货币:(quasi money)货币制度:(monetary system)本位制:(standard)金本位:(gold standard)造币:(coinage)铸币税:(seigniorage)本位币:(standard money)辅币:(fractional money)货币法偿能力:(legal tender powers)复本位制:(bimetallic standard)金汇兑本位:(gold exchange standard)金平价:(gold parity)金块本位制:(gold bullion standard)2.国际货币体系与汇率制度浮动汇率制:(floating exchange rate regime)货币局制度:(currency board arrangement)联系汇率制度:(linked exchange rate system)美元化:(dollarization)最优通货区理论:(theory of optimum currency area)货币消亡:(money disappearance)外汇:(foreign currency)外汇管理:(exchange regulation)外汇管制:(exchange control)可兑换:(convertibility)不可兑换:(inconvertibility)经常项目:(current account)资本项目:(capital account)汇率:(exchange rate)牌价:(posted price)直接标价法:(direct quotation)间接标价法:(indirect quotation)单一汇率:(unitary exchange rate)多重汇率:(multiple exchange rate)市场汇率:(market exchange rate)官方汇率:(official exchange rate)黑市:(black market)固定汇率:(fixed exchange rate)浮动汇率:(floating exchange rate)管理浮动:(managed float)盯住汇率制度:(pegged exchange rate regime)固定钉住:(fixed peg)在水平带内的盯住:(pegged within horizontal bands)爬行钉住:(crawling peg)外汇指定银行:(designated foreign exchange bank)货币的对外价值:(external value of exchange)货币的对内价值:(internal value of exchange)名义汇率:(nominal exchange rate)实际汇率:(real exchange rate)铸币平价:(mint parity)金平价:(gold parity)黄金输送点:(gold transport point)国际借贷说:(theory of international indebtedness)流动债权:(current claim)流动负债:(current liablity)国际收支说:(theory of balance payment)汇兑心理说:(psychology theory of exchange rate)货币分析说:(monetary approach)金融资产说:(portfolio theory of exchange rate determination)利率平价理论:(theory of interest rate parity)外汇风险:(exchange risk)中国的外汇调剂:(foreign exchange swap)3.信用、利息与信用形成信用:(credit)利息:(interest)收益:(yield)资本化:(capitalization of interest)高利贷:(usury)利率:(interest rate)债权:(claim)债务:(debt obligation)借入:(borrowing)贷出:(lending)盈余:(surplus)赤字:(deficit)跨时预算约束:(intertemporal budget constraint)资金流量:(flow of funds)部门:(sector)借贷资本:(loan capital)实体:(real)商业信用:(commercial credit)银行信用:(bank credit)本票:(promissory note)汇票:(bill of exchange)商业本票:(commercial paper)商业汇票:(commercial bill)承兑:(acceptance)背书:(endorsement)直接融资:(direct finance)间接融资:(indirect finance)短期国库卷:(treasury bill)中期国库卷:(treasury note)长期国库卷:(treasury bond)国债:(national debt)公债:(public debt)资本输出:(export of capital)国际资本流动:(international capital flow)国外商业性借贷:(foreign direct investment,FDI)国际游资:(hot money)4.金融范畴的形成与发展财政:(public finance)公司理财:(corporate finance)投资:(investment)保险:(insurance)财产保险:(property insurance)人身保险:(mutual life insurance)相互人寿保险:(mutual life insurance)信托:(trust)租赁:(leasing)5.金融中介体系金融中介:(financial intermediary)金融机构:(financial institution)借者:(borrower)贷者:(lender)货币中介:(monetary intermediation)权益资本:(equity capital)中央银行:(central bank)货币当局:(monetary authority)存款货币银行:(deposit money bank)商业银行:(commercial bank)投资银行:(investment bank)商人银行:(merchant bank)财务公司:(financial companies)储蓄银行:(saving bank)抵押银行:(mortgage bank)信用合作社:(credit cooperative)保险业:(insurance industry)跨国银行:(multinational bank)代表处:(representative office)经理处:(agency)分行:(branch)子银行:(subsidiary)联营银行:(affiliate)国际财团银行:(consortium bank)中国人民银行:(People’s Bank of China)政策性银行:(policy banks)国有商业银行:(state-owned commercial banks)资产管理公司:(assets management company)证券公司:(securities company)券商:(securities dealer)农村信用合作社:(rural credit cooperatives)城市信用合作社:(urban credit cooperatives)信托投资公司:(trust and investment companies)信托:(trust)金融租赁:(financial leasing)邮政储蓄:(postal savings)财产保险:(property insurance)商业保险:(commercial insurance)社会保险:(social insurance)保险深度:(insurance intensity)保险密度:(insurance density)投资基金:(investment funds)证券投资基金:(security funds)封闭式基金:(closed-end investment funds)开放式基金:(open-end investment funds)私募基金:(private placement)风险投资基金:(venture funds)特别提款权:(special drawing right,SDR)国有化:(nationalization)6.存款货币银行货币兑换商:(money dealer)银行业:(banking)贴现率:(discount rate)职能分工型商业银行:(functional division commercial bank)全能型商业银行:(multi-function commercial bank)综合性商业银行:(comprehensive commercial bank)单元银行制度:(unit banking system)总分行制度:(branch banking system)代理行制度:(correspondent banking system)银行控股公司制度:(share holding banking system)连锁银行制度:(chains banking system)金融创新:(financial innovation)自动转账制度:(automatic transfer services,ATS)可转让支付命令账户:(negotiable order of withdrawal account,NOW)货币市场互助基金:(money market mutual fund,MMMF)货币市场存款账户:(money market deposit account,MMDA)不良债权:(bad claim)坏账:(bad loan)不良贷款:(non-performing loans,NPL)存款保险制度:(deposit insurance system)金融资本:(financial capital)7.中央银行中央银行:(central bank)一元式中央银行制度:(unit central bank system)二元式中央银行制度:(dual central bank system)复合中央银行制度:(compound central bank system)跨国中央银行制度:(multinational central bank system)发行的银行:(bank of issue)银行的银行:(bank of bank)最后贷款人:(lender of last resort)再贴现:(rediscount)在抵押:(recollateralize)国家的银行:(the state bank)8.金融市场金融市场:(financial market)证券化:(securitization)金融资产:(financial assets)金融工具:(financial instruments)金融产品:(financial products)衍生金融产品:(derivative financial products)原生金融产品:(underlying financial products)流动性:(liquidity)变现:(encashment)买卖差价:(bid-ask spread)做市商:(market marker)到期日:(due date)信用风险:(credit risk)市场风险:(market risk)名义收益率:(nominal yield)现时收益率:(current yield)平均收益率:(average yield)内在价值:(intrinsic value)直接融资:(direct finance)间接融资:(indirect finance)货币市场:(money market)资本市场:(capital market)现货市场:(spot market)期货市场:(futures market)机构投资人:(institutional investor)资信度:(credit standing)融通票据:(financial paper)银行承兑票据:(bank acceptance)贴现:(discount)大额存单:(certificates of desposit,CDs)回购:(counterpurchase)回购协议:(repurchase agreement)隔夜:(overnight)银行同业间拆借市场:(interbank market)合约:(contract)远期:(forward)期货:(futures)期权:(options)看涨期权:(call option)看跌期权:(put option)期权费:(option premium)互换:(swap)投资基金:(investment funds)契约型基金:(contractual type investment fund)单位型基金:(unit funds)基金型基金:(funding funds)公司型基金:(corporate type investment fund)投资管理公司:(investment management company)共同基金:(mutual fund)对冲基金:(hedge fund)风投基金:(venture fund)权益投资:(equity investment)收益基金:(income funds)增长基金:(growth funds)长期增长基金:(long-term growth funds)高增长基金:(go-go groeth funds)货币市场基金:(money market funds)养老基金:(pension fund)外汇市场:(foreign exchange market)风险资本:(venture capital)权益资本:(equity capital)私人权益资本市场:(private equity market)有限合伙制:(limited partnership)交易发起:(deal origination)筛选投资机会:(screening)评价:(evaluation)交易设计:(deal structure)投资后管理:(post-investment activities)创业板市场:(growth enterprise market,GEM)二板市场:(secondary board market)金融创新:(financial innovation)金融自由化:(financial liberalization)全球化:(globalization)离岸金融市场:(off-shore financial center)9.资本市场权益:(equity)剩余索取权:(residual claims)证券交易所:(stock exchange)交割:(delivery)过户:(transfer ownership)场外交易市场:(over the counter,OTC)金融债券:(financial bond)抵押债券:(mortgage bond)担保信托债券:(collateral trust bonds)信用债券:(trust bonds)次等信用债券:(subordinated debenture)担保债券:(guaranteed bonds)初级市场:(primary market)二级市场:(secondary market)公募:(public offering)私募:(private offering)有价证券:(security)面值:(face value)市值:(market value)股票价格指数:(share price index)有效市场假说:(effective market hypothesis)弱有效市场:(weak efficient market)中度有效市场:(semi-efficient market)强有效市场:(strong efficient market)股份公司:(stock certificate)股票:(stock certificate)股东:(stock holder)所有权:(ownership)经营权:(right of management)10.金融体系结构功能主义金融观:(perspective of financial function)金融体系格局:(pattern of financial system)激励:(incentive)公司治理:(corporate governance)路径依赖:(path dependency)市场主导型:(market-oriented type)银行主导型:(banking-oriented type)参与成本:(participative cost)影子银行体系:(the shadow banking system)11.金融基础设施金融基础设施:(financial infrastructures)支付清算系统:(payment and clearing system)跨境支付系统:(cross-border inter-bank payment system,CIPS)全额实时结算:(real time gross system)净额批量清算:(bulk transfer net system)大额资金转账系统:(whole sale funds transfer system)小额定时结算系统:(fixed time retail system)票据交换所:(clearing house)金融市场基础设施:(financial market infrastructures)中央交易对手:(central counterparties,CCPs)双边清算体系:(bilateral clearing system)系统重要性支付体系核心原则:(the core principles for systemically important payment system)证券清算体系建议:(the recommendations for central counterparties)中央交易对手建议:(the recommendations for central counterparties)金融业标准:(financial standards)盯市:(mark-to-market)公允价值:(fair value)金融部门评估规划:(financial sector assessment program)12.利率的决定作用可贷资金论:(loanable funds theory of interest)储蓄的利率弹性:(interest elasticity of saving)投资的利率弹性:(interest elasticity of investment)本金:(principal)回报率:(returns)基准利率:(benchmark interest rate)无风险利率:(risk-free interest rate)补偿:(compensation)风险溢价:(risk premium)实际利率:(real interest rate)名义利率:(nominal interest rate)固定利率:(fixed interest rate)浮动利率:(floating rate)官定利率:(official interest rate)行业利率:(trade-regulated rate)一般利率:(general interest rate)优惠利率:(preferential interest rate)贴息贷款:(loan of interest subsidy)年利率:(annual interest rate)月利率:(monthly interest rate)日利率:(daily interest rate)拆息:(call money interest)13.货币需求货币需求:(demand for money)货币数量论:(quantity theory of money)货币必要量:(volume of money needed)货币流通速度:(velocity of money)交易方程式:(equation of exchange)剑桥方程式:(equation of Cambridge)现金交易说:(cash transaction approach)现金余额说:(cash balance theory)货币需求动机:(motive of the demand for money)交易动机:(transaction motive)预防动机:(precautionary motive)投机动机:(speculative motive)流动性偏好:(liquidity preference)流动性陷阱:(liquidity trap)平方根法则:(square-root rule)货币主义:(monetarism)恒久性收入:(permanent income)机会成本变量:(opportunity cost variable)名义货币需求:(nominal demand for money)实际货币需求:(real demand for money)客户保证金:(customer’s security marign)金融资产选择:(portfolio selection)14.现代货币的创造机制纯流通费用:(pure circulation cost)原始存款:(primary deposit)派生存款:(derivative deposit)派生乘数:(withdrawal multiplier)现金损露:(loss of cashes)提现率:(withdrawal rate)创造乘数:(creation multiplier)现金:(currency)基础货币:(base money)高能货币:(high-power money)货币乘数:(money multiplier)铸币收入:(seigniorage revenue)15.货币供给货币供给:(money supply)准货币:(quasi money)名义货币供给:(nominal money supply)实际货币供给:(real money supply)股民保证金:(shareholder’s security margin)货币存量:(money stock)公开市场操作:(open-market operation)贴现政策:(discount policy)再贴现率:(rediscount rate)法定准备金率:(legal reserve ratio)财富效应:(wealth effect)预期报酬率变动效应:(effect of expected yields change)现金持有量:(currency holdings)超额准备金:(excess reserves)外生变量:(exogenous variable)内生变量:(endogenous variable)16.货币均衡均衡:(equilibrium)投资饥渴:(huger for investment)软预算约束:(soft budget constraint)总需求:(aggregate demand)总供给:(aggregate supply)面纱论:(money veil theory)流:(flow)余额:(stock)17.开放经济的均衡国际收支:(balance of payments)居民:(resident)非居民:(nonresident)国际收支平衡表:(statement for balance of payments)经常项目:(current account)资本和金融项目:(capital and financial account)储备资产:(reserve assets)净误差与遗漏:(net errors and missions)自主性交易:(autonomous transaction)调节性交易:(accommodating transaction)偿债率:(debt service ratio)顺差:(surplus)逆差:(deficit)最后清偿率:(last liquidation ratio)资本流动:(capital movements)项目融资:(project finance)外债:(external debt)资本外逃:(capital flight)冲销性操作:(sterilized operation)非冲销性操作:(unsterilized operation)债务率:(debt ratio)负债率:(liability ratio)差额:(balance)18.通货膨胀和通货紧缩通货膨胀:(inflation)恶性通货膨胀:(rampant inflation)爬行通货膨胀:(creeping inflation)温和通货膨胀:(moderate inflation)公开性通货膨胀:(open inflation)显性通货膨胀:(evident inflation)隐蔽性通货膨胀:(hidden inflation)输入型通货膨胀:(import of inflation)结构性通货膨胀:(structural inflation)通货膨胀率:(inflation rate)居民消费物价指数:(CPI)零售物价指数:(RPI)批发物价指数:(WPI)冲减指数:(deflator)需求拉上型通货膨胀:(demand-pull inflation)成本推动型通货膨胀:(cost-push inflation)工资-价格螺旋上升:(wage-price spiral)强制储蓄:(forced saving)收入分配效应:(distributional effect of income)财富分配效应:(distributional effect of wealth)滞胀:(stagflation)工资膨胀率:(wage inflation)紧缩性货币政策:(tight monetary policy)紧缩银根:(tight money)紧缩信贷:(tight squeeze)指数化:(indexation)通货紧缩:(deflation)19.货币政策货币政策:(monetary policy)金融政策:(financial policy)货币政策目标:(goal of monetary policy)通货膨胀目标制:(inflation targeting)逆风向原则:(principle of leaning against the wind)反周期货币政策:(counter cycle monetary policy)相机抉择:(discretionary)单一规则:(single rule)告示效应:(bulletin effects)直接信用控制:(direct credit)信用配额:(credit allocation)流动性比率:(liquidity ratio)间接信用控制:(indirect credit control)道义劝告:(moral suasion)窗口指导:(window guidence)信用贷款:(lending)传导机制:(conduction mechanism)中介指标:(intermediate target)信贷配给:(credit rationing)资产负债表渠道:(balance sheet channel)时滞:(time lag)预期:(expectation)透明度:(transparency)信任:(credibility)软着陆:(soft landing)20.货币政策与财政政策的配合赤字:(deficit)经常性收入:(current revenue)税:(tax)费:(fee)经常性支出:(current expenditure)资本性收入:(capital revenue)补助:(grant)资本性支出:(capital expenditure)账面赤字:(book deficit)隐蔽赤字:(hidden deficit)预算外:(off-budget)透支:(overdraft)净举债:(net fiancing)未清偿债券:(outstanding debt)或有债务:(contingent liability)准备货币:(reserve money)国债依存度:(public debt dependency)国债负担率:(public debt-to-GDP ratio)国债偿债率:(government debt-service ratio)财政政策:(fiscal policy)补偿性财政货币政策:(compensatory fiscal and monetary policy) 21.开放条件下的政策搭配与协调米德冲突:(Meade’s conflict)国际政策协调:(international policy coordination)信息交换:(information exchange)危机管理:(crisis management)避免共享目标变量的冲突:(avoiding conflicts over shared targets)合作确定中介目标:(cooperation intermediate targeting)部分协调:(full coordination)汇率目标区:(target zone of exchange rate)马歇尔-勒纳条件:(Marshall-Lerner condition)J曲线效应:(J curve effect)22.利率的风险结构与期限结构单利:(simple interest)复利:(compound interest)现值:(present value)终值:(future value)竞价拍卖:(open-outcry auction)贴现值:(present discount value)利率管制:(interest rate control)利率管理体制:(interest rate regulation system)存贷利差:(interest rate regulation system)利率风险结构:(risk structure of interest rates)违约风险:(default risk)利率期限结构:(term structure of interest rates)即期利率:(spot rate of interest)远期利率:(forward rate of interest)到期收益率:(yield to maturity)现金流:(cash floe)预期理论:(expectation theory)流动性理论:(liquidity theory)偏好理论:(preferred habitat theory)市场隔断理论:(market segmentation theory) 23.资产组合与资产定价市场风险:(market risk)信用风险:(credit risk)流动性风险:(liquidity risk)操作风险:(operational risk)法律风险:(legal risk)政策风险:(policy risk)道德风险:(moral hazard)主权风险:(sovereign risk)市场流动性风险:(product liquidity)现金流风险:(cash flow)执行风险:(execution risk)欺诈风险:(fraud risk)遵守与监管风险:(compliance and regulatory risk)资产组合理论:(portfolio theory)系统性风险:(systematic risk)非系统性风险:(nonsystematic risk)效益边界:(efficient frontier)价值评估:(evaluation)市盈率:(price-earning ratio)资产定价模型:(asset pricing model)资本资产定价模型:(capital asset pricing model,CAPM)无风险资产:(risk-free assets)市场组合:(market portfolio)多要素模型:(multifactorCAPM)套利定价理论:(arbitrage pricing theory,APT)期权加价:(option premium)内在价值:(intrinsic value)时间价值:(time value)执行价格:(strike price)看涨期权:(call option)看跌期权:(put option)对冲型的资产组合:(hedge portfolios)套利:(arbitrage)无套利均衡:(no-arbitrage equilibrium)均衡价格:(equilibrium price)多头:(long position)空头:(short position)动态复制:(dynamic replication)头寸:(position)风险偏好:(risk preference)风险中性:(risk neutral)风险厌恶:(risk averse)风险中性定价:(risk-netural pricing)24.商业银行业务与管理银行负责业务:(liability business)存款:(deposit)活期存款:(demand deposit)支票存款:(check deposit)透支:(overdraft)定期存款:(time deposit)再贴现:(rediscount)金融债券:(financial bond)抵押贷款:(mortgage loan)信用贷款:(credit loan)通知贷款:(demand loan)真实票据论:(real bill doctrine)商业贷款理论:(commercial loan theory)证券投资:(portfolio investment)中间业务:(middleman business)表外业务:(off-balance sheet business)无风险业务:(risk-free business)汇款:(remittance)信用证:(letter of credit)商品信用证:(commercial letter of credit)代收业务:(business of collection)代客买卖业务:(business of commission)承兑网络银行:(internet bank)虚拟银行:(virtual bank)企业对个人:(B2C)企业对企业:(B2B)挤兑:(bank runs)资产管理:(assets management)自偿性:(self-liquidation)可转换性理论:(convertibility theory)预期收入理论:(anticipated income theory)负债管理:(liability management)资产负债综合管理:(comprehensive management of assets and liability)风险管理:(risk management)在险价值:(value at risk,VAR)25.货币经济与实际经济两分法:(dichotomy)实际经济:(real economy)货币经济:(monetary economy)虚拟资本:(monetary capital)泡沫经济:(bubble economy)虚拟经济:(virtual economy)货币中性:(neutrality of money)相对价格:(relative price)货币面纱:(monetary veil)瓦尔拉斯均衡:(Walras equilibrium)一般均衡理论:(theory of general equilibrium)超中性:(super-neutrality)26.金融发展与经济增长金融发展:(financial development)金融自由化:(financial liberalization)金融深化:(financial deepening)金融压抑:(financial repression)金融机构化:(financial institutionalization)分层比率:(gradation ratio)金融相关率:(financial interrelation ratio,FIR)货币化率:(monetarization ratio)脱媒:(distintermediation)导管效应:(tube effect)27.金融脆弱性与金融危机金融脆弱性:(financial fragility)金融风险:(financial risk)长周期:(long cycles)安全边界:(margins of safety)汇率超调理论:(theory of exchange rate over shooting)金融危机:(financial crises)资产管理公司:(asset management corporation,AMC)金融恐慌:(financial panic)优先/次级抵押贷款债券:(senior/subordinate structure) 28.金融监管金融监管:(financial regulation)公共选择:(public choice)最低资本要求:(minimum capital requirements)监管当局的监管:(supervisory review process)市场纪律:(market discipline)宏观审慎框架:(macro-prudential framework)分行:(branch)子行:(subsidiary)并表监管:(consolidated supervision)。

货币的时间价值与现金流贴现分析

2013-2014(2)

Financial Economics

2

本章主要内容

1. 复利 2. 复利的频率 3. 现值与折现 4. 其他折现现金流决策规则 5. 复合现金流 6. 年金 7. 永续年金 8. 贷款的分期偿还 9. 汇率与货币的时间价值 10.通货膨胀与折现现金流分析 11.税收与投资决策

总结出一点:当期限非常长时,非常小的利率差别将导

致很大的终值变化。

2013-2014(2)

Financial Economics

10

§3 按不同的利率进行再投资

1. 假定你正面临着一项投资决策:你拥有10000美元可用于两 年期的投资。通过分析,你决定投资于银行定期存款( CDs)。 两年期存款单的年利率为7%,1年期的存款单的利率为6%, 你应该选择哪一种呢? 2. 在做决定之前,你必须先判定下一年的1年期存单的利率可能 是多少,这称为再投资利率,是指在计划投资的期限内能再次 进行投资的资金获得的利息率。假设你判定在投资率将为每年 8%。 3. 这时你可以用计算终值的方法进行你的投资决策。首先,计算 出每一种投资方式的终值,然后选择两年后所获资金最多的方 案。两年期的存单的终值为: FV=10 000×1.072=11449(美元) 4. 连续两年投资于1年期存单的终值为: FV=10 000×1.06×1.08=11 448(美元) 5. 因此,投资两年期存单,你的获利将略多。

PV=现值,即你账户中的起始金额。这里是 1000美元。 i=利息率,通常以每年的百分比为单位表示。这里是 10%(用小数表示则为0.1)。 n=计算利息的年数。 FV=n年年末的终值。

2013-2014(2) Financial Economics

资金时间价值的概念

资金时间价值的概念资金时间价值(Time Value of Money, TVM),是财务管理中的一个重要概念。

它指的是资金在时间上具有的价值变化。

换句话说,未来的一定金额的资金是不等同于现在的同样金额的资金的,因为资金可以通过投资获得利息或收益。

在理解资金时间价值之前,首先需要了解两个基本概念:现值和未来值。

现值(Present Value)是指将未来的一定金额的资金折算到现在所具有的价值。

未来值(Future Value)是指将现在的一定金额的资金在一定时间内获得一定利率或收益后的价值。

在实际生活中,人们通常更愿意拥有或使用现在的一定金额的资金,而不是同等金额的未来资金。

这是因为现金具有流动性,可以在需要的时候随时使用,而未来的资金则存在不确定性和风险。

资金时间价值的概念就是基于这个观点提出的。

资金时间价值可以通过两种方式来解释:一是将未来的一定金额折算到现在的现值,二是将现在的一定金额的资金投资获得利息或收益后,计算其未来值。

首先,我们来看如何将未来的一定金额折算到现在的现值。

这需要考虑到时间价值的核心原理,即未来的一单位货币价值小于现在的一单位货币价值。

这是因为未来的资金存在时间成本、通胀等因素的影响,而现在的资金可以立即使用和投资。

使用现值公式可以计算未来的一定金额的现值。

这个公式是:PV = FV / (1 + r)^n,其中PV表示现值,FV表示未来值,r表示利率,n表示时间期限。

比如,如果我们要计算5年后1000元的现值,假设利率为5%,那么现值就是1000 / (1 + 0.05)^5 = 783.53元。

其次,我们来看如何将现在的一定金额的资金投资获得利息或收益后,计算其未来值。

这个过程需要考虑到资金的增值效应,即通过投资获得的利息或收益。

在计算未来值时,还需要考虑到复利效应,即将获得的利息或收益重新投资获取更多的利息或收益。

使用未来值公式可以计算现在的一定金额的资金在一段时间内的未来值。

《金融学》答案第四章 货币的时间价值与现金流贴现分析

CHAPTER 4THE TIME VALUE OF MONEY AND DISCOUNTED CASH FLOW ANALYSISObjectives∙To explain the concepts of compounding and discounting, future value and present value.∙To show how these concepts are applied to making financial decisions.Outline4.1Compounding4.2The Frequency of Compounding4.3Present Value and Discounting4.4Alternative Discounted Cash Flow Decision Rules4.5Multiple Cash Flows4.6Annuities4.7Perpetual Annuities4.8Loan Amortization4.9Exchange Rates and Time Value of Money4.10Inflation and Discounted Cash Flow Analysis4.11Taxes and Investment DecisionsSummary∙Compounding is the process of going from present value (PV) to future value (FV). The future value of $1 earning interest at rate i per period for n periods is (1+i)n.∙Discounting is finding the present value of some future amount. The present value of $1 discounted at rate i per period for n periods is 1/(1+i)n.∙One can make financial decisions by comparing the present values of streams of expected future cash flows resulting from alternative courses of action. The present value of cash inflows less the present value of cash outflows is called net present value (NPV). If a course of action has a positive NPV, it is worth undertaking.∙In any time value of money calculation, the cash flows and the interest rate must be denominated in the same currency.∙Never use a nominal interest rate when discounting real cash flows or a real interest rate when discounting nominal cash flows.How to Do TVM Calculations in MS ExcelAssume you have the following cash flows set up in a spreadsheet:A B1t CF20-1003150426053706NPV7IRRMove the cursor to cell B6 in the spreadsheet. Click the function wizard f x in the tool bar and when a menu appears, select financial and then NPV. Then follow the instructions for inputting the discount rate and cash flows. You can input the column of cash flows by selecting and moving it with your mouse. Ultimately cell B6should contain the following:=NPV(0.1,B3:B5)+B2The first variable in parenthesis is the discount rate. Make sure to input the discount rate as a decimal fraction (i.e., 10% is .1). Note that the NPV function in Excel treats the cash flows as occurring at the end of each period, and therefore the initial cash flow of 100 in cell B2 is added after the closing parenthesis. When you hit the ENTER key, the result should be $47.63.Now move the cursor to cell B7to compute IRR. This time select IRR from the list of financial functions appearing in the menu. Ultimately cell B7 should contain the following:=IRR(B2:B5)When you hit the ENTER key, the result should be 34%.Your spreadsheet should look like this when you have finished:A B1t CF20-1003150426053706NPV47.637IRR34%Solutions to Problems at End of Chapter1.If you invest $1000 today at an interest rate of 10% per year, how much will you have 20 years from now,assuming no withdrawals in the interim?2. a. If you invest $100 every year for the next 20 years, starting one year from today and you earninterest of 10% per year, how much will you have at the end of the 20 years?b.How much must you invest each year if you want to have $50,000 at the end of the 20 years?3.What is the present value of the following cash flows at an interest rate of 10% per year?a.$100 received five years from now.b.$100 received 60 years from now.c.$100 received each year beginning one year from now and ending 10 years from now.d.$100 received each year for 10 years beginning now.e.$100 each year beginning one year from now and continuing forever.e.PV = $100 = $1,000.104.You want to establish a “wasting” fund which will provide you with $1000 per year for four years, at which time the fund will be exhausted. How much must you put in the fund now if you can earn 10% interest per year?SOLUTION:5.You take a one-year installment loan of $1000 at an interest rate of 12% per year (1% per month) to be repaid in 12 equal monthly payments.a.What is the monthly payment?b.What is the total amount of interest paid over the 12-month term of the loan?SOLUTION:b. 12 x $88.85 - $1,000 = $66.206.You are taking out a $100,000 mortgage loan to be repaid over 25 years in 300 monthly payments.a.If the interest rate is 16% per year what is the amount of the monthly payment?b.If you can only afford to pay $1000 per month, how large a loan could you take?c.If you can afford to pay $1500 per month and need to borrow $100,000, how many months would it taketo pay off the mortgage?d.If you can pay $1500 per month, need to borrow $100,000, and want a 25 year mortgage, what is thehighest interest rate you can pay?SOLUTION:a.Note: Do not round off the interest rate when computing the monthly rate or you will not get the same answerreported here. Divide 16 by 12 and then press the i key.b.Note: You must input PMT and PV with opposite signs.c.Note: You must input PMT and PV with opposite signs.7.In 1626 Peter Minuit purchased Manhattan Island from the Native Americans for about $24 worth of trinkets. If the tribe had taken cash instead and invested it to earn 6% per year compounded annually, how much would the Indians have had in 1986, 360 years later?SOLUTION:8.You win a $1 million lottery which pays you $50,000 per year for 20 years, beginning one year from now. How much is your prize really worth assuming an interest rate of 8% per year?SOLUTION:9.Your great-aunt left you $20,000 when she died. You can invest the money to earn 12% per year. If you spend $3,540 per year out of this inheritance, how long will the money last?SOLUTION:10.You borrow $100,000 from a bank for 30 years at an APR of 10.5%. What is the monthly payment? If you must pay two points up front, meaning that you only get $98,000 from the bank, what is the true APR on the mortgage loan?SOLUTION:If you must pay 2 points up front, the bank is in effect lending you only $98,000. Keying in 98000 as PV and computing i, we get:11.Suppose that the mortgage loan described in question 10 is a one-year adjustable rate mortgage (ARM), which means that the 10.5% interest applies for only the first year. If the interest rate goes up to 12% in the second year of the loan, what will your new monthly payment be?SOLUTION:Step 2 is to compute the new monthly payment at an interest rate of 1% per month:12.You just received a gift of $500 from your grandmother and you are thinking about saving this money for graduation which is four years away. You have your choice between Bank A which is paying 7% for one-year deposits and Bank B which is paying 6% on one-year deposits. Each bank compounds interest annually. What is the future value of your savings one year from today if you save your money in Bank A? Bank B? Which is the better decision? What savings decision will most individuals make? What likely reaction will Bank B have? SOLUTION:$500 x (1.07) = $535Formula:$500 x (1.06) = $530a.You will decide to save your money in Bank A because you will have more money at the end of the year. Youmade an extra $5 because of your savings decision. That is an increase in value of 1%. Because interestcompounded only once per year and your money was left in the account for only one year, the increase in value is strictly due to the 1% difference in interest rates.b.Most individuals will make the same decision and eventually Bank B will have to raise its rates. However, it isalso possible that Bank A is paying a high rate just to attract depositors even though this rate is not profitable for the bank. Eventually Bank A will have to lower its rate to Bank B’s rate in order to make money.13.Sue Consultant has just been given a bonus of $2,500 by her employer. She is thinking about using the money to start saving for the future. She can invest to earn an annual rate of interest of 10%.a.According to the Rule of 72, approximately how long will it take for Sue to increase her wealth to $5,000?b.Exactly how long does it actually take?SOLUTION:a.According to the Rule of 72: n = 72/10 = 7.2 yearsIt will take approximately 7.2 years for Sue’s $2,500 to double to $5,000 at 10% interest.b.At 10% interestFormula:$2,500 x (1.10)n = $5,000Hence, (1.10)n = 2.0n log 1.10 = log 2.0n = .693147 = 7.27 Years.095310rry’s bank account has a “floating” interest rate on certain deposits. Every year the interest rate is adjusted. Larry deposited $20,000 three years ago, when interest rates were 7% (annual compounding). Last year the rate was only 6%, and this year the rate fell again to 5%. How much will be in his account at the end of this year?SOLUTION:$20,000 x 1.07 x 1.06 x 1.05 = $23,818.2015.You have your choice between investing in a bank savings account which pays 8% compounded annually (BankAnnual) and one which pays 7.5% compounded daily (BankDaily).a.Based on effective annual rates, which bank would you prefer?b.Suppose BankAnnual is only offering one-year Certificates of Deposit and if you withdraw your moneyearly you lose all interest. How would you evaluate this additional piece of information when making your decision?SOLUTION:a.Effective Annual Rate: BankAnnual = 8%.Effective Annual Rate BankDaily = [1 + .075]365 - 1 = .07788 = 7.788%365Based on effective annual rates, you would prefer BankAnnual (you will earn more money.)b.If BankAnnual’s 8% annual return is conditioned upon leaving the money in for one full year, I would need tobe sure that I did not need my money within the one year period. If I were unsure of when I might need the money, it might be safer to go for BankDaily. The option to withdraw my money whenever I might need it will cost me the potential difference in interest:FV (BankAnnual) = $1,000 x 1.08 = $1,080FV (BankDaily) = $1,000 x 1.07788 = $1,077.88Difference = $2.12.16.What are the effective annual rates of the following:a.12% APR compounded monthly?b.10% APR compounded annually?c.6% APR compounded daily?SOLUTION:Effective Annual Rate (EFF) = [1 + APR] m - 1ma.(1 + .12)12 - 1 = .1268 = 12.68%12b.(1 + .10)- 1 = .10 = 10%1c.(1 + .06)365 - 1 = .0618 = 6.18%36517.Harry promises that an investment in his firm will double in six years. Interest is assumed to be paid quarterly and reinvested. What effective annual yield does this represent?EAR=(1.029302)4-1=12.25%18.Suppose you know that you will need $2,500 two years from now in order to make a down payment on a car.a.BankOne is offering 4% interest (compounded annually) for two-year accounts, and BankTwo is offering4.5% (compounded annually) for two-year accounts. If you know you need $2,500 two years from today,how much will you need to invest in BankOne to reach your goal? Alternatively, how much will you need to invest in BankTwo? Which Bank account do you prefer?b.Now suppose you do not need the money for three years, how much will you need to deposit today inBankOne? BankTwo?SOLUTION:PV = $2,500= $2,311.39(1.04)2PV = $2,500= $2,289.32(1.045)2You would prefer BankTwo because you earn more; therefore, you can deposit fewer dollars today in order to reach your goal of $2,500 two years from today.b.PV = $2,500= $2,222.49(1.04)3PV = $2,500= $2,190.74(1.045)3Again, you would prefer BankTwo because you earn more; therefore, you can deposit fewer dollars today in order to reach your goal of $2,500 three years from today.19.Lucky Lynn has a choice between receiving $1,000 from her great-uncle one year from today or $900 from her great-aunt today. She believes she could invest the $900 at a one-year return of 12%.a.What is the future value of the gift from her great-uncle upon receipt? From her great-aunt?b.Which gift should she choose?c.How does your answer change if you believed she could invest the $900 from her great-aunt at only 10%?At what rate is she indifferent?SOLUTION:a. Future Value of gift from great-uncle is simply equal to what she will receive one year from today ($1000). Sheearns no interest as she doesn’t receive the money until next year.b. Future Value of gift from great-aunt: $900 x (1.12) = $1,008.c. She should choose the gift from her great-aunt because it has future value of $1008 one year from today. Thegift from her great-uncle has a future value of $1,000. This assumes that she will able to earn 12% interest on the $900 deposited at the bank today.d. If she could invest the money at only 10%, the future value of her investment from her great-aunt would only be$990: $900 x (1.10) = $990. Therefore she would choose the $1,000 one year from today. Lucky Lynn would be indifferent at an annual interest rate of 11.11%:$1000 = $900 or (1+i) = 1,000 = 1.1111(1+i)900i = .1111 = 11.11%20.As manager of short-term projects, you are trying to decide whether or not to invest in a short-term project that pays one cash flow of $1,000 one year from today. The total cost of the project is $950. Your alternative investment is to deposit the money in a one-year bank Certificate of Deposit which will pay 4% compounded annually.a.Assuming the cash flow of $1,000 is guaranteed (there is no risk you will not receive it) what would be alogical discount rate to use to determine the present value of the cash flows of the project?b.What is the present value of the project if you discount the cash flow at 4% per year? What is the netpresent value of that investment? Should you invest in the project?c.What would you do if the bank increases its quoted rate on one-year CDs to 5.5%?d.At what bank one-year CD rate would you be indifferent between the two investments?SOLUTION:a.Because alternative investments are earning 4%, a logical choice would be to discount the project’s cash flowsat 4%. This is because 4% can be considered as your opportunity cost for taking the project; hence, it is your cost of funds.b.Present Value of Project Cash Flows:PV = $1,000= $961.54(1.04)The net present value of the project = $961.54 - $950 (cost) = $11.54The net present value is positive so you should go ahead and invest in the project.c.If the bank increased its one-year CD rate to 5.5%, then the present value changes to:PV = $1,000= $947.87(1.055)Now the net present value is negative: $947.87 - $950 = - $2.13. Therefore you would not want to invest in the project.d.You would be indifferent between the two investments when the bank is paying the following one-year interestrate:$1,000 = $950 hence i = 5.26%(1+i)21.Calculate the net present value of the following cash flows: you invest $2,000 today and receive $200 one year from now, $800 two years from now, and $1,000 a year for 10 years starting four years from now. Assume that the interest rate is 8%.SOLUTION:Since there are a number of different cash flows, it is easiest to do this problem using cash flow keys on the calculator:22.Your cousin has asked for your advice on whether or not to buy a bond for $995 which will make one payment of $1,200 five years from today or invest in a local bank account.a.What is the internal rate of return on the bond’s cash flows? What additional information do you need tomake a choice?b.What advice would you give her if you learned the bank is paying 3.5% per year for five years(compounded annually?)c.How would your advice change if the bank were paying 5% annually for five years? If the price of thebond were $900 and the bank pays 5% annually?SOLUTION:a.$995 x (1+i)5 = $1,200.(1+i)5 = $1,200$995Take 5th root of both sides:(1+i) =1.0382i = .0382 = 3.82%In order to make a choice, you need to know what interest rate is being offered by the local bank.b.Upon learning that the bank is paying 3.5%, you would tell her to choose the bond because it is earning a higherrate of return of 3.82% .c.If the bank were paying 5% per year, you would tell her to deposit her money in the bank. She would earn ahigher rate of return.5.92% is higher than the rate the bank is paying (5%); hence, she should choose to buy the bond.23.You and your sister have just inherited $300 and a US savings bond from your great-grandfather who had left them in a safe deposit box. Because you are the oldest, you get to choose whether you want the cash or the bond. The bond has only four years left to maturity at which time it will pay the holder $500.a.If you took the $300 today and invested it at an interest rate 6% per year, how long (in years) would ittake for your $300 to grow to $500? (Hint: you want to solve for n or number of periods. Given these circumstances, which are you going to choose?b.Would your answer change if you could invest the $300 at 10% per year? At 15% per year? What otherDecision Rules could you use to analyze this decision?SOLUTION:a.$300 x (1.06)n = $500(1.06)n = 1.6667n log 1.06 = log 1.6667n = .510845 = 8.77 Years.0582689You would choose the bond because it will increase in value to $500 in 4 years. If you tookthe $300 today, it would take more than 8 years to grow to $500.b.You could also analyze this decision by computing the NPV of the bond investment at the different interest rates:In the calculations of the NPV, $300 can be considered your “cost” for acquiring the bond since you will give up $300 in cash by choosing the bond. Note that the first two interest rates give positive NPVs for the bond, i.e. you should go for the bond, while the last NPV is negative, hence choose the cash instead. These results confirm the previous method’s results.24.Suppose you have three personal loans outstanding to your friend Elizabeth. A payment of $1,000 is due today, a $500 payment is due one year from now and a $250 payment is due two years from now. You would like to consolidate the three loans into one, with 36 equal monthly payments, beginning one month from today. Assume the agreed interest rate is 8% (effective annual rate) per year.a.What is the annual percentage rate you will be paying?b.How large will the new monthly payment be?SOLUTION:a.To find the APR, you must first compute the monthly interest rate that corresponds to an effective annual rate of8% and then multiply it by 12:1.08 = (1+ i)12Take 12th root of both sides:1.006434 = 1+ ii = .006434 or .6434% per monthOr using the financial calculator:b.The method is to first compute the PV of the 3 loans and then compute a 36 month annuity payment with thesame PV. Most financial calculators have keys which allow you to enter several cash flows at once. This approach will give the user the PV of the 3 loans.Note: The APR used to discount the cash flows is the effective rate in this case, because this method is assuming annual compounding.25.As CEO of ToysRFun, you are offered the chance to participate, without initial charge, in a project that produces cash flows of $5,000 at the end of the first period, $4,000 at the end of the next period and a loss of $11,000 at the end of the third and final year.a.What is the net present value if the relevant discount rate (the company’s cost of capital) is 10%?b.Would you accept the offer?c.What is the internal rate of return? Can you explain why you would reject a project which has aninternal rate of return greater than its cost of capital?SOLUTION:At 10% discount rate:Net Present Value = - 0 + $5,000 + $4,000 - $11,000 = - 413.22(1.10)(1.10)2 (1.10)3c.This example is a project with cash flows that begin positive and then turn negative--it is like a loan. The 13.6% IRR is therefore like an interest rate on that loan. The opportunity to take a loan at 13.6% when the cost of capital is only 10% is not worthwhile.26.You must pay a creditor $6,000 one year from now, $5,000 two years from now, $4,000 three years from now, $2,000 four years from now, and a final $1,000 five years from now. You would like to restructure the loan into five equal annual payments due at the end of each year. If the agreed interest rate is 6% compounded annually, what is the payment?SOLUTION:Since there are a number of different cash flows, it is easiest to do the first step of this problem using cash flow keys on the calculator. To find the present value of the current loan payments:27.Find the future value of the following ordinary annuities (payments begin one year from today and all interest rates compound annually):a.$100 per year for 10 years at 9%.b.$500 per year for 8 years at 15%.c.$800 per year for 20 years at 7%.d.$1,000 per year for 5 years at 0%.e.Now find the present values of the annuities in a-d.f.What is the relationship between present values and future values?SOLUTION:Future Value of Annuity:e.f.The relationship between present value and future value is the following:FV = PV x (1+i)n28.Suppose you will need $50,000 ten years from now. You plan to make seven equal annual deposits beginning three years from today in an account that yields 11% compounded annually. How large should the annual deposit be?SOLUTION:You will be making 7 payments beginning 3 years from today. So, we need to find the value of an immediate annuity with 7 payments whose FV is $50,000:29.Suppose an investment offers $100 per year for five years at 5% beginning one year from today.a.What is the present value? How does the present value calculation change if one additional payment isadded today?b.What is the future value of this ordinary annuity? How does the future value change if one additionalpayment is added today?SOLUTION:$100 x [(1.05)5] - 1 = $552.56.05If you were to add one additional payment of $100 today, the future value would increase by:$100 x (1.05)5 = $127.63. Total future value = $552.56 + $127.63 = $680.19.Another way to do it would be to use the BGN mode for 5 payments of $100 at 5%, find the future value of that, and then add $100. The same $680.19 is obtained.30.You are buying a $20,000 car. The dealer offers you two alternatives: (1) pay the full $20,000 purchase price and finance it with a loan at 4.0% APR over 3 years or (2) receive $1,500 cash back and finance the rest at a bank rate of 9.5% APR. Both loans have monthly payments over three years. Which should you choose? SOLUTION:31.You are looking to buy a sports car costing $23,000. One dealer is offering a special reduced financing rate of 2.9% APR on new car purchases for three year loans, with monthly payments. A second dealer is offering a cash rebate. Any customer taking the cash rebate would of course be ineligible for the special loan rate and would have to borrow the balance of the purchase price from the local bank at the 9%annual rate. How large must the cash rebate be on this $23,000 car to entice a customer away from the dealer who is offering the special 2.9% financing?SOLUTION:of the 2.9% financing.32.Show proof that investing $475.48 today at 10% allows you to withdraw $150 at the end of each of the next 4 years and have nothing remaining.SOLUTION:You deposit $475.48 and earn 10% interest after one year. Then you withdraw $150. The table shows what happensAnother way to do it is simply to compute the PV of the $150 annual withdrawals at 10% : it turns out to be exactly $475.48, hence both amounts are equal.33.As a pension manager, you are considering investing in a preferred stock which pays $5,000,000 per year forever beginning one year from now. If your alternative investment choice is yielding 10% per year, what is the present value of this investment? What is the highest price you would be willing to pay for this investment? If you paid this price, what would be the dividend yield on this investment?SOLUTION:Present Value of Investment:PV = $5,000,000 = $50,000,000.10Highest price you would be willing to pay is $50,000,000.Dividend yield = $5,000,000 = 10%.$50,000,00034. A new lottery game offers a choice for the grand prize winner. You can receive either a lump sum of $1,000,000 immediately or a perpetuity of $100,000 per year forever, with the first payment today. (If you die, your estate will still continue to receive payments). If the relevant interest rate is 9.5% compounded annually, what is the difference in value between the two prizes?SOLUTION:The present value of the perpetuity assuming that payments begin at the end of the year is:$100,000/.095 = $1,052,631.58If the payments begin immediately, you need to add the first payment. $100,000 + 1,052,632 = $1,152,632.So the annuity has a PV which is greater than the lump sum by $152,632.35.Find the future value of a $1,000 lump sum investment under the following compounding assumptions:a.7% compounded annually for 10 yearsb.7% compounded semiannually for 10 yearsc.7% compounded monthly for 10 yearsd.7% compounded daily for 10 yearse.7% compounded continuously for 10 yearsa.$1,000 x (1.07)10 = $1,967.15b.$1,000 x (1.035)20 = $1,989.79c.$1,000 x (1.0058)120 = $2,009.66d.$1,000 x (1.0019178)3650 = $2,013.62e.$1,000 x e.07x10 = $2,013.7536.Sammy Jo charged $1,000 worth of merchandise one year ago on her MasterCard which has a stated interest rate of 18% APR compounded monthly. She made 12 regular monthly payments of $50, at the end of each month, and refrained from using the card for the past year. How much does she still owe? SOLUTION:Sammy Jo has taken a $1,000 loan at 1.5% per month and is paying it off in monthly installments of $50. We could work out the amortization schedule to find out how much she still owes after 12 payments, but a shortcut on the financial calculator is to solve for FV as follows:37.Suppose you are considering borrowing $120,000 to finance your dream house. The annual percentage rate is 9% and payments are made monthly,a.If the mortgage has a 30 year amortization schedule, what are the monthly payments?b.What effective annual rate would you be paying?c.How do your answers to parts a and b change if the loan amortizes over 15 years rather than 30?EFF = [1 + .09]1238.Suppose last year you took out the loan described in problem #37a. Now interest rates have declined to 8% per year. Assume there will be no refinancing fees.a.What is the remaining balance of your current mortgage after 12 payments?b.What would be your payment if you refinanced your mortgage at the lower rate for 29 years? SOLUTION:Exchange Rates and the Time Value of Money39.The exchange rate between the pound sterling and the dollar is currently $1.50 per pound, the dollar interest rate is 7% per year, and the pound interest rate is 9% per year. You have $100,000 in a one-year account that allows you to choose between either currency, and it pays the corresponding interest rate.a.If you expect the dollar/pound exchange rate to be $1.40 per pound a year from now and are indifferentto risk, which currency should you choose?b.What is the “break-even” value of the dollar/pound exchange rate one year from now?SOLUTION:a.You could invest $1 today in dollar-denominated bonds and have $1.07 one year from now. Or you couldconvert the dollar today into 2/3 (i.e., 1/1.5) of a pound and invest in pound-denominated bonds to have .726667(i.e., 2/3 x 1.09) pounds one year from now. At an exchange rate of $1.4 per pound, this would yield 0.726667(1.4) = $1.017 (this is lower than $1.07), so you would choose the dollar currency.b.For you to break-even the .726667 pounds would have to be worth $1.07 one year from now, so the break-evenexchange rate is $1.07/.726667 or $1.4725 per pound. So for exchange rates lower than $1.4725 per pound one year from now, the dollar currency will give a better return.。

时间价值系数

时间价值系数1. 什么是时间价值系数时间价值系数(Time Value of Money)是金融学中的一个重要概念,用于衡量时间对于资金的价值影响。

简单来说,它指的是同一笔资金在不同时间点的价值不同。

在现实生活中,我们常常需要在不同时间点进行资金的投入和回收。

而时间价值系数则帮助我们计算出这些资金在不同时间点的真实价值,以便做出更明智的决策。

2. 时间价值系数的原理时间价值系数基于以下两个基本原理:2.1 资金的未来价值假设你手上有一笔钱,你可以选择立即使用它,或者将其投资以获取更多利润。

如果你选择后者,在未来某个时刻你将会得到一笔更大的金额。

这是因为投资可以让资金增长,从而提高其未来的价值。

而这种增长可以通过利息、股息、利润等形式体现。

2.2 资金的折现与未来金额相反,现在手上拥有的金额具有更高的使用价值。

这是因为你可以立即使用它来满足自己当前的需求。

然而,我们常常会面临一个问题,即在未来某个时间点获得的资金并不等于现在手上拥有的资金。

这是因为资金的使用价值会随着时间的推移而下降。

因此,我们需要对未来金额进行折现,以便将其转换为现在的价值。

这个折现率通常由市场利率来决定。

3. 时间价值系数的计算时间价值系数可以通过一些数学公式进行计算。

以下是两个常用的计算公式:3.1 现值公式现值(Present Value)指的是将未来金额折现到现在所得到的金额。

它可以通过以下公式计算:其中,PV表示现值,FV表示未来金额,r表示市场利率(或折现率),n表示投资期限。

3.2 未来价值公式未来价值(Future Value)指的是将现在金额投资一段时间后所能获得的金额。

它可以通过以下公式计算:其中,FV表示未来价值,PV表示现在金额,r表示市场利率(或折现率),n表示投资期限。

4. 时间价值系数的应用时间价值系数在金融领域有广泛的应用。

以下是几个常见的应用场景:4.1 投资决策时间价值系数可以帮助我们评估不同投资方案之间的优劣。

金融学课件PPT李健第三版第5章:货币的时间价值与利率

• 案例:李四向银行申请了一笔贷款,年利率为8%,如果某年的物 价水平上涨了4%,则这一年李四的实际利率负担是多少?

• 根据简易公式,可得实际利率:i = r − p = 8% − 4% = 4% • ➢根据精确公式,可得实际利率为:

关于利息实质的不同观点

现代经济学关于利息的基本观点 利息实质已不再是现代经济学研究的重点,目前的研究更加侧重于对利 息补偿的构成以及利率影响因素的分析 基本观点:将利息看作投资者让渡资本使用权而索取的补偿或报酬, 该补偿一般包括两部分:①对放弃投资于无风险资产的机会成本的补偿; ②对风险的补偿,即:风险资产的收益率=无风险利率+风险溢价

单期终值和现值

• 案例:假设利率为5%,张三投资10000元,一年后他将得到10500 元。在该案例中,第0期的现金流C0(即现值PV)为10000元,投 资结束时获得的现金流C1(即终值FV)为10500元,利率r为5%, 时间区间为1年

多期终值和现值

• 案例:王五以面值10万元购买了期限5年,年利率为10%,复利计 息到期一次还本付息的公司债券,到期后王五将获得本利和 161051元。本案例中,第0期现金流C0 (即PV)为10万元,投资 结束时现金流Ct(即FV)为161051元,利率r为10%,时间区间为5 年

• 利息向收益的一般形态转化,其主要作用是导致收益资本化 (capitalization of return),即各种有收益的事物,不论它 是否是一笔贷放出去的货币金额,甚至也不论它是否为一笔资本, 都可以通过收益与利率的对比,倒算出它相当于多大的资本金额